Accounting Assignment Evaluating Cash Flow Statements of JB Hi Fi

Question

Research the cash flow statements of JB Hi Fi for the last two years and write a report on accounting assignment. In the report, you need to

- Critically analyse and evaluate the cash flow statements using appropriate approaches, e.g. horizontal analysis, vertical analysis, ratio analysis, etc.

- Investigate the possible internal and external reasons for the changes of the cash flows.

- Provide suggestions for improvement.

Answer

Introduction

JB Hi Fi is a top- giant retailer of electronic goods in Australia. The company is also listed on Australian securities exchange and has its headquarter based in Southbank. JB Hi-Fi deals in the home entertainment and other household electronic products like television, computers, cooking appliances, audio equipment, gaming and other music devices such as CDs and DVDs. Apart from the retail business of such electronic goods the company also deals in offering the services related to information technology. It has multiple stores located across Australia and New Zealand (Reuters, 2020).

Operating activities

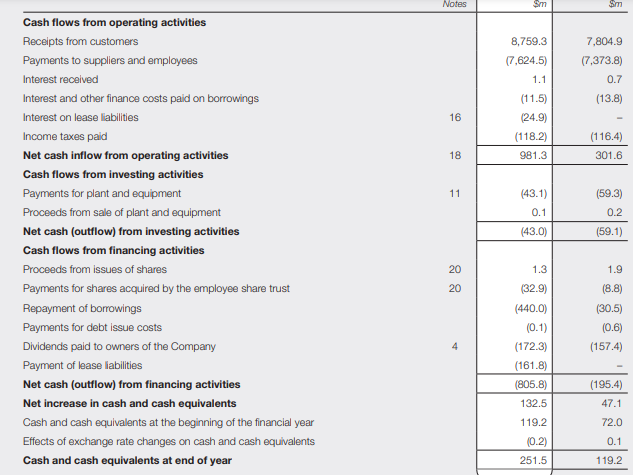

The cash flows statement of JB Hi Fi have been prepared using the direct method of preparation of cash flow statement wherein actual cash flows which have been occurred in the course of operating the business are taken into account to determine the net cash flow from the operating activities (Soboleva,et al., 2018). JB Hi Fi’s cash inflow from operating activities includes actual receipt generated out of core business operations such cash received from the customers for the sale of products dealt by it. Apart from this, company has also earned interest income which has also been included in its cash inflows. The cash outflows include payment made to the vendors who supplies the goods to JB Hi Fi. Also, the company has to make payments towards the salaries and wages of its employees which results in cash outflow. The other items that forms part of cash flow from operating activities of JB Hi Fi are its payment toward interest expenses on its financial obligations and the taxes paid on its overall income. In 2020, there has been a significant increase in the cash inflow from operating activities as compared to that of 2019 majorly due to increased sales in the current year (Annual Report, 2020). The cash flow margin ratio 2020 is achieved as 12.39% while the same was reported as 4.25% in 2019. Further, the cash flow coverage ratio in 2020 is 47.95% while the same was reported as 19.80% in 2019. This indicates that the company has attained more capability to pay off its total debt obligation using the cash generated from the operating activities like sales collection from the debtors (Foerster & Tsagarelis & Wang, 2017).

Investing activities

The major investment related activities that occurred in both the years under consideration in this report includes acquisition of long-term assets such as plant and equipment and also the improvements undertaken for leasehold properties. Besides this, company has generated cash inflow from the disposal of certain plant and equipment (Annual Report, 2020). In 2020, company has purchased plant and equipment of $ 43.1 million which was comparatively lower than the investments made in other plant and equipment in 2019. This has resulted in increase in the outflow from investing activities by 27.24% in 2020 as compared to 2019. Since the proceeds from the sale of long-term assets was quite low in both the years it could not contribute to overall positive cash flows from investing activities.

Financing activities

Financing activities are those activities that have impacts on the capital structure of the company. Capital structure comprises of debt and equity components. JB Hi Fi has undertaken multiple activities which has affected its capital structure in both 2020 and 2019 (Annual Report, 2020). In order to raise funds using the equity options company had issued shares from which cash could be generated for financing the business operations. Apart from this the company believes in striking the proper balance of its capital structure. Hence, it has made efforts to reduce its cost of capital by repaying its long-term financial obligations such as bank loans, lease liabilities, debt issue expense, employee share trust. In 2020, the company has made huge payments to reduce its debt obligations in the market and the net cash outflow from the financing activities in 2020 was around 3 times more than the cash outflow under financing activities in 2019. The major reason behind such differences in the quantum of cash outflow under financing activities for both the years was the repayment of bank by an amount which has around 14 times of the amount of bank loan that was repaid in 2019.

Change in cash position

The position of cash at the start of the 2019 was $72 million and the net cash flow from all the three major kind of activities i.e. operating, investing and financing amounted to $ 47.1 million which is further adjusted for the exchange rate differences on cash and cash equivalent for the amount $1 lakh. Therefore, the closing balance for the year 2019 resulted as $ 119.2 million. Subsequently, the net cash flow from all the 3 activities resulted in total cash flow of $ 132.5 million majorly due to increased sales. The sales in 2020 has increased due to the fact that during the Covid-19 pandemic, people had started using more of entertainment appliances. This is one of the external factors that has affected company’s sales. The online sales growth of all the 3 segments has elevated significantly in 2020 (Annual Report, 2020). After adjusting the exchange rate differences on cash and cash equivalents for the amount of negative 2 lakhs, the closing balance for the year 2020 resulted as $251.5 million. The internal factors that has contributed to increased cash balance in 2020 as compared to 2019 was the increased productivity of the company with reduced expenses of business.

Suggestions for improvement

While comparing the total sales with the net cash flow from all the three activities, it can be said that company has left with lesser cash balance in hand in both the years. Hence, it must make more efforts to improve its operating cycle so as to maintain proper liquidity position. Also, the firm must reduce its debt obligations further by paying off more external liabilities (Easton, McAnally, Sommers & Zhang, 2018).

Conclusion

From the above analysis, it has been identified that 2020 has proved to be another successful year for JB Hi Fi. The major factor that contributed to the remarkable success of company from both the aspects of increased profitability and increased cash balances was the increase in the use of entertainment products that are dealt by the company in the period of Covid-19. On account of more sales of the electronic goods, the company could generate more revenue from its operating activities and hence it was able to repay more of its debt obligations to maintain an optimum capital structure. More profitability has enabled the company to pay more dividend in 2020 which is again a good indicator of its sound financial position.

References

Annual Report (2020). JB Hi Fi Annual Report-2020. Retrieved from: https://investors.jbhifi.com.au/wp-content/uploads/2020/09/FY20-Annual-Report_Printers-Version.pdf Accessed on: 26th September, 2020.

Easton, P. D., McAnally, M. L., Sommers, G. A., & Zhang, X. J. (2018). Financial statement analysis & valuation. Boston, MA: Cambridge Business Publishers.

Foerster, S., Tsagarelis, J., & Wang, G. (2017). Are cash flows better stock return predictors than profits?. Financial Analysts Journal, 73(1), 73-99.

Reuters. (2020). JB Hi Fi-Company Profile. Retrieved from https://www.reuters.com/companies/JBH.AX Accessed on: 26th September, 2020.

Soboleva, Y. P., Matveev, V. V., Ilminskaya, S. A., Efimenko, I. S., Rezvyakova, I. V., & Mazur, L. V. (2018). Monitoring of businesses operations with cash flow analysis. International Journal of Civil Engineering and Technology, 9(11), 2034.

Appendices

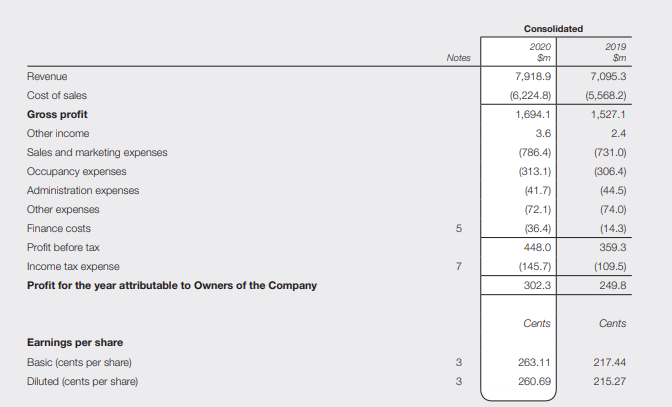

Income Statement

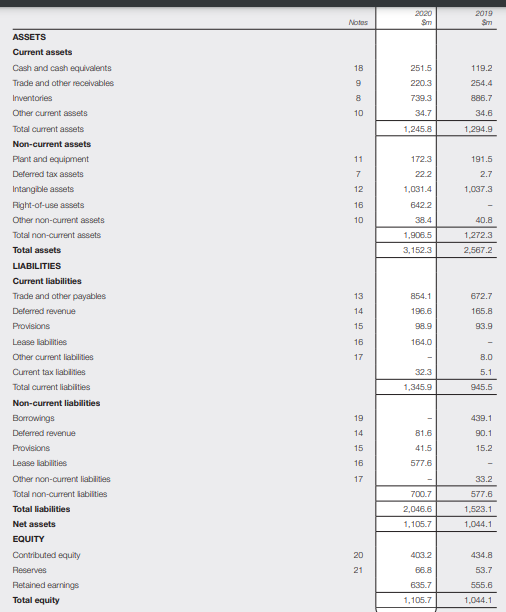

Balance Sheet

Cash Flows Statement

Vertical Analysis

|

Cash flows from operating activities |

2020 |

2019 |

|

Receipt from customers |

66.11 |

165.71 |

|

Payments to suppliers and employees |

(57.54) |

(156.56) |

|

Interest Received |

0.01 |

0.01 |

|

Interest and other financial expenses on borrowings |

(0.09) |

(0.29) |

|

Interest on lease liabilities |

(0.19) |

|

|

Income tax paid |

(0.89) |

(2.47) |

|

|

|

|

|

Net cash flow from operating activities |

7.41 |

6.40 |

|

|

|

|

|

Cash flows from investing activities |

|

|

|

Payments for plant and equipment |

(0.33) |

(1.26) |

|

Proceeds from sale of plant and equipment |

0.00 |

0.00 |

|

|

|

|

|

Net cash (outflow) from investing activities |

(0.32) |

(1.25) |

|

|

|

|

|

Cash flows from financing activities |

|

|

|

Proceeds from issues of shares |

0.01 |

0.04 |

|

Payments for shares acquired by the employee share trust |

(0.25) |

(0.19) |

|

Repayment of borrowings |

(3.32) |

(0.65) |

|

Payments for debt issue costs |

(0.00) |

(0.01) |

|

Dividends paid to owners of the Company |

(1.30) |

(3.34) |

|

Payment of lease liabilities |

(1.22) |

|

|

|

|

|

|

Net cash (outflow) from financing activities |

(6.08) |

(4.15) |

Horizontal Analysis

|

Cash fl ows from operating activities |

2020 |

2019 |

% Differences |

|

Receipt from customers |

8,759.30 |

7,804.90 |

12.23% |

|

Payments to suppliers and employees |

-7,624.50 |

-7,373.80 |

3.40% |

|

Interest Received |

1.1 |

0.7 |

57.14% |

|

Interest and other financial expenses on borrowings |

-11.5 |

-13.8 |

-16.67% |

|

Interest on lease liabilities |

-24.9 |

– |

|

|

Income tax paid |

-118.2 |

-116.4 |

1.55% |

|

|

|

|

|

|

Net cash flow from operating activities |

981.30 |

301.60 |

225.36% |

|

|

|

|

|

|

Cash flows from investing activities |

|

|

|

|

Payments for plant and equipment |

-43.1 |

-59.3 |

-27.32% |

|

Proceeds from sale of plant and equipment |

0.1 |

0.2 |

-50.00% |

|

|

|

|

|

|

Net cash (outflow) from investing activities |

-43 |

-59.1 |

-27.24% |

|

|

|

|

|

|

Cash flows from financing activities |

|

|

|

|

Proceeds from issues of shares |

1.3 |

1.9 |

-31.58% |

|

Payments for shares acquired by the employee share trust |

-32.9 |

-8.8 |

273.86% |

|

Repayment of borrowings |

-440 |

-30.5 |

1342.62% |

|

Payments for debt issue costs |

-0.1 |

-0.6 |

-83.33% |

|

Dividends paid to owners of the Company |

-172.3 |

-157.4 |

9.47% |

|

Payment of lease liabilities |

-161.8 |

– |

|

|

|

|

|

|

|

Net cash (outflow) from financing activities |

-805.8 |

-195.4 |

312.38% |

|

|

|

|

|

|

Net increase in cash and cash equivalents |

132.5 |

47.1 |

181.32% |

|

Cash and cash equivalents at the beginning of the financial year |

119.2 |

72 |

65.56% |

|

Effects of exchange rate changes on cash and cash equivalents |

-0.2 |

0.1 |

-300.00% |

|

Cash and cash equivalents at end of year |

251.5 |

119.2 |

110.99% |

Ratios

|

Cash Flow Margin Ratio= Cash Flow from Operating Cash Flows ÷ Net Sales |

12.39% |

4.25% |

|

Cash Flow Coverage Ratio= Cash Flow from Operations ÷ Total Debt |

47.95% |

19.80% |