Business Simulation assignment – developing a business simulation plan for Toyota

Question

Task: How can Toyota use Business Simulation assignment strategies to develop an effective business expansion plan?

Answer

Introduction

This Business Simulation assignmentwill describe the comparative environment of Andrews simulation company with that of Toyota manufacturing company, one of the largest manufacturing companies in the automobile sector. The report's primary purpose is to understand how the actual company's competitive environment and the simulation company's comparative environment are being focused on. Based on the differences that will be evaluated through the report concerning the comparison, Toyota company must adopt relevant strategies that would help the company benefit in the international market with its existing product that will help the company to address new marketing opportunities that will ensure the various risks through which the company needs to be aware of. The report's first section will effectively describe the internal and external analysis (Brandl,Ridolfi and Reinhart, 2020). Next, it will identify the competitive landscape for Andrews's simulation based on the three rounds observed concerning the simulation. Additionally, it will focus on the market structure and the strategy that the Andrew simulation company has implemented to effectively analyse all the aspects of the external and internal strategy. Lastly, it will compare the real-world company with the simulation company to derive the areas where Toyota needs to focus more. The report will also suggest some recommendations through which Toyota company could adopt specific strategies that would have them in future market analysis.

Overview of the company

Toyota Motor corporation is one of the Japanese Multinational Automotive manufacturing companies headquartered in Japan. Toyota is one of the largest manufacturing companies, producing more than 10 million vehicles annually. The company has an operating income of more than 2197748 million as of the fiscal year of 2021. Currently, the company's net income is nearly 2282378 million. The total number of employees working in Toyota is 366,283, according to 2021 (Dave, 2020). Since the Second World War, Toyota has been famous for developing and producing automobiles. It did give rise to a new production system which came to be known as the Toyota production system, which uses Lean manufacturing practices that mainly aims to transform a small company into the leader of the automobile industry. Business Simulation assignmentresearch findings show Toyota has taken advantage of the rapid increase in Japanese regarding the cell of the cars in the middle-class, and they have become the all-time best-selling automobile company globally (Morgan and Liker, 2020). Due to the booming economy, it has also funded an international expansion for Toyota that has helped the company to grow as one of the world's largest automakers and the ninth most prominent company in the world concerning revenue. The company, the leader in development and sales, has produced hybrid electric cars, for which it is famous and has successfully embraced sustainability, which is the future of the automobile sector.

External analysis

Business Simulation assignmentPESTLE analysis

|

Factors |

Description |

Impact |

|

Political |

One of the significant opportunities that Toyota business has been gaining is the political stability in most of its markets that have been able to provide Toyota companies with a prominent area to business effectively (Ariwibowo et al., 2021). Government support for eco-friendly products and free trade agreements are some of the other opportunities that the Toyota company enjoys. It is clear from the Business Simulation assignmentresearch that It has improved the market penetration strategy for the company and does help to enhance its product safely and meet the customers' demand. Under this pestle analysis dimension, Toyota enjoys many more opportunities in the business environment. |

High |

|

Economic |

Economic Trends also influence the organisational development of the company. Due to the weakness of Japan's currency, the Yen concerning the US dollar has provided much more opportunity for the company to trade with European countries. Gradual growth in the US economy has provided many opportunities for Toyota to improve its revenue based on these markets (Buzatu et al., 2019). Since middle-class families are more engaged in Selling cars, the company has been able to develop its business rapidly in developing countries that have provided many opportunities for the company. Concerning this factor, Toyota enjoys and creates many opportunities for business growth due to the stable economic condition in most of its markets. |

Medium |

|

Social |

Concerning the social factors, it has been observed that the increasing interest of customers concerning hybrid cars has provided many opportunities for Toyota to target this customer group. With the growing interest in sustainability, it has catered for the need for electric vehicles that have created a compelling opportunity for Toyota to develop its market-based in these countries where the customers are much more concerned about the sustainability approach (Alexandru-Ilie et al., 2020). One of the major threats the company faces is the vast wealth gap, especially in developing countries where the rich are becoming more affluent, and the poor are becoming poorer. The threat concerning the winding wealth gap among middle-class families may cause potential harm in addressing the majority of the revenue for the company. |

High to moderate |

|

Technological |

Technological factors impact Toyota based on the Technology business is another important factor observed on this Business Simulation assignment. With the rising use of The E-Commerce facilities and mobile Technology, trends have been one of the significant opportunities that are helping Toyota to invest rigorously in its research and development procedure and thus undertake investment arenas that would help Toyota to improve its E-Commerce facilities and to exploit the third party services for the sale of identical products. With the enhancement of its mobile application, Toyota has increased customer engagement and loyalty (Vargas-Hernández and Garcia, 2019). Concerning these technological factors, one of the major threats the company faces is in relation to the increasing cybercrime that mainly includes corporate cyber espionage, which is very harmful to the company's technological security. |

High |

|

Legal |

Concerning the legal factors, it has been observed that Toyota has the opportunity to grow with reduced concern concerning the infringement of intellectual property laws as the government mainly works towards improving intellectual property protection (Christodoulou and Cullinane, 2019). With the increasingly complex environment, it will not be able to affect the revenue of the company as the company is already implementing its production system in order to address the sustainability factors for the car company effectively, which has provided many opportunities for Toyota to develop electric cars (Sari et al., 2021). With the increase in complex consumers, Toyota has been offered many options as the company is producing more satisfactory products to fulfil the customers' needs. |

Low |

|

Environmental |

The Business Simulation assignmentresearch shows that Toyota has been enjoying its more environment-friendly products as the rising climate change has not created any issues for the company. Toyota is mainly focused on delivering environment-friendly products that emit fewer gases. Since the company is manufacturing electric cars, the declaration of the global oil reserves will not be another threat that could affect the financial perspective of the company (Muhaimin et al., 2019). The increase in the emphasis on business sustainability has been another significant opportunity that will help the form to use for future growth and create a sustainable company with all its electric cars and different environmentally friendly products. |

Low |

The competitive perspective of Andrews Company

Andrews is a car company mainly focused on sailing high-specification and premium quality cars. Under the Business Simulation assignmentsimulation, it has been observed that the company has made a heavy investment in the research in development and automation process, unlike Toyota, in order to keep the production cost low and increase the profit margin that would provide much revenue for the company concerning its other competitors which is mainly Chester, Digby and Baldwin (Lábaj et al., 2018). Andrews company has made higher investments in the Total Quality Management process and other human resources to keep the initial cost low so that the profit from the product will be increased, enabling the company to gain much more revenue. The company's main target is to develop premium products, unlike real-world car companies like Toyota (Valarezo et al., 2021). This section will effectively describe the external and internal analysis of Andrews company that will help to understand the comparison between natural wall and simulation company.

Porter's five forces

• Bargaining power of suppliers: The bargaining power concerning the automobile company is very low. As many suppliers provide parts for automobiles, the Andrews company is on a high opportunity with respect to the bargaining power of suppliers as the dominant and change the market price effectively. The company has the privilege of purchasing quality products from other suppliers that provide raw materials at low prices. Due to the low bargaining power of the suppliers, it has provided many opportunities for Andrews company to reduce its production cost and to get hold of quality raw materials from the best suppliers. They are engaged in the production of sustainable raw materials.

• Bargaining power of customers: The bargaining power of the customers is very low concerning the automobile sector due to the lack of competition in the automobile sector for premium products. Andrews has high flexibility in product sales and thus enjoys much power in the automobile sector (De Corniere and Taylor, 2020). Since the bargaining power of the customers is very low, it creates a high advantage for Andrews for the organisation's effectiveness, which will lead to higher revenue for the company.

• Threat from substitute: There is a medium threat for a substitute for Andrews company as some of the competitors, Baldwin, Chester and Digby, produce the same products but at a very low quality; hence it helps Andrews to enjoy much more effectiveness in the automobile sector. Since there are many substitutes available for the company, Andrew's company must address that will enable the significance of the threat that has been faced by the company concerning the maintenance of the other products (Souza and Aste, 2019). Though there is low competition as some of the other companies are not able to produce premium quality cars, that is the major advantage of Andrews company. The majority of the customers tend to look for quality products when factors such as price or quality are being hampered.

• New entrants in the industry: The threat from the new front is very low as per data findings made on this Business Simulation assignment. In order to establish a business in the automobile sector requires high capital investment and advanced Technology, which is very difficult for new companies. Additionally, it can be observed that new entrants in the industry face difficulty in promoting and advertising their business (Acosta, Ihle and von Cramon-Taubadel, 2019). Thus, Andrews company does not have any threat from the new entrants and has established its business more successfully by adapting to the changes in the consumer preference and needs that will help the company to survive in the automobile sector effectively.

• Competition in the industry: After looking at the financial statistics data concerning the other company, it has been evaluated that raised low competition in the automobile industry, and it needs to constantly assess effective strategies by Andrews in order to survive in the automobile sector effectively without any issue. Some of the competitors observed concerning Andrews are Chester, Digby and Baldwin, but they are not posing much threat to the company. The company must adopt unique strategies that will help to maintain its dominant power in the automobile market.

Comparative analysis

It has been observed on this Business Simulation assignmentthat Andrews company survives in a less comparative market as it has high dominant power in influencing the price which helps the company to address and acknowledge high-profit margin. Compared to the real world company, it has been observed that Toyota survives in a highly competitive market for which the company has to continuously invest in research on development to find out many unique strategies so that it can incorporate them effectively in order to gain much of its revenue. But since Andrews Company has an oligopolistic and monopolistic market structure, it has provided an opportunity for the company to influence the price of the market, and there is a dominant power in respect to the bargaining of the suppliers as well as the customers. From the comparative background of the Andrews company, it could be effectively stated that since the company's market structure is oligopolistic and monopolistic, there are very few computers, and mainly there are few companies that are prevailing in the market. When compared with the real company of Toyota, there are many competitors in the market, which pose a great threat to the company, and survival is difficult for Toyota concerning the Andrews company (Behrens et al., 2020). From the external analysis of Toyota, it has been observed that the change in the customer preferences along with the winding gap of the income premium product range is very threatening for the company in the future market. Unlike Andrew's company, Toyota must reduce the initial cost of production, which will help the company sell its product at a lower price than its competitors. Hence from the competitive analysis of both Andrews and Toyota company, it could be stated that if Toyota can reduce its cost and use a low-cost leadership strategy, it will be easier for the company to handle its competitors and increase its growth in the international market.

Market structure

Concerning the company, it has been observed that its market structure is an oligopoly with very limited competition and standardised products. Concerning the features of the oligopoly market, it has been observed that Andrew's company has an oligopolistic structure where the number of large firms is very low; thus, it provides an advantage for Andrew's company to address all the aspects of the automobile company effectively. The company also enjoys non-price competition where the form is in the position to influence the price and avoid price competition or policy of price rigidity, which provides many privileges for the company to enjoy the privilege of the automobile company. The entry of the new firms is also reduced under the oligopoly market structure, which is one of the significant advantages Andrews company gets in its market.

Another major market structure that has been observed by Andrews company is the monopolistic market structure where the competitors are very small for the company, and the science of the competitors is also very small; it provides a market opportunity for the company to differentiate its product by investing heavily on the research and development aspects. The characteristic of the monopolistic market allows the company to maximise its profit by setting a higher price than the competitive market. It enables the company to have much higher profits. Looking at the company's financial statement, it has been observed that Andrews company has been enjoying high net profit that mainly relates to the overall achievement of the product effectively. Another most effective privilege that Andrews company get is that price discrimination. Since the company is operating in a monopolistic market, it can change the price in the quantity of the product as its suitable factor. Then price discrimination occurs while selling the same product to different buyers at different prices.

Business Simulationassignment -New market opportunity

After the competitive analysis it has been observed that Toyota should enter into a new market environment, Namibia of Africa. It is one of the attractive market which will help the company to grow in future as well as develop effective strategies that are related to it. It is one of the attractive market as it is a developing country and thus it will help the company to flourish effectively. Namibia is one of the attractive country that will help company to expand globally as well as increase their revenue effectively.

Internal analysis

Porter's value chain analysis

Business Simulation assignmentPrimary activities

• Inbound logistics: Toyota, the largest automobile company, has managed an extensive supply chain where it receives parts from thousands of suppliers all across the globe and assembles it to develop its model. The company has handled its inbound logistics efficiently throughout the years, and it does its distribution centres where houses receive many efficient and productive parts from all the suppliers.

• Outbound logistics: since the company has its parts and Logistics centres worldwide, it ships thousands of parts and orders daily from the various network chains concerning the warehouse and other distribution sectors (Zhou, 2019). The company Centre is in Belgium and ships thousands of parts daily to its other regional depots. On average, it has been estimated that Toyota receives and ships nearly 5 lakh parts and accessories for the car each day.

• Operations: Toyota, a global brand in the automobile sector, has its operations spread throughout the world. The brand serves customers across all groups through its vast distribution network. Apart from the manufacturing side, the brand has been able to distribute its products worldwide. Currently, the company sells its products to nearly 170 countries.

• Marketing and sales: Due to the highly competitive environment in the automobile sector, it has been challenging for Toyota to sustain and retain its market share and customer base (Li, 2018). The company makes significant investments in its advertisement and marketing promotion. It uses mixed traditional and modern advertisement mediums to reach customers through its marketing channel, both online and offline.

Support activities

• Technology: Toyota is known for its exceptional engineering and Technology and does use great production Technology for which the company is very famous. Toyota mainly used its research centres and has entered into partnerships with various Institutions to increase its investment concerning technological innovation for the growth that has the company to invest mainly in its production system that would help to sustain the future automobile sector.

• Infrastructure: Toyota has maintained an extensive global infrastructure, from its headquarters in Japan to Northern South America as well as in other parts of Asia and Europe (Sahib and Idan, 2019). The Business Simulation assignmentdata shows that currently, the company has been able to create impressive presents in most markets across the world, and thus, it has established its infrastructure firmly.

• Human resource management: Toyota currently has more than 3 lakh employees per the records of 2021, and the brand believes that undertaking a human-centric approach to value creation will help the company focus more on developing its human resources. In the automotive sector, intelligent and skilled human capital is a significant competitive advantage that a company can have.

• Procurement: the company mainly prokaryotes its raw materials from different suppliers worldwide. In 2009, the brand was formulated as a specific Toyota way of purchasing that includes policies and principles from the procurement staff. Toyota is always working towards contributing to the local economies of the country.

Business Simulation assignment-VRIO analysis

Concerning the brave analysis model, the non-core competencies of the Toyota organisational resources and capabilities have been evaluated concerning all the requirements of the VRIO analysis. Concerning the case study of Toyota, it has been observed that high efficiency concerning the manufacturing process has been one of the organisational capabilities that mainly contribute to increasing the company's competitiveness in the other automobile sector (Nkomo, 2019). Manufacturing ability is not a core competency, as different automobile manufacturers have developed high-efficiency production. With that respect, the company's high production capacity has been declared a capability that cannot be emitted by other automated technologies, which is the best practice Toyota has in its operational management. Hence it could be effectively discovered from the VRIO table illustrated below that high production capacity is a non-core competency that provides comparative equality and even supports competitive advantages over other automobile companies. The non-core competencies of Toyota also include the global network of manufacturing facilities strategically located in different parts of the world. The company's international expansion has led to the establishment of various facilities (Hofbauer and Sangl, 2018). From the analysis of the VRIO model, it has been evaluated that the manufacturing network of Toyota is precious but not rare, as many other automobile companies have a similar strategic approach to expanding their manufacturing process. Hence, concerning this resource, it could be stated that Toyota Motors is not the only company with manufacturing locations in various other parts of the world.

|

Valuable · Toyota's high-efficiency manufacturing process is one of the value factors that the company has, which differs from the other automobile companies. · With the high production capacity and global network of manufacturing facilities in various locations, Toyota has precious factors that help the company gain customer loyalty (Dutta, 2021). · Partnership and alliances with other companies and the capacity to drive much more Technology have been successfully achieved by Toyota, which is very valuable for the company. |

Rare · Toyota’s rapid innovation in research and development is one of its rare capabilities. · High popularity and technological expertise concerning the research on the development are some of the rare aspects of Toyota that other automobile companies cannot easily copy. |

|

Inimitability · Accessibility to support from diverse businesses via the Toyota group has been one of the inimitable factors that other companies cannot easily. · High brand popularity for the company is also one of these factors that other automobile companies cannot easily portray. |

Organisation · Toyota has a high capacity to compete with other automobile companies based on cost and pricing strategy. · With the help of the innovative production system, Toyota is one of the largest automobile companies, with its product lineup mainly moving towards sustainability. |

Strategies used in simulation-Ansoff matrix

Concerning the framework of the Ansoff matrix, one of the growing strategic frameworks that have effectively addressed that, Andrews company have used a product development strategy to survive in the automobile sector. Under this Business Simulation assignmentstrategy, the company has produced premium quality products in order to gain more profit and maintain a high-profit margin. The company has constantly invested in the research and development process to understand the market and develop more premium quality products that would enhance the organisation's effectiveness. In comparison to the growth strategy that has been used by the Andrews company in the real world, it has been observed that Toyota use a market penetration strategy in order to promote its product into the new international market, which will enhance the effectiveness of the organisation and have the company to acquired many international markets by providing and acknowledging all the factors prominently (Dhingra and Morrow, 2019). With the help of the Ansoff matrix, it has enabled us to understand that if a company wants to expand its business in the international market, Andrew's company must implement penetration effectively, which has mainly described the ways the company needs to grow effectively. Concerning the real-world growth strategy used by Toyota, it has been effectively observed that Andrews Company needs to adopt such a Business Simulation assignmentstrategy if it wants to explain its business in the global market.

Recommendations

Some of the recommendation that has been observed which is necessary for Toyota to handle other which will be required effectively for the higher global presence, the following strategies will work better for Toyota than Andrews is basically as follows:

• The company needs to change its rigid hierarchy where the order mainly flows in one direction from top to bottom. The lack of flexibility in the organisational structure has created many issues for the company in maintaining the proper company structure. The lack of motivation concerning the employees has created problems for Toyota.

• The company needs to implement a proper international market strategy as the company has a partial global presence, and the other is necessary to consider ancient markets more effectively, which will provide the company to boost its sales as well as increase its revenue of the company. Implementing strong marketing strategies will enable Toyota to explore more international markets, ultimately increasing the company's revenue.

• After the economic crisis, it has been observed that Toyota's sales have dropped by 74%, so the company must invest rigorously in its marketing activities and strategies to increase its revenue and feel the gap it has been facing throughout the economic crisis.

• The technology gap is another major issue that has faced by Toyota. The company must invest highly in the technical environment and minimise the gap between technical aspects. The company needs to promote advanced Technology in most of its cars so that it can provide a competitive age to its competitor Tesla.

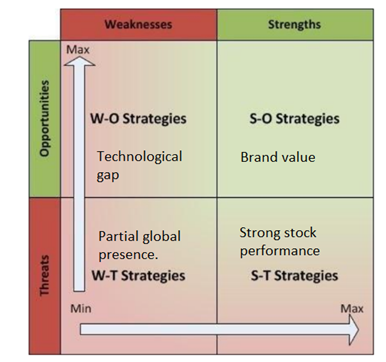

Business Simulation assignment-TOWS matrix

Figure 1: TOWS Matrix

(Source: created by author)

Conclusion

To sum up, from the above report, it could be effectively concluded that there has been a comparative analysis between the simulation automobile company and rules with that of real-world company Toyota. In the initial stage of the external and internal analysis of Toyota, it could be a certainty that Toyota enjoys high profits due to the stable political condition in most of its global market that has allowed the company to develop many new products and ascertain the various ways they could move towards sustainability of the product. From the internal analysis, it could be effectively stated that Toyota has very strong suppliers built and distribution network that have helped the company to embrace many new developments of the products and does ensure that the company code effectively understands the various ways in which they could apply the strategy in order to get premium products. Compared to the simulation company and rules, it has been observed that Toyota needs to develop its pricing strategy in such a way that it can be dominant in the market of automobiles. Andrews has maintained a monopolistic and oligopolistic market structure that has provided many privileges for the company to reduce the competition and enjoy the supremacy of changing the pricing policy according to its will. Hence this Business Simulation assignment concludes that Toyota needs to develop some strategies, unlike Andrews which would help the company achieve successful results in the future market.

References List

Acosta, A., Ihle, R. and von Cramon-Taubadel, S., (2019). Combining market structure and econometric methods for pricetransmission analysis. Food Security, 11(4), pp.941-951. https://link.springer.com/article/10.1007/s12571-019-00951-wBusiness Simulation assignment

Alexandru-Ilie, B., Alexandru, P.D., Iulian, C.C. and Valentin, W.P., (2020). MANAGING ORGANIZATIONS FOR SUSTAINABLE BUSINESS DEVELOPMENT: INTERACTION BETWEEN VRIO FRAMEWORK AND McKINSEY 7S FRAMEWORK. http://basiq.ro/papers/2019/Managing_Organizations_for_Sustainable_Business_Development_Interaction_between_VRIO_Framework_and_McKinsey_7S_Framework.pdf

Ariwibowo, P., Saputro, F.B. and Haryanto, H., (2021). Analysis of Strength & Weakness, Using the Concept of Resource-Based View with the VRIO Framework in Sharia Cooperatives. JurnalManajemenStrategi dan AplikasiBisnis, Business Simulation assignment4(1), pp.279-294. http://www.ejournal.imperiuminstitute.org/index.php/JMSAB/article/download/313/201

Behrens, K., Mion, G., Murata, Y. and Suedekum, J.,( 2020). Quantifying the gap between equilibrium and optimum under monopolistic competition. The Quarterly Journal of Economics, 135(4), pp.2299-2360. https://academic.oup.com/qje/article-pdf/135/4/2299/34542504/qjaa017.pdf casa_token=1ZqzfRaXsKcAAAAA:Dj701ud-8VzhSao-d9OHsegjP8cCzsFvHQtwLBTvZnEGAeRd8E471LJOMLvdFUPJRV_ZJecI93hLsX0

Brandl, F.J., Ridolfi, K.S. and Reinhart, G., (2020). Can we adopt the toyota kata for the (re-) design of business processes in the complex environment of a manufacturing company. Procedia CIRP, 93, pp.838-843. https://www.sciencedirect.com/science/article/pii/S2212827120307162/pdf md5=c75b8e9492056d275e07c3debbb94f51&pid=1-s2.0-S2212827120307162-main.pdf

Buzatu, A.I., Pleea, D.A., Iulian, C. and Valentin, W.P., (2019, May). Managing organizations for sustainable business development: Interaction between VRIO framework and Mckinsey 7s framework. In New trends in sustainable business and consumption. Bari: BASIQ International Conference Business Simulation assignment (pp. 243-251). https://www.researchgate.net/profile/Ann-Katrin-Arp-2/publication/333902657_Study_on_European_funding_programmes_for_sustainable_development/links /5dbaf94d299bf1a47b05a8d3/Study-on-European-funding-programmes-for-sustainable-development.pdf#page=243

Christodoulou, A. and Cullinane, K., (2019). Identifying the main opportunities and challenges from the implementation of a port energy management system: A SWOT/PESTLE analysis. Sustainability, 11(21), p.6046. https://www.mdpi.com/2071-1050/11/21/6046/pdf

Dave, P.Y., (2020). The History of Lean Manufacturing by the view of Toyota-Ford. International Journal of Scientific & Engineering Research, 11(8), pp.1598-1602. https://www.researchgate.net/profile/Pranav-Dave-4/publication/344460563_The_History_of_Lean_Manufacturing_by_the_view_of_Toyota-Ford/links/5f787daa299bf1b53e09c53a/The-History-of-Lean-Manufacturing-by-the-view-of-Toyota-Ford.pdf

De Corniere, A. and Taylor, G., (2020). Data and competition: a general framework with applications to mergers, market structure, and privacy policy. Business Simulation assignment http://publications.ut-capitole.fr/34074/1/wp_tse_1076.pdf

Dhingra, S. and Morrow, J., (2019). Monopolistic competition and optimum product diversity under firm heterogeneity. Journal of Political Economy, 127(1), pp.196-232. http://eprints.lse.ac.uk/59226/1/__lse.ac.uk_storage_LIBRARY_Secondary_libfile_shared_repository_

Content_Dhingra%2C%20S_Monopolistic%20competition_Dhingra_Monopolistic_competition.pdf

Dutta, S., (2021). A Research Background of Global Value Chains. Available at SSRN 3784153. https://mpra.ub.uni-muenchen.de/106204/1/MPRA_paper_106204.pdf

Hofbauer, G. and Sangl, A., (2018). Considerations to rearrange the value chain. Archives of Business Research, 6(4). https://www.researchgate.net/profile/Anita-Sangl/publication/325104379_Considerations_to_Rearrange_the_Value_Chain/links/5d512e274585153e594eab25

/Considerations-to-Rearrange-the-Value-Chain.pdf

Lábaj, M., Morvay, K., Silani, P., Weiss, C. and Yontcheva, B.,( 2018). Market structure and competition in transition: results from a spatial analysis. Applied Economics, 50(15), pp.1694-1715. https://www.tandfonline.com/doi/pdf/10.1080/00036846.2017.1374535

Li, Z., (2018). Business Network Positioning Analysis of Toyota. American Journal of Industrial and Business Management, 8(07), p.1693. https://www.scirp.org/html/3-2121267_85940.htmBusiness Simulation assignment

Morgan, J.M. and Liker, J.K., (2020). The Toyota product development system: integrating people, process, and technology. Productivity press. https://www.ame.org/sites/default/files/target_articles/06-22-4-BR_Toyota_Prod_Dev_Sys.pdf

Muhaimin, A.W., Wijayanti, V. and Yapanto, L.M., (2019). ANALYSIS OF MARKET STRUCTURE, CONDUCT AND PERFORMANCE OF CORN (ZEA MAYS L.) IN KEDUNG MALANG VILLAGE, PAPAR DISTRICT, KEDIRI REGENCY, EAST JAVA. International Journal of Civil Engineering and Technology (IJCIET), 10, pp.10-16. https://www.academia.edu/download/60494493/IJCIET_10_06_03520190905-36360-1ku3bzw.pdf

Nkomo, T., (2019). Analysis of Toyota Motor Corporation. http://dspace.vnbrims.org:13000/jspui/bitstream/123456789/2458/1/Toyota%20Case%20study.pdf

Sahib, A.A. and Idan, A.A., (2019). Integrate target cost techniques and value chain analysis to achieve competitive advantage. Opción: Revista de CienciasHumanas y Sociales, (21), pp.676-690.https://dialnet.unirioja.es/descarga/articulo/8348445.pdf

Sari, P.N., Gusti, A., Suci, I. and Pratama, M., (2021, April). Sustainability of the climate village program to prevent the impact of climate change on water supply and sanitation: a perspective from the PESTLE analysis. In IOP Conference Series: Earth and Environmental Science Business Simulation assignment (Vol. 708, No. 1, p. 012086). IOP Publishing. https://iopscience.iop.org/article/10.1088/1755-1315/708/1/012086/pdf

Souza, T.T. and Aste, T., (2019). Predicting future stock market structure by combining social and financial network information. Physica A: Statistical Mechanics and its Applications, 535, p.122343. https://arxiv.org/pdf/1812.01103

Valarezo, O., Gómez, T., Chaves-Avila, J.P., Lind, L., Correa, M., Ulrich Ziegler, D. and Escobar, R., (2021). Analysis of new flexibility market models in Europe. Energies, 14(12), p.3521. https://www.mdpi.com/1996-1073/14/12/3521/pdf version=1624344694

Vargas-Hernández, J.G. and Garcia, F.C., (2019). The Link between a Firm´ s Internal Characteristics and Performance: GPTW & VRIO Dimension Analysis. REBRAE, 12(1), pp.19-30. https://periodicos.pucpr.br/REBRAE/article/download/24645/23214

Zhou, X., (2019). Corporate Governance and Corporate Governance Index: A Study on Toyota Company Recall Scandal. Available at SSRN 3385229. https://papers.ssrn.com/sol3/papers.cfm abstract_id=3385229Business Simulation assignment

Business Simulation assignment - Appendix

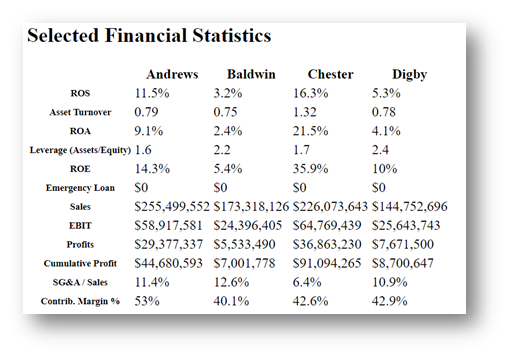

Figure 2: Financial statistics round 4

(Source: Simulation)

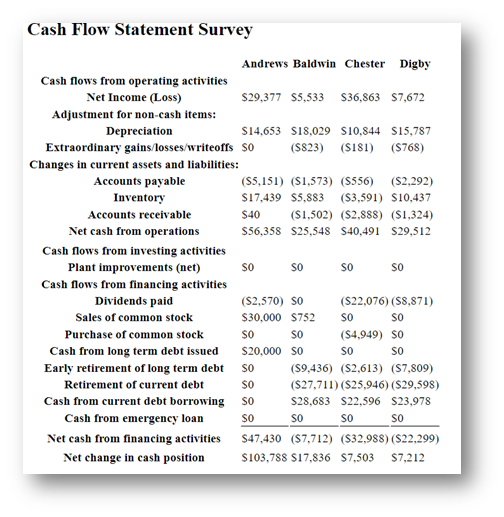

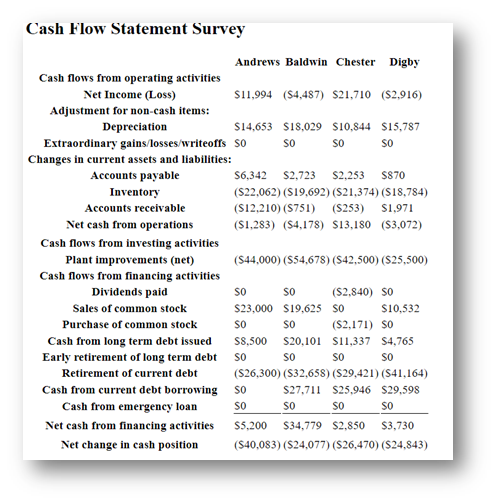

Figure 3: Cash flow survey round 4

(Source: Simulation)

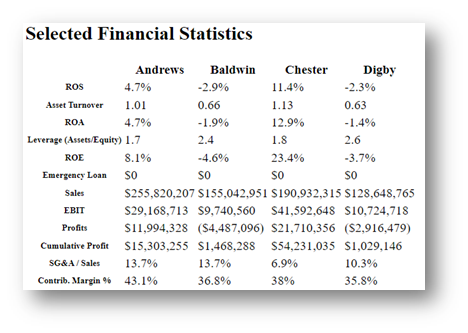

Figure 4: Financial statistics round 3

(Source: Simulation)

Figure 5: Financial statistics round 3

(Source: Simulation)