Management Assignment: Banking System of UAE

Question

Task

Provide a well-researched management assignment on the topic “Banking System of UAE”.

Answer

Executive Summary

The comprehensive report on management assignment covers the banking system of the UAE with several aspects that have been analyzed accordingly. Initially, the historical development of the banking system of the UAE has been analyzed. The social, political, and economic factors in UAE have also been demonstrated that have generated significant impacts on the historical development of banking. The development of prescribed laws and regulations of UAE banking have also been discussed. The method wherein central banks of UAE have set the payment system, monetary policy, and banking regulations has been discussed. The central bank's relationship with several well-known organizations like the World Bank, BIS, and IMF has also been evaluated. The Structure of banks has been demonstrated, and the working of each category has been analyzed. The banking system's overall performance has been analyzed based on mortgages, profitability, and growth of deposits, capital requirements, and liquidity positions. The several difficulties of the banking system have been evaluated based on frauds, accumulated losses, and non-performing assets. The difficulties associated with fines and penalties on UAE banks have been analyzed. Central Bank of UAE has performed a significant function in the reformation of banking operations and maximizing the assurance of customers.

History

It is essential to demonstrate the historical developments of the banking system in the UAE. It is also essential to analyze how the social, political, and economic factors in the country have impacted the historical development of banking. It has been reviewed that UAE ranks as the second-largest economy in the Arab world after Saudi Arabia. The banking system of UAE comprises 23 national commercial banks with approximately 799 branches, 24 financing organizations, 28 foreign commercial banks with 108 branches. The growth of profit for banks in the country was approximately 15 percent. The UAE possesses a fragmented banking sector. The banking sector is quite preserved, and as per the research, foreign banks are growing quite active in the economy (Sleimi, Musleh, and Qubbaj, 2020). The UAE central bank adequately manages the banking sector that is considered as an optimistic factor for the development and globalization potential of the UAE since the banking sector of UAE has expanded significantly and is aiming for global competition. As per the researches, 46 foreign and domestic banks are operating in UAE. The influence of social, political, and economic factors is also immense. The factor has led to trade blocks, international transactions, economic globalization, cross-border movements, cultural openness, and many other factors. These are the reasons for the development of banking in the UAE.

UAE maintains effective diplomatic and trading connections with Saudi Arabia, United States, China, India, and several other countries. The UAE is regarded as a major power in the Middle East and possesses efficient influences globally. UAE is considered one of the richest countries in the world based on per capita earnings. Over the years, UAE has made remarkable progress, and the factors responsible for such developments are economic diversification, abundant natural resources, innovation. UAE is also a constituent of worldwide political and economic forums such as IMF, World Bank, Arab league. The UAE is a federal constitutional monarchy. The procedures of banking development are strongly associated with economic development in broad cross-section countries.

Regulation

Development of Banking laws and Regulations in UAE

UAE, in recent years, has developed to become a major Middle Eastern financial hub. The categories of banks are divided into three categories foreign, commercial, and Islamic. A new Banking Law repealed the prior Federal Law of 1980 on September 30th, 2018. As per the Federal Law, banks were prohibited from accepting deposits that mature in less than two years. When the new Banking Law was established, a Central Bank of UAE was also established. The new Banking Law brought in many changes in the old Federal Law regulation (Harnay and Scialom, 2015). Many changes were brought in regarding the regulations and decisions of the Central Bank, charging of interest for credits, maintenance of consumer confidentiality, and the authorizes of Central Banks to impose penalties.

Quality of Regulation and Role of Government

The new banking regulation of UAE is more consumers focused on developing frameworks and policies to protect the consumers. The new framework will include various regulations that will enable consumer confidentiality and protection of their data. The new regulation will work towards quick consumer complaints addressing, consumer awareness, resolving consumer disputes, and other financial services.

The Government of UAE supervises and regulates the activities of the financial institutions of UAE. The Government collaborates with the state and federal authorities to keep track of the financial institutions' activities. The Government ensures that the banking sector is providing equitable and fair services to the public. The Government also gathers information with the help of bank examiner to make decisions regarding monetary policies.

Regulatory Organizations of UAE

The regulatory organization of UAE is the Dubai Financial Services Authority, which is a part of Dubai International Financial Centre. In the Middle East, Dubai International Financial Centre is a leading hub for financial services. The organization is responsible for facilitating the flow of investment and trade in Middle Eastern countries and foreign nations. It provides capital for new ventures, innovative schemes, capital for start-ups, and licensing services. The role of the Dubai Financial Services Authority is the administration of the Regulatory Law of 2004. The Regulatory Law of 2004 is an essential element of the regulatory regime of the banking sectors of UAE. The DFSA is involved with the formulation of a framework for banking regulations in the UAE. The law authorizes the power of DFSA to implement rules and regulations that will be followed by the banking institutions that come under DIFC.

Important Laws Developed On Banking

The important laws developed on banking have been implemented for boosting the banking and financing sector of UAE. These laws were developed in reaction to the global economic crisis of 2008. The newly developed laws are anti-monetary laundering laws; this law criminalizes money laundering and allows financial institutions to monitor it. Second is the netting law according to which payment can be settled by the banking institution when two parties have disagreements. The third is the public debt law which supports the promotion of efficiency in the financial sector of UAE through infrastructure development. Lastly, the Central Bank law has been developed to create an apex bank that can monitor all the banks in UAE.

Role of Central Bank

It is essential to analyze the connection between the central bank of UAE and the Government. The Central Bank of the UAE's sole purpose is mainly responsible for retaining economic stability and sustaining monetary growth in the UAE. The Central Bank in UAE is also accountable for preserving consumers through suitable supervision. The Central Bank of the UAE was incorporated in the year 1980. The Central Bank in UAE possesses three significant objectives. Initially, the banking institution is putting potential to maintain UAE Dirham's stability within the Structure of the financial system. The bank's second objective is to secure the country's monetary system by retaining the present stability. Lastly, the bank also desires to practically manage foreign exchange reserves (Tadele and Kalyebara, 2020). The purposes of the Central Banks of UAE have transformed over the years since their objective has been transformed from supervising banking activities and issuing currency to overcoming inflation, applying capital adequacy ratios, and retaining stability in economic and exchange rate. The Central Bank of UAE monitors several areas such as financial investment organizations, commercial banks, investment banks, financial and monetary intermediaries.

The three broad segregations of banks in the UAE are the foreign banks, commercial banks, and Islamic banks, regulated by the Central Bank of UAE. In 2019, the banking system of UAE remained stable and had been quite effective in terms of maximum capital, stable funding. The Central Bank in UAE has reviewed the present operational setup of implementing the monetary policy in the UAE in association with the key objectives such as maintaining a reliable and convertible domestic currency. While implementing the monetary policy objectives, the central bank of UAE is also required to scrutinize the liquidity stance within the banking sector. The Central Bank has also evolved improved monetary tools, involving improved standing facilities as a constituent of the monetary management framework.

Payment systems are of great significance in the financial sector and the overall economy (I. Tabash and Anagreh, 2017). Hence, the central bank of UAE performs an effective role in the evolvement, operation, and reviewing the payment system. The Central Bank operates the following significant systems of payment in UAE-

The fund's transfer System of UAE- It is referred to as the Real Time Gross Settlement of UAE, hosted by the Central Bank. It facilitates the transfer between the monetary institutions in UAE and other banks.

Image Cheque Clearing System- This system aims to allow for the truncation of cheques at the instance of approval to provide an effective payment system in the UAE.

Wages Protection System of UAE- The purpose of this system is to offer an effective and secured mechanism so that payment of wages to workers is made on a specified period.

Under the prescribed laws of banking, the Central Bank in UAE was established. It had been granted the authority to issue and manage the country's currency and monitor the financial and banking sectors.

The central bank of UAE is also granted the authority to co-operate with banking organizations and worldwide standard bodies such as the World Bank and the International Monetary Fund. The IMF's sole objective is to encourage international money-associated collaboration, encourage international trade and involve a maximum degree of employment. The purpose of the World Bank is to maximize financial development in developing regions to maximize productivity and efficiency. However, the purpose of BIS is to act as a bank for the central banks. It functions as a facilitator of interaction between worldwide monetary organizations. World Bank assists only the developing countries by providing financial mortgages based on long-term for the development of several projects and programs. The Central Bank of UAE aims to foster confidence in the monetary system of the country. Global organizations, mainly the World Bank and IMF, are making maximum efforts to make central banks independent worldwide. The Central Bank also has to actively overcome the transformations in financial intermediation so that a productive and effective monetary system is ensured to fulfill the UAE's requirements.

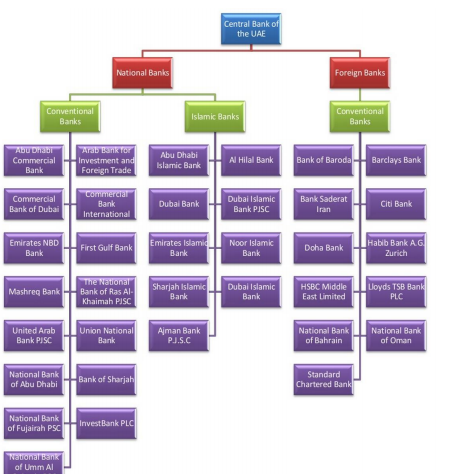

Structure of Banks in UAE

The banking structure consists of Central Bank at the top, and then comes the national and foreign banks. There are two bank categories under national banks, and they are conventional banks and Islamic banks. The Central Bank at the top provides financial aids and advice to other financial institutions and the Government. The Central Bank is responsible for licensing and regulating foreign and local banks of UAE. The investment banks of UAE are the banks that accept deposits, which have a maturity of a minimum of 2 years.

The central bank is the government-controlled bank of UAE and is the successor of the Currency Board. The Central Bank of UAE has the authority of issuing and managing the flow of currency in the economy (Al-Asbahi, Ahmed, and Nobanee, 2020). This means that the Central Bank of UAE can print money and circulate it in the economy. The credit policies are also monitored and managed by the Central Bank of UAE. Credit policies are the guidelines that manage and control credit transactions' rules and regulations in the economy. It lay down the guidelines for the actions to be taken for late payment or default in payment. The Central Bank of UAE also supervises the development of the banking system. It also provides the Government of the UAE will financial assistance when needed. Lastly, the Central bank acts as a representative of UAE in IMF, World Bank, and AMF.

The Commercial Banks of UAE perform various financial functions associated with accepting deposits, issuing loans, providing financial services, etc. There are different types of deposits accepted by the Commercial Banks of UAE. Current deposits, saving deposits, and time deposits are accepted by the Commercial Banks of UAE (Kandil and Markovski, 2019). Commercial Banks also issues loans, credits, bank overdrafts, and other lending facilities to their customers. The Commercial Banks of UAE's secondary functions are accepting cheques and bills, redeeming securities, performing the role of trustee, and so on. They also provide financial advice to their customers.

An Islamic Banking system was developed in UAE as an alternative for interest-based banks. This bank caters to the financial needs of the Islamic population in the UAE. This bank was developed to provide banking facilities to the people who were considered to be non-bankable by other banks. The Islamic Banks are the highest contributors to the annual GDP of Dubai in the year 2018. The customers of Islamic Banks are both Muslim and Non-Muslim, and it is one of the fast-growing banking institutions of UAE (Jawad and Christian, 2019). The Islamic Banks have also contributed to the creation of stability in the financial matter of UAE. It is considered one of the most stable financial institutions as it can promote growth for a long duration and ensure employment in the economy. The services provided by the Islamic Banks are innovative and customer-oriented, due to which their demands are rapidly growing. The economic growth of the UAE has also been improved to some extent by the Islamic Banks (Kamarudin, 2018).

Figure 1: Banking Structure of UAE

Source: (Kareem, 2015)

Analyzing the performance of the banking system

It is essential to analyze the overall performance of the banking system of UAE based on the development of deposits, profitability, loans, liabilities, assets, liquidity positions, and capital requirements. The current global crisis has generated a major impact on the UAE bank's economic performance, specifically the profitability measured by Return on Equity and Return on Assets. During the crisis period, the profitability ratios of UAE banks have also been minimized. The liquidity of UAE banks has also been minimized, specifically in cash and portfolio investments to deposits. On the other hand, it has been observed that the leverage ratios of the banking sector of UAE have maximized during this specified period in contrast to the pre-crisis period.

In addition to Kuwaiti banks and Saudi Arabian banks, UAE banks have conquered the Middle Eastern and the GCC Banking Sector. However, UAE banks' involvement in the local market and local deposits has also been demonstrated, as per Ravichandran and Ahmed (2015). The National Bank of Abu Dhabi has the maximum deposit and mortgage market share of approximately 13 percent. The National Bank of Dubai ranks second in terms of deposits, and the Emirates International Bank ranks second in terms of loan issues. The banks in UAE are not segregated from non-banking commercial activities. According to Phaneuf (2019), banks in UAE also possess the authority to participate in real estate brokerage, stock brokerage, securities market, and several other non-banking activities. Since earnings based on real estate brokerage and stock are unstable, banks in UAE cannot be completely dependent on them. Several other sources of non-interest earnings are earnings and commissions associated with foreign exchange.

Waal, Mroueh, and Schiavo (2017) states that the UAE possesses a rapidly advancing retail sector of banking due to the country's maximizing expatriate population. At present, banks in UAE emphasize corporate customers since they are regarded as lucrative and minimum risk. The banking sector of UAE has effective liquidity and is ready for adequate developments in 2019.

Problems with the Banking System

It is also essential to analyze the problems with the banking system of UAE based on frauds, accumulated losses, non-performing assets. It is also essential to analyze the problems of fines and penalties on banks by the regulators. The problems related to these fines and penalties levied on the banks are that they turn out to be a burden for them. These will create a negative image of the banks among their consumers, and they might as well lose their consumers. The banking sector of UAE has experienced issues of compliance (Kumar and K S, 2015). It is quite probable for UAE to view the major disruptors in the banking sector. The banking sector of UAE is required to adopt optimistic strides towards blockchain technology, artificial intelligence, and cognitive disrupting. The central bank of UAE had imposed monetary sanctions on approximately eleven banks operating in the country for their failure to acquire definite degrees of compliance based on sanctions and anti-money laundering. The central bank of UAE had provided the specific time to all the banks conducting its operations in UAE to adopt reliable measures for the potential shortcomings (Antwi et al., 2017). They were also advised in the middle of 2019 to ensure that compliance is maintained by the end of the year and informed that shortcomings in the future would lead to certain kinds of penalties. As per the researches and estimates, banks in UAE are becoming proactive towards financial crime compliance. As per the UAE Central Bank report in the year 2019, several finance companies conducting their operations in UAE decreased from 27 to 21 during 2018. The overall assets of the finance companies of UAE also declined by approximately 11.1 percent in 2018.

The main reason behind the decline was minimization in the number of finance organizations and an entire reduction in the assets of present organizations in contrast to the estimates of 2017 (The Asian Banker, 2021).

Conclusion

The entire banking system of the UAE has been analyzed. Several aspects have been analyzed, such as prescribed banking laws and regulations in UAE, the Central Bank's role, the Structure of banks, analyzing the performance of the banking system, and problems with the banking system. The banking industry of the UAE is beneficial and is effectively assisted by the central bank. It has been reviewed that the banking sector of UAE is performing an effective responsibility in the globalization of the UAE economy. Banks perform a major role in the adequate growth of every economy by mobilizing investments based on productivity. Though the US's banking sector is recovering due to the financial crisis since the 2000s, several issues have been faced, such as inadequate economic growth and uncertainties in fiscal policy. However, there are several kinds of banks; banks in the US conduct their operations simultaneously by performing similar activities. Through much analysis, it has been evident that the USA's banking sector will see future trends such as an end in the decline of interest rates, deleveraging of consumers, population aging, and end of sovereign borrowers, and so on. These future trends of the USA banking sector will bring about major changes in the long term. It will allow innovation, development, and improvement in the banking industry of the USA.

References

Al-Asbahi, M.K., Ahmed, F.A. and Nobanee, H. (2020). (PDF) An Overview of the Central Bank of UAE. [online] ResearchGate. Available at: https://www.researchgate.net/publication/342703501_An_Overview_of_the_Central_Bank_of_UAE [Accessed March 3rd. 2021].

Antwi, G.O., Banerjee, R., Mohammed, A.A. and Muna-Habib, M.J. (2017). The Degree of Competition in the UAE Banking Industry. International Finance and Banking, 4(2), p.1.

Didenko, O. and Dordevic, S. (2017). The optimization of banking regulation intensity from the perspective of financial stability in banking sector: an empirical analysis. Financial Markets, Institutions, and Risks, 1(1), pp.43–53.

Harnay, S. and Scialom, L. (2015). The influence of the economic approaches to regulation on banking regulations: a short history of banking regulations. Cambridge Journal of Economics, 40(2), pp.401–426.

I. Tabash, M. and Anagreh, S. (2017). Do Islamic banks contribute to the economy's growth? Evidence from United Arab Emirates (UAE). Banks and Bank Systems, 12(1), pp.113–118.

Jawad, A. and Christian, K. (2019). ISLAMIC BANKING AND ECONOMIC GROWTH: APPLYING THE CONVENTIONAL HYPOTHESIS. Journal of Islamic Monetary Economics and Finance, 5(1).

Kamarudin, F. (2018). Price Efficiency on Islamic Banks vs. Conventional Banks in Bahrain, UAE, Kuwait, Oman, Qatar & Saudi Arabia: Impact of Country Governance. International Journal of Monetary Economics and Finance, 11(4), p.1.

Kandil, M.E. and Markovski, M. (2019). UAE Banks’ Performance and the Oil Price Shock: Evidence across Conventional and Islamic Banks. Review of Middle East Economics and Finance, 15(3).

Kareem, B. (2015). Financial Performance of UAE Banking Sector: Domestic vs. Foreign Banks. [online] . Available at: http://i-rep.emu.edu.tr:8080/xmlui/bitstream/handle/11129/2256/KareemBakhtiyar%20Omar.pdf?sequence=1 [Accessed March 3rd. 2021].

Knapp, A., Bois-Maublanc, J., Mayer-Duverneuil, C., Etting, I., Lefeuvre, S. and Alvarez, J.-C. . (2014). W5: Hair analysis in DFSA cases. Toxicologie Analytique et Clinique, 26(2), pp.S2–S3.

Kumar, R. and K S, S. (2015). Wealth Creators in the Banking Sector in UAE during 2010-2015 Period. Asian Journal of Finance & Accounting, 7(2), p.152.

Nobanee, H. and Ellili, N. (2017). Impact of Economic, Environmental, and Social Sustainability Reporting on Financial Performance of UAE Banks. SSRN Electronic Journal.

Phaneuf, A. (2019). The future of retail, mobile, online, and digital-only banking technology - Business Insider. [online] Business Insider. Available at: https://www.businessinsider.com/future-of-banking-technology?IR=T [Accessed March 3rd. 2021].

Ravichandran, K. and Ahmed, H.I. (2015). Performance Analysis of UAE Banks-An Exploratory Study. International Journal of Economics and Finance, 7(9).

Sleimi, M., Musleh, M. and Qubbaj, I. (2020). E-Banking services quality and customer loyalty: The moderating effect of customer service satisfaction: Empirical evidence from the UAE banking sector. Management Science Letters, pp.3663–3674.

Tadele, H. and Kalyebara, B. (2020). CEO power and bank risk in the UAE. Banks and Bank Systems, 15(3), pp.117–128.

The Asian Banker (2021). Largest Banks. [online] www.theasianbanker.com. Available at: https://www.theasianbanker.com/ab500/2018-2019/largest-banks-mea [Accessed March 3rd. 2021].

Waal, A. de, Mroueh, M. and Schiavo, L. (2017). Analyzing Performance in the UAE Manufacturing Industry Using the High-Performance Organization Framework. Middle East Journal of Business, 12(1), pp.3–11.