Compliance with AASB Standards in JB Hi-Fi Limited Method of Depreciation: Improving Relevance and Authenticity of Financial Reports

Question

Task: You are required to verify the accounting standards of JB Hi-Fi. Evaluate the JB Hi-Filimited method of depreciation. State how it is following the guidelines of AASB.

Answer

Introduction

Selecting and altering an organization's accounting policy is the most crucial aspect of following accounting standards and professional judgment. Both have to work in conjunction to deliver a quality financial report.In this assignment, the JB Hi-Fi limited method of depreciation will be evaluated. Its policies related to property, plant, and equipment (PP&E) will be discussed here, along with its strengths and weakness. The consequences of using professional judgment will be highlighted in this assignment on JB Hi-Fi limited method of depreciation.

Peeping at JB Hi-Fi limited method of depreciation

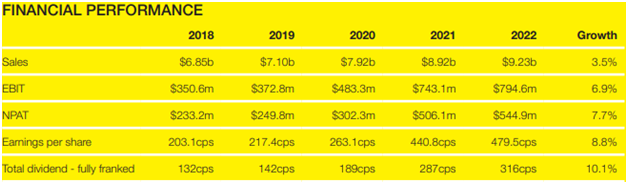

The Melbourne-based electronics retailing company was established in 1974, and since then, it has expanded across Australia and New Zealand.The rapid expansion in its operations has enlarged in the past few years.The company is famous for its specialization in personal electronic items and home appliances. In August 2018, the company was ranked as the 7th biggest retailer globally.Being a large company, JB Hi-Filimited must use professional judgments while making its financial reports.The following table in the JB Hi-Fi limited method of depreciation is taken from the annual report 2022 and is a witness to the company's growth over the last five years.The figures under different financial heads are a testament to the company's success.

Figure 1: Financial performance of JB Hi-Fi

The assignment concerning JB Hi-Fi limited method of depreciation further delves into verifying the policies related to PP&E. It will also analyze the impact of professional judgments on the company's accounting policies.

Choosing and amending policies as per AASB

Choosing policies

As per the JB Hi-Fi limited method of depreciation findings, AASB 108 has mentioned the guidelines to be considered by an entity while making amendments or changing its accounting policies.The entity is anticipated to follow the guidelines mentioned in AASB 108 unless there is no effect, and in such situations, the entity may disregard the specific standard. Nevertheless, standard 108 of the AASB refuses to use this reason to aid entities in acquiring any representation of their financial statements. The management has to decide on how to treat a policy when it is not applyingto any standard in a situation. While taking a decision, the management should consider similar cases that previously occurred internally and in otherstandard-setting boards. As per the JB Hi-Fi limited method of depreciation findings, management must be motivated to consider the measurement and recognition criteria of pertinent accounts according to the conceptual framework.The set policies are anticipated to endorse certain yardsticks basis the information produced by it.

Additional information on choosing policies

Each AASB standard mentions the degree of guidance it should provide, and in certain cases, it forms an integral part of the accounting policy.Some of the standards are mandatory and are required to be used.For example, paragraph 13 of the ASSB 108 specifies that an entity must comply with consistent accounting policies when facing similar events, transactions or conditions. Exceptions to this can be made only if prescribed in the specific standard.

Amending current accounting policies

Changes in the current accounting policy of an entity can only be made when AASB has permitted it to do so.Such changes may only occur if the resultant proves to be a relevant and reliable representation of the financial positioning of the entity.

Impact of professional judgment on accounting policies

An individual's professional judgment provides the necessary inputs for developing an accounting policy for an entity.The individual exerts their expertise about certain events making it one of the vital factors while creating a policy.

As per the JB Hi-Fi limited method of depreciation findings, making decisions under various circumstances will lead to several answers; hence, professional judgments help in comparing the changing conditions.It has been reported that professional judgment is more useful when transactions and events go hand in hand with incomplete standards and ambiguous situations.

Summarizing the accounting policy of JB Hi-Fi

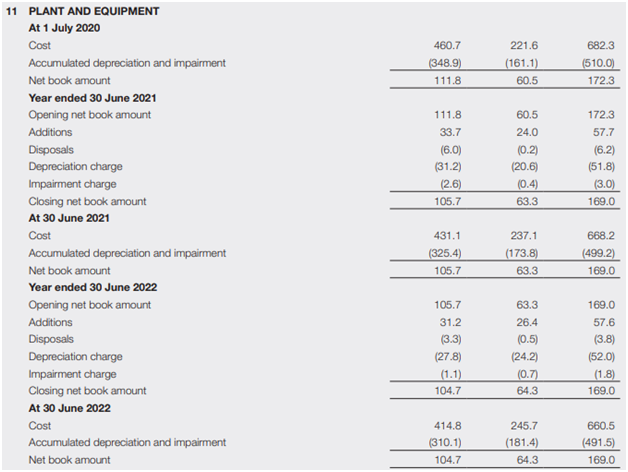

The company's directors and auditors have clearly stated in their annual financial report that it adheres to the standards mentioned in the AASB, IFRS and the Corporation Act 2001.Therefore, the annual financial report represents a true and fair representation of its financial position for the year ended 30 June 2022. The property, plant, and equipment (PP&E) figures of the company can be found in the below table mentioned in the JB Hi-Fi limited method of depreciation.

Figure 2: Plant and Equipment in 2020, 2021, and 2022

Estimating values

As per AASB standard 116 (15), the cost of PP&E is an expense related to asset acquisition. Therefore, when adhering to the cost model rules laid down in the AASB standard 116 (30), objects of PP&E are assessed at their cost, deducting any retained depreciation and impairment loss.

Handling depreciation

The expenditure involved in depreciation is estimated on a straight-line method using an approximate functional life of 1.5 to 15 years.At the end of the financial year, the approximate functional life, depreciation method and residual value are assessed for making vital changes per AASB 108, AASB 116 (51) and AASB 116 (60).According to the findings in the JB Hi-Fi limited method of depreciation, if the entity decides to make any changes in its policies, then the same is applied to all the succeeding financial reports.

Handling impairment

The impairment test iscarried out when the carrying amount of the PP&E objects is adjudged irrecoverable.As per the JB Hi-Fi limited method of depreciation findings, the impairment loss is calculated by deducting the recoverable amount of the assets from its carrying amount.To determine the impairment, assets are placed at lower costs. It is done as cash flows are autonomous and can be identified from other assets generating cash.

Handling derecognition

Derecognition is the elimination of all or a portion of a former recognized asset or liability from the financial statement by an entity.It occurs when the prospective benefits from an asset become nil. The gain or loss upon disposing of the asset is determined by the difference in the sale income and carrying value of the PP&E.The entry is made under the other expenses in the profit and loss statement. AASB standard 116 paragraphs 67 and 68 deal with these types of incomes.

Evaluating the accounting policies of JB Hi-Fi

Depreciation

The straight-line method helps in predicting and estimating depreciation without any difficulty. But the method disregards the real consumption of an asset during the beginning of its useful life. Therefore, the asset consumes more value during its starting days. The drawbacks of this method cannot take away its consistency and convenience.

Estimated useful life

As previously discussed in this assignment on the JB Hi-Fi limited method of depreciation, the approximate functional life is 1.5 to 15 years. But as per IRS 35 (6) (10), 2 to 10 years is the equipment's estimated useful life. The growing useful life of equipment leads to cutting down depreciation annually. It adds temporary value to the assets and displays an engaging image to the investors.The disparity can be explained with the help of the differences in the type of PP&E in possession of the entity.Hence, the agreement to increase the equipment's estimated useful life may be considered reasonable and correct as it was done to boost the financial report.

Impairment

As per the accounting policies of JB Hi-Fi, testing takes place when it is confirmed that the carrying amount may not be recoverable.Therefore, the assumption of JB Hi-Fi defies the guidelines mentioned in the AASB standard 136 (9), which directs entities to evaluate and specify any impairment at the end of each financial year.It is found from the JB Hi-Fi limited method of depreciation that Harvey Norman, a competitor of JB Hi-Fi, had disclosed the valuation checks performed in its 2018 annual financial report.

JB Hi-Fi had mentioned that its assets are arranged at the lowest classes, which may combine the low-cost expenses.Therefore, the information enhances the reporting capability and seems reasonable. Hence, it can be said that the approach of JB Hi-Fi is reasonable, but its ignorance of the AASB guidelines is inappropriate.

Disposal

As per the JB Hi-Fi limited method of depreciation, the present derecognition of the company for PP&E allows it to maximize the utilization of the assets.Carrying PP&E for longer enhances the reported level of assets and positively impacts the financial reports.Therefore, the disposal policy of JB Hi-Fi is logical, and it adheres to the AASB standards, so it can be deduced that the policy is appropriate and reasonable.

Recommendations

JB Hi-Fi adheres to both AASB and IFRS standards in its accounting policies, but there are a few differences which can be drawn from both documents. The difference is clearly seen in the treatment of impairment.The company may reconsider its decision related to impairment tests and may conduct them annually.It is found from the JB Hi-Fi limited method of depreciation that the company should have a detailed disclosure in its financial reports. It should use methods such as equipment table or total plant for disclosures. It should also mention how it has calculated the estimated useful life for the equipment.

Conclusion

By reviewing the JB Hi-Fi limited method of depreciation, it can be said that the company employs a solid professional judgment in auditing and framing accounting policies related to PP&E. There is a high correspondence in the treatment depreciation and disposal with the reporting standards of AASB and IFRS. But we can find some alterations in accounting for impairment and estimated useful life.

Bibliography

Aasb.gov.au (n.d).Accounting Policies, Changes in Accounting Estimates and Errors. https://www.aasb.gov.au/admin/file/content105/c9/AASB108_07-04_COMPapr07_07-07.pdf

Aasb.gov.au (n.d).Australian Accounting Standards Board.https://aasb.gov.au/

Aasb.gov.au (n.d).Property, Plant and Equipment.https://www.aasb.gov.au/admin/file/content105/c9/AASB116_08-15_COMPdec16_01-19.pdf

Gao, P and Zhang, G (2019). Auditing Standards, Professional Judgment, and Audit Quality.American Accounting Association, 94 (6).

Investors.jbhifi.com.au (2022).JB HI-FI Annual Report.https://investors.jbhifi.com.au/wp-content/uploads/2022/09/Annual-Report-2022-with-Chairmans-CEOs-Report.pdf

Ivannikov, I and Dollery, B (2o20).Accounting Problems in Infrastructure Asset Valuation and Depreciation in New South Wales Local Government.Australian Accounting Review, 30 (2).

Jbhifi.com.au (n.d).About us.https://www.jbhifi.com.au/pages/about-us

Frequently asked questions

1. What are the three useful methods of depreciation?

The three useful depreciation methods are the straight-line method, the write-down value method, and the units of production method.

2. What is the JB Hi-Fi limited method of depreciation?

JB Hi-Fi uses a straight-line method to estimate its depreciation.

3. What is impairment, and state an example?

Impairment is the gradual reduction of the value of an asset possessed by an entity. For example, heavy equipment, buildings, computer hardware, etc., can be cited as examples of impairedassets.