A Short Account of the Association between Inflation and Unemployment

Question

Task:

- Discuss if there exists any type of connection between inflation and unemployment. Is it fair if the government intrudes into the economy to limit the level of inflation and unemployment? Elucidate using practical and real cases.

- Consider the case of our mother country and select a case study that pertains to the subject of inflation and unemployment along with the trends in the development. Also make it distinct, in what aggregate curve range does your country comes.

- Provide a detailed account of how the fiscal policies of the government could make an impact on the domestic economy along with contemplating the exchange rate ratios and degree of employment.

Answer

1. The domestic economic environment of the company comprises of various factors and dimensions which depends on the consumers in the internal markets of the company. Before we should enter into the detailed analysis of inflation unemployment, the major theme of these terms should be understood. If taken the term Inflation, it is one of the most used terms in the field of economics which indicates the overall increase in the cost of essential goods. The occurrence of inflation is being stimulated by many elements like less availability of the essential materials and thereby higher demand of the same, which eventually leads to a rise in the prices. In simple words, it is the situation when “a lot of money would go after very little money”. Besides Inflation, the term Unemployment is also a very widely used one and even a normal citizen is well acquainted with it. This term signifies the condition in which a citizen who is eligible and capable to be employed, but remain unemployed because of some economic factors. The state of unemployment could be voluntary or involuntary choices of the citizen. Thus, this report majorly aims at identifying any association between inflation and unemployment. The best method to understand and point out any relation between inflation and unemployment is by looking into the Philips curve. If looked at the Philips curve, it could be observed that inflation and unemployment hold an indirect relation with each other. This roughly indicates the piece of information that, higher the level of inflation gets lower the level of unemployment goes. This indicates that a considerable increase in the level of inflation would consequentially increase the rate of employment.

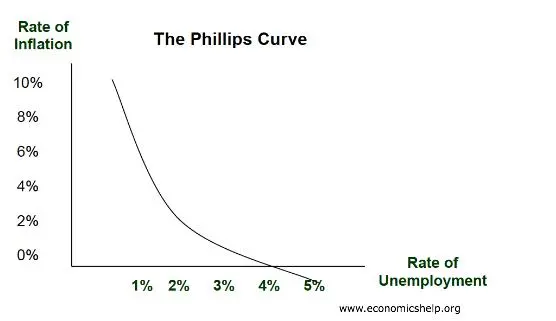

The Philips curve is represented in the graph provided above. If observed, it could be easily noted that the rate of unemployment and the rate of inflation holds an inverse relationship with each other.

The concept of the Philips curve was put forward by A.W. Phillips which provided that inflation and unemployment hold a very steady and reverse connection. It is simple words that claim that when the domestic economy of a country performs well, a substantial level of inflation rises. This condition generates a considerable degree of employment in the respective country. Although the incidence of stagflation in the later 1970s has generated a little bit of incredulity on the theory of the Phillips curve. This contradiction when both the inflation and high degree of unemployment existed simultaneously in the world economy. This instance was later termed as stagflation.

If you consider again the Philips curve provided above, the inversely proportional relationship between the inflation and unemployment is being displayed via the concave curve which is in a downward sloping position. The variable of inflation is represented on the Y-axis and the x-axis, the variable of unemployment is symbolized. In the later decades of the twentieth century, it was considered that a monetary incitement in the economy has the potential to increase the demand for labor which lessens the availability of talented and skilled labors. In an attempt to attract these employees and retain them, the companies offer higher salaries and emoluments. To cope up with the hike in the expenditure on the disbursement of the payroll, the business firms increase the projected price of the customers in the market. Thus, transferring all the burden indirectly in their customers. By referring to this theory many governments in the world have implemented a “stop-go” policy by which a limited amount of money is fused into the economy to induce controlled inflation which was accompanied by some other financial and economic policies to attain the targeted objectives. However, as mentioned earlier the theory was questioned in the later 1970s by the discovery of the condition called stagflation. Then, the theory of the Phillips curve had poised itself at a questionable position among economists.

When looked backed into the history, the process of ascertaining any association between inflation and unemployment was very easy. But because of the new advancements in the world economy as mentioned above, there were some modifications made in Phillip's curve since the earlier version became obsolete and useless for the modern economic scenarios. Thus, the theory was modified into two divisions, which are long-run Phillips curve, and short-run Phillips curve.

This curve could be symbolized by using the numerical equation provided below: -

Inflation = [(expected inflation) – B] x [(cyclical unemployment rate) + (error)]

In which the variable B signifies a positive number higher than integer zero which displays the reliability of unemployment on the magnitude of inflation.

The major reason behind this inversely proportional relation roots to the instance in which the requirement is a very elevated but very limited source of supply because of many instances and influences in the economy. It is a commonly known fact that when there is substantial demand for a product or service in the desired market then the production units start to manufacture a lot of product in surplus to meet the extreme demand and requirement of the targeted consumers. Hence, the companies require to increase their efficiency multiple times to reach the required production rate. For acquiring this level of efficiency, the relevant industries require a large number of new employees, suppliers, and other stakeholders. This huge demand for skilled employees would give jobs to unemployed and unoccupied people and contribute to eradicating unemployment in a very effective way. In this way, an increase in inflation would help in limiting unemployment to a certain level.

As mentioned above, the relation between inflation and unemployment is being depicted by the Phillips curve, but the reliability of the Philips curve for the long period was always under question. It was being opined by famous economists of the world that the Phillips curve is not reliable for long run purposes. They have argued that, although there may happen a dip in the level of unemployment, only a short-term increase in the level of inflation in the economy. If taken the case of an extended version it could be observed that there is no such projected relationship between inflation and unemployment. If mentioned this statement with relevance to the graph provided above, when the natural rate of unemployment occurs the curve in the graph becomes vertical. The interference of the government in the economy and any other steps for eradicating the issue of unemployment just end up in the movement of economy on this proposed vertical line.

The term ‘natural rate of unemployment’ which is also known as ‘non-accelerating inflation rate’ was introduced by two internationally known economists Edmund Phelps and Milton Friedman. As per the natural rate of unemployment theory by these economists, any interference or activity to boost up the employment in the economy would only a short-term impact and thereafter this effect fades away because of the adaptation to the altered surroundings. The natural rate describes a point beyond which if the rate of unemployment goes, the rate of inflation substantially decreases. It would now come in everyone's mind that what if the rate of unemployment is stuck exactly on the natural rate. In this instance, the rate of inflation becomes steady and longstanding.

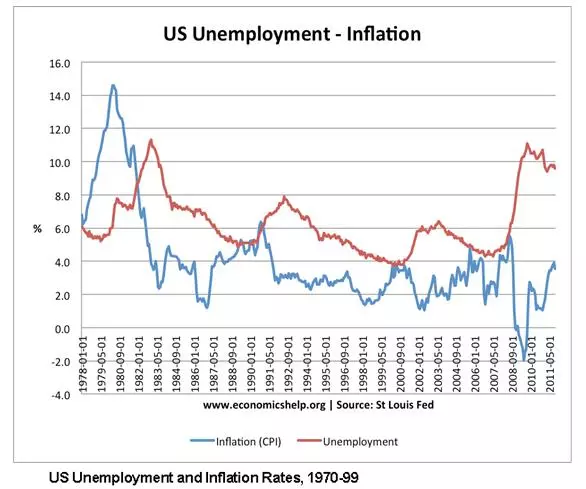

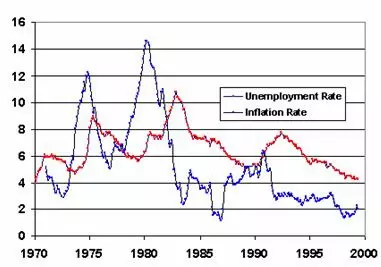

To display the real-life example of the theories explained above, the domestic economy of the US is selected in this report.

In the diagram given above, it is being depicted how the economy of the USA has achieved a lower level of unemployment while keeping the level of inflation low. If looked into the graph, it could be noticed that in the period between the years 1979 to 1983, the rate of inflation has decreased from the level of 15% to that of 2.5%. As per the ideologies put forward by Phillip's curve, the rate of unemployment should have been increased. Following this ideology, the American economy had shown an increase in the unemployment level from 5% to 11%. Similarly, if observed the graph movement in the year 2008the level of inflation goes down from the level of 5% to -2%. As a consequence of this condition, the unemployment rate has shown a steep increase in its rate from 5% to 10% (Pettinger, 2011).

In this context, the major motive of any government would be to keep the variables of both inflation and unemployment at a very controlled and balanced level. The rate of inflation must be under a controlled rate of growth otherwise the citizens have to pay very high prices for the commodity which is necessary for their daily life. Similarly, the rate of unemployment should also be checked by the government. Since every mature and eligible citizen should have a job to find expense for their daily needs thus avoiding the condition of abject poverty which may lead to extreme hunger and suffering. In most the developing countries the factor of Unemployment is the major cause of poverty and destitution. Apart from inflation, the magnitude of unemployment is also associated with the degree of health. Major studies had revealed that the state of unemployment had initiated the symptoms of several psychological illnesses like depression. The citizens possessing relatively less education and skill sets are vulnerable to the perils of unemployment.

In practicality, the domestic economy of a country possessing unrestricted and limitless market without any sort of involvement from the authority or other governmental bodies shows an upward trend in the growth of the inflation. As a consequence of which the level of unemployment diminishes but not to the extent to which the inflation rises. It is observed that after a certain point of inflation, the unemployment remains constant and require some other action or external boost from the government to bring it down. This is the reason, why the government needs to interfere with the economy of the country to address some social issues, which if left unattended would lead to great discomfort and poverty among the citizens of the country. Hence from the humanitarian point of view, the government bodies should interfere in the economy to bring down the variables of inflation and unemployment.

Below are given the tools used by developed countries to regulate inflation and unemployment in the economy: -

- Wage control policy

- Fiscal policy

- Monetary policy

- Exchange rate policy

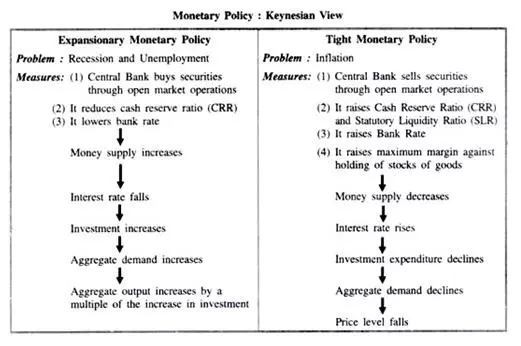

Monetary Policy

In developed countries like the US, tools like monetary policy come very handy in handling and controlling inflation. The central bank of the country predicts and calculates the level of inflation which may happen in the future. A very detailed analysis is conducted on this predicted value and if it seems that the level of inflation would harm the economy of the country, then the central bank would elevate the rate of interest. If the interest is increased, it would reduce the saving capacity of citizens and consequentially affect the purchasing power of the population. The decrease in the purchasing power of the population hence decreases the level of the demand about the market thus eventually resulting in a lesser level of inflation. The increase in the rate of interest impacts the customer in several aspects, which are: -

- Curtailing the power of the consumer to spending and borrowing money

- The consumers would be encouraged to put more money into their saving accounts because of their heavy interests.

- Reduced the rate of export and import because of the high exchange rate of the currency in the international market.

Fiscal Policy

Similar, to the monetary policy, the government uses the tool of fiscal policy in the economy. In this sort of policy, instead of a tax, the government uses the variations in the annual budget and rate of tax to decrease the existing demand in the economy. By the method of increasing the tax, the disbursements from the government treasury. Normally this tool is avoided by the governments of many countries since the increase in tax is not considered as a favorable move among the citizens. Hence the tool of fiscal policy would be politically expensive, although it would be very beneficial in the monetary aspect.

Wage control policy

This tool is the most effective one among all the tools used in controlling the inflation and unemployment prevailing in the economy. It is a commonly known fact that inflation would surely hike if the wages of the working diaspora is higher. In the later decades of the 20th century, many economists and politicians had attempted to introduce this too in the economy. Although the huge protest and dissent against this policy had made the governments withdraw this policy.

Exchange rate policy

This tool was first introduced by the government of the United States of America to keep the high inflation at check by keeping the exchange rate of the dollar at a very higher rate. This was done in an attempt to carry out the transactions in the import process in a cheap way. Another motive behind increasing the value of the dollar was to decrease the demand prevailing in the domestic market. Although these methods had reduced the rate of inflation, a state of recession emerged after this action.

The tools mentioned above were implemented by the government of the United States of America to control the issue of increasing inflation and unemployment. Although the market of the USA is a free and uninterrupted one, the government had to interfere with the economy to control the hostile condition. The government of the USA, instead of concentrating only on policy, had implied an amalgamation of effective tools to control the uncertainties in the economy.

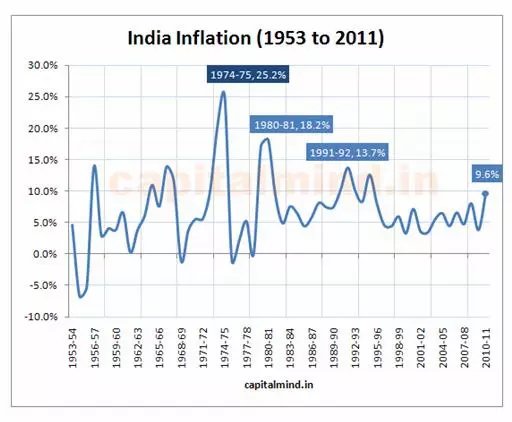

2. In an attempt to address this question, India is selected as the home country. The economy of the local market of India is selected to scrutinize the level of growth, inflation and unemployment ratios. To make this analysis a more authentic one, the scrutiny of the supply curve is done in this report.

In the answer to question 1, we have already discussed the meaning and various elements comprised in the topic of inflation and unemployment. Although the union of India comes under the classification of developing nations, it has a very dynamic and well-performing market. India, from the time of its independence, has improved itself tremendously in the international market and its population has acquired a great purchasing power the time and all the major competitors in the global market are craving to trade in its market. India currently holds the position of 10th in the list of biggest economies in the world in terms of Gross Domestic Product. Although a various section of the Indian economy is performing extremely well, its abusive colonial history is holding it back from dominating the global market. The company had a very interesting history of inflation and the unemployment issue in the past.

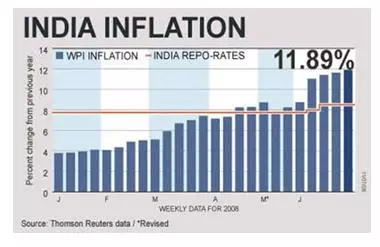

As per the annual statistical report provided by the Indian Ministry of Statistics and Program Implementation, the average yearly inflation rate in India amounts to 6.46%. Although this statistic is very less than that of the average yearly rate of 9.6% as observed in the year of 2011.

If explained the term inflation with relevance to the economic atmosphere of India, it is the alteration in the rate of value of Wholesale Price Index calculated every year. This method would be very good at calculating the average annual increase in the price of goods and services in the domestic market of India. The government has selected WPI as the base for calculating the inflation and the empirical formula to calculate this is given below.

(WPI in the month of current year-WPI in same month of the previous year) ------------------ X 100 (WPI in the same month of the previous year)

It could be noted that many factors are making the domestic economy of India susceptible to the variation in the rate of inflation. As discussed earlier in this report, the base for the estimation of inflation is done by using the unit of WPI. It was always a major issue faced by the government of India; whatever measures could have been taken to control the inflation some imminent elements are raising the rate of inflation. Below are given some major factors which are affecting the inflation fluctuation in the economy.

- Unstable rate of growth in the economy: Although the economy of India has displayed an extraordinary performance, various contributing elements comprised in it have displayed a very unstable output. This inadequate performance by the essential units is requiring the import of goods and services into the domestic economy. This heavy import of the products leads to the weakening of the Indian currency. The weakening of the currency would surely lead to a higher level of inflation.

- Population: The magnitude of the population in India is one of the most factors which influences the dynamics of inflation. The resources needed to suffice the needs of the public are directly proportional to the size of the population which would eventually lead to an increased demand for every product in the economy. It is a commonly known fact that increased demand for commodities in the economy would lead to an uncontrolled increase in the rate of inflation.

- Spending capacity: The Indian economy has much recovered from the period of stagnation at the period of independence. The per capita income in the Indian population has increased substantially which has increased their purchasing capacity. Roughly saying, the population could hold much more able to spend money. It is a well-known theory that if too much money chasing the limited commodities, it would generate high demand and eventually the higher level of inflation.

It could be noted that although high inflation affects the consumers adversely, the level of lower inflation would turn out to be very hostile for the manufacturers and producers. As mentioned earlier in the Monetary policy section, the central bank of the country (in the case of India it is Reserve Bank of India) decides the supposed or appropriate level of inflation which could be tolerable to the respective economy. The interest rates are being used by the central bank to control the rate of inflation and unemployment in the country. The Reserve bank of India has devised out some tools to calculate the inflation in the economy.

A) Consumer Price Inflation

There was a new approach accepted by the Reserve Bank of India that targeted towards the innovative inflation pursuing regime in the year of 2016. This approach had facilitated a margin of 2% flexibility in the inflation level for a further 5 years.

B) Core Inflation

The method of core inflation is a more refined one than that of the consumer price inflation approach and was devised out because a great majority of the economists believed the prevalence of low inflation in the economy.

In the approach of Core inflation, eliminates the prices of commodities like essential food and energy sources from its analysis since they keep unaffected by the monetary policy changes. There has been a much-concentrated version of this approach formulated by the Indian economists which were termed as 'core inflation'. This approach went on further by eliminating elements like jewelry, gold, transportation, etc. This is done to get a better outlook and character of the instability prevailing in the economy. The instance in which the overall demand of the domestic economy is rising at a very accelerated pace which is relatively exponential to the hike in supply would lead to very high core inflation. Thus, the concept of core inflation helps in contemplating and justifying the process of an upsurge in the overall prices though the overall inflation is below the average level. The same trend has been observed in the economy of India recently. Though the overall inflation in the year of 2018 was reported to be 2.34 %, the level of core inflation was denoted to be around 5.87%.

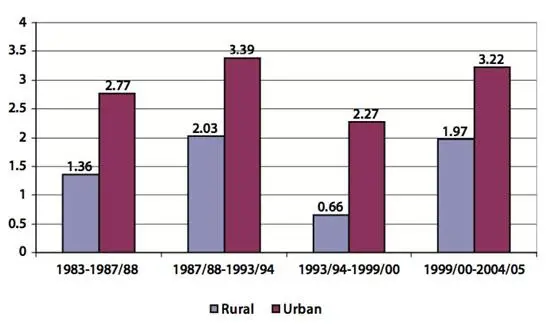

In the figure provided above, the rate of unemployment that prevailed in the earlier decades is being depicted. If considered the rate of growth of population it has been very exponential and explosive and is now the second-largest population holding country next to China. It is very clear from the current rate of growth in the population that the country would overtake the population of China in 2024. Since the country is still only in a developing stage and could provide employment which could match the rate of population explosion in India and hence it would lead to a situation where most of the population remains unemployed. It should also be contemplated that the economy India hadn’t achieved that much pace of development and would lead to a great gap in the unemployment level and population growth rate. Although the overall economic growth is very slow in India, sections like the industrial area are providing a great contribution and hence have provided a lot of job opportunities for the Indian population. Thus, the government of India has given its maximum focus on the industrial sector to revive the domestic economy of India by fighting inflation and unemployment. Before concluding, we should also contemplate the traditional values followed by the citizens of India. The citizens of India possess a need to keep proximity to their households and family members. Thus, they try their maximum to find a job near to their house and hence get adjusted to whatever small opportunity is available in their city. This would amplify the issue of unemployment since the citizens are very immobile and don't go further to other places seeking better jobs. It could also be noted that the literacy rate in India has increased at a very fast rate than any other country, which has generated a strong demand for white-collar jobs in the market. The number of eligible candidates for the white-collar job had surpassed the available opportunities in the domestic market of India. Significantly, the government of India should generate more employment opportunities to match the available workforce present in the company. There should be efficient government schemes to address this issue, otherwise, this gap between demand and availability would increase to an extreme level.

Apart from the voluntary and involuntary type of unemployment, there are also some significant facets of unemployment that prevail in India. They are provided below: -

- Open unemployment

- Frictional unemployment

- Disguised unemployment

- Seasonal unemployment

- Cyclic unemployment

- Structural unemployment

Cyclic Unemployment

This type of unemployment occurs in an economy when the overall demand for the commodity suddenly falls in the domestic commodity. If the instance of cyclic inflation and unemployment remains for a while it would lead to a very worse condition of unemployment which is also termed Keynesian unemployment. In this case, the citizens of the country lose their jobs and the country dumps into the condition of abject poverty.

Structural Unemployment

This sort of unemployment occurs because of some abrupt and long-lasting changes in a certain section or specific sort of industry. If taken an instance, take the car manufacturing companies in the United Kingdom. Many employees have lost their jobs after new giant companies have sprouted in the eastern globe since the companies in the UK had lost a large area of the market in the world economy. The major cause of structural unemployment had been prevalent in India and developed countries like the United Kingdom because of world events like Globalization.

Seasonal Unemployment

This type of unemployment exists because some sort of employment only comes into prevalence on a seasonal basis in certain months of year. In India, this sort of unemployment could be seen in the agricultural field.

Frictional UnemploymentThis sort of unemployment is prevalent all over the world, which is also be termed as search unemployment in world history. In this process, the citizens seem to be in the unemployed condition since they are in search of another after resigning from their existing job. In this type of situation, the government can’t do anything significant. Hence it could be observed that no country could attain the level of zero percent unemployment since some of the citizens would always be busy in altering their occupation.

Voluntary UnemploymentWhen the present rate of salary or emoluments provided by the companies, then the person choose to remain unemployed and idle. Although this may be not the sole reason that the person chose to remain to be unemployed. The factors like high welfare benefits prevailing in the country and increased level of taxes also increase the chances of voluntary unemployment.

Disguised Unemployment

In this type of unemployment, the citizens lack the availability of a full-time job and hence this type of employment also comes under the division of unemployment. The citizens like those who have been compelled to take retirement, those working in part-time jobs, handicapped or sick people, etc.

Open Unemployment

When the population of a country faces the condition of having no occupation or vocation to follow. In this condition, the citizens are forced to remain unemployed because the market of the country doesn’t hold any opportunity for them. Open unemployment is also termed by some of the economists as naked unemployment.

Apart from the reasons mentioned earlier, the major factor which impacts the rate of unemployment in the domestic economy of India includes the factor like:-

- Scarcity of Stock in Physical Market: As per the statistics provided by Indian Statistical Department, the labor force of India is increasing at the rate of 2% annually. Since India is a developing country, there are not many industries in the economy to the employee all the labors. The economy needs to be invested with new stocks to start new companies and industries in the country. Thus, the lack of new stock and investment in the domestic economy is increasing the rate of unemployment.

- Less availability of land per person: India is mostly an agricultural company, but most of the citizens in India have no access to agricultural land. The major problem faced by the rural population of India is that most of them consist of landless farmers and have been facing an acute condition of unemployment.

- Very strict labor laws: Because of very strict legislation regarding the labors, the company couldn't make or coerce the workers to work in very punctual and demanding conditions. The liberal approach towards the workers is making it hard for the investors to bring the best efficiency out of their staff. Hence the companies in India are very reluctant to employ the citizens of India to avoid this issue.

- Lack of Infrastructure: It is a very daunting issue for India, that the unavailability of essential infrastructure is making it hard for every company to sustain in India. This condition is causing a high rate of unemployment and drawing back the domestic market of the country.

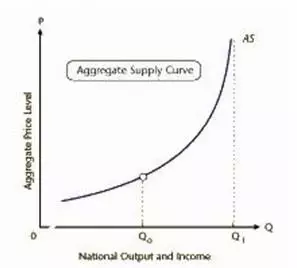

Although many problems are prevailing in India, the current proceedings in the domestic market show very positive signs and a higher rate of development than that of other developing countries. A graph displaying the aggregate supply curve prevailing in the domestic market of the country.

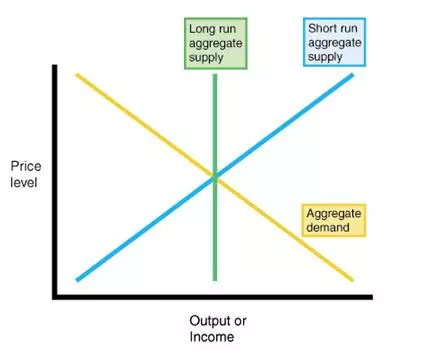

The executives in the organizations make the required calculations and try to predict the amount of product the company may have to supply to attain the previously set profit. Although the range or profit also depends on the market price, the cost of manufacturing the refined product, and the expenditure on buying the required raw materials. The Aggregate supply curve represents the aggregate sum of production that a GDP of a country would manufacture. Roughly saying, the aggregate supply curve is the probable manufactured amount to be prepared in a country int a specific period. It should be noted that various factors would affect the elements in the process of long term supply curve and short term supply curve.

In the figure represented above, a detailed overview of association among various variables of supply and demand. It could be observed from the above diagram that all the variables are depended on each other.

3. Let’s talk about the meaning and implementation of the monetary policy before elaborating on different elements in the economy which could be affected by the means of monetary policy. From the term monetary policy itself, it could be assumed that the concept has to do something with the amount of money flowing in the market or economy. The tool of the monetary policy is being implemented by the central bank of the country to control the flow of money in the economy. The factors like rate of interests, the requirement for goods, and some other macroeconomics are being controlled by the implementation of various monetary policies.

A general understanding of the monetary policy is elaborated and the way it is being used by the government to interfere with the economy in this part of the report. The tool of monetary activity is being controlled by the central bank of the respective country which is followed by the management of the money supply. The management of the money supply is being controlled by the central bank by controlling the elements like mutual funds, money market, cash, interest, credits, etc. Among all these elements control on the credit is the most significant one since it comprises factors like mortgages, loans, bonds, etc. The liquidity of the currency is being increased by the central bank using the monetary policy which would eventually lead to the development of the company. If the liquidity is increased in a specific economy then the rate of inflation would subdue. The tool of the monetary policy is considered as a very effective tool among majority of the countries. The major benefit of using this tool is effective in controlling inflation very effectively. It is also effective in controlling inflation and overcoming the issue of unemployment simultaneously. For sustaining the reasonable rate of long-term interest in the economy, the monetary policy has proved to be a very effective tool. The optimum range of inflation is considered to be between 2 % and 2.5 % for a well-performing economy. Similarly, the optimum range of unemployment is considered to be below the rate of 4.7 %. This level could only be attained by using the tool of monetary policy.

The majority of the central banks utilize the policy of reverse monetary policy to keep the level of inflation under control. The monitory policy brings under the rate of inflation under control by putting a limit on the quantity of loan a ban could loan. Apart from the restriction on the amount the loan, the central also coerce the subordinate banks to elevate the rate of interest which would make a large section of population devoid of credit. In an attempt to bring down the rate of unemployment the central banks use the tool of expansionary monetary policy. By this tool the level of liquidity is increased in the domestic economy of the country by elevating the availability of loans to the public. The probability of the recession would be eliminated since, the investors try to endow more money in upgrading the equipment, technology, and business operations. If considered the case at an individual level, the citizens purchase quality products to upgrade their lifestyle which eventually brings out economic growth.

By the medium of Monetary policies, the central banks use three different types of tools which are open market operations, reserve requirement, and discount rate.

While implementing the tool of open market operations, various debentures and government bonds held by various banks are bought by the central banks which would reduce the standby amount held by these subordinate banks thus limiting their ability to provide credit.

Although by the tool of reserve requirement, the amount of money to be held or reserved overnight daily is being prescribed by the central bank. This requirement is to prevent the banks from collapse since thee banks tend to lend out almost all of their reserves to their clients. This tool is also used by the central bank to decrease the level of currency liquidity in the economy. Although the central bank doesn’t often use this tool since its implementation requires a lot of red-tapism and official procedures.

The last tool implemented by the central bank by using monetary policy is the discount rate. This term signifies the rate at which the subordinate banks take a loan from the central bank. If the rate of interest for this loan is increased, then obviously it would affect the borrowing capacity of a bank. And thus, aa a substantial increase in the discount rate would reduce the circulation of money in the economy and eventually dampen the domestic economy.

Along with this, it could also be kept in mind that the central bank is the highest authority in the country which deals with the issuance of the national currency and other banknotes. Hence t is evident that the central bank holds the monopoly in the distribution of the currency denomination and thereby possess the power to control the way and procedure in which the banks could conduct their business in the market. It has been observed by most of the central banks all over the world that controlling several factors in the economy like the supply of money, by using the tool of monetary policy would ultimately bring a variation in the level of inflation. Although if considered the long period it would affect the rate of inflation and unemployment prevailing in the economy, the rate of unemployment is not much responsive to the application of monetary policy. Hence the power of central banks is limited to bringing down the level of inflation thus bringing a stage of equilibrium in the economy by bringing up a balanced price for goods and services produced thus takin up the overall accountability in maintaining the purchasing power for the customers. The effects made by the monetary policy would be very temporary and fade away concerning time. Although it would provide a sudden shock in the economy and is effectual in bringing a sudden desirable change. Even though the current knowledge and modern technologies are still inadequate to predict the possible degree of changes the tool of monetary policy could bring in the economy. The sometimes the result of the monetary policy gets delayed and it brings up the change when the economy has already adjusted itself with the financial conditions. The effects of the monetary policy are very limited in many aspects. Many financial crises like allocating the people at the lower strata with an apt job, increased fuel rate, disaster in the real estate, etc. remain impervious to the effects of monetary policies on inflation and unemployment.

The major basis on which the monetary policy becomes effective in the economy since it makes a huge impact on the circulation of money and thus creates a balanced or intended change in the economy. As stated by the renowned economist Dr. Don Brash The major motive or utility of the monetary policy is based on the results it could bring on the consistency of the process which has the potential to bring the economy to its maximum potential which is the aim of the domestic economies all over the world.

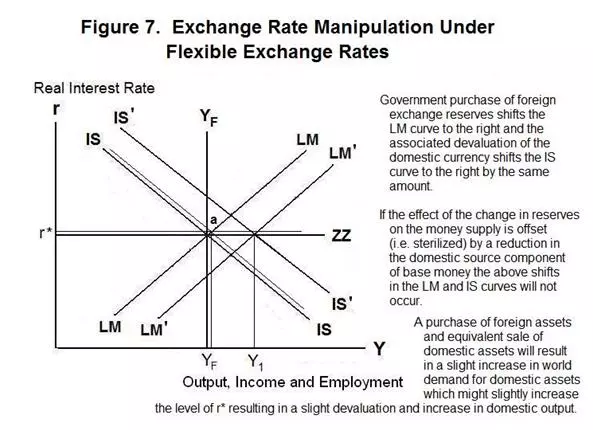

In many instances and conditions all over the world, it was noticed that the rate of exchange in the global economy could signify how the particular country is utilizing the monetary policy. And it could be thought in a reverse manner also, hence it could be claimed that the tool of monetary policies has the potential to impact the rate of exchange. Since the monetary policies could stabilize the economy and could dive it towards the path of development. And it is a well-known known aspect that the development of an economy could directly impact the rate of the exchange rate.

In the figure provided above, the progressive relation between the rates of interest and foreign exchange is depicted which could have been occurred because of the implementation of monetary policy.

A country that displays a very high fluctuation in its inflation level and if the average level is very low, then the value of currency also plunges to a very low point which increases the purchasing power of the population. Since there is a proportional relation among the inflation, rate of exchange and the rate of interest, the fluctuation in any of these factors would bring a respective change in the value of the other two variables. Because of the convenience and contextual rightness, central banks make fluctuations in the interest rate to control the rate of interest and exchange rate of currencies. The increase in the rate of interest would aid in drawing the foreign investment which would indirectly increase the rate of exchange. Though the variation in the rate of interest would not affect these factors if the country holds a higher rate of inflation and unemployment than that of others.

It was being already provided and evaluated in this report that various tools under the category of monetary policies have the potential to control the rate of inflation in the domestic economy. Although the decrease in the rate of inflation is not much appealing and intimidating for investors from overseas or foreign countries. Since the prices would be very less, the local investors would be well ready to invest in the global economy. This condition would lead to the devaluation of the domestic currency since there would be very less demand for the domestic currency. Since both domestic and global investors would be after the foreign currencies, the situation could cause a hike in the value of them in the global market. Thus, the foreign currency would get affected significantly by the implementation of effective financial tools under the monetary policy because of the high gap between the foreign and domestic currency. Hence it could be evidence that the monetary policies have the potential to impact the foreign exchange to a great extent, which has a chain effect on the inflation and unemployment. As mentioned earlier, the increased movement or circulation of money in the market would come into existence because of the low value of the currency which brings to a condition called expansionary monetary policy. If the central bank ends up with a very strict and abiding monetary policy the exchange rate of the company would be very high and create a very opposite situation in the market than that of the previously mentioned context. It could reveal another aspect of the implementation of the monetary policy that could be manipulated by the central banks and other governmental bodies for the desired result. Roughly saying, the tool of monetary policy could be used as a strategic tool to measure inflation and unemployment by the political bodies to increase the value of the national currency via increasing the bank rates. Inflation and unemployment assignments are being prepared by our economics assignment help experts from top universities which let us to provide you a reliable assignment help online service.

Reference List

Jindal, A. (n.d.). What is the single most important cause for inflation in India? Retrieved 1 20, 2015, from www.quora.com: https://www.quora.com/What-is-the-single-most-important-cause-for-inflation-in-India

Pettinger, T. (2011, 11 21). Trade-Off Between Unemployment and Inflation. Retrieved 1 20, 2015, from www.economicshelp.org: https://www.economicshelp.org/blog/571/unemployment/trade-off-between-unemployment-and-inflation/

Unemployment levels rising in India, experts say. (2014). Retrieved 1 20, 2015, from www.timesofindia.indiatimes.com: https://timesofindia.indiatimes.com/business/india-business/Unemployment-levels-rising-in-India-experts-say/articleshow/29403619.cms 4... (). The Tradeoff Between Inflation and Unemployment. Available: https://www.sparknotes.com/economics/macro/measuring2/section3.rhtml. Last accessed 20th Jan 2015.

HANS SENNHOLZ. (1986). Inflation and Unemployment.Available: https://fee.org/freeman/detail/inflation-and-unemployment. Last accessed 20th Jan 2015.

Ramaa Vasudevan. (). Dear Dr. Dollar: Back in first-year economics we learned that there is a tradeoff between unemployment and inflation, so you can't really have both low inflation and low unemployment at the same time..Available: https://dollarsandsense.org/archives/2006/0906drdollar.html. Last accessed 20th Jan 2015.

Rajesh Goyal. (). What is Inflation, Deflation, Stagflation, Hyperinflation.Available: https://www.allbankingsolutions.com/banking-tutor/inflation.htm. Last accessed 20th Jan 2015.

Tejvan Pettinger. (2010). Definition of Unemployment.Available: https://www.economicshelp.org/blog/2247/unemployment/definition-of-unemployment/. Last accessed 20th Jan 2015.

Inflation and Unemployment.Available: https://www.fte.org/teacher-resources/lesson-plans/rslessons/inflation-and-unemployment/. Last accessed 20th Jan 2015.

Definition of 'Inflation'.Available: https://economictimes.indiatimes.com/definition/inflation. Last accessed 20th Jan 2015.

Inflation India – current Indian inflation.Available: https://www.inflation.eu/inflation-rates/india/inflation-india.aspx. Last accessed 20th Jan 2015.

Aparna Ramalingam. (2015). For customers, benefits of repo rate cut will take time.Available: https://timesofindia.indiatimes.com/business/india-business/For-customers-benefits-of-repo-rate-cut-will-take-time/articleshow/45960315.cms. Last accessed 20th Jan 2015.

Shankar Acharya. (2013). India's growth - trends and imbalances.Available: https://www.business-standard.com/article/opinion/shankar-acharya-india-39s-growth-trends-and-imbalances-113011000137_1.html. Last accessed 20th Jan 2015.

Ashima Goyal and Ayan Kumar Pujari. (2004). IDENTIFYING LONG RUN SUPPLY CURVE IN INDIA.Available: https://www.isid.ac.in/~planning/agakp.pdf. Last accessed 20th Jan 2015.

How does monetary policy influence inflation and employment?.Available: https://www.federalreserve.gov/faqs/money_12856.htm. Last accessed 20th Jan 2015.

The Effects of Monetary Policy on the Economy.Available: https://www.banxico.org.mx/politica-monetaria-e-inflacion/material-de-referencia/intermedio/politica-monetaria/%7B601CE3EA-2E44-F5EA-81B7-80E03FEBDF78%7D.pdf. Last accessed 20th Jan 2015.

Jonathan Kearns and Phil Manners. (). The Impact of Monetary Policy on the Exchange Rate: A Study Using Intraday Data.Available: https://www.ijcb.org/journal/ijcb06q4a6.pdf. Last accessed 20th Jan 2015.

David Steele and John Lepper . (1998). Monetary Policy and Employment The Alliance takes on the Reserve Bank and its effect on jobs .Available: https://www.jobsletter.org.nz/jbl08410.htm. Last accessed 20th Jan 2015.

How does monetary policy affect the U.S. economy?.Available: https://www.frbsf.org/us-monetary-policy-introduction/real-interest-rates-economy/. Last accessed 20th Jan 2015.

HOW DOES MONETARY POLICY AFFECT THE ECONOMY? inflation and unemployment Available: https://www.bcl.lu/en/bcl/missions/MoPo/How/. Last accessed 20th Jan 2015.

Get Top Quality Assignment Help and Score high grades. Download the Total Assignment help App from Google play store or Subscribe to totalassignmenthelp and receive the latest updates from the Academic fraternity in real time.