Business Plan Assignment: Case Analysis Of Abbley

Question

Task:

Prepare a detailed business plan assignment critically discussing about the case of Abbley.

Answer

1. Executive Summary

1.1 Background and Ownership of company selected in the business plan assignment

Abbley Electrics and Repairs is the new start-up business that will be set up in Chelmsford. It will be a full-service repair business of electronic devices that will also sell electronic parts and fixtures. The business is a proprietorship business, where the owner is having the experience to work in the field of electronic repair for customers. Further, the owner is also having a reputation of excellence in this field for being a highly-recognised electronic instructor in the college of the community at a certain time before. Apart from the owner, two technicians, one accountant and one customer service executive will be employed in the business under the owner.

1.2 Services and Product

Abbley will mainly focus on the service aspect for providing high-quality repairing services of different electrical devices, for which the management will focus on prompt and convenient services. The services include warranty repairs or out of warranty repairs for washer/dryer, cooking equipment, refrigerators, televisions, laptops, and DVD players, which are the main among others. The products include small parts of the electronics that can be changed if damaged in the main equipment.

1.3 Market

Abbley will service the general public and customers for repairs and maintenance along with selling different items. The residential community in the city will be the key target for the business as the growth of population in this region will form a strong customer base for Abbley.

1.4 People and Facilities

The business will be a privately-owned business with one owner and four employees. There will be a provision to increase the number of employees with the increase and expansion of the business operations of Abbley. At first, the facility if the business will provide home repair services of large equipment within the community. After the business expands, Abbley will start providing services to small equipment also through the home service.

1.5 Financial Needs

The financial needs of Abbley comprise of the cash and assets requirements, which are the start-up business requirements. The cash requirements for meeting the initial business expenses and starting its operations will include £150,000, which will be met from the capital provided by the owner and the remaining from the long-term loan taken by him. From this, the capital provided by the owner is £50,000 and the remaining £100,000 is from the loan.

1.6 Key Forecasts and Returns

The return of the amount that will be invested in the business is expected to be returned back by the business within the fifth year of its operations. It is forecasted that the net profit of the business will be lower in the first year, which will increase from the second year. It also expected to incur losses from the first few months of its operations, thus making its profit to be much lower than expected in the first year.

2. Company’s Business

2.1 Targets and Purpose

Abbley will be set-up based on certain future targets or objectives to be fulfilled within the next five years of its operations, which are:

- To achieve growth in the sales revenue by a steady per cent over five years

- To achieve a maximum portion of the market in the locality

- Expand and diversify the services and product offerings for initiating new sales

2.2 Location

The business will be located within the residential area that is near to the Anglia Ruskin University. The location will be effective for its rising population that will help in forming an effective customer base. Further, the region will be convenient for the local to reach the shop and the business too as it will be easier for the employees to provide home services. The business will be set up in a rented space initially, which may be purchased with the enhancement of operations.

2.3 Customer Preferences

The customers will prefer to buy from the business for the experienced and high-quality services provided by the employees. All the employees will be well-trained and professional that can be reliable for the customers. Further, Abbley will position the business in a way that it can meet the rising needs of the upper and middle-class customers by providing quality services. As there are no established repair shops currently in the area, the customers will rely more on the business.

2.4 Pricing Strategy

The business will have the policy of charging 5%-10% above the cost of the replacements made in the repairing that can be afforded by its target market. Further, the market of Abbley will dictate its pricing strategies. The approval of the plan and loan for business will highlight that the pricing strategy will be acceptable in the market for having a fair price system.

2.5 Promotion and Sales Strategy

The business of Abbley will perform direct marketing, which will be done by house visit and distribution of pamphlets in the community. Fliers will also be posted for increasing public awareness. Customer feedback policy will be practised for increasing customer engagements, which can be the key medium of promotion for the business. With the expansion of business, the promotion will be made through advertising in the local newspapers.

3. History and Principal Activities

3.1 Company’s History, Services and Products

Abbley Electrics and Repairs will be a new business in the place that it will be set up as there are no major repairing business centres in the region. The economic growth of the region is quite high, thus making it a favourable place for the growth of the Abbley’s business operations. The needs of this region are also convenient for repairing services. The key offerings of the new business will be repairing services and replacement of parts for a number of electronic equipment such as cooking equipment, refrigerator, laptop, DVD players, televisions and several others. The business will also sell original spare parts and fixtures of the equipment from different companies.

3.2 New Product Options

The options for the new products of Abbley are expected to be fulfilled with the expansion of its business within three years. New types of spare parts that are more complex along with small electronic equipment will be displayed in the store at reasonable prices so that customers can purchase them according to their convenience. These may include rental service of TV/DVD, selling of TV/DVD, and stereos.

4. Market, Customer and Competition

4.1 Size and Trends of Market

The market size is quite large and currently expanding, thus providing Abbley with an option to grow further in the coming years. The current market of Abbley is quite large as the business is expected to have a large number of local customers along with the students from the nearby university. All throughout the year, Abbley shall conduct its business activities of providing repairing services to various electronic devices. As the region is having economic growth due to the growth of population, a strong market is expected to be formed for Abbley with a good number of long-term customers.

4.2 Long-term Market Potential

The business is expected to run as a long-term business, as the situations in the market explained that the number of customers will increase in the coming years until there are no strong competitors. As the location of the establishment of Abbley does not have any strong competitors currently, this will provide a great opportunity for the business to have a successfully running business in the long-term.

4.3 Potential Customers

The targeted customers are the general public and residents living in the community region of Chelmsford. Further, for situations near to the university, a number of students are also expected to appear, probably for repairing laptops and mobile phones. The after-sale services of Abbley shall serve as a USP for the company which will foster the business to gain a huge customer base as well as the customers will be inclined to purchase products from Abbley.

4.4 Competitors

One great advantage for Abbley is the presence of weak competition in the region as there are no established business or store offering repairing services. However, competitors are expected by the management of Abbley in the coming years. Currently, as there is no properly established electronics repair business in the area, the size of the market is expected to be large and productive. This will enable attracting more loyal customers, which can be again helped by changing reasonable prices through an effective pricing strategy.

4.5 Price, Quality and Services

The price of the repairing services will be set based on the market requirements and the price that is currently being charged by the businesses in other areas. The repairing charges will be kept low by a few per cent than the market price. However, the quality of the services shall also be focused on as Abbley intends to offer high-quality services to the customers at reasonable prices so that more customer engagement can be achieved through long-term relationships. The services shall also be ensured to be fulfilled at the best based on the skills and knowledge of the recruited technicians. The customers shall expect to be charged a lower price as compared to the other market players for repairing services in exchange of providing durable and high quality of services.

5. Research and Development

5.1 Product Development

With time, Abbley will focus on researching the smallest of improvements with fewer efforts and costs that can make more effective results. Based on the enhancement of business, materials can be imported in the future years so that such advanced improvements can be made. Employees will be trained regarding the same based on educational programs. The total finance required for the start-up requirement is £1,50,000. As the company is start-up business hence, there is no pre-planned or current stage of its product development.

5.2 Costs

The development of products will not incur any costs for Abbley as the business will purchase the required stock and raw materials from the external suppliers. Further, only the required parts have to be purchased so that they can be changed and replaced during the repairing services for customers. If product development is focused on in the future year, then extra costs will be required in the aspects of research and development.

6. Management

6.1 Business Management Team

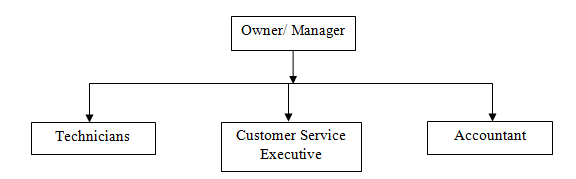

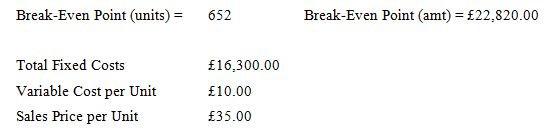

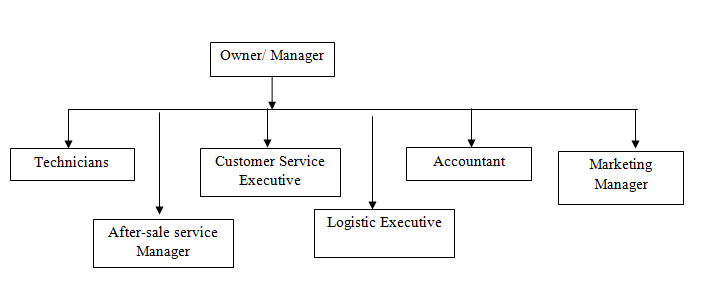

Based on the requirements of the business, the management will hire competent, skilled, experienced and qualified employees in three different positions of the business. The owner is the chief executive or manager of the business with all employees working under him. Apart from the owner, the following comprise the entire team of the business.

- Technicians for electronic maintenance and repairs- 2 employees

- Client service executive

- Accountant

The hierarchical set-up of the business of Abbley can be set as below.

6.2 Roles of Employees

The roles and responsibilities of the employees are individually allocated so that they can fulfil the requirements of the business and make the operations more effective. The roles of the employees along with the owner can be explained. All the three departmental employees work in collaboration to achieve the organisational goals of Abbey. The technician group performs the repairing and maintenance work which is further proceeded by customer service executive. The accountants perform the role of making the invoice of the repairing services conducted.

Owner/ Executive officer/ Manager

- Handling the overall management activities including human resource management

- Generating and implementing the objectives and vision of the business

- Communicating with suppliers, and creditors to ensure business deals

- Meeting the basic and necessary requirements of the business

Technicians

- Performing all repairs services for customers, both in-store and home service based on responsibility

- Commuting with the customers for the requirements of repairs

- Maintaining the stock and reporting the same to the owner

Client service executive

- Welcoming customers, listening to their queries and doing the needful

- Communicating with customers, online and telephonic, for home services

- Provisioning the customers with personalized and high-quality service experience and maintaining contacts with customers in the long-term

Accountant

- Preparing financial statements, budgets, and financial forecasts for the business

- Maintaining all financial transaction of the business such as payments and receipts

- Cash management and administration payrolls

- Performing risk analysis and management

- Maintaining taxation and other legal aspects

- Functioning as internal auditor

6.3 Managers, Duties and Career Highlights

The owner is the manager of Abbley, who will be managing all the fundamental activities of the store such as management and HR services. Further, he will be responsible for all the business transactions, regarding their approval and execution. He is holding degrees in engineering regarding the electronic repairs and replacement aspects. Further, he also has vast experience from his 25 years of service in this field. He has also been a reputed lecturer in the Electronics Engineering Technology department in the community college.

6.4 Payroll

The salary of the employees will be individually set-up based on the roles and importance of the work process. The owner of the business will not have any fixed salary, and he will take 5% of the monthly profit as his salary. However, if losses are incurred, then the owner will be responsible for meeting the loss. The monthly payroll salary for other employees is provided below.

|

|

£ |

|

Technician 1 |

3,000 |

|

Technician 2 |

3,000 |

|

Customer Service Executive |

2,000 |

|

Accountant |

4,000 |

|

Total |

12,000 |

7. Basis of Operation

7.1 Operational Plan

The key target of Abbley will be electronics repairing business that will be served across a wide range of equipment portfolio. Small electronic equipment and replacement parts will be bought from the suppliers and stocked by the business. These will be purchased from the suppliers who supply electric space parts and other equipment in the market of Chelmsford.

Abbley is predicted to maintain and practice a healthy financial position that will be enhanced over the period of the coming five years of operations. The loan amount can be repaid after three years, thus providing an option of business growth over three years. However, further, expansion can be made after five years of operations.

7.2 Suppliers

The suppliers of Abbley will be the reputed ones that supply different parts and fixtures in the Chelmsford market. As they supply original parts of different companies offering electronic gadgets and appliances, a strong business relationship can be shared with these suppliers in the long-term. With the business expansion, more new suppliers can be engaged for the supply of small appliances to be displayed in the store of Abbley.

7.3 Alternative Supply Sources

Alternative sources for supplying the required products to be sold by Abbley will be available for the local market of Chelmsford. Though these will be a bit expensive for the business, it shall be ensured that Abbley does not rely on the alternative sources for a much longer time.

7.4 Manufacturing Process

As the business of Abbley will focus on the repairing and replacement services based on the parts that will be purchased and stuck from different suppliers, no manufacturing will be required in the business. However, this process may be required in the future years with the inclusion of research and development aspects in the business store of Abbley.

7.5 Accounting System

The accounting system will be maintained according to the guidelines of the Accounting Standard Board and the accounting standards issued by this entity known as the Financial Reporting Standards. All the accounting procedures will be maintained by the accountant of Abbley, who is also the internal auditor and responsible for preparing monthly, quarterly and yearly financial statements and budgets. The depreciation of the assets used in business will be den using the straight-line method.

8. Resource Requirements

8.1 Finance

The financial requirements of the business are entirely based on the assets and equipment that will be worth purchasing or leased for the business and the initial expenses such as rent, utilities and others. Further, certain finance may have to be used in the business for meeting the payroll expenses in the initial months. Purchasing sufficient stock initially for maintaining business operations is also one major financial requirement for Abbley. The financial requirements of Abbley consist of the business assets and expenses are provided below.

|

Start-up Expenses and Assets |

£ |

|

Expenses |

|

|

Legal |

3,000 |

|

Rent and utilility |

1,000 |

|

Stationery |

300 |

|

Start-Up Inventory |

15,000 |

|

Start-Up Equipment |

21,500 |

|

Total Start-up Expenses |

40,800 |

|

Assets |

|

|

Beginning Cash |

9,200 |

|

Long-term Assets |

1,00,000 |

|

Total Assets |

1,09,200 |

|

Total Start-up Requirements |

1,50,000 |

8.2 Reasons for Financial Requirements

The financial requirements are the basic requirements, without which the business of Abbley cannot be started. For instance, space is required for walk-in customers, which cannot be afforded without paying rent initially. Further, sufficient stock of spare parts and fixtures of the electronic appliances have also to be maintained in order to carry out the business, though there will be a small number of customers in the beginning.

8.3 Pay-back

The pay-back will be required for the loan amount of £100,000 that is taken by the owner for meeting the business expenses. As this loan is taken from the local bank under the requirements of a small business enterprise, this can be returned back after five years of the business operations. Hence, after the return on the investments amounts is received by the management of £100,000 within five years, this can be returned after five years of its business.

8.4 Time Scale

At the Year 1 of incorporation of the business, the required start-up capital of £1,50,000 shall be invested into the business.

9. Financial Information

9.1 Projected Profit and Loss Statement

The projected profit and loss statement of Abbley is provided for three years with a monthly breakup of the pro-forma for the first year of its operations. (Appendix 2 & 6)

9.2 Cash Flow Forecast

The forecast of the cash flow statement of Abbley is provided for three years with a monthly breakup of the pro-forma for the first year of its operations. (Appendix 3 & 7)

9.3 Projected Balance Sheet

The projected balance sheet of Abbley is provided for three years with a monthly breakup of the pro-forma for the first year of its operations. (Appendix 4 & 8)

9.4 Break-even Analysis

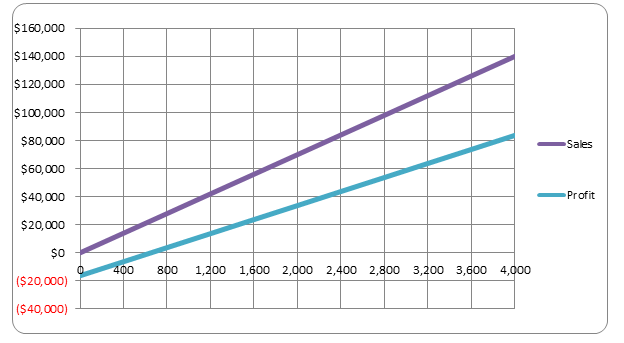

The break-even analysis of Abbley is provided in terms of the yearly break-even of the business. According to the analysis, if the average price of the reporting services is £35 per unit with the variable expenses of £10 per unit and fixed cost of £16,300, then the break-even point in units for Abbley will be 652 and the break-even sales amount will be £22,820. (Appendix 10)

10. Principal Risks

10.1 Deviation from Sales

The deviation from sales is measured in terms of pessimistic, good and optimistic approach. The expected Year 1 sale is £235000 which is pessimistic and at optimal level of £258500.

10.2 Changes in Cost of Sales

The cost of sales of Abbley is expected to incur an indirect cost of sales as £10250 against the pessimistic COGS of £9225 and £11275 as optimistic COGS showing variety of indirect costs.

10.3 Changes in Large Expenditure

The changes in large expenditure of Abbley is expected to incur a total operating expense consisting of payroll, depreciation, lease payments, sales and marketing expenses, utilities, rent and payroll tax is expected to cost £204020 as against £183618 for 90% capacity and £224422 for 110% capacity.

10.4 Changes in Pricing Policy

A change in the pricing policy for the new business shall bring about a change in the net profit margin for the business as 90%, 100% and 110% capacity. The net profit margin at three levels are £6759.90, £7511 and £8262 respectively. The net profit margin for the three levels are 2.88%, 3.20% and 3.52%.

10.5 Changes in Distribution Policy

A change in the distribution policy shall about a change in the EBITDA of the business at three different capacity level of 90%, 100% and 110% which is also known as pessimistic, good and optimistic level as £20655, £22950 and £25245.

11. Long-term Plan

11.1 Long-term Business Objectives

In the long-term, the management of Abbley aims to achieve a sustainable profit target, which can be possible through gaining a large number of loyal customers. With the expansion of its business, different business strategies will be applied so that more customers can be attracted and retained for longer periods, which can be achieved by providing high-quality services. Further, more experienced and skilled technicians will be employed in the business for managing a large number of customers in the future years. If competitors rise up in the location of Abbley’s business, the application of different competitive strategies and the business goodwill of Abbley will help it in gaining a sustainable competitive advantage.

11.2 Future Investors and Profits

It is predicted that Abbley will be capable of attracting investors in its business, which can be achieved with the enhancement of its operations. They will be capable of realizing profits from the business through gaining expected returns from their investments, as Abbley can surely form up to be one of the most successful, profitable and sustainable repairing businesses in the market of Chelmsford. Further, Abbley will focus on the diversification of its offering’s portfolio, which can also be beneficial for ploughing back required returns from the investments made by its investors in the coming years.

11.3 Medium-Term Plan

The mid-term plan of the company is to include the wide range of electronic appliance under its repairing services criteria to expand its service horizon. Not only commercial but also household electronic appliance shall be repaired and servicing of such products will be carried out by the company after the completion of 3 years of initial business operations.

Bibliography

Day, J. (2020). 7 steps to starting a business in the UK Available at: https://www.simplybusiness.co.uk/knowledge/articles/2020/09/how-to-start-a-business-in-7-steps/ [Accessed 16 December 2020]

gov.uk, (2020). Set up a business Available at: https://www.gov.uk/set-up-business [Accessed 16 December 2020]

great.gov.uk, (2020). How to expand to the UK Available at: https://www.great.gov.uk/international/content/invest/how-to-setup-in-the-uk/ [Accessed 16 December 2020]

icaew.com, (2020). Knowledge guide to UK accounting standards Available at: https://www.icaew.com/library/subject-gateways/accounting-standards/knowledge-guide-to-uk-accounting-standards#:~:text=From%201%20August%201990%2C%20all,Accounting%20Standards%20Board%20 (ASB).&text=All%20accounting%20standards%20developed%20and,Reporting%20Standard%20for%20Smaller%20Entities). [Accessed 16 December 2020]

nordeatrade.com, (2016). Country profile United Kingdom business plan assignment Available at: https://www.nordeatrade.com/en/explore-new-market/united-kingdom/accounting [Accessed 16 December 2020]

startuploans.co.uk, (2020). Setting up a small business – The complete guide Available at: https://www.startuploans.co.uk/business-advice/how-to-start-a-business/ [Accessed 16 December 2020]

Appendices

Appendix 1: Start-up Financial Requirements

|

Start-up Requirements |

(£) |

|

Start-up Expenses |

40,800 |

|

Start-up Assets |

1,09,200 |

|

Total |

1,50,000 |

|

Assets |

|

|

Non-cash Assets |

1,00,000 |

|

Cash Requirements |

9,200 |

|

Total Assets |

1,09,200 |

|

Liabilities and Capital |

|

|

Liabilities |

|

|

Long-term Liabilities |

1,00,000 |

|

Accounts Payable |

0 |

|

Total Liabilities |

1,00,000 |

|

Capital |

|

|

Owner |

50,000 |

|

Additional |

0 |

|

Total Investment |

50,000 |

|

Loss at Start-up |

-40,800 |

|

Total Capital |

9,200 |

|

Total Capital and Liabilities |

1,09,200 |

|

Total Available Fund |

1,50,000 |

Appendix 2: Projected Profit and Loss Statement

|

Year 1 |

Year 2 |

Year 3 |

Year 4 |

Year 5 |

|

|

Sales |

235000 |

252000 |

275000 |

330000.00 |

396000.00 |

|

COGS |

10250 |

11700 |

12800 |

15360.00 |

18432.00 |

|

Gross Margin |

224750 |

240300 |

262,200 |

314640.00 |

377568.00 |

|

Gross Margin % |

0.9564 |

0.9536 |

0.9535 |

1.14 |

1.37 |

|

Payroll |

144,000 |

156,000 |

174,000 |

208800.00 |

250560.00 |

|

Depreciation |

2220 |

2220 |

2220 |

2664.00 |

3196.80 |

|

Lease payments |

14400 |

14400 |

14400 |

17280.00 |

20736.00 |

|

Sales and Marketing |

7400 |

5400 |

5400 |

6480.00 |

7776.00 |

|

Utilities |

2400 |

2400 |

2400 |

2880.00 |

3456.00 |

|

Rent |

12000 |

12000 |

12000 |

14400.00 |

17280.00 |

|

Payroll Tax |

21600 |

23400 |

26100 |

31320.00 |

37584.00 |

|

Total Operating Expenses |

204,020 |

215820 |

236,520 |

283824.00 |

340588.80 |

|

PBIT |

20730 |

24480 |

25680 |

30816.00 |

36979.20 |

|

Depreciation |

2220 |

2220 |

2220 |

2664.00 |

3196.80 |

|

EBITDA |

22950 |

26700 |

27900 |

33480.00 |

40176.00 |

|

Interest (10%) |

10000 |

10000 |

10000 |

12000.00 |

14400.00 |

|

Tax (30%) |

3219 |

4344 |

4704 |

5644.80 |

6773.76 |

|

Net Profit |

7511 |

10136 |

10976 |

13171.20 |

15805.44 |

|

Net Profit % |

0.032 |

0.0402 |

0.0399 |

0.05 |

0.06 |

Appendix 3: Projected Balance Sheet

|

Year 1 |

Year 2 |

Year 3 |

Year 4 |

Year 5 |

|

|

Assets |

|||||

|

Cash |

25,618 |

38,162 |

51,700 |

62040 |

74448 |

|

Long-term Assets |

1,00,000 |

1,00,000 |

100,000 |

120000 |

144000 |

|

Accumulated Depreciation |

-2,220 |

-4,440 |

-6,660 |

-7992 |

-9590.4 |

|

Total Assets |

1,23,398 |

1,33,722 |

145,040 |

174048 |

208857.6 |

|

Liabilities and Capital |

0 |

0 |

|||

|

Accounts Payable |

6,687 |

6,875 |

7,217 |

8660.4 |

10392.48 |

|

Long-term Liabilities |

1,00,000 |

1,00,000 |

100,000 |

120000 |

144000 |

|

Total Liabilities |

1,06,687 |

1,06,875 |

107,217 |

128660.4 |

154392.5 |

|

Capital |

50,000 |

50,000 |

50,000 |

60000 |

72000 |

|

Retained Earnings |

-40,800 |

-33,289 |

-23,153 |

-27783.6 |

-33340.3 |

|

Earnings |

7,511 |

10,136 |

10,976 |

13171.2 |

15805.44 |

|

Total Capital |

16,711 |

26,847 |

37,823 |

45387.6 |

54465.12 |

|

Total Liabilities and Capital |

1,23,398 |

1,33,722 |

145,040 |

174048 |

208857.6 |

Appendix 4: Projected Cash Flow Statement

|

Year 1 |

Year 2 |

Year 3 |

Year 4 |

Year 5 |

|

|

Cash from Operational Activities |

|||||

|

Cash Sales |

2,35,000 |

2,52,000 |

275,000 |

330000 |

396000 |

|

Total |

2,35,000 |

2,52,000 |

275,000 |

330000 |

396000 |

|

Cash from Financial Activities |

0 |

0 |

|||

|

Bill Payments |

-74,582 |

-83,456 |

-87,462 |

-104954 |

-125945 |

|

Cash Spending |

-1,44,000 |

-1,56,000 |

-174,000 |

-208800 |

-250560 |

|

Total |

-2,18,582 |

-2,39,456 |

-261,462 |

-313754 |

-376505 |

|

Cash from Investing Activities |

0 |

0 |

0 |

0 |

0 |

|

Net Cash Flow |

16,418 |

12,544 |

13,538 |

16245.6 |

19494.72 |

|

Opening Balance |

9,200 |

25,618 |

38,162 |

45794.4 |

54953.28 |

|

Closing Balance |

25,618 |

38,162 |

51,700 |

62040 |

74448 |

Appendix 5: Sales Forecast (Year 1)

|

Month 1 |

Month 2 |

Month 3 |

Month 4 |

Month 5 |

Month 6 |

Month 7 |

Month 8 |

Month 9 |

Month 10 |

Month 11 |

Month 12 |

|

|

Walk-In Customers |

4,000 |

5,000 |

7,000 |

8,000 |

9,000 |

10,000 |

8,000 |

9,000 |

10,000 |

10,000 |

9,000 |

9,000 |

|

Home Service |

9,000 |

11,000 |

12,000 |

12,000 |

12,000 |

12,000 |

12,000 |

11,000 |

12,000 |

11,000 |

12,000 |

11,000 |

|

Total Sales |

13,000 |

16,000 |

19,000 |

20,000 |

21,000 |

22,000 |

20,000 |

20,000 |

22,000 |

21,000 |

21,000 |

20,000 |

|

COGS |

||||||||||||

|

Walk-In Customers |

200 |

200 |

300 |

350 |

350 |

400 |

450 |

450 |

500 |

500 |

500 |

500 |

|

Home Service |

300 |

400 |

450 |

400 |

400 |

450 |

500 |

500 |

475 |

575 |

600 |

500 |

|

Total COGS |

500 |

600 |

750 |

750 |

750 |

850 |

950 |

950 |

975 |

1,075 |

1,100 |

1,000 |

Appendix 6: Profit & Loss Forecast (Year 1)

|

Month 1 |

Month 2 |

Month 3 |

Month 4 |

Month 5 |

Month 6 |

Month 7 |

Month 8 |

Month 9 |

Month 10 |

Month 11 |

Month 12 |

|

|

Sales |

13,000 |

16,000 |

19,000 |

20,000 |

21,000 |

22,000 |

20,000 |

20,000 |

22,000 |

21,000 |

21,000 |

20,000 |

|

COGS |

500 |

600 |

750 |

750 |

750 |

850 |

950 |

950 |

975 |

1,075 |

1,100 |

1,000 |

|

Gross margin |

12,500 |

15,400 |

18,250 |

19,250 |

20,250 |

21,150 |

19,050 |

19,050 |

21,025 |

19,925 |

19,900 |

19,000 |

|

Expenses |

||||||||||||

|

Payroll |

12,000 |

12,000 |

12,000 |

12,000 |

12,000 |

12,000 |

12,000 |

12,000 |

12,000 |

12,000 |

12,000 |

12,000 |

|

Depreciation |

185 |

185 |

185 |

185 |

185 |

185 |

185 |

185 |

185 |

185 |

185 |

185 |

|

Lease payments |

1,200 |

1,200 |

1,200 |

1,200 |

1,200 |

1,200 |

1,200 |

1,200 |

1,200 |

1,200 |

1,200 |

1,200 |

|

Sales and Marketing |

800 |

800 |

900 |

1,000 |

500 |

400 |

500 |

500 |

300 |

600 |

600 |

500 |

|

Utilities |

200 |

200 |

200 |

200 |

200 |

200 |

200 |

200 |

200 |

200 |

200 |

200 |

|

Rent |

1,000 |

1,000 |

1,000 |

1,000 |

1,000 |

1,000 |

1,000 |

1,000 |

1,000 |

1,000 |

1,000 |

1,000 |

|

Payroll Tax |

1,800 |

1,800 |

1,800 |

1,800 |

1,800 |

1,800 |

1,800 |

1,800 |

1,800 |

1,800 |

1,800 |

1,800 |

|

Total expenses |

17,185 |

17,185 |

17,285 |

17,385 |

16,885 |

16,785 |

16,885 |

16,885 |

16,685 |

16,985 |

16,985 |

16,885 |

|

PBIT |

-4,685 |

-1,785 |

965 |

1,865 |

3,365 |

4,365 |

2,165 |

2,165 |

4,340 |

2,940 |

2,915 |

2,115 |

|

Interest (10%) |

833 |

833 |

833 |

833 |

833 |

833 |

833 |

833 |

833 |

833 |

833 |

833 |

|

Tax (30%) |

-1,655 |

-786 |

39 |

309 |

759 |

1,060 |

399 |

399 |

1,052 |

632 |

624 |

384 |

|

Net profit |

-3,863 |

-1,832 |

93 |

723 |

1,773 |

2,472 |

933 |

933 |

2,455 |

1,475 |

1,458 |

898 |

Appendix 7: Balance Sheet Forecast (Year 1)

|

Month 1 |

Month 2 |

Month 3 |

Month 4 |

Month 5 |

Month 6 |

Month 7 |

Month 8 |

Month 9 |

Month 10 |

Month 11 |

Month 12 |

|

|

Assets |

||||||||||||

|

Cash |

10,044 |

9,334 |

10,650 |

11,915 |

13,824 |

16,771 |

17,444 |

18,561 |

21,662 |

23,302 |

24,961 |

25,618 |

|

Long-term Assets |

1,00,000 |

1,00,000 |

1,00,000 |

1,00,000 |

1,00,000 |

1,00,000 |

1,00,000 |

1,00,000 |

1,00,000 |

1,00,000 |

1,00,000 |

1,00,000 |

|

Accumulated Depreciation |

185 |

370 |

555 |

740 |

925 |

1,110 |

1,295 |

1,480 |

1,665 |

1,850 |

2,035 |

2,220 |

|

Total Assets |

1,09,859 |

1,08,964 |

1,10,095 |

1,11,175 |

1,12,899 |

1,15,661 |

1,16,149 |

1,17,081 |

1,19,997 |

1,21,452 |

1,22,926 |

1,23,398 |

|

Liabilities and Capital |

||||||||||||

|

Accounts Payable |

4,522 |

5,460 |

6,499 |

6,856 |

6,808 |

7,098 |

6,653 |

6,653 |

7,115 |

7,096 |

7,113 |

6,687 |

|

Long-term Liabilities |

1,00,000 |

1,00,000 |

1,00,000 |

1,00,000 |

1,00,000 |

1,00,000 |

1,00,000 |

1,00,000 |

1,00,000 |

1,00,000 |

1,00,000 |

1,00,000 |

|

Total Liabilities |

1,04,522 |

1,05,460 |

1,06,499 |

1,06,856 |

1,06,808 |

1,07,098 |

1,06,653 |

1,06,653 |

1,07,115 |

1,07,096 |

1,07,113 |

1,06,687 |

|

Capital |

50,000 |

50,000 |

50,000 |

50,000 |

50,000 |

50,000 |

50,000 |

50,000 |

50,000 |

50,000 |

50,000 |

50,000 |

|

Retained Earnings |

-40,800 |

-40,800 |

-40,800 |

-40,800 |

-40,800 |

-40,800 |

-40,800 |

-40,800 |

-40,800 |

-40,800 |

-40,800 |

-40,800 |

|

Earnings |

-3,863 |

-5,696 |

-5,603 |

-4,881 |

-3,109 |

-637 |

295 |

1,227 |

3,682 |

5,157 |

6,614 |

7,511 |

|

Total Capital |

5,337 |

3,504 |

3,597 |

4,319 |

6,091 |

8,563 |

9,495 |

10,427 |

12,882 |

14,357 |

15,814 |

16,711 |

|

Total Liabilities and Capital |

1,09,859 |

1,08,964 |

1,10,096 |

1,11,175 |

1,12,899 |

1,15,661 |

1,16,148 |

1,17,080 |

1,19,997 |

1,21,453 |

1,22,927 |

1,23,398 |

Appendix 8: Cash Flow Forecast (Year 1)

|

Month 1 |

Month 2 |

Month 3 |

Month 4 |

Month 5 |

Month 6 |

Month 7 |

Month 8 |

Month 9 |

Month 10 |

Month 11 |

Month 12 |

|

|

Cash from Operational Activities |

||||||||||||

|

Cash Sales |

13,000 |

16,000 |

19,000 |

20,000 |

21,000 |

22,000 |

20,000 |

20,000 |

22,000 |

21,000 |

21,000 |

20,000 |

|

Total |

13,000 |

16,000 |

19,000 |

20,000 |

21,000 |

22,000 |

20,000 |

20,000 |

22,000 |

21,000 |

21,000 |

20,000 |

|

Cash from Financial Activities |

||||||||||||

|

Bill Payments |

156 |

4,710 |

5,684 |

6,735 |

7,091 |

7,053 |

7,327 |

6,883 |

6,899 |

7,360 |

7,341 |

7,343 |

|

Cash Spending |

12,000 |

12,000 |

12,000 |

12,000 |

12,000 |

12,000 |

12,000 |

12,000 |

12,000 |

12,000 |

12,000 |

12,000 |

|

Total |

12,156 |

16,710 |

17,684 |

18,735 |

19,091 |

19,053 |

19,327 |

18,883 |

18,899 |

19,360 |

19,341 |

19,343 |

|

Cash from Investing Activities |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

|

Net Cash Flow |

844 |

-710 |

1,316 |

1,265 |

1,909 |

2,947 |

673 |

1,117 |

3,101 |

1,640 |

1,659 |

657 |

|

Opnening Balance |

9,200 |

10,044 |

9,334 |

10,650 |

11,915 |

13,824 |

16,771 |

17,444 |

18,561 |

21,662 |

23,302 |

24,961 |

|

Closing Blanace |

10,044 |

9,334 |

10,650 |

11,915 |

13,824 |

16,771 |

17,444 |

18,561 |

21,662 |

23,302 |

24,961 |

25,618 |

Appendix 9: Personnel Plan Forecast (Year 1)

|

Month 1 |

Month 2 |

Month 3 |

Month 4 |

Month 5 |

Month 6 |

Month 7 |

Month 8 |

Month 9 |

Month 10 |

Month 11 |

Month 12 |

|

|

Technician 1 |

3,000 |

3,000 |

3,000 |

3,000 |

3,000 |

3,000 |

3,000 |

3,000 |

3,000 |

3,000 |

3,000 |

3,000 |

|

Technician 2 |

3,000 |

3,000 |

3,000 |

3,000 |

3,000 |

3,000 |

3,000 |

3,000 |

3,000 |

3,000 |

3,000 |

3,000 |

|

Customer Service Executive |

2,000 |

2,000 |

2,000 |

2,000 |

2,000 |

2,000 |

2,000 |

2,000 |

2,000 |

2,000 |

2,000 |

2,000 |

|

Accountant |

4,000 |

4,000 |

4,000 |

4,000 |

4,000 |

4,000 |

4,000 |

4,000 |

4,000 |

4,000 |

4,000 |

4,000 |

|

Total |

12,000 |

12,000 |

12,000 |

12,000 |

12,000 |

12,000 |

12,000 |

12,000 |

12,000 |

12,000 |

12,000 |

12,000 |

Appendix 10: Break-Even Analysis

Appendix 11: Sensitivity Analysis

|

Pessimistic/ Worst |

Year 1/Good |

Optimistic/ Best |

|

|

90% |

100% |

110% |

|

|

Sales |

211500 |

235,000 |

258500 |

|

COGS |

9225 |

10,250 |

11275 |

|

Gross Margin |

202275 |

224,750 |

247225 |

|

Gross Margin % |

86.07% |

95.64% |

105.20% |

|

Payroll |

129600 |

144,000 |

158400 |

|

Depreciation |

1998 |

2,220 |

2442 |

|

Lease payments |

12960 |

14,400 |

15840 |

|

Sales and Marketing |

6660 |

7,400 |

8140 |

|

Utilities |

2160 |

2,400 |

2640 |

|

Rent |

10800 |

12,000 |

13200 |

|

Payroll Tax |

19440 |

21,600 |

23760 |

|

Total Operating Expenses |

183618 |

204,020 |

224422 |

|

PBIT |

18657 |

20,730 |

22803 |

|

Depreciation |

1998 |

2,220 |

2442 |

|

EBITDA |

20655 |

22,950 |

25245 |

|

Interest (10%) |

9000 |

10,000 |

11000 |

|

Tax (30%) |

2897.1 |

3,219 |

3540.9 |

|

Net Profit |

6759.9 |

7,511 |

8262.1 |

|

Net Profit % |

2.88% |

3.20% |

3.52% |

Appendix 12: Organisational Chart- Current, Year 2, Year 5

Appendix 13: Glossary of terms

Start-up Capital: It is the initial invested capital to the business for a new company.

Repairing Services: An entity which serves to provide repairing, maintenance and after-sale services.

Appendix 14: Market entry report by external consultants

Appendix 15: Marketing Plan

Marketing in the electronic repairing and maintenance industry is realised as the curb side appeal for the new customers. A high-quality service will result in bringing back customers back time and time again to the business. The company shall invest into local radio station and word of mouth advertising of satisfied customers that will help in growing customer base. The budget for marketing and selling is competitive.

Appendix 16: Order and Enquiry status- New Product

The new product order and enquiry status for Abbley shall only begin with the expansion plan of the business after three years. The company is planned to introduce new designed and better function spare parts that are complex with small electronic equipment which will be displayed at the store for sale at reasonable pricing. The new product will include rental services of TV/DVD and selling of TV/DVD and stereos.

Appendix 17: Current shareholders

- Technicians for electronic maintenance and repairs- 2 employees

- Client service executive

- Accountant

- Owners

Appendix 18: CV of senior management

John Williams

E: williams.john85@gmail.com¦ (123) 456-7890¦ A: London, UK, 533425

PROFESSIONAL SUMMARY

Abbley focused on assisting cross-functional teams that can increase customer satisfaction through process improvement. Respectful and respected professional manager having previous experience in top management with exceptional knowledge of developing strategic plans for service excellence.

SKILLS

- Operations management

- Strategic planning

- Business planning

- Process improvement

- Business Development

- Staff Management

- Customer relationship building

Appendix 19: Assumptions

The financial plan depends upon on important assumptions which are majorly shown in the form of following table as yearly assumptions. From the commencement of the business, the company has recognised that variable cost is critical. Cost of employees (payroll), payroll and rent are the company’s largest expenses. The following are the important underlying assumptions

- We assume that the long-term financing of the business includes none months of interim interest for repayment.

- We assume that the economy shall be sound without any major recession despite the modest pricing strategy.

- We assume that there shall be no unforeseen changes in the local government regulations that shall interrupt the services.

General Assumptions

|

Plan Months |

1 |

2 |

3 |

|

Current Interest Rate |

7.50% |

7.50% |

7.50% |

|

Long-Term Interest ate |

8% |

8% |

8% |

|

Tax Rate |

20.83% |

20% |

20.83% |

|

Others |

0 |

0 |

0 |