Discussion On Commonwealth Bank Of Australia Organisational Structure

Question

Task:

Introduction (100 words)

Introduce the topic, state the purpose of the essay and the key points (scope) to be covered.

Case company synopsis (100 words)

Briefly provide some background information which you deem essential and highly relevant to your analysis.

Body paragraphs (1300 words)

You decide how to allocate words per question listed below, I would suggest that questions (a) and (b) are descriptive in nature, answers are expected to be concise and straightforward. Remember to incorporate definitions of key concepts in your answer. (See criteria 2 in Marking Rubric). Questions (a) to (d) require critical thinking and analysis based on your research, hence allocate more words accordingly. In-text citation is very important in this part of the essay, as it corresponds to evaluation criteria 2 and 3 (which combined account 20% of your score for this assignment) and criteria 6.

- How are the business and governance structures of your chosen companies different/similar, and why might this be the case?

- What are the environmental factors that influence your chosen companies’ performance and/or decision-making?

- What are the top three risks your chosen companies face and how might this influence their decision making?

- Make 3 suggestions regarding how the companies might improve their business practices.

Conclusion (100 words)

Once again, be concise. Provide a summary of your key points in the essay (avoid using same sentences). Avoid introducing new topics (e.g., recently, the company is involved in a scandal etc.), but do highlight implications on the management of the company in the future on the basis of your analysis.

Answer

Introduction

In this research a comprehensive study on the Commonwealth bank of Australia organisational structure which is a multinational banking system with circulation of their business through the United States, UK, Asia, and New Zealand, is discussed. The key purpose of this is to do case study on the Commonwealth Bank of Australia so one can understand its contribution into the banking world by providing numerous services related to financing constituting the institutional and business banking, retail, superannuation, fund management, investment, and insurance policies. In this discussion Commonwealth bank of Australia organisational structure along with the external and internal environmental factors will be analyzed with precision. The key risks the chosen companies along with its influence their decision making also discussed and viable suggestions for improvement of the business are also given.

Case Synopsis

The Commonwealth Bank of Australia was created by the “Commonwealth Bank Act” which was established in the year 1911. It was established by the “Andrew Fisher Labor Government” which stood high doing great favor to the nationalism of banks. The bank was first in the continent of Australia to get a guarantee from the federal government. The earliest founder of the bank was the Australian-American politician of labors, “King O’Malley”. The bank got Sir “Denison Miller” as its first governor. The first branch was established in the state of Melbourne in the year 1912. By collaborating with the Australian posting services, the bank also traded across the agencies of post office. By the year 1913, it had its branches established in all the states (Commonwealth Bank Australia, 2020).

a) Governance structures of the chosen company

The Commonwealth bank of Australia organisational structure contains a business and governance structure which helps their business operation (Babkin & Chistyakova, 2017). The Commonwealth bank of Australia organisational structure varies from company to company in accordance of their goals and motifs. The main structures of the business organizations are Sole Trader, Joint Venture, Trust, Partnership, Company, Corporate Association. Among all these mentioned structures, the chosen bank works on Corporate Association (Owen & Taylor, 2019). In this Commonwealth bank of Australia organisational structure there is one corporate body that is the trader al well runs, controls and manages the business. The legal and tax requirements in this Commonwealth bank of Australia organisational structure are very complex. The profit and the income is the companies income and can trade on companies’ “Tax File Number”. The company is responsible for any liabilities of the company, such as paying the tax (Bergeron, Raymond, & Rivard, 2004).

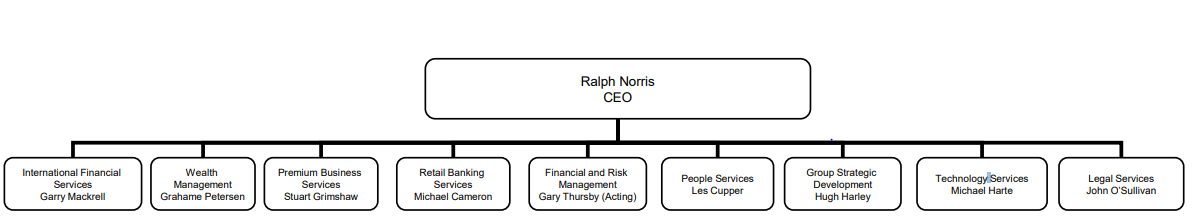

b) Commonwealth bank of Australia organisational structure

Commonwealth bank of Australia extended in various international locations such as New Zeeland, United Kingdom, Asia. There are 52,000 employees across multiple locations whereas 80000 shareholders across global market. There are functional departments operating in global perspective such as retail banking service, financial services, insurance and banking and business services (Commonwealth Bank Australia, 2020).

Functional department of Commonwealth Bank Australia

Source: (Commonwealth Bank Australia, 2020)

c) Environmental factors and its influence on the chosen companies’ performance and decision-making

i. PESTLE analysis

The Australian Commonwealth Bank conduct PESTLE analysis when the forces drive changes in the organizational environment. The environment refers to Political, Economic, Socio Cultural, Technological, Legal and Ecological environment (Perera, 2017). It mainly determines the three major driving forces that are causing changes in the industry and the market. The PESTLE analysis involves finding the evidence for the force. Then comes up with a metric that measures the impact level of the chosen organization Commonwealth bank of Australia organisational structure (Sheedy & Griffin, 2018). Once the analysis is done the PESTLE is up for review for factual errors, biasness, false assumption and etcetera.

PESTLE Analysis of Commonwealth bank of Australia organisational structure

|

Political |

Economical |

|

Shares warm relationship with China and other Asian countries |

· “Ageing population and evolving economy” · Saddened macroeconomic “outlook with looming risks” |

|

Social |

Technological |

|

Holds diverse and cosmopolitan culture. |

· Aims to help CBA to build a strong technological infrastructure. Hence, invested in next generation financial technology · Considers cyber security to be the primary lookout for “financial institutions” |

|

Legal |

Environmental |

|

· Money laundering allegations against the bank |

· Regulates land and water to create banks · Legal actions to be taken if fails to reveal climate changes risk |

ii. The McKinsey 7-S Framework – Soft S’s

In the McKinsey 7 S framework the ‘Soft’ S’s are Style, Shared values, Skills and Staff (Paquibut, 2017). These factors generally appear in the lower part of the framework. They are the realm of the human capacities and resources for learning and development. The Commonwealth bank of Australia organisational structure holds all the Soft S’s efficiently and has a great outreach throughout the world.

iii. Five Forces Industry Model

The Five Forces industry model consists of two purposes. It makes an assessment on the correlative allurement of an industry for a new aspirant. And let the occupant firm to check out the current industry environment forces for competition. The model states that the firms need to know the various factors of environmental shifts within the industry (Taha, 2018). The five forces industry model involves the application of system thinking, “competitive rivalry”, and simplified microeconomic theory. It also helps in the prediction of “long run rate of returns” in a specific industry. The Australian commonwealth bank can handle all the five forces. It involves innovative products and services (Bergeron, Raymond, & Rivard, 2004). It builds up economies of scale so that it lowers the fixed cost per unit. It tackle the bargaining power of suppliers by making efficient supply chain with more than one suppliers. It involves the development of suppliers whose businesses are dependent on Australian commonwealth bank.

iv. SWOT analysis

|

Strengths |

Weaknesses |

|

· It is the leading bank in Australia · Credit Portfolio is of higher quality · Strong technology · “Robust economic position and capital ratio” · Keeps improving the organizational environment |

· Depends on offshore debts · Involved in money laundering allegations · Geographical diversity is not as much · Operating costs are high |

|

Opportunities |

Threats |

|

· Could enlarge its size by entering the Asian and other banking market · “Indigenous customer assistance line” |

· Government guarantees can be misused · Business environment is week in China |

v. The TOWS Matrix

The TOWS Matrix of a company helps identifying the strategic alternatives of strengths and opportunities, strength and threats, weaknesses and opportunities and weaknesses and strengths (Jibai, Alaaraj, & Issa, 2018). The Commonwealth bank of Australia organisational structure keeps growing its strength so that the threats cannot be bigger. It improves the organizational environment as well as it works on its credit portfolio. It focuses on expanding the size of the company throughout the world. By doing so, the weaknesses are rectified and replaced with positive feedback from the customers (Buell & John, 2018). It is the leading bank in Australia and follows all the strategies that keeps it going and reaching out all the targeted missions.

d) Top three risks the chosen companies and its influence on decision making

i. Risk assessment matrix

Risk indicates the uncertain future outcomes. It is the expression of challenging the objectives of Australian Commonwealth Bank. The assessment method of risk is called the risk assessment matrix. If Commonwealth bank of Australia organisational structure apply this tool in their objectives, they can easily assess the coming risks in terms of its probability conflicting the degree of impact. The risk assessment matrix allows analysing the particular event emerging against its predicted severity on the company (Katz & Robinson, 1991). The risk assessment matrix provides the Australian Commonwealth Bank with instructions to improve their strategies. It helps in hedging, “contingency planning”, “security plans”, “crisis planning” and etcetera (Saitta, Chowdhury, Ferro, Nalis, & Polosa, 2017). It helps to guess the critical probabilities that may hamper the Australian Commonwealth Bank’s objectives.

If the Australian Commonwealth Bank is not aware of their rivals and the new entrants of the sector, there are high chances that the company will fail to succeed any further. Hence, it is very important for Australian Commonwealth Bank to be updated about the competitors in the market. The Australian Commonwealth Bank must keep up with the continuous change of economy. The chosen company will be remained with risk factors if there is no contingency planning in financial controls and operations. Along with the economy, the continuous changes of government legislative can affect the Australian Commonwealth Bank massively. Government legislative refers to taxation, business reporting standards, product controls and the trade restrictions.

The risk factors for Commonwealth bank of Australia organisational structure include political risks as well. The different policies by the foreign government can have a huge impact on the Australian Commonwealth Bank. Then comes the global risk. To assess the global risks the Australian Commonwealth Bank need to investigate the basis of the country’s legal systems and assess if the laws are properly understood and enforced in to organizational policies (Gul & Guneri, 2016). The Commonwealth bank of Australia contains lesser risks in worker’s compensation claims. The higher risk factors of the company are the commodity risk and exchange rate risks. The medium risk factors of the company involve machine breakdown, skilled employee turnover and the environmental risk such as, fire or flood.

|

Ranking |

Threats (1) |

Vulnerabilities (2) |

Contextual factors |

|

12 - High |

9 - Medium |

new entrants and reduction in market share |

Commonwealth bank need to take care of new entrants and products in Australian market |

|

12 - High |

medium |

statutory and regulatory constraints |

changing statutory and regulatory constraints may reduce productivity |

|

10 - Medium |

medium |

changing political scenario can hinder business |

changing political scenario will impact regulatory and banking policy which directly impacts business |

|

8 - Medium |

medium |

competition and rivalry |

higher degree of competition will impact product value and customer preferences |

|

Risks |

Likelihood from 1 to 5 |

Impact |

Reduction of Threats |

|

New entrant |

4 |

3 |

innovation and customer friendly startegy |

|

change in regulatory and statutory policy |

3 |

4 |

flexible banking and regular updation with regulatory bodies |

|

changing political scneario |

4 |

2 |

standard and flexible policy |

|

competition |

3 |

2 |

innovation and customer friendly approach |

e) Can you provide three suggestions for improvement of the business practices for Commonwealth bank of Australia organisational structure?

High Work performance can bring more profit and wealth to the commonwealth bank of Australia. This practice will help bringing the enhanced performance. The recruitment of such employees who conceive, design and have the capacity to articulate that into mission will help the bank.

If the marketing department efficiently researches and understand the requirements of the customer base, that will help the company come up with more innovative ideas. It will also help in meeting the required standard of the market. The development of the marketing strategies needs to be taken care of to increase the brand and the products and services.

The Commonwealth bank of Australia organisational structure can focus on developing its information system. This development will help getting all the external and internal information regarding strategies and market position which may lead to a greater success of the company.

Conclusion

Keeping all the factors related to the Commonwealth bank of Australia organisational structure in mind, it may be concluded that in order to run a business in banking operation, an organization must be provided with clarity regarding all of its strengths, weaknesses, opportunities and threats in functioning of a business properly. An organization must appoint stakeholders through whom they will be capable of managing the functioning of the different parts of such a large corporation. The role of the management in maintain Commonwealth bank of Australia organisational structure must be primarily taking approaches to deal with their observations in the employment satisfaction and behaviour management. They must initiate leadership styles in order to rule the functioning body by incorporating several policies featuring an overall developmental growth in business and economy.

Bibliography

Babkin, A., & Chistyakova, O. (2017). Digital economy and its impact on the competitiveness of business structures. Russian entrepreneurship, 18(24), 4087-4102. doi:10.18334/rp.18.24.38670

Bergeron, F., Raymond, L., & Rivard, S. (2004). Ideal patterns of strategic alignment and business performance. Commonwealth bank of Australia organisational structure Information & management, 41(8), 1003-1020. doi:1O.1016/j.im.2003.10.004

Buell, R., & John, L. (2018). Commonwealth Bank of Australia: Unbanklike Experimentation. Harvard Business School , Case 619-018.

Commonwealth Bank Australia. (2020, 4 3). About Commonwealth Bank. Retrieved from Commonwealth Bank Australia: https://www.commbank.com.au/about-us.html?ei=CB-footer_about-commbank

Commonwealth Bank Australia. (2020, 4 4). Organizational Chart of Commonwealth Bank Australia. doi:https://bit.ly/2V68RCT

Gul, M., & Guneri, A. (2016). A fuzzy multi criteria risk assessment based on decision matrix technique: a case study for aluminum industry. Journal of Loss Prevention in the Process Industries, 40, 89-100. doi:https://doi.org/10.1016/j.jlp.2015.11.023

Jibai, B., Alaaraj, H., & Issa, A. (2018). Developing SWOT/TOWS Strategic Matrix for E-Banking in Lebanon. International Business and Accounting Research Journal, 2(1), 13-22. doi: http://dx.doi.org/10.15294/ibarj.v2i1.27

Katz, L., & Robinson, C. (1991). Foster care drift: A risk-assessment matrix. Child Welfare: Journal of Policy, Practice, and Program. doi:https://psycnet.apa.org/record/1991-28497-001

Owen, N., & Taylor, W. (2019). Succession planning for family-owned wineries: Business structures. Australian and New Zealand Grapegrower and Winemaker(669), 78.

Paquibut, R. (2017). Building Research Ethos from the Ground up Using McKinsey 7-S Framework: The Case of the Modern College of Business and Science. Asian Journal of Education and Training, 3(2), 92-96. doi:10.20448/journal.522.2017.32.92.96

Perera, R. (2017). The PESTLE analysis. Commonwealth bank of Australia organisational structure Nerdynaut.

Saitta, D., Chowdhury, A., Ferro, G., Nalis, F., & Polosa, R. (2017). A risk assessment matrix for public health principles: The case for e-cigarettes. International journal of environmental research and public health, 14(4), 363. doi:10.3390/ijerph14040363

Sheedy, E., & Griffin, B. (2018). Risk governance, structures, culture, and behavior: A view from the inside. Corporate Governance: An International Review, 26(1), 4-22. doi:https://doi.org/10.1111/corg.12200

Taha, T. (2018). Competitive Analysis of the Global Oil and Gas Industry using Porters Five Forces Model. doi:https://bit.ly/3bTRuMd