Financial Decision Making Assignment Focusing On The How Financial Decision Must Be Made By Organisation Heads

Question

Task: how can organisation heads use financial decision making assignment to determine the most appropriate strategies to make financial related decisions?

Answer

Task 1

Part 1.1: Accounting and Finance departments

This financial decision making assignmentidentified that financial accounting and financial functions have become an essential part of Modern day business activities. A detailed understanding of the importance of accounting and finance in functions will be discussed.

1. Accounting department:

a) Financial accounting function

The accounting and finance function is majorly related to accounting related transactions of the monetary transactions operating within an organisation as per research performed during this financial decision making assignment. The management can prepare present and take informative information from the statements prepared. With the help of accounting, the management will navigate into the business and it’s prospective to make performance assessments, taking adequate information regarding the company's performance, considering the needs of the business and analyses the profitability, liquidity and other relevant measures as per need.

Financial decision making assignment: financial records

One of the basic job roles of the Accountants of the financial managers of the organisation is to prepare the financial report And keep the records relating to the presentation, such as inventory bookkeeping, receivable bookkeeping, payment summary, cash ledger and other valuable business-related data. In addition, for the statutory Record Keeping of the financial transactions, the companies will be required to keep the organisation's financial records as for the relevant accounting standards within a particular format (Ganyam and Ivungu, 2019)

This financial decision making assignment also identifies that the external users of the financial statement say the investors, customers, suppliers and others do not have access to the organisational activities of their code to perform any decision regarding the business or investment,

Analysing performance

Besides the qualitative performance measure, the company will be required to conduct a qualitative

financial analysis which will include the financial factors as the performance indicators for the company.

For instance, using a performance measurement by comparing the revenue generated by the company in a previous financial year to the current financial year will indicate the performance measurement in terms of revenue increment. At the same time, the company will also be required to make various performance-related analyses regarding the departmental obligations and their actual performances with the help of the financial analysis objective of the accounting concepts (Doktoralina et al, 2018).

External communication

As discussed above on this financial decision making assignment, the preparation of financial statements, one of the basic reasons for preparing financial statements is to present the company's performance for a particular period to the external user. The external users will include the investors, shareholders, lenders, customers, suppliers and other persons or groups of people interested in the company in terms of investment or any other relation. Therefore to present the company's performance for a particular period regarding the revenue, financial position, income attributes, liabilities, and any other obligations will be presented by preparing the annual financial statements and quarterly financial statements, which will communicate the company's performance with the external users of The organisation.

b) Management accounting function

Internal communication

Beside The need of the business to have a good and efficient financial and accounting process is also required to develop the internal communication between the company in terms of performance measurement of different departments, cost allocation, estimating the performance of the company for a relevant period because the senior manager and board of directors will be taking adequate steps if the performance of the company is not satisfied with their expectation. At the same time, if the company or the managers identify any potential opportunity for the company to expand its operation, this can only be possible with the help of accounting and financing options to estimate whether the company is eligible to gain any advantageous position (Osmyatchenko et al, 2019).

Strategy development

Regarding any financial situation or economic situation concerned with the company's profitability and financial position, with the help of appropriate financial and accounting tools, the company can easily prepare the financial Strategies for the organisation. For instance, at the time of the covid-19 pandemic, the liquidity position of many companies is getting affected; therefore, the company is willing to improve their liquidity by improving the collection of receivables to minimise the packet related expenses and improving the liquidity of the organisation. Therefore with the help of financial tools, the company can easily prepare for any situation by preparing appropriate strategies.

Making financial projections for the company: financial decision making assignment

As a part of organisational forecasting obligations, the financial and accounting data and tools will be required to forecast the business environment. Every business is prepared its financial budget for the coming periods to enhance understanding the company's resource requirements and fix a benchmarking to attain the organisational goals and objectives. The relevant financial accounting tools and previous year papers will be required to prepare financial projections such as budget, which will include various concepts of accounting, considering the current organisational performance and others.

For instance, if the company is willing to prepare the master budget for the coming period, it will be required to know about the average receivable collection time, companies payment policy towards the credit purchase, expected sales revenue and others for the preparation of cash budget and the master budget which can only be done with an expert who is having efficient financial and accounting knowledge.

c) Tax function

Another basic liability of the accounting or financing job role identified on this financial decision making assignmentis to avoid the legal consequences in terms of avoiding taxes, not preparing the financial statements as per requirement, and liability to pay GST and other related expenses on time to avoid the legal problems arising towards the company for not fulfilling the required financial obligations. At the same time, the company will be required to manage the repayment of borrowings as a part of financial conduct to avoid any legal consequences.

d) Auditing function

Statutory obligation:

The companies will be required to perform significant statutory obligations such as preparing the tax statement, annual reports and others for which appropriate knowledge of financial accounting and taxation and accounting will be required to prepare the financial statement in relevance with the IFRS norms and taxation rules applicable to the company. If the company do not have an efficient accounting and financial department, it will get affected and will not be able to perform the statutory obligations (Odoh et al, 2018).

2. Finance department:

a) Investment function

In addition to that the finance department will be useful for making investment related decision by identifying the potential opportunities, and it's earning capacity by conducting various investment appraisal techniques namely the net present value analysis internal rate of return and other (Vaidya, 2021)

b) Financing function

this financial decision making assignment also identified that financing will be an essential part of the overall job process of accountant because they will be required to raise finances from the external sources as well and it should be keeping in mind to maximize the solvency position and minimising the WACC (Andreev, 2019).

c) Dividend function

the dividend is the proportion of income that the company will be distributed to the shareholders against the earnings generated during a particular period. there are many dividend policies and it will depend upon the management expertise to find the best dividend payment policies such as if it is willing to expand its operation and require capital for future business expansion then it will be following the residual Dividend policy in which it will be written in the maximum portion of earning and only distributing the portion which is not required (Pahi and Yadav, 2018).

d) Financial decision making assignment:Working capital function

the working capital will be an essential component of the financial accounting because it will be required for the operational needs of the organisation. In general understanding the working capital is not getting heavily finance with organisational resources that the company depends on the external sources such as the suppliers to getting finance for a majority of the working capital. if the company is able to manage the working capital efficiently than it will be improving the working capital cycle and the cash conversion cycle therefore it will be delivering more revenue and profits with minimum capital investment (Haque et al, 2019).

Part 1.2: Sources of Financing for small and medium companies

The sources of finance are important for the organisation to meet and finance their capital name; the access to capital depends on the nature and size of the business. The potential options for raising finances for the small and medium companies we discussed are follows. The primary objective while rising for any organisation, irrespective of its size, is the consideration that should be made regarding the minimisation of the weighted average cost of capital. The weighted average cost of capital is the cost that a company with a payor bear to get access to the capital. The sources of finance are discussed below: Equity capital: the small and medium companies can finance their capital needs by using the equity source of finance. The company will be issuing equity shares of the company to the potential investors to get taken to the company against the payment.

Debt sources of finance:

Besides the equity source, the debt source of finance is heavily used in small and medium businesses. There are multiple ways from which the company can raise Debt, and many companies are fond of using a significant portion of their capital employed with the help of debt financing because of its tax saving nature and low-cost capital.

Some of the common sources of raising Debt are described as follows. Lending from banks and Financial Institutions: The company can easily get finance from the bank and financial institution if it qualifies for the solvency aspect and the blanks requisites.

Issuing debentures or convertiblebonds:

Companies can raise finance for Debt by issuing their own debenture or convertible bonds to get finances.

Task 2:financial decision making assignment

Part A: Calculation of financial ratios

Gross Profit margin

|

Gross Profit margin |

||

|

|

2018 |

2019 |

|

gross Profit |

3500 |

3265 |

|

Revenue |

10000 |

11500 |

|

Gross Profit margin |

35.0% |

28.4% |

|

Operating Profit margin |

||

|

|

2018 |

2019 |

|

Operating profit |

2765 |

2305 |

|

Revenue |

10000 |

11500 |

|

Operating Profit margin |

27.7% |

20.0% |

|

Return on Capital Employed |

||

|

|

2018 |

2019 |

|

Operating profit |

2765 |

2305 |

|

capital Employed |

8755 |

10211 |

|

Return on Capital Employed |

31.6% |

22.6% |

|

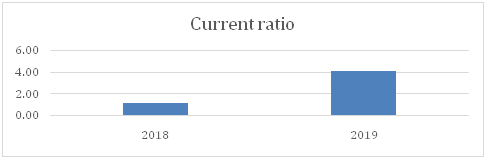

Current ratio |

||

|

|

2018 |

2019 |

|

Current Asset |

1175 |

2110 |

|

Current Liabilities |

970 |

512 |

|

Current ratio |

1.21 |

4.12 |

|

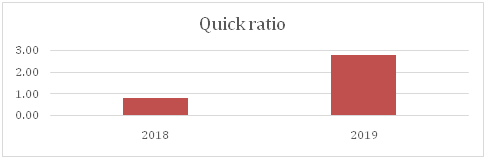

Quick ratio |

||

|

|

2018 |

2019 |

|

Current Asset-Inventory |

825 |

1436 |

|

Current liability |

970 |

512 |

|

Quick ratio |

0.85 |

2.80 |

|

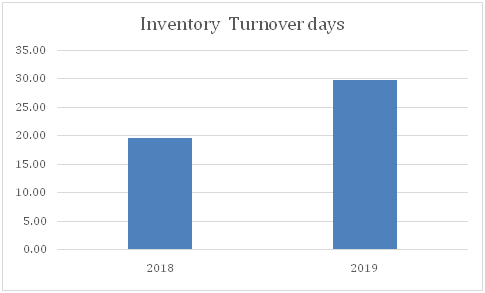

Inventory Turnover days |

||

|

|

2018 |

2019 |

|

Cost of sales |

6500 |

8235 |

|

Inventory |

350 |

674 |

|

Inventory Turnover days |

19.65 |

29.87 |

|

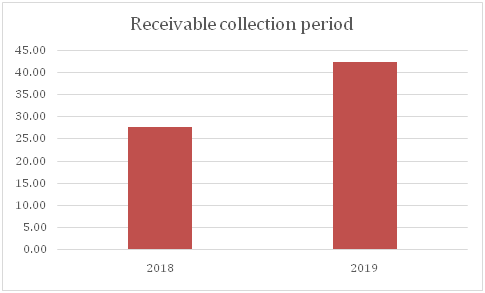

Receivable collection period |

||

|

|

2018 |

2019 |

|

Sales |

10000 |

11500 |

|

Accounts Receivable |

760 |

1340 |

|

Receivable collection period |

27.74 |

42.53 |

|

Payable payment period |

||

|

|

2018 |

2019 |

|

cost of Sales |

6500 |

8235 |

|

Accounts payable |

920 |

495 |

|

Payable payment period |

51.66 |

21.94 |

Part B: Comment on Panini Ltd.’s performance for 2018-2019

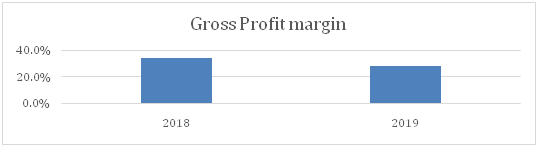

I. Gross profit ratio

Definition: the gross profit ratio, which indicates the proportion of income getting secured by the company in terms of profit against the revenue (Aziza, Maida and Magdalena, 2021).

Indication: with the help of the gross profit ratio, the company's percentage of morning secured photograph properties can be calculated.

Comparison:

This financial decision making assignmentresearch shows the gross profit margin of the company was 35% in 2018, which decreased to 28.4% in 2019.

Reason for changes:

There might be many reasons for the change in profit profitability. For instance, the increase in the cost of sales will be the most influential factor which has caused a reduction in the gross profit margins of the company.

Recommendation to improve theratio:

In order to improve the gross profits, the company will have two different options that to minimise the cost of sales for increasing the product prices to maximise the gross profits.

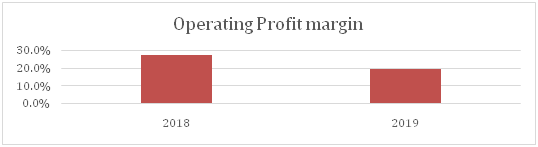

II. Operating profit margin

Definition: operating profit margin will indicate the percentage of operating profit getting secured by the company against the total revenues generated for the particular period. The operating profit is the income that the company will generate after adjusting all the business-related expenses from the gross profit (Maris, Dorner and Mills, 2021).

Indication: with the help of operating profit margin, the business income against the sales revenue can easily be estimated by the use of.

Comparison 2018 -2019:

In the financial year 2018, the company was able to secure 27.7 % of its revenue in terms of operating profits. However, in the financial year 2019, the company was only able to secure 20% of its revenue in terms of gross profit.

Reason for changes:

There are two different reasons identifiable for the decrease in operating profitability of the organisation is that the decrease in profitability. And secondly, the operational expenses for the company have increased significantly in 2019 compared to the previous year's operational expenses.

Recommendation to improve theratio:

In order to improve the operating profit margin, the company will have to improve the gross profit margin cost, and the company will also be required to minimise the operating expenses to maximise the operating profits.

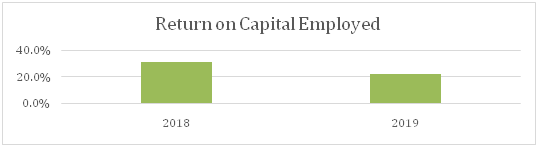

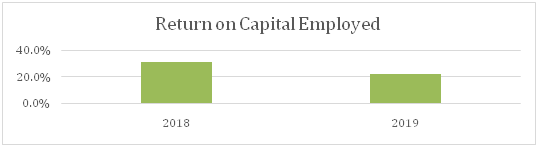

Return on capital employed:

Definition: the return on capital employed compares the operating profit against the total capital employed in the business to measure the profits earned by the organisation against the total capital employed in the business (Shrotriya, 2019).

Indication: with the help of the return on capital employed, the percentage of earnings generated by the organisation against its total capital employed can be estimated.

Comparison 2018 -2019 :

In the financial year 2018, delivered a return of 31.6% on the total capital employed, which is decreased by 22.6% by the end of 2019.

Reason for changes :

The total capital employed By the company is significantly increased in 2019 compared to the total capital invested in 2018. In comparison, the total operating profit for the company decreased in 2019 compared to the total operating profits generated in 2018.

Recommendation to improve the ratio :

To improve the return on capital employed, the company will be required to improve its operating profits first to maximise the return on the capital.

Current ratio :

Definition: the current ratio compares the current assets and current liabilities of the organisation for the specified period (Khairunisa et al, 2022).

Indication: the current ratio will indicate the liquidity position of the company.

Comparison 2018 -2019 :

The current ratio of the company increased significantly in 2019 to 4.12 times which was 1.21 times in 2018. Under general acceptance, the current ratio of the company should be more than 2; however, the company's performance is exceeding the limit.

Reason for changes :

The reason for changes in the current ratio is because of the increase in current assets and decrease in current liabilities.

Recommendation to improve the ratio :

The current ratio of the company is highly efficient, and the company is not required to improve it further; rather, it should hold the current liquidity position.

Quick ratio:

Definition: the quick ratio can be calculated by deducting the inventory assets from the current assets and then comparing it with the current liabilities (Elhindwan and Nobanee, 2020).

Indication: the quick ratio will be helpful in instant liquidity estimation of the company.

Comparison 2018 -2019 :

The quick ratio of any company should not be less than one. However, the quick ratio of the company was not efficient in 2018 when it had a quick ratio of 0.85. However, the situation improved in 2019 because of an excessive increase in current assets, and the company is able to have a quick ratio of 2.8.

Reason for changes :

The increase in the quick ratio is a result of an increase in the current assets of the company.

Recommendation to improve the ratio :

The company will not be recommended to improve it for them because it will extend of working capital needs of the organisation. Rather it will be recommended to hold the liquidity position.

Inventory turnover days :

Definition: indicates the number of days taken by the company to sell the inventory.

Indication: will indicate the working capital efficiency management of the organisation.

Comparison 2018 -2019 :

The inventory turnover days have increased from 19.65 to 29.87 days in 2019.

Reason for changes :

The increase in total inventory value is the reason behind the decrease in inefficiency.

Recommendation to improve the ratio :

This financial decision making assignmentrecommends the company to minimise the inventory investment to improve the inventory turnover.

Receivable collection period

Definition: indicates the time taken by the company to collect the state itself by comparing the average accounts receivable with the total credit sales made during the period.

Indication :

Indicates the efficiency of the company in collecting the dues for the credit sales.

Comparison 2018 -2019 :

The receivable collection Period of the company has increased from 27.74 days in 2019 to 42.53 days.

Reason for changes :

The increase in outstanding accounts receivable balance is the main reason behind the increase in the receivable collection period.

Recommendation to improve the ratio :

The company will be recommended to implement an efficient receivable management policy and give discounts to improve the receivable collection period.

Payables payment period:

Definition: Compares the time taken by the organisation to make payments for the credit purchase.

Indication: will indicate the average number of days taken by the company to make payment for the credit purchases.

Reason for changes :

The suppliers of the company have limited the facility available to the company; therefore, it is required to make prompt payment against the purchase.

Recommendation to improve the ratio :

The company will be required to improve their solvency aspect and will negotiate with the suppliers to give higher credit days.

Conclusion :

This financial decision making assignment has helped deliver a overall, understanding of the company Panini Ltd, it will be recommended to the investors not to make an investment in the company because the overall position of the company has degrees in terms of profitability and efficiency.

References:

Andreev, Y., 2019. FEATURES OF ACCOUNTING FOR FINANCING AGRICULTURAL PRODUCERS. Trakia Journal of Sciences, 17(1), pp.378-381.http://tru.uni-sz.bg/tsj/Volume%2017,%202019,%20Supplement%201,%20Series%20Social%20Sciences/3/za%20pe4at/62.pdf

Azizah, N., Muwidha, M. and Magdalena, M., 2021, July. Analysis of Cash Flow Components, Gross Profit, Earnings per Share on Stock Returns Manufacturing Company Listed in the Indonesian Stock Exchange from 2016 Until 2018. In 2nd Annual Management, Business and Economic Conference (AMBEC 2020) (pp. 111-115). Atlantis Press.https://www.atlantis-press.com/article/125959030.pdf

Doktoralina, C.M., Bahari, Z., Herliansyah, Y., Ismail, N.A. and Putri, P.P., 2018. Role of accounting zakat as a support function in supply chain management: A resurrection of the Islamic economy, financial decision making assignment. International Journal of Supply Chain Management, 7(5), pp.336-342.https://www.cmdpublish.com/wp-content/uploads/2019/01/Role-of-Accounting-Zakat-as-a-Support-Function-in-Supply-Chain-Management-A-Resurrection-of-the-Islamic-Economy.pdf

Elhindwan, A.A. and Nobanee, H., 2020. Working Capital Management Ratios of Walmart. Ratio, 2019(2018), p.2017.https://www.researchgate.net/profile/Haitham-Nobanee/publication/342703225_Working_Capital_Management_Ratios_of_Walmart/links/

5f02439745851550508da2b1/Working-Capital-Management-Ratios-of-Walmart

Ganyam, A.I. and Ivungu, J.A., 2019. Effect of accounting information system on financial performance of firms: A review of literature. Journal of Business and Management, 21(5), pp.39-49.https://www.researchgate.net/profile/Amos-Ganyam/publication/333340200_Effect_of_Accounting_Information_System_on_Financial_Performance_of_ Firms_A_Review_of_Literature/links/5ce7c59a92851c4eabba3ccd/Effect-of-Accounting-Information- System-on-Financial-Performance-of-Firms-A-Review-of-Literature.pdf Haque, A., Fatima, H., Abid, A. and Qamar, M.A.J., 2019. Impact of firm-level uncertainty on earnings management and role of accounting conservatism. Quant Financ Econ, 3, pp.772-794.https://www.researchgate.net/profile/Abdul-Haque-7/publication/338173084_Impact_of_firm-level_uncertainty_on_earnings_management_and_role_of_accounting_conservatism/links/ 5e0dd71d4585159aa4abe0d2/Impact-of-firm-level-uncertainty-on-earnings-management-and-role-of-accounting-conservatism.pdf Khairunisa, M., Putr, L.S., Mulia, S., Prakoso, I.B., Novayani, O. and Arnan, S.G., 2022. THE EFFECT OF CURRENT RATIO, QUICK RATIO, DEBT TO ASSET RATIO, DEBT TO EQUITY RATIO AND RETURN ON EQUITY ON FIRM VALUE (A study on property companies listed on the Indonesia Stock Exchange from 2014 to 2020). CENTRAL ASIA AND THE CAUCASUS, 23(1).https://www.ca-c.org/submissions/index.php/cac/article/download/330/237

Maris, R., Dorner, Z. and Mills, R., 2021. Cost Efficiency Analysis using Operating Profit Margin for the New Zealand Dairy Industry (No. 21/04).http://130.217.226.42/wai/econwp/2104.pdf

Odoh, L.C., Echefu, S.C., Ugwuanyi, U.B. and Chukwuani, N.V., 2018. Effect of artificial intelligence on the performance of accounting operations among accounting firms in South East Nigeria. Asian Journal of Economics, Business and Accounting, 7(2), pp.1-11.https://www.researchgate.net/profile/Victoria-Chukwuani/publication/326085292_Effect_of_Artificial_Intelligence_on_the_Performance_of_Accounting_

Operations_among_Accounting_Firms_in_South_East_Nigeria/links/6188014ed7d1af224bc2f7ad/Effect-of-

Artificial-Intelligence-on-the-Performance-of-Accounting-Operations-among-Accounting-Firms-in-South-East-Nigeria.pdf

Osmyatchenko, V., Oliinyk, V., Mazina, O., Matselyukh, N., Ilin, V. and Orze?, A., 2019. THE INFLUENCE OF THE GLOBAL TECHNOLOGICAL CHANGES ON PRINCIPLES AND FUNCTIONS OF ACCOUNTING AND FORMATION OF THE ORGANIZATION STRATEGY. Journal of Security & Sustainability Issues, 8(4).https://www.jssidoi.org/jssi/papers/journals/pdownload/32#page=89

Pahi, D. and Yadav, I.S., 2018. Role of corporate governance in determining dividend policy: Panel evidence from India. International Journal of Trade, Economics and Finance, 9(3), pp.111-115.http://www.ijtef.org/vol9/598-FR0012.pdf Shrotriya, V., 2019. Analysis of Return on Total Assets (ROTA) and Return on Capital Employed (ROCE) of IFFCO Limited. Shrotriya, V., 2019. Analysis of Return on Total Assets (ROTA) and Return on Capital Employed (ROCE) of IFFCO Limited. Vaidya, R., 2021. Role of Accounting Information in Making Share Investment.financial decision making assignment,https://ace.edu.np/wp-content/uploads/Role-of-Accounting-Information-in-Making-Share-Investment-Decisions_-A-Survey-of-Investors-in-Nepalese-Stock-Market.pdf