Discussion On Mergers And Acquisitions Target Of Woolworths Group

Question

Task:

Individual case study strategy and valuation for mergers and acquisitions (M&A) pape

This assessment is an individual development of a strategy involving identification and justification of an M&A target and valuation of the M&A target from the position of the chosen case study business. This work is presented in the form of a management report.

Details

Assume that you are a consultant employed by the focus business to develop a strategy for value creation involving M&A and provide advice on an M&A target and valuation of the target. In this assessment, you are expected to complete a review of the objectives and operations of the case study business as a foundation for your management report. From the current position of the focus business, you are expected to develop a strategy for value creation for the business that involves an M&A transaction. The strategy and valuation for M&A are to be presented as a recommendation to management of the case study business in the form of a management report.

In the assessment, you will need to justify your choice of an M&A target from a range of identified potential targets and complete a valuation of the target from the perspective of the case study business. At least 3 potential targets should be nominated and evaluated. The paper should conclude with a strong argument justifying the chosen target and recommendation on price to pay for the business. The valuation of the target should be completed in a spreadsheet. Relevant sections of the spreadsheet should be included in the written report and assumptions clearly outlined. Assumptions should be justified with reference to independent and reliable data.

The analysis of potential target, choice of target and valuation are to be presented in an 1,800-word strategy and valuation M&A management report. The 1,800-word paper should include a review of key elements of the strategy and valuation including the proposed purchase price, range of potential values to the purchaser and justification of assumptions. The valuation spreadsheet is to be submitted as supporting evidence only for the work not as a substitute for discussion of the valuation in the management report. Marks will be allocated based on the information, discussion and recommendations presented in the management report paper only.

Note that 1,800 words is the maximum word count for the management report and the word count includes all tables and diagrams.

Assessment submissions should address the choice of target and valuation of the target as the focus of the management report. Students have the flexibility to structure the report as they choose, but the expectation is that the submission will:

- Briefly describe the industry context, the organisation’s products/services and customers, and identify a specify objectives for the organisation.

- Identify at least 3 potential M&A targets for the organisation and offer a specific recommendation about which target to pursue. The choice should be clearly justified with reference to the objectives of the organisation.

- Provide an overview of the target and develop a valuation of the target for M&A in a spreadsheet. The report submitted should include information that is relevant to management decision-making on whether to continue to investigate the proposed acquisition.

- Include a detailed valuation of the target business including clearly outlined assumptions, justification of assumptions and supporting evidence for assumptions.

- Provide supporting data and evidence for the valuation and price recommendations. Assumptions should be clearly justified with reference to reliable and independent data.

The target audience for this report is the senior management/owner(s) of the focal organisation. The analysis that supports the recommendations should assume that the focal organisation can make an acquisition in the short term and contemplate the implications for the business in the medium to long-term (typically five years, depending on the industry and size of the organisation). To prevent overemphasis of the short term, the minimum time horizon is five years.

Answer

Introduction

The selected organization for this mergers and acquisitions (M&A) report is Woolworths Group. This organization is situated in New Zealand and Australia and has an extensive retail grocery market. The grocery industry in Australia is widely spread all over the landmass and is constantly evolving in every aspect. The Supermarkets and grocery stores in Australia are increasing immensely; therefore, the industry is expected to grow by 3.3% by 2021. The supermarket and grocery industry in Australia are ruled by two leading companies, i.e., the Coles Group and the Woolworths Group. Woolworths Group is one of the largest supermarket companies in Australia. This organization mainly deals with groceries and operates in a retail outlet whereby the organization sells the grocery products to their customers. This report primarily focuses on the M&A targets of the organization and states the main objectives of the organization for the target groups. This report will identify the three major potential organizations for the merger and acquisition of the company and then state the valuation details for each organization. This report will also provide some recommendations for the organization and state how the organization may be beneficial in merging with other organizations. In conclusion, this report will mainly deal with the merger and acquisition of the organization and provide strategies to help the organization grow and maintain it5s leading position in the market.

Industry And Context

The selected industry for this report is the supermarket and grocery industry. The supermarket and grocery industry is one of the largest industries in Australia. The supermarket and grocery industry in Australia is constantly growing and evolving from time to time. This industry is one of the highest profit-yielding industries in the nation. This industry is mainly dominated by two major companies, i.e., the Coles Group and the Woolworths Group. These two companies are the largest grocery franchises and focus on expanding their services to the customers (Greve & Man Zhang, 2017).The main target group for this organization to connect with organizations for mergers is to eliminate the organization's highest and potential competitors to continue to maintain its highest place in the market.

The two leading organizations in this sector hold around 30% of the market share, resulting in a valuation of approximately 90 million Australian dollars per financial year. This industry also has an immensely growing annual turnover, increasing every year and proving to be highly beneficial for the industry (Koi-Akrofi,2016). However, according to the statistics, sometimes this industry undergoes steady growth, which mainly depends on different aspects.

Further, the presence of a developed co-relationship between the grocery chains, suppliers, and their customers has successfully attempted to gather the attention of various politicians and other competing industries in the past years, which has resulted in the industry's evolution. Due to the changing legislations of the country, many small and middle scale businesses are attracted to the industry (Davenport& Barrow, 2017). They are opening up the retails in the industry to grow their own business and achieve profitability. The Trade Practices Act has also ensured the protection of rights and interests of businesses. Further, the variety of products and services that this particular industry deals with focuses on administering services and products to the customers. The customers often observe that the supermarket and grocery industry only deals with grocery and manufacturing products, but this is a big misconception. The industry also administers various services to the customers (Rozen-Bakher, 2018). Hence, it can be observed that the industry deals with a variety of products and services.

The supermarket and grocery industry comprises several leading companies in different segments with very high valuations of the organizations (Singh& Das,2018). Therefore, such organizations may prove to be very beneficial for the leading organizations.

Potential Targets For The Organisation

A leading organization mainly focuses on merging with another organization for various reasons. One of the most important reasons for merging with another organization is to negate the potential competition in the industry and acquire more profit by merging with the other organization. It is why M & A is significant for any organization.

In the present scenario, the three potential targets for Woolworths Group for M & A are the following:

-

Wellness and beauty solutions

-

Merchant house international

-

Elders limited agriculture manufacturing company

Wellness and beauty solutions are one of the largest companies in the beauty products and services industry with a high valuation. It will be one of the most profitable acquisitions and mergers for the company and help the organization to yield even more profit. This merger and acquisition will also help the organization grow immensely and continue to maintain its leading position in the market.

The second potential target for the organization is that of Merchant house international. Merchant house international is one of the leading companies in the manufacturing industry and is growing immensely (Ermolovskaya, 2018). This organization mainly deals with the manufacturing and marketing of leather boots and shoe products. Additionally, this organization also deals with the manufacturing of home textile products and focuses on manufacturing such products. This organization mainly comprises four major segments: home textile trading, home textile manufacturing, footwear manufacturing, and footwear trading. The organization has a high valuation in the manufacturing and trading industry and thus has been acknowledged as one of the leading manufacturing organizations. This organization is also the largest in-home decoration and other ornamental products; therefore may prove to be highly beneficial for Woolworths Group. After the merger of both organizations, it will prove to be a highly beneficial merger for the organization.

The third potential organization for Woolworths Group is Elders limited. Elders limited is one of the leading manufacturing companies in the agricultural industries. The Elders limited is a growing organization that provides agro-business services such as wool production, crop growth, water trading, tech services, and farm supplying appliances (Brueller et al., 2018). These major services are provided by the organization, which may be highly beneficial for Woolworths Group after the productive and profitable analysis of the products after merging both the organizations with each other. Moreover, the valuation of this organization is also very high, and therefore, this organization deals with the operations and services of farm supplies and livestock services. As regards the present organization of Woolworths Group, which is a growing and prospering grocery company, mainly concentrates on acquiring other organizations that may be beneficial for the company's growth.

In conclusion, it can also be said that three of the organizations are equally important for the merger and acquisition and must be considered thoroughly. However, one of the recommendations will be the first organization that is Wellness and Beauty solutions. The wellness and beauty solutions will be more profitable for Woolworths Group and help in developing more products for the organization. The Wellness and Beauty solutions have a high-value valuation and therefore will be beneficial for the organization even in terms of product diversity.

Moreover, according to Ansoff Matrix, Wellness and Beauty solutions will be more beneficial for the first organization therefore product diversity and product expansion will be more beneficial for the organization.

Valuations

The valuation of Wellness and beauty products is approximately 10.79million, and net balance is approximately AUD 11.97million. Thus, it is certain that merging with Wellness and beauty solutions will be very beneficial for Woolworths Group. The organization will expand its business in the beauty products sector and grow its targeted customers to attract more new customers. It will also help Woolworths Group to increase its valuation in total.

Similarly, the valuation of Merchant House International is AUD 18.6 million. This organization is one of the leading manufacturing companies and, therefore, will increase the valuation of Woolworths Group in its entirety.

Further, the valuation of Elders Limited is AUD 58.7 million. Thus, the valuation will increase even further on merging with this particular organization. This organization may highly benefit Woolworths Group and help the organization to grow its business. It will thus help the organization to increase its valuation and expand its business in the market. Therefore, considering the valuations of all the three potential organizations, it can be said that the organization, i.e., Woolworths, will be heavily benefitted from the merger and acquisition deal. This deal will turn out to be beneficial for Woolworths Group.

Recommendations

During merger and acquisition, various factors must be considered reasonable to perform the merger and acquisition process. One of the factors in such a case is to consider the value of the acquisition and make it with a reasonable mind frame after a serious discussion with all the organization members (Reddy et al., 2016). It is so because securing a higher value or a value equivalent to that of the organization is significant for performing mergers and acquisitions. If the valuation of the organization selected for the merger upholds a lesser value than that of the present organization, then the merger may not be very beneficial.

The other recommendation for the merger and acquisition process will be to follow the major teamwork involved in the merger and acquisition process. It must be noted that rapid and sudden decision-making may affect and impact the deal. Therefore, it is wise to consider the opinions and views of each member of the organization (Küçükkocao?lu & Bozkurt, 2018). Regarding the opinion of each member of the organization may help in benefitting the other members of the organization. It is important to consider all the major aspects during the merger and acquisition process, which may even comprise the associated risks and other such components.

Another recommendation for this merger and acquisition process is to avoid any restrictions of the normal business process (Y?lmaz & Tanyeri, 2016). It may cause heavy and impact the organization to a great extent. It is so because disrupting the ordinary business process may disrupt and affect the organization's valuation, and therefore, the merger deal may result in a not-so-profitable manner. Therefore, this is important for the successful merger and acquisition deal of the organization.

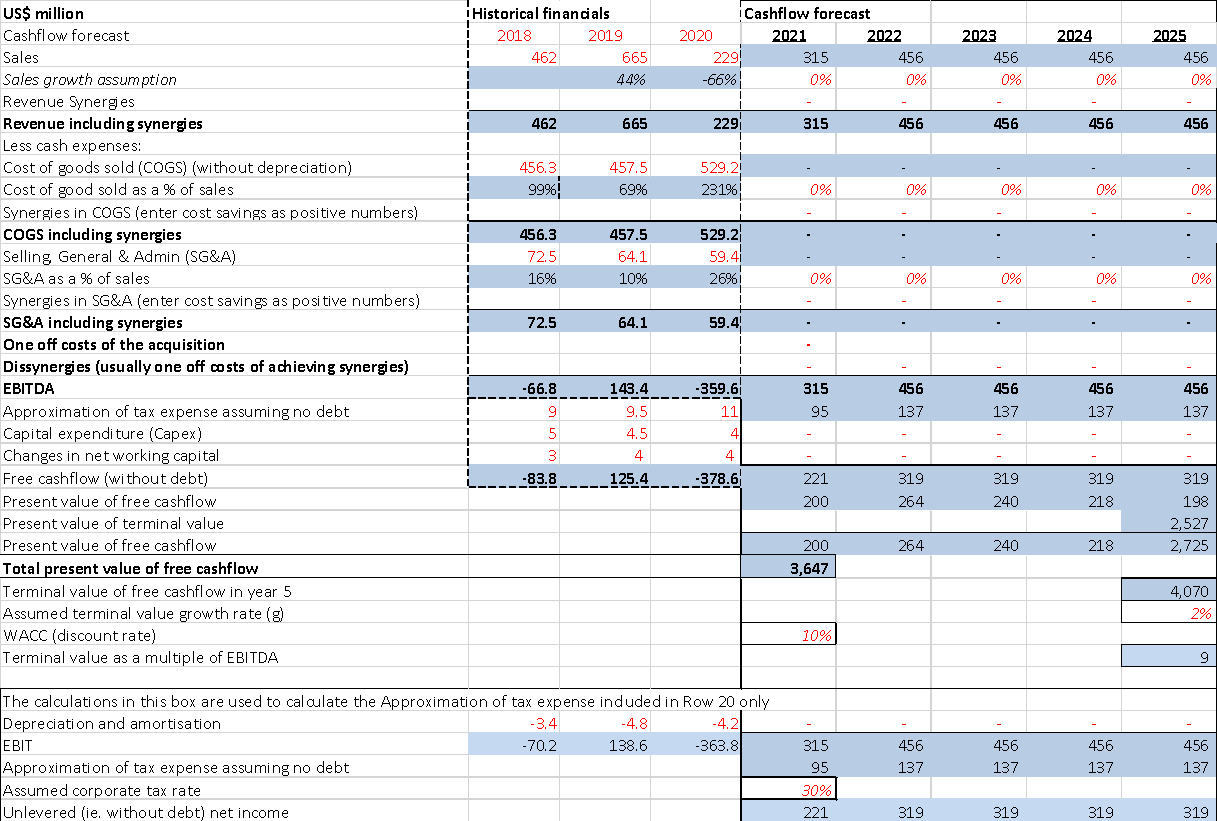

Table 1: Valuation Details

Source: Author

Conclusion

As regards the above discussion, it is clear that merger and acquisition for Woolworths with the three identified organizations will be very beneficial. The organization will have to consider the various factors and consider the different aspects regarding the valuation process for successfully carrying out the merger and acquisition process. The organizations, i.e., Wellness and beauty solutions, Merchant house international, and Elders limited agricultural manufacturing company, are the three potential targets for the merger and acquisition of the organization. Therefore, merging with these organizations will benefit Woolworths Group because this will help the business grow even more and maintain its leading position in the industry. Woolworths Group is grocery retail, and therefore Wellness and Beauty solutions will help the organization expand its business in the beauty products and services industry and attract more customers. Similarly, the merchant house international and Elders limited are two manufacturing organizations and therefore focus mainly on expanding business in the agro-business and merchandise sector. Thus, developing the industry in all these sectors will help the company grow in every aspect and then increase the valuation of Woolworths in totality.

References

Brueller, N. N., Carmeli, A., & Markman, G. D. (2018). Linking merger and acquisition strategies to postmerger integration: a configurational perspective of human resource management. Journal of Management, 44(5), 1793-1818.

Davenport, J., & Barrow, S. (2017). Employee communication during mergers and acquisitions. Routledge.

Ermolovskaya, O. Y. (2018). Problems of the Russian market of merger and absorption transactions. Journal of Reviews on Global Economics, 7, 825-833.

Greve, H. R., & Man Zhang, C. (2017). Institutional logics and power sources: Merger and acquisition decisions. Academy of Management Journal, 60(2), 671-694.

Koi-Akrofi, G. Y. (2016). Mergers and acquisitions failure rates and perspectives on why they fail. International Journal of Innovation and Applied Studies, 17(1), 150.

Küçükkocao?lu, G., & Bozkurt, M. A. (2018). Identifying the effects of mergers and acquisitions on Turkish banks performances. Asian Journal of Economic Modelling, 6(3), 235-244.

Reddy, K. S., Xie, E., & Huang, Y. (2016). The causes and consequences of delayed/abandoned cross-border merger & acquisition transactions: a cross-case analysis in the dynamic industries. Journal of Organizational Change Management, 29(6), 917-962. https://doi.org/10.1108/JOCM-10-2015-0183

Rozen-Bakher, Z. (2018). Comparison of merger and acquisition (M&A) success in horizontal, vertical and conglomerate M&As: industry sector vs. services sector. The Service Industries Journal, 38(7-8), 492-518.

Singh, S., & Das, S. (2018). Impact of post-merger and acquisition activities on the financial performance of banks: A study of Indian private sector and public sector banks. Revista Espacios Magazine, 39(26), 25.

Y?lmaz, I. S., & Tanyeri, B. (2016). Global merger and acquisition (M&A) activity: 1992–2011. Finance Research Letters, 17, 110-117.