Tesco SWOT analysis for the year 2023

Question

Task: what do you understand by SWOT? Write a SWOT analysis of Tesco and determine its strength and weaknesses

Answer

Overview of Tesco

Tesco came into existence in the form of a group of market stalls in 1919 by Jack Cohen. The company showed rapid growth within a few years of its existence.The expansion made it the largest retailer in the United Kingdom and the second-largest worldwide. The company is currently being managed by Dave Lewis in the position of CEO.

While gathering information for the Tesco SWOT analysis, we found interesting statistics. As per the statistics, Tesco encounters 80 million shoppers per week worldwide; it serves 66 shoppers every second and makes £141,000 in sales per minute.

Since its inception, it is found that Tesco has established itself as one of the favorite and biggest supermarkets in the United Kingdom.The excellent services have helped the company to gain this status.

In this article, Tesco SWOT analysis, we will be exploring the company in length and analysing different facts and figures which have helped in its operations.

Tesco SWOT analysis

The SWOT analysis of Tesco is performed underneath:

Strengths of Tesco

UK's biggest grocery retailer: As stated previously in this Tesco SWOT analysis, the company is the country's leading and first-rated grocery retailer and supermarket.In contrast to other supermarket chains in Britain, Tesco has the highest sales and revenue. As per Tesco's annual report for the fiscal year 2021, it generated £57.8 billion in revenues.

Highest market share: Tesco has dominated the supermarket sector since its inception. It has 27.9 per cent of the market share and has overpowered the other supermarkets in the country, which are ASDA, Morrison’s and Sainsbury. In Ireland, it is considered one of the popular supermarkets.

Geographical diversity: As per the annual report of 2022, the presence of Tesco has been growing globally, and it has more than 4752 stores in five markets. These markets are located in the United Kingdom, Czech Republic, Ireland, Hungary and Slovakia. In addition, it has both an online and offline presence, and it has a significant market share in Asia as well.

Expanding stores: Tesco has been operating in 4752 stores worldwide compared to its 3751 stores in 2008.As per the Tesco SWOT analysis, adding new stores and operational chains has helped Tesco increase its revenue each year.

Diversified stores: The Company has launched stores in diversified forms. These different forms of Tesco are Tesco Bank, One stop convenience stores, Tesco Express, wholesale business, Tesco supermarkets, Booker, dunnhumby, data-science business, Tesco Extra, Tesco Metro, and Tesco mobile.

Diversified product range and markets: The diversification strategy of Tesco has shown beyond doubt its success for the company. The company's global products range from clothing, mobile phones business, cotton fair-trading, telecom services, DVD rentals, music downloads, financial services, uniforms, andhome-ware items.

Generating high employment: Tesco is one of Europe's largest private employers worldwide.As per the annual report 2022, it has a team of 345,000 colleagues working with the company. As per the Tesco SWOT analysis, the company has opened job opportunities worldwide.It has been applauded as the biggest opportunity creator in Europe.

Achieving international awards: Tesco has achieved many international awards for its successful commercial performance in the industry.Some of the prestigious awards won include Britain's Favorite Supermarket, Drink Awards, The Grocer's Own Label Food, Best Grocer Award, The Grocer of the Year, and Waste Not Want Not Award by it.

Exceptional usage of technology:To enhance the shoppers' shopping experience, the company uses high-end technologies in the best possible ways.To save time in counting products, it has employed an RFID-enabled barcode system for automated counting.As per the Tesco SWOT analysis, it has employed mobile payment applications and an M-commerce facility.

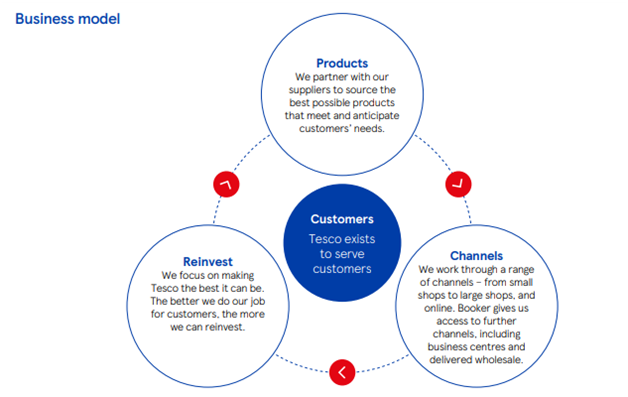

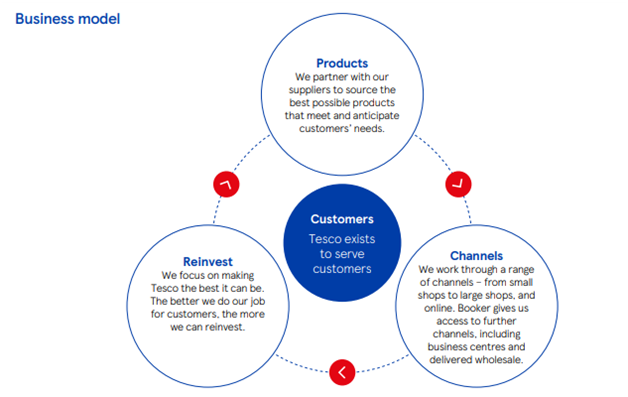

Structured supply chain: Tesco has a simplified business model that has reduced its incurring costs and effectively managed its waste. It has built effective waste management policies to create a reliable and effective supply chain network. As a result, the company has a profitable association with its suppliers.

Online shopping: After the coronavirus pandemic, it is seen that Tesco has achieved 60 per cent growth in its online sales. It is believed that in the coming years, Tesco will double the percentage of its online sales and will recruit over 16,000 workforces to allow the best shopping experience for its online users.

Weaknesses of Tesco

Unsuccessful performance in Japan and US: In 2012, Tesco had to drawback its operations in Japanese and American markets.The failed export operations compelled it to shut down its stores in the US after 5 years and in Japan after 9 years of operation.

Accounting scandals and fraud trials: For many years, Tesco did not disclose its correct accounting figures, and in 2017, it had to face heavy fines. As per the Tesco SWOT analysis, the company was charged for falsely declaring its accounting details and misrepresenting its profits.

Reduction in operating profits: As per the 2021 annual report, Tesco’s operating profit was cut down to 21.3 per cent, which is £1.7 billion. The company's share price had to suffer due to the falling operating profit.In the first quarter of 2022, there was an 8 per cent reduction in its share price.

Charged for selling expired items: While scrutinising the information for collecting data for the Tesco SWOT analysis, it was found that the company was fined £7.5 million for selling expired items. These items were related to food, such as soup, pizza, flavored milk, etc.As per the details, 3 of its stores during 2015-2017 sold these items. As a result, Tesco was found guilty and charged with compromising consumer safety norms.

Low-cost strategy: Though Tesco is considered one of the price leaders, its low-cost strategy leads to falling profit margins.

Bad performance in some markets: In certain countries, it was found that Tesco was not performing well. As per the market analysts, Tesco failed to conduct enough research before opening its stores and grocery outlets in these markets.

Clubcard controversy: During analysing the Tesco SWOT analysis, we found that the company, without any prior notice, stopped its Clubcard scheme in January 2018. The scheme is used to double or quadruple the points present in the card. The information about the closure was not provided to the customers with the card, which led to huge retaliation.

Unfair business practices: It was found that Tesco was restricting the landlords from giving out properties to other supermarket owners if in the proximity of its stores.In doing so, Tesco intentionally restricted its rivals which was unlawful and unethical. The act was not in consonance with fair competition.

Universal withdrawal: Worldwide expansion of Tesco failed miserably as it was poorly planned. In this Tesco SWOT analysis, the company in 2020 left the foreign marketplace and returned to a European retailer. Many of its operations were sold off, like in Thailand, China and Malaysia. Today Tesco has limited its operations to five countries, the United Kingdom, Czech Republic, Hungary, Ireland, and Slovakia.

Exploitative labor: It is found in this Tesco SWOT analysis that the company had exploited and abused migrant workers at its stores in Malaysia and Thailand. This was one of the major reasons behind the closure of its distribution centers in these countries.

Negative publicity: Consumers do not like company executives who are greedy and demanding during crisis times. The shareholders of the company in 2020 voted against a decision in which a greedy chief executive was to be paid a raised bonus at the time of retirement.

Call-back of in-demand snacks and pastries: The Company decided to call back some of its in-demand snacks and pastries in an emergency.These use-by-date items were claimed to have salmonella. As per the Tesco SWOT analysis, the recalled items were Tesco Ready Rolled Puff Pastry 375 grams, Tesco Pizza Dough 400 grams, and Tesco Rolled Puff Pastry 320 grams.Tesco had asked its customers not to eat these items and return them to their nearest location.

Opportunities of Tesco

Amplifying Jack’s business: The Company has added a new discount store, Jack, which has exhibited remarkable growth.Tesco can enlarge its business and compete at a low cost with Lidl and Aldi.

Strategic alliance with other brands: Tesco has an excellent opportunity to make a strategic alliance with other reputable companies. It will help Tesco in attracting more customers and offer them various products.

Joint venture: As per Tesco's SWOT analysis, a joint venture can be undertaken in the regionswhere the company is underperforming. Companies already having control in that region can provide their knowledge and expertiseand help Tesco improve its performance.

Emerging markets: Tesco can expand its stores in developing countries like Turkey, South Korea and Indonesia.As per the Tesco SWOT analysis, this can be one of the profitable decisions for Tesco.

Cashless stores: The coronavirus has highlighted the health risks of touching banknotes and coins. Hence, many consumers opt for cashless transactions to avoid any kind of virus.Keeping this in mind, Tesco opened its first cashless store and planned to open more such stores.

Matching prices:As per the Tesco SWOT analysis, the company has informed us that it will try to match its prices on certain items with the prices of Aldi. The price matching strategy will help Tesco stop and reverse the loss of market shares to the rival company.

Payment without cash or card: Tesco has run a scheme using which its customers can purchase its products without using any cash or card. The company floated its Tesco Clubcard pay+to be used by its 20 million shoppers. The innovative and enticing scheme is valid for those members who are Clubcard holders. The card has a pre-payment feature which can be recharged by using any bank account in the UK with the help of the banking application of Tesco.

Hourly delivery: With its Whoosh facility, Tesco has introduced one-hour home delivery services.It is available at 100 stores, and as per the Tesco SWOT analysis findings, the company plans to expand this facility to 600 more stores by 2023.

Threats to Tesco

Controversy related to Christmas advertisement: Tesco 2017 launched its Christmas advertisement, which faced retaliation on social media. It was considered a disrespectful act against the community, and the store was boycotted by many.

Legal threat for using ‘Fake Farm’: The Company was accused by many of using misleading farm names to advertise its food items.The name ‘Woodside Farms’ was used to mislead the customers.As per the findings of the Tesco SWOT analysis, in 2017, the company faced many legal threat proceedings for this issue.

Brexit referendum: As Britain opted out of the European Union, the company faced threats related to costs and trade deals.

Competition with well-established rivals: Tesco's market position has been threatened by the expansion and growing performance of supermarket giants and its rivals like Wal-Mart, Aldi and Carrefour.

Credit crunches and economic crisis: As per the findings of the Tesco SWOT analysis, government regulations, slowdown in credit, legal and tax matters, economic turbulence, etc., can affect the performance and operational efficiency of the company.

Rising costs: The increasing costs of doing business due to recent developments have affected many companies, including Tesco. It is estimated by Tesco that it has to bear costs of up to $ 830 million to $1.18 billion due to the recent health crisis.

Issues in the supply chain: The supply chain issues have threatened the operations and profitability of the company. Due to the pandemic, the governments of many countries have restricted the supply of commodities apart from essential items.

Faces hygiene investigation: As per the findings of the Tesco SWOT analysis, there was a hygiene investigation at Tesco when someone found a nibbled bag of popcorn at one of the stores. The incident sparked questions related to food security and handling.The store was thoroughly investigated, and a second complaint led to the investigation at Tesco's East London outlet. In addition, Waltham Forest Council reported the bad cleaning standards in Tesco’s stores, including the stores which were reported.

Recommendations generated from the Tesco SWOT analysis

The grocery industry is one potential area where Tesco can gain its lost market shares. By using effective marketing tools and strategic decisions, the company can enhance its profits and compete with its rivals.In the below section of this Tesco SWOT analysis article, we have mentioned some company recommendations.

• The company must delve into emerging markets and consider opening its stores in African and Asian countries.

• It must resolve all controversial issues quickly.

• It must conduct thorough market research and analyse the marketbefore entering it to save itself from losses or failures.

• It must upgrade its e-commerce websites and online shopping business to provide its customers with a smooth and easy shopping experience.

• It must analyse the feedback from the customers regarding any new item or advertisements. It would help in avoiding public disapproval.

• It must resolve all financial and legal disputes, including matters related to high debts, credit card crunches and tax payments.

• As per the findings of this Tesco SWOT analysis, it must reform its marketing and advertising campaigns to attract the attention of more customers.

Bibliography

Davey, J. (2020, February 25). Britain’s Tesco tests a cashless store in London. Reuters

Davey, J. (2020, February 25). Tesco completes China exit with a $357 million stake sale. Reuters

Davey, J. (2020, April 8). Tesco defends dividend payout as warns coronavirus costs could top $1 billion.

Reuters

Jahshan, E. (2020, May 31). Tesco faces shareholder revolt over CEO’s bonus hike. Retail Gazette

Lee, L. (2020, May 16). British grocer Tesco’s slavery review reports abuse in Malaysia. Reuters

Tescoplc.com. (2022). Annual report and financial statements 2022. https://www.tescoplc.com/media/759057/tesco-annual-report-2022.pdf

Vizard, S. (2020, March 5). Tesco becomes the first supermarket to directly price match with Aldi. Marketing Week

Wilson, B. (2020, March 8). Tesco limits sales of essential items. BBC News

Wood, Z. (2020, February 14). Tesco stopped rivals opening nearby stores, watchdog finds. The Guardian