Corporate Governance Assignment Analysing the Issues Encounter by Tata Group

Question

Task: Corporate Governance Assignment Task: Students will need to research and select an organization that has been or is currently being investigated for governance issues. Using academic literature, court documents, news media and industry publications, identify the type of governance issues that have occurred, eg, the type of fraud that has occurred. You may find more than one type so you will need to identify each. Using at least two theories or perspectives from this subject analyse the likely causes of the issues (including inadequate governance and accountability issues). Conclude the report by making recommendations to prevent future incidences.

Answer

1.0. Introduction

1.1. Background of a Company Selected in the Corporate Governance Assignment

Corporate governance is the process and regulations under which a firm operates following the pillars of independence, fairness, accountability, transparency and responsibility. Tata Group having a high net promoter scores in the commercial vehicle and the passenger vehicle business is one of the attractive automobile brands recognized in 2018. The company is highly committed to safety and quality in the customer service standard being the leading global manufacturer of automobiles. Tata Group abides by environmental regulations and compliance in order to reduce the CO2 emissions through an integrated sustainable business model. Transparency along with fair compliance is the main values of the organization with incorporation of fiduciary responsibilities. Tata’s Code of Conduct is based on honesty and integrity for ethical behaviour of the stakeholders.

1.2. Purpose of Report

The report aims to discuss the corporate governance issues arising from the risks and the various factors leading to it. It also focuses the study on the theoretical perspective of the issues with final recommendations on addressing them. This report also seeks to address the issues of corporate governance with links to the business ethical frameworks.

2.0. Type of governance issues in organization

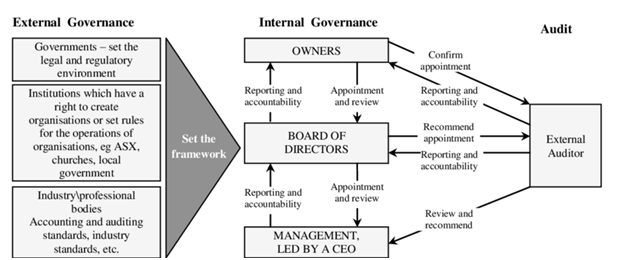

Figure 1: Governance issues

(Source: Backhouse & Wickham,2020)

The external governance and the internal governance being the decision-making authorities are required to be audited monthly for effective reporting of scams and fraudulent activities. Ethical corporate governance is resting on the functions of the internal governance like owners, board of directors and the management. Tata Group’s majority of the decisions are taken by the Board of directors. However, the reporting and accountability of the auditors from the internal governance is very less leading to popular scams like 2G scam, AirAsia scam and the removal of Cyrus Mistry from chairman board. Board Membership Issue (Tata v/s Cyrus Mistry)- Cyrus Mistry has been the chairman in Tata Group from 2012 but due to board membership issue, he has been dismissed from the board based on complaints of business operations undertaken on immoral grounds (Paul and Upadhyay, 2018).

With a172-page order, NCLAT with the pleas of Cyrus Mistryhas considered this to be a violation of decision-making by the board of management of Tata Group with removal of the chairman under no prior notice (Jain, 2018). The board of 50 independent directors of Tata Group has taken an un-ethical decision to use dominance through majority of the decisions being against Cyrus Mistry to leave Tata Group with circumstantial evidence under no grounds of natural justice (Mohile, 2017). The accusation imposed on Cyrus Mistry has made the largest shareholder of Tata Sons get a removed from the Tata Group due to unethical practices on the company operations as per the lawsuit. But the share proportion as shared by Cyrus Mistry on Tata Sons with removal of the chairman has been considered as a huge violation of corporate governance under the fiduciary duty of Corporation’s Act. The quasi-partnerships run by Tata Group with various shareholders holding decision-making right in the organizations have been found to be holding less power in the company ownership rights. The chairman rights with the board of directors in the top hierarchy level of management are highly biased with respect to the inadequate shareholding rights and the directorship. The high-level of interference form external parties into the corporate governance structure of Tata Group with the majority of shareholders lead to much bias under immoral grounds. Profit-sharing objective of the directors and shareholders has made the decision-taking rights have been violated under corporate structure norms.

Company illegal benefits (2G scam) - The Central Bureau of Investigation has held Ratan Tata to be a victim in the whole 2G spectrum scam reported against Tata Group with Swan Telecom(Tripathi, 2018). Public media favours the indulgence into bribery with the big decision-making bodies in the government, has made the MNC gain much better advantages on the protection of brand reputation. Involvement of Tata group with the small companies through chit funds has become a much-reported issue of unethical behaviour of the company shareholders. It was acknowledged that CBI shielded Tata Group on the note of exchange of business favours leading to corruption(Maheshwari, 2019). The non-sustainable business relationships with the stakeholders like Government, public media and the shareholders bring corruption in the internal operations. Spice Company, a brand extension of Tata Group has suffered much media backlash from the scam. Such kind of poor governance issues by Tata Group with getting added benefits from the media and government makes the small companies attached with it and the other brand lines suffer low market demand in the business. The award of telecom licenses to Tata Group with 176,000 crore in 2001 made the company aim high favours from government officials with no proper investigation(Bhatia, 2019). Leakage of tapes with the framing of ‘smokescreen’ has kept the whole scenario in hidden cover in order to protect the brand reputation from the customers. Such kind of stakeholder conflict leads to constrained relations causing damage to the business operations and loss in the long-run.

Mismanagement of internal operations (Air Asia scam) - Tata Sons Ltd has been held guilty in the Air-Asia scam with Vistara partnership of 22 crore rupees under the chairman, Cyrus Mistry. Directors of AirAsia India along with the Tata Sons group shareholders have been found to be engaged in fraudulent transactions with the clients. Petitions files have been found to be having huge mismanagement among the shareholders in the internal decision-making board with unanimous approvals over any decisions. It has been reported that the CEO of AirAsia India has been involved in the whole fraudulent act (Kotoky and Saxena, 2020). The forensic investigation performed by Deloitte has highlighted AirAsia and Tata Group being partners in the bidding agreement with 51% share of Tata Group in the joint venture for the strategic decision of divestment of AirAsia (ANI, 2018). The transaction made with $32.66 million to Tata Sons by Air Asia India has been performed under the illegal grant of transport service license to Air Asia. Such kind of business mismanagement of funds causing high loss for the company shareholders and the venture capitalist is a big ethical violation to the code of conduct under internal reporting. The market diversification strategy of Air Asia in India has made Tata Group to take illegal decisions with the profit-making objective of increasing market shares without any proper inspection and transparency of business records with the other stakeholders under legal provision(Vakhariya, 2017).

Profit-oriented branding over ethics (Singur controversy of Tata Nano)- The branding of Tata Nano as the cheapest car to the suppliers and the other stakeholders has made the overall notion of the product to be fake. Ratan Tata has declared that the Tata Nano is an affordable car in contrast to the cheapest car in India. Such faulty statements bring a violation to the transparency of the message to be communicated to the media public and the consumers buying it. The idea of selling the automobile to the Indian market with the 1 crore rupees model of Tata Nano has been found to be zero production when Tata Nano retires. With a high amount of debt in the market, and having a high profit regime for gaining market leadership, the decisions taken by ex-chairman, Ratan Tata along with the board of Directors and the CEO have resulted in the business loss with many illegal operations. The market capture in Singur of plant production of Tata Nano has led to much big community conflicts in the region. Although employment has been promised to the community dwellers in Singur, West Bengal yet the honesty and transparency values have been violated with much coercion to the stakeholders (Business Today, 2015). Therefore, it has been found that the Tata Group has taken biased decisions on the basis of profit to gain dominance and power in the automobile industry through illegal ways of community disadvantage in Singur and the faulty message communication of product brands to consumers.

3.0. Theoretical perspective of the cause of issues

Stakeholder Theory

Under stakeholder theory, the company undertakes a big network of relationships with the external and internal stakeholders(Jensen, 2017). Through this theory, the company assumes a dominant position to control the stakeholders through a profit-oriented objective.

Accountability issue - The teleological approach to ethics is highly considered in Tata Group that gives a biased perception of the results perceived as the violation to ethics of conduct. Much of the results produced from the injustice met by the directors and the CEO has led to the loss of employment by the operating labour class and the other partners in the agreement. Such a kind of profit-oriented business philosophy in order to gain market leadership has made Tata Group indulge into various business partnership agreements without the need for inspection on the strategic portfolio of the companies(Jacob, 2019). The lack of accountability of the auditors, shareholders, managers and the organizational leaders with such immoral values in the company lead to the violation of the ethical code of conduct in the sustainable business operations(Naciti, 2019). It produced huge losses for the external stakeholders like communities and the public affected by it.

Transaction cost theory

Under this theory, the company is found to associate itself through multiple acquisitions and contracts in order to enhance its market position(Ketokivi and Mahoney, 2017). The transactions made with the other stakeholders and the clients at a higher cost bring much high benefits to the market shares.

Inadequate governance- The inadequate governance resulting from the inconsistent application of moral values among the higher decision-making authority bodies lead to the poor corporate governance(Aguilera et al. 2019). Most importantly, Tata Group indulges in the stakeholder theory approach to ethics. In line with the Business Ethics Excellence model, it has been found that the cause of the corporate ill-governance is due to the lack of internal audit monitoring.

Transparency issue- Much of the business analytics is due to the less reporting of the business performance as conducted in the business supply chain of Tata Group as whole. The closed channel of communication in the hierarchy ladder of Tata Group in relation to the divisional structure of the organization creates the huge barrier of decisions being made among the management levels(Mehta and Chandani, 2020). The social activities as involved in the whole business operations with the environmental actions are less transparent to the pirates making the big issue of improper message flow.

4.0. Conclusion and recommendations

4.1. Conclusion

Tata Group indulged in various fraudulent activities under the stakeholder theory approach of dominating the market shares in the automobile industry. It has been found that the accountability, transparency and the issue of inadequate governance resulted in the poor corporate governance in Tata Group. Therefore, Tata Group has made violations to ethical code of conduct in business operations through the popular scams like 2G scam, Air Asia partnerships and the illegal termination of chairman from board.

4.2. Recommendation

Quarterly audit- The annual financial statements along with the internal control systems of Tata Group are required to be reviewed quarterly. There should be strict monitoring in the use of funds by the shareholders in the company operations.

Remunerations- The audit committee should be given remuneration for the ethical reporting in the organisation. The statutory compliance is required to be abided by in terms of the dividend payments. Strict monitoring and inspection should be made with the Registrar and Transfer body of Agents involved in the supply chain.

CSR and risk management policy initiatives- The formulation of CSR policies in Tata Group should be assessed on the basis of the capital risk liquidity and the use of CSR funds in the short-term projects. The risk management process of Tata Group should be reviewed monthly by the external and internal auditors to reduce the bottlenecks of fraud and data theft in the company.

Development of sustainable stakeholder relationships- The policies and strategies in the Tata Group should be re-designed with respect to developing ethical governance among the stakeholders. In order to avoid the fraudulent scams in the internal audit reports with the creation of a safe and healthy environment, sustainable stakeholder relationships should be encouraged.?

Reference List

Aguilera, R.V., Marano, V. and Haxhi, I., 2019. International corporate governance: A review and opportunities for future research. Journal of International Business Studies, pp.1-42.

Backhouse, Kim & Wickham, Mark. 2020. Corporate governance, boards of directors and corporate social responsibility: The Australian context. Corporate Ownership and Control. 17. 60-71. 10.22495/cocv17i4art5.

Bhatia, J., 2019. Crime in the Air: Spectrum Markets and the Telecommunications Sector in India. The Wild East, pp.140-67.

Jacob, W., 2019. Corporate Governance at Tata. Indira Institute of Management, p.138.

Jain, D., 2018. Who’s at Fault? Tata Sons in 2012 or Mistry in 2016: A Case Study on Tata Group. IIUM Journal of Case Studies in Management, 9(1), pp.1-6. Jensen, M.C., 2017. Value maximisation, stakeholder theory and the corporate objective function. In Unfolding Stakeholder Thinking (pp. 65-84). Routledge.

Ketokivi, M. and Mahoney, J.T., 2017. Transaction cost economics as a theory of the firm, management, and governance. In Oxford Research Encyclopedia of Business and Management.

Maheshwari, S., 2019. Self-Censorship of the Nira Radia Tapes: A Critical Juncture in the Indian Journalistic Field. International Journal of Communication, 13, p.20.

Mehta, M. and Chandani, A., 2020. Corporate Governance and Tata Steel Governance. Corporate Governance, 7(2).

Naciti, V., 2019. Corporate governance and board of directors: The effect of a board composition on firm sustainability performance. Journal of Cleaner Production, 237, p.117727.

Paul, M. and Upadhyay, P., 2018. Tata Sons Vs Cyrus Mistry: A Corporate Governance Tale. Globsyn Management Journal, 12. Tripathi, S., 2018. 2G SPECTRUM SCAM. GLOBAL FINANCIAL FRAUDS AND CRISES, 1(1), pp.207-244. Vakhariya, S., 2017. Tata at a Crossroads. American Journal of Educational Research, 5(3), pp.284-295.

Media Articles

ANI, 2018. AirAsia scam: Cyrus Mistry tears into Tata for dragging his name. Business Standard India. [online] 1 Jun. Available at: https://www.business-standard.com/article/news-ani/airasia-scam-cyrus-mistry-tears-into-tata-for-dragging-his-name-118060100108_1.html [Accessed 31 May 2021].

Business Today, 2021. Ratan Tata says branding Nano as cheap car was wrong. [online] www.businesstoday.in. Available at: https://www.businesstoday.in/sectors/auto/ratan-tata-says-branding-nano-as-cheap-car-was-wrong/story/221726.html [Accessed 31 May 2021].

Kotoky, A. and Saxena, R. 2020. The $113 Billion Tata Empire Faces Tough Decisions Over Airlines. [online] BloombergQuint. Available at: https://www.bloombergquint.com/business/tata-at-crossroads-as-fledgling-airlines-reach-critical-juncture [Accessed 31 May 2021]. Mohile, S.S. 2017. Ratan Tata refutes Cyrus Mistry’s allegations on Tata Nano. [online] mint. Available at: https://www.livemint.com/Companies/JnWsD6mDoOiEPHVExcrdVP/Tata-Nano-Caught-in-the-crossfire-between-Ratan-Tata-and-Cy.html [Accessed 31 May 2021].