Management Accounting Assignment:Discussion of the Newcastle Industrial Manufacturers Case

Question

Task: Newcastle Industrial Manufacturers (NIM) manufactures parts that are used in large earthmoving trucks typically used in the mining industry. It specialises in the production of 3 parts: A-12, P-37 and K-51. NIM has produced K-51 in high volume for many years, however demand has steadily declined over the past 2 years. NIM recently lost one of its major customers for the part as they were able to buy an equivalent part for 10% less form a foreign manufacturer. Recent analysis by the marketing manager indicates it is very difficult for NIM to meet current competitor pricing for the K-51 equivalent parts. A-12 and P-37 are more recent additions to NIM’s product offerings and significantly more complex to manufacture than the K-51. Both the A-12 and P-37 require special tools and set-ups for each batch. NIM believes it has to set a premium price for both of these parts to account for the complexities involved in their manufacture. NIM currently uses a traditional product costing system, allocating overhead based on machine hours.

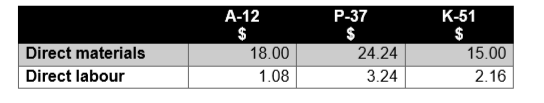

The current direct costs per unit are as follows:

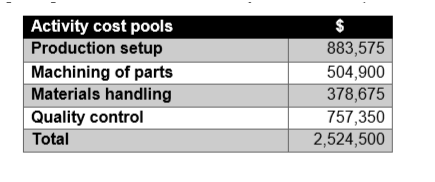

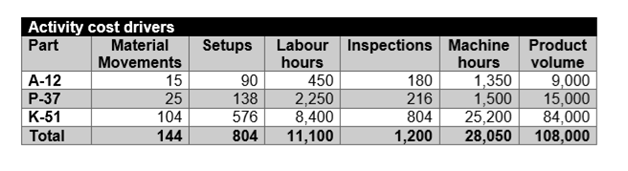

NIM’s management have asked you, as the newly appointed Management Accountant, to advise on cost management matters. They would like you to examine the possibility of using activity-based costing. You have gathered the following information regarding overhead costs and activity drivers for the past 12 months:

Required:

1. Calculate the total unit cost of the three products using NIM’s traditional method of cost allocation. (3.5 marks)

2. Calculate the total unit cost of the three products using activity-based costing. (9.5 marks)

3. Compare the costs calculated in 1 and 2 above. Explain the difference in cost figures. You must explain how well the overhead rates reflect the overhead costs incurred and consumed, drawing on information from the case facts to illustrate your answer. Which method of allocation would you recommend NIM management use? (10 marks) See appendix for guide as to how question will be marked.

4. Explain (in your own words) the advantages and disadvantages of using an ABC system. (5 marks)

Answer

PART 1

TRADITIONAL COSTNG

|

|

A 12 |

P 37 |

K 51 |

|

Direct Material |

$ 18.00 |

$ 24.24 |

$ 15.00 |

|

Direct Labour |

$ 1.08 |

$ 3.24 |

$ 2.16 |

|

Conversion Cost Per Unit |

$ 19.08 |

$ 27.48 |

$ 17.16 |

|

Number of items produced |

9000 |

15000 |

84000 |

|

Total Conversion Cost |

$ 171,720.00 |

$ 412,200.00 |

$ 1,441,440.00 |

|

Overheads (W.N. 2) |

$ 121,500.00 |

$ 135,000.00 |

$ 2,268,000.00 |

|

Total Product Cost |

$ 293,220.00 |

$ 547,200.00 |

$ 3,709,440.00 |

|

Number of items produced |

9000 |

15000 |

84000 |

|

Unit cost |

$ 32.58 |

$ 36.48 |

$ 44.16 |

Workings:

W.N. 1

|

Total Overheads |

$ 2,524,500.00 |

|

Total Machine hours |

28050 |

|

|

|

|

Total overhead per hour |

$ 90.00 |

W.N. 2

|

Overhead Allocation |

Machine Hours |

Overheads |

|

A 12 |

1350 |

$ 121,500.00 |

|

P 37 |

1500 |

$ 135,000.00 |

|

K 51 |

25200 |

$ 2,268,000.00 |

PART 2

ACTIVTTY BASED COSTING

|

|

A 12 |

P 37 |

K 51 |

|

Direct Cost Per Unit |

|

|

|

|

Direct Material |

$ 18.00 |

$ 24.24 |

$ 15.00 |

|

Direct Labour |

$ 1.08 |

$ 3.24 |

$ 2.16 |

|

Conversion Cost Per Unit |

$ 19.08 |

$ 27.48 |

$ 17.16 |

|

Number of items produced |

9000 |

15000 |

84000 |

|

Total Conversion Cost |

$ 171,720.00 |

$ 412,200.00 |

$ 1,441,440.00 |

|

Overheads |

|

|

|

|

Set Up Cost |

$ 98,907.65 |

$ 151,658.40 |

$ 633,008.96 |

|

Machining of Parts |

$ 24,300.00 |

$ 27,000.00 |

$ 453,600.00 |

|

Material Handling |

$ 39,445.31 |

$ 65,742.19 |

$ 273,487.50 |

|

Quality Control Cost |

$ 113,602.50 |

$ 136,323.00 |

$ 507,424.50 |

|

Total Overheads Cost |

$ 276,255.46 |

$ 380,723.58 |

$ 1,867,520.96 |

|

Total Cost |

$ 447,975.46 |

$ 792,923.58 |

$ 3,308,960.96 |

|

Number of Parts |

9000 |

15000 |

84000 |

|

Unit cost |

$ 49.78 |

$ 52.86 |

$ 39.39 |

Working Notes:

|

Set Up Cost |

|

|

Production Sets |

$ 883,575.00 |

|

Total Number of set ups |

804 |

|

Cost Per Set Up |

$ 1,098.97 |

|

|

|

|

|

|

|

Machining Cost |

$ 504,900.00 |

|

Total Machine Hours |

28050 |

|

Machine cost per hour |

$ 18.00 |

|

|

|

|

|

|

|

Material Handling Cost |

$ 378,675.00 |

|

Total Number of Material Movement |

144 |

|

Material handling cost per movement |

$ 2,629.69 |

|

|

|

|

Quality Control Cost |

$ 757,350.00 |

|

Number of Inspections |

1200 |

|

Quality Control Cost per inspection |

$ 631.13 |

PART 3

The present report discusses the case of Newcastle Industrial Manufacturers (NIM) which is a manufacturing concern engaged in the manufacturing of parts which are being used in the trucks that are typically used in mining industry. It primarily produces three products viz. A-12, P-37 and K-51. The company has been producing K-51 in large quantum due to high demand since many years but in the last 2 years the demand has declined gradually and it has recently lost its major customers they could procure the parts similar to K-51 from the foreign firm at a price 10% lesser than that is charged by NIM.

By far, the company has been costing its products on the basis of traditional costing wherein the total overheads incurred related to manufacturing of parts are charged to different products on the basis of machine hours consumed in the production of respective parts. However, it is important to note that not all the overheads are related to machine work and hence it is not a reasonable approach to allocate the overall overhead cost to the products on machine hours. Costing the product using such traditional management accounting approaches leads to identification of inaccurate cost that ultimately leads to incorrect pricing of the products as price of the product is determined by adding certain mark-up percentage to the cost of the product. Therefore, the correct product costing approach in the present case wherein there are multiple activities undertaken by the company in order to accomplish the manufacturing of the products, would be activity based costing. Activity based costing is the advanced management accounting technique which involves allocation of overheads on the basis of the cost drivers associated with them (Cokins&C?pu?neanu, 2010). In basic sense, it means allocation of overheads cost to different products on the basis of the overheads consumed in the activities that are used to produce such products. The overheads incurred in the present case are related to set up cost, machining of parts, handling of material and the quality control test. Hence, all these overheads are to be charged to the three products on the basis of the drivers of such cost applied in each activity.

|

Product Cost |

A 12 |

P 37 |

K 51 |

|

Traditional Costing |

32.58 |

36.48 |

44.16 |

|

ABC Costing |

49.78 |

52.86 |

39.39 |

Above table shows the product cost of each part produced by NIM as per traditional costing and activity based costing. The table clearly shows that there is significant difference in the costing of all the three parts as produced by the company. The use of traditional costing for A-12 and P-37 is leading to negligence towards the complexities involved in their production process which is necessary to be taken into consideration to set correct prices for these parts. Hence, as per traditional costing the cost of A-12 and P-37 is quite less than their cost determined as per activity based costing. The adoption of activity based costing will help the company to account for the cost keeping into consideration factors like use of special tools and set-ups which is being ignored in the current costing approach. Application of traditional costing approach in the business is leading to determination of inaccurate cost of manufacturing which is ultimately causing loss of profitability on account of setting of lower selling prices of the said products. Further, the cost determined for K-51 under traditional costing method is quite higher than the reasonable cost as there are lesser complexities in manufacturing such product. Determination of higher product cost of K-51 has resulted in setting of higher product price which has resulted in loss of major customers in the market for the business. From the above analysis it is highly recommended to NIM to put in place activity based costing in place of traditional costing methods so as to achieve accuracy of results which will help in making correct decision making leading to higher profits and wider customer base.

PART 4

The present part of the report discusses certain advantages and disadvantages of activity based system on the basis of the above discussion. Following are certain specific advantages of the said system:

Accurate Product Costing: Implementation of activity based costing brings in accuracy in the costing of products manufactured or dealt by a firm as it focuses on the direct cause and effect relationship of a cost. In cases where there is generally more diversity of the products manufactured like high volume products or the low volume goods, ABC offers reliable and accurate cost (Cokins, 2002).

Tracing of activity wise costing: ABC allocates overheads to different products on the basis of the quantum of activities involved in their production. Thus, it facilitates the cost accountant to identify the real nature of cost and thereby identifying those activities which do not offer value to the product. This ultimately helps the firm in reducing its cost of product (Briciu&C?pu?neanu, 2010).

Better decision making: The use of ABC provides accuracy of result in terms of cost identification of the products manufactured by a firm and thus it helps in determining the correct selling price of the products so as to achieve desirable profitability (Kaplan& Atkinson, 2015).

Though the system of ABC has multiple advantages but at the same time it suffers certain limitations which prevent the firms to adopt it. Following are those limitations:

Selection of driver: While implementing ABC in the business, it is very important to identify correct cost driver for the correct overhead cost and it requires certain skill sets and expertise to select correct cost driver for the allocation of overheads (Emblemsvåg& Bras, 2012).

Expensive and time consuming: As use of ABC techniques requires experienced and trained personnel due to the technicality involved in its system, such accounting professionals are expensive enough to be procured from the market and it involves significant cost to train the existing employees about the ABC system (Javid, Hadian, Ghaderi, Ghaffari&Salehi, 2016).

References:

Briciu, S. and C?pu?neanu, S., 2010.EFFECTIVE COST ANALYSIS TOOLS OF THE ACTIVITY-BASED COSTING (ABC) METHOD. AnnalesUniversitatisApulensis-Series Oeconomica, 12(1).

Cokins, G. and C?pu?neanu, S., 2010. Cost drivers. Evolution and benefits. Theoretical and Applied Economics, 8(8), p.7.

Cokins, G., 2002. Activity-based cost management: an executive's guide (Vol. 10). John Wiley & Sons.

Emblemsvåg, J. and Bras, B., 2012. Activity-based cost and environmental management: a different approach to ISO 14000 compliance. Springer Science & Business Media.

Javid, M., Hadian, M., Ghaderi, H., Ghaffari, S. and Salehi, M., 2016. Application of the activity-based costing method for unit-cost calculation in a hospital. Global journal of health science, 8(1), p.165.

Kaplan, R.S. and Atkinson, A.A., 2015. Advanced management accounting.PHI Learning.