Accounting Assignment: Strategic Information Systems for Business & Enterprise

Question

Task: Accounting Assignment Tasks:

Question 1[Words Limit: Up to 300 words.]

ABC Limited is a manufacturing firm with a workforce of more than 100 employees. Mr Peter has recently joined the firm as the account payable clerk. Miss Emma is the accounting department head, and she is concerned about the cash disbursement system. Therefore, she has asked Mr Peter to analyse the firm's cash disbursement system and identify the internal control weaknesses from the system. Following is the description of the cash disbursement system.

In the temporary file, the account payable clerk receives the supplier's invoice and reconciles it with the purchase order. The accounts payable clerk records the purchase in the purchases journal from the clerk's computer terminal and records the liability by adding a record to accounts payable subsidiary ledger. The clerk then updates the inventory control and accounts payable control accounts in the general ledger. The purchases order and invoice are later filed in the department.

Each day, the clerk visually searches the accounts payable subsidiary ledger from the computer terminal for invoices that are due to be paid. The clerk prepares the cheque and records it in the digital cheque register. The negotiable portion of the cheque is mailed to the supplier, and a cheque copy is filed. The clerk then closes the liability in the accounts payable subsidiary ledger and updates the accounts payable control and cash accounts in the general ledger.

Required: Analyse the internal control weakness in the system. Question 2 [Words Limit: Up to 500 words.]

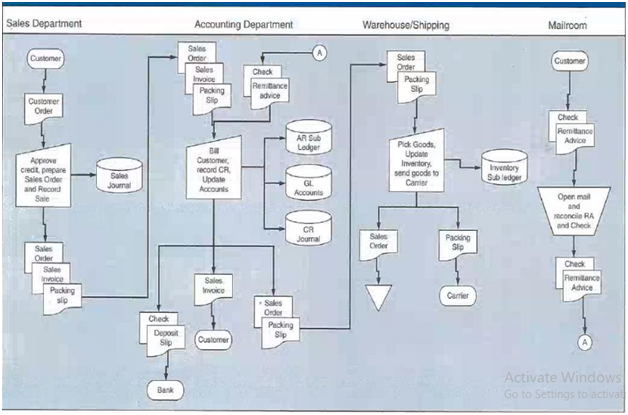

XYZ Limited is a clothing wholesaler that sells the name-brand clothing to department stores and boutique dress shops. Figure on Page No 4 describes the credit sales procedures of XYZ Limited. In particular, the Figure describes different business activities of four departments, including (1) Sales Department, (2) Accounting Department, (3) Warehouse/Shipping, and (4) Mailroom. Further, these activities are elaborated below.

The sales department received the customer orders by fax and email. You should be aware that these sales orders are usually unstandardised sales order. The sales clerk, who works on commission, performs the following tasks:

- approves the credit sales,

- calculates commission and discounts, and

- records the sales in the sales journal from the PC in the sales department. After entering these records, the sales clerk then prepares three documents, including (1) a sales order, (2) a customer invoice, and (3) a packing slip. These documents are forwarded to the department of accounting for further processing.

The accounting clerks received these documents and update the account receivable subsidiary ledger. After updating this subsidiary ledger, the accounting clerk forwards the invoice to the customer. According to the prevailing standards, the accounting clerk forwards the sales order and packing slip to the warehouse/shipping department. Based on this given information, the warehouse/shipping clerk arranges the inventory and sends the inventory along with the packing slip to the carrier for shipment to the customer. Finally, the clerk updates the inventory subsidiary ledger and files the sales order in the department.

Cash receipts from customers go to the mailroom, which has one supervisor overseeing 32 employees performing similar tasks:

- a clerk opens the envelope containing the customer check and remittance advice,

- inspects the check for completeness,

- reconciles it with the remittance advice, and

- sends the remittance advice and check to the accounting department

The accounting department clerk reviews the remittance advice and the checks, updates the AR subsidiary ledger, and records the cash receipts journal's cash receipt. At the end of the day, the clerk updates the AR control, cash, and sales accounts in the general ledger to reflect the ' 'day's sales and cash receipts.

Required:

a) Describe the uncontrolled risk associated with this system as it is currently designed.

b) For each risk, describe the specific internal control weakness (s) in the system that causes or contributes to the risk.

Question 3 [Words Limit: Up to 400 words.]

a) Explain the importance of an active board of 'directors' audit committee to an organization.

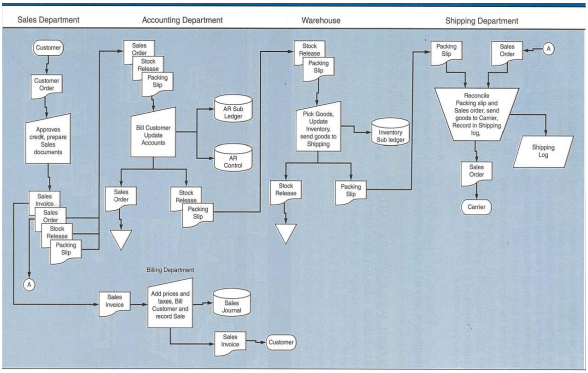

b) The given system flowchart elaborates the business activities involved in different departments, including (1) Sales Department, (2) Accounting Department, (3) Warehouse, (4) Shipping Department, and (5) Billing Department. The bottom part of this Figure indicates that the Sales Department sends the sales invoice to the Billing Department. Here, it is assumed that this sales invoice only contains non-financial information. For instance, the customer and quantity details. Based on these control weaknesses and the associated risk, what types of frauds are possible in this business environment.

Question 4 [Words Limit: Up to 300 words.]

After finishing your accounting degree, you joined an accounting firm. This is a medium-size accounting firm with a reasonable range of clients. You are in an engagement meeting with one of your clients, and your client's management raises some concerns. In particular, the management is concerned that the audit tests that you perform will disrupt operations. Your client has recently implemented a data warehouse. The management suggests that you draw the data for analytical reviews and substantive testing from the data warehouse instead of the operational database. Further, the management points out that operational data are copied weekly into the data warehouse, and all data you need are contained there.

Required: Based on the given scenario, outline your response to the management's proposal and mention any concerns you might have.

Question 5 [Words Limit: Up to 500 words.]

Part (a)

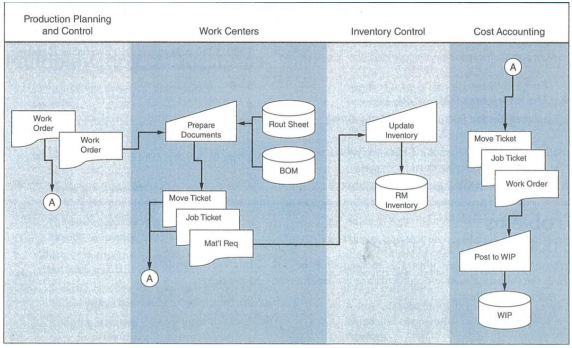

The flowchart on Page No 7 illustrates the business activities of four departments, including (1) Production Planning and Control, (2) Work Centres, (3) Inventory Control, and (4) Cost Accounting. Examine these activities and determine any control threats. In particular, discuss the control problems, the possible dangers, and any corrective procedures you would recommend.

Part (b)

There is an ongoing debate on the elimination of receiving functions. One strand of accountants argues that the receiving department should be eliminated. Conversely, another strand of accountants is in favour of receiving department. Discuss the objective of eliminating the receiving function. Also, discuss the accounting and audit problems need to be resolved.

Question 6 [Words Limit: Up to 350 words.]

After finishing Bachelor of Commerce, Miss Emma completed her Master of Computer Sciences (MCS) and started her career as a network engineer in XYZ Limited, Melbourne. She worked for six months in XYZ Limited. Unfortunately, she was fired from the firm last year. Due to the competitive market conditions, she could not find any position as a network engineer.

In 2018, she moved to Brisbane in search of a job. She was desperately working for the job when one of her roommates informed her about a vacant position for the post of account payable clerk in the ABC Limited. Miss Emma was successful in her interview, and she joined the ABC Limited as an account payable clerk. However, she did not disclose her technology background. Early on, Miss Emma established a reputation as a hard-working, enthusiastic, and reliable employee. She often works late and is dedicated to doing an excellent job. Her late-night presence in the company became a common occurrence that was at first appreciated by her boss, and then virtually went unnoticed. Overall, Miss Emma is considered the most hard-working employee of the company.

While working late, Miss Emma used her computer skills to install a sniffer program on the intranet to capture employee IDs and passwords. This information was beneficial for Miss Emma since she could play many roles and establish herself as a vendor, receiving clerk, cash disbursement clerk, and general ledger clerk. With this authority and her legitimate role of AP clerk, Miss Emma implemented a vendor fraud scheme, which she has been perpetrating for over a year for $150,000 to ABC Limited. Required: Describe the controls that could have prevented Miss Emma from perpetrating this fraud.

Answer

Case Study 1

Answer 1

a) The given case study undertaken in this law assignment has been analyzed as per the IRAC method in order to figure out the three elements of Negligence are involved in the case and need to be proved by Angela.

Issue- As per the case study, it has been identified that Angela was on her holiday trip wherein she was offered a cup of tea that was hot enough to have a sip. Considering the case study, she was already warned by the seller, his name is Johnson, though she was warned by him in her excitement of watching penguin she had a huge gulp of tea. Here, Angela got injured and was rushed to the Melbourne hospital wherein she has stayed into the hospital for the six months and as an outcome of her injuries, she was not able to travel on the due-date her deposits.

Rule-Considering the case study, the three elements required to prove negligence under Negligence Law are Duty of care, Breach of duty and damages(Luntz, 2021).

Application- As per the Negligence Law, the three elements articulates the important element of a legal claim wherein the applicant must prove these three elements to prove negligence. In the case study, the first element of addressing negligence is either or not the defendant yet to be paid the plaintiff a legal duty of care(Oup.com.au, 2021). Therefore, it can be said that though Johnson had already stated a caution note to Angela he should maintain his belongings in safe conditions and operate it safely for other travellers too. The second element is the breach of duty, wherein the court will conduct this matter in order to determine if the defendant breached this duty through his or her activities than a normal person would do if they were in same conditions. Additionally, the third element focuses on the damages that Angela had to face during her holiday trip. As the plaintiff suffered loss or injury which a practical person in that similar condition could foresee or expect, financial compensation might be the only matter of relief for those damages. Generally, these damages include lost wages, medical care, emotional chaos and more.

Conclusion-To conclude, it can be said that Angela had to bear for negligence that Johnson had performed during her trip. Though she was already warned by him to be very careful as the served tea was extremely hot but as concerned with the law of negligence, Johnson needs to be careful and vigilant to his responsibilities as this activity comes under Negligence Law that is a breach of duty. Therefore, the damages that Angel had to bear needs to be compensated by Johnson as well as the travel company because she was not able to travel as per the travel itinerary.

However, the list of losses or damages that needs to be awarded to Angela is:

- Medical Expenses- As per the case study, Angela has suffered painful burns on her mouth, lips, throat and nose and had to do plastic surgery on her nose, wherein she had to stay in the hospital for six months. Therefore, the medical expense needs to be awarded to Angela for the damages she faced.

- Lost wages- As she was working as a part-time waitress, she also loses $20,000 for her employment. Her Lost wages must be awarded as she had to face financial issues as well.

- Refund of the earlier made a payment on travel and accommodation package- As per the given case study, Angela had already paid $3,000 to Qantas wherein she was not able to complete her journey, therefore refund must be made by them and awarded to Angela for the same.

b) Considering the case study, the two main defences that have been identified wherein Johnson as a defender can argue for his defence are:

Comparative negligence- This negligence minimizes a recovery of the plaintiff by the percentage wherein the plaintiff is at fault for her damages. On this note, it can be said that Johnson can claim negligence against Angela as she was not able to help herself with the damages she was already made aware of.

Assumption of risk- While a plaintiff believes the involved risk in an evidently dangerous doings but proceed to engross in the activity anyway, she might not be able to overcome damages for her injuries. Thus, for this doctrine to be executed, the plaintiff mutts have factual, material knowledge of the risk involved in the actions(Aflvic.com.au, 2021).

However, it can be said that from the two main defences that Johnson had, he can choose the assumption of risk in order to claim for defence negligence. Here, he can appeal to the court that he does not have any fault as he had already made a warn statement regarding the tea Angela was about to have and it is evident that she was all on her sense about the fact.

Case Study 2

Answer 2

a)Consumer Guarantees refers to a group of regulations that is applicable to the commodities and services obtained by consumers as per the ACL. The regulations involved in the consumer guarantees impose the situationsin which a corporateshould offer a consumer with a medication. The consumer guarantees mechanicallyrelateirrespective of any charitable or protractedguarantee provided by a seller or producer of commodities, or in case such a guarantee has deceased. However, the four consumer guarantees applicable to the given case study regarding the purchase of the Ladder form Mohan’s Home Appliances Pty Ltd are as follows:

Express warranties to be honoured to the consumer: It is the most suitable guarantees for the given case because it can be seen that Sunny is not only injured by crashing into the floor but the goods that he had just received was also damaged. Therefore, under the Australian Consumer Law, the selling company should provide some warranty for the goods sold (Techhouse.com.au, 2021).

No undisclosed securities on the goods and services: The goods sold to the consumer should not include any disclosed securities with it as it might hamper the consumer while using it. Therefore, in the given case, the seller should ensure that they guarantee the consumer regarding the securities of the goods and should make sure that those securities are all disclosed to the consumer.

Acceptable quality: In the given case study, Sunny wanted to purchase the product for some essential use and to renovate his business. Therefore, the selling company should make sure that the quality of the product is at its best. It can also be considered one of the suitable and important consumer guarantee for the given case study. Fit for a Particular Purpose: As per the fact that the business run by Sunny and his wife was closed, they wanted to re-operate the business and gain profit. However, Sunny wanted the product as soon as possible as he desired to renovate the business. Therefore, the selling company should make sure that the product delivered to the consumer is fit for a particular purpose and provide satisfaction to the consumer. It is also one of the most important consumer guarantees that can be applied in the given case as well (Accc.gov.au, 2021).

As per the Australian Consumer Law, it is no legal to have a sign or no refund policy because the Australian government considers that the consumers have the right to get their money back or plead for a replacement of the product in case of the product being damaged or any wrong with the same. Therefore, Mohan's Home Appliances Pty Ltd will be legally penalised for applying the 'no refund' policy in their product. The remedies likely to be awarded to Sunny are that the company must at least compensate him for his loss (Websitepolicies.com, 2021).

b) Section 18 of the Australian Consumer Law situated in the scheduled 2 of the Competition and Consumer Act 2010, forbids demeanour by the corporation in trade or commerce that is dishonest or unreliable or is about to misinform or cheat. Considering the given case study, the Mohan's Home Appliances Pty Ltd has breached the Misleading Conduct Provision as they delivered the product to Sunny which was not in a good state or quality. In the first place, the Australian Consumer Law does not allow to sign No refund policy, secondly, the selling company has applied the policy when their product was not of good quality. Therefore, Sunny had to bear greater loss after using the product from Mohan's Home Appliances and had to suffer from sickness as he broke his bone after crashing into the ground (Legislation.gov.au, 2021).

As per the Australian Consumer Law, the maximum penalties that to be tolerated by the selling company after the breach of Section 18 involving unacceptable behaviour, creating incorrect or deceptive depictions, and providing customer commodities, which do not fulfil the safety standards or which are banned. The penalties for the corporations will be the supreme of $10000000, thrice the profit gained or 10% of annual turnover in preceding 12 months, if the court cannot determine profit gained from the offence. Whereas penalties for the individuals will be $500000.

However, in the given case study, the Mohan's Home Appliances will be penalized for applying 'No Refund' policy, which is against the Australian consumer law. It is because the selling company sold the product knowingly that it was of bad quality and could harm the consumer. The penalization for the corporation will be suitable to Mohan's Home Appliances and will have to pay $10000000, thrice the value of the profit gained or 10% of the yearly turnover (Accc.gov.au, 2021).

Case Study 3

Answer 3

a) As per the given case study, it has been analyzed that Sathia is working as a chef under Kathleen and said to be an Independent Contractor. But due to the incident that has taken place within the restaurant had made them know the differences between Employee and Independent Contractor’s status under the Employment Law(Employsure AU, 2021). Generally, the variance between workers and a free-lancer (contractor) is sometimes unclear. As per the employment law of Australia, the affiliation amidemployee and employers is a service agreement, but the affiliation amid them and am independent contract is a contract for service. However, the differences can be understated, yet crucial. Usually, a worker works part-time, full-time or informally and need to work under the supervision of the employers.

On the other hand, contactor normally works for the set agreed hours and has more control over the system they function. Yet, even these aspects are not sufficient to regulate whether a person is aworker or an independent contractor. Considering the matter, a court or tribunals addresses the complete picture wholly of relationship and all probable aspects and the process to identify the status of Sathia as an employee or independent contractor has been discussed on the following grounds:

The Independent Contractors Act 2006 that is related to the Fair Work Act 2009 protect the rights and power of independent contractors(Knowledge.leglobal.org, 2021). However, relating the case study with the given table that has been demonstrated above reflects that though Kathleen stated that Sathia was just an independent contractor but was failed to give him the status of an independent contractor. Consequently, it can be said that Sathia is employee than that independent contractor.

b) As per the law, a plaintiff who makes a negligence claim on a person or a corporation must prove four elements of negligence action such as duty, breach, proximate causation and injury. It means that if a consumer is accusing a person of a negligence action, the accused person must have neglected the above four elements mentioned. Therefore, in the given case Manpreet must prove four elements of negligence action in order to win her case against Medieval Meats. However, the Damage/Losses that are likely to be awarded to Manpreet by Medieval Meats are Medical expenses and expense for the damage to her watch (Etheringtons.com.au, 2021). However, in this case, Kathleen will be liable for the claim because although Sathia is the independent contractor of the restaurant, he is treated as an employee of the corporation. Therefore, under the Employment Law, Kathleen will be liable for the medical expenses and watch expenses to Manpreet. The restaurant has proved one of the essentials in the act of negligence that is Duty to take care. It is because neither Kathleen nor Sathia has taken the responsibility to take care of the health of their customers, which falls under the criteria of ‘Duty to take care’. It is one of the reason for the medical expenses to be paid to Manpreet as she was suffering from severe gastro and was in need of major medical treatment. On the other hand, there was an expense liable to Kathleen as Sathia had damaged Manpreet’s watch. They also have to pay for this damage because the restaurant is wholly responsible for the losses and damages that Manpreet was going through. As per the law, Kathleen has fallen under the categories of the essentials in 'Action for Negligence', for which they have to pay. As per the law, the negligence case is only liable for those losses or damages that the defendant could have foreseen through his actions. It means that the accused person will only pay for the losses and damages that are proved and seen through his or her action but will not have to pay for the assumed losses and damages. Likewise, in the given case, Kathleen will have to pay only for the damages that fall under the categories involved in the Action for Negligence.

Answer 4

a)Yes

b)Yes

c)Yes

d)Yes?

References

Accc.gov.au. (2021). Consumers' rights & obligations. Retrieved 16 February 2021, from https://www.accc.gov.au/business/treating-customers-fairly/consumers-rights-obligations#:~:text=Consumer%20guarantees%20are%20a%20set,by%20consumers%

20under%20the%20ACL.&text=The%20consumer%20guarantees%20automatically%

20apply,such%20a%20warranty%20has%20expired.

Accc.gov.au. (2021). Fines & penalties. Retrieved 16 February 2021, from https://www.accc.gov.au/business/business-rights-protections/fines-penalties#australian-consumer-law

Aflvic.com.au. (2021). Retrieved 16 February 2021, from https://www.aflvic.com.au/wp-content/uploads/2013/08/Advice-THE-LAW-OF-NEGLIGENCE-18-December-14-Final.pdf

Employsure AU. (2021). Employee versus Independent Contractor | Employsure Guides. Retrieved 16 February 2021, from https://employsure.com.au/guides/employment-contracts-and-legislation/employee-v-independent-contractor/#:~:text=Employee%20vs%20Contractor,-The%20difference%20between&text=Under%20Australian%20employment%20law%2C%20the,can%20be% 20subtle%2C%20but%20important.

Etheringtons.com.au. (2021). What Is the Tort of Negligence? When Does Duty of Care Apply?. Retrieved 16 February 2021, from https://etheringtons.com.au/what-is-the-tort-of-negligence/#:~:text=For%20a%20person%20to%20be,duty%20has%20caused%20the%20harm.

Fairwork.gov.au. (2021). Welcome to the Fair Work Ombudsman website. Retrieved 16 February 2021, from https://www.fairwork.gov.au/how-we-will-help/templates-and-guides/fact-sheets/rights-and-obligations/independent-contractors-and-employees Knowledge.leglobal.org. (2021). Re-Characterisation of Independent Contractors as Employees.

Retrieved 16 February 2021, from https://knowledge.leglobal.org/eic/country/australia/re-characterisation-independent-contractors-employees-2/ Legislation.gov.au. (2021). Competition and Consumer Act 2010. Retrieved 16 February 2021, from https://www.legislation.gov.au/Details/C2017C00281

Luntz, H. (2021). Retrieved 16 February 2021, from https://www.researchgate.net/publication/228191772_The_Use_of_Policy_in_Negligence_Cases_in_ the_High_Court_of_Australia Oup.com.au. (2021). Retrieved 16 February 2021, from https://www.oup.com.au/__data/assets/pdf_file/0021/140880/BARKER_9780195572391_SC.pdf

Techhouse.com.au. (2021). Australian Consumer Guarantees - Tech House - Tech Repairs & Solutions. Retrieved 16 February 2021, from https://www.techhouse.com.au/consumer-guarantees/ Websitepolicies.com. (2021). Retrieved 16 February 2021, from https://www.websitepolicies.com/blog/no-refund-policy#:~:text=Australia,problem%20with%20something%20they%20bought