Accounting Assignment: Case Analysis Based On Australian Accounting Standards & Corporate Legislation

Question

Task:

The questions to be answered in this accounting assignment are:

Week 6

Asia Pacific Ltd started operating on 1 July 2017 with 12 employees. Three years later all of those employees were still with the company. On 1 July 2019 the company hired 15 more people but by 30 June 2020 only 10 of those employed at the beginning of that year were still employed by Asia Pacific Ltd.

All employees are entitled to 13 weeks’ long-service leave after a conditional period of 10 years of employment with Asia Pacific Ltd.

At 30 June 2020 Asia Pacific Ltd estimates the following:

- The aggregate annual salaries of all employees hired on 1 July 2017 is now $1,200,000.

- The aggregate annual salaries of all current employees hired on 1 July 2019 is now $800,000.

- The probability that employees hired on 1 July 2017 will continue to be employed for the duration of the conditional period is 40 per cent.

- The probability that employees hired on 1 July 2019 will continue to be employed for the duration of the conditional period is 20 per cent.

- Salaries are expected to increase indefinitely at 1 per cent per annum.

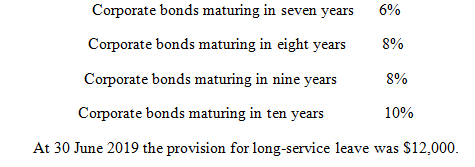

The interest rates on high-quality corporate bonds are as follows:

Required:

- Calculate the total accumulated long-service leave benefit as at 30 June 2020.

- What amount should be reported for the long-service leave provision as at 30 June 2020 in accordance with AASB 119?

- Prepare the journal entry for the provision for long-service leave for 30 June 2020 in accordance with AASB 119.

- Which employee benefits are required to be discounted in accordance with AASB 119?

Week 7

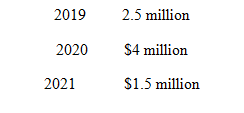

Big Construction Company signs a contract on 1 July 2019, agreeing to build a warehouse for Buyer Corporation Ltd at a fixed contract price of $10 million. Buyer Ltd will be in control of the asset throughout the construction process. Big Construction Company estimates that construction costs will be as follows:

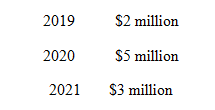

The contract provides that Buyer Corporation Ltd will make payments on 31 December each year as follows:

The contract is completed and accepted on 31 December 2021. Assume that actual costs and cash collections coincide with expectations and that cost (an input measure) is used as the basis for assessing progress on the construction contract. Big Construction Company has a financial year ending 31 December.

Required:

- Using the above data, compute the gross profit to be recognised for each of the three years, assuming that the outcome of the contract can be reliably estimated.

- Prepare the journal entries for 2019, 2020 and 2021 financial year to recognise revenue on the assumption that the measure of progress on the contract can be reliably estimated.

- Prepare the journal entries for 2019, 2020 and 2021 financial year, assuming that the measure of progress on the contract cannot be reliably assessed.

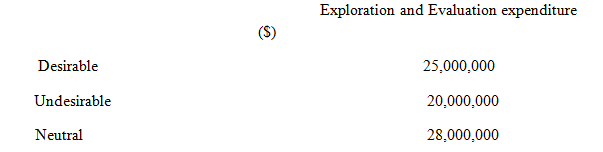

Week 8 Gem Limited commences operations on 1 January 2019. During 2019 Gem Limited explores three areas and incurs the following costs:

In 2020 oil is discovered at Desirable Site. Undesirable Site is abandoned. Neutral Site has not yet reach a stage that permits a reasonable assessment at the existence or otherwise of economically recoverable reserves, and active and significant operations in the area of interest are continuing. In relation to the exploration and evaluation expenditures incurred at Desirable Site and Neutral Site, 70 percent of the expenditures related to property, plant and equipment, and the balance relates to intangible assets.

In 2020, development costs of $48,000,000 are incurred at Desirable Site (to be written off on a production basis). $32,000,000 of this expenditure relates to property, plant and equipment, and the balance relates to intangible assets. The development of Desirable Site is completed but the production is not started yet. (i.e. there is no production, inventory and sales)

Required:

Provide the necessary journal entries using the area-of-interest method.

Week 9

Alps Ltd has a net income after tax of $1 500 000 for the year ended 30 June 2019. At the beginning of the period Alps Ltd has 900 000 fully paid-up ordinary shares on issue. On 1 December 2018 Alps Ltd had issued a further 300 000 fully paid-up ordinary shares at an issue price of $2.00. On 1 March 2019 Alps Ltd made a one-for-six bonus issue of ordinary shares out of retained earnings. The last sale price of an ordinary share before the bonus issue was $2.50. At the beginning of the current period Alps Ltd also had 500 000, $1.00, 8% cumulative preference shares on issue. The dividends on the preference shares are not treated as expenses in the statement of comprehensive income. The basic earnings per share for the period ended 30 June 2018 was $1.50 per share.

Required:

- Calculate the basic EPS amount for 2019 and provide the adjusted comparative EPS for 2018.

- Explain what is diluted EPS. Give one example of a security that can dilute the basic EPS

Week 10

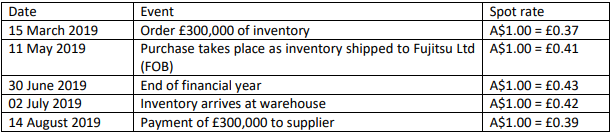

Fujitsu Ltd purchases inventory from DFO Ltd, a listed British company. Relevant events and the spot rates at each date are shown as follows:

Required:

- Prepare appropriate journal entries for each relevant event. (Round amounts to the nearest dollar). Show your working.

- What is a qualifying asset? Provide two (2) examples.

Answer

Accounting Assignment Week 6

|

Date |

Employees |

|

Employees Remaining |

Aggregate Annual Salaries |

Probability |

Remaining Years |

Interest Rate |

Salary at completion of 10 years |

Probable Salary |

Cost of Entitlement |

Cost per year |

|

01-07-2017 |

12 |

|

12 |

$ 1 200 000 |

40% |

7 |

10% |

1286562.42 |

514624.97 |

128656.24 |

12865.62 |

|

01-07-2019 |

27 |

=12+15 |

10 |

$ 800 000 |

20% |

9 |

10% |

874948.22 |

174989.64 |

43747.41 |

4374.74 |

|

30-06-2020 |

22 |

=12+10 |

|

|

|

|

|

|

|

|

|

Increment Rate of Salary – 1 per cent per annum

Provision on 30-06-2019

Answer a

Total accumulated long service leave benefit

For first 12 employees = 12865.62*3 = 38596.86

For next 10 employees = 4374.74*1 = 4374.74

Answer b

Present Value of Cost

For first 12 employees = 12865.62*PV for 7 years at 10% =12865.62*0.513 = 6600.06

For next 10 employees = 7374.74*PV for 9 years at 10% =4374.74*0.424 = 1854.89

Total = 8454.95

Total Amount to be reported as at 30-06-2020

Opening Balance = 12000

Interest = 1200

Current Year = 8454.95

Total Provision = 21654.95

Answer c

Journal

|

Employee Benefits A/C |

8454.95 |

|

|

Interest Charge A/C |

1200.00 |

|

|

To Provision for Long-Service Leave A/C |

|

9654.95 |

|

( Being Employee benefit cost and interest charge for the year due to long service leave entitlement) |

|

|

Answer d

As per AASB 119 : Employee Benefits the benefits which are of long tern nature are required to be discounted and present value should be shown as employee benefit expense. The expenses or entitlements which are not required to be settled in twelve months are considered as long term and need to be discounted. These include long term benefits like termination benefits, post employment benefits, etc. The interest charge is separately charged till actual entitlement.

Answer 7

|

Big Construction |

|

|

|

|

|

Contract Price |

$ 10 million |

|

|

|

|

|

|

|

|

|

|

Year |

Cost ($ m) |

Percent Complete |

Cumulative Percent |

Payment Received ($ m) |

|

2019 |

2.5 |

31.25% |

31.25% |

2 |

|

2020 |

4 |

50.00% |

81.25% |

5 |

|

2021 |

1.5 |

18.75% |

100.00% |

3 |

|

|

8 |

|

|

10 |

Answer a

|

Profit from the Contract |

=10-8 |

2 |

|

Year |

Profit to be Recognized ($ millions) |

|

|

2019 |

0.63 |

|

|

2020 |

1.00 |

|

|

2021 |

0.38 |

|

Answer b

|

Journals |

|

|

|

Amount ($ m) |

|

31-12-2019 |

Buyer Corporation Ltd A/C |

|

3.13 |

|

|

|

To Contract Revenue A/C |

|

|

0.63 |

|

|

To Cost of Contract A/C |

|

|

2.50 |

|

|

(Being contact revenue and cost recorded as per percent of completion) |

|

|

|

|

|

|

|

|

|

|

31-12-2020 |

Buyer Corporation Ltd A/C |

|

5.0 |

|

|

|

To Contract Revenue A/C |

|

|

1.0 |

|

|

To Cost of Contract A/C (Being contact revenue and cost recorded as per percent of completion) |

|

|

4.0 |

|

|

|

|

|

|

|

31-12-2020 |

Buyer Corporation Ltd A/C |

|

1.88 |

|

|

|

To Contract Revenue A/C |

|

|

0.38 |

|

|

To Cost of Contract A/C (Being contact revenue and cost recorded as per percent of completion) |

|

|

1.50 |

Answer c

When there is uncertainty the revenue will be recognized on realization basis

|

Journals |

|

|

|

Amount ($ m) |

|

31-12-2019 |

Buyer Corporation Ltd A/C |

|

2.50 |

|

|

|

To Cost of Contract A/C (Being contact revenue and cost recorded as per percent of completion) |

|

|

2.50 |

|

31-12-2020 |

Buyer Corporation Ltd A/C |

|

4.50 |

|

|

|

To Contract Revenue A/C |

|

|

0.5 |

|

|

To Cost of Contract A/C (Being contact revenue and cost recorded as per percent of completion) |

|

|

4.0 |

|

31-12-2020 |

Buyer Corporation Ltd A/C |

|

3.00 |

|

|

|

To Contract Revenue A/C |

|

|

1.50 |

|

|

To Cost of Contract A/C (Being contact revenue and cost recorded as per percent of completion) |

|

|

1.50 |

Week 8

|

Gem Limited |

|||

|

|

|

|

|

|

|

|

|

Amount ($) |

|

2019 |

Property, Plant and Equipment at Desirable Site |

17500000 |

|

|

|

Intangible Assets at Desirable Site |

7500000 |

|

|

|

To Bank |

|

25000000 |

|

|

(Being amount carried forward as future economic value exists) |

|

|

|

|

|

|

|

|

|

Exploration and Evaluation Cost at Undesirable Site |

20000000 |

|

|

|

To Bank |

|

20000000 |

|

|

(Being amount carried forward as future economic value exists) |

|

|

|

|

|

|

|

|

|

Property, Plant and Equipment at Neutral Site |

19600000 |

|

|

|

Intangible Assets at Neutral Site |

8400000 |

|

|

|

To Bank |

|

28000000 |

|

|

(Being amount carried forward as future economic value exists) |

|

|

|

|

|

|

|

|

2020 |

Property, Plant and Equipment at Desirable Site |

32000000 |

|

|

|

Intangible Assets at Desirable Site |

16000000 |

|

|

|

To Bank |

|

48000000 |

|

|

(Being development cost carried forward) |

|

|

|

|

|

|

|

|

|

Expenses of Undesirable Written Off |

20000000 |

|

|

|

To Exploration and Evaluation Cost at Undesirable Site |

|

20000000 |

|

|

(Being site abandoned and thus all the expenses written off) |

|

|

Week 9

|

30-06-2019 |

|

|

|

Income after Tax |

|

1500000 |

|

|

|

|

|

Equity Shares |

|

900000 |

|

01-12-2018 |

Issued |

300000 |

|

01-03-2019 |

Bonus (900000+300000)/6 |

200000 |

|

|

|

|

|

8% Preference Shares |

|

500000 |

|

Preference Dividend |

500000*8% |

40000 |

|

BEPS 30-06-18 |

$ 1.50 per share |

|

Basic EPS of 30-06-19 = ( Net Income - Preference Dividend ) / Weighted Average Outstanding Equity Shares

|

Income |

1460000 |

|

|

Weighted Average Shares |

|

|

|

Opening (900000*12/12) |

900000 |

|

|

Issued (300000*7/12) |

175000 |

|

|

Bonus (200000*12/12) |

200000 |

|

|

|

1275000 |

|

|

|

|

|

|

Basic EPS of 30-06-19 |

=1460000/1275000 |

1.15 |

|

|

|

|

|

Adjusted EPS for 2018 |

|

|

|

Income (1.5*900000) |

1350000 |

|

|

|

|

|

|

Weighted Average Shares |

|

|

|

Opening (900000*12/12) |

900000 |

|

|

Bonus (200000*12/12) |

200000 |

|

|

|

1100000 |

|

|

|

|

|

|

Adjusted Basic EPS of 30-06-18 |

=1350000/1100000 |

1.23 |

Part b

Diluted EPS can be defined as a computation utilized to ascertain the quality of the EPS of the company if all the convertible securities are exercised. Here convertible securities are all shares, stocks, and warrants that are outstanding in nature (Peirson et al 2015). Diluted EPS is exhaustive as compared to the normal EPS because it projects the real shareholder value on which the allocation of EPS is done. Moreover, the diluted EPS impacts the firm PE ratio and other methods of valuation. Diluted EPS is computed ad projected in the notes to the financial statements. This reveals investors and creditors the result that would happen if all the option of stock and conversion are transformed into common shares overnight. Moreover, it even projects the capital structure of the organization.

Income part and the equivalent equity that is required to be issued are included in the EPS calculation. Thus with the Diluted EPS, we get the picture of the earning of the company if the equity is issued in order to settle the liability. The potential equity shares are equity shares to be issued for Convertible Preference Shares, Convertible Debentures, options, etc. The diluted EPS is always lower than the Basic EPS as only those instruments are considered which reduces the EPS if the instrument does not reduce the EPS it is considered as non-dilutive and is not considered (Peirson et al 2015). The convertible debentures can dilute the EPS as on the maturity date the equivalent equity shares will be issued to them. Thus the interest payments will stop after the issue and thus if the amount of interest is lower than the EPS than the increase in the number of shares will be higher in comparison to savings in the expenses. Thus this is reported through diluted EPS.

Week 10

Part a

|

In the books of Fujitsu Ltd |

|||

|

|

|

|

Amount ($) |

|

11-05-2019 |

Purchase A/C |

731707.32 |

|

|

|

To DFO Ltd A/C |

|

731707.32 |

|

|

(Being goods purchased and shipped) |

|

|

|

|

|

|

|

|

30-06-2019 |

DFO Ltd A/c |

34032.90 |

|

|

|

To Foreign Exchange Gain/Loss A/C |

|

34032.90 |

|

|

(Being Foreign Exchange fluctuation gain or loss booked on Goods in Transit ) |

|

|

|

|

|

|

|

|

14-07-2019 |

DFO LTd A/C |

769230.77 |

|

|

|

To Bank A/C |

|

769230.77 |

|

|

(Being £ 300 000 paid for purchases) |

|

|

|

|

|

|

|

|

14-07-2019 |

Foreign Exchange Gain/Loss A/C |

71556.35 |

|

|

|

To DFO Ltd |

|

71556.35 |

|

|

(Being foreign exchange adjustment on final payment recorded) |

|

|

Part b

The borrowing cost is allowed to be capitalized only for the qualifying assets and the qualifying asset is defined as any asset which takes a substantial period of time in development to bring it in the position of its intended use or sale (Carlon 2019). The entity can capitalize on borrowing in relation to the qualifying asset used for its acquisition, construction, or production with the cost of the asset. Thus this will lead to charging the depreciation on the same instead of charging the full amount in the income statement. Depending on the circumstances even the inventories, intangibles assets, etc can also be classified as a qualifying asset. There is a fixed time frame determined for classifying the asset as qualifying but it depends upon the normal operating cycle of the company if the asset takes more time than the operating cycle than it will be determined as qualifying assets otherwise not (Carlon 2019). For example in case of a construction of the machinery which will take a substantial amount of time to get ready than it will be treated as a qualifying asset and the borrowing cost will be capitalized with the cost of the machinery. The example for the intangible asset being a qualifying asset can be that of a permit acquired for acquiring, construction, or production of the qualifying asset will also be treated as a qualifying asset.

References

Carlon, S., 2019, Financial accounting: reporting, analysis and decision making. 6th ed. Milton, QLD John Wiley and Sons Australia, Ltd

Peirson, G, Brown, R., Easton, S, Howard, P. & Pinder, S 2015, accounting assignment Finance, 12th ed. North Ryde: McGraw-Hill Australia.