Strategic Management assignment on the role of the financial sector towards economic development

Question

Task: how to assess the financial sectors contributions towards development usingStrategic Management assignment research methods?

Answer

Organisational and industry context

On this Strategic Management assignment it is observed that the Banking sector plays a central role in the financial system of Australia because it holds the majority of financial system assets. Banking industry in Australia incorporates 250 per cent of GDP to the country which is about $2.3 trillion (Gov.au, 2022). There are currently 53 numbers of banks operating in Australia, among those 53 numbers, 14 are predominantly Australian owned. Commonwealth Bank of Australia has been selected as the organisation for the strategic analysis in this report. The Commonwealth Bank of Australia (CBA) is the Australian multinational bank that offers a variety of financial services. All financial services provided by this bank includes superannuation, institutional banking, retail banking, funds management, investment, insurance and broking services (Commbank.com.au, 2022). This bank also has operations in different nations including the Asian countries, the US, New Zealand and the UK. It is necessary to state that Commonwealth Insurance is the largest Australian firm listed among the three strategic influences implemented by commonwealth bank. As per the Strategic Managementassignment findings, the Primary mission of this bank is to empower people and the communities and make sustainable, transparent and balanced business decisions.

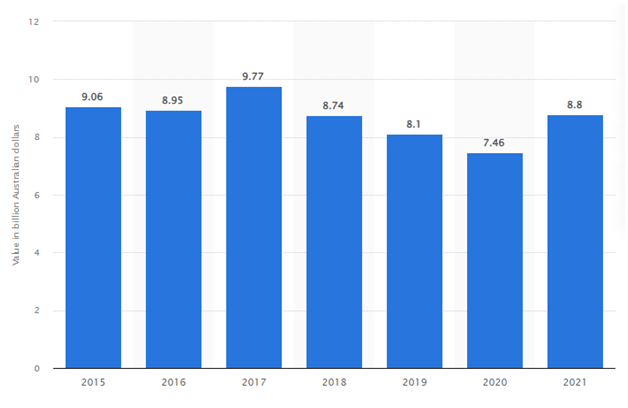

Figure 1: Net profit after tax of the Commonwealth Bank of Australia

(Source: Statista.com, 2022)

It has been identified that after tax, 8.8 billion Australian dollars profit generated by the Commonwealth Bank of Australia in the year 2021 (Statista.com, 2022). According to the latest statistics in 2020, the largest Australian bank in the world has a total of 43,585 employees.

Strategic Management assignment key priorities

Issues identified

From the Strategic Management assignmentone, it has been identified that Commonwealth Bank of Australia is facing certain kinds of strategic issues. All these issues are mentioned below:

Governance issue:

According to the Strategic Management assignmentreport of an expert of APRA, the bank is facing issues regarding the governance. Under the governance issue, there is an absence of effective nonfinancial risk supervision methods in the Commonwealth Bank of Australia (Richardson, 2022). The bank is also facing issues associated with the poor application of benchmarking tools to measure the performance. This is due to the poor “ability to self-reflect” of managers and financial experts of the bank.

Lack of structure

The Australian Commonwealth Bank has a lack of clear structure towards risk management responsibilities especially at the top level. As stated by Alazabet al. (2021), due to the unique internal organizational structures, the bank is unable to achieve competitive advantage in terms of managing issues associated with the customer security data security and privacy breaches. Unfavorable cultural qualities present within the bank also hindered them to achieve high end productivity.

Pandemic issue

Australian Commonwealth Bank has a customer base which had high purchase standards but after the pandemic, the purchase capacity has significantly decreased. As a result of such a crisis, capacity there had been an overall fluctuation of financials for the bank. Under suchStrategic Management assignment conditions, their competitors followed digital mode for banking operation which strongly betrayed their performance.

Pressure from industry

Australia has a highly competitive banking industry where the power of suppliers is increasing day by day. According to Astuti and Saputra (2019), entrance of new banking organisation into the sector creates high competition in terms of innovation and customer attraction. Suppliers in the sector also have the capability of lowering the profit margin by applying their monopoly position. Along with high market competition there has been a lot of substitute services provided by start a business that create issues for Australian Commonwealth Bank to survive.

Reason to prioritize issues

It is necessary to prioritize all the strategic issues so that the Commonwealth Bank is able to manage any kind of risk during any crisis. It is necessary to manage the governance issue presence within the Australian Commonwealth Bank so that the internal structure of the organisation can be improved to provide unique services to its customers. It is also necessary to prioritize the issues related to the high power of suppliers because it can increase future profit margin on Commonwealth Bank of Australia by raising the operating cost. High pressure from the competitive rivalry and development of substitutes also should be prioritized by the Australian Commonwealth Bank so that it cannot interfere with a loyal customer base.

Recommendation of competitive strategies

Under the current competitive conditions observed on this Strategic Management assignment, Commonwealth Bank of Australia needs to focus on the implementation of certain kinds of strategies to manage all the strategic issues identified. All those recommendations are as follows:

Good governance structure

Commonwealth Bank of Australia needs to focus on implementing good organisational governance policies. There is also a need to establish a duty of care along with implementation of good organisational culture. Establishment of good government not only helps to improve the responsibility of top management but it would also help them to maintain a unique organisational structure too. The bank is also recommended to implement effective risk management approaches so that it can help them to manage any kind of pandemic in future.

Strategic Management assignment - Merger and acquisition

It has been identified that there are strategic issues regarding the entry of a new banking organisation into the Australian financial services sector (Kitsioset al. 2021). In order to manage the strategic issue of entry of new banking businesses, Commonwealth Bank is recommended to merge with small existing financial service businesses. The bank is also recommended on this Strategic Management assignmentto carry out the acquisition process for the start-up financial service businesses so that it can help them to add resources and improve capabilities to fight against market competitions.

Recruiting variety of vendors

It has been stated earlier that supplier in the Australian financial service sector have a monopoly market position (Comerton-Forde et al. 2018). Under monopoly market position, suppliers exert power in the banking organisation resulting in the decreased profit margin of Commonwealth Bank. Instead of relying on a single supplier Commonwealth Bank is recommended to build connections with multiple suppliers. Connecting with multiple suppliers would not be able to create any kind of issue by applying their single authority on the bank.

Service differentiation

It is another important recommendation given to the Commonwealth Bank to manage the issue of market substitution affecting the customer base of the bank. According to Vives (2019), digital disruption in the banking sector creates an opportunity to provide a unique service experience to users. In this regard Commonwealth Bank is also recommended to disrupt the digital technology to provide unique digital financial services to their customers especially during the time of any crisis. Commonwealth Bank is recommended on this Strategic Management assignment to follow blue-ocean strategy to differentiate services like discounting bills of exchange, special loan for orphans, and extra benefit for old age people, where they can create market threat for their rivalries.

Partnership, collaboration and strategic alliance

Commonwealth Bank of Australia is recommended to follow the partnership, collaboration and strategic alliance process with their competitors to reduce pressure from them. As mentioned by Chadderton and Norton (2019), private and government bank partnerships in Australia help to improve strategic capability. Australian Commonwealth Bank is also recommended to follow the partnership and collaboration with other private banks or other government banks. Collaboration not only helps to decrease competitive pressures but it would also help to improve strategic capability to survive against any kind of market risk.

Complementary strategic actions

Commonwealth Bank of Australia is needed to follow a certain kind of complementary strategy to improve their strategic position into the competitive market. All the strategic options that could be taken by the bank to strengthen their competitive position are mentioned in the below section:

Strategic Management assignment - Defensive strategy

Defensive strategies are used by banking organisation to defend their business from potential competitors. Commonwealth Bank of Australia can implement both the active and passive defensive strategy to improve competitive position in the market. Under the active defensive strategy, Commonwealth Bank can provide promotion discounts and lower price financial service opportunities to their customers. All those active Strategic Management assignmentdefensive strategies can help Commonwealth Bank to cut down the sales and profitability of their competitors like Westpac banking, BNZ bank, HSBC bank, ANZ, The Royal Bank of Scotland and OCBC bank. Under the passive defensive strategy, Commonwealth Bank can innovate new services and expand their business operation. Innovative Strategy may include the implementation of Robotic Process Automation in the banking operation of Commonwealth Bank.

Community marketing

In order to improve the strategic position of Commonwealth Bank of Australia it is necessary to implement a unique idea of community banking. As mentioned by Stambaugh et al. (2020), community banking is a process where banking organisation start providing traditional banking services in their local communities. Community marketing strategy would help Commonwealth bank to attract local customers as well as help to build stronger connections with them. It would also help the bank to achieve competitiveness in the Australian banking sector. It would definitely help Commonwealth banks to increase their market share by spreading risk and diversification of financial services for their costumes.

Strategic Management assignmentFirst mover strategy

First mover strategy focuses on gaining competitive advantage by acquiring lots of customers with help of strong brand recognition and customer loyalty before competitors enter the arena. As opined by Carter and McKenzie (2020), first mover strategy in banking helps to first introduce services to the market to gain popularity. Commonwealth Bank of Australia can also follow this strategy to introduce innovative technology to provide unique experiences to their customers. Such a first mover strategy Commonwealth Bank can introduce predictive artificial intelligence and robotic branch assistants in their different branches. The right here will be the first mover one that can help to save the operation cost of the bank as well as provide unique customers experience to gain competitive benefit.

Blue-ocean strategy

Blue Ocean Strategy is about creating an uncontested market place and making the competition irrelevant. As stated by Rahman et al. (2022), the banking sector plays the most crucial role in the economic development of a nation. In order to strengthen market position Commonwealth Bank needs to focus on implementation of Blue Ocean Strategy that could incorporate a better economy to Australia. Under such a strategy Commonwealth Bank of Australia needs to focus on unexplored new segments of customers who are eventually not targeted by other private and government competitive banks. The Strategic Management assignment findings show Instead of fighting for a share in the highly competitive market, shrinking the market by targeting new segments of customers would make competition placed by rivalries of Commonwealth banks irrelevant.

Premier services

Premier services will be another important strategy that could help Commonwealth Bank to improve their governance structure and manage strategic issues. It would also help to provide unique privileges to its stakeholders regarding improvement of Banking performance. According to Souidenet al. (2020), Premium banking services offer help to develop suitable relationships between banking organisation and customers. providing premium banking service also helps to exclusively increase the Profit margin of Commonwealth Bank compared to other private banks. Access to the bank's global centres, preferential rates, tailored investment offerings for customers, transactional specialists and emergency assistance to family members would be some of Premier services that could be provided by Commonwealth Bank to attract customers for increasing sales volume to strengthen competitive position.

Strategic Management assignmentMerger and acquisition

In order to improve the market position Commonwealth, focus on improving their resources and capabilities. It has been identified that entry of new businesses is creating lots of pressure on the customer building policy of Commonwealth Bank (Astuti and Saputra, 2019). In order to manage such kind of issues towards achievement of competitive benefit, the Commonwealth can merge and acquiesce to start up business. Such merger and acquisition would help to strengthen the competitive position of the bank by diversifying risk and acquiring much talent.

Strategic alliance

This is another important factor identified on this Strategic Management assignmentthat could be followed by the Commonwealth Bank of Australia to reduce market competition. According to Heet al. (2020), Strategic alliances in the banking sector aim at rationalizing business operations. As the market competition in the Australian financial service sector is very high and the power of suppliers is increasing day by day, Commonwealth Bank of Australia can follow strategic alliances with their competitors. development of alliances with competitors would help to suppress the competitive pressure on the back as well as help to increase economic scale by increasing profit margin.

Two areas the organisation should consider

All the recommended strategies are provided to improve the market performance of the bank as well as to strengthen their competitive position. For the implementation of all the strategy it is necessary to consider certain areas, these two areas are as follows:

Organisational culture

Organisational culture is the underlying norms, rules, principles, behaviour and attitude of members of an organisation. As stated by Tewari (2021), a good company culture helps to take action and coordinate against competitors. In the present context a good organisational culture is required within the Commonwealth Bank of Australia to build competency and more top management to respond against any kind of risk. It has been stated earlier that the organisation is facing issues regarding governance and organisational structure hindering them to achieve competitiveness. Hence, an effective organisational culture is necessary to implement suitable organizational structure and governance. As opined by Ismail et al. (2018), good organisational culture is able to build strong competencies and capabilities between organisations to carry out merger and acquisition processes. In order to implement the merger and acquisition process as per the Strategic Management assignment guidelines the Commonwealth Bank of Australia needs to focus on development of suitable organisational culture. This is because organisational culture is required in the merger process to manage differences among people. With the help of suitable organisational culture Commonwealth Bank of Australia can be able to implement merger without facing issues of employee management in the volatile, uncertain, complex, and ambiguous environments. According to Elia et al. (2019), culture diversity is necessary for the achievement of innovation in business performance. In this regard Commonwealth Bank of Australia needs to consider the area of their organisational culture so that it can be able to develop strong cooperation and collaboration between people within the organisation.

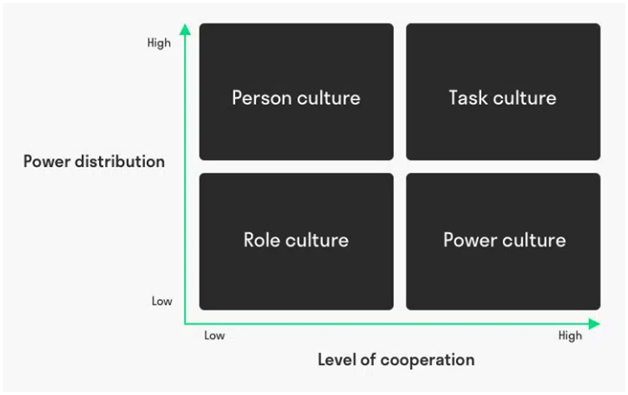

In order to implement strategic alliances and partnerships, development of suitable organisational culture is necessary to manage future cultural incompatibility with those businesses. A suitable organisational culture is able to provide unique skills and competences to their employees which would help Commonwealth Bank of Australia to implement strategic alliances and partnership with their competitors. Commonwealth Bank of Australia is also recommended to recruits variety of vendors and manage a strong supply chain. In order to implement such kind of strategy it is necessary for the Commonwealth Bank of Australia to Develop suitable organisational culture. As criticised by Altay et al. (2018), supply chain performance of business organisation strongly depends upon the skill and capability of people within it. It is necessary for the Commonwealth Bank of Australia to integrate their supply chain to reduce operation cost required staff takes of profit margin of the bank. As per Handys organisational culture model, rask culture is needed to implement within the bank (Hiršováet al. 2018). Under such a type of culture strong cooperation needs to be given focus by the bank so that it can help them to build suitable connections with multiple suppliers and vendors and manage their power to decrease profit margin.

Figure 2: Handy’s organisational culture model

(Source: Hiršová et al. 2018)

Strategic Management assignmentLeadership

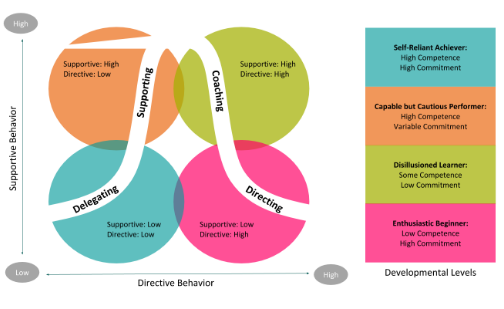

It has been stated earlier that the bank is facing strategic issues regarding poor organisational culture and corporate governance structure. Top management are unable to take responsibility to manage any kind of crisis like covid-19. According to Feng et al. (2019), leadership is the primary base to build competitive capability for a business organisation. In order to build competitiveness in the market and manage competitive pressure, it is recommended to the Commonwealth Bank of Australia to implement supportive leadership. Leadership will be the basic factor that can help Commonwealth Bank of Australia to think creatively and implement service differentiation towards achievement of customer satisfaction. As mentioned by Haider et al. (2022), leadership helps to build competitive capability in reading business organisation by improving skill and competencies. For implementation of Blue Ocean Strategy, Commonwealth Bank of Australia me too strongly focus on implementation of effective leadership style. Transformational leadership would be effective to identify the need for change of financial service option from offline into the more digitised one by the bank.Strategic Management assignmentSituational leadership Theory can also be applied in this context to manage cross-cultural issues, especially after implementing strategic alliances by the Commonwealth Bank of Australia towards achievement of competitive benefit. For implementing good governance and organisational structure democratic leadership is also needed within the Commonwealth Bank of Australia. Effective leadership can help to develop core competencies and skill within the employees and build capabilities to differentiate services towards achievement of competitive benefits.

Figure 3: Situational leadership Theory

(Source: Haider et al. 2022)

Conclusion

From the overall discussion it can be concluded that Commonwealth Bank of Australia is the largest Australian bank in the world facing strategic issues regarding poor governance and uncleared organisational structure. The organisation is also facing issues of high power of suppliers and different purchasing capacity of customers resulting from the incident of pandemic crisis. Disruption of digital technology has also resulted in the decreased performance of Commonwealth Bank of Australia to hold their customers for the long run. In order to manage such a crisis, the organisation needs to focus on building strong capabilities. Commonwealth Bank has been recommended to follow Blue Ocean Strategy to make competition in the market irrelevant along with the implementation of service differentiation. As the bank digitally has poor performance it is also recommended to follow the fast mover strategy by implementing predictive artificial intelligence and robotic branch assistants. Development of strategic alliances with the computer has also been recommended to the bank so that competitive pressure can be reduced. Merging with the start-up business would also help the bank to improve their business capability towards management of any kind of crisis in future. While implementing of all the Strategic Management assignmentstrategy there is a strong need to focus on two most important areas namely organisational culture and leadership.

Reference list

Alazab, M., Hong, S.H. and Ng, J., 2021. Louder bark with no bite: Privacy protection through the regulation of mandatory data breach notification in Australia. Future Generation Computer Systems, 116, pp.22-29.Strategic Management assignment

Altay, N., Gunasekaran, A., Dubey, R. and Childe, S.J., 2018. Agility and resilience as antecedents of supply chain performance under moderating effects of organizational culture within the humanitarian setting: a dynamic capability view. Production Planning & Control, 29(14), pp.1158-1174.

Astuti, U.H.W. and Saputra, P.M.A., 2019. Efficiency and competition in banking industry: case for asean-5 countries. Scientific annals of economics and business, 66(2), pp.141-152.

Carter, A.V. and McKenzie, J., 2020. Amplifying “keep it in the ground” first-movers: Toward a comparative framework. Society & Natural Resources, 33(11), pp.1339-1358.

Chadderton, P. and Norton, S., 2019. Public-private partnerships to disrupt financial crime: An exploratory study of Australia’s fintel alliance.Strategic Management assignment

Comerton-Forde, C., Ip, E., Ribar, D.C., Ross, J., Salamanca, N. and Tsiaplias, S., 2018. Using survey and banking data to measure financial wellbeing. Commonwealth Bank of Australia and Melbourne Institute Financial Well-being Scales Technical Report, (1).

Commbank.com.au, 2022. Banking. Available at: https://www.commbank.com.au/ [Accessed in 25th September 2022]

Elia, S., Petruzzelli, A.M. and Piscitello, L., 2019. The impact of cultural diversity on innovation performance of MNC subsidiaries in strategic alliances. Journal of Business Research, 98, pp.204-213.

Feng, T., Wang, D., Lawton, A. and Luo, B.N., 2019. Customer orientation and firm performance: The joint moderating effects of ethical leadership and competitive intensity. Journal of Business Research, 100, pp.111-121.Strategic Management assignment

Gov.au, 2022. The Structure of the Australian Financial System [1]. Available at: https://www.rba.gov.au/publications/fsr/2006/mar/struct-aus-fin-sys.html [Accessed in 25th September 2022]

Haider, M., Shannon, R.M. and Vatananan-Thesenvitz, R., 2022, August. Digital Leadership for Sustainable Community-Based Tourism (CBT). In 2022 Portland International Conference on Management of Engineering and Technology (PICMET) (pp. 1-9). IEEE.

He, Z., Huang, J. and Zhou, J., 2020. Open banking: credit market competition when borrowers own the data (No. w28118). National Bureau of Economic Research.

Hiršová, M., Komárková, L. and Pirožek, P., 2018. The prediction of financial performance in dependence on the type of organisational culture. Trends Economics and Management, 12(32), pp.63-74.Strategic Management assignment

Ismail, M., Baki, N.U. and Omar, Z., 2018. The influence of organizational culture and organizational justice on group cohesion as perceived by merger and acquisition employees. Organizations and Markets in Emerging Economies, 9(2), pp.233-250.

Kitsios, F., Giatsidis, I. and Kamariotou, M., 2021. Digital transformation and strategy in the banking sector: Evaluating the acceptance rate of e-services. Journal of Open Innovation: Technology, Market, and Complexity, 7(3), p.204.

Rahman, L.A.K., Jassim, L.A.N. and Abdullah, A.L.H.O., 2022. The Blue Ocean Strategy And Its Impact On Achieving A Sustainable Competitive Advantage For The Organization Is A Survey Study In A Number Of Government And Private Banks In Basra Province. Webology (ISSN: 1735-188X), 19(2).

Richardson, D., 2022. Foreign investment in Australia: Australian big business is not Australian at all.

Souiden, N., Ladhari, R. and Chaouali, W., 2020. Mobile banking adoption: a systematic review. International Journal of Bank Marketing. Strategic Management assignment

Stambaugh, J., Lumpkin, G.T., Mitchell, R.K., Brigham, K. and Cogliser, C., 2020. Competitive aggressiveness, community banking and performance. Journal of Strategy and Management.

Statista.com, 2022. Net profit after tax of the Commonwealth Bank of Australia (CBA) from financial years 2015 to 2021. Available at: https://www.statista.com/statistics/1250910/commonwealth-bank-of-australia-net-profit-after-tax/ [Accessed in 25th September 2022]

Tewari, R., 2021. Shaping Organisational Culture For Success. Invincible Publishers.

Vives, X., 2019. Digital disruption in banking. Annual Review of Financial Economics,Strategic Management assignment 11, pp.243-272.