Critical evaluation of the capital structure of Burberry in the finance assignment

Question

Task: State whether the capital structure of Burberry is aligned with its strategic goals. Critically analyze the financial performance of the organization in your finance assignment.

Answer

Evaluation of the capital structure in the finance assignment

Burberry comprises of a capital allocation framework that have a major bearing on the utilization of cash and at the same time maintain an appropriate capital structure for the business. The cash as per the finance assignmentis utilized for the purpose of reinvestment for the organic growth. Furthermore, the company pays a progressive dividend and investment is made in strategic initiatives. The excess cash is returned to the shareholder depending on the target leveraged ration that is underpinned by the maintenance of a strong credit rating grade (Burberry 2021).

(Burberry 2021)

According to the finance assignmentdebt helps the business until the businesses have an issue in discharging the obligation withers with the new capital of the free cash flow. If things go bad, the lender will take control of the business. Debt can be an important tool when it comes to businesses mainly when it is capital intensive business. While evaluating the companys use of debt the initial point of consideration is the cash and debt together.

The present balance sheet in the finance assignmentprojects that Burberry contained liabilities amounting to UK£702.8m due within the year and liabilities amounting to UK£1.24b due after that. When the obligations are offset the cash would be UK£1.26b and the receivables will be UK£277.0m due within 12 month (Burberry 2021). Hence, total liabilities will total UK£404.2m which will be more than the cash and near-term receivables in total.Though Burberry Group contains a strong market capitalization of UK£8.32b as per the finance assignmenthence these liabilities can be managed easily. However, just by looking at the balance sheet the same cannot be commented because it changes with the due passage of time (Yahoo finance 2021). The group has more cash as compared to debt hence the debts can be managed easily.

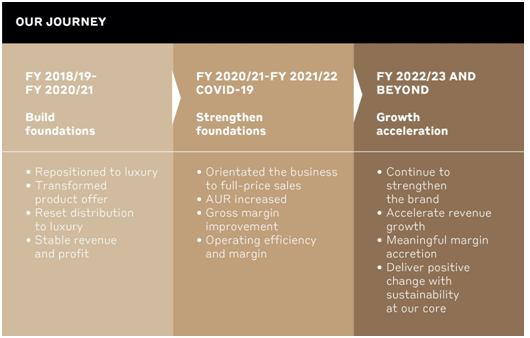

The capital structure of the company as per the finance assignmentis aligned with the strategic goals of the company. The strategic goal of the company is to elevate Burberry to a commendable position. Thereby, the company has ensured higher leveraged position because such a position brings leads to betterment in the growth followed by the attainment of the goals, For attaining a commendable position in the market Burberry need funds and the funds cannot be equity always thereby the resort to debt will help the company (Yahoo finance 2021). However, debt should be sufficient and must be used in a proportionate manner. A perfect blend of equity and debt helps the company to create a better capital structure (Atril 2014). Such a capital structure leads to better return and is less risky. The investors and other related parties are as per the finance assignmentinterested in those organizations that have a optimum capital structure. Moreover, the group witnessed a drop in the EBIT by 5.4% in the past 12 months. If the earnings continue to drop in the similar rate then the company will face difficulties in management of the debt load. The debt level can be evaluated with the help of the balance sheet but the profitability will be decided if the company can strengthen the balance sheet over a period of time. The company can meet the debt with the hard cash and not the accounting profits as per the finance assignment. Though Burberry has net cash on the balance sheet, it is still important to check whether the company will be able to convert the EBIT to free cash flow that will enables proper understanding of the building or eroding of the cash balance. In the past three years Burberry group provided a free cash flow amounting to 84% of the EBIT and hence it puts the company in a strong position when it comes to the payment of debt. Repayment of the debt as per the finance assignmentis an essential criteria and if the same is observed it is well shown that Burberry does not have any signs of difficulty while repaying the debt. The cash flow of the company is strong and hence the performance of the company will remain undisturbed.

In the year 2021 as per the finance assignment, Burberry has a debt ratio of 56% while the equity ratio stands at 44%. This means that the company is utilizing more of debt as compared to equity. A high debt ratio indicates higher level of risk which indicates the business has undertaken large amount of risk. A debt ratio above 50% indicates that the company is highly leveraged which signals maximum of the assets are financed with the aid of debt and not equity. Gearing enables to boost the performance of the company. Gearing as per the finance assignmentgenerates higher level of return from investment as compared to the cost of financing the debt (Carlon 2019). Higher level of gearing brings potential return but if the performance of the assets becomes poor it can drag the performance with a burden of interest that goes ahead of the portfolio return (Sherman 2015). Hence, if Burberry assets performance becomes weak it will fail to create the desired return. During the past three years as per the finance assignmentthe free cash flow of Burberry amounted to 96% of the EBIT and that puts the company in a strong position to repay the debt.

During the last five years in terms of share price growth, Burberry Group attained compound EPS growth of 15% every year. The growth in the EPS as per the finance assignmentis more impressive as compared to the yearly share price of 3% over the same tenure. Burberry group shareholders attained a return of 10% during the year however was short of the market average. The gain was better as compared to the average annual of 5% during the past 5 years. The return will significantly improve with the fundamentals of the business (Mersland &Urgeghe 2015). There are different factors that can impact the share price however other factors too play a dominating role. Hence it can be said in the finance assignment, Burberry evaluates the risk and return prudently so that the business can accelerate and the stakeholders can get desired return. As per the overall discussion, it is noted that Burberry is properly structured and the cash flow is adequate for repaying the liabilities.

Evaluation of the financial performance

Burberry keeps records of different financial statements and books of accounts for tracking the financial performance. The main financial statement as per the finance assignmentis the balance sheet, P/L account which is also known as the income statement and the cash flow statement. Coming to the revenue growth of the company it provides a general assessment of the Burberry brand to the customers through the sales channel. The FY 2021 revenue enhanced by 23% and the comparable sales increased by 18% due to the improvement in the sales mix in the current year and the influence of Covid-19 on the trading aspect (Burberry 2021).

The adjusted profit margin enhanced by 160 bps due to the enhanced gross margin and the leverage from the growth in the revenue that in excess of operating cost growth. On the other hand, adjusted diluted increased by 40% on a yearly basis due to the enhancement in the adjusted operating profit. Moreover, the adjusted ROIC increased to 24.6% and was due to the increment in the adjusted operating profit. However, the average operating assets declined by 5%. The gross margin of the company in both the years 2020 and 2021 standard at 71% as per the finance assignmenthowever, it needs to be noted that sales of the company in the year 2021 has increased (Yahoo finance 2021). Though there was an increment yet the company failed to produce any increment in the ratio. The net profit ratio of the company declined in the year 2021 which dropped to 14% as compared to 16% in 2020. The decline in the ratio was owing to the increment in the net finance expenses that led to the change. Moreover, the current ratio of the company is 2.53:1 in 2021 meaning the company consists of sufficient current assets for meeting the obligations. However, having a current ratio of 2.53:1 devoid company of returns because huge funds are locked up in inventory and the company could have invested elsewhere for generating the returns (Yahoo finance 2021). Thereby it can be said in the finance assignment, Burberry need to invest the funds elsewhere for generating returns as the company is loosing opportunities in this case.

The Board is well versed with the fact that the obligation towards the stakeholders will lead to betterment of the company. The major stakeholders of the company as per the finance assignmentare people, customers, shareholders, communities, partners and government.

People: The people here refer to the employee of the company which are the greatest assets of the company. The company polices are such that it helps the employee to build a good career with Burberry. The finance assignment also takes into consideration about the wellbeing and personal life of the employee and flexible working of the employee for better work life balance. The company has maintained well grievance addressal and regular interaction with its employee for better understanding the needs of the employee. The management has organized many training tools and B-learning for regular updates and development of employee and to improve operational efficiency (Burberry 2021). Herein the finance assignment, the company ensures that the adequate attention is being provided for the overall benefit of the employee.

Customer: There are diversified customers of the company across the world and the company focus on production innovation and newness in its product to better serve the customer desire and needs. The company as per the finance assignmenthad huge focus on customer service by understanding the needs and requirement of the customer and provides a better experience to the customer (Burberry 2021). The company also has high focus on building brand and also considers environmental and social impact for the wellness of the society as a whole

Shareholders: The Companyfocuses on growth of the company and profitability of the company which in turn will provide capital appreciation on the investment made by the shareholder (called capital appreciation) and also provide dividend from the profit earned so that the company get the return from investment as desired. The shareholder as per the finance assignmentexpects best people managing the board, thus shareholder expect best management running the business for brighter future of the company.

Communities in finance assignment: The Companyfocuseson the business of the impact of the environmental and social factors. The company grow and make business but on the stake of the environmental and social factor but make a positive working environment and assess the impact of the business on environment and social factor and make efforts to reduce to acceptable level (Burberry 2021). The company as per the finance assignmentalso focuses on increasing employee in the society in which it is located to increase employment. Thereby, the company has provided adequate attention for the benefit of the community as a whole. Proper consideration of the community helps in creating a better society and the fuller development of the company

Partner: The company partner includes their supplies, companies, NGOs, Civil society group and retail third parties. The company has collaborated with different NGOs and contributing to the United Nation SDGs. The company has run various Covid-19 relief support for the welfare of the employee and its family member and also extent the support to the people of the society by running vaccine drive, medical and food support to the people in need (Burberry 2021). The company as per the finance assignmenthas increased focus on Environment and social governance and compliance of the same.

Government: The Company adheres to the rules and laws laid by the local government in which the company is running business such as employment laws, trade and other laws. The company pays its duties and taxes on timely basis. The company gets engaged with the government to understand the concern on Environment & Social factor and to adhere the risk associate in it.

Hence, it is observed in this finance assignmentthat the company was able to meet the expectation of the stakeholder by adhering to different regulations. Moreover, the fundamentals of the company is strong and year 2021 provided strong return for the company as a whole.

Recommendations for improvement in the finance assignment

One of the major issuesaccording to the finance assignmentwas the debt to equity wherein the company has higher proportion of debt in comparison to equity. This was reducing the profit of the company. The best mechanism that the company can undertake to reduce debt to equity is by way of increment of the sales revenue and thereby will impact profit. This is done by way of raising prices, increment in sales, and reduction of cost. The extra cash generated can thereby be used for the payment of the debt that is existing.

Restructuring of debt as per the finance assignmentcan be done for the reduction in the debt to equity ratio. If the company is facing huge interest on loans and the current interest rates are lower then the company can vouch to refinance the debt that is existing. This will enable reduction of both interest expenses and the payment in monthly mode improving the profitability of the company and the cash flow and increasing the capital stores. Another mechanism that can be followed for reduction of the debt to capital ratio is the effective management of inventory. Inventory comprise of a great portion of the working capital of the company. Maintenance of irrelevant level of inventory beyond what is required by customer is a waste of cash flow as per the finance assignment. Herein, it is observed that the company is having high current asset which means the company has higher level of funds locked in inventory. In this scenario, the company needs to keep adequate stock level and the same can be dealt by the company. The current ratio of the company is high which not a good indicator is. In this scenario the company is not being able to utilize the current assets or the short term financing facilities in an efficient manner. It is thereby recommended that the company should reduce the current ratio by increasing the current liabilities. Hence, Burberry can increase the short terms loans proportion as compared to the long term obligations. This will help the company to focus on the short term obligations thereby will change the current ratio. Higher level of current assets should be offset by higher current liabilities.

The recommendation mentioned in the finance assignmentwill enable the company in having a better composition of debt and equity. This will enable better allocation of funds and hence the company will need to pay lower interest rate. This will ultimately boost up the profit as profit wont be hampered in the payment of the interest. Moreover, a company with a lower level of debt gets priority when it comes to the bank loan. Overall, it is best recommended in this finance assignmentfor Burberry to look after the debt composition and to reduce the current ratio for better functioning.

References

Atril, P 2014, Financial Ratios. In: Financial Management for Decision Makers in finance assignment. Pearson Education Limited

Burberry 2021, Burberry 2021 annual report & accounts, viewed 17 July 2022 https://www.burberryplc.com/en/investors/annual-report-21-22.html

Carlon, S 2019, Financial accounting: reporting, analysis and decision making,. 6th ed. Milton, QLD John Wiley and Sons Australia, Ltd, https://eprints.qut.edu.au/125138/

Mersland, R., & Urgeghe, L 2013, International Debt Financing and Performance of Microfinance Institutions, Strategic Change, vol. 22, pp. 36-47

Sherman, E 2015, A manager's guide to financial analysis in finance assignment : Powerful tools for analyzing the numbers and making the best decisions for your business (6th ed) Ama Self-Study

Yahoo finance 2021, Is Burberry Group (LON:BRBY) Using Too Much Debt, viewed 17 July 2022 https://uk.finance.yahoo.com/news/

burberry-group-lon-brby-using-004624442.html#:~:text=What%20Is%20Burberry%20Group's%20Debt,%C2%A3918.8m%20net%20cash