Managerial Accounting Assignment: The Job Costing System In Australian companies

Question

Task:

Managerial Accounting Assignment Task: You are required to conduct a literature search and critically review a costing system in this assignment.

Part A

Choose ONE of the costing systems studied in this unit from the list below, and answer the questions that follow:

- Job Costing

- Process Costing

- Operation Costing (Hybrid Costing)

- Activity-based Costing (ABC)

Questions:

1. Briefly discuss the features of your chosen costing system.

2. Identify 2 specific Australian companies that your chosen costing system is suitable for, and explain why.

3. Discuss two potential uses of the cost information for decision-making, to the managers in each of the 2 organisations selected in Q2 above.

Part B

Choose one peer reviewed journal article (from any country) on the: Use of your chosen costing system in a real-life organisation (i.e. a case-based empirical study). The article should be published between 2005 – 2020. Choose your article only after you have accessed and reviewed several relevant articles, and then choose the best article that will answer the questions below.

Questions:

1. Based on your chosen costing article, briefly summarise how the costing system was designed and implemented in your real-life organisation.

2. Based on your chosen costing article, did the costing system in the study satisfy the features discussed in Part A (Q1)? Why or why not? Include examples in your answer from your costing article.

3. Based on your chosen costing article, how useful was the cost information to the internal users in the organisation? Discuss with examples from your costing article.

4. Based on your literature findings, state two key lessons that would inform contemporary organisations about the practical use of your chosen costing system.

Answer

Abstract

The costing system holds a place of significant importance in the organization as it helps in delivering an answer to whether the business is managed appropriately in terms of cost. The present managerial accounting assignment is related to the job costing system which is a system where overheads are assigned to one or more cost pools. The report revolves around the job costing system followed by the Australian companies that utilize the system. In addition to it, the benefits of the system are described. Further, the study is undertaken considering the article of Job costing and the observation from the study is that the costing system which is suitable for one organization might not be suitable for another.

Introduction

A cost accounting system can be defined as the system or the framework utilized by the firms for the estimation of cost of the products for evaluation of the profit, inventory, and the control of cost. Estimating the correct costs of the product is vital for the operations of the company. The aim of the assignment is to conduct an analysis of the costing system of the organization and specifically the job costing system. Proper job costing helps in enhancing profitability, estimation of the project, and financial reporting. Proper job costing utilizes the cost that is recorded to a specific project to highlight the profitability. The report is divided into two parts whereby the initial part discussed the features of the system coupled with the enterprises of Australia that uses the system together with the potential utilization of the cost information. The other part of the report is based on an empirical case study and discusses the cost system through the article. Based on the discussion and the literature, the feedback is provided and the conclusion is drafted.

Part A

1. Features of Job costing

Job costing is utilized for smaller works that spread to a shorter duration. This method is mainly used by manufacturers of small tools, printing press, makers of furniture, and repair shops. It is utilized to evaluate the cost and profit or loss for every job in a specific manner. In a short job, costing can be defined as the process that accurately tracks the cost to deliver a specific product or a specific function. When the job costing process is effectively done, it helps in accurately estimating the gross profit margin and helps in the decision of hiring and charges for the new products (Cuzdriorean 2017). The job costing mechanism can be used in any industry to check whether the cost of production goes past the overheads and the prices of the materials that would help in arriving at the profit for the entire process.

The main features of job costing are as follows:

Jobs are undertaken against the customer orders and as per their directions

Production is not linked to stock and future sales. It is a regular mechanism.

The jobs differ from each other that need a different mechanism, materials, and treatment.

The job passes through different operations and departments as per the needs. There cannot be any uniformity in the production outflow.

Every job is considered as a cost unit and a job number is issued. The identification of the job is done with the number through various phases of production (Karadag 2015).

A specific cost sheet is prepared for every job to know the cost and profit.

Hence estimation of the cost and quotations is done considering that basis.

2. Application of job costing in the Australian companies

The job-order costing system is used by food companies, aircraft manufacturing companies, accounting firms, service organizations, hospitals, law firms, clothing factories, and so on. This system is also suitable for companies that design and produce custom made machines and tools (Azudin & Mansor 2018).

Accounting firms like Moore Stephens use the job-order costing system as every client is unique and hence the costing is worked out for every client separately. The actual costs that are direct and indirect costs are related to every client and the profitability of the firm is calculated based on the number of hours of efforts of the professionals that are put in. In the real world, the costs are worked out on a timely basis and it can be determined once the job is completed (Douma & Hein 2013). Due to the adoption of this system, the company is also able to work out its breakeven point in an accurate manner.

Alloy Computer products is another Australian company that has adopted the job-order costing system. The overheads rate is determined by the company using a formula and this also helps the company in estimating the budgeting manufacturing overheads. The predetermined rates are applied to the overhead costs based on the machine hours and the labor hours (c). The company uses this approach for the calculation of the work-in-progress inventory also. The T-account is used for the determination of the manufacturing overheads. There could be under-applied overhead or over-applied overheads also.

It can be understood that companies have adopted this in various sectors. The benefits of the same can be understood in terms of working out the costing of the specific jobs and the profitability analysis can be worked out by the management. Strategic management is also facilitated by the successful implementation of this system.

Usefulness of the cost information

The job costing system from the article reveals that the respective debit entries are passed to the overhead accounts. The internal users will be able to track the amount from one specific overhead to another. From the article it is observed that the individual account is subsidiary accounts that projects in a particular place in the schedule to the cost of goods manufactured (Pollard 2018). Hence, the system leads to effective computation of cost and facilitates the data cross verification. Therefore, as discussed initially the process of job costing enables the presenting of information that is reflected in the firm’s books. The cost accountant is responsible for the assumptions and providing all the desired information.

Moore Stephens utilize the system of job order costing as client is vital and therefore the costing is worked out for individual client in a separate manner. The projection of actual cost that is direct or indirect can be related to every client and the profitability is computed as per the number of hours that are devoted. The article indicates that the process of job costing helps in allocating the cost to direct and indirect costs and hence the determination becomes easier. Thereby, if the process is followed by Moore Stephens then the company will be able to work out the break even with accuracy.

From page 19 it is noted that the dual concept of presentation of the journal entries will help in tracking the influence of the entries on the factory accounts. This is every effective when it comes to the job order costing technique. The benefits can be availed through the steps that helps in the determination of the overhead rate and the steps applied to present the overhead to product (Pollard 2018).

Hence, from the discussion of the process and the job costing system it can be commented that the features of job costing are predominant and helps in the proper ascertainment of cost.

Part B

1. Design and implementation of the costing system in real-life organization

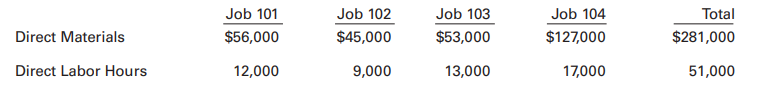

The job-order costing system usually deals with working out the cost of manufacturing each product. This system involves the working out of direct materials, direct labor, and manufacturing overheads that are related to a particular job.

This review is about the implementation of the job-order costing system in a manufacturing organization. In manufacturing organizations, the process or the job flow is a vital element. A few processes can be simple while a few others can be complicated and require specialization. Before implementation of the costing system, the manufacturing process has to be envisioned and walked through to see the key benefits to b achieved from the implementation (Gerhard 2017).

The system details the step-by-step procedures of capturing the sequence of determination of the overhead rate and then application of this rate throughout the period. The actual overheads and applied overheads are compared at the end of the period to determine the differences that can then be closed by passing journal entries through the overheads account (Patterson et al 2013). The system also facilitates the analysis of the over-applied and under-applied overheads and also the accounts that need to be closed.

Once all the costs are calculated, the next step in accounting is passing the journal entries. The journalizing of the accounting entries are done through a dual approach. The journal entries and their impact on the factory accounts by using the T-accounts approach are followed. This helps in drawing concurrent references for tracing the manufacturing pathways through factories and accounts. These entries are recorded in line with the requirements of the job-order costing system. The job-order costing system requires the accounting to include a double-entry when a sale is made, one for sale and another for transfer of inventory to the cost of goods sold (De Toni et al 2017). The system also offers one compound entry for recording the transaction as an alternative option.

The overheads account can be closed in several ways one of which is to transfer it to the cost of goods sold or another option is to close it proportionally to the ending balances in the finished goods, work-in-progress and the cost of goods sold account (Parkinson 2011).

2. Does the system satisfy the features?

The costing system that has been implemented aims towards the creation of a more positive environment. The system offers flexibility to include the new variables. The system is designed to assist in the difficult areas and offers significant help in the accumulation and assignment of the manufacturing overheads in the costing process. The research suggests that there are many benefits of this system. The application of the concepts increases the practicability and encourages the understandability of the subject matter. This system has encouraged the focus on the basic concepts and its application. The job-order costing system implemented in the manufacturing organization under review is a rather difficult topic but the business stimulations have been designed in such a way that the higher-level benefits can be tapped.

The system has been designed in such a way that it can handle any of the numbers that come across. Upon analysis, it can be understood that the system has satisfied all the features of standard costing also except for the part of the variance. Process costing also gets covered in this system except for the fact that the cost of goods transferred out of the work-in-progress inventory needs to be determined separately. The features of the job-order costing system are effectively laying the foundation for several other concepts of standard costing and process costing. The job-order costing system helps in getting an overall picture and the same can be subdivided into the information relating to the individual jobs (Pollard 2018).

A pictorial representation of the same as adapted from the article has been provided below:

The cost sheets are prepared in such a way that the orderly presentation of the specific items of direct materials and direct labor and applied overheads about each job is provided.

The closing of accounts by transfer to three respective accounts helps in transferring to the appropriate accounts. This is an important feature of this system.

It can thus be understood that the features of the costing system are met by implementation in the organization under review.

The usefulness of the costing system to the internal users

The accounting and costing information should be prepared and presented in such a way that it can benefit the users of the information. The users can be internal and external. Upon analysis, the areas which prove to be useful to the internal users are discussed here. The overheads for manufacturing are journalized in such a way that the business used two overhead accounts and name each separately which are Overhead-Actual and Overhead-Applied. These are the control accounts for passing the debit entries to the overhead account. The internal users can track the amounts from one individual overhead account to another. These individual accounts are subsidiary accounts that show up in a proper place in the schedule of the cost of manufactured goods (Pollard 2018). Thus this system leads to not just effective costing calculations but also facilitates the cross-verification of the data.

The process or the flow of journal entries through the direct materials and the overheads are useful for the overall analysis. Direct materials pass from the raw materials into the work-in-progress and indirect materials go from raw materials to work-in-progress but first pass through the overheads accounts. The steps for the determination of the overheads rate and the application of the amounts to the production are carried out appropriately by the managers. The sequence helps in the clarification and connection of the reasons over how overheads are handled and tacking the production through the factory. Thus this is vital data for the management discussion and analysis that helps in further strategy formulation and implementation. The overhead expenses are proportioned among the cost of goods sold, work-in-progress and finished goods in an appropriate manner based on the ending balances (Pollard 2018). There are also methods for the verification of the accuracy and the rounding off problems for the determination of the total overhead amounts the total of which equals the total under-applied overheads amount.

The total cost of the jobs can be reconciled with the individual costs. A timely review of the overheads is possible by linking the cost drivers with the product and estimation of the total overheads (Pollard 2018). This system also facilitates the tracking of the individual job-order cost sheets that are specific for every job. Thus the aggregate costs and the individual costs data can be obtained. Thus the system of job-order costing has provided vital information to the internal users of the organization.

Key lessons for contemporary organizations

The series of journal entries are rather confusing with every possibility of error creeping in at the various stages. There could be instances where the direct materials could be debited in place of the work-in-progress and indirect materials could be debited in place of the overheads. Journalizing is effective yet it can be deceiving due to its tricky nature and similarity of the events. Every system comes with its pros and cons.

Thus extra care needs to be taken to ensure that the entries are appropriately passed in the respective accounts. The flow of entries is not very simple for a layman to understand and interpret. Identification of the correct and relevant accounts is vital and the determination of the amounts can be a problematic feature. It becomes challenging to capture the sequence for the determination of the overheads rate before the commencement of the manufacturing. The application of the pre-determined overheads rate has to be followed throughout the process. Thus this is a system that has linked the direct costs with the cost drivers applied in the production. It provides key data for the organizations and can be implemented owing to its multiple benefits. It also integrates existing systems and processes.

The job-order costing system has thus proved to be very effective and beneficial due to the pre-determined series of steps involved in the determination of overheads. The pathway can vary for different organizations but the destination is the same. The accumulation, assignment, and tracking of the various costs have been facilitated by this system. Thus it could prove to be useful for contemporary organizations that can customize it according to their requirements.

Conclusion

The aim of the assignment was to provide a detailed analysis into the job costing mechanism. The overall study gives a complete reflection of the process of job costing and the manner in which the system tracks costs that is detailed for every job. It is a helpful tool for every business owner and hence can help to understand that expenses can be lessened on similar projects in the future. The various costing systems are compared in the light and requirements of the current scenario and it can thus be concluded that the type of costing system that is suitable for one organization might not be suitable for another. The reasons could be the nature of the business and the size and type of products manufactured, the complexities and product mix, and so on. Adoption of any system comes with a set of challenges that have to be tackled in such a way that the transiting is beneficial. Thus every organization should weigh the factors and adopt such a costing system that is best suited for its nature. The best benefit of the system comes in the form of usage as the method is widely prevalence and can be used in any industry. Further, it can be used to know whether the cost of production surges the overheads and the materials price that leads to profit for the entire process.

References

Azudin, A. & Mansor, N. 2018, ‘Management accounting practices of SMEs: The impact of organizational DNA, business potential and operational technology’, Asia Pacific Management Review, vol. 23, no. 3, pp. 222-226.

Cuzdriorean, D.D. 2017, ‘The Use of Management Accounting Practices by Romanian Small and Medium-Sized Enterprises: A Field Study’, Accounting and Management Information Systems, vol. 16, no. 2, pp. 291-312.

De Toni, D., Milan, G.S., Saciloto, E.B. & Larentis, F. 2017, ‘Pricing strategies and levels and their impact on corporate profitability’, Revista de Administracao, vol. 52, no. 2, pp. 120-133.

Douma S & Hein, S 2013, Economic Approaches to Organizations, Managerial accounting assignment London: Pearson

Gerhard, S 2017, Creativity research in Management accounting: A Commentary. Journal of management accounting research, vol. 29, no. 3, pp. 49-54.

Karadag, H. 2015, ‘Financial Management Challenges In Small And Medium-Sized Enterprises: A Strategic Management Approach’, Emerging Markets Journal, vol. 5, no. 1, pp. 26-40.

Parkinson, J. 2011, Costing In Process Manufacturing: The Myth And The Reality, Thomson Reuters (Tax & Accounting) Inc, Boston.

Patterson, J.D., O'Brien, D., Hanson, M. & Allen, J. 2013, Should cost Estimating is Fundamental to Constraining costs and achieving effective cost based program management,, National Contract Management Association, McLean.

Pollard, W.B., PhD. 2018, ‘An Active Learning Approach to Teaching Job-Order Costing’, Management Accounting Quarterly, vol. 19, no. 4, pp. 10-19.