Organisational Performance Assignment Evaluating Functioning of AGL

Question

Task

Assuming the role of an organisational consultant, you are to write a organisational performance assignment that clearly articulates the organisation’s strategy and business model and outlines a detailed approach to Competition Strategy, how the chosen organisation’s performance is/can be measured against their strategies. You will also be required to prepare a Balanced Scorecard for their chosen organisation. Attention should be paid to the use of secondary research and insights.

Answer

Executive Summary

The aim of this organisational performance assignment is to prepare a business report for AGL from the point of view of an organisational consultant. The report will include a short overview of the organisation. The aspects which will be dealt in details in the business report include the business strategies of AGL, the competition strategies of the company, the performance measurement, preparing a balanced scorecard for the company and their approach towards enhancement of performance. The report will present few recommendations which will facilitate improvement of the company’s performance in future.

Introduction

The purpose of this business report is to evaluate the performance of AGL. The report will focus on the organisation’s strategies. The aspects that will be covered in this business report include analysis of the competition strategy of AGL, performance measurement of the organisation and presenting a balanced scorecard of the company. The report will also provide recommendations for AGL which will help the organisation to improve its performance in future. This business report will be written from the perspective of an organisational consultant. Therefore, the report will specifically articulate the strategy and business model of AGL. The report will be based on secondary research.

Summary of Organisation’s Strategy

AGL is an organisation which is leading the industry in essential services. The company has been in the market for the last 185 years. AGL as an integrated essential service provider has a huge customer base consisting of 4.2 million people in Australia. The customers comprise large and small businesses, residential and wholesale industrial customers. The forte of the company is its focus on technology, human resource development and progress. The services which AGL provides include internet, energy, renewable and electric vehicles and mobile. AGL alone covers 20 per cent of the National Electricity Market in Australia. They have a generation capacity of 11,105 MW (AGL Energy, 2021).

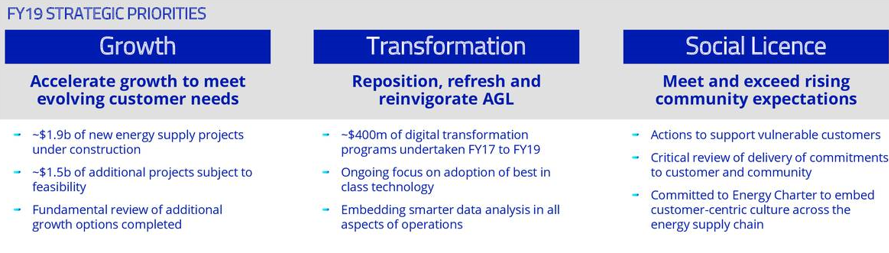

The company has been able to sustain in the market for so many years and bear the flagship in the industry because of its innovative and updated strategies. AGL has mainly three strategies or priorities. These include growth, social licence and transformation (BIZCLIK MEDIA LIMITED, 2021).

Growth is a very significant strategy of AGL. The company believes that they can grow only when their customers’ needs are met. The customers’ needs as per AGL are seen along three horizons. The company must be able to optimise the existing portfolio for value as well as performance. AGL needs to evolve and expand its offerings in the core energy market. The company has to further create new opportunities with the linked customers (Clean Energy Regulator, 2021).

Social licence is another important strategy of AGL. By social licence, it implies that the company is expected to meet the expectations of the community or exceed it. The ongoing investment of the company in the energy supply is with the purpose of meeting their customers’ expectations. The company aims at yielding better customer outcomes. AGL is striving to support their vulnerable customers. They continuously review their key customers, try to meet their community commitments and integrate it within their system. The urge of the company has not satiated. They know there is a still a long way to go in terms of updating their strategies (Mazengarb, 2021).

Transformation is another significant strategy of AGL. The company is focusing on building of heritage. The company has been operating for more than 180 years. Therefore, they need to update themselves with the changing market environment. Repositioning is important to adapt to the modern world. AGL is constantly growing and transforming by emphasizing on digital transformation. They are trying to analyse the data, innovate, adapt and embrace the best-in-class technology (Galer, 2021).

Organisation’s Approach to Competition Strategy

As per Tampubolon, Ceribasicand Boche (2020), competition strategy is important aspect of business. Every organisation has a competition strategy. With the help of this competition strategy, the organisation is able to outperform its competitors. AGL also has a competition strategy which helps it to perform better than its competitors in the market. The company tries to strengthen its competitive advantage so that they have an added edge over their competitors. There are many companies in Australia and around the world who are offering the same services as AGL. The major competitors of AGL are Origin energy, Red energy, Alinta energy, Energy Australia and Simply energy (Murphy, 2021).

AGL is trying to create competitive advantage by focusing on integrated services. They are trying to optimise their portfolios, expand their service base and provide better services to their connected customers. The company is focusing on management of the trusted relationship with their customers (PEACOCK, 2021). This will give them better market position over their rivals, by increasing their NPS. The company also aims at building effective relationships with their key stakeholders. The building of strong brand image and reputation could be their best competition strategy for growth. AGL has invested and acquired adequate infrastructure for technology. In order to become eco-friendlier and more sustainable in approach, they are expanding their renewable energy plants. The company aims at abandoning their coal generated electricity plants.

As per Nissan Australia (2018), AGL’s competitive strategy has great prospects as they have huge opportunities to explore in the energy sector. The main area in which the company can grow and give tough competition to its rivals is electric cars. In the future, most of the people will shift to electric cars. The advancement in terms of technology will also increase the demand for electricity, which will enhance the market demand for AGL’s services. The company has adopted 4HANA ERP/SAP S along with increased use of digital platforms which is increasing its competitive advantage. AGL’s innovations have helped it to minimize the plat downtime, save 60 percent time and enhance the operations in health and safety (RBA, 2021).

Organisation’s Approach to Performance Measurement

According to Warren(2021), performance measurement is the process in which the data or relevant information is collected and analysed. This analysis is then presented in the form of a financial review or report about the organisation. The performance measurement can be done by analysing the financial reports of the company.

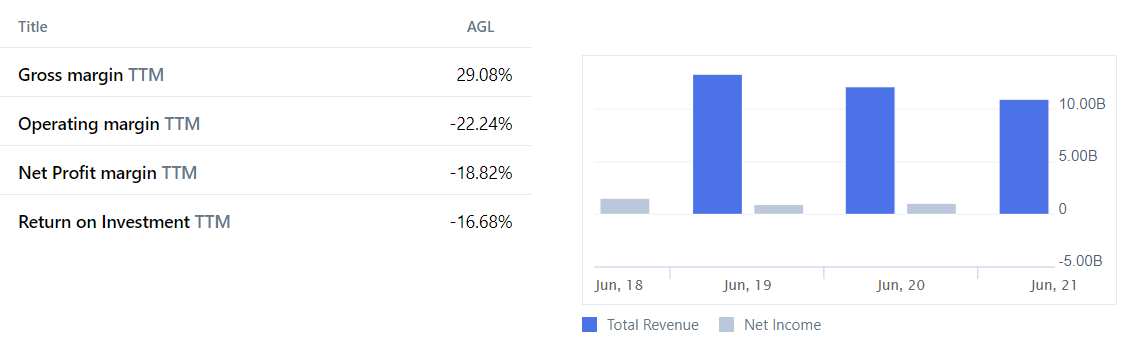

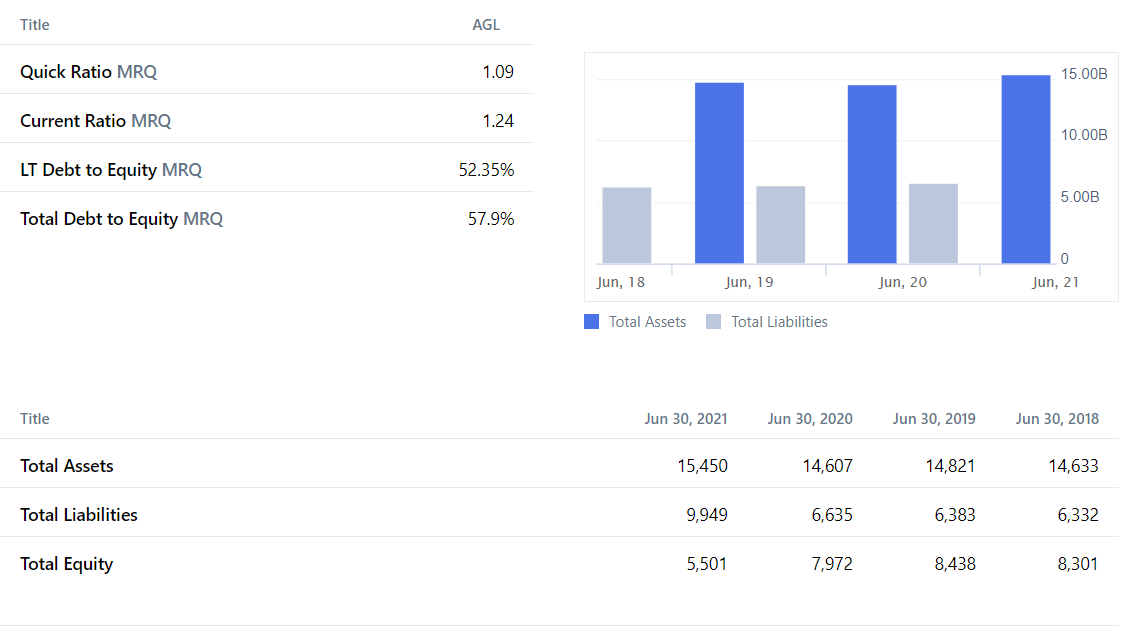

During the fiscal year which ended on 30th June, 2021, AGL Energy Limited saw a steady decrease in its revenues. The revenue reduced by 10 percent to 10.94 billion Australian dollars. The company’s net losses summed up to A$ 2.06 billion versus the income of A$ 1.01 billion. The revenue report clearly reflects the decrease in the integrated energy segment of the company. This segment saw a reduction by 25 percent which went down to a loss of A$ 3.37 billion. In the customer market segment there were losses as well. The segment experienced a decrease of 1 percent which totalled to A$ 7.58 billion. The net losses of AGL increased to A$ 1.93 billion. There were few fixed assets which were impaired. This also summed up to A$ 1.17 billion. The statistics pertaining to the income statement, cash flow and balance sheet of AGL has been presented below (AnnualReport, 2021).

AGL Income Statement

AGL Balance Sheet

AGL Cash Flow

(Source: Annual Report, 2021)

The financial results of fiscal year 2021 suggeststhat the energy market has sustained the falls of financial year 2020 and is expected to turn around for better. This gives hope to AGL. The company had experienced a decrease in the underlying profit after tax of 33.5 per cent which amounts to A$ 537 million. The corresponding dividends have also reduced for the year 2021 to 75 cents for each share. This includes the special dividend of 10 cents which had been paid in March. Though AGL Energy has a very competitive cost in the generation of electricity, the reduction in the wholesale price of electricity has created a pressure on the profitability of the company. The reports suggest that the performance of AGL Energy as a company, in terms of its finances have not been great during 2020-21. The Covid-19 pandemic and many other factors have led to the underpotential performance of the company. The reduction in the wholesale prices has also led to A$ 3.6 billion’s impairments. However, considering the growth prospect and upcoming opportunities to AGL, it is expected that the company’s performance will improve during 2021-22 (Annual Report, 2021).

Organisation’s Balanced Scorecard

The scorecard of AGL is a balanced one. The fiscal year of 2021 has set its priorities. The priorities include growth, transformation and social licence.

The company is aiming at accelerating their growth so that they can meet the needs of the evolving customers.

- To grow:

- The company is investing around 1.9 billion Australian dollars in new energy supply projects.

- They are planning for other innovative projects for which they have allocated a budget of 1.5 billion Australian dollars (Annual Report, 2021).

- The company is fundamentally reviewing every growth option.

AGL is planning its transformation strategically. They are repositioning, reinvigorating and refreshing their operations and structure.

- To transform:

- Between the years 2017 to 2019, AGL has taken up digital transformation programs summing up to A$ 400 million (Annual Report, 2021).

- The on-going emphasis of the company is on imbibing and incorporating the best-in-class technology.

- In their operations AGL is embedding better and exhaustive data analysis.

In terms of social licence, AGL acknowledges its responsibility towards the community. AGL is planning their operations in such a way so that they are able to meet the needs of the community. The company aims to excel and exceed in meeting the rising expectations of the community.

Fiscal Year 2021 Operational Goals

|

Safety |

Customers |

People |

Financial |

|

Reducing the TIFR of combined contractor/ employee |

Based on ranking of NPS versus the other retailers in tier-1 |

Enhance engagement towards the levels of fiscal year 2016 |

LTIP targets and per guidance |

Recommendations to Enhance Organisation’s Performance

The performance of AGL has been satisfactory over the last decade. However, the year 2020-21 saw a downfall of the company. The reasons include its internal drawbacks. But the biggest cause is the global pandemic of Covid-19 and the subsequent recession. To enhance the performance and improve the financials in the coming years, the company has to aggressively concentrate on strategic planning and its execution.

As an organisational consultant, there are few recommendations that can be suggested.

- AGL should start focusing on the reduction of carbon emissions. This will improve their brand image for being environmentally responsible. Reduction in carbon footprints is a part of their social responsibility towards the community.

- AGL needs to handle the demerger strategically. This year in June, AGL Energy planned for its demerger. The company announced to demerge and create two different energy generating companies. The two companies will be listed separately on the ASE. This demerger was proposed with the aim of improve the business of AGL Energy. As per the demerger plan, AGL Energy will now be known as Accel Energy Limited. This company will be generating electricity and concentrate on acceleration of the energy transition. The new entity that will demerge from Accel Energy will be known as AGL Australia Limited. This company will focus on energy-based multi-product retailing. The USP of the company should be flexible trading in energy, storage as well as supply. The demerger needs to be handle strategically to align it with the organisational goals. The two entities should separately focus on their target audience.

- Through demerger, AGL Australia will cater to the needs of Australian customers, while Accel Energy will concentrate on meeting the requirements of the industrial partners and large users of energy. This segregated operational structure must protect the shareholder value, focus on strategic opportunities and accelerate energy transition while moving towards a low carbon future.

- The company as a provider of energy/ electricity should concentrate on generating renewable energy. This will improve the environmental conditions and also provide sustainability to the company.

- AGL has to plan and develop strategies to address the demand for electric charging fleets.

- The company should focus on the well-being of the people, the community and empowerment of their employees.

Conclusion

AGL Energy has to prepare a strategic roadmap to achieve its business goals. The company’s performance has not been great during FY20. They are trying to improve their performance in FY21 by demerging and planning many more market moves strategically. The company has to develop an anticipatory culture which will be able to anticipate the changes in the market trends and adapt accordingly. The company needs to improve its productivity to meet the increasing energy demand in the industries. AGL has to review its portfolio and allocate the capital where required. AGL can improve its strategies and market standing by updating their operations as per the changes in the energy retail market. The use of digital solutions for meeting the needs of their customers could be low cost incurring.

Reference list

AGL Energy 2021, AGL Energy | An Electricity Provider & Gas Supplier | AGL, Agl.com.au, viewed 18 August 2021,

Annual Report 2021, viewed 18 August 2021,

BIZCLIK MEDIA LIMITED 2021, Telstra’s New Entity moves into Australian Energy Sector | Utilities, Energy Digital, viewed 18 August 2021,

Clean Energy Regulator 2021, Renewable Energy Target RET, www.cleanenergyregulator.gov.au, organisational performance assignment viewed 18 August 2021,

Galer, S 2021, SAP BrandVoice: AGL Energy Digitally Transforms For A Brighter Future, Forbes, viewed 18 August 2021,

Mazengarb, M 2021, AGL hit by huge losses as it scrambles to catch up with switch from baseload, RenewEconomy, viewed 18 August 2021,

Murphy, L 2021, Electric vehicle sales surge as Australia recovers, www.mynrma.com.au, viewed 18 August 2021,

Nissan Australia 2018, Two in three Australians feel the move to electric vehicles is inevitable, Nissan Australia, viewed 18 August 2021,

PEACOCK, B 2021, NSW’s largest electricity user plans to go green, abandoning AGL’s coal, pv magazine Australia, viewed 18 August 2021,

RBA 2021, Key Economic Indicators Snapshot, Reserve Bank of Australia, viewed 18 August 2021,

Tampubolon, E., Ceribasic, H. and Boche, H., 2020. On Information Asymmetry in Competitive Multi-Agent Reinforcement Learning: Convergence and Optimality. arXiv preprint arXiv:2010.10901.

Warren, M 2021, How energy colossus AGL could be the first victim of a brave new grid, Australian Financial Review, viewed 18 August 2021,