Joint Venture Essay: Operational Changes at Telefonica

Question

Task: Identify a company that has undertaken some major changes in its operations (for example, a major restructuring or takeover). Evaluate the nature of these changes and how effectively the organisation has responded or is responding to these changes in the short and long term. Determine what important lessons can be learned from this experience. Students will have to demonstrate in-depth knowledge and practical applications of the business models covered during the course. Please note: This assessment must be in an essay format and approximately 2,500 words in length.

Answer

Introduction

As per the investigation on joint venture essay, the global telecom industry has been witnessing an unprecedented growth owing to the assistance of advanced technologies and consistently improvingalgorithms of networking, connectivity, and digitisations.Telefonica,hailed as one of the leading telecommunication company operating inLatin America and Europe offering extensive digital services including mobile connection and fixed networking that spansfrom business to residential consumers and possesses with its credit approximately 344 million customers. Liberty Global is known to be one of the reputed and admired as a proficientvideo service providerwith converging technologies, broadband, and communications,operating in 6 countries in the EU. The company functions with its affiliates Virgin Media, UPC, and Telenetall of which are consumer-specific brand, with the intention to revolutionise the digital platforms with latest features possible. This is done on behalf of the company through engaging consumer’s relationships, scalable operative mechanisms, and innovative endeavours to ensure next-generation networks in the form of TV, broadband, telephony, and Wi-Fi services. These two companies examined in the joint venture essay specifically cable broadband ISP Virgin Media, a part of the Liberty Global and O2, theMobile operator and a part of Telefonica have consented on a merger recently to establish a superfluous network connection across the UK.

Figure 1: The Joint Venture of Virgin Media and O2

(Source:Munbodh, 2020)

In this thread of discussions on joint venture essay, the following study would tailor an in-depth analysis of this merger evaluatingthe changes that could be potentially taken as beneficial for both the companies and unforeseen changes or inherent challenges that might have or could cross the path in future while executing different operative mechanisms. Moreover, the study developed within this joint venture essaywould also take into account the important lessons that could be learned from the study of this merger and cite suitablerecommendations to help the company to enhance its existing parameters of functioning and objectives.

Discussion

Information about the acquisition

The deal between O2 and Virgin Media that accounted for £12.7 and £18.7 billion respectively, the net amount of which is the total enterprise value that materialised their intension of setting up a combined enterprisedevoid of debts.It has been claimed in the joint venture essay that Virgin Media will add to the joint venture with £11.3 billion of net debt and debt-related issues. The two network companies have reached a consensus of a complementary 50-50 joint venture wherein they would condense their concernedoperative techniques of broadband and mobile network phenomena of business. The combined company of virgin media and O2 seem to retain the essential features of both the brand as they have set an ambitious goal of contributing through an investment of £10 billion into the UK telecom industry in the coming 5 years (gmal, 2020).

Changes that have been facilitated due to the merging

As observed by Lanxon (2020), it is clear in the joint venture essay thatthe combined O2 and Virgin media entity used to adhere to different market trends fixed and mobile, therefore, by integrating the Virgin Media’s most-demanded v6 video services as well asgig-inducedbroadband coupled with the O2’s mobile provisions of 5G, the company will have the optimised potential and efficacy to discharge highest quality network services possible in the market punctuated latesttechnological underpinnings, superior connectivity, and extensive entertainment facilities. Matthew Bloxham, an analyst at the Bloomberg intelligence also predicts that around 2.2 million UK homes can be targeted through this merger that hasn't yet started using Virgin Media to shift their preferences towards virgin’s media.

Moreover, this joint venture would empower the entity to head the B2B market arena as a powerful enterprise, since the coalescence of Virgin Media and O2 will accentuate the digital skills, network features and product configuration such as the IoT, Big data, Cybersecurity, and Cloud services. This, in turn, would ensure enterprisesranging from small size to multinational corporations to ensuresustainable and digitally powered competitions and operations that will ultimatelybenefit the overallBritisheconomy (Armitage 2020).

In addition to this, as stated by Sweney (2020) with regards the joint venture essay, the deal would bring together almost Virgin Media’s 33.6 million mobile customers and O2’s 5.3 million broadband, 3.7 million on pay-tv and 4.9 million of phone users and this smart consolidation would induce substantial and progressive growth in the UK’s telecommunication industry. The combined company having the potential enough to seize the name of the largest telecom brand operating in the UK that will together have 46.5 million customers that will overpower and exceed the BT Group’s 46.3 million customers, Sky’s 22.7 Million consumers and Vodafone’s 20.2 million consumers, Three’s 11.6 million and lastly 9 million holders of TalkTalk. The joint entity would have the capacity to attract a revenue turnover, operating profit, and cash flow narrowly sitting behind the unrivalled position of BT.

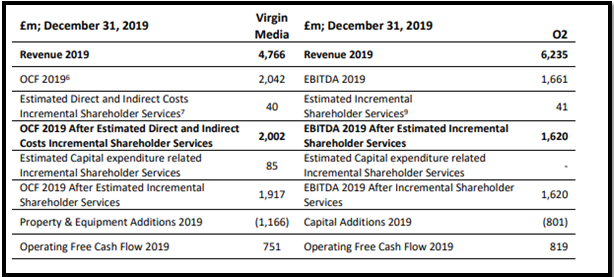

Figure 2:Illustrations of Capital Flow of Virgin Media and O2, dating till December 31st, 2019.

(Source:nationalconnectivitychampion, 2020)

The financial profile of the joint venture would also undergo significant changes wherein all the services related to IT and technology would be mutually carried out along with procurement costs, ancillary support services, and brand management. Furthermore, herein joint venture essay, the yearlyexpenditureof the combined company would be calculated on the basisof the servicesperpetuated by the joint venture. In addition to this, the joint venture would incorporate periodic furtherrecapitalisationheadedmutuallyand subject toindustrial and functioning parameters in order to retain the target net leverage of 4.0x-5.0x.

What are the benefits obtained from the merging within this joint venture essay?

According to the terms of the contracts, both the parties involved in the merging are supposed to conceive a pre-defined capital at the termination of the merging procedure that will follow recapitalizations series that will produce £1.4 billion for Liberty Global and£5.7 billion for Telefonica.In addition to this, substantial synergies will also be induced amounting to almost £6.2 billion after the integration gets completed and the whole transaction gets over in 2021that is equalto capex, cost, and revenueturnoverworth£540million annually by the end of 5th year after closing of the deal ends. In addition to this, according to the expectancies of Liberty Global CEO Mike Fries considered in the joint venture essay, the joint venture would stimulate ‘massive value creation’ because upgraded the condition of the market wherein the investors were getting “Zero value” on the UK assets. The CEO assured about the fact that the synergies would attract an additional market share of US$6 billion that will increase the Return-On-Investment on the part of the investors and gravitate the brand impression even more (Lunden, 2020).

The joint venture essay examines the words of Thomson (2020) that the most commendable and overwhelming benefit that would be ushered to the denizens of the UK is that the merged company would have the potential to deliver an integrated network of power possessing the capacity of creating a vast network having 46 million video consumers, broadband, and mobile subscribers and could extract a whopping amount of £11billion of revenueturnover.In addition to this, the UK citizen would be profitable because they would be exposed to a convergence network from the merging of O2 and virgin media. This is because virgin media is knownto haveredefinedthebroadband and entertainment industry of the UK proficiently with its lightning-fast speed and most innovative features of video mechanisms. While on the other hand, O2 being widely recognised as one of the most reliable and viable mobile operators in the UK prioritising consumer demands and needs as the foremost. Now they would conveniently intertwine the best of the qualities from the respectivecompanies and forge all-encompassing telecommunication and digitalnetworks.Furthermore, the demands for the connectivity would also be feasibly delivered by the efforts of the combinedcompany and could include potentially the lower-end customers (BBC, 2020).

As observed by Earley (2020) within this joint venture essay, the IP-fixed seamless network connectivity conditioned by the merging has attributed a competitive edge to the combined companies with significant scalable economy garnering the strength to compete and viably invest on a long-term commitment in the UK digital infrastructure facilitating a wide spectrum of connectivity choices and greater value to the consumers, business world, and public sectors alike.Moreover, the new network provider amalgamating theVirgin media's national fibre-optic network and O2's mobile network would roll-out ultrafast 5G infrastructure across the UK enabling the mobile operator to drive organic to grow and launch broadband products of its own.As rightly pointed out by Browne (2020), the merger will empower the joint entity of Virgin Media and O2 to possibly overpower the reputed and competent telecom rivals like Sky. It is stated in the joint venture essaythat Vodafone, and Comcast-owned BT with its fixed and wireless broadband networks possibly because it will have a larger database owing to the intertwining of the operations capabilities. Even, Paolo Pescatore, a tech-savvy, media, and telecommunications analyst at PP Foresigh are of the view that the merger is nonetheless an intriguing move and would ably appease the mobile operators more convincingly than it could have done individually.

As opined by Kester Mann with regards to the joint venture essay, an industry analyst at CCS, since converged network and service is in peak demand and extremely preferred across the UK, the deal is beneficial for boththe telecom companies because both the companies could diversify the risk associated with them that could have induced, had they attempted to incorporate converged networking protocols single-handedly. This is because they have become complementary for each other fulfilling the inherent lack of assets in them like mobile for Virgin Media and fixed for O2.In addition to this, as opined by Earley (2020), the joint venture will promulgate services to the customers by assembling the existing infrastructure of the individual entity at a lower cost as compared to standalone or wholesales capabilities that would allow the company to attract massive trove of prospective customers from all stratum of life. Moreover, the migration of the traffic would ensure a free-flowing network across the UK to the customers of both or any one of the brands that will exponentially help the regional and national networkinfrastructure to foster growth and embolden the IT systems of the country.Another beneficial aspect of the joint venture illustrated in this section of joint venture essay is the reduction of the marketing expenditures, facilitating lessening of the overhead and administration cost along with site rationalization. Apart from this, as rightly stated by Daws (2020), the joint venture would also induce exponential growth through cross-selling of opportunities and capturing the scalable ones, reinforcing synergy in revenue collection with an estimatedyearlyturnover of £110 million approximately.

What are the possible challenges and disadvantages caused by the merging outlined in the joint venture essay?

In order to achieve the ambitious mission of accomplishing an investment worth £10 billion into the UK for accentuating the connectivity and network infrastructure along with the motive of ensuring latest superfluous network delivery to billions of consumers across the global sphere reckons for huge existing upkeep cost and stablecapital flow across the organisationalendeavours and constant changes to adapt the inherent differences of performing dimensions of both the companies (ispreview, 2020). The reduced competition in the market with the only Sky and BT to compete, the most powerful duopoly, there are scopes of hike in the prices of the services or products offered by the joint company of virgin media and O2.

Moreover, the competitive threat from Vodafone is a potential challenge that should be dealt with through strategic measures and skilled digital knowledge. This is because as presumed by Warner (2020), Vodafone is a powerful business partner of Virgin Media for a long time now and the partners have viably and efficiently executed some of the major projects in the telecom services. Apart from this, Vodafone has already forged anagreement for acquiring the Virgin's media' backhaul services initiating in 2021for 5G and has been benefitting from the cross-selling and cost-efficient services to drive the optimum services in the company. Therefore, the possibility of Vodafone's approaching with an offer of being a better partner in comparison to O2 could not be wholly ruled out after the evidential prospectsofVodafone splashing out on Liberty’s global assets.

Another crucial problem discussed in this joint venture essaythat could most probably hit the joint venture is the sudden deterioration in the connectivity efficiency on the part of Virgin mobile as it suffered a crash and the consumer had problems coming to online. As reported by Parsons (2020), and shown in the picture below, the influx of the disgruntled Virgin’s consumers would hamper the brand value and impression of the joint entity because the consumers have been repeatedly complaining about the network speed and tenacity of the networkimpeding them to either work from home or office.

Figure 3: Glimpses of consumer’s complaints and poor working of Virgin Media (Source:Parsons, 2020)

What are the important facts learned in this joint venture essay?

While evaluating the various dimensions of this joint ventures and their respective dynamics with future endeavours it could be asserted that both the companies despite knowing the overpowering position of BT in the UK telecom industry, managed to venture forth in their proceedings to build fasterbroadbandinfrastructure in the UK telecomindustry by showing the inherent competence of handling risks and secure commercial goals on a long-term basis. Moreover, the way both the companies have strategized the measures taken and considered every aspect of the probable risks and accordingly devised the contingency planning is also something to be noted because the joint venture has entered the extremely competitive space shared by the leading and powerful telecom companies of the UK marketing millions of millions of shares and holding billions of consumers in their credit.

Recommendations

Since the demand for unhindered and superfast connectivity is the need of the hour that calls for critical and efficient strategies to meet the high spike of networking owing to the coronavirus pandemic. The global outbreak of the deadly virus has reinforced and surged the demand of the network services of all kind as people have to comply with the governmental impositions of repeated long lockdowns and social distancing in the UK. Therefore, as observed by Harroch (2020) within this joint venture essay,financing the merging terms of the agreements would seemextremely difficult due to the economic recession and falling stock market implyingthe stoppage of the essentialoperative functions of the joint venture of virgin mobile and O2 along with the pre-defined endeavours. In order to tackle this unforeseeable pandemic crisis, both the company could reconfigure their operative strategy by re-negotiating their terms and conditions under the “Material Adverse Effect” provisions in merging protocols wherein the involved parties are expected to disseminate liabilities of the risk between them which might have occurred due to certain negative circumstances in the given period of time. Therefore, this would help joint company entity to induce proper risk management strategy to recoup the significant losses that have been incurred and devise measures contingent to the contemporary times and demands so that the network connectivity could be delivered conveniently.

Conclusion

It can be concluded from the discussion on joint venture essay that the joint venture of these two telecom companies wouldattribute the UK telecom industry a much-awaited shakeup because the strategiesdeployed by the major telecom companies globally preliminary hinges on ensuring convergence network and selling bundle of profitable and attractive services to the consumers. Moreover, from the aforementioned discussion of the various benefit and challenges, it could be rightly inferred that the latest combination of the mobile carrier of broadband providers would soon reach the pinnacle of success with their inherent capabilities of Virgin Media and O2 respectively on the global platform of the telecommunication industry.Moreover, the recommendation cited in this joint venture essaywould help the joint venture to surpass the immediate present crisis that it has been facing.

Reference list

Armitage, J. 2020.What does the O2 and Virgin Media merger mean for you Joint venture essay [Online]. Available at:

bbc.com 2020.Virgin Media and O2 join forces to take on BT. [Online]. Available at:

Browne, R. 2020. Virgin Media and O2 agree on $39 billion merger to create a new UK telecom giant, CNBC. [Online]. Available at:

Daws, R. 2020.O2 and Virgin Media consider merging to fight BT and Sky, Telecoms Tech News.[Online]. Available at:

Earley, K. 2020. O2 and Virgin Media agree on £31bn merger, Silicon Republic. [Online]. Available at:

Earley, K. 2020. O2 and Virgin Media UK are discussing a potential merger, Silicon Republic. [Online]. Available at:

gmal.co.uk 2020.Virgin Media and O2 Merging To Compete Against BT – GMA.[Online]. Joint venture essayAvailable at:

Harroch, R. 2020. The Impact Of The Coronavirus Crisis On Mergers And Acquisitions, Forbes.[Online]. Available at:

ispreview.co.uk 2020.Virgin Media and O2 Agree UK Broadband and Mobile Merger - ISPreview UK. [Online]. Available at: https://www.ispreview.co.uk/index.php/2020/05/virgin-media-and-o2-agree-uk-broadband-and-mobile-merger.html [Accessed 10th July 2020].

Lanxon, N. 2020.Bloomberg - Are you a robot?[Online]. Available at:

Lunden, I. 2020.TechCrunch is now a part of Verizon Media.[Online]. Available at:

Munbodh, E. 2020. O2 and Virgin Media in talks to merge - affecting more than 40million users, mirror. [Online].Joint venture essay Available at:

nationalconnectivitychampion.co.uk 2020. Nationalconnectivitychampion.co.uk.[Online]. Available at:

Parsons, J. 2020.Virgin Media suffers another outage amid rumours of O2 merger | Metro News.[Online]. Available at:

Sweney, M. 2020. Virgin and O2 plan merger to challenge Sky and BT, the Guardian. [Online]. Available at:

Thomson, S. 2020. Fries: Virgin Media-O2 merger is ‘huge opportunity’ to target wider market, Digital TV Europe. [Online]. Available at:

Warner, J. 2020. O2 and Virgin Media merger: what you need to know.[Online].Joint venture essayAvailable at: