Macroeconomics Assignment: Evaluation of UK Economy

Question

Task:

The macroeconomics assignment is divided into two parts:

Part 1: Consider an economy where the level of production (Y) is not at the natural level (Yn), that is, an economy in which Y?Yn. Using the AS/AD model, explain what will happen next and suggest a monetary and/or a fiscal policy to adjust output and analyse the effect of this policy on price level and employment.

Part 2: Find, collect, present and analyse data from the United Kingdom or France or Italy or the Netherlands or Germany or Belgium or Spain that as perfectly as possible illustrate your Part 1’s answer by identifying and describing two occasions (each covering about 2 to 5 years) anytime since 1950 in which such adjustment process took place.

Answer

Macroeconomics Assignment Part 1: Impact on AD AS model -

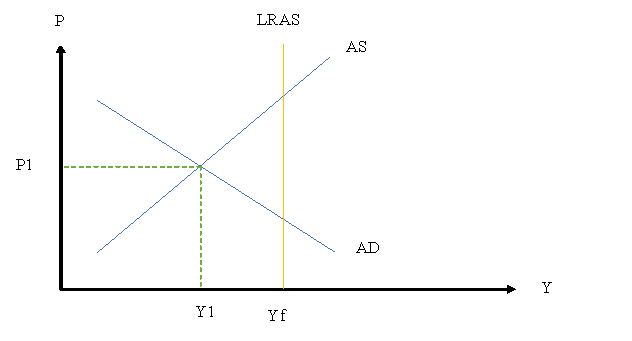

As per the given information, output is lower than natural level of output; this means the economy is in recession. As per AD-AS model, short run equilibrium takes place where the Short Run AggregateSupply curve intersect with the Aggregate demand curve (Bekaert et al. 2020). However, as per the figure 1, it can be seen that market is operating at such a place, where the output is Y1 and the price is P1. Thus, the output is lower than full employment situation and it is resulting recession as the output gap is negative.

Figure 1: AD-AS model with employment situation

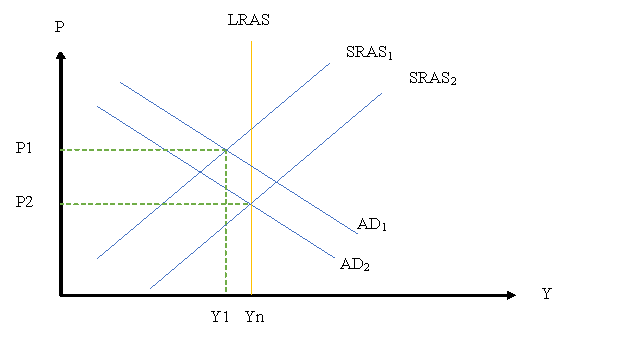

Now to overcome the situation, government can take expansionary fiscal policy or monetary policy or both. In case of fiscal policy government will be able to enhance the public funding and infrastructure development that will lead to job creation. With higher job creation, there will higher flow of money towards population leading to higher demand. With the higher demand Aggregate demand will shift to AD2 as per figure 2.

Figure 2: Shift in AD-AS model

As the figure also demonstrates, with the shift in the aggregate demand, there will be rise in supply as the price will increase eventually leading to rise in the inflation and this will lead to fluctuation in the interest rate as well. With the upward pressure, interest rate will rise leading to potential rise in savings. This will bring the economy to a new equilibrium where the economy can reach full employment in long run. However, this process can be slow and take long time to demonstrate impact on the economy. Thus, monetary policy can also be taken; however, this would limit the rise in the employment to full employment situation. With implementation of the monetary policy, disposable income will rise through the rise in the money supply and fall in the interest rate. With falling interest rate, more people will prefer to hold cash rather than savings (Bekaert et al. 2020).

This way, investment will increase through the private entity leading to rise in the job creation. However, in long term this may cause further liquidity trap that can result in fall in business and employment. Thus, considering the fiscal policy would be ideal as it will increase the employment to full employment situation and resultant output will be higher.

Part 2: Empirical presentation –

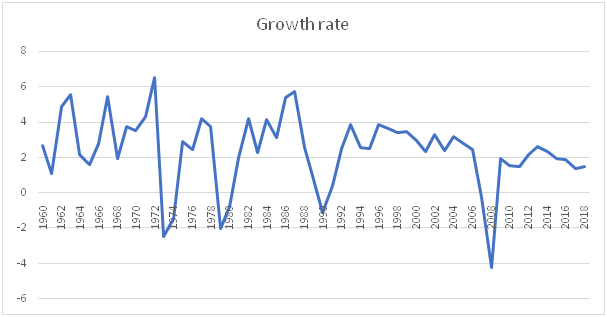

Various economies over the time have taken various strategies in order to overcome the fall in the economic performance. There are various measures to define when the economy has faced recession; however, among many Gross Domestic Product (GDP) growth rate is the simple and effective one. Here, in order to explain the situation demonstrated in figure 1, case of UK GDP growth rate has been considered. Here, UK has faced various recession situation over the last six decades starting from 1960s (Crafts 2021). during 1972 and 1978, there has been great recession in UK economy and next came back in 1990s. Post this UK economy was impacted by the recession during 2008 at the time of Great depression. Among all these depressions, 1972 and 2008 has been considered for analysis in the present study to demonstrate the phenomenon explained in part 1.

Figure 3: Growth rate of UK

Source: (data.worldbank.org 2021)

As per the figure 3, it can be seen that during 1972 there has been much amount of fall in the GDP growth rate due to the fall in the output and market demand through recessionary situation. Same situation can be observed during the time of 2008, where Global Financial Crisis (GFC) hit the international economies and most exclusively US and UK. During both the time, economy faced financial issue that led to popping up of financial bubble resulting in massive fall in the financial institutions around the state (Glockeret al. 2019). This has resulted in fall in unemployment that has led in fall in market demand. Moreover, with the fall in the market situation, investment scenario has also reduced and the output deviated from the full employment situation. As the economy has been facing recession, thus output was lower than the full employment situation.

In order to overcome the situation, government in both the situation took help of the expansionary fiscal policy. Although, it is important to highlight that, during the 1972, government initial took contractionary fiscal policy with tighter tax regime and policy implementation to boosting corporatisation of the public sectors. This move of the Miss Thatcher, who was the then prime minster of the UK was opposed by several economists, however, government took six years to realise their dumbness in policy implementation. During 1978, finally expansionary fiscal policy was taken and economy moved toward a long-term output growth through growth in demand scenario as well as equilibrium in labour and capital market.

Same scenario can be observed in case of the GFC, however, during this time, government was prompt to consider expansionary fiscal policy (Bhattarai and Trzeciakiewicz 2017). This enhanced the public investment by the government and reestablishment of the banking service through sovereign bonds. Moreover, through the expansionary fiscal policy government has been able to enhance the market demand by creating jobs. On the other hand, with the rise in disposable income, demand increased and the government also focused on money market through reducing the interest rate that increased the investment potential of the population of UK. Thus, empirically it can be seen that government of UK took expansionary fiscal policy that helped it to overcome the recessionary situation.

Reference:

Bekaert, G., Engstrom, E. and Ermolov, A., 2020. Aggregate demand and aggregate supply effects of Covid-19: a real-time analysis. Available at SSRN 3611399.

Bhattarai, K. and Trzeciakiewicz, D., 2017. Macroeconomic impacts of fiscal policy shocks in the UK: A DSGE analysis. Economic Modelling, 61, pp.321-338.

Crafts. N., 2021. Returning to growth in the UK: Policy lessons from history | VOX, CEPR Policy

Portal. Macroeconomics assignment Available at: https://voxeu.org/article/returning-growth-uk-policy-lessons-history

data.worldbank.org2021. GDP growth (annual %) | Data. Available at: https://data.worldbank.org/indicator/NY.GDP.MKTP.KD.ZG

Glocker, C., Sestieri, G. and Towbin, P., 2019. Time-varying government spending multipliers in the UK. Journal of Macroeconomics, 60, pp.180-197.