Project Management Assignment: Development Appraisal For Grade A Office At Newcastle

Question

Task:

Task:

This project management assignment will require students to understand the theoretical principles and practical application of development appraisal by producing a report for a private sector property development project.

Project Information:

A private sector client is considering the acquisition of a vacant freehold land of 1.2 acres off Benton Lane, Newcastle Upon Tyne to develop a Grade A office development and has appointed you as the consultant to appraise the development proposal. The client plans to achieve the BREEAM Excellent rating as a minimum standard. The main contractor is expected to comply with the requirements of the Considerate Contractor Scheme. The client has provided the necessary data and appointed you as the consultant to appraise the development option.

The data provided by your client are as follows:

- Land Price= 550,000

- Construction Area (GIA)= 4000 m2

- Expected tender date= February 2021

- Construction Period=2 yaers

- Pre-build Period=1 year

- Letting Void= 1 year

- All risk yield based on the market value= 5%

Your task is to use the land cost given in the above work brief & the location to be Newcastle and address the following parts.

Task 1 -The Order of Cost Estimate should be based on the BREEAM, NRM1 & the BCIS data with 3 samples, each of minimum 30 suitable cost analyses from BCIS online data base (Snap shot of BCIS data should be included in the Appendices).

Task 2- Based on the above order of cost estimates to evaluate the 2 options provided in the course works brief for the whole life costing.

Based on the above feasible outcomes under task 2, development appraisal to be done which from the Task 3

Task 4 Evaluation and recommendation to include the below but not limited;

- To discus on the profit / Loss based on the outcome of the development cost.

- To include the impact of taxation, Brexit.

- To include the impact of the embodied carbon management & sustainable construction and there by its relaxation if any.

- To include the impact of the embodied carbon management & sustainable construction and there by its relaxation if any.

- To include the impact of COVID 19

Answer

Background Information of project management assignment

When it comes to the basic issues on the quantity surveying in building then costs and budgeting estimates will be considered in the first considerations. We have identified number if potential sites where we are going to perform a further investigation. In the report we have considered the development of site for residential purposes. Our report is based on the RICS guidance notes where we have used the Residual Land Value (RLV) approach. We also did an analysis on the viability of the project that is dependent on the land owners that is willing to release the site for development. In the analysis that we have done we are going to consider values such as the Threshold Land Value (TLV) this is the price above the Existing Use Value (EUV). Let’s get started with our analysis.

Task 1

From the BCIS Benchmark Report we are going to consider the project of building a Grade A Office development. These are the project details.

Location of the Project

Newcastle Upon Tyne, Benton Lane

Contract Sum; ? 1, 909,793.

Function of the building; Grade A offices

Land Price = ? 550,000

Construction Area (GIA)= 4000m2

Letting Void = 1 Year

Expected Tender Date= February 2021

Contract Period 43 weeks

Floor Area 535 m2

Base date 1Q2019

Additional Information;

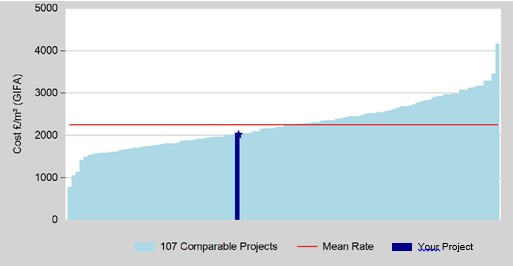

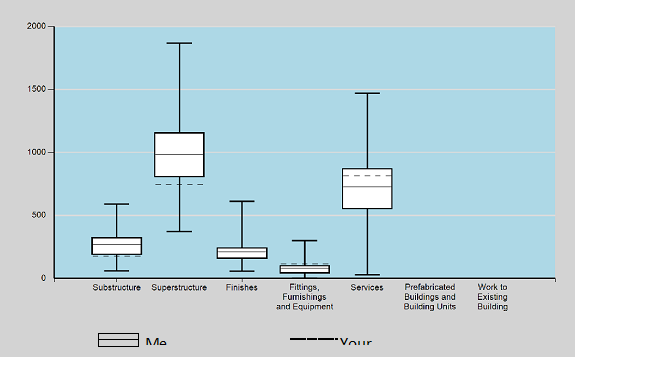

At ? 2,020/m2 your project costs that are 10% less than comparable buildings. The element showing the largest cost difference is Superstructure, which is 24% lower than the mean of similar projects. In comparison the furnishings, fittings and equipment is 46% higher than the mean of the similar project. We made a meaningful comparison during the project analysis using the BCIS Standard form and the summary of the project that was included in the report of this project.

From the above information we were able to provide the BCIS Building Calculator Results as shown;

BCIS Building Calculator Results

Estimate of Building Cost from BCIS.

The building cost is estimated to be £28,000,000 based on the information and assumptions listed below (1).

The property is smaller than the cost models available: in order to calculate a building cost a larger property has been assumed.

Quality and facilities make a big difference to the building cost. While the figure above is a reasonable estimate of the likely cost for a good quality office with typical facilities, a basic quality flat of the same size with minimal facilities might be rebuilt for £47,000 while an excellent quality flat might cost £84,000 torebuild.

The information we based this estimate on was:

Flat in a purpose built block built with brick external walls (2) and tile roof built around 2010 (3). The property is not listed and does not include any special or unusual features.

Postcode NE12 8EH.

Gross internal floor area: 4000m2 (4). 1 bathrooms.

BCIS has assumed the following:

There is no cellar.

An allowance for external works has been made which might typically comprise drive or hard standing, paths and patio, walls and fences, drainage. However there can be big differences in the scale and cost. External works may not be the responsibility of an individual flat and this must be checked. Special or unusual features, such as long boundary walls, swimming pools etc have not been allowed for.

The prices used are for December 2020. This report was generated at 09:41:53 on 21Jan2021.

Notes:

This estimate is based on minimal details. If you have a listed property or one with special or unusual features you should obtain professional advice on the rebuilding cost. You may also wish to obtain professional advice to be more certain about the rebuilding cost. A list of chartered surveyors in your area capable of carrying out a rebuilding cost assessment can be found athttp://www.ricsfirms.com/.

Brick external walls include brick faced timber framed houses and cementrendered walls.

It is assumed that the property is built in a style typical of itsage.

The Gross Internal Floor Area is the area measured to the internal face of the external walls (includes the space taken up by internal walls andpartitions).

BCIS recommends that wherever possible, a block of flats is insured as whole rather than individual flats.

BCIS is the Building Cost Information Service of the Royal Institution of Chartered Surveyors. For further details please visit http://www.bcis.co.uk.

This report copyright RICS 2020.

22Jan202109:42 Page 1 of1

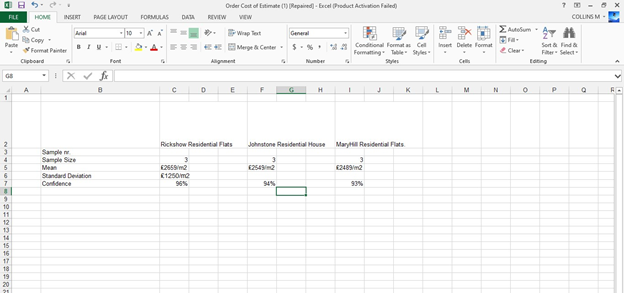

We made a comparison for against 3 similar projects. The building costs of the project was ? 2,020/m2 compared to the average costs of ?2,251/m2 for similar projects. This results are summarized below in the graph;

We therefore created distribution average elemental costs. We factored in the inflation that was able to forecast what the building would cost ? 12, 000. The lifecycle costs was based on the 30 year period buildings like the costs was typically costs approximately ? 1, 300, 000.

|

Element |

Your project (£/m²) |

Mean of compararable projects (£/m²) |

% above comparable projects |

|

|

Substructure |

177 |

268 |

-34% |

|

|

Superstructure |

747 |

985 |

-24% |

|

|

Finishes |

137 |

212 |

-35% |

|

|

Fittings, Furnishings and Equipment |

115 |

79 |

46% |

|

|

Services |

814 |

726 |

12% |

|

|

Prefabricated Buildings and Building Units |

31 |

0 |

n/a |

|

|

Work to Existing Building |

0 |

0 |

n/a |

|

From the data above we can be able to show the average building costs, the standard deviation and the confidence intervals of the selected sample. The distribution of the average group elemental costs was shown in the graph below

From the above information we created the Order of Cost Estimates. £

|

|

Works Costs Estimate |

|

|

|

|

|

Variable |

Rate |

Cost |

|

|

Facilitating Works Estimate |

|

|

? 0 |

|

|

Building Estimate |

4,000/m2 |

? 2,349/m2 |

?9396000 |

|

|

Location: Newcastle Upon Tyne, Benton Lane |

Index 87 |

|

?8125400 |

|

|

External Works |

|

|

?2000000 |

|

|

Adjustments and Additions |

|

|

? 0 |

|

|

Difference between date of source data and date of estimate |

|

|

? 0 |

|

|

Works Cost Estimate [subtotal A] |

|

|

?20125000 |

|

|

Project/Design fees and Other Development Costs |

|

|

|

|

|

Project/design team fees |

|

10% |

?2000000 |

|

|

Other development/project costs estimate |

|

|

? 600000 |

|

|

Project/design fees and other development costs(subtotal B) |

|

|

?2600000 |

|

|

Base Cost Estimate |

|

|

|

|

|

Base Cost Estimate A+B (Subtotal C) |

|

|

? 12000000 |

|

|

Risk Allowance Estimate |

|

|

|

|

|

Design development risks estimate |

|

|

?120000 |

|

|

Construction risks estimate |

|

|

?0 |

|

|

Employer’s change risk estimate |

|

|

?100000 |

|

|

Employer’s other risks estimate |

|

|

? 0 |

|

|

Risk allowance estimate (Subtotal D) |

|

|

? 220000 |

|

|

Cost Limit (excluding Inflation) |

|

|

|

|

|

Cost limit C + D (Subtotal E) |

|

|

?12560000 |

|

|

Tender Inflation Estimate |

|

|

? 0 |

|

|

Cost Limit |

|

|

|

|

|

Cost Limit (firm-price tender)E + F (Subtotal G) |

|

|

?12560000 |

|

|

Construction inflation estimate |

|

|

|

|

|

Firm-price contract, no allowance |

|

|

- |

|

|

Construction inflation estimate (subtotal H) |

|

|

? 0 |

|

|

Cost Limit |

|

|

|

|

|

Cost Limit [Including Inflation] G + H [rounded] |

|

|

?12560000 |

|

Results;

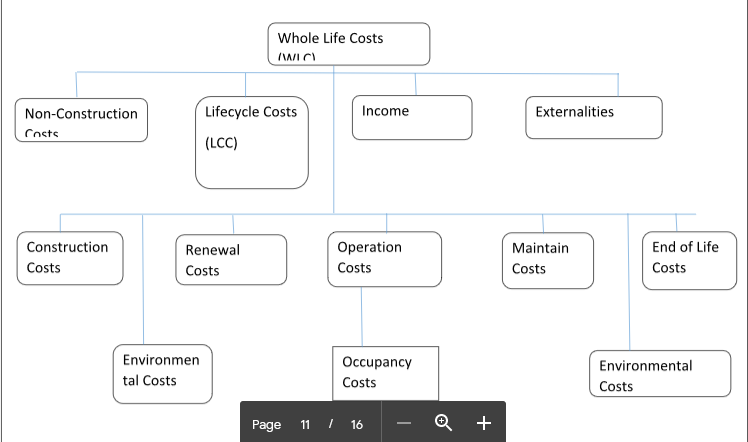

TASK 2: whole life costing

Whole Life Costing is an investment appraisal and maintenance tool that is used in the assessment of the total costs of an asset over its whole life. In this section we are going to perform a whole life costing analysis of the data provide below. We will consider the initial capital costs, the operational and maintenance costs. The repair, upgrade and eventual disposal costs.

Design A

|

Description of the task |

Fittings on the TraditionalLighting and HVAC. |

|

Total Gross Floor Area |

4000 m2 |

|

Overall costs on the Construction. |

Cost Per M2 based on Task 1 |

|

General Costs on the Repairs |

% of the initial capital cost (For every 10 year period) |

|

Major Renovations Taking Place |

? 200,000 |

|

Running cost |

? 50,000 per annum |

Design B

|

Description of the design tasks |

Installation of the Low Energy Internal Light wells. Installation of Programmable Controls. Lastly is the installation of the Thermostats |

|

Total Gross Floor Area |

4000 m2 |

|

Total Construction Cost Incurred |

Additional 10% based on the cost per m2 of Design A |

|

General repairs costs |

0.5 % of initial capital cost (for a 10 year period) |

|

Major Renovations costs incurred |

?400000 (For the 30year period) |

|

Running Cost incurred |

? 30000 per annum |

We performed the Whole-life costs which are deemed to be a better way of assessing the value of money than the constructions costs which is as a result of the short-term costs. This assessment focuses in the higher ongoing costs through the life of the building.

We generated the following ratios;

0.1:0.15 For the design ratio

The ratio of 1 is for the construction costs

5 will handle the maintenance and building operation costs during the lifetime of the building.

In the long run we developed the 1:0.6:6 ratios that were calculated based on the actual figures for a specific business. From the assessment we can conclude that managing the building within a period of 30 years will be viable.

Task 3 Development Appraisal

The local area is undergoing major development and regeneration, making it a prime location for the proposed scheme.The site is located on the main road and allows for relatively easy access for construction and development.The proposed development on the 1 acre site is for:

166,351 square feet of Office user Class (B1) space, with a typical floor space being open plan with a net internal area of approximately 16,000 square feet;

A 2,150 square foot community public open space.

Over 167,000 square feet of underground parking for residents and commercial tenants.

Planning considerations demonstrate that the proposed development is compatible with Newcastle Council’s planning policies and should not pose any risk of planning consent refusal.

Comparable evidence demonstrates that the scheme is viable with potential increases in market prices.

The development appraisal and residual valuation demonstrate:

A Gross Development Value for the entire scheme to be over £33 million

Total profit of over £52 million

o A lead time of approximately 24 months from the commencement of the construction project to the stage of fully selling and letting of the building.

Risk analysis of the scheme demonstrate an increase in costs risk tolerance of over 20% versus a reduction in sales value risk tolerance of over 30%.

The Design of the Building

The design of the building will be that of glass and steel and will be of modern architecture. This allows the development to keep in line with designs similar to the directly adjacent One Valentine Place and TheResidence and other developments along the Benton Lane such as The Wedge, the One Blackfriarsand 240 Blackfriarsdevelopments. The design will aim to make use and implementthe latest building standards, with emphasis on sustainability, equality and energy efficiency. The frontage of the property on Blackfriars Road will be similar in design for both the North and South Wings, with minor architectural adjustment to accommodate the different needs of the office occupiers.

The residential North Wing will be made up of 150 units over 10 floors.

|

|

|

|

SQM (GIA) |

|

|

SQFT (GIA) |

|

|

SQM (NIA) |

|

|

SQFT (NIA) |

|

|

% Share per user class |

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

Total Office (B1) |

17,000 |

|

183,000 |

|

**15,455 |

|

166,351 |

55.44% |

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

Total Net Development Excluding Parking |

31,100 |

|

334,757 |

|

27,882 |

|

300,071 |

100.00% |

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

Under Ground Parking |

|

15,550 |

|

|

167,380 |

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

Public Open Space |

200 |

|

2,150 |

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

Total Dev Including Parking and Public Open Space |

|

46,850 |

|

|

504,300 |

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

Legend: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

* NIA for Residential is 15% less than GIA |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

** NIA for Office is 10% less than GIA |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

NIA= Net Internal Area |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

The office South Wing will house 10 floors of tenant customizable open plan office space, with each floor having a net internal area of 16,635 square feet. The implementation of a modern building design and the use of the latest technological resources is what will allow this development to be as customizable as proposed, thus allowing for an increase in its attractiveness to a wider range of potential tenants.

An underground parking/services space from the proposals is that there wills one lower level below ground level. This is made available to the residents and occupiers of the residential, office and retail spaces. Access to and from the underground area from outside the development will be through Benton Street north of the site, which is the current access to the car park of Friars House, thus reducing the need for permission to alter the public highway for access.

The residential development project was made attractive by the implementation of the 2150 square foot central public open space. The space was designed to accommodate attractive landscaping and vegetative features. The space was designed to add both value and goodwill to the proposed development. Its main emphasis was on the community, togetherness openness during recreative moments. In the long run the relationship with the surroundings can be improved.

Task 4 Report of the Analysis

Getting the right comparable for the analysis and evaluation of the residential units within specific building development proposals has proved to be difficult. Most of the streets do have many new buildings and there is a mixed used development for the market that are up to sales ("Project Management for Construction: The Design and Construction Process", 2021). There from the data of the sold units in those streets it has enables us to make comparative analysis for the non-existing projects. The comparable scheme that was available and one which we used was that for residence houses which came into the market between late 2015 and early 2016. This provided a foundation for the applied value on the residential prices of the proposed development.

Our main objective for performing this development appraisal was to assess the construction project in terms of the economic, social and financial viability. We also went ahead to accept and reject the project. In addition to that we can use the tool to check for the viability of the project proposal.

We have performed a development appraisal and the construction sections. We determined and performed analysis on the paper so as to determine the overall costs of developing the building.

In order to mitigate for the lack of data, a new approach was taken, which is a similar approach used by John Lang LeSalle (JLL) during the development appraisal for the One Blackfriars Road development on the South Bank ("JLL - Investor relations", 2021). Under the freedom of information act, the relevant development appraisal documentation was obtained and is available under (What Do They Know, 2014). I turn the assessor’s attention to the document under (Whatdotheyknow.com, 2016), where it is clearly obvious that the document reflects JLL’s residential comparable analysis, for which the said company analyses a variety of comparable buildings, similar to those of the relevant development, and analyses not only sold price information, but asking price information as well. This allowed JLL to formulate an opinion of the current prices of the residential units, based on number of beds, size and price per sq. ft. within comparable buildings only.

From the above study we have seen that development appraisal is very important in determining the right budges for coming up with a building ("All You Need to Know about Development Appraisals", 2021). Despite that the development appraisal is usually misunderstood and misused (Franks, 1994). Despite when its main objectives is understood then it would results to a very important document. From this study we have seen that the working on the development appraisal for the project has enabled us to determine the viability of the residential project. From the analysis we have seen that the project is very viable to be actualized. From the objective point view we were able to analyses the research constraints and the opportunities that the location has concerning the residential houses. We also able to test the financial liability of the project and this enabled us to come with the right budget for the construction project. As a real and informed valuer we checked the valuation against the market evidence that we were provided with.

The above document was also very critical in ensuring that the developers may set out the proposed development impact by the local plan for the area regarding the planning history of the local place.

References

Construction Industry Training Board - view and make Freedom of Information requests. (2021). Retrieved 22 January 2021, from https://www.whatdotheyknow.com/body/constructionskills

Project Management for Construction: The Design and Construction Process. (2021). Retrieved 22 January 2021, from https://www.cmu.edu/cee/projects/PMbook/03_The_Design_And_Construction_Process.html

JLL - Investor relations. (2021). Project management assignment Retrieved 22 January 2021, from https://ir.jll.com/

Franks, T. (1994). Managing sustainable development: Abdul Karim's dilemma. Project Appraisal, 9(3), 205-210. doi: 10.1080/02688867.1994.9726950

All You Need to Know about Development Appraisals. (2021). Retrieved 22 January 2021, from https://www.lawyer-monthly.com/2019/05/all-you-need-to-know-about-development-appraisals/