Economics Essay: Defining Negative Externality And Automotive Market Structure

Question

Task: a) Explain what negative externalities are, and why there may be a case for government intervention to address them. Describe how taxes/charges and regulation can be used to correct the negative externalities and the pros and cons of each method. Provide real life examples. (6 marks)

(b) Choose a case study from your home country where an externality exists in a current market. Using your case study (real data) explain the effect of externality on market outcomes including dead-weight loss and discuss ways that your government has addressed the presence of negative externalities in the market. (10 marks)

(c) Suggest other options for dealing with negative externalities in your case study. (6 marks)

(d) Using the key characteristics of the market structures identify the market structure in your case study. (6 marks)

Answer

Answer to question a:

Negative externalities and reason of government intervention

As per the concept of Macroeconomics, it can be stated that negative externality is referred as a cost, which bears by the third party due to the resultant of economic transaction. In the transaction procedure, both the manufacturers and the customers are considered as the first and second party respectively. In this context of this economics essay, it can be mentioned that both the first and second party do not pay any compensation to the third party, who are outside of the market. According to Mariappanadar (2012), negative externality is also known as spill over effect. This is the reason described in this economics essay, why marginal social cost (MSC) is higher than the marginal private cost (MPC) in case of negative externality. It is noted that the private cost is experienced either by the producer or by the customers, whereas the marginal social cost is enjoyed by the society, which is the third party. More specifically, the social cost is the summation of external cost and private cost. Therefore, it can be said that the consequences of the over production or market failure that is externalities would not be taken by the account of theproducers in their account.

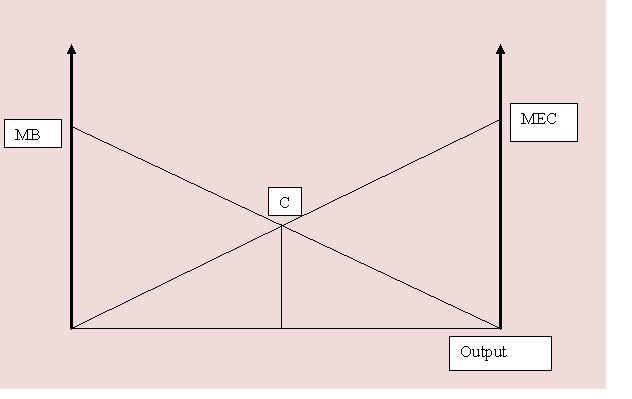

Figure 1: Negative externality

(Source: Created by author)

As per the depicted diagram in this economics essay, it can be observed that the MSC curve exceeds the PMC curve in case of negative externality. In the opinion of Demir et al., (2015), negative externality occurs when an organisation makes decision instead of paying the full cost for the decision. Consequently, the society suffers from the net welfare loss, which is highlighted by the triangle ABC in the above diagram.

In order to prevent the adverse consequences on the society as well as on the third party, the government of the countries require to intervene for helping price. There are two alternatives, which can be used by the government. Firstly, the government can regulate lawsuits or can penalise the producers, secondly, the government can use the optimal market solutions. In order to minimise the negative consequences of negative externality, the government would need to levy environmental taxation. As a result, under the governmental intervention, an economy can achieve two incidents. The first incident is, the economy would be capable to fix the damage arise due to the negative externality. The second incident is; the economy can improve the financial price on the marginal social cost. As a result, after the intervention of the government, the welfare of the society can be improved.

Imposition of taxation and the pros and cons

As per the above discussion in this economics essay, it can be observed that for preventing the consequences of the negative externalities on the economy government intervention has strong influence on the society. As opined by Rahwan et al., (2012), for preventing the consequences of negative externalities on the society, the government usually imposes pigovian taxation on the activity of the producers. As per the concept of pigovian taxation, the tax rate is imposed in order to deal the situation like over production. Consequently, the government can equivalent both the marginal social cost and the marginal private cost. Therefore, after the imposition of taxation, the producers would be bound to minimise the quantity of production for maintaining the operational cost in the business. It helps to move the economy towards the healthy equilibrium.

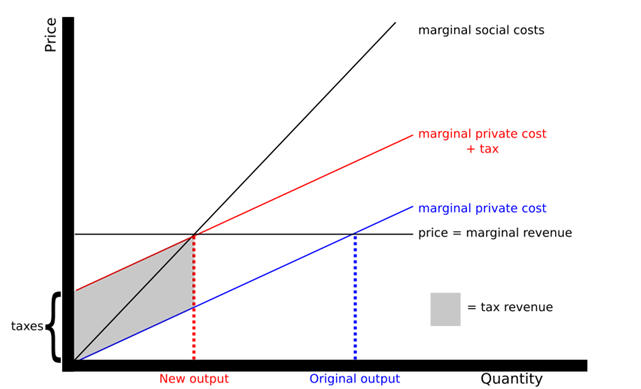

Figure 2: Pigouvian taxation

(Source: Khan et al., 2015)

As per the figure given above in this economics essay, it can be seen that the imposition of taxation has shifted the marginal private cost curve to the upward direction, which is equivalent to the amount of externality. With the help of the imposition of this taxation, the government can prevent the percentage of negative externality on the per unit production. In a nutshell, pigouvian taxation discourages the activities, which have been charged a net of production cost on the third party that is on the society.

Answer to question b:

Negative externality in India

Air pollution in India is a serious issue, which has been increasing in epidemic form with the passage of time. Since, the last 30 years, the private firms and industries have been increased across the country and hence India has been growing as one of the popular destination of industrial hub. However, Wood and Sullivan (2015) argued that the rapid growth rate of industrialisation has adverse effect on the environmental. Consequently, destruction of trees and forest has been increasing and hence, ecological balance of the country has been degraded. Over the years, the pollution level of the country has been increasing; more specifically the emission of carbon di oxide to air has been rising. Apart from the rapid industrialisation, uses of massive vehicles have added the level of CO2 in air. For instance, air pollution in the big cities like Mumbai, Delhi, Bangalore and Kolkata is very high. It has direct effect on the society. It directly affects the respiratory system of the people. Therefore, from this point, it can be stated that the third party has been suffering from the cardiovascular effect or from asthma. Though, industrialisation has positive effect on the economy and it can increase the employment rate. With the rising of production of the companies, the level of emission of carbon to air would be increased. On the other hand, it would also dump the harmful chemicals of the manufacturing process directly to the land and water. As a result, the level of greenhouse gas in the air has been rising with the passage of time. As per the statement of Dröes and Koster (2016), land pollution would lead to loss the ecological balance. It is known that India is an agricultural based economy; however, land pollution affects the quality of the crop. Therefore, it is clearly evident that with the growth rate of industrialisation of India, though the economic position of the country has been growing, however, pollution level in the air has also been increasing. As a result, the society who are considered as the third party, are suffering from chronic diseases. In addition, the environmental balance has been declined.

Effect of negative externality on the market and the concept of dead-wright loss

India is at the third ranking in the emission of per capita harmful gas, just after the US and China. As per the report of 2013, 30% non-smokers Indians had been suffering from lungs infection than the Europeans (Shakhramanyan, Schneider & McCarl, 2013).This refers that the third party unnecessarily bear the consequences of pollution of air in India. In this context, it can be stated that the burden of pollution is bearing by the people and hence, they are suffering from the long term health issues and the livelihood problem. Therefore, India will need to go to a long way for bringing environmental equality. On the other hand, itcan be mentioned that pollution not only affect the environment or the human being, but also it has adverse effect on the gross domestic product of the country (The Economic Times, 2018). As per the statistical report published by World Bank, India had lost approximately 8.5% of the total GDP in the year 2013, which had declined the economic health of the country. Since, the welfare cost has been increased as well as the organisations have been lost a large number of labours. More specifically, India was suffering the problem like premature deaths of the labour and hence, the labour income and the overall economic earningof India had declined in the year 2013. Conversely, as per the study of Indian Institute of Technology, during the year 2015, the air pollution cost in Delhi and Mumbai was $10.66 billion (The Economic Times, 2017). It was equivalent to the 0.71% of the country’s GDP during the period. In a nutshell, it can be inferred that the since the higher air pollution level of India has been increased the premature death of the labour, therefore, it has affected the standard of living the family members of the victim’s family (who are assumed as the third party). Since, the family is dependent upon the earning of the employee;therefore, the premature death of the labour directly affects the well-being of the family. From this point, it can be said that pollution in India is not only harmful for the health status of the third party as well as for the citizens, but also it also affects the well-being and standard of living of the family members.

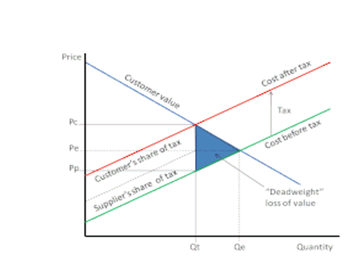

Higher air pollution level has not only adverse effect on the GDP growth rate of the economy, but also it has negative impact on the economic efficiency level. For instance, the number of automotive manufacturing firms in India is high, which have been emitted a large percentage of carbon and other harmful gas in the environment. On the other hand, uses of vehicles across the country have also been increased. This refers that the number of the purchasing of cars across the country has been increased. The negative consequences of the air pollution can be analysed with the help of the concept of deadweight loss. In terms of macroeconomics, deadweight loss in the market is considered as the societal cost, which is created by the inefficient market resources in the economy. In order to increase the societal welfare as well as to minimise the emission of carbon by the manufacturers, the government has imposed taxation on per unit of carbon emission by the organisations. As a result, for maintaining the revenue earnings even after the minimisation of production as well as after the tax imposition, the producersincrease the price level of the products. Consequently, the supply curve shifts to the upward direction. Conversely, after increasing the price level of the goods, the customers also feel reluctant to consume the goods and hence, the quantity sold of the goods is decreased. The customers feel that the price of the goods is high compared to the perceived utility and hence, feel reluctant to purchase the goods. From this point, it can be mentioned that dead weight loss in the society will be occurred when both the demand and supply are not in the equilibrium level. As a result of discussed in this economics essay, overall welfare of the society can be decreased. With the help of the situation, it can prove that air pollution level also has negative impact in minimising the societal welfare level.

Figure 3: Effect of deadweight loss

(Source: Chen et al., 2015)

Role of government in addressing the negative externality in India

In order to prevent the consequences of negative externality on the third party, the government of India can impose landfill tax on the automobile manufacturers. As per the landfill tax, the government motivates the car manufacturing producers to minimise the emission of wastages to the environment. In addition, the government also targets to encourage the manufacturers to focus on the recovery of the value from wastage. For instance, in this context, the automobile companies of India need to use recycling and environmental friendly goods during the manufacturing process, so that the waste disposal to the environment can be minimised. Consequently, for minimising the negative consequences of non-biodegradable products in the air, the government of India has taken essential step. The automobile sector is needed to restrict the uses of plastic, polymerised products or aluminium tins during the operational process, so that the harmful and non-environmental friendly products would be added in the air (Narain, 2016). In addition, government has taken initiatives and encourages the automobile sector of India to promote electric cars. Initially, government has made a policy for the manufacturing of electric cars in the small scale (Singh, 2018).The e-vehicles would be started the services across the nine cities of India (which are assumed to be the busiest and populated city). For instance, the Indian car manufacturing firm Reva Electric Car Company (REEC) as well as the app based transportation network company like Ola have started to work on the manufacturing of electric cars in large percentage on the next two decades. In spite of this, the electric cars like Tata Tiago Electric, Mahindra e-Verito, Mahindra e20Plus, Tata Tigor etc. are available across the Indian market. On the other hand, not only the electric cars, but also the government of the country encourages the automobile manufacturing industry in the production of electric buses, scooters, bicycles etc. The newly launched policy of the Indian government would bound the automobile manufacturing firms to manufacture more electric cars instead of the traditional cars for minimising the emission of carbon to air as well as for improving the health status and welfare of the third party.

Answer to question c:

Other options of dealing negative externalities

In order to minimise the consequences of negative externality like pollution on the Indians, the government has started to take initiatives such as the implementation of landfill tax and also the launching of the manufacturing of electric vehicles across the country. In addition, it can be recommended that the government of India can also impose vehicle excise duty on the users. As per the concept of vehicle excise duty, the government of the country will levy a certain percentage on the money annually for using the vehicles on the public roads. After getting the success in the UK, the Indian government can start to impose the duty after a certain limitation of the uses of public transport on the roads. It is the other way of controlling the pollution level in air.

Apart from this, for restricting the emission of carbon or other harmful gases to the environment by the automobile manufacturing firm, the Indian government can follow the Coase theory. If the residents beside the automobile manufacturing industry will suffer from any hazardous issues due to the disposal of harmful gases in land or the emission of carbon to air, then the government can charge a certain percentage of money as the cost of burdenfor the affected parties. Therefore,the manufacturing firms would be bound to pay the money to the third party according to the rules and regulations.

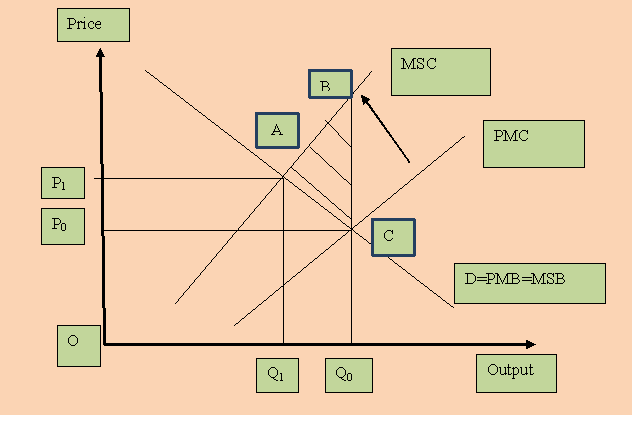

Figure 4: Coase theory

(Source: Created by author)

As per the above drawn diagram given in this economics essay, it can be said that both the marginal benefit as well as the marginal environmental cost would be negotiated by the manufacturing firms and the third party under the norms of the government at the point C. As per the concept of Coase theorem, the legal rules or the property rights of the government are required to follow. In case of any violation, the third parties or the victims would be paid money as the penalty fee from the others. It is playing an essential role in obeying the environmental law and hence, the environmental pollution can be minimised.In addition, the compensation to the third party would increase their pareto optimal outcome and the social surplus.

Answer to question d:

Key characteristics of the Indian automotive market structure

Indian automobile manufacturing industry is monopolistically competitive in nature and some of the popular car manufacturing companies are Tata Motors, Maruti Suzuki, Ashok Leyland, Mahindra and Mahindra, Hindustan Motors Limited, Chinkara Motors etc. As per the concept of monopolistically competitive market structure, there are large number of buyers and sellers in the market. Since, the number of buyers and sellers in the market in high, therefore, no one gets the power to influence with its pricing strategy to the competitors. Therefore, no firm will get the access to control the market. For instance, in the automobile manufacturing firm, all of the firms get opportunity to maximise its sales by attracting the customers with their business strategy.

The available products in the monopolistically competitive market are closely substitutes in nature and they are not exactly identical. More specifically, product differential is the other characteristic of monopolistically competitive market. For instance, cars manufactured by the automobile manufacturing firms are different to the vehicles manufactured by other firms. According to Zhelobodko et al., (2012) whose work is reffered in this economics essay, though the firms are manufactured differentiated models of cars from the others, however, the firms have monopoly power in the manufacturing of own products. However, it can be observed that the firms are facing high level of competition in the Indian manufacturing industry and it is reflected in the sales percentage of the companies. For instance, the product differentiation is dependent upon the design, colour,material used, features of the models etc.

In the opinion of Nikaido (2015), the monopolistic firms have power to freely enter and exit in the industry. When the existing organisations would get opportunities to make supernormal profit, then the new firms would enter into the market. As a result, it can be said that with the rising of suppliers in the market, the price level of the manufacturing items starts to be declined and thus, the companies can earn only normal profit in the market. Likewise, if the existing manufacturing firms would start to sustain loss, then the marginal firms would exit from the industry. Consequently, the price level of the goods would be increased due to the availability of less supply in the market.

The customers would not get perfect knowledge on the manufacturing goods and the market since there are innumerable goods. In addition, the products are closely substitutedto each other (Balistreri & Rutherford, 2013). As a result, the consumers do not know the actual price level and the product specification of the manufacturing items. Mobility of the factor of production in the monopolistic market is less than the other type of market structure. Besides this, advertisement is playing an important role to attract the customers towards the manufactured items by the monopolistically competitive firms. Therefore, it can be stated that selling cost affects both the cost of production and the demand. The firms try to adjust the price level of the products in order to achieve the maximum profitability in the market. The demand curve of the firms under the monopolistic competitive market is highly elastic (Dhingra & Morrow, 2012). Therefore, for increasing the sales percentage, the Indian automobile manufacturing companies need to minimise the price level.

Reference List

Balistreri, E. J., & Rutherford, T. F. (2013). Computing general equilibrium theories of monopolistic competition and heterogeneous firms. In Handbook of computable general equilibrium modeling (Vol. 1, pp. 1513-1570). Elsevier.

Chen, Z. M., Liu, Y., Qin, P., Zhang, B., Lester, L., Chen, G., ... & Zheng, X. (2015). Environmental externality of coal use in China: Welfare effect and tax regulation. Applied Energy, 156, 16-31.

Demir, E., Huang, Y., Scholts, S., & Van Woensel, T. (2015). A selected review on the negative externalities of the freight transportation: Modeling and pricing. Transportation research part E: Logistics and transportation review, 77, 95-114.

Dhingra, S., & Morrow, J. (2012). Monopolistic competition and optimum product diversity under firm heterogeneity. London School of Economics, mimeograph.

Dröes, M. I., & Koster, H. R. (2016). Renewable energy and negative externalities: The effect of wind turbines on house prices. Journal of Urban Economics, 96, 121-141.

Khan, M. T., Huo, X., Li, Z., & Kanich, C. (2015, May). Every second counts: Quantifying the negative externalities of cybercrime via typosquatting. In 2015 IEEE Symposium on Security and Privacy (pp. 135-150). IEEE.

Mariappanadar, S. (2012). The harm indicators of negative externality of efficiency focused organizational practices. International Journal of Social Economics, 39(3), 209-220.

Narain, S. (2016). In Need of a Landfill Tax. Retrieved from https://www.business-standard.com/article/opinion/sunita-narain-in-need-of-a-landfill-tax-116050800663_1.html

Nikaido, H. (2015). Monopolistic Competition and Effective Demand.(PSME-6). Princeton University Press.

Rahwan, T., Michalak, T., Wooldridge, M., & Jennings, N. R. (2012). Anytime coalition structure generation in multi-agent systems with positive or negative externalities. Artificial Intelligence, 186, 95-122.

Shakhramanyan, N. G., Schneider, U. A., & McCarl, B. A. (2013). US agricultural sector analysis on pesticide externalities–the impact of climate change and a Pigovian tax. Climatic change, 117(4), 711-723.

Singh, S. C. (2018). Government plans new policy to promote electric vehicles. Retrieved from https://economictimes.indiatimes.com/industry/auto/auto-news/government-plans-new-policy-to-promote-electric-vehicles/articleshow/65237123.cms

The Economic Times. (2017). Smog hangs heavy over India's GDP too. Retrieved from https://economictimes.indiatimes.com/news/economy/indicators/smog-hangs-heavy-over-indias-gdp-too/articleshow/61587387.cms

The Economic Times. (2018). Pollution doesn't kill just humans but businesses too. Retrieved from https://economictimes.indiatimes.com/news/politics-and-nation/pollution-doesnt-kill-just-humans-but-businesses-too/articleshow/66430184.cms

Wood, R. M., & Sullivan, C. (2015). Doing harm by doing good ? The negative externalities of humanitarian aid provision during civil conflict. The Journal of Politics, 77(3), 736-748.

Zhelobodko, E., Kokovin, S., Parenti, M., & Thisse, J. F. (2012). Monopolistic competition: Beyond the constant elasticity of substitution. Econometrica, 80(6), 2765-2784.