Initiating Prospa Organisational Development Plan

Question

Task:

1. Using relevant workplace resources that you gathered in the researching and planning stage, prepare a draft of an organisational development plan for senior management to consider. The plan should include details on the following:

- The development plan’s goals and objectives and possible measures of success

- Key personnel and their roles in implementing the proposed development plan

- A list of the stakeholders that need to be consulted, with an outline of what their needs and competing demands may potentially include

- A stakeholder consultation and communication strategy that outlines what needs to be communicated, who will receive the communication and how it will be communicated

- Strategies that will be used to gather stakeholder feedback throughout the implementation phase

- A proposed time line with milestones to achieve full implementation

- An outline of resources that will be required to implement the proposed development plan

- An outline of possible risks and an assessment of the effects that may exist with the implementation of the development program

- An evaluation of the proposed development program in terms of the costs, benefits and potential risks

Answer

Executive Summary

The project management of Prospa organisational development is the practice executing, planning, initiating, closing and controlling to achieve the specified objectives to gain success according to the given time and resources. In this assignment, the project manager will be going to create a new business strategy for the Prospa organisational development to attract all new borrowers who are not getting too confident of registering the application. Prospa is mainly targeting consumers who are from Australia. The primary objective of Prospa is achieving the goals within the given constraints of the project.

Introduction

The Prospa organisational development is mainly an objective based methodology which is being used to initiate the change of the workplace as the entity. The Prospa organisational development is primarily achieved by shift the communications channel. The communication channel had been used for transferring the information to the sender for producing more understanding about the project work. The present assignment will be going to discuss Prospa organisational development program that will be used by the company. The Prospa is being located in Australia.

Organisation Vision

The firm named Prospa main aim vision to meet all the desired objectives for improving business performance. The business organisations are developing the business models continuously through studying the quality of the product through implementation, development and evaluation of the new system.

Organisation goals

The goal of Prospa organisational development is to increase the overall efficiency and productivity of the company. The open communication system will enable all the employees Prospa to understand the change in the organisation.

Organisation Chat

Brief of the company

Prospa is one of the most popular fintech company located in country Australia. Prospa utilises advanced technology to speed up the process of unsecured lending by approving the loan within 24 hours. The Prospa organisational development is using digital sources for creating the process online. The firm Prospa is highly accessible to develop the standard product for providing unsecured business loan to SMEs, which is not being provided by the bank. None of the companies, whether it is public or private providers, does provide loans which have a quicker turnaround. The unsecured credit is the loan that had been supported and issued by the help of borrower’s creditworthiness (Nguyen, 2016).

The borrowers can able to pay any type of collateral to the lenders through the online channel created by Prospa, who is analysis the lending process. The Prospa firm is targeting SMEs or small firms which have high credit rates located only in the Australian countries. Presently the financial technology industry also known as fintech, are aiming to provide financial help by using modern technology and software using internet technology (Chishti and Barberis, 2016). The online business is growing at a faster rate in country Australia which is a considerable opportunity for Prospa. Majority of the customers are demanding the flexibility and convenience in loan service that is offered by Prospa.

Discussion

Prospa organisational development plan goals and objectives

SWOT analysis

|

Strength · Interaction between financial and consumer service is accessible using Fintech · Enhance efficiencies and reduce costs in economic infrastructure |

Weakness · A data breach is a common cause in the application |

|

Opportunities · Removing the key drivers to eliminate bank relationships · The decline of internet service and increase of smartphone penetration |

Threat · With no regulation, there is no proper access to finance where there is risk · The access limited to developed countries |

PEST analysis

|

Political |

· Political stability needs to be high to make the business process more successful · The military invasion will create a huge problem for Prospa organisational development · Level of corruption must be less so that Prospa does not have an effect · Tariffs and trade regulation must be maintained to develop a good relationship between the borrower and lender |

|

Economy |

· The intervention of government in the free market will create benefit for Prospa · Infrastructure quality in the software industry will improve the UI of Prospa · The economic growth rate will help Prospa organisational development to provide more support to the SMEs · Productivity in the economy will be increased if Prospa able to create a good relationship between |

|

Social |

· The skill level and demographics among the population · SMEs must be in high number to improve the Prospa business process in future · Society must be from a different cultural background which provides more opportunity to Prospa organisational development |

|

Technology |

· The utilisation of the internet technology is rising in Australia · The usage of the smartphone technology will help Prospa organisational development to flourish in Australia · The people do not visit the bank for loan physically which they can apply using their smartphone |

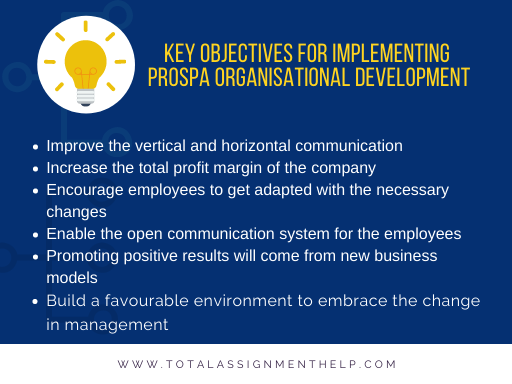

What are the major objectives of Prospa organisational development plan?

The goals that need to be achieved by the organisation for implementing Prospa organisational development are :

- To improve the vertical and horizontal communication

- To increase the total profit margin of the company

- To encourage employees to get adapted with the necessary changes

- To enable the open communication system for the employees

- To promote positive results will come from the new business models

- To build a favourable environment to embrace the latest change in the management

The Prospa organisational development will be going to help the organisation to develop a robust business model. The business model will be creating a constant for improvement of the company. The main strategies involved in this business are the evaluation and development of well quality products. The new process is going to create a more favourable working environment where the employees can able to embrace the total change, both externally and internally (Mihet,2019).

The open commutation system will help the employees to understand the central importance of the change in management. The Prospa organisational development will be going to emphasis and encourage their employees to get adapted with the given changes for their benefits (Farboodi & Veldkamp, 2017). Through the change in management, the overall skills of the employees will get improved in future. The employees will equip improved and renowned marketing skills to attract a new customer base. Employee engagement needs to be high, to enhance productivity and innovation by promoting the necessary changes inside the organisation.

Personnel and their roles

The stakeholders play an essential role in the Prospa organisational development. For this reason, the project sponsor first job is to hire a project manager who will manage the whole project operation in future for improving the management system of Prospa. The primary key personnel for the Prospa organisational development project are the project team members from two different departments (Liu, Peng & Yu, 2018). One of the project team are managing the customers or borrowers, and another group are manging the vendors or lenders. The project team members from the customer department who are being involved with this particular project are project manager, web developer, project sponsor, system administrator and salesperson. In lender department, the project team members are service manager, coordinator, tester, marketing specialist and supporters.

List of Stakeholders

|

Stakeholder list |

Department |

Type of Stakeholder |

Role |

|

project manager |

Customer Department |

Internal |

The project manager is the person who has high responsibility for successful design, monitoring, planning, initiating, closure and controlling of the project work (Thompson, 2017). |

|

Front end and backend web developer |

Customer and vendor Department |

External |

The frontend developers are highly responsive to look at the application design of the computer to create the integrated graphics and site’s layout. The developers write application programs using different computer languages, like Javascript and HTML (Micu & Micu, 2016). |

|

Project sponsor |

Customer Department |

Internal |

The project sponsor is the individual whose central role is to provide financial support for the project and to improve the total design of the project in future. |

|

system administrator |

Vendor Department |

External |

The system administrator is in charge of maintaining, installing and supporting the computer systems and servers. |

|

Salesperson |

Customer Department |

Internal |

The primary responsibility of the salesperson is increasing the total sales |

|

service manager |

Lender Department |

Internal |

The service manager is responsible for managing agreements at service levels with external service providers and customers. The service manager had to manage the service with high level agreements with the customers. |

|

Coordinator |

Lender or Vendor department |

Internal |

The main tasks of the coordinator are creating a communication portal between the team members and clients for the chosen project work. The coordinator needs to facilitate the overall project deliverables. |

|

marketing specialist |

Lender department |

External |

The marketing specialist always works with the marketing team who utilises different research methodology to behaviour and attention of the target audience in the chosen market sector. |

Figure 1: Stakeholder Consultation

( Source: Mori, 2016)

Stakeholder consultation and communication strategy

The stakeholder consultation is the involvement of a productive and constructive relationship to gain long terms of sustainability in business. The stakeholder consultation will be going to enable the firm Prospa to examine trends. The trends like tackling any upcoming challenges in the market. The Prospa organisational development needs to study the concerns of each stakeholder and provide valuable feedback to improve the project outcome or design in future (Mori, 2016). The stakeholder consultation will enable Prospa to monitor the identified trends, perceptions and challenges. The stakeholder consultation will be going to help the Prospa to control all the external risks. The stakeholder consultation will help Prospa to establish the brand positioning and values of the business corporations. Prospa needs to consult with the customers for organising all the future needs.

Communication plan

|

Type of Stakeholder |

Information needs to be communication |

How |

When |

Record of Information |

|

Project manager |

The project manager needs to make sure the lower the uncertainty and manage the entire risk present in the project work |

The communication channel that will be used by the project manager is Whatsapp, Emai, telephone, video call, Message etc. |

Daily basis and monthly basis to the project sponsor |

Writing a weekly report |

|

Front end and backend web developer |

Looks after the database and servers of the application against external users and sending application programs using different computer languages like Javascript and HTML |

The Communication channel that will be used by the developers are Chatbox, Whatsapp, Email and face to face meeting |

Weekly basis with the project manager and monthly basis to project sponsors |

Creating a report during the meeting |

|

Project sponsor |

The project sponsor always receives weekly and monthly reports about the project. |

The communication channel that will be used by the project sponsor is WhatsApp, face to face meeting, video call and voice call |

Daily basis with the project team members |

The assistance will write daily reports for the project manager |

|

system administrator |

The system administrators make sure the software is working pretty well without any errors in the hardware system. |

The communication channel that will be used by the project system administrator is WhatsApp, face to face meeting, video call and voice call |

Weekly basis with the project manager |

Creating a report during the meeting |

|

Salesperson |

attracting the high number of lenders and borrowers in their online portal. |

The communication channel that will be used by the project Salesperson is WhatsApp, face to face meeting, video call and voice call |

Weekly basis with the project manager |

Creating a report during the meeting |

|

service manager |

the project service manager is WhatsApp, face to face meeting, video call and voice call |

Weekly basis with the project manager |

Creating a report during the meeting |

|

|

Coordinator |

Had to manage the service with high level agreements with the customers. |

The coordinator is Whatsapp, face to face meeting, video call and voice call |

Weekly basis with the project manager |

Creating a report during the meeting |

|

marketing specialist |

The marketing specialist always makes sure their decision-making process will inspire the employee to work hard. |

marketing specialist is WhatsApp, face to face meeting, video call and voice call |

Weekly basis with the project manager |

Creating a report during the meeting |

Figure 2: a Stakeholder Feedback system

(Source: Firmansyah & Anwar, 2019)

A strategy used to gather stakeholder feedback during the implementation process

The project manager of Prospa organisational development plan is highly responsive for creating a strategic plan to identify the project sponsors and other relative stakeholders during the beginning of this particular project work. The project manager needs to use tips and strategies to gather feedback from the stakeholders. The project managers will have to ensure the team members are providing the right amount of inputs to influence the total authority of the project (Firmansyah & Anwar, 2019). The project manager will need to schedule a regular meeting for managing the expectations of the stakeholders by explaining their roles they will be doing for this project work.

The project manager needs to prepare report more carefully after having the weekly meetings to discuss the issues. All the problems must be solved constructively. The project manager is highly concerned about the time, quality and cost required for the project which needs to be done through heated discussion among the internal stakeholders of the company Prospa. The project manager must create a separate plan for managing the conflict inside the meeting room, which could be done by establishing rules. The rules that are implied are discouraging interruptions, encouraging participation, keeping up the schedule, assigning action times and behaviour (Yeo & Fisher, 2017). The project manager and other stakeholders must send email updates or use voice calls in case of privacy or emergency. The Stakeholders needs to use active listening techniques for making the project manager gather feedback. The project manager must use repeating or paraphrasing the whole speech that is being provided by the stakeholders. It will be going to make them sure they understand their manger better.

Timeline for achieving the implementation

The total time required for implementing Prospa organisational development plan is about eight months or one year because some of the members working in this company are not very skilful.

Outline of the resources

The first resource that will be used by Prospa for updating the service is BankNXT which act as one of the financial professionals that are seeking leadership and industry knowledge. The BankNXT support by Prospa, which is creating strategic analysis. Credit unions and banks had faced a diverse range of critical issues. The website of Prospa must be updated regularly by updating details about retail channels, branding, product design, mobile, sales strategies and innovations process. The Prospa needs to use the fintastico to curate the design interface by using selected sources that had been presented in the fintech industry (Leong & Sung, 2018).

In Prospa organisational development, the company needs to create a payment source using mobile payments in various stores. The payment source had allowed their users to send money quickly to any individuals or friends. The mobile payment will help Prospa to keep in the tab about the ongoing change in a transaction by providing details inside the digital wallets. The new transaction system called bitcoin to promote the use of cryptocurrency among all the borrowers and lenders. The bitcoin is attracting all the major tech companies like Microsoft and IBM. The coin desk is one of the authoritative sources for information and news on all the digital currencies like blockchain technology and bitcoin. All of these resources need to be implemented for Prospa organisational development to make the proposed project successful for all the users.

Outline of possible risks

|

Hazard |

Source of Risk |

Risk Assessment |

Acceptability |

Risk Management |

|

financial stability |

The personal and financial data are highly at stake by connecting with the financial institutions and banks |

Presently the financial technology is becoming highly popular, but Prospa organisational development needs to shed light on the potential threats to provides |

Medium |

Weekly calculation of the lender and borrowers data |

|

Cyber risk |

The cybercriminals increase the overall attack of the vendors, which disrupts the entire economy by reducing the vulnerabilities that are present inside the servers. |

Checking the database server regularly to find out any external users |

High |

The rapid development in innovation and technology must be covered by the organisation Prospa to improve the service. |

|

micro-financial risk |

The fintech company can face micro-financial risk, which could create a significant effect on the financial institutions or the main itself. |

The chances that are being associated with the micro-financial risks are credit liquidity, pricing, market, strategic and legal risks is another issue that needs to be maintained by Prospa. |

High |

The risk that could arise in the Prospa is the maturity mismatch where the loan could be extended for a more extended period, and rollover risk management must be implemented. |

|

liquidity mismatch |

The next possible risk faced by the company Prospa is the liquidity mismatch where both liabilities and assets have different types of liquidity characteristics which can disrupt the whole market (Palmié et al., 2020) |

The leverage of finance technology is very high, which implies the quality value is very less, which absorb a tremendous amount of loss. |

High |

The liquidity is being measured based on the ratios. Early detection of liquidity mismatch is improtant |

Evaluation of Prospa organisational development program in terms of potential risks, benefits and costs

The Prospa had increased the total reliance of all the third-party service, which had created systematic risks for creating cyber chances. All the Fintech services are providing financial institutions and cloud computing company to remove the operational downturn. For this reason, the project manager of Prospa needs to use telecommunications system for regulating the relationship between the lender and borrower. Prospa organisational development needs to hold their financial technology in higher standards to avoid any financial risks that could appear between the borrowers and lenders (Rachman & Salam, 2018). The structure of the financial market is highly vulnerable to the external factors which can profoundly impact the business process in future. The business loans that are being provided by banks require property and persona documents as the security in country Australia. Prospa uses a Robo advisor who helps the company to manage the investment profile of ETF funds that are highly based on the investment amount. Prospa can use digital wallets to initiate contactless payments among borrowers and lenders.

Conclusion

From the overall analysis of the assignment, it could be seen the Prospa organisational development can be applicable by encouraging the employees to get adopted with the new change. Prospa needs to provide benefits to their stakeholders so that they will be able to understand the importance of Finance technology. The Prospa has ready to make small business finance highly accessible among the borrowers without the requirements of commercial or residential property as the collateral.

Reference

Chishti, S. and Barberis, J., 2016. The FinTech book: the financial technology handbook for investors, entrepreneurs and visionaries. John Wiley & Sons.

Farboodi, M., & Veldkamp, L. (2017). Long run growth of financial technology (No. w23457). Prospa organisational development National Bureau of Economic Research.

Firmansyah, E. A., & Anwar, M. (2019, January). Islamic financial technology (FINTECH): its challenges and prospect. In Achieving and Sustaining SDGs 2018 Conference: Harnessing the Power of Frontier Technology to Achieve the Sustainable Development Goals (ASSDG 2018). Atlantis Press.

Leong, K., & Sung, A. (2018). FinTech (Financial Technology): what is it and how to use technologies to create business value in fintech way?. International Journal of Innovation, Management and Technology, 9(2), 74-78.

Liu, Y., Peng, J., & Yu, Z. (2018, August). Big Data Platform Architecture under The Background of Financial Technology: In The Insurance Industry As An Example. In Proceedings of the 2018 International Conference on Big Data Engineering and Technology (pp. 31-35).

Micu, I., & Micu, A. (2016). Financial technology (Fintech) and its implementation on the Romanian non-banking capital market. SEA-Practical Application of Science, 11, 379-384.

Mihet, R. (2019). Who Benefits from Innovations in Financial Technology?. Available at SSRN 3474720.

Mori, T. (2016). Financial technology: blockchain and securities settlement. Journal of Securities Operations & Custody, 8(3), 208-227.

Nguyen, Q. K. (2016, November). Blockchain-a financial technology for future sustainable development. In 2016 3rd International conference on green technology and sustainable development (GTSD) (pp. 51-54). IEEE.

Palmié, M., Wincent, J., Parida, V., & Caglar, U. (2020). The evolution of the financial technology ecosystem: an introduction and agenda for future research on disruptive innovations in ecosystems. Prospa organisational development Technological Forecasting and Social Change, 151, 119779.

Rachman, M. A., & Salam, A. N. (2018). The reinforcement of zakat management through financial technology systems. International Journal of Zakat, 3(1), 57-69.

Thompson, B. S. (2017). Can financial technology innovate benefit distribution in payments for ecosystem services and REDD+?. Ecological Economics, 139, 150-157.

Yeo, J. H., & Fisher, P. J. (2017). Mobile financial technology and consumers’ financial capability in the United States. Journal of Education & Social Policy, 7(1), 80-93.