Accounting assignment for New Adventures Travel and Tourism

Question

Task: Prepare for management an accounting assignment outlining the Income Statements for year ending 2021 and 2022. Calculate the breakeven points (BEPs) for both years and provide an explanation of any difference in the BEPs. Critically evaluate whether a difference indicates that BEP has limited usefulness.

Answer

Analysis of attached working sheetin the accounting assignment

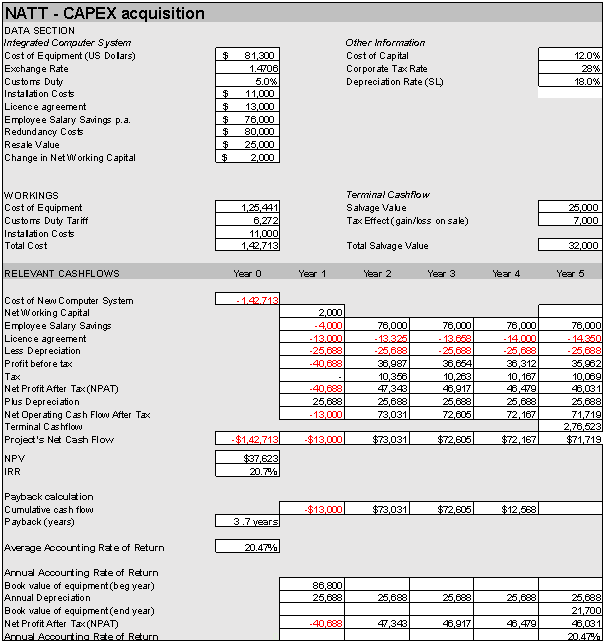

The attached excel sheet with the accounting assignmentcovers the two proposal of investment, here we have to analysis whether it is advisable to buy an equipment in order to control the excess cost of human resources management or to acquired the equipment on lease. the CAPEX part covers the information regarding the acquisition of equipment, and shows the value of saving in employment wages. Whether an equipment is bought or it is taken on lease there will be saving in wages of $76000every year. but the biggest advantage of purchase of equipment is that an owner of equipment can claim expenses of depreciation and interest on borrowed capital, in addition to that at the end of useful life of assets, an owner of depreciable assets can gain a benefit of realisable value. (Al-Mutairi, A., Naser, K., & Saeid, M. (2018).

In the accounting assignment we make an assumption that the sales of asset is not subject to any tax consequence if any gain is realised from the sales of assets.

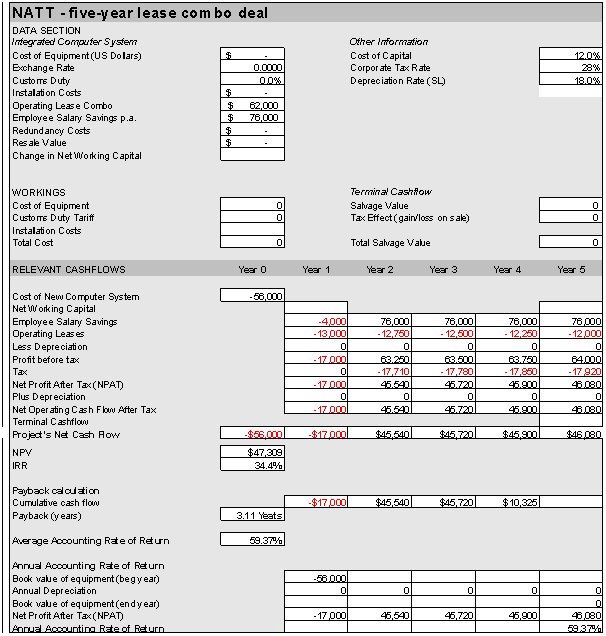

While on another hand the second part of this working five-year lease combo, here instead of buying of assets, an users is planning to bought the assets on lease, which required the payment of lease rent.( Baker, H. K., & English, P. (Eds.). (2011)The lease expenses are deductible expenses, while computing an taxable income. However, such benefits are not eligible for any other deduction such as depreciation on assets or any amount realised at end useful life of assets. The saving of employee wages will be same as per the accounting assignment it can be found in case of purchase of machinery, the differ is in term of non-availability of benefits for depreciation and resale value of assets at end of useful life of assets.

Six correct Risk factors and six correct implication and six correct ways to minimise the risk

FINANACIAL RISK ASSOCIATED WITH INVESTMNET in the accounting assignment

A) Possible increase in financial obligation over the company considered in theaccounting assignmentas the new project is either finance equity capital or through debt capital in both the cash financial obligation over company is there

B) Another financial risk is that the project may not be in position to generate expected rate of return, here the rate of return is equivalent or in excess of cost of capital for the given project

C) Amount invested in employee to make them educated with new technology may leave the organisation considered in theaccounting assignmentones they complete their learning Period and this fact indicate about the potential financial risk associated with operation of company

Non financial risk face by NATT

A) All employees of the organisation considered in accounting assignmentmay not agreed to continues with new system adopted by NATT and they may leave the organisation and this may result into high employee turnover

B) New system required major change in the operating structure and new business structure may not be suitable to NATT for long term survival

C) Change in technology is one of the non financial risk, and which indicate that business should or up-grade its operating system in order to meet change in the external environment.

OTHER RISKS ASSOCIATED WITH accounting assignmentPROJECT

A) Loss or damage of acquired computed system due to any external uncontrollable factors

B) Change in technology as result of which acquired assets becomes outdated (Kengatharan, L. (2016).

C) Legal dispute from employee due to loss of their employment

D) Excess amount of maintenance cost and wrong projection of inflow from new technology

E) Possible change in government policy and introduction of new policy which support labour laws

Ways to minimise above stated risk in theaccounting assignment

A) Cover the acquired assets with insurance covers

B) Update technology with change in time

C) Formulate a corporate strategy for acquisition of computer system in a way where zero possibility for legal dispute

D) Replace the existing job of employees with other employment aspects, if employees are not agreed to up-date themselves with new technology

E) Acquired annual maintenance contract for computer from the seller of this assets

F) If there is any change in government policy related to labour laws, we have to adjusted our self with new policy framework.

Whether the propose computer system is financial sound for acquisition

Acquiring an computer system is Less suitable then the leasing an computer system, as we have seen the numbers of benefits found in case of acquisition are Lessthan the leasing of the assets. The purchase assets required the major outflow at initial stage, which is not there in case of leasing of the assets. The overall financial effect of this transaction will create and maximise the wealth of NATT in long term . in addition to that NATT project has a positive value of NPV, under both the case. lease option has greater value of NPV then the purchasing of asset. Hence it is best to lease the assets instead of simply buying of assets. A contractual authorization signed between two parties namely the lessor and the lessee is called a lease. In simple words, a lease is an agreement made between two parties or companies

Recommendation

Based on the above stated computation and after analysing the overall situation in theaccounting assignment, it is advisable to use the option to Lease an equipment instead of acquiring assets. the primary reason for such decision is that the acquisition of assets has comparative less benefits as again the Leasing of an assets. The NPV of lease project is higher then the purchase of computer machinery.

Reference

Al-Mutairi, A., Naser, K., & Saeid, M. (2018). Capital budgeting practices by non-financial companies listed on Kuwait Stock Exchange (KSE). Cogent Economics & Finance, 6(1), 1468232.

Baker, H. K., & English, P. (Eds.). (2011). Capital budgeting valuation: financial analysis for today's investment projects in accounting assignment(Vol. 13). John Wiley & Sons.

Dayananda, D., Irons, R., Harrison, S., Herbohn, J., & Rowland, P. (2002). Capital budgeting: financial appraisal of investment projects. Cambridge University Press.

Kengatharan, L. (2016). Capital budgeting theory and practice: a review and agenda for future research. Research Journal of Finance and Accounting, 7(1).

Mao, J. C. (1970). Survey of capital budgeting in accounting assignment: Theory and practice. Journal of finance, 349-360.