Detailed Report on Samsung Business Analysis

Question

Task: Prepare a detailed report on Samsung business analysis to estimate the financial and competitive stand with Apple and Lenovo?

Answer

1. Introduction to Samsung business analysis

1.1. Companies overview

Samsung,is one of the best multinational conglomerate companies in South Korea, which was established by Lee Byung-Chul in 1938. It has its headquarters in Seoul, South Korea and comprises various electronic businesses. Apple Inc. is a globalized American based technological company. It was established in 1976 by Steve Woziak, Steve Jobs & Ronald Wayne. Its headquarters is in California, USA. Appledevelops designs, software, electronic items and so on (Levy, 2020). Lenovo is a Hong Kong-based global technology company founded in 1984 and its headquarters is situated in Quarry Bay, Hong Kong. It also produces electronic goods and technological products (Lenovo. 2020).

1.2. Purpose

Samsung business analysis is generally used to articulate and identify the requirements of change in an organization. Samsung business analysis identifies the issues, expounds the solutions and minimizes the issues of an organization.It is a research on identifying business needs, resources and suggesting the mode of improvements.The motive of this Samsung business analysisis to estimate the competitive and financial stand with the comparison of Apple and Lenovo. The business surroundings and the effects of the business of Samsung can be analysed by PESTLE framework and Porter’s five forces analysis. Also, this study examines the challenges of Samsung business analysisand estimates its acceptance, stability and other factors according to business needs.

1.3. Identified issues

It examines that Samsung had continuously contravened the designs of Lenovo and Apple. Also, Samsung faces the issues of overheating and lagging, which results customer dissatisfaction. Alongside this, it faces lots of internal issues that reduce its market value.Global technological rivals have ruled in the market for a long time. Apple and Lenovo both had a remarkable start on this technological field. Samsung business analysisintroduced its data transmission and wireless operation around the world. These two companies' products have a huge demand among their worldwide customers. To maintain its existence in this market, Samsung should focus on its designs, software issues and customer satisfaction (Cain, 2020).

2. Environmental analysis of business

2.1. PESTLE analysis

Through the PESTEL analysis of any organization, it will examine the uncertain environment and discuss the factors that affect the functioning and performance of the business obtained through Samsung business analysis.

Economic Factors: Economically, South Korea is the 4th largest in Asia and 11th largest globally. South Korea has a mixed economical and family-oriented structure. Automobiles, telecommunication, electronics are the main industries in South Korea. The GDP rate of South Korea is 2.7% annually (Xinhua net. 2020). The good quality of workers, strong leadership quality, and developed Hardware sectors is the key areas that help the business of Samsung to grow up in South Korea.

Political Factors: South Korea’s political system has many variations. It has good trade and diplomatic relations with all countries. Relations with North Korea are almost aggressive. It has a stable government for regaining the trust of the global community and it is beneficial for the Samsung Company for growing up its business.

Social Factors: South Korea is known as the country of Christian and Buddhist religions. It is slightly an echeloned society. Loyalty towards a communist culture is the most important key factor and the society of South Korea is seen to be self-controlled, so that the Samsung Company easily spreads its business over here. This customers of this society are loyal and descent and always accepts something new. This approach helps to grow up the company in South Korea’s marketplace.

Technological Factors: As per the Samsung business analysis, South Korea has the highest broadband subscription ratio around the world.South Korea has mobile production companies like LG, Samsung, Pantech. It is sixth in automobile production around the world.So, there is a good technical base is already established in this country. Samsung Company gets many technical supports from the marketplace. Moreover, it is the best environment for growing up the business of Samsung.

Legal Factors: South Korea’s law system is influenced by German and US law system. The enforce contract, protection of property, legal efficiency to settle the disputes are the main key factors. The court protects the fundamental rights of citizens and checks the power of government effectively (Ahmed, 2018). It helps the Samsung Company to reduce the legal issues, which may occur during growing its business effectively.

2.2. Five Forces analysis

Porter’s analysis is a structure that describes an industry's surroundings. The Porter five forces include buyers’ power of bargaining, suppliers’ power of bargaining, threat in replacement products, rivalry with fellow firms and threat of new entries (Lee et al. 2020).

Buyers bargaining power (High): Buyers can intimidate the industry for bargaining the prices low and high. A powerful buyer can guide the suppliers. It is a mirror image of it and helps the organization to grow rapidly.

Suppliers bargaining power (Low): The supplier's power of bargaining indicates to the potentiality of suppliers’ price rise and reduces characteristics. A powerful distributor, whose services and products are available in high rate, can switch the high cost. The threat of alternative products (High): A customer’s need can be satisfied by different kinds of products. The threat of replacement is mainly depend on the closeness of the replacement of other technologies (Zenith research. 2020).

Rivalry with fellow firms (High): Rivalry among established industries is a huge threat of desirability. As there are many companies present in New Zealand, based upon this, so the competition level will be on high level for Samsung business analysis.

New entry threat (Moderate): All the new entrances are a purpose of threat. If the entry barrier is high, the force of competition becomes weaker. The origin of entry barriers are mainly cost switching among customers, primary capital, rules and regulations of the government, loyalty toward any brands, economic structure and others (Zenith research. 2020).

3. Samsung business analysis: Financial Environment Analysis

3.1. What are the key financial indicators considered for Samsung business analysis?

Profitability: The profit is defined as the amount of revenue that a company can generate as compared to its investment of the capital. Initially, a large amount of capital is invested for a business during its start-up and also in the subsequent years for the launching of new products and some issues may arrive like business growth, and Samsung’s statistics shows good results regarding the profit margins. The revenues increased by 6% in the last three months, ending in March 2020 (Investing. 2020b). Whereas for Lenovo, revenue is decreased by 1% (Investing. 2020a). Samsung is the leading revenue generator in terms of Smartphone, leaving behind Apple and Lenovo. But Apple holds a better position as a whole in the market. It approaches mainly to the elite class as the products are costly. Samsung faces competition from the cheap rate of Chinese products.

Net profit margins: It is defined by the amount of profit that ismade after deducting all the expenses required for business proceedings. The expenses may include paying of taxes, wages of workers, cost of raw materials and some other. The net profit margin of any company determines its performance over the years. Profit can only be achieved if enough revenue can be generated by the sale of its products. Various effective measures need to be taken to increase the sale like innovations, implementing improved technologies and correct pricing of the products. The net income is decreased by 4% in the last three months (Investing. 2020b). The net income, which is applied to common stakeholders of the company is increased by 12% (Investing. 2020b).

Return on assets ROA is defined as the amount of profit that a company makes on its assets. It is calculated before the financial effects start on an organisation. The total assets of Samsung were 352,564,497 in December 2019 (Investing. 2020b).

|

Metric |

Apple |

Samsung |

Lenovo |

|

Net income |

$53.32 billion |

$40.61 billion |

$ 47.9 M |

|

Profitability |

$247.42 billion |

$222.91 billion |

$50.72 billion |

|

Free Cash Flow |

$53.73 billion |

$20.03 billion |

$32.411 M |

Table: Samsung vs. Apple

Source: (Tenebruso, 2018)

The current ratio and its effect in liquidity: Current ratio obtained through Samsung business analysis defines the Company’s capacity or ability to pay its debts in the current year (Restianti&Agustina, 2018). This shows the liquidity of any company that is related to its solvency. A company with a higher current ratio as compared to its competitors is more solvent. More solvency, means a company is more capable of paying off its short-term liabilities with its assets before entering into financial profit margins.

3.2. Industry-specific performance:

The mobile markets are analysed based on certain performance indicators: The Key Performance Indicators (KPI) are asfollows:

- Several potential customers - It is defined as how many permanent customers a company can be acquired. Samsung’s market share is more than 22 % and of apple’s is 12.5 % (Gelder, 2017).

- Cost per acquisition (CPA)- To convince the buyers for purchasing a product, needs a certain amount of investment. For example, advertisement, discounts and other benefits can be given which is called as Cost per Acquisition.

- Sales revenue- Amount of revenue that is generated for making any campaigns, creating banners, hoardings and advertisements (Business of Apps. 2017).

4. Appraisal of the Analytical Models

4.1. Appraisal of Pestle analysis

Samsung business analysis through Pestle factors is one of the best approaches to observe and identify with the external environment where the business needs to be set. It helps to know various external factors that influence the work directly. Herein Samsung business analysis, knowledge about a situation beforehand is provided by PESTLE. Good understanding of buyers' minds helps in innovating products and defining actual prices. Pestle always gives an edge over its competitors because it provides an insight about the market needs.

Pestle analysis deals with Political, Economic, Social, Technological Legal and Environmental factors of the country in which it works (Helmold, 2019). These are external to the company that is related to the macro environment which influences the growth of a company. It is highly beneficial but also has some limitations.Any kind of change will affect the business strategies as there are dynamic Government policies of a country, which may vary from time to time. The economy is always an unstable component. PESTLE analysis only provides the information about external factors, but not the internal factors that is important too. Most of the data are hard to find and not all these data remain same and accurate due to continuous change of those factors. The mindset of an individual varies from one to another in a society and change continuously with time. The Samsung business analysisshould know about all these risks and take steps accordingly.

4.2. Appraisal of Porter’s five forces

Porter’s 5 forces help to gain insight into the characteristics of competitors of an organisation. It provides information about the bargaining capacity of customers, threats produced by new products launched in the market and replacement of rival companies. These above factors are beneficial to understand and analyse the ongoing situations and take decisions accordingly.

The major drawback of Porter’s5 forces is that it considers the environment to be ideal and static (Hill et al. 2019). But in reality, it is dynamic. The entry of competitors can always happen who have better knowledge about how to bargain with the customers. The negotiable capacity of the customers is always changing as they are getting influenced by other products available in the market. In this era of globalisation, the market is not confined to a single country.

4.3. Appraisal of financial analysis

Financial Analysis under Samsung business analysis helps in understanding the statistics of a company regarding its growth rate, profit margins and revenue generations. A reputed industry will always show good statistics which influences the customers. More people buying a product will indicate good profits. This value will create an impression that the products are of good quality. The price also plays a part which will increase the number of customers for a company.

Herein Samsung business analysis, the financial analysis is based on historical data of any organisation (Areas, 2018). It deals with the amount of profit that it has incurred for a certain period. Now the current market shares may vary which will largely affect the net profit margins of a company. The economy is volatile and the currency is variable. The evaluation of money may also change over time. This can affect the overall profit margins of a company.

The data regarding the profit ratios available never indicate whether they are positive or negative values. It doesn't give any idea whether this ratio can be sustained for a longer period or not. Liquidity ratio obtained through Samsung business analysis identifies a company’s capacity to pay its debts with its assets. It is considered a positive factor if the ratio is high. But to put it in another way, it also indicates a company’s incapability to utilise its capitals to its utmost potential. The decline in Net Profit Margin and revenue generation results in degradation of an organisation.

5. Conclusion

5.1. Key issues or opportunities

There are so many opportunities identified through Samsung business analysisfor the company that take forward its growth in the upcoming days. There are:

- Digital Marketing.

- China Market.

- HR Management.

- Diversification and Acquisitions.

Digital Marketing

Samsung is an internationally recognized brand and for growing in the market, it should focus on the branding of its products. An organization can operate high to the customers worldwide by using the social media and digital marketing strategy. The Smartphone and Laptops oriented markets are very competitive now. For gaining and growing in this industry organizations are using the digital marketing platforms (Pratap, 2020).

Some years ago, it announced a campaign named ‘Useless Bid’. This supposed the customers' other gadgets were out of date. The customers can do things without their laptop, camera, TV. Samsung has had a great rivalry relation with Apple for a long time. Samsung business analysishas great satisfaction to mock Apple nowadays. As everyone knows, Apple has some complaints against their iPhone on social media.

5.2. Evaluation of the issues through Samsung business analysis

Samsung faces a lot of issues in this global business market in the competition with Apple and Lenovo.

Global Business Strategy

Apple’s plan to grow in the international market is production capacity. Like other companies, Apple has focused on his relationship with China to grab the Chinese market. Lenovo is a china based company and it has a great impact on the China market. Apple’s business strategy plays a huge role in the transformation of the global technological market. The entry of Apple and Lenovo is not an occurrence. Both companies are growing faster because of their international business strategy. The main difference between Apple, Lenovo & Samsung’s business strategy is that Samsung’s main focus is the US market. The reason behind it is that the US has international brand status. Samsung’s international marketing strategy is based on the US market.

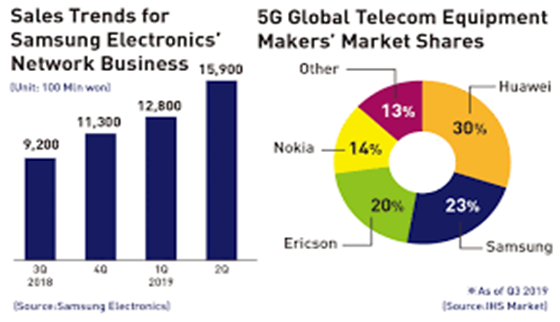

Figure 1: Position of Samsung in Network Business in world

Source: (newworld. 2019)

Samsung business analysisintegrates many segments to keep its existence in the global market. Samsung needs to focus on close and better relations with their customers like Apple and Lenovo. Samsung’s business strategy is far behind Apple and Lenovo. Nowadays, Samsung tries to adopt an extensive marketing strategy to impose its presence in the international market (Ivy Panda. 2019).

6. Recommendations

6.1. Identification of two strategic options

Market and Product Development:

Samsung’s entry in the new market is the cause of the increase in the growth of the market. It also grows the share of the global market. This Samsung business analysis strategy help the company to enter a new world market of technology. New markets like new cities or new countries. Samsung introduces its product in urban and village sides of various countries.

The other business strategy is to target the old customers but this time with new services and products. By introducing new products it tries to attract more consumers and grows the share in the global market. It also advertises its product on newspaper, TV and social media platforms.

Market Penetration

Samsung has maintained its share in the market by its potential customers. An organization always tries to attract its customers (Soltani et al. 2018). If the customers are happy with the services, this can take forward Samsung to the greater market.

6.2. Application of SAF framework

At the time of formulating a business, SAF model is very important to identify the objectives of any organization. SAF stands for Suitability, Acceptability & Feasibility.

Suitability

It is the major factor in this framework of Samsung business analysis. It is mainly used for environment, capability and expectation suitability. It strategies the company’s upcoming plans. This strategy directly reflects the customer's needs, which fulfil the market penetration strategy.

Acceptability

It is the other factor of the SAF model that helps to maintain market penetration strategy. It measures the risk factors, returns reactions. The calculation of return can measure through the cost-benefit analysis. Risk can measure through sensitivity analysis, acceptance strategy and liquidity impact. Return amount is calculated by profit analysis, the value of share analysis.

Feasibility

Feasibility can break or make any type of business strategy like market penetration strategy to meet the consumers’ needs. The key tothe implementation of this strategy is its success. This strategy is connected with the power of management, manpower, instruments etc. For the remembrance of feasibility, organizations use the M-word model: make-up, money, management, machinery, manpower (Helmold, 2020).

6.3. Implementation plan

In 2012, Samsung,there are 2% equal market shares in China. Samsung business analysistargets mainly middle-class customers. It tries to grasp a low-end marketing strategy like market penetration strategy. Samsung demands HEG to resolve the issue of flexibility. In 2009, Samsung announced ‘Vision 2020’ to set a specific goal to grow its business.

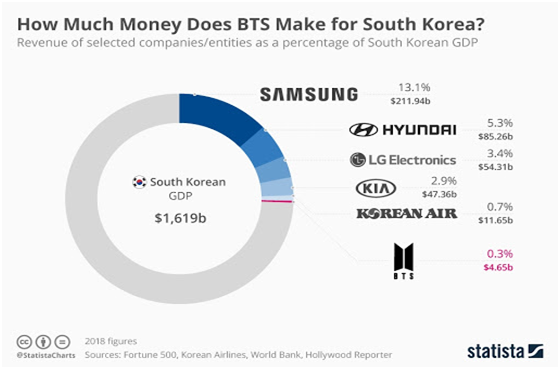

Figure 2: Earings Of Samsung by implementing plan in South Korea

Source: (Buchholz, 2019)

Samsung business analysishas succeeded to execute its plan of action to gain growth and profit. Samsung is always known for its R&D efforts (Samsung. 2020). Its goals are particular. Samsung wants to achieve the Vision 2020 and it's very interesting to see its growth in upcoming years.

7. Financial modelling

In previous years, Samsung increased its net profit. Though in previous years, Samsung gained some profit but in recent times the gain percentage has been slowed down. Samsung business analysistries to improve its infrastructure and implement more features of its products to achieve the consumer satisfaction and the gross profit in the future. In the year 2019, Samsung becomes the 5th technological company in global markets (Statista, 2020). But, the company targets to achieve the rank 1 position in the future and for this reason it tries to increase its economic growth in the business market.

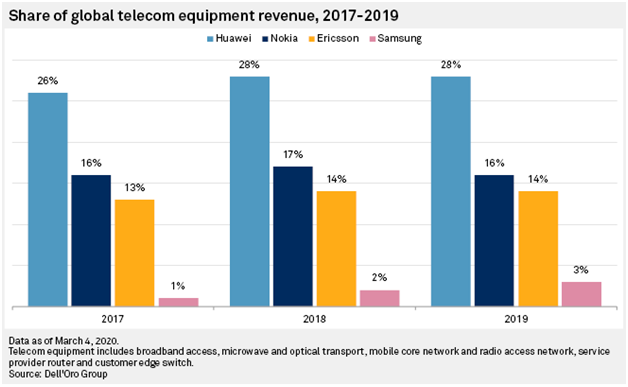

Figure 3: Samsung’s Market Share of Global Telecom Equipment Revenue (2017-2019)

Source: (Shah & Zhu, 2020)

The revenue of Samsung business analysisis 19% of South Korea in aspects of total GDP rate (Statista, 2020). Stability growth of Samsung will increase in future. The financial condition of this company looks like good condition.

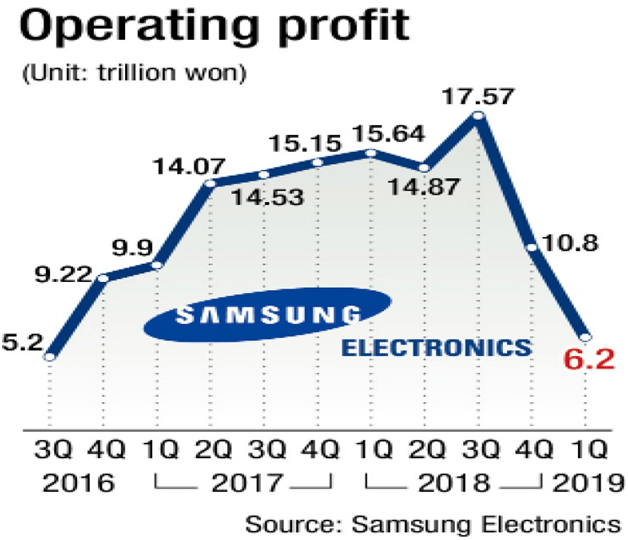

Figure 4: Operating profit

Source: (Byung-yeul, 2020)

If the Samsung business analysismaintains the rules of customer satisfaction and a good relation with the customers, it will be beneficial for the company to compete with Apple and Lenovo. The company will continue its journey in the international business world with great success.

References

Ahmed, N. (2018). PESTLE analysis South Korea. Retrieved 10 August 2020,Samsung business analysis from https://www.slideshare.net/NabilAhmad4/pestle-analysis-south-korea

Areas, B. (2018).Financial analysis. growth, 30, 10.

Buchholz, K. (2019). Infographic: How Much Money Does BTS Make for South Korea?. Retrieved 10 August 2020, from https://www.statista.com/chart/19854/companies-bts-share-of-south-korea-gdp/ Business of Apps.(2017). How to Identify Better KPIs for a Mobile Performance Marketing. Retrieved 10 August 2020, from https://www.businessofapps.com/news/identify-better-kpis-for-mobile-performance-marketing/ Byung-yeul, B. (2020). Samsung's operating profit falls to 2-year low. Retrieved 10 August 2020, from https://www.koreatimes.co.kr/www/tech/2019/05/129_268052.html

Cain, G. (2020). Samsung vs. Apple: Inside The Brutal War For Smartphone Dominance. Retrieved 10 August 2020, from https://www.forbes.com/sites/forbesdigitalcovers/2020/03/13/samsung-vs-apple-inside-the-brutal-war-for-smartphone-dominance/ Gelder, I. (2017).Samsung Electronics Customer Analysis & Marketing Strategy Analysis. Retrieved 10 August 2020, from https://www.slideshare.net/IdevanGelder/ samsung-electronics-customer-analysis-marketing-strategy-analysis

Helmold, M. (2019).Tools in PM.In Progress in Performance Management (pp. 111-122).Springer, Cham.

Helmold, M. (2020).Pricing as Part of Corporate Strategy.In Total Revenue Management (TRM) (pp. 29-42).Springer, Samsung business analysisCham.

Hill, A. D., Recendes, T., & Ridge, J. W. (2019). Second?order effects of CEO characteristics: How rivals' perceptions of CEOs as submissive and provocative precipitate competitive attacks. Strategic Management Journal, 40(5), 809-835.

Investing.(2020a). Lenovo Group Financials (0992) - Investing.com. Retrieved 10 August 2020, from https://www.investing.com/equities/lenovo-group-ltd-financial-summary

Investing.(2020b). Samsung Electronics Co Ltd (005930) Financial Summary - Investing.com. Retrieved 10 August 2020, from https://in.investing.com/equities/samsung-electronics-co-ltd-financial-summary

Ivy Panda. (2019). Comparative Study of Business Strategy for Apple and Samsung. Retrieved 10 August 2020, from https://ivypanda.com/essays/

comparative-study-of-business-strategy-for-apple-and-samsung/

Lee, H., Kim, M., & Park, Y. (2020).An analytic network process approach to operationalization of five forces model. Retrieved 10 August 2020, from https://www.mendeley.com/catalogue/74b62cb0-34e3-3205-9bf9-414e12ded0bf/

Lenovo.(2020). Lenovo Official UK Site| Laptops, PCs, Smartphones, Data Center | Lenovo GB | Lenovo UK. Retrieved 10 August 2020, from https://www.lenovo.com/gb/en/ Levy, S. (2020). Apple Inc. - Desktop publishing revolution. Retrieved 10 August 2020, from https://www.britannica.com/topic/Apple-Inc/Desktop-publishing-revolution newworld. (2019). Retrieved 10 August 2020, from http://newsworld.co.kr/detail.htm?no=6198 Pratap, A. (2020). SWOT Analysis of Samsung - 2020. Retrieved 10 August 2020, from https://notesmatic.com/2020/03/swot-analysis-of-samsung-2020/

Restianti, T., &Agustina, L. (2018). The effect of financial ratios on financial distress conditions in sub industrial sector company. Samsung business analysisAccounting Analysis Journal, 7(1), 25-33.

Samsung.(2020). Who We Are | Samsung Research. Retrieved 10 August 2020, from https://research.samsung.com/whoweare

Shah, S., & Zhu, X. (2020). Samsung must spend big on 5G kit, M&A to gain market share, say analysts. Retrieved 10 August 2020, from https://www.spglobal.com/marketintelligence/en/news-insights/latest-news-headlines/samsung-must-spend-big-on-5g-kit-m-a-to-gain-market-share-say-analysts-57509007 Soltani, Z., Zareie, B., Milani, F. S., &Navimipour, N. J. (2018).The impact of the customer relationship management on the organization performance. The Journal of High Technology Management Research, 29(2), 237-246.

Statista. (2020). Samsung Electronics: global net income 2005-2019. Retrieved 10 August 2020, from https://www.statista.com/statistics/236699/global-income-of-samsung-electronics-since-2005/

Tenebruso, J. (2018). Better Buy: Apple Inc. vs. Samsung | The Motley Fool. Retrieved 10 August 2020, from https://www.fool.com/investing/2018/07/12/better-buy-apple-inc-vs-samsung.aspx

Xinhuanet. (2020). S.Korea's real GDP growth hits 10-year low in 2019 - Xinhua English.news.cn.. Retrieved 10 August 2020, from http://www.xinhuanet.com/english/2020-01/22/c_138726425.htm Zenith research. (2020). Retrieved 10 August 2020,Samsung business analysis from http://www.zenithresearch.org.in/images/stories/pdf/2011/Oct/ZIJMR/30_vol-1_issue-6_%20Choong%20Y.%20Lee.pdf