Auditing Assignment Based on Oxley Act(2002) & Audit Fees Determination

Question

Task:

Auditing Assignment Task:

Part 1: Demand of adequate Assurance:

In 2002, the audit firm Arthur Andersen collapsed following charges brought against it in the United States relating to the failure of its client, Enron. Some other clients announced that they would be dismissing Arthur Andersen as their auditor even before it was clear that Arthur Andersen would not survive.

Required:

a. Explain demand from audit and assurance services under Sarbanes- Oxley Act (2002)? b. Explain auditors understanding of corporate governance revision, update and arguments after SOX Act (2002)

Part 2: Audit Fees Determination and ASX CGC Principles

All companies are required to disclose in their annual reports the amounts paid to their auditors for both the financial report audit and any other services performed for the company.

Required:

a. Obtain a copy of a recent annual report (2019) from ASX Top 100 listed companies list (most companies make their annual reports available on the company’s website) and find the disclosures explaining the amounts paid to auditors. How much was the auditor paid for the audit and non-assurance, or other, services? Explain your understanding about demand and supply theories of audit fees from this company?

b. Explain your selected company’s (same selected company from question a) application of ASX CGC principles using Corporate Governance Principles and Recommendations (4th Edition) was released on 27 February 2019?

Answer

Introduction

The assessment of audit, assurance, and compliance, is segregated into two parts. In the first part, the services based on audit and assurance must be demonstrated as per the Sarbanes-Oxley Act, 2002. Detailed analysis of auditors based on principles of corporate governance, arguments has to be discussed as per the SOX Act. On the other hand, from the list of ASX listed companies, Woolworths has been chosen. As per the audit reports of 2019, the payment made by auditors for audit, non-assurance, and several other services have to be mentioned. Demand and Supply theories based on audit fees of Woolworths also have to be critically evaluated. Lastly, the application of principles and recommendations based on Corporate Governance must be analyzed. In this particular assessment, identification of several modifications and transformations to re-establish the audit process and to increase disclosures through the SOX Act must also be comprehended.

Part 1

a. Audit and Assurance services under the Sarbanes Oxley Act (2002)

The Sarbanes Oxley Act of 2002 came into existence by the federal legislation, which was instituted by the United States of America on 30th July 2002 in order to safeguard the accounting and business sector. Sarbanes Oxley Act 2022 was instituted in the name of Senator Paul Sarbanes and Representative Michael G. Oxley and was countersigned into decree by President George W. Bush. The Sarbanes Oxley Act of 2002 made compulsion that the audit committee will fall under the direct purview and shall be directly responsible for the supervision of work of the organization's independent auditor (US Securities and Exchange Commission, 2020). This Act made the provision that the Securities and Exchange Commission regulations are fashioned to consider that auditors are from the purview of their audit clients (Sanzgiri, 2014). This Act was a response and reaction to the accounting person of different companies like WorldCom, Enron, Tyco, Adelphia, and various other traditional auditors.

The Sarbanes Oxley Act 2002 was also known as the SOX Act and the Corporate Responsibility Act, as it instituted various business reforms to existing contract regulations and enforced harder restrictions on the lawbreakers (US Securities and Exchange Commission, 2020). The United States had to face one of the grave failures in auditing, which is known as the Enron Scandal. Enron Company was the US seventh-largest energy company based in Houston. The Enron Company implied poor accounting practices and made an improper financial statement to hide the details of the unsuccessful projects and deals. In addition to that, it also obscured billion dollars of assets. As a result of that, it brought the need for harder and strict informing practices.

The Sarbanes Oxley Act highlighted some commission rules and various other authoritative legislation in relation to the audit committee roles and responsibilities with regard to the auditor's independence.

General Standard of Auditor Independence

In order to check the independence of the auditor, the general standard of auditor independence should be made to ensure that the auditor is competent enough of conducting valid and unbiased proceedings on all matters related to the audit ppproceedings.

Restrictions relating to non-audit services

This Act provided restrictions to the auditor from performing the services of non-audit with regard to audit clients, including its affiliation such as bookkeeping, data-related systems designing, application, the function of management or human resources, services related to legal, and expert not related to the audit, etc.

Prior Approval of Allowed Services

With regard to some exceptions, the audit committee should make prior approval of the allowed services granted by the independent auditor. This Sarbanes Oxley Act made certain provisions relating to prior endorsementnecessities that the audit committee must comply with.

Restrictions in terms of the relationship

In addition to the above provisions, some relationships between the business of audit and the companies they comply with are not allowed, such as the relationship to employees, contingent fees, relationship in terms of finances.

b. Auditors understanding of CGC revision, arguments, and update after SOX Act

In order to reinstate the investor's confidence regarding the financial market and to erase all the possibilities that permitted the public companies to deceive the investors, in July 2002, the Sarbanes-Oxley Act was enforced. After the introduction of the Act, it had a great impact on the governance of the corporate in the US. After the initiation of the Act, now the public companies need to have strong audit committees, perform a test on internal control, and make the officers and directors responsible for giving financial statements (DataInsider, 2019). After the enactment of the Sarbanes-Oxley Act, there is the introduction of strict criminal penalties for those who commit securities fraud and for those who try to change the manner on how the public accounting firm operates. After the enactment of the SOX, the auditors now have to understand the setting of new auditor standards in order to reduce the conflicts that arise from interest, and the auditors have to disclose material off the arrangements in the balance sheet (DataInsider, 2019). The effect of the SOX is that now the auditors have to understand that the managers are personally responsible for certifying the accuracy of the financial reports submitted by them. The other direct effect of the SOX is that if the managers knowingly make false certification of the financial report, then according to SOX, such managers will have to face 10 to 20m years in prison. In this matter, if the companies are forced to make accounting restatement due to the false certification made by the managers, then according to SOX, the managers have to sacrifice their profits and bonuses which they made by stock sales of their organization (Özbilgin, 2019).

The next rule of SOX states that if the directors or the officers of the company are involved in the violation of the security laws, therefore the director or the officer can be prohibited from further serving the public company in the same role (Özbilgin, 2019). Further, the auditors must understand that after the enactment Sarbanes-Oxley Act, public organizations are now necessary for disclosing the materials from the balance sheet arrangement, materials such as special purpose entities and operating leases. Now the firms are also required to use usually accepted accounting principles (GAAP), and the companies have to disclose or submit any pro forma statements (Özbilgin, 2019).

Due to the enactment of the SOX, the insiders of the company now has to report the transaction of their stock to the Securities and Exchange Commission (SEC) within two working days (Sarbanes Oxley, 2019).

The auditors now have to understand that the Sarbanes-Oxley Act imposes a very harsh penalty for convictions of securities scam, fraud in wires, fraud in mails, and for obstructing justice. According to the SOX Act, the convictions regarding securities fraud will lead to 25 years in prison, while convictions regarding mail and wire fraud will lead to 5 to 20 years in prison, and the punishment for obstructing justice has been increased to 20 years (Sarbanes Oxley, 2019). The Sarbanes-Oxley Act also imposes increased penalties for public companies that are involved in the same crime. The Sarbanes-Oxley Act encourages organizations to make the financial statements in a more automated, centralized, and efficient manner; therefore, now the public companies have to conduct the widespread internal test and embrace it with their annual audits. For this, it requires the involvement of not only the external accountants but will also include the involvement of experienced IT personals(Sarbanes Oxley, 2019). All these will increase the cost of those companies who greatly rely on controls that are manual. Further, the Sarbanes-Oxley Act, in order to stop fraudulent activities, established the Public Company Accounting Oversight Board, which shall follow the standards of accounting, and requires the rotation of the lead audit partners to be held in every five years for the same company (Sarbanes Oxley, 2019).

Under the Sarbanes-Oxley Act, section 404 states that the independent auditors of the company have to show to the evaluation of procedure and internal controls made by the management and in accordance with the standards that are established by the Public Company Accounting Oversight Board (Özbilgin, 2019). The internal audit that is conducted by the external auditors is placed in the Audit Standard No. 5 by the Public Company Accounting Oversight Board and considers that the external auditors may rely on the report of the internal auditors. Under section 409 of the Sarbanes-Oxley Act, it is necessary for public companies to disclose to the public the additional information that is associated with the changes in the operation of the organization or the changes in the financial condition of the organization (Özbilgin, 2019). While disclosing the information, the Disclosure Committee is responsible for implementing and designing the procedure for the organization's disclosure (Sarbanes Oxley, 2019).

Part 2

a.Payment to auditing services and application of auditing theories

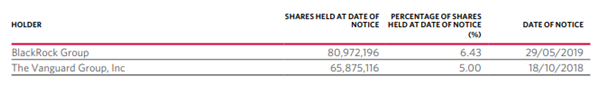

The company chosen from ASX's top listed companies is Woolworths. Woolworths is regarded as a chain of supermarkets and grocery stores in Australia. The company is not only specializes in groceries but also sells household products, beauty products. Due to the smooth functioning of its stores, the company decided to enlarge its grocery stores. As per the audit reports of 2019 Woolworths Group Limited and its subsidiaries, Consolidated Statement of financial position, Consolidated Statement of Changes in Equity, Consolidated Statement of Profit and Loss, Consolidated Statement of Cash flows are included. In addition to this, a detailed overview of important policies of accounting is also included. The audit proceedings of Woolworths have been conducted in association with the auditing standards of Australia. The responsibilities associated with ethics have also been fulfilled as per the prescribed requirements of the Code. Principle matters of the audit are of major importance in the audit reports for the present period. As per the annual reports, Woolworths Group Limited has acquired the following notifications of substantial shareholders.

Fig 1– Notification of Substantial Shareholder

Sources-(Annual Report, 2021)

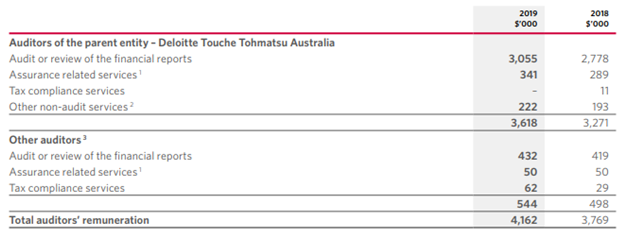

However, considering the company’s annual report 2019, it can be said that during the period, Australian Deloitte Touche Tohmatsu, the auditor of Woolworths have performed some other services in alternative to their legal duties. The report shows a satisfaction that the provision of those services of non-audit during the period of an audit by the auditor was compatible with and did not negotiate. It has been found that under Corporation Act 2001 (Cth), the requirements of auditor independence have been maintained as the Accounting Professional and Ethical Standards Board issued well as professional conduct with Code of Conduct APES 110. Hence, the company had made disclosures concerning the Auditors’ Independence Declaration in accordance with section 307C of the Corporation Act 2001, and the financial report of the company was conducted for 53 weeks and was ended on 30th June 2019 (Gachie and Govender, 2017). Thus, for the overall audit process, the company had paid $3,055 for the auditors who had reviewed the financial reports of the company. The services that are related to assurance were paid about $341, and services of tax compliance services and other non-audit services. Additionally, the other auditors like audit or review of the financial report; assurance related services, and tax compliance services were paid around $544. Moreover, the overall remuneration of auditors within the company's financial statement 2019 was $4,162.

Fig 2–Disclosures of Auditors

Sources-(Annual Report, 2021)

There are significant factors that affect the demand and supply functions of Woolworths Group Limited. The demand and supply activities of a particular company are reliant on the tasks performed by the auditor. The demand and supply theories in accordance with audit fees of Woolworths Group Limited are demonstrated below- The policeman theory- In this particular theory, the auditor is mainly responsible for identifying, evaluating, and preserving fraud. At present, the sole objective of auditors is to offer reasonable assurance and assess the fairness of financial statements.

The theory of lending credibility- As per this particular theory, the significant function of the audit is to involve credibility in the financial statements. After analyzing this particular perspective, the services provided by auditors to their clients are referred to as credibility. It is essential for the users to acquire benefits from maximizing credibility.

The theory of inspired confidence- In this particular theory, the demand in the case of audit services is the implementation of third parties of a particular company. On the other hand, as per the supply of audit assurance, the auditor must always put potential towards fulfilling the public expectations. It is possible to acquire accountability through the introduction of periodic reports based on finance(Audit Theories, 2021).

The theory of Agency- According to this theory, the auditor is responsible for looking after the interests of third parties as well as the management. However, the most widely applied theory of audit is the agency theory. The three significant hypotheses for demonstrating the role of the audit are illustrated below-

The monitoring hypothesis- In this particular hypothesis, while delegating the power of framing decisions to a particular party, as in the case of the theory of agency, the agent must be influenced to monitor in situations when such activities are greater than the associated costs.

The information hypothesis- This particular hypothesis is regarded as the complement of the monitoring hypothesis.

The insurance hypothesis- This particular hypothesis demonstrates the manner in which the demand for audits is associated with liability exposure of the management.

b) The application of ASX CGC principles on Woolworths

Corporate governance refers to the framework of relationships, rules, processes, and systems that is exercised by a particular organization for controlling its organizational activities. Good corporate governance ensures a boost in investors' confidence that is crucial for the ASX listed companies in terms of achieving competitive advantage (ASX CGC, 2019). There are eight central principles that promote the structures of CGC Principles and Recommendations.

- Laying solid foundations for oversight and management: According to this principle, an ASX listed entity should be able to clearly delegate the respective responsibilities and roles along with conducting regular performance reviews.

- Structuring of the board to ensure value addition and effectiveness: An ASX listed entity should be of the proper size and must possess the knowledge, skills, and commitment of the industry in which it operates.

- Instilling a culture of responsible, ethical, and lawful culture: According to this principle, an ASX listed entity should continuously instill a culture in its working environment based on the ethical, legal and responsible Act.

- Safeguarding corporate reports’ integrity: An ASX listed entity must practice appropriate processes to maintain the integrity of its corporate reports.

- Making the disclosures timely and balanced: According to this principle, an ASX listed entity must provide a timely and balanced discourse of all concerning business matters.

- Respecting the security holders’ rights: An ASX listed entity must provide its security holders with proper facilities and information that will allow them in exercising the security holders' rights effectively.

- Managing and recognizing risk: An ASX listed entity must develop a framework of sound risk management that can review the framework’s effectiveness periodically.

- Responsible and fair remuneration: An ASX listed entity must be able to pay the director with sufficient remuneration so that the top directors can be attracted and retained.

In the 2019 annual report of Woolworths, the corporate governance (CGC) report indicates the extent of the company adhering to principles of corporate governance (ASX CGC, 2019). The board of Woolworth's reviews and approves its strategies by keeping a regular track of the progress based on the company’s strategic direction. The CGC Principles and Recommendations application on Woolworths indicates that the company tends to streamline its annual report by opting to publish its governance disclosures that include its corporate governance statement under the listing rule 4.1.03.

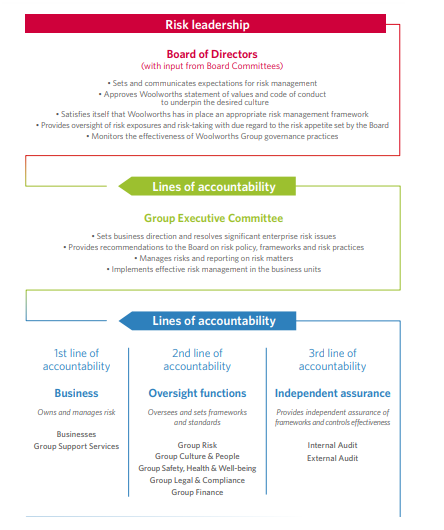

Figure 1: CGC framework Woolworths

Source:(Annual Report, 2021)

The above figure indicates the various levels of risk management followed by Woolworths in terms of skills, experience, and knowledge. Woolworths gives an informative explanation of their arrangements in corporate governance by not taking a legalistic or pedantic approach in their disclosures. The company views its corporate governance as an opportunity to demonstrate the importance of its management and board rather than a compliance document. This ensures appropriate communication with the company's security holders, along with providing them with the power to exercise their powers.

Woolworths outlines the governance arrangements with a thorough explanation of the governance arrangements along with implementation practices. Based on the ASX CGC Principles and Recommendations, the investors of Woolworths find the disclosures helpful as it provides the material insights that are gained from the evaluation and review of the governance arrangements. Woolworths, as an ASX listed entity, properly explains the company's policies and practices by establishing an audit committee, all of whom are non-executive directors. In addition to that, the company complies with the recommendations 4.1 of ASX CGC Principles and Recommendations (ASX CGC, 2019). There are certain recommendations in the corporate governance report of Woolworths that might get modified when it will be applied to its external business activities. The company provides an annual report in a completed appendix 4G that consists of the keys of all the disclosures, and if there are certain aspects of corporate governance statements not mentioned in the annual report, then the company gives ASX a copy of the corporate governance statement. Woolworths includes the statement of its corporate governance in its annual report along with its website as it is acceptable for the company's corporate governance materials. Therefore, the security holders of Woolworths find its CGC statements helpful in terms of understanding then company's decision to not adhere to a particular recommendation. Overall, Woolworths follows the ASX CGC Principles and Recommendations for benefitting from the invaluable contributions made by various associations of the industry.

Conclusion

Lastly, it can be recommended that the evolvement of the Sarbanes-Oxley Act has assisted the organizations in the US to acquire the appropriate financial statement of the company. It has been reviewed that Woolworths Group Limited acquired superior management reports and has made subsequent changes as per the requirements of the SOX Act. In this particular assessment, all the prescribed divisions of legislation have been covered. The annual report of Woolworths Group Limited has been able to reveal several significant aspects like autonomy, non-auditing services, principle concerns of audit, and the remuneration of the committee of the audit. The sole purpose of the Sarbanes-Oxley Act is to preserve investors by framing relevant corporate disclosures. In the first part of this assessment, services based on demand from audit and assurance have been demonstrated as per Sarbanes-Oxley Act. The analysis of auditors based on updates and arguments of Corporate Governance has been analyzed. In the second part of the report, demand and supply theories based on audit fees of Woolworths has been analyzed. The principles and recommendations of Corporate Governance of the Company have also been demonstrated.

References

Annual Report, 2021. [online] Asx.com.au. Available at:

ASX CGC (2019).Corporate Governance Principles and Recommendations 4th Edition. [online] corporate governance and principles. Available at: https://www2.asx.com.au/content/dam/asx/about/corporate-governance-council/cgc-principles-and-recommendations-fourth-edn.pdf [Accessed 1 Feb. 2021].

Audit Theories, 2021. [online] Available at:

DataInsider (2019).What is SOX Compliance? 2019 SOX Requirements & More. [online] Digital Guardian. Available at: https://digitalguardian.com/blog/what-sox-compliance [Accessed 1 Feb. 2021].

Gachie, W. and Govender, DW, 2017. Practical application of corporate governance principles in a developing country: A Case Study. Risk Governance & Control: Financial Markets & Institutions, 7(2), pp.67-75.

Özbilgin, M. (2019).The Role of Internal Audit in SOX Compliance. [online] Internal Audit 360. Available at: https://internalaudit360.com/the-role-of-internal-audit-in-sox-compliance/ [Accessed 1 Feb. 2021].

Sanzgiri, A. (2014). Overview of Sarbanes Oxley Act 2002. [online] . Available at: https://www.wirc-icai.org/images/material/Ia-SOX%202002.pdf [Accessed 1 Feb. 2021].

Sarbanes Oxley (2019). Sarbanes-Oxley (SOX) Audit Requirements. [online] Sarbanes-oxley-101.com. Available at: https://www.sarbanes-oxley-101.com/sarbanes-oxley-audits.htm [Accessed 1 Feb. 2021].

U.S Securities and Exchange Commission (2020).SEC.gov | Audit Committees and Auditor Independence. [online] www.sec.gov. Available at: https://www.sec.gov/info/accountants/audit042707.htm#:~:text=The%20Sarbanes%2DOxley%20Act%20of [Accessed 1 Feb. 2021].