Risk Management Implementation Plan

Question

Task: You have been asked to write a risk management system for a new company. The company is setting up interstate rail passenger operations in Australia. The company’s operation will include a fleet of second-hand locomotives and passenger carriages, a major maintenance facility and offices and passenger handling facilities at capital city railway stations. The trains will operate scheduled services and all facilities, infrastructure, equipment and track access will be leased. Based on your readings and study in this Unit, describe the features of the RMS you would develop, the business risk issues, including rail safety, OHS, and regulatory compliance risks, you might have to consider.

Answer

IntroductionRailways are considered as being the most efficient, economic, environment friendly and safest mode of transportation. Railways are a crucial component of many countries and contribute directly towards the social and economic development and currently. Currently countries are experiencing significant social, economic, environmental and political pressure to enhance safety and operations. In Australia, safety is important among railway operators i.e. intensive use of railway enhances the probability of accidents. This report focuses on the risk management system for a new company. The company is setting interstate rail passenger operations in Australia. The operations of the company will include passenger carriages, fleet of secondhand trains, maintenance facility and passenger handling facilities at the city railway stations. Along with this, the trains will be operated on schedules, and infrastructure, equipment, track access and facilities will be managed (Arena, M., Arnaboldi, & Azzone 2011). It is well known that every organization has to face various risks while starting the business at initial level. The objective of this report is to identify various risks incurred in the business operations and prepare the risk management system for that company. Risk management system is the procedure of scheduling, controlling, and using the resources and actions of the organization that can be used to protect and grow the corporate assets (Beasley, Clune& Hermanson, 2011).

Potential risksThe company has to deal with wide range of current and possible risks while operating the business at the initial level. In order to identify, evaluate and minimize these risks, the company needs to establish a system so that uncertainties and threats in the business can be controlled or monitored. The risks affecting the business are considered into key categories i.e. operational, strategic, compliance and financial. All these risks will have significant impact on the company’s financial condition, business, prospects and operational results in the future. Some of the risks that will impact on the ability and business operations of the company are discussed below:

Strategic riskThe company will mainly operate in Australia and other emerging markets in future. These markets are subject to high level of risks in terms of political, economic, legislative uncertainties, and social factors. The business of the company will be depending on the demand of Australian freight rail transportation market that depends on the economic conditions of Australia. Further, due to technological shifts, political crisis and economic downturn and other factors can negatively impact on the company’s growth and business.

The company will be subjected to regulatory risk related to the operations of Australian railway transportation market and railway industry reform. Any kind of changes in the regulatory environment of Australian railway transportation markets in which the company is operating. Along with this, railway tariff regulations, and technical requirement for fleet maintenance can also negatively impact on the business, profitability and future growth and development. Further, the government of the country also has significant impact over the functions of Australian fleet rail market. The regulations of railway in Australia may change and that limiting the access of company’s stock on some regions (Bromiley, McShane, Nair & Rustambekov, 2015).

Operational riskThere can be various operational risks related to human resource, operational performance, and customer satisfaction. The success of the company depends upon the ability of human resource department to attract, retain and motivate the existing employees and qualified people in particular experienced management team. There is strong competition for such personnel with relevant area due to the small number of skilled and qualified candidates with relevant experience in the rail industry (Enmao&Yaqi, 2011).

Further, rising inflation in the country may enhance the cost of the company while the company has limited opportunities in order to enhance tariffs to the consumers. There can also be risk while satisfying the customers in the business. Customers always rely on the companies for high-quality freight rail transportation and other services. They also expect from the company to fulfill their needs i.e. timely collection and delivery of cargo, and availability of rolling stock. There can be risk in satisfying the customers as the timely delivery of cargo is dependent on the third party which performance could be unsatisfactory for the customers of the company (Zwaan, Stewart & Subramaniam, 2011).

Financial riskAt the initial level, company will have negligible share in the market. The company will be affected by the currency fluctuations in the country. Further, the operating cash flows and income of the company will also be affected by the interest rates in the market. Increase in the market rates will negatively impact on the profits of the company. Along with this, the business of the company will be capital intensive. Fluctuations in the financial market can restrict the access of source of fund for the company. Lack of funding from the market sources and increased market interest rates will negatively impact on ability of the company to achieve financing for the settlements of the liabilities and meeting the financial objectives (Suh, 2000).

Railway staff risksDespite of high level of safety measures, there is high risk in the industry in terms of injuries and fatalities. Track workers are helpless because of moving trains, use of heavy plants and equipment’s, high voltage of electricity, poor environmental conditions and need of working anti-social hours. So, it is the challenge for the company to implement range of measures in order to enhance the workers’ and employees’ safety by the use of high-visibility clothing, safety culture interventions, safe-working process on track and various technologies to warn the workers of upcoming trains (?underlík, 2004). Along with this, there will be high risk of accidents in the rail industry that are needed to minimize for the safety of employees. The staff may also face various risks including injuries from moving trains and assaults from passengers, trips and falls and slips (Khaddour, Cherkaoui, Koursi&Berrado, 2011).

Occupational health safetyIn case of employees’ safety, occupational health safety is the big concern for the company. So, it is very important to identify various types of health hazards of the employees while working in the project of rail transportation. In case of occupational health safety, proper training to the work should be given to the employees. Along with this, appropriate safety equipment’s should also be given to the employees so that they can keep themselves safe. Further, the company must ensure that it is following the OHS rules and regulations imposed by the Government of Australia. Company should use the equipment’s and devices that are approved by the government of the country. While carrying out the project of rail transportation, the company should focus on the regulations that are set by OHS.

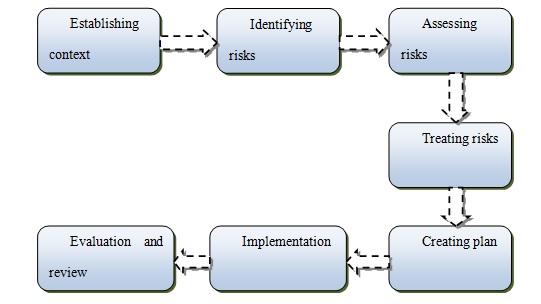

Risk management planThe term risk management can be defined as the continuous and developing process that should be able to address all the associated risks of past, present and future. Risk management process basically includes risk identification, risk evaluation, and risk monitoring and response. Based on the above identification of risks, there is the need to implement the risk management plan in the company so that potential risks can be addressed at the initial level. The managers need to coordinate in a proper manner with the stakeholders in the company for establishing effective risk management strategy and plan by which managers in the company will be able to identify the strength, weakness, opportunities and threats for managing the business operations in the railway industry. For the current scenario, there are some reasons to implement risk management plan in the company (Khaddour, Cherkaoui,El-Koursi&Berrado, 2010).

Steps in risk management planThe steps included to develop risk management plan for the new company in railway industry are discussed below:

Step 1: Establishing the context- This is the first step that will identify the objectives of the stakeholders so that the availability of the resources can be determined. Along with this, the structure will be recognized for coping with different scenarios arising in the development phase.

Step 2: Identifying potential risks- This step includes identification of the probable risks by various methods i.e. talking with the stakeholders, recognizing major areas of safety concerns, and brainstorming.

Step 3: Evaluation of identified risks- The process of risk evaluation includes assessing the recognized risks on the basis of possibility of incident and harshness of loss. It will be helpful in prioritizing the risks.

Step 4: Strategies for the possible risks-This step includes the process of dealing with the risks by the methods or course of actions to deal with the risks.

Step 5: Risk management plan- The development of risk management plan depends upon proper action s, measures and controls for the improvement process.

Step 6: Execution of plan – The execution of plan includes with executing the intendedsystems for dealing with the impact of risks.

Step 7: Assessing and analyzing the plan- There can be need of changes or additional information in the plan. For this objective, evaluation and constant review of the plan will be done.

Risk identification Based on the above analysis of risks, there are some risks identified in the railway business. Those risks are technical risks, external risks, organizational risks, performance risk, project management risks, security risks, financial risks legal risks and social and potential risks.

Risk assessmentFor the assessment of risk, grading matrix will be used. The risk identified for this new company are prioritized based on the risk matrix that is given below:

|

Identified |

Incidence |

Level |

Rank |

|

Physical risks (conditions, accidents, natural disaster) |

Medium |

High |

2 |

|

Fiscal and economic risks (Funding and price increases) |

Low |

High |

3 |

|

Social and political (Public disorder, refusal with law) |

Low |

High |

1 |

|

Legal risks (disputes, payment delay and change in rules and policies) (Commonwealth of Australia, 2014) |

High |

Low |

2 |

|

Operational risks (lack of communication and coordination) |

Medium |

Low |

3 |

Treating the potential risks

|

Risk Description |

Risk Response |

|

Physical risks (conditions, accidents, natural disaster) |

Elimination or avoidance |

|

Financial and economic risks (Funding and inflation) |

Mitigation or reduction |

|

Social and political (Public disorder, non-compliance with law) |

Retention or accept |

|

Legal risks (disputes, payment delay and change in rules and policies) |

Retention or accept |

|

Operational risks (lack of communication and coordination) |

Share or transfer |

|

Security risks (Corruption, employee safety) (Bimini, 2013) |

Share or transfer |

Risk management planThere are various steps in the risk management plan and those are discussed below:

Setting the list of identified risks- The risks are scheduled based on the basis of rating of high to low risks. This will be helpful in the process of risk response planning.

List of possibleresponse- The process of risk recognition needs classification of all the risks based on their impact, possibility and particular nature (Bray, 2004).

Tools and techniques- this process includes identification of tools and techniques for the formation of risk response strategy. The techniques can be avoidance, mitigation and acceptance.

Monitoring and control of planThe risk management plan can be controlled and monitored with the definite tools, techniques, participation and productivity.

Participation- This includes risk management plan, communication plan, risk response plan, change on project scope, and risk analysis and identification

Tools and techniques- This includes risk reviews, risk response audit, performance evaluation and measurement, and earned value analysis.

Productivity- This factor includes risk database, change requests, risk response strategy matrix, work load plans, corrective and appropriate actions and checklist of risk identification.

Risk communication plan

|

Stakeholder |

Message |

Strategy |

Frequency |

Communicators |

Feedback |

|

Manager |

Previous day check point achieved |

Board meetings |

Weekly |

Project management team |

|

|

Sponsor |

Communicate about the projects |

Weekly status report |

Monthly |

E-mail, In person |

|

|

Team |

Top-down conversation and declaration of the issues |

Team conference |

On a daily basis |

Employees |

With each person |

|

Chartering committee |

Escalate the issues for resolution |

Weekly |

Administrative members |

Shared drive |

ConclusionThis report focuses on the risk management plan of a new company that is going to start its business in the Australian railway industry. The company is setting interstate rail passenger operations in Australia. The operations of the company will include passenger carriages, fleet of secondhand trains, maintenance facility and passenger handling facilities at the city railway stations. Based on the above analysis, it is observed that company needs to establish a system so that uncertainties and threats in the business can be controlled or monitored. There is the need to implement the risk management plan in the company so that potential risks can be addressed at the initial level. Risk management process will basically include risk identification, risk evaluation, and risk monitoring and response.

ReferencesArena, M., Arnaboldi, M., and Azzone, G. 2011, Is enterprise risk management real?.Journal of risk research, 14(7), pp.779-797

Beasley, M. S., Clune, R., and Hermanson, D. R. 2011, Enterprise risk management: An empirical analysis of factors associated with the extent of implementation. Journal of Accounting and Public Policy, 24(6), pp.521-531.

Bhimani, A. 2013, Risk management, corporate governance and management accounting: Emerging interdependencies. Management Accounting Research, 20(1), pp.2-5

Bray, D. 2004, Risk tolerability and rail safety regulation, (online). Available from: http://atrf.info/papers/2005/2005_Bray_b.pdf(accessed on 7th April 2018)

Bromiley, P., McShane, M., Nair, A., and Rustambekov, E. 2015, Enterprise risk management: Review, critique, and research directions. Long range planning, 48(4), pp.265-276.

Burrow, M. P. N. 2017, A Review of Risk Management Applications for Railways, (online). Available from: https://www.researchgate.net/publication/317749032_A_Review_of_Risk_Management_Applications_for_Railways (accessed on 7th April 2018)

Commonwealth of Australia, 2014, Trends Infrastructure and Transport to 2030, (online). Available from: https://infrastructure.gov.au/infrastructure/publications/files/Trends_Infrastructure_and_Transport_to_2030.pdf(accessed on 7th April 2018)

?underlík, D., 2004, Characteristics of business risk management. Economics focus characteristics of business risk management. 12 (6)

Enmao, W., &Yaqi, L., 2011, Research on Risk Management of Railway Engineering Construction. Systems Engineering Procedia. 1, 174-180

Khaddour, M., Cherkaoui, A., El-Koursi, E., &Berrado, A., 2010, A Framework for Risk Management in Railway Sector: Application to Road-Rail Level Crossings, (online). Available from: https://hal.archives-ouvertes.fr/hal-00542424/document (accessed on 7th April 2018)

Khaddour, M., Cherkaoui, A., Koursi, E., &Berrado, A., 2011, A Framework for Risk Management in Railway Sector: Application to Road-Rail Level Crossings. The Open Transportation Journal. 5, 34-44

Suh, S. D. 2000, Risk management in a large-scale new railway transport system project: Evaluation of Korean High Speed Railway Experience. IATSS Research, 24, 53-63

Zwaan, L., Stewart, J., and Subramaniam, N. 2011, Internal audit involvement in enterprise risk management. Managerial auditing journal, 26(7), pp.586-604