Google alphabet case study: A Critical Analysis

Question

Task: The case is written from the perspectives of Larry Page, CEO of Alphabet and Sundar Pichai, CEO of Google. The case focuses on opportunities and challenges faced by Alphabet’s largest business unit, Google. The case discusses Google’s history, its business model, and its role in Alphabet as it diversifies into other businesses. As Alphabet continues to implement an M-form structure to administer unrelated diversification, the adjacent business units will have a significant impact on Google. It needs to continue to innovate, even as it tries to retain the top talent that can create and commercialize new products. The road ahead comes with challenges in its core business in advertising, as well as the new corporate structure and accompanying moonshots of Alphabet.

The EMA tasks

There are three tasks that you must perform to complete this EMA.

Based on the Industry Analysis:

Task 1: Is the industry Google Alphabet in, an attractive industry? What does it take to remain competitive in this industry?

Based on the Management preferences and resources and capabilities:

Task 2 :Identify and critically evaluate Google Alphabet’s resources and capabilities using relevant BB835 frameworks and concepts.

In your answer you should use your evaluation of resources and capabilities to assess how Google Alphabet achieves competitive advantage in its industry.

Based on the Strategic Implementation: Focus on Recommendations and how to execute them:

Task 3:Following on from the managerial implications sections in Units 5, 6 and 7, what type of diversification strategy is Alphabet pursuing? What organizational structure is Alphabet using? What is the rationale behind this structure and diversification strategy?

Answer

Introduction

In this report, a detailed analysis based on the Google alphabet case study has been carried out. The need for organizations to comprehend their strengths and weaknesses in order to survive and gain success in the competitive industry is significant to consider. Likewise, the industry analysis of Google Alphabet for its competitiveness has been depicted in this report. Besides, Google Alphabet’s resources and capabilities to gain long term profit and success through its diversification strategy and organizational structure have been identified basis the given Google alphabet case studyas well for in-depth understanding.

Task 1: Based on the Industry Analysis

i. The attractiveness of the Google Alphabet Industry

Alphabet’s Google is one of the American multinational technology companies, operating under the leadership of SundarPichai, CEO. The subsidiary is operating under several industries including the internet, artificial intelligence, cloud computing, computer hardware, and software. However, based on the Google alphabet case study, it has been analyzed that online advertising and technology is its major industry attractiveness, accounting for 90% revenue in the business year 2016. In order to analyze the attractiveness of the Alphabet’s Google industry, the use of Porter's five forces model has been considered.

As stated by (Bischoff, 2016, p. 80) within this Google alphabet case study analysis, Porter's five forces model is a significant approach to identify and analyse the competitive forces around a particular industry that in turn assist to comprehend the weaknesses and strengths of the industry. Following are the five forces that have assisted Google Alphabet industry to stay ahead of the competition as well as to gain huge profits in long-term,

What is the bargaining power of suppliers in regards to the scenario of Google alphabet case study?

For Alphabet’s Google, the bargaining power of suppliers is relatively low, (Stucke and Grunes, 2016, p. 98). The driving factor contributing to its revenue and business is its search engine core product, which was accounted to answer over 2 trillion searches in the business year 2016. It also offered around $8.9 billion in mobile-search revenue for Google. Considering the given Google alphabet case study in this context it can be stated that in addition, the need for suppliers to drive its core products is limited as its engineers act as a significant factor to manage its core business. Other than that, Adsense technology opened the entire web to Google advertising which offered the company with financial power as well as brand image.

Bargaining power of customers-

Alphabet’s Google has recognized itself as a reliable firm due to its technological capabilities. The customers have moderate bargaining power over the firm and its main customers are the businesses that offer ads on the Adsense, double click, and AdMob platform for advertising. However, the rise of the advertising competitors including Facebook, AOL, Microsoft, Verizon, and Yahoo has led to an increase in competition as well as the rise in the bargaining power of customers. The rise of social media platforms as discussed in the Google alphabet case study has offered customers several options in this industry, (Sorin-George and Catalin, 2017, p. 71).

Threats of substitute products-

There is a moderate threat of this particular force over the Alphabet’s Google due to the rise of social media platforms for posting ads based on the interests and demographics of third-party businesses. Companies such as Facebook and Facebook ads are a potential threat to the firm for its substitute products, (Yeo, 2016, p. 121). Furthermore, it has been identified through the Google alphabet case study that Microsoft’s Bing search engine and Yahoo Bing Network has also gained 31% of market share due to the advertising platform which acts as a potential threat to the market share of Alphabet’s Google. However, the search engine and Google’s algorithm platform has been a significant factor to drive growth and attain huge market share, ruling the market explicitly.

The threat of new entrants-

The barriers to entry are relatively high for the technology and advertising industry, acting as a potential advantage for Alphabet’s Google. The legal and regulatory structure in the technology industry is complex for new companies to enter. In addition, Google’s search engine also possesses significant challenges in the European market due to privacy issues and unpaid taxes. However, based on the readings of Google alphabet case study it is depicted that its technological infrastructure has complemented its losses in the industry due to its skilled employees. The capital investment for overcoming the challenges including retaining talent, regulations, competitions, and branding is relatively high for new entrants, (Gruber, 2017, p. 328).

Competitive rivalry-

Based on the scenario provided in the Google alphabet case study, competition for Alphabet’s Google is relatively high in this industry. Companies including Facebook, AOL, Microsoft, Verizon, and Yahoo invest heavily in innovation and research as well as offer similar products like Alphabet’s Google. The bar is relatively high in the cloud industry as well due to players like Amazon and IBM in relation to customer service and technology, (Pilkington, 2017, p. 98). This critically impacts the market share of Alphabet’s Google explicitly.

ii. Alphabet Google’s competitiveness in this industry

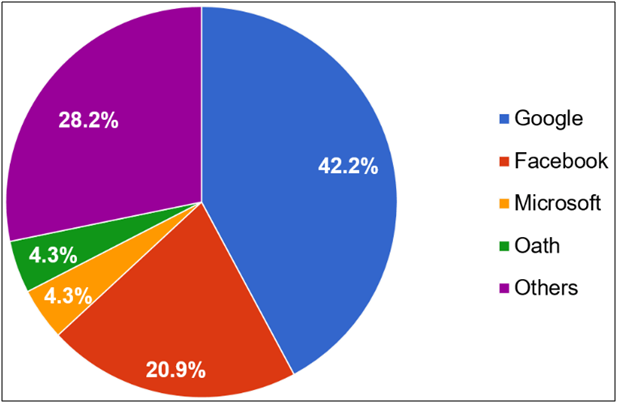

The competitiveness of Alphabet Google’s in this industry is relatively high as it possesses a strong desire to become more successful than its rivals, (Gablet al. 2016, p. 101). In relation to the Google alphabet case study, it has been analyzed that the major competitors of Google are Facebook and Microsoft followed by AOL, Yahoo, and Verizon. The company Facebook strategically grew by 42% of revenue in the business year 2016 and earned around $40 billion in the business year 2017 for its online advertising. Although the market share of AOL and Verizon is relatively low by 6%, these companies still have significant power in the market for its online advertising platform.

Fig: 1 (Competitiveness of Alphabet Google)

Source: (Jurevicius, 2020)

Based on Fig 1 highlighted above within this Google alphabet case study analysis, it has been comprehended that Google has the major net digital revenue in the market of the US compared to its competitors including Facebook and Microsoft. The firm Google has gained around 73.73% market share for its search engine use accounted for in the business year 2018, (Jurevicius, 2020). Hence, it can be stated that the dominance of Alphabet Google’s in this industry is relatively high compared to its competitors. However, the major challenges of Alphabet Google’s discussed in the context of Google alphabet case studyinclude regulation in the European market that has affected its 90% market share as well as its bad content and advertisements affecting the privacy of people.

Furthermore, Waymo subsidiary, retaining top talents and alphabetization has also become the current challenges for the competitiveness of Alphabet’s Google. However, through strategic initiatives and appropriate regulation compliances, the firm can attain growth and long-term profit in the future. Its strategic initiatives and acquisitions of firms such as AdMob and Adsense have offered the company a competitive advantage. In addition to the facts obtained from the Google alphabet case study, there are certain online advertising that requires Google algorithms for laying ads, this potentially acts as a significant competitive force for the firm to successfully retain in this industry along with growth and profits, (Peris-Ortiz et al. 2016, p. 10).

Task 2: Management preferences and resources and capabilitiesi. Analyzing resources

Value chain analysis of Alphabet’s Google-

Primary activities

Financial

The financial analysis of the Alphabet’s Google has been increasing consistently over the past few years. Based on the Google alphabet case study, in the business year 2016, the advertising platform accounted for 90% of revenue. In addition, Alphabet's ‘Other Bets’ has been accounted for in decreasing revenue; however, the company is still funding to offer services to the users. The ad revenues including a mix of good and bad news had grown by $79 billion in the business year 2016 which is an increase of 18% percent compared to the last year. (Grant, 2016, p. 78) highlighted that the net income of Google decreased from 2016 to 2017 due to the higher cost of R&D and marketing costs. In addition, the United States has been its major source of income by revenues specifically for its search engine and online advertising platforms.

Marketing

The firm heavily invests in marketing and R&D for driving product sales and brand recognition. Its marketing and R&D expenses reached around $50,000 million in the business year 2016, followed by $12.9 billion in the year 2017 in marketing expenses, (Mazzei and Noble, 2017, p. 411).

Operations

The firm is headquartered at Mountain View, California. However, the operations of the firm expand over the global world for its building space and research and development facilities including Asia, North America, South America, and Europe.

Inbound logistics

For the manufacturing of finished products and its assemblies, Alphabet’s Google relies on external suppliers. In addition, third-party distributors such as cellular network carriers are its suppliers. However, very little evidence has been identified for its supplier resources.

Outbound logistics

The firm explored in the Google alphabet case study offers online services for keeping its products such as Adsense, search engine, Google Maps, and others running successfully. It relies on data centers to maintain its operations successfully in the market, (Berg, 2016, p. 98).

Support Activities

Human

Based on the Google alphabet case study, it has been identified that the firm has been able to employ top talents from the market through its ‘Googleyness’. however, managing those talents have been critical for the firm; for instance, the cases of Marissa Mayer and Sheryl Sandberg, who left Google for positions at Yahoo and Facebook. In addition, companies such as Uber and Airbnb are poaching Alphabet’s Google employees which is critical for the firm. However, (?irjevskis, 2016, p. 134) specified that Alphabet’s Google has established itself as a significant corporate culture reinforcing employee empowerment and welfare along with offering major perks and fat salaries to retain employees.

Physical or infrastructure

Alphabet has several subsidiaries under its umbrella, where Google is one of the major subsidiaries offering higher revenue and success to compete in the market. The firm has a huge infrastructure at a global platform, (Moore, 2016, p. 234). The business of Alphabet other than Google operates independently based on market and industry standards. The buildings and R&D facilities are innovative and offer an appropriate environment to generate unique products.

Technological

Information technology is one of the core business models of Alphabet’s Google making the firm one of the Big Fours, (Benoit et al. 2017, p. 225). Its core product search engine has offered the firm growth and profits since ages. Innovation and creativity have been its major strategic initiatives to overcome the challenges in the industry. Its advertising segments including Google websites and mobile search engine have significantly offered growth and higher revenues.

ii. Resource Imitability

Alphabet’s Google VRIO analysis and its implications-

Innovation

Technological capabilities and focus towards innovation have been an essential part of the advantage for Alphabet’s Google. Its investment in R&D also reveals its focus on innovative products.

Skilled human resources

The firm examined in the context of Google alphabet case study has top talents for managing the technological resources offering a competitive edge for the brand, (Castrogiovanni et al. 2016, p. 1816). However, talent retention is a significant issue due to the industry poaching approach.

Customer Loyalty and Popularity

Alphabet’s Google has significantly gained popularity and customer loyalty. In the European region, it has more than 90% market share and in the US, it has around 70% market share. However, the substitution of products and the threat of rivalry have been immense within the past few years for Alphabet’s Google.

Cash

The firm has the highest advantage due to its funding and financial capabilities compared to its competitors. Due to higher market concentration, its financial structure is consistently growing.

Commodity

The firm’s advertising and core products have been in huge demand in the market due to its quality of services. In addition, an online advertising platform is a huge commodity for the firm to gain success and competitive edge, (Bijlet al. 2016, p. 153).

|

Resources and capabilities

|

Value |

Rare |

Inimitable |

Organized |

Implication |

|

|

Innovation

|

Yes |

Yes |

Yes |

Yes |

Higher competitiveness |

|

|

Skilled human resources

|

Yes |

Yes |

Yes |

Yes |

Higher competitiveness |

|

|

Customer Loyalty and Popularity

|

Yes |

Yes |

Yes |

Yes |

Moderate advantage |

|

|

Cash

|

Yes |

Yes |

No |

Yes |

Moderate advantage |

|

|

Commodity

|

Yes |

Yes |

No |

Yes |

Moderate advantage |

|

Table 1: (VRIO framework)

Task 3: Strategic Implementation

i. Type of diversification strategy Alphabet is pursuing.

In the business year 2015, August, the firm Google had restructured as a diversified conglomerate under the name ‘Alphabet’ by Sergey Brin and Larry Page. As stated by (Johnson, 2016, p. 97), conglomerate diversification integrates new products or services which are unrelated or not commercial or technological similarities. Although this diversification strategy has been integrated by the cofounders, it has significantly offered a rise in revenues through online advertising, other bets, and its core products. In addition, it has been also comprehended that this strategy can increase the transparency of the firm’s finances, resulting in growth in investment and the success of ‘moonshots’. However, the firm significantly invests in research and development costs along with advertising costs that highlight the probability of success due to this diversification strategy, (Allen et al. 2016, p. 6).

ii. The organizational structure of the Alphabet

The organizational structure of the Alphabet illustrated in the Google alphabet case study is based on both product-based and flatness. In relation to product-based structure, the operations including Capital Stage, Calico, Waymo, DeepMind, Verify, Google X, GV, Sidewalk Labs, Jigsaw, and Nest have offered customers with information technology based on current and future market demand. In addition, Google’s products have also extensive internet access to customers around the global world through its product-based structure. This ability certainly fulfils corporate vision and mission statements of Alphabet explicitly, (Král and Králová, 2016, p. 5172).

On the other hand, the minimal vertical hierarchical lines of authority and communication, irrespective of Alphabet’s product-based structure, has offered the firm with both top-bottom and bottom-top communication lines. The organizational structure based on flatness enabled the firm to engage employees, groups, and teams facilitating creativity and innovation, (Strese et al. 2016, p. 48). Furthermore, the Google alphabet case study also highlights that the dual-class structure has assisted the firm to retain control after the conglomerate diversification strategy raising outside equity capital.

iii. The rationale behind the structure and diversification strategy

The rationale behind the conglomerate diversification strategy is it can assist to mitigate the risks of market share and regulations in the event of the industry downturn for Alphabet. Also, the diversification enabled the firm to segregate its products and services based on the functional units, boosting profitability and brand image in the global market, (Zappa and Robins, 2016, p. 298). The competing companies including Facebook, Microsoft, Yahoo, and others can be defeated strategically through this diversification strategy through its diversified products.

The organizational structure of Alphabet can eventually address the flexibility issues in supporting the human resources, resulting in employee retention. Additionally, the flexibility of each product-based unit can assist to customize the products based on geographical and demographical factors, resulting in competitiveness and long-term profit. Other than that, product-based groups have to be integrated with industry policies and regulations in the firm’s structure in order to gain huge market share and to satisfy various customers through innovation and uniqueness in its products, (Grant, 2016, p. 87). However, it is recommended that the firm must develop policies for its organizational structure to address the issues in the European Union and offer significant services as required. This can ensure long-term success and competitiveness in this particular industry.

Conclusion

Hence from the overall Google alphabet case study analysis, it can be stated that Alphabet’s Google is in an attractive industry, exploiting the potential benefits offered in the technological industry. However, strategic initiatives have to be integrated to remain competitive. The resources and capabilities of the Alphabet’s Google have offered competitive advantages in the industry. In addition, the conglomerate diversification strategy and its organizational structure have the potential to gain long-term competitiveness and profit, irrespective of the contemporary challenges.

References

Allen, D.E., McAleer, M., Powell, R.J. and Singh, A.K., 2016.Down-side risk metrics as portfolio diversification strategies across the global financial crisis. Google alphabet case studyJournal of risk and financial management, 9(2), p.6.

Benoit, S., Baker, T.L., Bolton, R.N., Gruber, T. and Kandampully, J., 2017. A triadic framework for collaborative consumption (CC): Motives, activities and resources & capabilities of actors. Journal of Business Research, 79, pp.219-227.

Berg, J., 2016. Corporate diversification and firm performance: The effect of the global financial crisis on diversification in India.

Bijl, L., Kringhaug, G., Molnár, P. and Sandvik, E., 2016. Google searches and stock returns. International Review of Financial Analysis, 45, pp.150-156.

Bischoff, A.L., 2016. Porters Five Forces. Innovation through Business, Engineering and Design. European Journal of Business and Management, pp.75-85.

Castrogiovanni, G., Ribeiro-Soriano, D., Mas-Tur, A. and Roig-Tierno, N., 2016. Where to acquire knowledge: Adapting knowledge management to financial institutions. Journal of Business Research, 69(5), pp.1812-1816.

?irjevskis, A., 2016. Sustainability in information and communication technologies' industry: Innovative ambidexterity and dynamic capabilities perspectives. Google alphabet case studyJournal of Security & Sustainability Issues, 6(2).

Gabl, S., Wieser, V.E. and Hemetsberger, A., 2016. Public Brand Auditing: A Pathway to Brand Accountability', Consumer Culture Theory (Research in Consumer Behavior, Volume 18).

Grant, R.M., 2016. Contemporary strategy analysis: Text and cases edition. John Wiley & Sons. Gruber, H., 2017. Innovation, skills and investment: A digital industrial policy for Europe. Economia e politicaindustriale, 44(3), pp.327-343.

Johnson, G., 2016. Exploring strategy: text and cases.Pearson Education.

Jurevicius, O., 2020. Alphabet (Google) SWOT Analysis (5 Key Strengths In 2020). [online] SM

Insight. Available at:

Král, P. and Králová, V., 2016. Approaches to changing organizational structure: The effect of drivers and communication. Journal of Business Research, 69(11), pp.5169-5174.

Mazzei, M.J. and Noble, D., 2017. Big data dreams: A framework for corporate strategy. Business Horizons, 60(3), pp.405-414.

Moore, C., 2016. The future of work: What Google shows us about the present and future of online collaboration. TechTrends, 60(3), pp.233-244.

Peris-Ortiz, M., Ferreira, J.J., Farinha, L. and Fernandes, N.O., 2016.Introduction to multiple helix ecosystems for sustainable competitiveness.In Multiple Helix Ecosystems for Sustainable Competitiveness (pp. 1-13).Google alphabet case studySpringer, Cham.

Pilkington, M., 2017. Can blockchain improve healthcare management? Consumer medical electronics and the IoMT. Consumer Medical Electronics and the IoMT (August 24, 2017).

Sorin-George, T. and Catalin, G., 2017. The World’ s Most Innovative Companies in the Period 2015-2016. Ovidius University Annals, Economic Sciences Series, 17(1), pp.69-73.

Strese, S., Meuer, M.W., Flatten, T.C. and Brettel, M., 2016. Organizational antecedents of cross-functional coopetition: The impact of leadership and organizational structure on cross-functional coopetition. Industrial Marketing Management, 53, pp.42-55.

Stucke, M.E. and Grunes, A.P., 2016. Introduction: Big Data and Competition Policy. Big Data and Competition Policy, Oxford University Press (2016).

Yeo, S., 2016.From paper mill to Google data center.

Zappa, P. and Robins, G., 2016. Organizational learning across multi-level networks. Google alphabet case studySocial Networks, 44, pp.295-306.

Tomsho, G 2017, Guide to Operating Systems, 5th edn, Cengage Learning Australia.