Strategic Analysis Assignment: Case Analysis of Fiat Chrysler & Peugeot

Question

Task: This assignment is focused on the selected organisation, its industry and business environment. Please choose one case (featuring an organisation) for the purposes of this assignment.

The Strategic Report should address the following:

1) Carry out external analysis (business environment and industry) to identify a set of Opportunities and Threats and assess industry attractiveness. (30%)

2) Analyse the resources and key competences of the organisation to identify a set of Strengths and Weaknesses and identify core competences (key factors that may give the company its competitive advantage). (30%)

3) Evaluate the given strategy(as per chosen case)using SAFe criteria. (30%)

Answer

1. Introduction

Herein strategic analysis assignment, in the process of strategic analysis, there is the involvement of researching the business environment of the organisation in which it is operating (Bolland 2017). It essentially comprises of strategic planning for the purpose of decision making and the smooth functioning of the organisation. This process is important for developing a shared vision of the future of the organisation. There are some major steps which will be taken for moving the organisation in the correct direction.

In this report of strategic analysis assignment, the case study of Fiat Chrysler and Peugeot will be analysed. The external and internal environment will be providing an in-depth analysis of the companies and the automobile industry of the United Kingdom. A strategic evaluation will be done and this will be supported by the SAF model.

2. External Analysis

2.1 PESTLE Analysis

|

PESTLE Analysis |

Description |

Opportunity or threat analysis |

|

Political |

The United Kingdom is running under the influence of a parliamentary system. This country is quite fair and a stable one with a lot of opportunities. However, there are issues of corruption and uncertainty due to Brexit (Bbc.com 2019). Hence it is seen that in this industry there are around 41,000 job losses. |

Threat |

|

Economic |

The economy of the United Kingdom is in a stronger position than that of the other countries. They are having a high GDP but also some issues. There is a slow recovery from the economic recession. The turnover of this industry is worth 82 billion euros and it is adding 18.6 billion euros value to the UK economy (Smmt.co.uk 2019). It is found that eight out of the 10 cars are produced in the UK and exported overseas to approximately 160 markets. However, it is seen that the demand for cars is falling. It is because of the trade tensions and the huge competition. |

Opportunity |

|

Social |

The social factor is quite important for the analysis. It is seen that in the United Kingdom there are high social standards. There are free public services and the country is open to migration. However, there are issues due to ethnic groups and increasing dependency ratio. However, consumers are unable to handle the competition among the companies (Great.gov.uk 2019). There is no such loyalty towards a brand. |

Threat |

|

Technological |

The UK is having good access to technology. There is a high quality of innovation and high internal competition for stimulating growth. However, in comparison to the United States, there is slow technological development. It was necessary for the carmakers to sell electric cars. Hence they had to change the operations and the gear for the mass market. It was seen that the UK car output was driven down because of the demand from China (Bbc.com 2019). There was a lack of charging infrastructure on roads in the US and Europe. |

Opportunity |

|

Legal |

There are proper legal standards which are maintained by the government of the United Kingdom. The employees are being protected by the Employment Act 1996. Then there are paternity leave, holiday pay, minimum wages and many more. There is the Equality Act 2010 which protects people from any kind of discrimination. There is a shift taking place from ownership (Bbc.com 219). It is also seen that jobs are being lost due to the pandemic and also the impacts of Brexit. |

Threat |

|

Environmental |

The United Kingdom has reduced huge impacts on the environment. They are trying to reduce the negative impacts. This is being supported by the government, charities, newspapers and the local councils. The aim is to create environmental awareness and improve economic growth. However, there are issues due to emission woes in the UK. Car firms are taking tension due to the concerns of the air quality and taxation changes (Bbc.com 2019). There are tough carbon dioxide emission standards for handling global warming and this makes it expensive for the building of the cars. |

Threat |

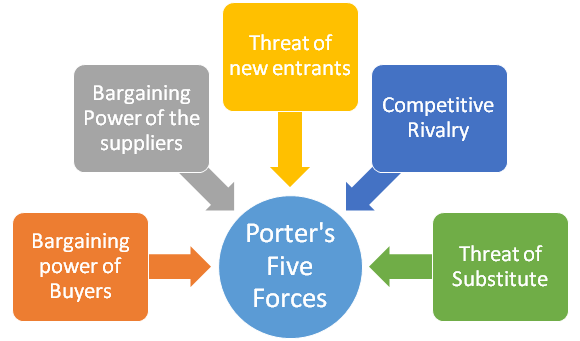

2.2 Porter’s five forces

The attractiveness of the industry is completely dependent on the porter’s five forces. According to AYDIN (2017, p.378), the opportunities and threats of the industry can be analysed by the model of porter’s five forces. This is an analytical tool which helps to determine the profitability levels and rivalry intensity. Strategies can be developed at later stages through the analysis of the forces. Given below are the factors of five forces which will help in knowing the automobile industry in a better way.

Figure 1: Porter’s Five Forces

(Source: Self-Developed)

|

Porter’s Five Forces |

Description |

Intensity |

|

Threat from the new entrants |

There is a low intensity of threat from the new entrants. It is because there is a high barrier for entry in this industry. There are hardly players who are capable of venturing into the automotive industry especially in the UK. There will be a requirement of capital investments, manufacturing facilities and the distribution network. It is possible for the present automobile companies to sustain by having augmented production. This usually leads the new entrants to enter in large scale. |

Low |

|

Competition from the substitute |

There is some existence of the substitute in the market. It is seen that the automobile industry does not provide cost-efficient solutions and hence there is an increasing threat. It is seen that the people of the United Kingdom can well make use of public transport instead of private cars (Rawlinson and Wells 2016). They can also consider the option of rented cars. |

Moderate |

|

Bargaining power of the suppliers |

There is a high switching cost in the automobile industry of the United Kingdom. It is mainly because there is a fair amount of investment required in part designing and specification requirement. The input cost usually has a significant effect on profitability. Globalisation is increasing in the industry and hence it is seen that the suppliers are from the UK and also from other parts of the world (Automotivecouncil.co.uk 2019). There are some manufacturers who have joined hands with the OEMs from India and China for sourcing the materials from the UK. |

Low |

|

Bargaining power of the Buyers |

It is seen that commercial companies, individuals and governments are the main buyers of motor vehicles. There is the influence of price on the individual customers and there is little power over the manufacturers. The power of the buyers is high because new designs are well differentiated. The purchasers are having the power of regulating the market and the competition is increasing. The consumers are having choices of the various brand which is making the situation difficult for the automobile industry of the UK. |

High |

|

Rivalry from the competitors |

The United Kingdom is the home of approximately 50 car manufacturers and they are known for selling 200 models. There is intense competition among companies. Some of the local manufacturers are Ford, GM and many more. There is competition from foreign manufacturers too. Most of the companies are having a similar market share and hence there are fights taking place for leadership. Chrysler is one such North American manufacturer who is trying to imitate the competition. |

High |

3. Internal Analysis

3.1 Resources and Capabilities

Tangible resources are the physical assets possessed by the company including retail outlets, equipment, products and manufacturing facilities. Intangible resources include brands, intellectual property and financial capital under the ownership of Peugeot (PSA).

|

Tangible Resources and Capabilities |

||

|

Resources |

Assessment |

Results |

|

Financial |

PSA possesses the strong financial capability of generating income. The company has expanded rapidly acquiring a number of car companies including a number of brands such as Fiat, Ambassador, Vauxhall and Opel Motors (Benhayoun et al.2017). PSA has a robust financial model based on which it has implemented various cost-cutting techniques gradually reducing the debt in the market. |

Financial capability is the strength of the company |

|

Physical |

PSA through its rapid expansion has ensured a strong presence in all its locations. Head office of the company is located in Rueil-Malmaison and all of the retail units in subsidiary sections are owned by the company. PSA has numerous vehicle manufacturing and development sites around the world. However, in developing units such as India, Tunisia and Atlanta the company is struggling to acquire quality raw materials. |

This resource is a weakness |

|

Technological |

Peugeot has in its possession a number of brands including Opel, Vauxhall and Peugeot. However, there is limited control over the trade secrets and intellectual property compared to its competitors. |

Weakness |

|

Intangible Resources of the company |

||

|

Human Resources |

Peugeot has skilled managers in its middle levels ensuring smooth operations for its business. Staffs at ground levels especially in units acquired later do not possess the contemporary specialised skills required in vehicles manufacturing. |

Weakness |

|

Innovation |

The research division of Peugeot is superior in terms of delivering quality products integrated with state of the art technology in automobile manufacturing. Peugeot has successfully developed the “Hybrid Air” engine applying technology to passenger cars (Bruin, Sanberg and Pataki 2019). The company has received “Car of the Year” 18 times owing to the path-breaking technology applied by it in vehicles. |

Innovation is a strength of the joint venture |

|

Reputation |

Peugeot has a superior reputation in its domain due to the well-built cars possessing ride comfort. More than the brand value customers prefer its products owing to the high reliability being provided by it to customers. It has a high-reliability index of 96. The cars are not as expensive compared to products of rivals |

Reputation is among the strength of the company |

Finances, innovation and high reputation are the resilient internal capabilities of Peugeot lending it with the desired edge. On comparison human resources, technology and distribution are some of the areas which require improvements.

3.2 Competences

Competencies are the advantages and resources lending the required edge to a business. Among the core competencies of Peugeot is its ability to generate capitals. The strong financial model being followed has resulted in strategic acquisitions and mergers critical for enhancing the brand presence of the company. The company as on date has huge buying power rendering it with the ability acquires non-performing units and ekes high levels of profitability. Debts of the company have been mitigated by the high revenues generated by it in its different sales channels (Qin 2016). Research and development are a succinct advantage of the company owing to the application of superior technology to harness electrical technology in hybrid vehicles. There are electric motor scooters and electric bicycles being manufactured by the company. The final products being manufactured by the company are considered to be of high reliability. Smooth rides coupled with well-functioning motors accentuate the overall reputation in its European markets. The interfaces and superior finish of the vehicles allure customers looking for differentiated options in the market. All of the above competencies contribute to the value chain of Peugeot providing it with an edge among the vehicle manufacturers in the market.

3.3 Value Chain analysis

Primary activities

The primary activities of PSA are linked with selling and producing the vehicles to its direct customers. An analysis can enhance the performance as listed below:

Inbound Logistics

Peugeot requires strong relationships with suppliers to receive, store and subsequently distribute the vehicles among direct customers. It can be seen that Peugeot has a strong relationship with suppliers under European operations affirming steady supplies of raw materials and spare parts required for the construction of quality automobiles. However, it is still struggling to develop strategic relationships with suppliers of quality components in the markets which have been newly acquired by it.

Operations

PSA has depicted strategic foresight in its operations. There are common technology and assembling assets with separate sales/marketing structure. PSA brand is spread over a number of nations including India, China, Tunisia, South Africa and Iran. The operational activities include assembling, machining, packing and testing which are carried out in separate plants. Segregation of the activities implies a strong control over the entire operational structure.

Outbound Logistics

An outbound logistics activity in PSA encompasses material handling, warehousing, scheduling, order processing and delivering to the required destination (Vazquez, Sartal and Lozano-Lozano 2016). PSA adheres to a timely schedule assuring minimal negative impact on the quality of the vehicles being delivered by it. This increases the growth of opportunity for PSA.

Marketing and Sales

It can be seen that PSA follows a push marketing strategy to reach out to target customers. Advertising, promotions, salesforce, competitive pricing and building relationships with the different channel members are focussed on to communicate the value being provided (Dewitz 2019). However, the company has a limited presence in social media channels which is a huge area for improvement.

Service

After-sales service and repair of PSA are not delivered on time, reducing the appeal among its target consumer base weakening its position in the market. However, pre-purchase services and reliability of the vehicles balance this major flaw.

Secondary activities

Firm Infrastructure

Quality management, legal matters, strategic management and financial planning are among the strengths of PSA tendering it with an intense competitive advantage in the external environment. Cost-cutting measures have been used by the company to salvage debts and expand rapidly (Dewitz 2019). Further, there is a high emphasis on quality. The company should look to reduce its overhead costs.

Human Resource

Human resources of PSA especially in ground levels do not possess the skills required for delivering quality products under contemporary circumstances. PSA needs to arrange for workshops to ensure superior material delivery in its shop floor activities.

Technology

PSA is well known for its use of technology in integrating vehicles with hybrid technology. Product and process developments are being used by PSA to enhance their products. The company needs to invest more in technology to sustain its position in the market. There is a huge focus by PSA for reducing the weight of vehicles and designing compact cars infused with versatility, modularity and reduction in emissions.

Procurement

This act involves the procurement of superior quality raw material. Deep investments are made by the company to establish strategic relationships with its partners (Dewitz 2019). High-quality standards are maintained from the base to top-level in its established market. PSA is yet to forge strong partnership alliances in its developing markets.

3.4 VRIO Analysis

|

Resources and Capabilities |

Valuable |

Rare |

Inimitable and Non-Sustainable |

Organised to Exploit |

Impact of the competitive advantage |

|

Financial Operations |

Yes |

Yes |

Yes |

Yes |

Sustainable Competitive Advantage |

|

Physical Resources |

Yes |

No |

No |

Yes |

Temporary Competitive Advantage |

|

Technological Resources |

Yes |

No |

No |

Yes |

Temporary Competitive Advantage |

|

Human Resources |

Yes |

No |

No |

Yes |

Temporary Competitive Advantage |

|

Innovation |

Yes |

Yes |

Yes |

Yes |

Sustainable Competitive Advantage |

|

The reputation of the company |

Yes |

Yes |

Yes |

Yes |

Sustainable Competitive Advantage |

4. Strategy Evaluation

4.1 TOWS

|

Internal Factors |

|||

|

External Factors |

|

Strengths (S) |

Weaknesses (W) |

|

Opportunities (O) |

· The financial position of PSA is strong and it is seen that there are opportunities in the technological sector of the automobile industry and hence some improvement can be done. The carmakers can use finance for innovation in the automobile sector. · Further, there are some economic opportunities which can help in building the reputation of the company even more. PSA is already having a good reputation in the market.

|

· Although there is economic opportunity, but the human resource of PSA is weak. Hence proper focus will be needed in this section.

|

|

|

|

Threats (T) |

· Environmental threat of the automobile industry can be managed by the strength of innovation of PSA. In this way, the problems of emission and other environmental impacts can be handled easily.

|

· Technology is one of the weaknesses which is a threat to society. It is seen that consumers look for technological development in the automobile industry. · PSA is having physical infrastructure as one of their weaknesses and it is seen that due to this reason there is a threat in the legal factors of the automobile industry. It is because a lot of employees are leaving their jobs. |

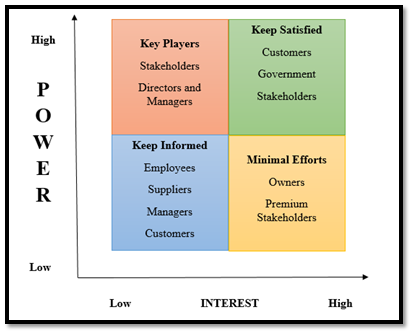

4.2 Interest/Power Matrix

According to Tjandra, Ensor and Thomson (2019), stakeholders are important to be identified and managed for the businesses. This leads to high chances of success. Hence, Mendelow’s matrix analyses the stakeholders on the basis of power and interest. It is quite important to analyse the stakeholders so that strategies can be made for the future. This matrix will help in managing communication and planning among all the groups. This is made below of PSA and Fiat merger. It is seen that the key players are stakeholders, managers and directors. It is necessary to keep customers, government, stakeholders. In case of keeping informed, there are employees, suppliers, managers and customers. However, minimal efforts are required for owners and premium stakeholders.

Figure 2: Interest/Power Matrix

(Source: Self-Developed)

For the SAF test, there are mainly two stakeholders chosen. This will be helpful in case of the merger. It is because there are some hurdles in the merger like political and financial ones. The deal between the PSA Group and Fiat Chrysler would create a business of the combined market value of $50 billion (Bbc.com 2019). Stakeholders and employees are the two main ones which are selected for SAF test.

4.3 SAF Tests

The SAF tests help in evaluating the strategic options. SFA stands for the suitability, feasibility and acceptability. Proper judgement is done in each of the criteria and scoring is done on the strategy.

|

Strategy |

Stakeholder involved |

Suitability |

Acceptability |

Feasibility |

|

It will be important to focus on the technological sector. It is because by the merger new innovation can be done. Hence the focus should be on technology and innovation. |

PSA and Fiat Chrysler Stakeholder |

This strategy will be suitable because PSA is having a strong financial position. It will be necessary for the stakeholders to take some important decision for this strategy. |

This strategy will be acceptable by the stakeholders of both companies. It is because the aim will be to attract more customers through new technology in the market. It will also be providing a competitive advantage in this merger. |

This strategy will be quite feasible because if new innovation is done then the financial positions of the companies will be improving. |

|

There needs to be some improvement made in human resources. The merger should satisfy the needs of the employees. It is because the economic situation of the automobile industry is strong and the companies will be having the capability of looking after the needs of the employees. |

Employees of Fiat Chrysler and PSA |

There is a high amount of suitability for this strategy. Once there is an improvement in human resources then productivity will be improved. |

This will be acceptable by the stakeholders and the company owners. It is because better development of the companies will take place. |

The strategy is feasible because a large number of efforts will not be required. Employee satisfaction will be improved. |

5. Conclusion

This report was on strategic analysis of the case study of Fiat Chrysler and PSA. This is the merger between the two companies. However, for better understanding, there was an external and internal analysis done. The external analysis was on the business environment of the automobile industry. The opportunities and threats were identified. Porter's five forces were done. In case of the internal analysis resources and capabilities were identified. This included competences and VRIO analysis. TOWS analysis and Interest Matrix was done. SAF tests were done by selecting two stakeholders. This strategy included stakeholders and employees especially.

Reference List

Automotivecouncil.co.uk. 2019.The automotive sector of the UK. Available at: https://www.automotivecouncil.co.uk/uk-automotive-sector-overview/ [Accessed on 4th November 2019]

AYDIN, O.T., 2017. Assessing the environmental conditions of higher education: in a theoretical approach using porter’s five forces model.Journal of Higher Education and Science, 7(2), pp.378-391. [Available at: http://higheredu-sci.beun.edu.tr/doi.php?doi=10.5961/jhes.2017.215]

Bbc.com. 2019,Automobile industry of the UK. Available at: https://www.bbc.com/news/business-48545733 [Accessed on 4th November 2020]

Bbc.com. 2019.PSA and Fiat Chrysler merger. Available at: https://www.bbc.com/news/business-50228611 [Accessed on 4th November 2020]

Benhayoun, I., Bonin, F., de Faverges, A.M. and Masson, J., 2017. Simulation and Optimization Driven Design Process for S&R Problematic-PSA Peugeot Citroën Application for Interior Assembly (No. 2017-01-1861).SAE Technical Paper. [Available at: https://www.sae.org/publications/technical-papers/content/2017-01-1861/]

Bolland, E.J. ed., 2017.Comprehensive Strategic Management: A Guide for Students, Insight for Managers.Emerald Group Publishing. [Available at: https://books.google.co.in/books?hl=en&lr=&id=G-3hDgAAQBAJ&oi=fnd&pg=PP1&dq=strategic+management+book&ots=8K7Menwn1X&sig=hjzEmrRyHSRZGdu _MERENs7AB9I]

Bruin, W., Sanberg, V. and Pataki, A., 2019.Positioning the French Goddess, The Citroën DS case. LBMG Corporate Brand Management and Reputation-Masters Case Series. [Available at: http://lup.lub.lu.se/student-papers/record/9007816/file/9007818.pdf]

Dewitz, P., 2019. Industry Initiatives Towards Environmental Sustainability in the Automobile Value Chains. In Sustainable Global Value Chains (pp. 565-583).Springer, Cham. [Available at: https://link.springer.com/chapter/10.1007/978-3-319-14877-9_30]

Great.gov.uk. 2019.UK automobile industry. Available at: https://www.great.gov.uk/international/content/about-uk/industries/automotive/ [Accessed on 4th November 2019]

Qin, Z., 2016. Can PSA Peugeot Citroën Succeed in China?.In Market Entry in China (pp. 45-58).Springer, Cham. [Available at: https://link.springer.com/chapter/10.1007/978-3-319-29139-0_6]

Rawlinson, M. and Wells, P., 2016.The new European automobile industry.Springer. [Available at: https://books.google.co.in/books?hl=en&lr=&id=1AW_DAAAQBAJ&oi=fnd&pg=PR8&dq=+automobile+industry+in+UK&ots=JXESGYRXYO&sig =XRcr7HGzJKd93oLKYkfFvLeNWgQ]

Smmt.co.uk. 2019.Automotive in the UK. Available at: https://www.smmt.co.uk/industry-topics/uk-automotive/ [Accessed on 4th November 2020]

Tjandra, N.C., Ensor, J. and Thomson, J.R., 2019.Co-Creating with Intermediaries: Understanding Their Power and Interest.Journal of Business-to-Business Marketing, 26(3-4), pp.319-339. [Available at: https://www.tandfonline.com/doi/abs/10.1080/1051712X.2019.1611086]

Vazquez, X.H., Sartal, A. and Lozano-Lozano, L.M., 2016. Watch the working capital of tier-two suppliers: a financial perspective of supply chain collaboration in the automotive industry. Supply Chain Management: An International Journal. [Available at: https://www.emerald.com/insight/content/doi/10.1108/SCM-03-2015-0104/full/html]

Appendix

Figure 1: UK Automobile industry