Research Essay Analysing Macroeconomic Conditions In Australia

Question

Task:

a) Briefly describe and contrast four market structures. (Hints: Use features of each market structure such as number of sellers, type of product, entry conditions, profits and losses in the short and long run, advertising, research and development and appropriate diagrams to answer this question. While your textbook is your first point of reference, you should consult other references in order to receive full marks. Use real life examples to support your discussion).

b) Choose an industry from your home country representing monopoly. Explain why it is a monopoly based on the characteristics of market structures outlined in part a). Analyse price and output decisions made by this monopoly using economic theory and illustrate it on a diagram. (Hint: this is your case study that you need to describe in details, provide relevant information, use table, diagrams where appropriate. You should use real data as much as possible).

c) Using your case study, evaluate the efficiency of your chosen monopoly. Explain it using economic theory and illustrate it on a diagram. (Hint: compare the allocation of resources and market outcomes between your chosen industry and perfectly competitive market structure using theory and real data from your case study).

d) Provide the case for or against the monopoly in your case study. Would you suggest to break up this monopoly into oligopoly? Explain using economic theory and diagrams. (Hint: use real life data from your case study. For example, if the monopoly has been investing in research and development, provide evidence with supporting references).

Answer

Introduction

This research essay has been structured based on the analysis of the macroeconomic conditions prevailing in a nation. The financial markets of a country are broadly classified into four structures, each having its distinct characteristics. These markets each have their types of customers and their own pricing policies. They also separately affect the economy of a country. Such market types have been discussed in detail in this report, along with the characteristics that define them. A monopolistic industry in Australia has also been referenced to elucidate this classification. The efficiency of the said industry has also been analysed based on market findings. Thereafter, the legibility of such industry on the ground of monopolistic market, in general, has been judged providing valid justifications. All the information provided in this report has been produced after making extensive research on the market structures in Australia and their characteristics.

-

Define four market structures in this research essay and compare them.

A market is a place or a community where buyers and sellers of various goods or communities meet and exchange them for a monetary value. Simply put, a market is a place that brings together two parties so that they can facilitate trade (Cox, 2016). The economy of a country is characterised by the presence of various kinds of market structures. Such market structures not only have their own unique characteristics, but they can also define the nature, extent and state of the economy of the country. Therefore, the government of any country is required to pay special attention to preserving the exclusive features of each market structure. Even though the market structures that can exist in a country are several, economists generally assume their existence based on four ordained classifications: - Perfect competition – This market structure exists when a large number of corporations or firms compete against one another. In this form of market, there is an absence of special freedoms in favour of a particular firm or corporation. None of the firms engaged in this form of the market can individually influence the general price level. Therefore, the industry functions unanimously with a socially optimum level of output. A perfectly competitive is built on the following assumptions: The entry and exit of the firms are unrestricted (which means any firm can enter into or exit the market), all the firms sell differentiated products (that is, no two products are similar) and the customers possess complete knowledge about the market (Becker, 2015). For instance, the stock market is perfectly competitive. There exists a large number of buyers and sellers selling differentiated products, and the customers have adequate knowledge about the products. Entry and exit of the firms are also unregulated

- Monopolistic competition – This refers to the market structure where numerous firms are in direct competition with each other. However, they vary from the perfect competition on the ground that unlike the latter, the seller in monopolistically competitive market sells homogenous, yet somewhat differentiated products (Mahoney & Weyl, 2017). This gives some firms a certain level of privileges over the others. A monopolistically competitive market is built on the following assumptions: The entry and exit of the customers in the market is not restricted, the firms sell slightly differentiate goods and the customers may have their own preferences. Companies engaged in the video-game or beverage industry are good examples of monopolistically competitive markets. Even though there exist slight variations between their products, they are almost homogenous

- Oligopoly – Within this structure of current research essay, the market is dominated by a few firms that result in a limited competition between them. Therefore, the firms can either chose to compete against each other or collaborate for profit maximisation. These markets have the following characteristic features: Oligopolies have the power to influence market prices, the entry and exit into the market are restricted, the firms can sell either homogenous or heterogeneous products and the customers do not possess perfect knowledge of the market (Head & Spencer, 2017). The industry for smartphone manufacturing is a good example of an oligopolistic market. There exist only a few big firms in any given country, that have the power to influence the price level of the entire industry

- Monopoly – This refers to the market structure that is entirely controlled by a single firm or corporation. In these markets, the firms have the absolute power and only they can influence the price level in the entire industry. There is an absence of substitutes for the customers and therefore, the firms enjoy the maximum market power. Such markets have the following characteristics: There exist high restrictions for entry and exit, the customers do not possess any knowledge about the condition of the market, and the monopolist is free to set his own prices. The WSA (Water Supply Authority) of Australia is an example of a monopolist. This authority exercises supreme control over the distribution of water all over the country. Since this is controlled by the government, entry and exit of new firms is also prohibited

-

Monopolistic industry in the home country

Australia enjoys a fair share of all the major types of market structures in the economy. Despite this, most of the indigenous companies in Australia operate as oligopolist, which means that the number of sellers ranges from three to five, and they have the power to influence the price levels. It has been stated by various researchers that three or four major companies dominate some industries in the country (Kollmorgen, 2019). It is mentioned in this research essay that some industries such as the commercial banking industry, the supermarket and the beverage industry are dominated solely by a few firms practising oligopoly. However, certain areas in the market are dominated by monopolists. One such example is the Australian postal service industry. The postal service industry in the country is dominated by Australia Post, a government-owned company that specialises in providing postal services throughout the country. The company has as many as 33,000 employees and generate revenue of $6.8 billion annually (austpost.com.au, 2019). - Presence of buyers and sellers – Even though there are a large number of customers in the postage industry in Australia, the number of service providers are only a handful. Besides, despite the presence of a few other service providers, the industry is dominated by Australia Post as it accounts for more than 94% of the postal services in the country

- Determination of prices – The prices in the industry are heavily influenced by the marketing decisions of Australia Post. The company charges about $3 to send letters weighing less than 250g, a trend that is followed by the other postage companies in the country (Khazabi, 2017)

- Entry and exit in the market – The entry of firms in the postal service industry in Australia is governed by various statutory norms which is why it is partly restricted. Australia Post is a government-owned company, therefore enjoys monopoly regarding the entry and exit of other firms in the industry

- Service provision – In addition to influencing the monopolistic price level in the industry, Australia Post also enjoys complete control over its competitors while providing postage services. Therefore, the company has both price and output-related supremacy in the industry

- The efficiency of the chosen monopoly

Australia Post has been practising monopoly trade in the postage industry in Australia for several decades. However, The ANAO (Australian National Audit Office) states that the company has not been able to develop and modernise as rapidly as its foreign counterparts (anao.gov.au, 2019). According to the authority, the efficiency plans of the company have been focused on procedure optimisation, workforce flexibility and process automation. However, the company has been unable to implement most of these changes due to its slow, bureaucratic style of management. Despite the lack of stringent competition in the market, the company has been unable to consolidate its position in the market (despite its mammoth market share in the postage industry). This is one of the major shortfalls of almost all prominent monopolies around the world – despite supreme authority over a particular sector in a country, it is usually not modernised in the long-run. The supernormal profits enjoyed by these firms are not efficiently used for their organisational improvement.

- Arguments against the monopoly industry

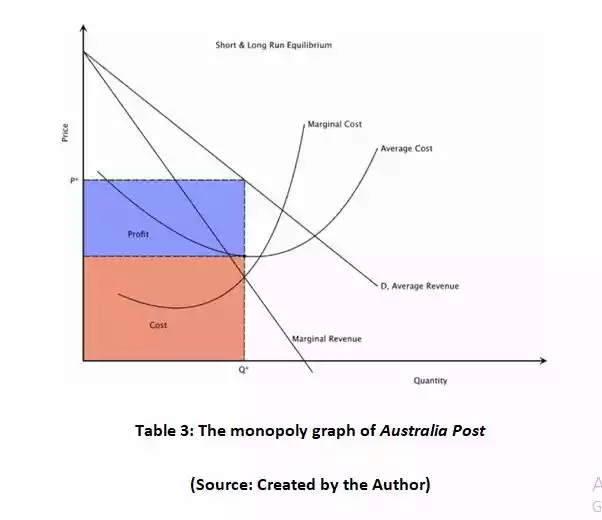

In the above question, it was discussed that the postal service industry is underperforming because of the monopoly nature assumed by the government-owned Australia Post. It has been seen that since at the profit-maximisation level of the companies, they are unable to produce as much as they are charging from their customers. This results in an allocative inefficiency (that is, P > MC), which disrupts the balance of the economy. Further, this research essay defines several other disadvantages of monopolistic nature of the postal service industry in Australia. They have been listed below: - Productive inefficiency – Since the monopolistic companies are not able to attain the lowest points of the AC curve (as shown in Table 3 above), they are unable to attain efficiency in their production

- X – inefficiency – Since the monopolies do not face stringent competition in the market, they are usually less inclined to cut costs. As a result, their AC curve is higher than usual (Leibenstein, 2017)

- Supernormal profit – The extraordinary amount of profit earned by the monopolies as a result of the excess of AR over AC leads to the uneven circulation of income

- Diseconomies of scale – The average costs of the Australian Post are certain to get higher if it operates monopolistically for a very long time (Investopedia.com, 2019)

The differences between the four market types have been presented in the table below:

|

Basis |

Perfect competition |

Monopolistic competition |

Oligopoly |

Monopoly |

|

Presence of sellers |

A large number of sellers |

A large number of sellers |

Few sellers |

One seller |

|

Entry and exit |

Free entry and exit in the market |

Free entry and exit in the market |

Entry and exit restricted |

Entry and exit highly restricted |

|

Knowledge of the customers |

The customers have perfect knowledge about the market |

The customers have perfect knowledge about the market |

The customers have limited knowledge about the market |

The customers do not have any knowledge about the market |

|

Setting of prices |

No single firm can influence prices |

The firms can influence prices to a certain level |

The firms can freely influence the prices |

The single firm always influences the prices |

|

Advertising |

Such companies need to undertake advertising and promotional activities |

Firms in this market structure also need to undertake advertising activities |

Firms engaged in oligopoly do not need to advertise. However, they may do so in certain cases |

Monopolistic firms seldom advertise. The relevant customers already know about such firms |

|

Market research |

Firms in this type of market need to conduct market research to analyse marketing trends |

Firms in the monopolistic competition also need to conduct market analysis to determine market forces |

Oligopolistic firms do not necessarily have to conduct market research |

Monopolistic firms do not conduct market research, They enjoy the autonomy in the market |

|

Examples |

The stock market |

The market for cereals, chocolates, aerated beverages and others |

The market for gaming consoles that is dominated by 3 or 4 firms |

The defence and aviation industry in countries are dominated by a single firm |

Table 2: Difference between the four market structures

(Source: Created by the Author)

According to the ACCC (Australian Competition and Consumer Commission), the company has a monopoly on the postal services in Australia. It has been ascertained by ACCC that Australia Post accounts for more than 94% of the postal services in Australia (accc.gov.au, 2017). It has also been held by the authority that it does not have any objections about the company increased its prices over a period of time. This is an important feature of a monopoly, whereby the prices are influenced solely by a single powerful corporation, without the interference of an external entity. In order to determine whether Australia Post exercises monopoly in Australia, it is imperious to check if it reconciles with the characteristics of a monopoly:

The following characteristics of Australia Post, when aligned with the characteristics of a typical monopolistic corporation reveals that the company indeed enjoys monopolistic privileges in the postal service industry. The monopoly graph of Australia Post presented in the diagram below shows the relation between the price charged by the firm and the quantity of output (that is, the provision of services) provided by them. In the case of this firm, like in the case of every other monopolistic company, profit maximisation occurs when MR = MC (that is, the marginal cost is equal to the marginal revenue). Monopolistic companies like Australia Post is able to make supernormal profits because the AR (Average Revenue) is much higher than the AC (Average Cost). Even though supernormal profits are certain to attract newer competitors in the market, the presence of several trade restrictions impose barriers to the entry of new firms (Kirzner, 2015).

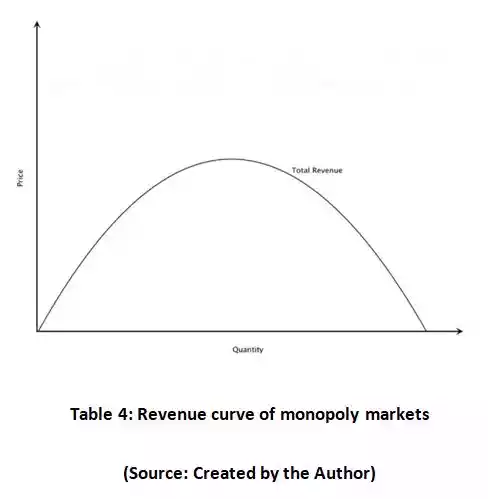

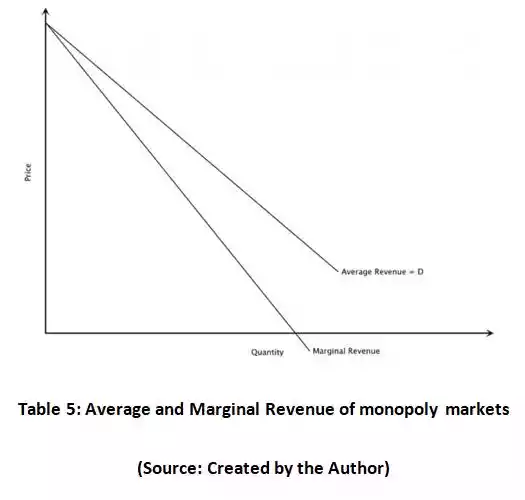

The excess profit earned by the monopolistic firms when they charge excess prices from the customers is known as ‘supernormal profit’. The supernormal profit has been depicted in the above diagram as AR-AC multiplied by the number of items produced by the company. In the case of Australia Post, the supernormal profit is equal to the excess of Average Revenue over Average Cost, multiplied by the amount it charges from its customers for each letter delivered by it. This also results in an unequal distribution of income in the economy which goes unchecked in the favour of the firms engaged in monopolistic practices (Allen, 2015). The Total Revenue and AR, MR (Average Revenue and Marginal Revenue) curves of a monopoly market has been shown below. It is to be noted here in this research essay that since a monopolist can determine the level of production and the price, the demand curve is negatively sloped. However, because of the same reason, the MR curve is twice as sloped as the AR curve.

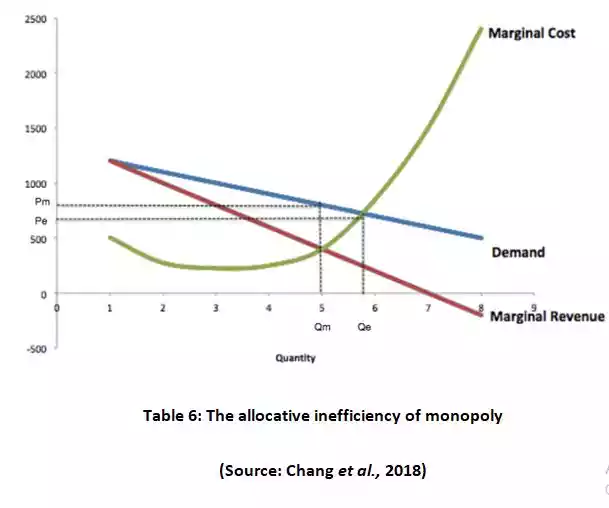

Most of the criticisers argue that monopolies charge excessive prices. This is the same in respect of Australia Post. However, the company like every other monopolistic company around the world is unable to provide enough output in order to be allocatively effectual. To understand the inefficiency of Australia Post, it is important to compare it with the standards of perfect competition. The concept of ‘allocative efficiency’ states about the efficiency of firms at the societal level. It refers to the level of output, where the societal marginal benefit is equal to the marginal cost (Chen & Irarrazabal, 2015). This is also known as the optimal quantity. Therefore, in the case of a perfectly competitive market, each firm looks to produce an output where its price is equal to its marginal cost, or, P = MC. The price reflects the demand of the customers in the market, while the marginal cost reflects the societal benefit. For output to be optimal, these two variables must be equal. Thus, when P = MC, allocative efficiency is achieved (Cothren & Radhakrishnan, 2018).

However, in a monopoly, since the firms charge excess profits to remain in a supernormal profit position, the price of the goods or services is always higher than the marginal cost. As seen in the case of Australia Post, P > MC. Which means that at the level of profit maximisation the demand of the customers is always higher than the benefit the company can provide to society. This can be understood by the help of the graph provided in this research essay, shown below:

However, in a monopoly, since the firms charge excess profits to remain in a supernormal profit position, the price of the goods or services is always higher than the marginal cost. As seen in the case of Australia Post, P > MC. Which means that at the level of profit maximisation the demand of the customers is always higher than the benefit the company can provide to society. This can be understood by the help of the graph provided in this research essay, shown below:

From the graph shown above, it can be understood that for a firm to attain allocative efficiency, the production at the point ‘Qe’ should lie where the price is equal to the marginal cost, or P = MC. A monopoly, on the other hand, owing to the concept of allocative inefficiency, will look to maximise its profits at ‘Qm’ and ‘Pm’, thereby selling lower quantities at a higher price. The same can be attested in the case of Australia Post, whereby its P > MC at the point ‘Qe’, thereby leading to a deficiency of service provision, while at the same time, charging prices that result in a supernormal profit. Hence, the customer in a monopoly market will certainly suffer from the lack of optimal production as compared to the perfect competition (Richard & Ravi, 2017). The problem of allocative efficiency is imminent in cases of all monopolistic economies across the globe.

The same problem persists in the case of Australia Post, as it is unable to provide relevant services to its customers even though the prices charged by it are high. Since the company also has the ability to impact the price level in the industry, it can continue its practices unchallenged. Additionally, the fact that the company is owned by the government, gives it various statutory relaxations to continue its monopoly run in the market. The problem of allocative inefficiency discussed in this research essay is the primary reason why despite being the go-to company for postage services in Australia, it is lacking behind its international competitors that do not enjoy monopolistic powers in their market (Decker et al., 2017).

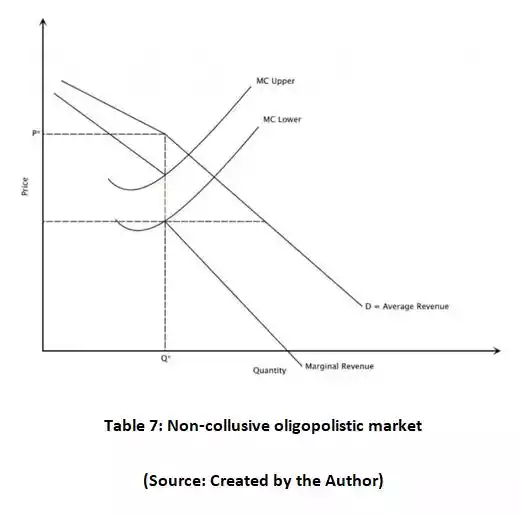

These are the drawbacks faced by the postage industry in Australia. In order to mitigate these, it is recommended that the industry turns itself into an oligopoly. With the presence of not one, but a few competitive firms, the customers and the industry as a whole will benefit. However, the oligopoly must be non-collusive in nature, thereby giving the other postage companies a chance to compete with Australia Post and occupy market share. All the postal companies in such an oligopolistic setting will produce the same output irrespective of the marginal cost (Gilbert, Riis & Riis, 2018). They will also be unable to independently affect the price level, thereby putting a check on the supernormal profit. The societal benefits can also then be considered by the firms wherein they charge reasonable prices from their customers (owing to competition), which in turn will balance the allocative inefficiency. For instance, in the non-collusive oligopolistic postal industry in Australia, other firms may not increase the price of services if one firm does. However, if one firm decides to cut down the prices of the services, the other firms are bound to follow to survive the competition (Bonatti, Cisternas & Toikka, 2017). This will serve the interests of the consumers in the industry which will grow. This aspect has been shown within this research essay in the graph below, where the AR curve is extra price-elastic.

Using the profit expansion concept – Marginal Cost = Marginal Revenue, any place on the perpendicular MC curve will show results. The cost and amount don't change paying little respect to the cost. The price stays at P* and yield Q*, even at the Upper or Lower MC.

Conclusion

It is concluded after analysing the above content in this research essay that the four basic structures of the market possess different characteristics. They differ from each other based on the number of sellers in the market, the knowledge of the customers, the influence of price level and various other factors. These aspects have all been discussed in the report. It has also been assessed as per the characteristics of monopolistic markets that the company ‘Australia Post’ exercises monopolistic dominance over the postal service industry in the country. In this context, the features of a monopoly have been discussed along with its drawbacks. Accordingly, it has been established in the report that monopolies face the problem of allocative inefficiency, which results in the disproportionate allocation of income. It has been suggested that this market be turned to a non-collusive oligopoly, which will help mitigate the ill-effects of a monopoly.

Research essay are being prepared by our economics assignment help experts from top universities which let us to provide you a reliable assignment help online service.

Reference List

ACCC delivers final decision on Australia Post's business mail prices. (2017). Australian Competition and Consumer Commission. Retrieved 30 August 2019, from https://www.accc.gov.au/media-release/accc-delivers-final-decision-on-australia-posts-business-mail-prices

Allen, D. (2015). The sharing economy. Institute of Public Affairs Review: A Quarterly Review of Politics and Public Affairs, The, 67(3), 24. https://search.informit.com.au/documentSummary;dn=546266948792380;res=IELAPA

Australia Post's Efficiency of Delivering Reserved Letter Services | Australian National Audit Office. (2019). Research essay Anao.gov.au. Retrieved 30 August 2019, from https://www.anao.gov.au/work/performance-audit/australia-posts-efficiency-delivering-reserved-letter-services

Becker, G. (2015). Perfect Competition. Wiley Encyclopedia of Management, 1-1. https://onlinelibrary.wiley.com/doi/abs/10.1002/9781118785317.weom080041

Bonatti, A., Cisternas, G., & Toikka, J. (2017). Dynamic oligopoly with incomplete information. The Review of Economic Studies, 84(2), 503-546. https://academic.oup.com/restud/article-abstract/84/2/503/2420613

Chang, H., Kao, Y. C., Mashruwala, R., & Sorensen, S. M. (2018). Technical Inefficiency, Allocative Inefficiency, and Audit Pricing. Journal of Accounting, Auditing & Finance, 33(4), 580-600. https://journals.sagepub.com/doi/abs/10.1177/0148558X17696760

Chen, K., & Irarrazabal, A. (2015). The role of allocative efficiency in a decade of recovery. Review of Economic Dynamics, 18(3), 523-550. https://www.sciencedirect.com/science/article/pii/S109420251400057X

Cothren, R., & Radhakrishnan, R. (2018). Productivity growth and welfare in a model of allocative inefficiency. Research essay Journal of Economics, 123(3), 277-298. https://link.springer.com/article/10.1007/s00712-017-0575-z

Could this be the end for Australia Post? . (2019). Queensland Times. Retrieved 30 August 2019, from https://www.qt.com.au/news/could-be-end-australia-post/3225585/ Cox, H. (2016). The market as God. Harvard University Press.

Decker, R. A., Haltiwanger, J., Jarmin, R. S., & Miranda, J. (2017). Declining dynamism, allocative efficiency, and the productivity slowdown. American Economic Review, 107(5), 322-26. https://www.aeaweb.org/articles?id=10.1257/aer.p20171020

Gilbert, R., Riis, C., & Riis, E. S. (2018). Stepwise innovation by an oligopoly. International Journal of Industrial Organization, 61, 413-438. https://www.sciencedirect.com/science/article/pii/S0167718718300997

Head, K., & Spencer, B. J. (2017). Oligopoly in international trade: Rise, fall and resurgence. Canadian Journal of Economics/Revue canadienne d'économique, 50(5), 1414-1444. https://onlinelibrary.wiley.com/doi/abs/10.1111/caje.12303

Khazabi, M. (2017). Postal service markets: an international comparison analysis. Journal of Public Affairs, 17(3), e1599. https://onlinelibrary.wiley.com/doi/abs/10.1002/pa.1599

Kirzner, I. M. (2015). Competition and entrepreneurship. University of Chicago press. https://books.google.com/books?hl=en&lr=&id=jLc3CgAAQBAJ&oi=fnd&pg=PR5&dq=monopoly+competition&ots=zI7xVwJlIZ&sig=47iEh_sWYmY3Cqz9e6XFmA082Rc

Kollmorgen, A. (2019). Market monopolies in Australia - CHOICE. CHOICE. Retrieved 30 August 2019, from https://www.choice.com.au/shopping/everyday-shopping/supermarkets/articles/market-concentration

Leibenstein, H. (2017). X-efficiency. The New Palgrave Dictionary of Economics, 1-4. https://link.springer.com/content/pdf/10.1057/978-1-349-95121-5_1888-2.pdf

Mahoney, N., & Weyl, E. G. (2017). Imperfect competition in selection markets. Review of Economics and Statistics, 99(4), 637-651. https://www.mitpressjournals.org/doi/abs/10.1162/REST_a_00661

Personal, Business, Enterprise & Government solutions. (2019). Auspost.com.au. Retrieved 30 August 2019, from https://auspost.com.au/

Richard, C., & Ravi, R. (2017). Trade and growth in a model of allocative inefficiency. The BE Journal of Macroeconomics, 17(2). https://econpapers.repec.org/article/bpjbejmac/v_3a17_3ay_3a2017_3ai_3a2_3ap_3a12_3an_3a2.htm

Understanding Diseconomies of Scale. (2019). Research essay Investopedia. Retrieved 30 August 2019, from https://www.investopedia.com/terms/d/diseconomiesofscale.asp