Statistical Analysis Assignment On The Performance Of Wood, Furniture & Paper Manufacturers Of UK

Question

Task: The client is a business investor. This client has not invested in the UK wood, furniture and paper manufacturing sector before. The client wants you to analyse the data provided on UK wood, furniture and paper manufacturers, and to present the analysis as a business report of no more than 2,500 (excluding tables, charts and appendices). The report should help the client in their aim to better understand potential company performance in the UK wood, furniture and paper manufacturing sector, in order to target future investment. The client has requested the following from you:

The client requires you to provide:

- An analysis of the distribution of the profit rate across all companies in the data set.

- An analysis of the distribution of the profit rate, comparing the large and SME (small & medium sized) firms in the data set.

- An analysis of the distribution of the profit rate, comparing manufacturers in the data set by their export activity.

- An analysis of the distribution of Return on Capital Employed comparing large and SME manufacturers in the data set.

- An analysis of the export activity of the manufacturers in the data set against their size, measured by whether they are large or SME companies

- An analysis of the extent to which the profit rate across all manufacturers in the data set is associated with the other quantitative variables in the data set.

- An analysis of the extent to which the profit margin for manufacturers in the data set that can be predicted using the other quantitative variables in the data set.

Answer

1: Introduction

In the present statistical analysis assignment we analyse the information on the performance of Wood, Furniture and paper manufacturers of UK. The information is available from the year 2017. Thus, information of 565 manufacturers from UK has been analysed in the present report. The performance has been measured through profit, sales, size, returns, production costs and the type of organization. The manufacturers have been segregated into two groups based on the export characteristics. It has been recorded that some of the manufacturers produce all their products for UK only. On the other hand, there are manufacturers who export a proportion of their produce. Further, the manufacturers are also classified based on the number of employees working. SMEs for the purpose of the manufacturers are defined as those who have less than 250 employees. On the other hand, manufacturers having more than 250 employees are classified as large organizations.

2: Answers to the questions

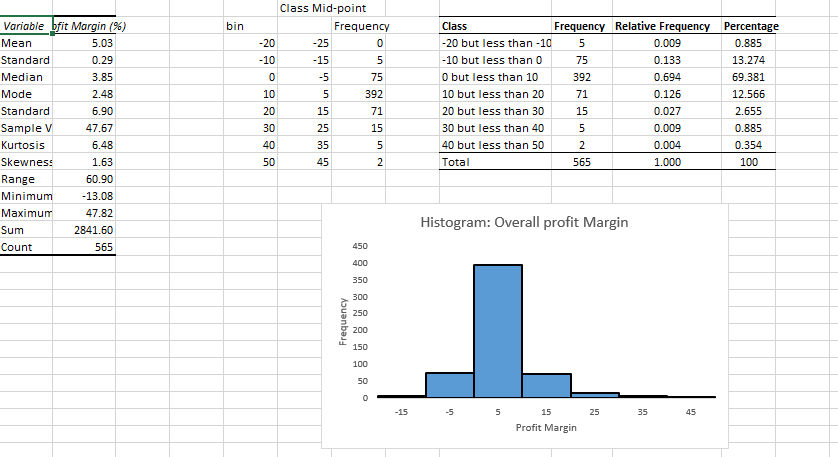

Part a: The profit margin is a numerical data. Hence to comprehend the distribution pattern of numerical information contained in Profit Margin we study the descriptive Statistics. Further, we analyse the Histogram within this statistical analysis assignment to study the distribution profit margins of manufacturers (Black 2019).

Table 1: Descriptive statistics – Overall Profit Margin

|

Variable |

Profit Margin (%) |

|

Mean |

5.03 |

|

Standard Error |

0.29 |

|

Median |

3.85 |

|

Mode |

2.48 |

|

Standard Deviation |

6.90 |

|

Sample Variance |

47.67 |

|

Kurtosis |

6.48 |

|

Skewness |

1.63 |

|

Range |

60.90 |

|

Minimum |

-13.08 |

|

Maximum |

47.82 |

|

Sum |

2841.60 |

|

Count |

565 |

The average profit margin of the 565 organizations identified in the context of statistical analysis assignment for 2017 is 5.03% of total sales revenue. The profit margin of the organizations in 2017 had a standard deviation of 6.90%. Further, from the analysis of the data it is found that for 50% of the organizations the average profit margin was less than 3.85%. The minimum and maximum profit margin was -13.08% and 47.82%.

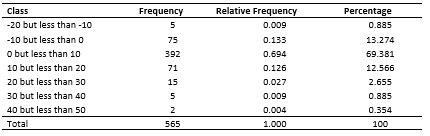

Table 2: Distribution - Overall Profit Margin

The distribution of the overall profit margin is right skewed. This is because the average profit margin is more than the median profit margin. Further, we find that 69.38% of the organizations have a profit margin in the range of 0 to 10%. 0.885% of the organizations have a profit margin between -20 to -10%. Furthermore, the study developed in the statistical analysis assignment noted that 0.354% of the organizations profit margin ranges from 40 to 50%.

Figure 1: Histogram- Overall Profit Margin

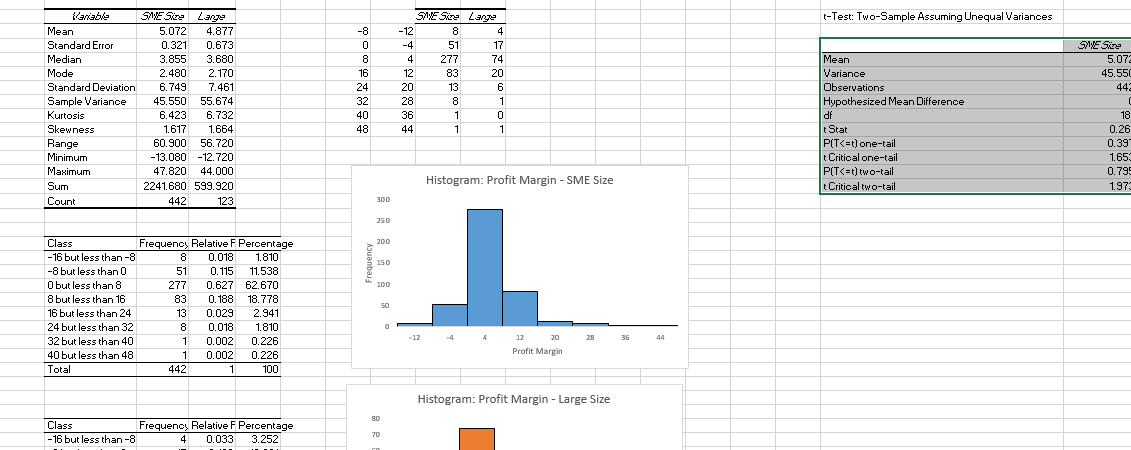

Part b

The statistical analysis assignment analyses the concept of Descriptive Statistics and Histogram that are used to investigate the profit rate across the size of the firms. The method provides information of the relation between mean and median of a numerical variable. In the condition that the median value is less than the mean then the variable is deemed to be right skewed. On the other hand, when the median is equal to mean then the variable is normally distributed. Further, histogram illustrated herein statistical analysis assignment provides information on the type of curve that the variable would produce.

Table 3: Descriptive Statistics – Profit Margin

|

Variable |

SME Size |

Large |

|

Mean |

5.072 |

4.877 |

|

Standard Error |

0.321 |

0.673 |

|

Median |

3.855 |

3.680 |

|

Mode |

2.480 |

2.170 |

|

Standard Deviation |

6.749 |

7.461 |

|

Sample Variance |

45.550 |

55.674 |

|

Kurtosis |

6.423 |

6.732 |

|

Skewness |

1.617 |

1.664 |

|

Range |

60.900 |

56.720 |

|

Minimum |

-13.080 |

-12.720 |

|

Maximum |

47.820 |

44.000 |

|

Sum |

2241.680 |

599.920 |

|

Count |

442 |

123 |

The average profit margin of SME size organization is 5.072%. The average profit margin has a standard deviation of the SME size organizations is 6.749% (Quirk 2016). Further, from the analysis of the data it is found that for 50% of SME size organizations the average profit margin was less than 3.855%. The minimum and maximum profit margin of SME size organizations were -13.08% and 47.82%.

The average profit margin of large organization is 4.877%. The standard deviation of the Large organizations is 7.461%. Further, from the analysis of the data it is found that for 50% of Large organizations the average profit margin was less than 3.680%. The minimum and maximum profit margin of Large organizations were -12.720% and 44.0%.

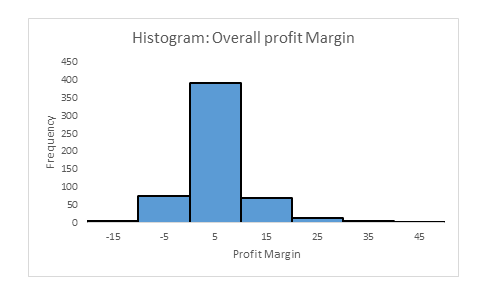

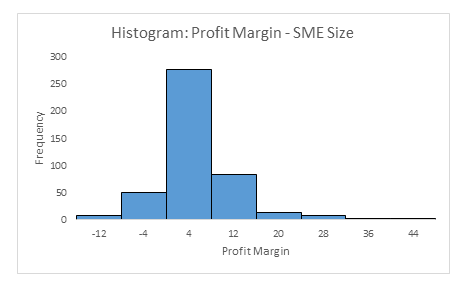

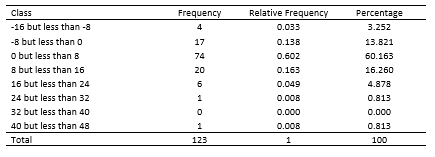

Table 4: Distribution – Profit Margin – SME size

The distribution of the overall profit margin for SME organizations is right skewed. This is because the average profit margin is more than the median profit margin. Further, we find that 62.67% of the SME organizations have a profit margin in the range of 0 to 8%. 1.81% of the organizations have a profit margin between -16 to -8%. In addition, 0.226% of the organizations profit margin ranges from 40 to 48% (Berenson 2012).

Figure 2: Histogram – Profit Margin – SME size

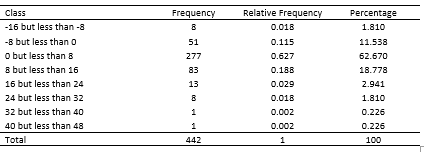

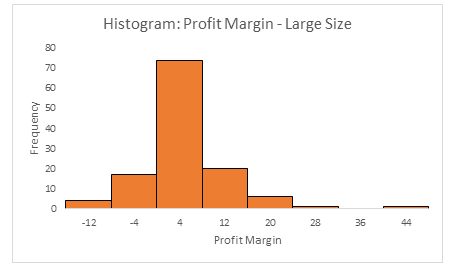

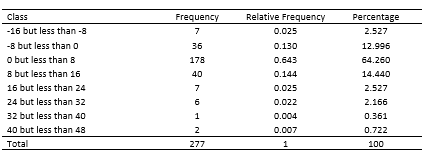

Table 5: Distribution – Profit Margin – Large

The distribution of the overall profit margin observed in the statistical analysis assignment for Large organizations is right skewed. This is because the average profit margin is more than the median profit margin for Large organizations. Further, we find that 60.163% of Large organizations have a profit margin in the range of 0 to 8%. 3.252% of the organizations have a profit margin between -16 to -8%. In addition, 0.813% of the organizations profit margin ranges from 40 to 48% (Anderson 2020).

Figure 3: Histogram – Profit Margin – Large

We analysed the profit margin of SME to Large organizations. Independent sample t-test is used to investigate the relation between the mean profit margins of SME to Large organizations.

Null Hypothesis: There is no difference in the profit margins of SME and Large Organizations

Alternate Hypothesis: There is difference in the profit margins of SME and Large Organizations

The level of Significance a = 0.05

Table 6: Independent Sample t-test – Size of Organization

|

SME Size |

Large |

|

|

Mean |

5.072 |

4.877 |

|

Variance |

45.550 |

55.674 |

|

Observations |

442 |

123 |

|

Hypothesized Mean Difference |

0 |

|

|

df |

181 |

|

|

t Stat |

0.261 |

|

|

P(T<=t) one-tail |

0.397 |

|

|

t Critical one-tail |

1.653 |

|

|

P(T<=t) two-tail |

0.795 |

|

|

t Critical two-tail |

1.973 |

From the analysis it is found that there no statistically significant difference between profit margins of SME and Large organizations, t (181) = 0.261, p-value = 0.795. Since p-value is more than the level of significance, hence we reject the Null Hypothesis (Black 2019).

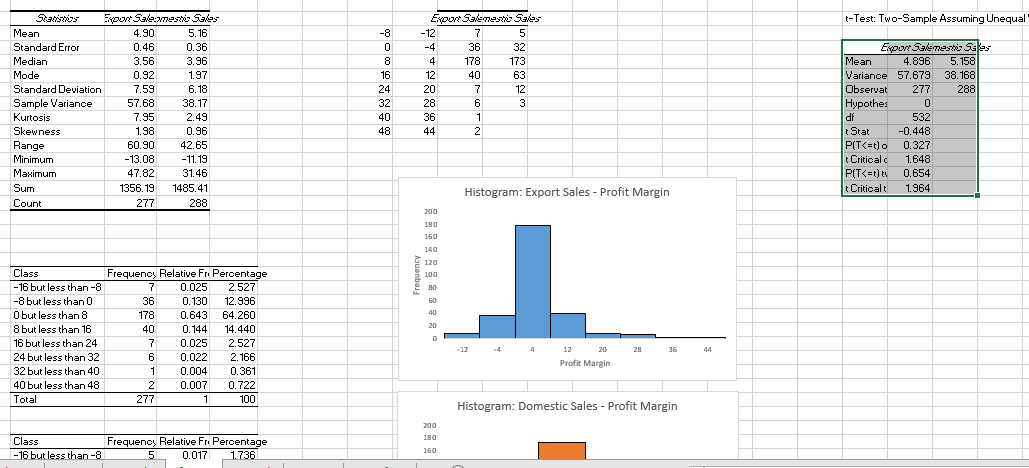

Part c

Table 7: Descriptive Statistics – Export Activity

|

Statistics |

Export Sales |

Domestic Sales |

|

Mean |

4.90 |

5.16 |

|

Standard Error |

0.46 |

0.36 |

|

Median |

3.56 |

3.96 |

|

Mode |

0.92 |

1.97 |

|

Standard Deviation |

7.59 |

6.18 |

|

Sample Variance |

57.68 |

38.17 |

|

Kurtosis |

7.95 |

2.49 |

|

Skewness |

1.98 |

0.96 |

|

Range |

60.90 |

42.65 |

|

Minimum |

-13.08 |

-11.19 |

|

Maximum |

47.82 |

31.46 |

|

Sum |

1356.19 |

1485.41 |

|

Count |

277 |

288 |

The average profit margin of organization with Export Sales is 4.90%. The standard deviation of the such organizations is 7.59%. Further, from the analysis of the data it is found that for 50% of organizations having Export Sales the profit margin was less than 3.56%. The minimum and maximum profit margin of organizations with production for export sales only were -13.08% and 47.82% respectively (Black 2019).

The average profit margin of organization with Domestic Sales is 5.16%. The standard deviation of the such organizations is 6.18%. Further, from the analysis of the data it is found that for 50% of organizations having Domestic Sales the profit margin was less than 3.96%. The minimum and maximum profit margin of organizations with production for domestic sales only was -11.19% and 31.46% respectively.

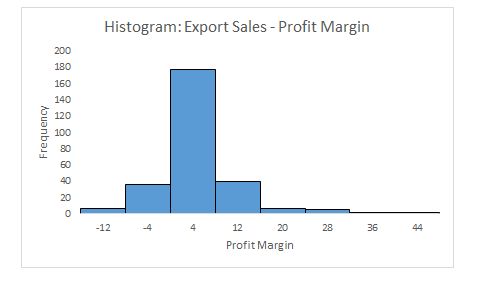

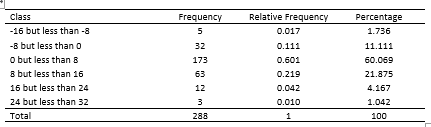

Table 8: Distribution – Profit Margin – Export Sales

Figure 4: Histogram – Export Sales – Profit Margin

The distribution of the overall profit margin for organizations which manufacture for Export is right skewed. This is because the average profit margin is more than the median profit margin for such organizations. Further, we find that 64.260% of the organizations have a profit margin in the range of 0 to 8%. 2.527% of the organizations have a profit margin between -16 to -8%. In addition, 0.722% of the organizations profit margin ranges from 40 to 48% (Quirk 2016).

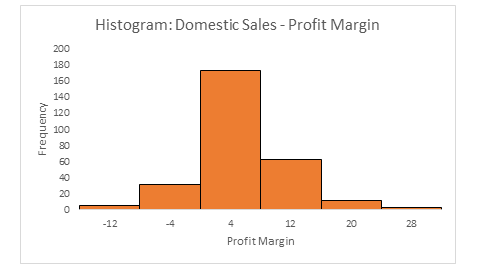

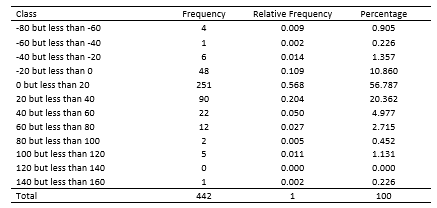

Table 9: Distribution – Profit Margin – Domestic Sales

Figure 5: Histogram – Domestic Sales – Profit Margin

The distribution of the overall profit margin for organizations where production takes place for domestic sales is skewed right. This is because the average profit margin is more than the median profit margin for the organizations. Further, we find that 60.069% of the organizations have a profit margin in the range of 0 to 8% (Anderson 2020). 1.736% of the organizations have a profit margin between -16 to -8%. In addition, 1.042% of the organizations profit margin ranges from 24 to 32% (Black 2019).

We analysed the profit margin between organizations having domestic sales and export sales within this statistical analysis assignment

Null Hypothesis: There is no difference in the average profit margins of domestic and export sales

Alternate Hypothesis: There is difference in the average profit margins of domestic and export sales

The level of Significance a = 0.05

Table 10: Independent Sample t-test – Export Activity of Organization

|

Statistics |

Export Sales |

Domestic Sales |

|

Mean |

4.896 |

5.158 |

|

Variance |

57.679 |

38.168 |

|

Observations |

277 |

288 |

|

Hypothesized Mean Difference |

0 |

|

|

df |

532 |

|

|

t Stat |

-0.448 |

|

|

P(T<=t) one-tail |

0.327 |

|

|

t Critical one-tail |

1.648 |

|

|

P(T<=t) two-tail |

0.654 |

|

|

t Critical two-tail |

1.964 |

From the analysis done in the context of statistical analysis assignment it is found that there no statistically significant difference between profit margins of Export and domestic sales organizations, t(532) = -0.448, p-value = 0.654. Since p-value is more than the level of significance, hence we reject the Null Hypothesis (Black 2019).

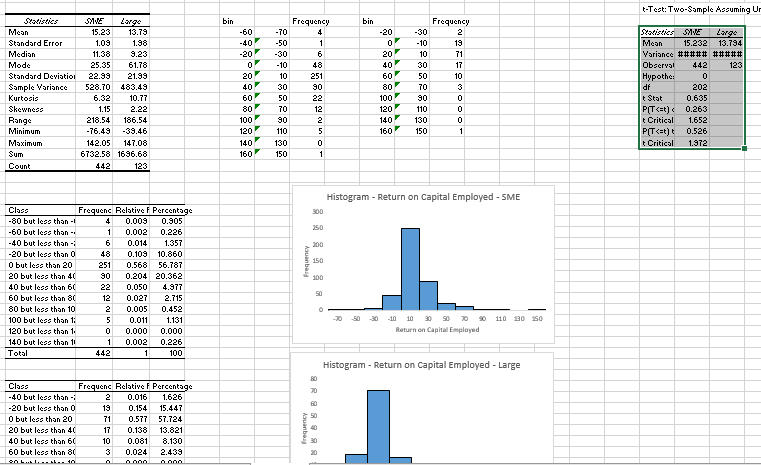

Part d

Figure 6: Descriptive Statistics – Return on Capital Employed

|

Statistics |

SME |

Large |

|

Mean |

15.23 |

13.79 |

|

Standard Error |

1.09 |

1.98 |

|

Median |

11.38 |

9.23 |

|

Mode |

25.35 |

61.78 |

|

Standard Deviation |

22.99 |

21.99 |

|

Sample Variance |

528.70 |

483.49 |

|

Kurtosis |

6.32 |

10.77 |

|

Skewness |

1.15 |

2.22 |

|

Range |

218.54 |

186.54 |

|

Minimum |

-76.49 |

-39.46 |

|

Maximum |

142.05 |

147.08 |

|

Sum |

6732.58 |

1696.68 |

|

Count |

442 |

123 |

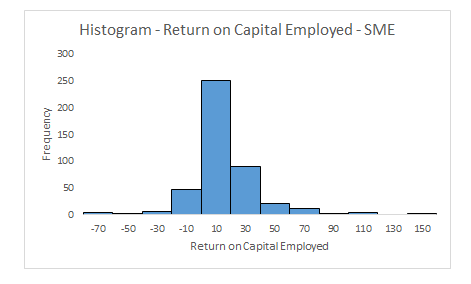

Table 11: Distribution – Return on Capital Employed – SME

Figure 7: Histogram – Return on Capital Employed – SME

The average return on capital employed (RCE) for SME manufacturers are 15.23. Further, from the analysis of the data it is found that for 50% of organizations having RCE less than 11.38. Thus, RCE for SMEs is right skewed. Further, it is found in the context of statistical analysis assignment that 56.787% of the manufacturers have a RCE between 0 and 20 (Anderson 2020).

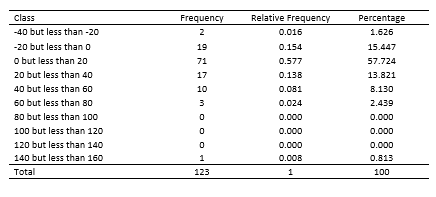

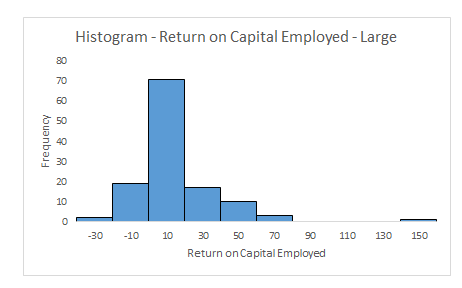

Table 12: Distribution – Return on Capital Employed – Large

Figure 8: Histogram – Return on Capital Employed – Large

The average return on capital employed (RCE) for large manufacturers are 13.79. Further, from the analysis of the data obtained in the statistical analysis assignment it is found that for 50% of organizations having RCE less than 9.23. Thus, RCE for Large manufacturers is right skewed. Further, it is found in the study developed in this statistical analysis assignment that 57.72% of large manufacturers have a RCE between 0 and 20 (Black 2019).

The mean return on capital employed for SME and Large organizations was analysed through independent sample t-test

Null Hypothesis: There is no difference in the average return on capital employed for SME and Large Organizations (Berenson 2012)

Alternate Hypothesis: There are differences in the average return on capital employed for SME and Large Organizations

The level of Significance a = 0.05

Table 13: Independent Sample t-test – Return on Capital Employed

|

Statistics |

SME |

Large |

|

Mean |

15.232 |

13.794 |

|

Variance |

528.698 |

483.494 |

|

Observations |

442 |

123 |

|

Hypothesized Mean Difference |

0 |

|

|

df |

202 |

|

|

t Stat |

0.635 |

|

|

P(T<=t) one-tail |

0.263 |

|

|

t Critical one-tail |

1.652 |

|

|

P(T<=t) two-tail |

0.526 |

|

|

t Critical two-tail |

1.972 |

From the analysis provided in the statistical analysis assignment it is found that there no statistically significant difference between average return on capital employed for SME and Large organizations, t(202) = 0.635, p-value = 0.526. Since p-value is more than the level of significance, hence we reject the Null Hypothesis.

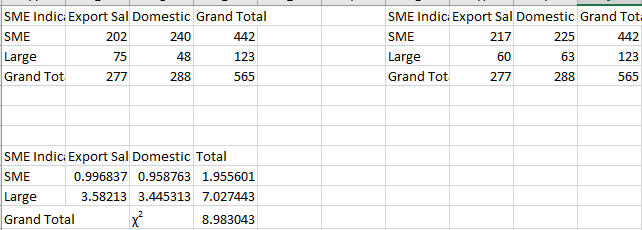

Part e

To investigate the relationship between export activity and size of the organization within this statistical analysis assignment, chi-square test of association is used.

Null Hypothesis: There is no association between SME indicator and Exporter type

Alternate Hypothesis: There exists an association between SME indicator and Exporter type

Level of significance: a = 0.05.

Table 14: Association between SME and Exporter

|

SME Indicator |

Exporter |

Row Total |

|

|

Export Sales |

Domestic |

||

|

SME |

202 (217) |

240 (225) |

442 |

|

Large |

75 (60) |

48 (63) |

123 |

|

Column Total |

277 |

288 |

565 |

An apparent pattern can be seen from the crosstab for SME indicator and Exporter Type. The manufacturers whose product are meant for exported only is more likely to be SME ( =73%), rather than Large SME’s

Manufacturers whose products are for domestic sales are more likely to be SME’s manufacturers than Large producers

Since there were only 2 rows and columns, the Yates correction has been used. Thus, the value of

From the table given in the statistical analysis assignment we find that

Since the test statistics is more than the critical value, hence we reject the Null Hypothesis (Black 2019). Thus we, find that there is an association between manufacturers export activity and exporter type.

Part f

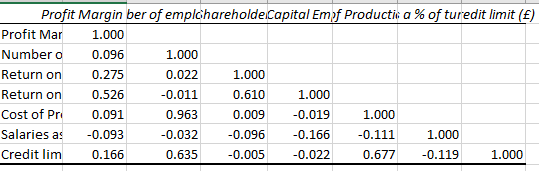

Table 15: Correlation of Profit Margin with other Variables

|

Profit Margin (%) |

|

|

Profit Margin (%) |

1.000 |

|

Number of employees |

0.096 |

|

Return on Shareholder Funds (%) |

0.275 |

|

Return on Capital Employed (%) |

0.526 |

|

Cost of Production (£) |

0.091 |

|

Salaries as a % of turnover (%) |

-0.093 |

|

Credit limit (£) |

0.166 |

Correlation analysis is used to measure the association between profit margin and other numerical variables.

From the analysis done in this segment of statistical analysis assignment we find that profit margin is positively correlated with Number of employees, Return on Shareholder funds, return on capital employed, cost of production and Credit limit. On the other hand, there is a negative correlation between profit margin and Salaries as % of turnover (Berenson 2012).

Part g

Bivariate analysis discuss in the statistical analysis assignment is used to analyse the degree to which profit margin of the manufacturers can be predicted through the use of other numerical variables (Anderson 2020).

Null Hypothesis: The regression coefficients of the independent variables is equal to zero

Alternate hypothesis: The regression coefficients of the independent variables is not equal to zero

The hypothesis is tested herein statistical analysis assignment at a = 0.05, level of significance.

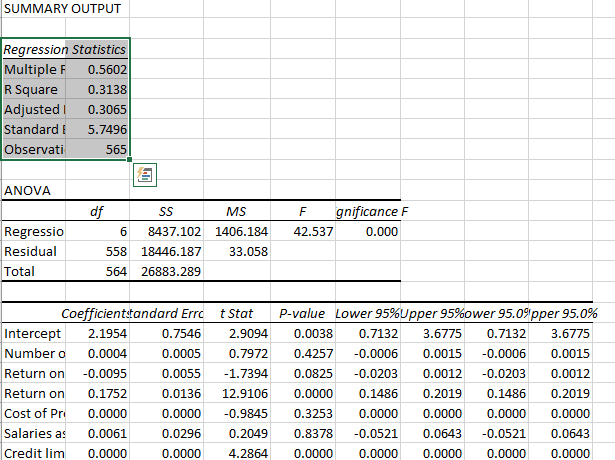

Table 16: Regression Statistics

|

Regression Statistics |

|

|

Multiple R |

0.5602 |

|

R Square |

0.3138 |

|

Adjusted R Square |

0.3065 |

|

Standard Error |

5.7496 |

|

Observations |

565 |

Table 17: ANOVA Table

|

df |

SS |

MS |

F |

Significance F |

|

|

Regression |

6 |

8437.102 |

1406.184 |

42.537 |

0.000 |

|

Residual |

558 |

18446.187 |

33.058 |

||

|

Total |

564 |

26883.289 |

Table 18: Regression

|

Coefficients |

Standard Error |

t Stat |

P-value |

|

|

Intercept |

2.1954 |

0.7546 |

2.9094 |

0.0038 |

|

Number of employees |

0.0004 |

0.0005 |

0.7972 |

0.4257 |

|

Return on Shareholder Funds (%) |

-0.0095 |

0.0055 |

-1.7394 |

0.0825 |

|

Return on Capital Employed (%) |

0.1752 |

0.0136 |

12.9106 |

0.0000 |

|

Cost of Production (£) |

0.0000 |

0.0000 |

-0.9845 |

0.3253 |

|

Salaries as a % of turnover (%) |

0.0061 |

0.0296 |

0.2049 |

0.8378 |

|

Credit limit (£) |

0.0000 |

0.0000 |

4.2864 |

0.0000 |

From the regression analysis performed in the statistical analysis assignment the prediction model for profit margin is:

Profit margin = 2.1954 + 0.0004(Number of employees) – 0.0095(Return on shareholder return) + 0.1752(Return on capital employed) + 0.0000(Cost of Production) + 0.0061(Salaries as a % of turnover) + 0.0000(Credit Limit).

31.38% of the variation in profit margin can be explained through the independent variables.

From the analysis done in the statistical analysis assignment we find that we can reject the F-stat test statistics, p-value is less than 0.05. Hence, we reject the Null Hypothesis.

This can be interpreted as: At least one of the independent variables significantly affects the profit margin.

3: Discussion, Conclusion and Recommendation

From the analysis of the data provided in the segments of statistical analysis assignment it can be seen that on an average there was positive sales revenue for the manufacturers of Wood, paper and furniture. Moreover, half of the organization had positive sales revenue. Further, it is found from the analysis that the average profit margins for SMEs are higher than large manufacturers. In addition, the average profit margin for manufacturers having domestic sales is higher than export sales. The average return on Capital for SMEs is higher than large manufacturers. There is an association between Exporter type and SME indicator. The percentage of profit margin that can be predicted is very less.

References

Anderson, D.R., Sweeney, D.J., Williams, T.A., Camm, J.D. and Cochran, J.J., 2020. Statistical analysis assignment Essentials of modern business statistics with Microsoft Excel. Cengage Learning.

Berenson, M., Levine, D., Szabat, K.A. and Krehbiel, T.C., 2012. Basic business statistics: Concepts and applications. Pearson higher education AU.

Black, K.U., 2019. Business statistics: for contemporary decision making. Wiley.

Quirk, T.J., 2016. Excel 2016 for Business statistics: a guide to solving practical problems. Statistical analysis assignment Springer.

Appendix

Part a

Part b

Part c

Part d

Part e

Part f

Part g