A finance assignment on estimation of the fair value of Alphabet Inc and the suggestion whether the firm may be a profitable choice for investment or not

Question

Task: Can you choose a firm of your choice to provide a complete valuation and recommendation finance assignment report in which you are expected to analyze the scope and performance of the business model of the firm?

Answer

Introduction

The finance assignmenthereunder focuses on the valuation of Alphabet Inc., a multinational technology conglomerate company headquartered in California. The finance assignmentinitiates with a description of the company with a focus on the activities that it undertakes, the managerial structure within the company, and its corporate governance. This is followed by an analysis of the financial performance of the organization, which then allows the readerof the finance assignmentto observe the risk profile that is to be applied.Analysing the risk profile further helps in determining the capital structure options that the company can use while also providing an opinion on the optimal capital structure. This will be followed by a discussion on the applied dividend policy, and a fair valuation of the company will be conducted in the finance assignment. Part B of the finance assignmentfocuses on the investment decision that should be taken based on the current scenario and records of the company.

This will be followed by a discussion of the methods to re-estimate the profitability of the project. A conclusion is stated at the end of the finance assignment.

Part A of the finance assignment

(a) Description of the company

Activities

Alphabet Inc. is a conglomerate company, which means that it has many subsidiaries that function in various industries under one corporate parent company. These companies, like Google, Waymo, X Development, Verily, Deepmind, XXVI, YouTube, Firebase, and many more, are a part of different industries. Through Google it is noted in the finance assignment, Alphabet Inc. functions as an advertising company that uses modern tools to promote businesses.It also focuses on AI, SEO, cloud computing, e-commerce, and consumer electronics (Carr and Hesse, 2020). The parent company is a part of the autonomous driving technology development industry through its subsidiary, Waymo. It also operates as a self-driving tax service facility. The research and development facility of Alphabet is named Google X, which is termed to be a semi-secret company. The parent company also has a subsidiary in the industry of research to study life sciences. Alphabet Inc. has another subsidiary as per the finance assignmentthat functions in the artificial intelligence industry; the name being DeepMind, which is a British company that was acquired by Google in 2014.It also has a subsidiary that is meant to own the equity of each Alphabet company and will take action on projects like Google’s self-driving car (Mulaydinov, 2021). To create and develop its mobile and web applications, Firebase was acquired and now is a subsidiary of Google and Alphabet. In this way, Alphabet Inc. has distributed and diversified its activities through the creation and acquisition of more than 160 subsidiaries.To diversify and acquire so many subsidiaries is a difficult task as per the finance assignment. Alphabet does this using the revenue earned through performance advertising and brand advertising, both of which can lead to the generation of such huge revenues.

Structure

As per the data of finance assignment, Alphabet Inc. is a holding company that has no operations of its own, but this company acts as a head or the provider for all of its subsidiaries. The structure that Alphabets Inc. applies to its massive family of subsidiaries is divisional. Each division is positioned as a separate brand. Some subsidiaries come under the sub-parent company Google. These are subsidiaries like Android, Search, YouTube, Chrome, Maps, Ads, etc. These subsidiaries have a matrix structure, i.e.,some percentage of the structure is team-based, and the rest is flat.According to the finance assignment, these subsidiaries have a general manager who leads the functional managers of departments like sales, marketing, engineering, legal, products, finance, etc., and these available managers lead a team of their respective department managers who in turn teach their subordinates. On each level, for example, the department managers are positioned on a flat basis, i.e., they are in the same position as the other department managers. The subsidiaries under Google, therefore, have a typical organizational structure. When the rest of the subsidiaries of Alphabet Inc. are considered, the ones that are not under Google, these subsidiaries function on a flat organizational structure, i.e., every employee is in an equivalent position as the other. Some of these subsidiaries employ very few employees (for example, Verily employs a total of 9 employees), and this allows the flat organizational structure to function effectively. The flat design of the finance assignmentallows employees of different experiences to work on a levelled platform and be prioritized if the idea is to be presented. Alphabet Inc. focuses more on intelligence rather than seniority; this is how the views of the less experienced come to flourish.

Corporate governance

It is found in the finance assignmentthat the guidelines of corporate governance of Alphabet Inc. are formed by its Board of Directorsand are prepared to be able to chase Alphabet’s goals for the advantages of its stockholders. The structure of the board and composition determine the board’s size, the criteria for board membership, independence of directors, tenure of directors, guidance for directors who change their present job responsibility, and the process for directors’ election.The guidelines of the finance assignmentthen cover the board of directors’ principal duties, which are: to oversee management and evaluate strategy, to select the chair and chief executive officer, to evaluate compensation and management performance, management succession planning review, to manage and manage potential conflicts of interest, to ensure the financial information’s integrity, and to monitor the efficiency of the practices of the board governance. The board comprises five committees, namely the Audit and Compliance Committee, Inclusion and Compensation Committee, Leadership Development Nominating and Corporate Governance Committee, and an Executive Committee, which are to be assessed to stay relevant with the requirements and disband or create new committees based on it. It is also mandatory for the board members that are newly appointed to go through an orientation program that includes oral presentations, written materials, and meetings with management’s senior members. The board member is required to maintain the minimum stock ownership requirement to maintain the alignment of interests. The governance guidelines of the finance assignmentrequire the audit and compliance committee to ensure the rotation of the audit review partner and the lead audit partner is conducted every five years. Finally, all of the stated guidelines have to be reviewed annually by the nominating and corporate governance committee. The recommendations will then be assessed by the board to take appropriate actions.

(b) Financial performance

The total revenue of Alphabet inc. was $182527 million in 2020, whichsurged to $257637 million in 2021 as per the data of the finance assignment. Therefore, the net income of the firm has increased from $40269 million to $76033 million. The increase in net income was due to the increase in revenue. The total revenue of the company has increased more than the increase in thecost of revenue. Also, the operating expense of the company did not increase very high. Therefore, the operating income of the company increased from $41224 million to $78714 million as per the data of finance assignment. Therefore, the profitability of the company is higher than it was in 2020. The company has three times more assets than liabilities; therefore, the company has a higher amount of assets to mortgage for future liabilities. Alphabet inc. has been able to increase its equity value by $30000 million. Therefore it is found in this finance assignment, the company issued several shares in 2021(Siagian, Wijoyo, and Cahyono, 2021). Hence, the company has been able to expand itself using the finance raised by the issuance of shares. Since the company has raised more finance in the form of equity than debt, therefore, in 2021 higher proportion of financing will be interest-free, and interest expense will be low overall. The operating cash flow of the company has increased from $65124 million to $91652 million. Therefore it is found in this finance assignment, the core activities of the company have performed very well. The company invested a higher sum of money in 2021. The free cash flow of the company has increased by approximately $20000 million implying that in the future, the company will have a very high valuation.

In 2020,the net profit margin was 22.06% that increases to 29.51% in 2021 as per the data of finance assignment. The rise in net profit margin means that the profitability of the company has increased. The increase in profitability of Alphabet inc. is due to the surge in net profit from $40269 million to $76033 million (Nariswari and Nugraha, 2020). The company has been able to increase its income due to an increase in revenue from $182527 million to $257637 million in 2021. However, the fact that the company has such a high net profit margin is due to the optimization of expenses that the company has incurred such that the total expense has declined. The return on equity of Alphabet inc. in 2020 was 18.09% which increased to 30.22% in 2021 according to statistics of finance assignment. The increase in ROE implies that the firm has been able to provide a higher return to the shareholders. The higher return of equity means that the shareholders will likely invest more in the company because the company has been able to use the shareholders' money very efficiently. The shareholders' equity increased from $222544 million to $251635 million so did the income. Therefore, it goes to show how efficiently the company has been able to operate. If the liquidity position of the company is being considered, then the current ratio of the company was 2.87, which is lower than the industry average of 8.13. Therefore, the liquidity position of the company is not as good as the industry; however, the current ratio of Alphabet inc. is more than one and still high; hence, the company has more current assets than short-term debt. As a result, if the company wants to pay off all the current liabilities with the current assets, then it can do so (Bunga and Muazaroh, 2022). The quick ratio of Alphabet inc. is 2.72, whereas the industry average is 2.08 as per the finance assignment. The quick ratio of the company is higher than that of the industry average. Therefore, it implies that the firm has higher cash to support the short-term debt it has incurred. If the industry average of current ratio and quick ratio is being considered, then it seems as if in the industry average, companies have higher inventory or lower cash; therefore, there is such a high difference in the current ratio and quick ratio of the companies (Nuryani and Sunarsi, 2020). Hence, it can be concluded in the finance assignmentby saying that Alphabet inc. has been able to grab hold of its liquidity position since it has a good balance of cash and overall current assets. The solvency position of the company can be gauged by the debt-to-equity ratio. The debt-to-equity ratio of Alphabet inc. was 0.11, whereas the industry average is 0.26. According to the finance assignmentthe higher the ratio, the lower the solvency position of the company (Syarifah, 2021). Therefore, it is evident that the solvency of the company is better than the solvency of the industry.

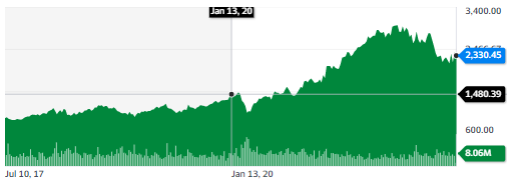

The share price of Alphabet inc. has increased from $955.99 to $2330.45. The increase in the share price of the company has been a very profitable investment for the investors. During the start of the pandemic, the company did face a sharp fall in the share price of the company; however, the price moved towards a bullish phase till November 2021, and the price during that time hovered around $2999.05. However, after that, the share price started to plummet, and currently, the price is at $2330.45 as per research conducted in finance assignment. Therefore, the investors who have been investing in the company for the past 5 to 6 years have received a very high number of returns on the company. However, the investors will be disappointed by the fact that the price of the share has been plummeting for the past nine months. The firm’s financial performance in terms of its share price has been very good. However, the fact that the USA is under the threat of a huge recession, as well as inflation has been rising, there is every chance that the price of shares of Alphabet inc. might fall. As per the finance assignment it mayresult into several investors losing a ton of money that they had invested in the company.

Figure 1: Share price trend

(Finance.yahoo.com, 2022)

(c) Risk profile in the finance assignment

The price to earnings of Google was a multiple of 23.24, which is higher than the median of 18.61. Therefore, it implies that the investor's sentiment overvalues the price of Alphabet. Therefore, there is a slight risk of overvaluation of Alphabet that can eventually turn out to be a loss for the investors. The price to cash flow of the company is 19.28, which is higher than the median of 9.17, implying that the market has placed a premium on the price of a stock that is relative to the cash flow of the company. The stock of the company is fairly valued since the EV/EBIT of the company is 17.53, which is slightly higher than the EV/EBIT of the sector median of 16.89 as per the finance assignment. The long-term debt coverage of Alphabet was 14.6whichat is approximately 15 times the necessary liquidity to cover the long-term debt of the company. Therefore, even if Alphabet might have higher debt resulting in elevated interest expense, the company will be able to pay off the interest easily (Vayas-Ortega et al., 2020). The company's short-term debt coverage is 2.93. Therefore it is noted in this finance assignment, it will be easily able to pay off the short-term interest. Hence, Alphabet will be threatened if the company incurs a higher amount of debt in the future. The stock price volatility is one of the factors to be considered when risk profiling. The 60-month trailing beta of Google is 1.08, and the 24-month beta was 0.92, which implies that the volatility in the price of stocks of Alphabet inc. is similar to the volatility of the S&P 500. The S&P 500 is under a bearish trend if the long-term trend is being considered. In the case of Alphabet, a similar movement has been found. Therefore it is noted in this finance assignment, considering that the price of shares of Alphabet is correlated with the S&P 500 in the case of future long-term bullish trends, the company will have a higher valuation of stock price. However, the matter of concern is that in the upcoming months USA will be facing an economic crisis where inflation might increase, and there can be several absurd issues that could result in the decline in the S&P 500. According to the finance assignmentthis will automatically result in a decline in the price of the stock of the company. Therefore, if the macroeconomic sentiments of USA thehave been considered, then the stock price of the company is at risk.

As per Infront Analytics, the risk score of the company is eight, implying that the company is significantly less risky than its competitors. Now, if the comparison is being made with NASDAQ 100, then it is certainly evident that even though NASDAQ 100 has grown by 107.7% in the last five years, Alphabet's stock price has gained 142.6% value (Analytics, 2022). Even in the time frame of 3 years mentioned in the finance assignment, the NASDAQ 100 has increased by 50.2%, whereas the stock price has increased by 102.2%. Therefore, the company has been outperforming the NASDAQ 100. The fall in the price of shares of Alphabet has been 20.2% in the year-to-date span. However, the NASDAQ 100 has fallen by 27.3%. Therefore, although Alphabet witnessed a rise in the price of stock more than NASDAQ 100, the fall in price is lesser than that of the index. The fall in the price of stocks of Alphabet is lower than that of the fall in the price of shares of Meta as per the finance assignment. The year-to-date decline in the price of stocks Meta is 51.6%. Therefore, it is evident that Alphabet is a more promising company for investors considering the risk of investing in the company is lower than most of its peers.

(d) Capital structure choices

The company’s capital structure is the proportion of debt and equity by which the firm has been financed. Equity financing is a means to raise money for the company where the investors only expect a higher valuation of the investments that they have made (Irman and Purwati, 2020). Equity financing has a higher cost as per the finance assignment; however, the fact that it is not to be paid back is a real advantage for the company. On the other hand, debt financing is a way of raising finance for the company in the form of loans (Dowling et al., 2019). Although the costof debt is low, however, the company will have to pay higher interests.

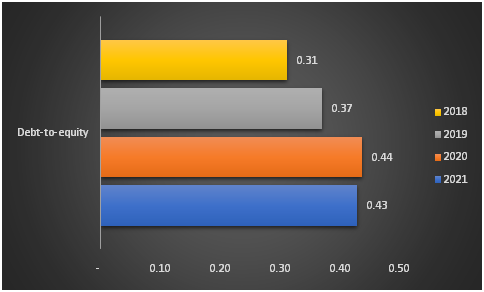

Figure 2: Debt to equity ratio

(Made by author)

In the case of Alphabet inc., the debt-to-equity ratio was 0.31 in 2018 and surged to 0.37 in 2019. The increase in this ratio as per the finance assignmentimplies that debt must have increased more than the increase in equity. However, the solvency position of the company did not get affected. In 2020, the ratio increased to 0.44, and then it declined to 0.43. Therefore, the overall capital structure of Alphabet is highly dependent on the equity that the company has. Therefore, the company must have to pay lower interest as well. Therefore, the firm has been able to manage its finance cost very efficiently. The capital structure of the company is very optimal for the needs of the company. The company has high equity, and the company has been generating higher income; therefore, the return on equity of the company is high as well. Therefore it is noted in this finance assignment, the company has been able to use its equity very efficiently, and in doing so, the company is attracting more and more investors to invest in the company (Orji, EO and Agubata, n.d.). The debt that the company has incurred over the past four years has increased. However, the company has higher assets to compensate for the debt as well.

The ratio has increased as per the finding of the finance assignment. However, the assets have increased as well. Therefore, the compensation of debt to the assets can be made easily. As a result, the company will not have to suffer from any kind of solvency problem, and the company will be able to keep more assets in the mortgage to incur more and more loans in the future.

The ratio in the finance assignmentindicates that Alphabet has maintained an average of 0.28 debt to capital ratio. Therefore, over the four years, the company has maintained 28% of its debt and 72% of the equity in the structure of its capital. Hence, the company’s capital structure is very optimal for the needs of Alphabet. Although the cost of equity is high, however, the company has been able to reduce the interest expense due to the lower debt over the years.

(e) Dividend policy

The dividend policy as per the finance assignment is the policy that the firms use to structure the dividend payout to the shareholders of the company. There are mainly three types of dividend policies that are being discussed below:

• Stable dividend policy: In a stable dividend policy, the companies are supposed to pay a steady dividend across the years. Therefore it is noted in this finance assignment, the number of dividends to be paid to investors is easily predictable (Kadim, Sunardi, and Husain, 2020). Hence, companies that give stable dividends are highly desirable to the investors because the investors are easily able to ascertain the amount of dividend that they could receive. Also, the companies that follow the stable dividend policy do not depend on the number of earnings generated by the company. Therefore it is noted in this finance assignment, even though the company has not been able to generate a steady income, still it will be distributing a healthy number of dividends to the shareholders of the organization.

• Constant dividend policy: As per the constant dividend policy, the companies pay a constant dividend for a longer period. Although it assures that investors would get paid, however, it also goes to show that the chances of experiencing a growth in the dividend of the company are faint (Pattiruhu and Paais, 2020).

• Residual dividend policy: The residual dividend policy is very turbulent; however, several investors would accept this kind of dividend policy. As per this dividend policy mentioned in the finance assignment, the companies will be paying dividends after the company has paid CAPEX and working capital (Driver, Grosman, and Scaramozzino, 2020).

In the case of Alphabet inc., it has never paid any cash dividend to its shareholders. Although it is a large-cap company, however, the company has never paid dividends and still has managed to amass a huge number of investors all over the world. Therefore it is noted in the finance assignment, it proves that the payment of dividends will not guarantee a higher pull of investors. Rather the companies should operate such that the companies can work efficiently, which gets reflected in the share price of the company.

(f) Fair valuation

The valuation model used in this is the discounted cash flow method. In this process, the firm’s forecasted cash flows are discounted using the WACC of the company (Pavel, 2018). Also, the terminal value of the company is being calculated using the formula: end cash flow * (1+perpetuity growth rate) / (WACC – perpetuity growth rate).

In the case of Alphabet inc., mentioned in the finance assignment the free cash flow in 2021 is $67012 million. The free cash flow is projected to increase annually at a rate of 17.06%. The terminal value of the company is calculated to be $2359060.45 million using a perpetuity growth rate of 2.5% and a WACC of 8.90%. Therefore, the company’s enterprise value amounts to $1958619 million. The value of equity of the company is calculated by adding the cash generated by the company in 2021 and reducing the debt of the company. The resultant equity value of the firms amounts to $2069873.99 million as per the data of finance assignment. Intrinsic value per share is measured by dividing the equity value by the number of outstanding shares of the company. Since the number of outstanding shares is 723 million, therefore, the intrinsic value per share is $2862.90.

Order to assess whether the shares of Alphabet inc. should be bought or sold depends on the comparison of the intrinsic value of shares with the shares current price. The current price of the company’s share is $2403.37. Since the intrinsic value of the firm is higher as per the finding of the finance assignmentthan share’s current price, therefore, it can be concluded by saying that the shares of Alphabet are undervalued. Since the intrinsic value of the firm is higher than the share’s current price, therefore, the price per share of the company can potentially increase more than the current share price of the firm.

The undervaluation of the shares of Alphabet implies that investors can easily purchase the shares of Alphabet inc. and expect a sharp rise in its price due to the sheer undervaluation of the stock. However it is to be noted in this finance assignment, the discount cash flow model is a method of valuation that is calculated based on several assumptions; therefore, the valuation of the company if the growth in the annual free cash flow of the company increases or decreases as per the external and internal factors of the company.

Part B

a) Investment decision

Before making any investment decision in the finance assignment, it is important to understand the time taken to recover the initial cost and the time after which the company will start earning profits. For Tyres Inc. to manufacture and market a newer type of tyre called super tyre, the company is required toevaluate the business decisions based on the following capital budgeting techniques:

• Payback period mentioned in the finance assignment: As per the computation of the payback period in the finance assignment, the time taken to generate the initial investment is 2.85 years. The payback period is referred to as the amount of time that investment would take to generate the initial cost of the project. It is very related to the break-even point of the project. With the help of the Payback period of the finance assignment, it is very easy and quick to determine the risk and opportunities related to the investment, but instead of being expressed in units like the analysis of break-even, the payback period is expressed in the number of years. It is said in the finance assignmentthat if the payback period is shorter, the more attractive the investment is as the time taken is very less for achieving break even. The use of the Payback period is not only for the financial organizations for the calculation of the rate of return on up-gradation for the new asset or technology, but it can also be used by small businesses for the determination of cost-effective choices. For calculating the payback period for the finance assignment, the initial outlay of cash for investment is to be divided by the net inflows of cash that the project will generate every year. The formula for payback period is easy to gauge and gives a faster overview of when can one expect to generate the initial amount of investment. It allows comparison between two projects and choosing the project which has a shorter payback period. But the simplicity of the payback period is a disadvantage. Also, it only shows the time taken for the return on the investment and does not show the exact amount of profits. It may be a chance that a project might be paid back way before expected, but in the long term, it might not be as from the table as the other option. Further it is noted in this finance assignment, it does not consider the value of money affected by time. This is a major flaw of this technique of capital budgeting (Gorshkov et al., 2019).

• Net present value: The net present value in the finance assignmentis the value of the positive and negative future cash flows over the life of the investment after discounting its present value. It is a type of intrinsic valuation and has extensive use in accounting and finance for the determination of the cost reduction program new venture capital project investment security or business valuation involving cash flow. Finance assignmentis used to understand the worth of the project. It is a comprehensive metric and takes into account the capital expenditure expenses as well as revenue in its free cash flow. Additionally, it also takes into account the timing of the cash flows. It has a strong influence on the investment's present value. For instance, it is better to have cash inflows faster and outflows in the later period than the opposite. As per the finance assignmentthe cash flows are discounted in the analysis of net present value for accounting for the time value of money as well as adjusting the risk in the investment proposal (Bogataj and Bogataj, 2019).

The net present value of the proposed investment in the finance assignmentcomes at 75.77 million dollars. This means that the investment has positive present value cash flows. This means that the investment proposal is attractive and has a positive discounted present value of the cash flows of the future. Thus, as per the NPV methods, the proposal can be accepted and will give positive returns in the long term.

• IRR: The internal rate of return mentioned in the finance assignmentis used as an estimation of the profitability of the proposed projects. The metric is a rate of discounting that makes the cash flows of the net present value equal to zero while analyzing of discounted cash flows. In a general sense, the investment is considered to be desirable if the internal rate of return is high. In comparison with the other investment options mentioned in the finance assignment, a higher internal rate of return is chosen (Hazen and Magni, 2021). The IRR is ideal for the analysis of the project of capital budgeting for comparing and understanding the annual return rates over time. The IRR of the proposal comes at 19%. This goes to show that the project can generate profits as it has a 19% annual rate of return as compared to the discounting rate of 12%.

• Accounting rate of return: The formula of ARRin the finance assignmentindicates the rate of return percentage that is expected on an asset or a project compared to the cost of the initial investment. Further, it cannot consider thevalue of money affected by time or cash flows in its calculations. The ARR does not differentiate between investments that yield different cash flows over the project lifetime (Jiko, 2021). The metric is used to determine the profitability of the investment quickly. Unlike other methods of Appraisal of investment mentioned in the finance assignment, the accounting rate of return is not based upon the cash flows but is based upon the profits. Does it gets affected by non-cash and subjective items such as depreciation in the calculation of profits? Also it is found in this finance assignment, it does not take into account the profit timings. The ARR for the new project is 15%. This makes the investment profitable in terms of the accounting rate of return.

Decision: The NPVin the finance assignmentis considered to be the most appropriate technique, which also shows that the investment has prospects of making profits in the future. From the analysis of the above techniques, it can be said that the investment proposal is profitable and can be invested in. It is found in the finance assignmentthat this is because the payback period is less than three years, and the Net present value is also positive. Further, the IRR and ARR also show the profitability of the project.

b) Methods to re-estimate the profitability of the project

For making a re-estimation of the profitability of the project mentioned in the finance assignmentto enter into the marketing of a new type of tyre named, SuperTyre, the company can go for the following methods:

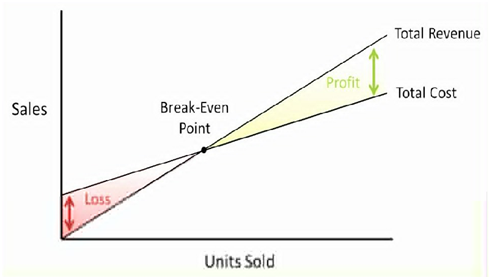

Cost volume profit method analysis is a tool of cost accounting that takes into consideration the effect of the volume and cost levels on the operational profit of the company. It is also known as the break-even analysis in the finance assignment. This is important for companies in taking short-term decisions. The use of CVP analysis can also be in the determination of contribution margin. To make the project profitable, the contribution margin must be more than the total fixed cost. But it must be taken care of in the finance assignmentthat it is a reliable method only at a particular level of production. All the units produced are considered to be sold, and the fixed cost is stable in the analysis of CVP. Also, the changes in expenses occur because of the activity level changes. The CVP analysis in the finance assignmentis used to determine whether there is a justification for the manufacture of the products or not. A target margin is added to the volume of break-even sales arriving at the desired amount of profit. Hence, the maker of decisions can compare the projections of sales with the target volume of sales to understand whether the project is was undertaking or not (Enyi, 2019).

Figure 3: CVP Analysis

Source: Made by the author

The cost volume profitin the finance assignmentincorporates the relationship between the profit revenue and the expenses. The objective of the analysis is to establish the interrelationship between the fluctuation in the volume of activity at a specified level, that is, changes in the sales volume of profit or loss on the financial outcomes the prices are dependent upon several internal and external factors such as the competitive conditions, market demand as well as the policies of the management. The product cost in the finance assignmentis influenced by the efficiency size of the plant, order size, price of the inputs, product, mix, and accounting method. There are no direct proportional changes in the volume and the level of profit. This is because of the outcome of the patterns of cost behaviour. Thus, the CVP analysis is an analytical tool for understanding the relationship between profit prices, cost, and volume and determining the requirement of the volume of sales for achieving the desired level of profit (Bauer and Bauer, 2018).So, this is one of the techniques which can be used for estimating the profitability of the investment in production and marketing, and you tired old super tired by the company. The method of sensitivity analysis in the finance assignmentcan be used to analyze the profitability of the project. It is also known as a water fun analysis technique for predicting the outcome of a specific action. Sensitivity analysishas significant because of its characteristics of improving the prediction of the model. It is a manner of determining different values for the independent variable that can have an impact on the specific dependent variable with the given assumptions. Sensitivity analysis is used for better decision-making. A range of outcomes in the finance assignmentis presented with the use of this analysis. Furthermore, the predictions are more reliable as it provides an in-depth study of the variables. The sensitivity analysis allows the management and identification of the scope of improvement in the future. It also adds credibility to the financial models by testing various possibilities. So it is found in this finance assignment, sensitivity analysis is used not only for understanding the relationship between the input and output variables but also for communicating the outcomes of the analysis. The analysis can also be used for the identification of the optimal strategy changes critical values as well as the break-even point. The sensitivity variables, as well as the assessment, become very easy with the help of sensitivity analysis (Marchioni and Magni, 2018).

In this finance assignment, for re-estimating the profitability of the project, If there is an increase in the market capture by 10% in the market and the replacement market, then the company will start producing more tires for the market. The market capture for the market would amount to 28%, and that of the replacement market would amount to 17 %. Further it is noted in the finance assignment, if the annual growth of prices and variable cost is increased to 5%, then in such a case, the net present value would amount to 144.96, IRR at 24%, ARR 29%, and the payback period at 2.75 years.

Conclusion

It can be concluded from the finance assignmentthat alphabet Inc is a holding company that does not operate on its own but focuses on a provider for its subsidiaries. It has a very efficient corporate governance structure, with its board comprising variouscommittees. Talking about the financial performance of Alphabet from the finance assignment, it can be observed that there has been a surge in the profitability of the firm in the past two years. The company has gained the trust of the equity shareholders. But the company is required to work upon its liquidity position as it is lower than that in the industry. The company is considered to be profitable by the investors, as can be seen in the rising share price. From the finance assignmentanalysis of the capital structure of the company, it can be concluded that it depends highly upon equity. In the case of dividends, it can be observed that the company has never paid dividends but still is popular among the investors. As per the findings from the finance assignmentthe shares of the company are undervalued, and investors can easily purchase the share. In the second part of the assignment, the various techniques of capital budgeting are used for the computation of the profitability of the project SuperTyre. From the analysis, it can be concluded that the net present value is the most appropriate technique for recommending a project for investment as it incorporates the time value of money in its computation method. Further it is noted in this finance assignment, other techniques for the estimation of profitability like the cost volume profit analysis and sensitivity analysis also give an understanding of the project profitability.

References

Analytics, I., 2022. Alphabet Inc.: Risk analysis (GOOGL | USA | Internet) - Infront Analytics. [online] Infrontanalytics.com. Available at:

Bauer, K. and Bauer, M., 2018. Possibilities to control the volume of production in CVP analysis: an example of companies providing taxi services in finance assignment. In The 6th International Scientific Conference IFRS: Global Rules and Local Use (trang 296-308). Prague:

BibliotekaPolitechnikiKrakowskiej. http://suw. biblos. pk. edu. pl/browseByAuthor&db= BPP.https://www.researchgate.net/profile/Kinga-Bauer/publication/329950452_POSSIBILITIES_TO_CONTROL_VOLUME_OF_PRODUCTION_IN_CVP_

ANALYSIS_AN_EXAMPLE_OF_COMPANIES_PROVIDING_TAXI_SERVICES/links/5c2546e292851c22a349700e

/POSSIBILITIES-TO-CONTROL-VOLUME-OF-PRODUCTION-IN-CVP-ANALYSIS-AN-EXAMPLE-OF-COMPANIES-PROVIDING-TAXI-SERVICES.pdf

Bogataj, D. and Bogataj, M., 2019. NPV approach to material requirements planning theory–a 50-year review of these research achievements. International Journal of Production Research, 57(15-16), pp.5137-5153.https://www.tandfonline.com/doi/abs/10.1080/00207543.2018.1524167

Bunga, O.P. and Muazaroh, M., 2022. The Effect of Liquidity Ratio, Asset Quality Ratio, Sensitivity Ratio, Capital Ratio, and Efficiency Ratio Towards Return On Asset (ROA) on Foreign Exchange National Private Commercial Banks.http://eprints.perbanas.ac.id/9266/1/171%20-%20174%20Oppi%20Putri%20Bunga_%20Muazaroh.pdf

Carr, C. and Hesse, M., 2020. When Alphabet Inc. plans Toronto’s Waterfront: New post-political modes of urban governance in finance assignment. Urban Planning, 5(1), pp.69-83.https://www.cogitatiopress.com/urbanplanning/article/viewFile/2519/2519

Dowling, M., O’gorman, C., Puncheva, P., and Vanwalleghem, D., 2019. Trust and SME attitudes towards equity financing across Europe. Journal of World Business, 54(6), p.101003.https://www.sciencedirect.com/science/article/am/pii/S1090951618302438

Driver, C., Grosman, A. and Scaramozzino, P., 2020. Dividend policy and investor pressure in finance assignment. Economic Modelling, 89, pp.559-576.https://www.sciencedirect.com/science/article/pii/S0264999318309623

Enyi, E.P., 2019. Joint Products CVP Analysis–Time for Methodical Review. Journal of Economics and Business, 2(4).https://www.academia.edu/download/61407738/JointProducts-CVP-new20191203-7209-sxete0.pdf

Finance.yahoo.com. 2022. Yahoo is part of the Yahoo family of brands. [online] Available at:

Gorshkov, A.S., Vatin, N.I., Rymkevich, P.P. and Kydrevich, O.O., 2018. Payback period of investments in energy saving. Magazine of Civil Engineering, (2 (78)), pp.65-75.https://cyberleninka.ru/article/n/payback-period-of-investments-in-energy-saving

Hazen, G. and Magni, C.A., 2021. Average internal rate of return for risky finance assignmentprojects. The Engineering Economist, 66(2), pp.90-120.https://www.researchgate.net/profile/Gordon-Hazen/publication/351542487_Average_internal_rate_of_return_for_risky_projects/links/60ec5c390859

317dbdd906df/Average-internal-rate-of-return-for-risky-projects.pdf

Irman, M. and Purwati, A.A., 2020. Analysis on the influence of current ratio, debt to equity ratio and total asset turnover toward return on assets on the otomotive and component company that has been registered in Indonesia Stock Exchange Within 2011-2017. International Journal of Economics Development Research (IJEDR), 1(1), pp.36-44.https://www.yrpipku.com/journal/index.php/ijedr/article/download/26/11

Jiko, M.S., 2021. Evaluation of Management Accounting Practices of MI Cement Company Limited: A Case Study on finance assignment. Evaluation, 13(18).https://www.researchgate.net/profile/Shahnewas-Jiko/publication/355162383_Evaluation_of_Management_Accounting_Practices_of_MI_Cement_Company_

Limited_A_Case_Study/links/616144d71eb5da761e67ea6b/Evaluation-of-Management-Accounting-Practices-of-MI-Cement-Company-Limited-A-Case-Study.pdf

Kadim, A., Sunardi, N. and Husain, T., 2020. The modeling firm's value based on financial ratios, intellectual capital and dividend policy. Accounting, 6(5), pp.859-870.http://m.growingscience.com/ac/Vol6/ac_2020_48.pdf

Marchioni, A. and Magni, C.A., 2018. Investment decisions and sensitivity analysis in finance assignment: NPV-consistency of rates of return. European Journal of Operational Research, 268(1), pp.361-372.https://iris.unimore.it/bitstream/11380/1239477/2/POST%20PRINT_Investment%20decisions%20and%

20sensitivity%20analysis.pdf

Mulaydinov, F., 2021. Digital Economy Is A Guarantee Of Government And Society Development. Ilkogretim Online, 20(3), pp.1474-1479.https://www.ilkogretim-online.org/fulltext/218-1612853896.pdf

Nariswari, T.N. and Nugraha, N.M., 2020. Profit growth in finance assignment: impact of net profit margin, gross profit margin and total assests turnover. International Journal of Finance & Banking Studies (2147-4486), 9(4), pp.87-96.https://www.ssbfnet.com/ojs/index.php/ijfbs/article/download/937/712

Nuryani, Y. and Sunarsi, D., 2020. The Effect of Current Ratio and Debt to Equity Ratio on Deviding Growth. JASa (JurnalAkuntansi, Audit dan SistemInformasiAkuntansi), 4(2), pp.304-312.https://journalfeb.unla.ac.id/index.php/jasa/article/download/1378/885

Orji, A., EO, N. and Agubata, N., A finance assignmenton Effect of Debt-Equity Financing on Firms Performance in Nigeria.https://www.iiardjournals.org/get/JAFM/VOL.%207%20NO.%203%202021/EFFECT%20OF%20DEBT-EQUITY%20FINANCING.pdf

Pattiruhu, J.R. and Paais, M., 2020. Effect of liquidity, profitability, leverage, and firm size on dividend policy. The Journal of Asian Finance, Economics and Business, 7(10), pp.35-42.https://www.koreascience.or.kr/article/JAKO202029062616211.pdf

Pavel, Z., 2018. The impact of cash flows and weighted average cost of capital to enterprise value in the oil and gas sector. Journal of Reviews on Global Economics, 7, pp.138-145.https://mail.lifescienceglobal.com/pms/index.php/jrge/article/view/5282/2964

Siagian, A.O., Wijoyo, H. and Cahyono, Y., 2021, March. The Effect of Debt to Asset Ratio, Return on Equity, and Current Ratio on Stock Prices of Pharmaceutical Companies Listed on the Indonesia Stock Exchange 2016-2019 Period in finance assignment. In Journal of World Conference (JWC).https://proceedings.worldconference.id/index.php/prd/article/download/366/171

Syarifah, S., 2021. Effect of Earnings Management, Liquidity Ratio, Solvency Ratio and Ratio Profitability of Bond Ratings in Manufacturing:(Case Study Sub-Sector Property and Real Estate Sector Companies listed on the Indonesia Stock Exchange (IDX)). International Journal of Business, Economics, and Social Development, 2(2), pp.89-97.https://journal.rescollacomm.com/index.php/ijbesd/article/download/144/128

Vayas-Ortega, G., Soguero-Ruiz, C., Rojo-Álvarez, J.L. and Gimeno-Blanes, F.J., 2020. On the differential analysis of enterprise valuation methods as a guideline for unlisted companies finance assignmentassessment (I): Empowering discounted cash flow valuation. Applied Sciences, 10(17), p.5875.https://www.mdpi.com/2076-3417/10/17/5875/htm

Appendix of the finance assignment

|

2021A |

2022E |

2023E |

2024E |

2025E |

2026E |

|

|

FCF |

$ 67,012.00 |

$ 78,444.25 |

$ 91,826.84 |

$ 1,07,492.49 |

$ 1,25,830.71 |

$ 1,47,297.43 |

|

Growth rate |

17.06% |

17.06% |

17.06% |

17.06% |

17.06% |

|

|

Terminal value |

$ 23,59,060.45 |

|||||

|

Total |

$ 67,012.00 |

$ 78,444.25 |

$ 91,826.84 |

$ 1,07,492.49 |

$ 1,25,830.71 |

$ 25,06,357.89 |