Cost management assignment on Bajaj finance strategy

Question

Task: How to analyse Baja Finance costing strategy using cost management assignment research methods?

Answer

Two options for cost techniques

Job Costing Process

This cost management assignment will analyse how Through job costing, the monetary value of each individual project is determined. When a manufacturing unit's job is not too repetitive, this strategy is used. Each job or lot should be identifiable by the number of orders fulfilled in production units that use job costing (SINDHU, 2019). Job costing is extensively employed in commercial foundries, drop forging shops, & specialist industrial equipment makers.

Pricing in a Contractual Relationship

The fundamentals of job costing & contract costing are equivalent as per research done on this cost management assignment. The difference between a contract & a job is that the former is much larger. Terminal costs may apply to either job or contract pricing (GANGIREDDIGARI, 2020). As per this technique, researchers simply can underst& the current situations of Bajaj Finance through various ways such as its pricing services, internal functions & many others.

The management & control of quality

For the four years ending on March 31, 2013, Bajaj Finance's portfolio performance increased dramatically as a result of an advantageous macro-economic environment & enhanced origination, underwriting, & collection 3 procedures. As of March 31, 2013, the rate of 180+ dpd (Days Past Due) has dropped to 1.8% from 13.3% as of March 31, 2009 (Finance, 2022). However, the firm has a substantial presence in high-risk areas; as of September 30, 2013, almost half of the portfolio was two- & three-wheeler loans, personal loans, small business loans, & consumer durable loans, all of which are vulnerable to economic cycles. Nonetheless, the cost management assignment research shows the portfolio performance has been very consistent thus far (see Segment-wise Portfolio Performance), notwithst&ing the uncertain state of the macro economy.

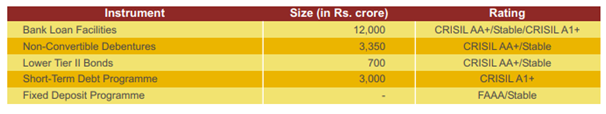

Table 1: Financial statement of BAJAJ FINANCE

(Source: Finance, 2022)

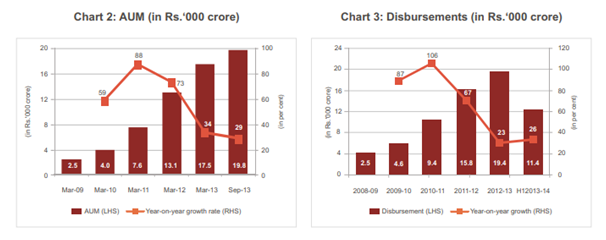

To add insult to injury, a significant chunk of Bajaj Financing's portfolio, which includes LAP, house loans, & infrastructure finance, has never been exposed to a wide range of economic & interest rate conditions. The organisation has quickly become one of India's most successful nonbank financial institutions (NBFCs). In the three years leading up to 2012–13, its AUM tripled, whereas the total AUM of retail asset-financing NBFCs grew by just 100%. Bajaj Finance's expansion has been spread out across business lines (see Product Overview), however captive financing's share of total AUM has fallen from 35% as of March 31, 2010 to 18% as of September 30, 2013 (Bajajfinserv.in, 2022. ABOUT US).

cost management assignmentStrategy’s importance of quality

Bajaj Finance's expansion has been spread out across business lines (see Product Overview), however captive financing's share of total AUM has fallen from 35% as of March 31, 2010 to 18% as of September 30, 2013. Group companies Bajaj Auto (India's second-largest two-wheeler manufacturer) & Bajaj Finserv (Bajaj Finance's parent) provide substantial financial, administrative, & operational assistance to Bajaj Finance (Statista.com, 2022).

Figure 1: AUM & Disbursements of Bajaj Finance

(Source: Statista.com, 2022)

Since Bajaj Finance is present in over 80% of Bajaj Auto's dealership network & around 95% of Bajaj Auto's retail network, it continues to finance a sizable percentage of the two- & three-wheelers manufactured by Bajaj Auto, thereby assisting the company in achieving its sales goal & preserving its market share (Ashwini, 2021). Bajaj Finance's market share of two- & three-wheeled vehicles has climbed consistently from roughly 20% in 2009-10 to 28% in 2012-13. Bajaj Finance's strategic relevance to the Bajaj group has grown substantially in recent years as a result of the company's increased product variety, increased AUM, & much higher profitability.

cost management assignmentAccounting role & control of quality

Aside from a 90+ dpd spike between March 2012 & March 2013, the performance of small business loans has been very steady from the company's launch in 2008. But CRISIL fears that the portfolio quality might worsen from here because of the uncertain state of the macroeconomy (Statista.com, 2022). In the beginning of its banking activities, the firm is likely to depend largely on wholesale finance & to solicit deposits mostly from corporations.

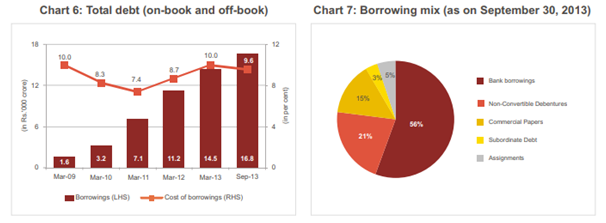

Figure 2: Total depth & borrowing mix

(Source: Statista.com, 2022)

The cost management assignment research shows, in the beginning, savings & checking accounts will make up a very small fraction of the total deposit mix. As a result, the business' operating expenses might be greater than those of similarly sized private banks (SATHISHKUMAR, 2018). Converting Bajaj Finance into a bank would be difficult for the company because of new RBI regulations that prohibit banks from offering zero-interest loans for durable goods. As of September 30, 2013, this sector represented for almost 12% of Bajaj Finance's AUM, & the firm had a comm&ing market position. Your privacy is important to CRISIL. We will use the information you supply about yourself (name, address, email address, etc.) to respond to your inquiry, service your account, & send you information about CRISIL & other aspects of McGraw Hill Financial that may be of interest to you. Please visit www.crisil.com/privacy for more details or to tell us how you'd want to be contacted for marketing purposes.

Comprehensive approach to control quality

Bajaj Finance, in CRISIL's estimation, is particularly vulnerable to high lending costs in the midst of severe macroeconomic circumstances. The organisation has more operational expenses than other NBFCs. Bajaj Finance's medium-term profitability will be determined by the company's ability to maintain tight reins on loan charges during economic cycles & cut down on operational expenses. The risk containment team reviews client profiles & supporting paperwork to determine which past-due cases pose the most threat.

Thecost management assignment portfolio is constantly being analysed by the risk & analytics team to compile a list of potentially problematic & cautious client profiles across all market categories. The teams responsible for origination, credit, & underwriting are informed of the results of the analysis so that they may take preventative measures to ensure the quality of the assets they h&le (Biswas et al. 2019). The company's "sell & collect" methodology places early collection responsibility squarely on the shoulders of the sales staff in the SME & commercial finance divisions. The organisation focuses on strengthening connections with borrowers & working via a network of referrals, guarantors, & business contacts to increase the intensity of follow-up for small business loans, LAP (to business class), construction equipment, & wholesale financing. Bajaj Finance has a specialised collection team that h&les early delinquencies in the consumer loan division. The firm focuses on preventing early defaults since it operates mostly in low-ticket size & unsecured areas, where seizure & sale of assets are impractical or unprofitable.

cost management assignmentSix Sigma

In order to be successful, you may stop at any of the three levels of the Six Sigma Belt certification. Choose the best level for your professional goals as per cost management assignment guidelines. You may get these credentials from organisations like the International Association for Six Sigma Certification (IASSC).

In the Six Sigma methodology, the White Belt is the entry level

Sigma Six Complete the required training to get your White Belt & you will have a solid foundational underst&ing of the Lean Six Sigma methodology. Improvement, variation, & negative impacts on process performance all play a role. Simply said, it describes the general responsibilities of each team member.

Obtaining Your Six Sigma Yellow Belt

You have mastered the finer points of Six Sigma & are familiar with its most effective applications. You will aid project teams in their quest to find solutions to issues.

Green Belt in Six Sigma

Employees may learn about the many Six Sigma responsibilities within a business & how to produce charts, process maps, & overall plans via the Six Sigma Green Belt certification training & course. The cost management assignment findings show that most often, the team leader or a senior member of the team who works closely with the team leader will be the one to wear the Green Belt.

Master Black Belt in Six Sigma

Individuals who have earned the rank of "black belt" are widely recognised as authorities & change-makers. In addition to guiding projects, they also provide training.

Taguchi quality

The Taguchi method of quality control is a strategy for minimising manufacturing errors that places an emphasis on the contributions of R&D & product design. Bajaj Finance saw an improvement in its asset quality, with gross & net NPA falling from 2.96% & 1.46%, respectively, to 1.25% & 0.51%. Based on 5,000 evaluations left by workers on AmbitionBox, Bajaj Finserv has earned a 4.1 out of 5 star rating (Rout, 2021). Bajaj Finserv's Skill development programmes are well regarded, earning a 4.1 out of 5 star rating. Contrarily, the Work-Life Balance was ranked the lowest at 3.5 & has room for development (Statista.com, 2022). Assets under control at Bajaj Finance were growing at a compound annual rate of 35% prior to the epidemic, the kind of growth that makes competitors green with envy & investors happy. It contributed to an increase of almost 11,000% in its stock price over a decade.

Financial information to support quality

The accompanying financial statements of Bajaj Finance Ltd. (the "Company") have been audited by us & include a balance sheet as of March 31, 2022, an income statement for the year ended March 31, 2022, a statement of changes in equity, a statement of cash flows, & a summary of significant accounting policies (Sujay, 2021). These financial statements accessed during the cost management assignment data collection show to the best of our knowledge & based on the explanations provided to us, give a true & fair view in accordance with the Indian Accounting St&ards prescribed under section 133 of the Act read with the Companies Rules 2015, as amended ('Ind AS') & other accounting principles generally accepted in India.

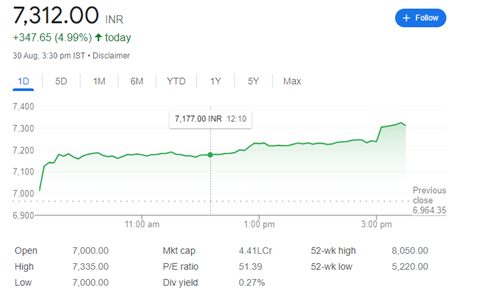

Figure 3: Financial report of Bajaj Finance

(Source: https://www.moneycontrol.com/financials/bajajfinance/balance-sheetVI/BAF)

Reference list

1. SINDHU, M.S.M.M., A STUDY ON CORPORATE FINANCE AT BAJAJ FINANCE.. Retrieved on 2nd September [https://www.mlsoft.in/jrmat.com/upload/-V12I3118.pdf]cost management assignment

2. K ANJAN VARA, P.R.A.S.A.D., 2022. A Study on Different Types of Loans & Advances offered by Bajaj Finance Limited.. Retrieved on 2nd September [http://14.99.188.242:8080/jspui/bitstream/123456789/16277/1/1NH20BA064.pdf]

3. GANGIREDDIGARI, J., 2020. A Study of Loans & Advances Offered in Bajaj Finance Limited..cost management assignment Retrieved on 2nd September [http://14.99.188.242:8080/jspui/bitstream/123456789/16429/1/1NH20BA141.pdf]

4. Finance, B. & Finance, M., 2022. Market snapshot. Retrieved on 2nd September [http://14.99.188.242:8080/jspui/bitstream/123456789/13235/1/1NH18MBA23.pdf]

5. KRITHIKA, H., 2020. A Study on Motor & Home Insurance Offered in Bajaj Finance Limited.. Retrieved on 2nd September [https://vid.investmentguruindia.com/report/2022/January/MORNING_INDIA-20220105-MOSL-MI-PG01805022.pdf]

6. Ashwini, R. & Reddy, G.S., CONSTRUCTION OF OPTIMAL PORTFOLIO USING SHARPE’S SINGLE INDEX MODEL. Journal homepage: www. ijrpr. com ISSN, 2582, cost management assignmentp.7421.. Retrieved on 2nd September [https://ejournal.lucp.net/index.php/ijmhs/article/download/1739/1927]

7. SATHISHKUMAR, R. & BALAMURUGAN, G., PROFITABILITY ANALYSIS OF LEASE FINANCING COMPANY.. Retrieved on 2nd September [http://www.jctjournal.com/gallery/108-nov2019.pdf]

8. Biswas, B., Financial Performance of Non Banking Financial Companies (NBFCS): A Critical Analysis. IITM Journal of Business Studies (JBS), p.65.. Retrieved on 2nd September []

9. Sujay, V. & Mamatha, J., Study on Dynamic Relationship between Technical Indicator & Equity Share Price of Selected Sectors.. Retrieved on 2nd September [http://www.jctjournal.com/gallery/108-nov2019.pdf]

10. Rout, B. &P&a, J., 2020. Construction of Optimal Portfolio on Selected Stocks of BSE Using Sharpe’s Single Index Model. Srusti Management Review, 12(1), pp.27-41.. Retrieved on 2nd September [https://www.academia.edu/download/62836659/86_Pages_JBS_Final_320200405-94451-4c0ttf.pdf#page=65]cost management assignment