Business Case study assignment for dominos pizza

Question

Task: How to establish Dominos current performance and future improvements using Business Case study assignment research methods?

Answer

Domino’s Pizza Harvard Business Case study assignment

1. Profitability of Dominos

It has been identified from the Business Case study assignmentthat cost control is the primary aspect of achievement of the profitability of the Dominos. It has been investigated that the pizza market was highly competitive that affected the sales volume of Dominos. According to the Business Case study assignment, annual global sales of Dominos reached $6.2 billion which was the highest in the history of the company since 2006 (David, Philips Andrews, Met shelman, 2017). It was a 23% increase in the sales along with the financial value of the company. As per 2017 record, it has been identified that approximately $193.5 billion has been generated by Dominos when compared with Pizza Hut its primary rivalry. In 2020 the overall profitability rank of the company is 16.27% indicating the strong financial performance. Since its establishment in 1960, the organisation has generated vast numbers of economies (David, Philips Andrews, Met shelman, 2017). By 1983, only 1000 stores were opened by the company while it had reached 1700 stores by 1999. when compared with Pizza Hutn in the 20s-decade, Dominos had only 4475 domestic stores along with the profitability margin only 6.9% as per Business Case study assignment. Strong supply chain as the primary factor resulting in the strong financial value of Dominos since its establishment.

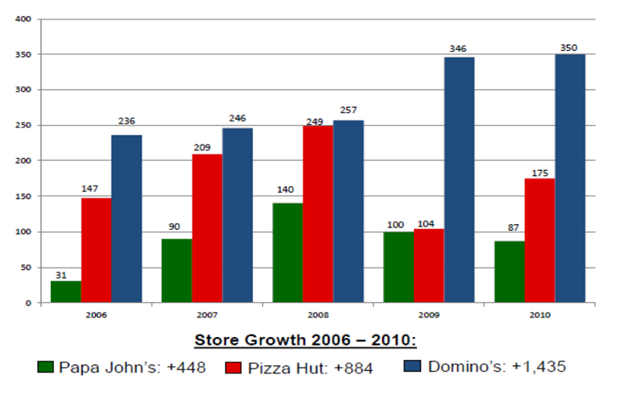

Figure 1: Store growth of Dominos

(Source: Adapted from David, Philips Andrews, Met shelman, 2017)

Even the Business Case study assignment and equivalence are significantly increased from 2006 to 2008 indicating strong profitability (Statista.com, 2021). Significant rise in property, plant and equipment constitutes total assets 380.2 in 2006 to 460.9 in 2008. Even the amount of liabilities has decreased from 2006 to 2008 providing opportunities to increase the financial assets of Dominos. When compared to its competitors. Overall store numbers have also significantly increased indicating stable profit margin. It was only 236 in 2006 while it became 350 just in 2010 when compared with Pizza Hut.

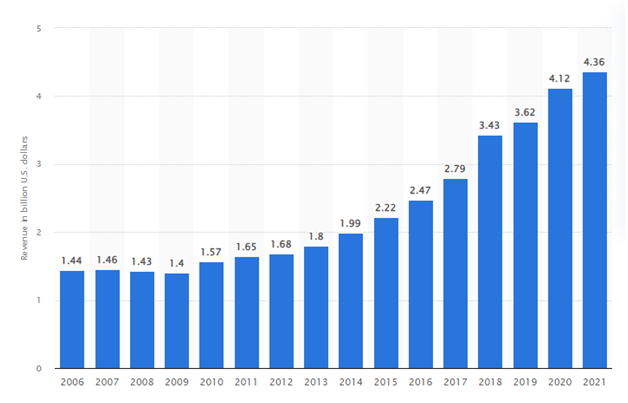

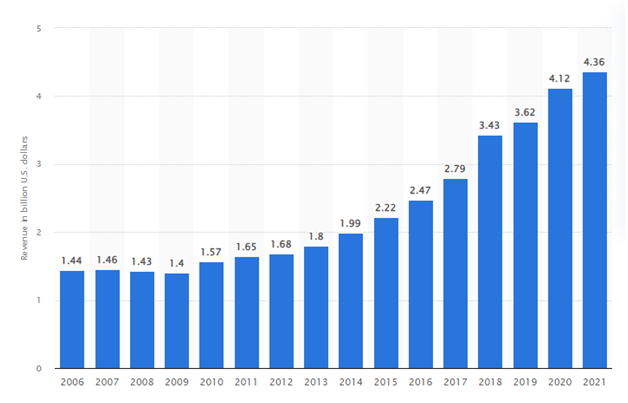

Today's Dominos have 17,000 franchised and corporate-owned stores in more than 90 international markets. Maintaining cost control was a big aspect that helped Dominos to decrease its operation cost and increase its overall profitability. In 2004, the company began trading common stock and opened 442 stores. Dominos generated 4.36 billion U.S. dollars worldwide in 2021 from 1.44 billion U.S. dollars just in 2006 (Statista.com, 2021). The graph indicates the fact that from 2006 to 2021 there is an over improvement of profitability and financial value of Dominos due to its extensive distribution and supply can network. In overall it can be said that Dominos is so precise for increasing the financial assets and profitability.

Figure 2: Profitability margin of Dominos

(Source: Statista.com, 2021)

2. Dominos value chain

Dominos has a strong distribution and supply chain network that helps to create unique value to their business operation. The organization has a total of 4900 US stores along with the 240 numbers of individual products and menus. As per Macksood in the Business Case study assignment, executive supply chain operations are the core creating value to Dominos. As mentioned by David, Philips Andrews, Met shelman(2017), Dominos uses a centralized purchasing process that helps in adding high volume economic and financial to the company. Domino's supply chain has a total of 19 facilities located in 15 states in the USA. Domestic menu has reached a certain level that helps in offering 4 different kinds of pizza crusts, 8 types of oven baked sandwich, 215 kinds of toppings, 6 different kinds of chicken dishes and 5 desserts options.

90% of sales of the company comes from serving pizza to their customers with the help of a strong supply and distribution system creating value (Bhosale and Deo, 2018). Dominos has strong partnership with the wide range of drink companies like Pepsi, coca cola and Jubilant Food Works Limited. Leprino's Foods, Paradise Tomato, Ardent Mills are the most important supplies of the company created value for Dominos. Dominos have a strong relationship with their suppliers that helps them to add special value to their business. Primary aim of the supply chain management of Dominos is to break the back-of-store activities (Dominos.com, 2022). In the Business Case study assignment it has been identified that Dominos has a strong supplier base with whom they have strong connections for more than 20 years. They have made it possible to drive high operation cost to low operation cost for Dominos. Dominos has their own poultry suppliers, farmers that can supply vegetables and corn. They even have direct suppliers of milk products for making some kinds of desserts. It is necessary to state that people between 18-35 in demographics are the customers targeted by Dominos.

3. Dominos adds value to its customers

Getting mobile right has allowed Domino's to create more value than its competitors by implementing more convenience and customized services. As stated by Ignacia et al. (2018), Prices of pizza are usually very high in the pizza delivery industry that are not always supported by customers. In this regard, Dominos set its price slightly lower than other competitors. This is how it provides opportunities to its customers having poor purchase capacity to purchase pizza with lower cost and create unique value. According to David, Philips Andrews, Met shelman(2017), Dominos tried to maintain its unique consistency, quality and price of Pizza so that it can help them to create a unique experience for their customers.

In terms of quality and consistency, Dominos has strongly created unique value for its customers, it has three different distributions. One is for take away, another is for dining in and the last one is for home delivery (Dominos.com, 2022). For the home livery it takes only 30 minutes which is very satisfying for the customers and for dine in and take away it only takes 10 minutes. Each store provides discretionary offers and promotional facilities that help customers to afford high quality lower priced pizza. As per Business Case study assignment, improvement in the buying process and use of digital systems allows Dominos to create unique value for its customers (David, Philips Andrews, Met shelman, 2017). Even the sustainability of using non plastic material for service and delivery of pizza is another important aspect that helps to create unique value to customers. Seasonal offers along with a free query resolution system allows customers to easily communicate with each other.

4. Dominos investments “pre-emptive”

Maintaining a strong supply chain is the primary strength of Dominos, even it has been identified from the Business Case study assignment of Dominos that pre-emptive was never a part of the company. According to the viewpoint of the David, Philips Andrews, Met shelman(2017), pre-emptive has never been a part of the pizza manufacturing and delivery operation of Dominos. It has badly implicated overall profitability and increased operation cost. Increase in the operation cost in turn increases overall profitability where the organisation needs to deliver pizza at low cost over the high-cost manufacturing process. In the Business Case study assignment it has also been identified that outside the US, several places have been identified by Dominos that can help them open new stores. As stated by Paul (2019), it has been identified that in the international level, Dominos uses a master franchise that operates on its own supply system. Dominos provides timely payment to each and every supplier and even the special risk mitigation payment is provided. But no incentive for early investors is provided by the company that might be ineffective to increase their supply chain base more efficiently.

Reawakening the Magic Business Case study assignment

1. Disney theme park review

Yes I have visited Disney theme park which is one of the five major business segments of The Walt Disney Company. It is actually a project of Walt Disney for the purpose of enjoyment and entertainment of the public (Disneyconnect.com, 2020). I have identified that it has Disney, Pixar, Marvel, Star Wars, ESPN, Twentieth Century Studios and National Geographics. I have identified that Walt Disney resorts have four theme parks namely Epcot, Disney's Hollywood Studios, Magic Kingdom Park, and Disney's Animal Kingdom Theme Park. I have gained some magical experience by visiting the place as it has helped me to identify the actual feeling of fun and happiness. Animation features have high-quality real-life incidents that have attracted me a lot. I have found out that the park is not so expensive and it can easily be afforded by any tourist. All the rides and fun activities are effective enough to spend weekend time with either friends or family members. I would like to suggest people to visit the place for having some kind of fun.

2. Corporate-level strategy of Disney theme park

Overall, it has been identified from the Business Case study assignment that Disney does have successful corporate level strategy. It has been identified that the primary aim of Disney is to become the best company in terms of service delivery in its theme park. According to the Business Case study assignment it has been identified that competition in the field is very high that might hinder the achievement of competitive benefit. According to JaunAlcaceret al. (2021), Pixar’s and Disney have tried to merge two different cultures together. But lack of creativity among people and lack of skill set hinders them from implementing a strong corporate culture. Pixar focuses on the primacy of people while Disney focuses on creativity and innovation. But overall corporate culture was effective because both the companies focused more on the talent but not on their ranking upon interview or hiring process (Disneyconnect.com, 2020). Trusting, cooperative and supportive environment results in a strong corporate culture within the company as well. Even the company thought that an animator is more an anchor than an artist and this type of treatment indicates successful and strong corporate level strategy of the company after all.

3. Wrong at Disney

When there were Wells, overall revenue of the company had increased to $8.5 billion from $1.5 billion. As per the Business Case study assignment it has been identified, market value reached to $22 billion from $2 billion, specially from theme parks and resorts tripled. But after the death of the Wells, overall management corrupted and it ultimately affected the strong and supportive culture of Disney. Management became corrupted and even all levels of employees were showing arrogant behavior that directly affects the overall productivity and reputation of the company. that JaunAlcaceret al. (2021), Mr. Katzenberg left Disney in 1994 because Mr. Eisner has refused to be promoted at the designation as president. After he left Disney, competitiveness of the company has increased. This is because of the fact that he tried to form a new studio with David Geffen and Steven Spielberg called DreamWorks SKG. initially after that he launched Quibi, a streaming mobile app that betas Disney provide them with strong competitiveness. Hence, after the fire of Katzenberg, overall competitive pressure and corporate culture pressure have been increased upon the Disney.

4. Acquisitions

Iger has taken so many acquisitions that Disney can buy the USA by 2050 and renaming it to the Disney States of America. As observed by David Collis and Ashley Harman (2018), Disney was never able to create identity on its own. Primary reason for carrying out such lots of acquisitions to signal to everybody at Disney that it was a new day. As per the Business Case study assignment, it has been identified that lots of acquisition not only helps to merge different types of culture into a strong platform. In addition to his, acquisition has helped them to increase their different kinds of resource base. Develop in house are time consuming where the acquisition can take short time to access talent and innovation and for this reason acquisition have been effective for Disney than develop in house.

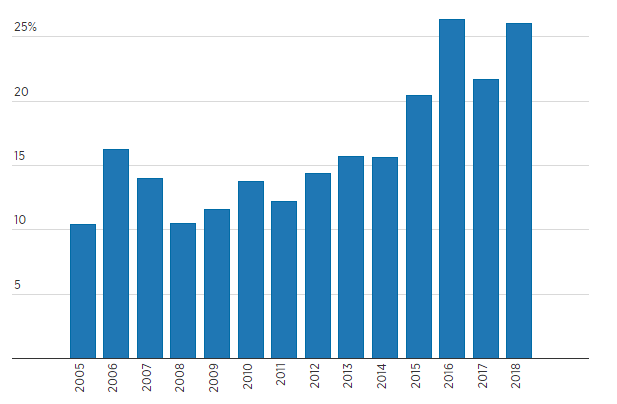

Figure 3: Disney's domestic box office market share 2005-2019

(Source: Cnbc.com, 2022)

Reducing the overall market competition, Iger has taken the decision to carry out lots of acquisitions. Even the many acquisitions have helped them to build strong resources and make a unique position in the market. In order to exert creativity in the global streamline services they have acquired lots of business-like ABC, Pixar, Marvel, National Geographics and Hulu.

5. Challenges Disney face

There are certain kinds of issues faced by Disney that can affect their future profitability and reputation. As per Business Case study assignment it has been identified that Demand for the parks is high but the capacity is not so large to support the demand of people. As opined by JaunAlcaceret al. (2021), Annual Pass sales are still paused that affect the sales and financial value of the Disney. Disney isn't fully staffed yet and it means there is a shortage of manpower which much more requires to develop a unique brand image. Supply shortages are another important issue faced by Disney beyond the issue of pandemic after all. Strong market competition is also a common issue that Disney is also facing decreasing their overall profitability. Development of local start-ups and development as a substitute are the most important threats that Disney is now facing to sustain the market.

The Walt Disney Company and Pixar, Inc

1. Disney and Pixar's joint venture

Joint venture between Walt Disney Company and Pixar, was successful because investors were able to see the potential of Disney to leverage the computer-animated character of Pixar to be used in Disney's vast network market. As Disney and Pixar are holding great market reputation regarding animation movies, the partnership has to be successful. As opined by JaunAlcaceret al. (2021), each organisation tried to access their composite culture since the last 10 years but the next release Toy Story 2 has created issues for them. This is because Disney refused to consider this movie as a part of their three-picture deal. Highest average gross per movie earlier have been already generated by the organisation but still it feels that ongoing arrangements are not so equitable (Blog.ipleaders.in, 2022). After that by the end of 2004, Pixar’s demand had been rejected by Disney as it aimed to own 100% of profits and to be paid a 10-15% distribution fee by Pixar. Disney has done wrong by denying the partnership agreement against Pixar for $7.4 billion. After that they started working in such a way that they worked separately for the same industry in different ways.

2. Purchase of Pixar by Disney

It has been identified in the Business Case study assignment that by the end of 2005, Pixar became a giant in the animation movie developer’s world (JaunAlcaceret al. 2021). As per the Business Case study assignment it has been identified that by that time Disney has identified the need for the acquisition of the Pixar Animation Studios with a worth of $7.4 billion in a stock deal that not only gives Pixar's chief executive, Steven P. Jobs, a powerful role in Hollywood but also stirs hopes for rekindling the animated storytelling tradition at Disney (Nytimes.com, 2022). Actually, as a part of the agreement Pixar is asked to sell their 2.3 shares for every share of Pixar stock that is worth $1 billion in cash. It was a value deal of $59.78 a Pixar share, based on Disney's $25.99 closing price constitute 3.8 percent premium over Pixar's closing price of $57.57. It is necessary to share the fact that it's a part of Disney, Mr. Jobs asked for the power of a non-independent director at Disney.

Reference list

Bhosale, P. and Deo, S., (2018). An examination of the inventory management system at Dominos. AMC, 1 (2), pp 1 to 89.

Blog.ipleaders.in (2022). About the agreement between Pixar and Disney. Retrieved from: https://blog.ipleaders.in/partnership-agreement-between-disney-and-pixar/ [Retrieved on 20th June 2021]

Cnbc.com (2022). Disney's domestic box office market share 2005-2019. Retrieved from: https://www.cnbc.com/2019/08/06/bob-iger-forever-changed-disney-with-4-key-acquisitions.html [Retrieved on 20th June 2021]

David Collis and Ashley Harman (2018). Reawakening the magic, Bob Iger and Walt Disney company. Harvard business review.

David E Bell, Philips Andrews, Met shelman (2017). Dominos Business Case study assignment: for exclusive research in 2022. Harvard business review. Disneyconnect.com (2020). About us. Retrieved from: https://disneyconnect.com/dpep/about-us/ [Retrieved on 20th June 2021]

Dominos.com (2022). About us. Retrieved from: https://dominos.com/ [Retrieved on 20th June 2021]

Ignacia, S.N., Wiastuti, R.D. and Lemy, D.M. (2018). Restaurant mobile application towards purchase intention. International Journal of Advanced Science and Technology, 117, pp.113-128.

JaunAlcacer, David Colis and Mary Furey (2021). Reawakening the Magic: Bob Iger and the Walt Disney Company Harvard Business Case study assignment: Harvard business review. Nytimes.com (2022). Disney Agrees to Acquire Pixar in a $7.4 Billion Deal. Retrieved from: https://www.nytimes.com/2006/01/25/business/disney-agrees-to-acquire-pixar-in-a-74-billion-deal.html [Retrieved on 20th June 2021]

Paul, P., (2019). Marketing of Pizza in Dhaka City-A Business Case study assignment of Domino’s Pizza of Jubilant Golden Harvest. Statista.com (2021). Revenue of Domino's Pizza worldwide from 2006 to 2021. Retrieved from: https://www.statista.com/statistics/207133/revenue-of-dominos-pizza/ [Retrieved on 20th June 2021]