Finance Assignment: Risk and Return Analysis in Corporate Finance

Question

Task: Each group needs to select a topic of interest from section 2.5 of the subject outline. Topics are listed below and explanation of the selected topic.

Presentation topics:

(a) The Finance and financial systems

(b) Time value of money

(C) Risk and return

(d) Bond valuation

(e) Share valuation

(f) Capital budgeting

(g) Cost of capital

(h) Capital rising and Dividend policy

(i) Capital Structure

In youransweryou should explain and analyse howthe topic you choose Is applied in finance an organisation. Provide examples where possible to demonstrate your understanding.

Answer

Introduction to Risk and Return

Every opportunity in finance is accompanied by a certain amount of risk, after which the return has to be identified.

Risk is the condition of variable returns that are associated with a given financial investment. Risk, along with the return, is a major factor that influences our capital budgeting decisions(CHEN, 2019)

For example, for an investment of $100, the risk would mean the maximum loss and gain the capacity of the investor, and return would mean the minimum extra the investment will get. No investment is complete without proper risk assessment and understanding of the risk will be large, small or medium, and will it be worth the return obtained on the investment or not.

It is the general rule of thumb that as much greater is the risk in an investment, the subsequent return for that investment will be great as well. For example, if an investor is risk-averse, he or she may invest in the safest investment possible but it is highly to give low returns. However, for a risk-prone investor, the investment chosen will come with a huge risk, and thus, with a huge return. However, chances of losing are also a lot for such investors.

Risk and its Components

Risk is of two types: systematic risk and non-systematic risk.

• Systematic Risk: it is the risk component associated with the opportunity/assetinvested in

• Unsystematic risk: it is the risk possessed by the industry of the asset we invest in(CFI, 2020)

Risk is essential in investment as it is the defining factor of the gain or loss that the individual investor may have to go through. The investor needs to assess these respective risk components before investing. Both these risks are always at play when an investment is being made, and neither of these risks can be avoided at any cost; these types of risks can only be managed.

These different types of risks are to be taken into account by a firm when making a financial decision. All these risks are different, however, they ultimately impact the profit-making of the company/individual and hence, require a lot of pre-assessment and risk management prior and after the investment is made.

Risk Aversion

Usually, the risk appetite of an investor can be defined in three ways:

• Risk-averse: an investor or an organization which is scared of losses and hence, will not take a risk ever. They are usually happy with low returns than lose all their money

• Risk neutral: these individuals or organizations are neutral ie, they may or may not like/prefer taking the risk. It solely depends on their capacity and appetite. They have no fixed thought process

• Risk Loving: risk-loving or risk-seeking organizations or individuals take high-risk investment and are not scared to lose big (ET, 2017)

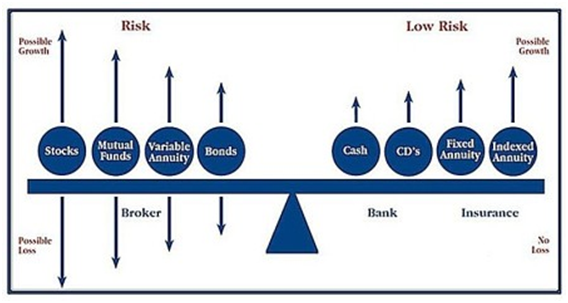

Fig 1: Investment Instruments and Risk Types

In this figure, we can see that different investment instruments have different risk level associated with them. They are classified as high risk or low-risk instruments. While investing, the investor needs to look for the risk and subsequent return and decide if he/she can afford the risk or not. When a firm makes an investment, its first priority is to at least recover the investment (considering inflation) in cases if the losses are conceived.

Risk-Return Spectrum

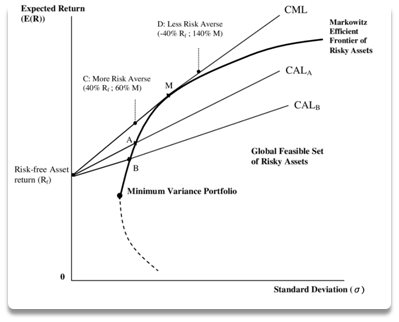

Fig 2: Risk-Return Spectrum

This risk and return trade-off are also known as the risk-return spectrum. Every investment has its strength and weakness, and they are all relative to each other. this graph tells us the risk strength concerning the beta function of the market (or the investment). This graph works on the efficient market hypothesis. Here we can see how with an increase in risk, the expected return increases as well(PIMCO, 2018)

Here, another important aspect or parameter to take into consideration is the beta.The beta coefficient is an important term as it indicates the return sensitivity of an investment about its risk.

In simple words, the beta assesses the how correlated and volatile the asset iswith respect t the volatility of the benchmark that said asset is being compared to. The benchmarks are often set by the industry itself as they help in levelling the playing field to determine the best returns possible for a particular investment opportunity, given all the conditions remain constant. Investment with high beta is more volatile than investments with lower beta.

Diversification and Risk

Diversification in investment is important. For example, if all the investment is made in risk-free asset, the returns will be very low. And if all the money is put into risky assets, any loss incurred will be huge. Hence a balanced portfolio is the best. Diversification helps in balancing the portfolio so that the loss in one can be compensated by the gain in other. it is essential to understand market volatility to ensure that the investment is managed in the right manner without hampering the situation.

While assessing the risk in an investment, it is important to note the following:

• Risk and return have a high correlation

• It is important for the organization/individual to properly understand the market and subsequent investment opportunities before investing

• All investment returns are a function of the risk they possess; higher the risk, higher the return

• If an investment has a default risk, the risk is assessed by the notion that the investment may not be recovered at all

• It is in the best interest of the investor to always diversify their investment and have a good blend of risk-free and risky assets for optimized returns

References

CHEN, J. (2019). Risk-Return Tradeoff. Retrieved from https://www.investopedia.com/terms/r/riskreturntradeoff.asp

CFI. (2020). Risk and Return A highly correlated relationship. Retrieved from https://corporatefinanceinstitute.com/resources/knowledge/trading-investing/risk-and-return/

PIMCO. (2018). Risk-Return Spectrum. Retrieved from https://www.pimco.com/en-us/resources/education/stepping-up-the-risk-reward-spectrum

ET. (2017). Definition of 'Risk Averse'. Retrieved from https://economictimes.indiatimes.com/definition/risk-averse