international finance assignment on the effect of Covid 19 on the major global economies

Question

Task: how to assess the effects on Covid 19 on global economies using international finance assignment research techniques?

Answer

Introduction

On this International Finance assignmentwe explore the effects on Covid 19 on major global economies. Covid-19 has caused a significant negative impact on the financial market and the real economy at a global level. The contingent events followed by the pandemic promoted large monetary and fiscal policy intervention (Poddar, 2020). The exchange rate is one of the significant indicators of the economy which has been affected by the pandemic, and the volatility can be seen in the unpredictability of the exchange rates. The scope of the study states that India was the third most affected nation worldwide due to Covid-19. It involved low spending on the health facilitates as a % of GDP and there were shortages in the medical aid with the declining currency rate on a daily basis. In this case study, one of the significant currencies of the world, which is INR or the Indian Rupee, is selected to discuss the impact caused on this currency in the Indian financial markets by Covid-19 in the past two years. The objective of this International Finance assignmentis to study the impact of Covid-19 pandemic on the Indian economy and its currency fluctuation caused during the two years of pandemic.

The method of investigation undertaken for the research study is secondary qualitative method to depict the various spheres of the economy of how Covid-19 affected the Indian economy. The research question is

“What impact did Covid-19 had on the Indian currency (INR) and its effect on the financial market?”

Impact of Covid on the national currency

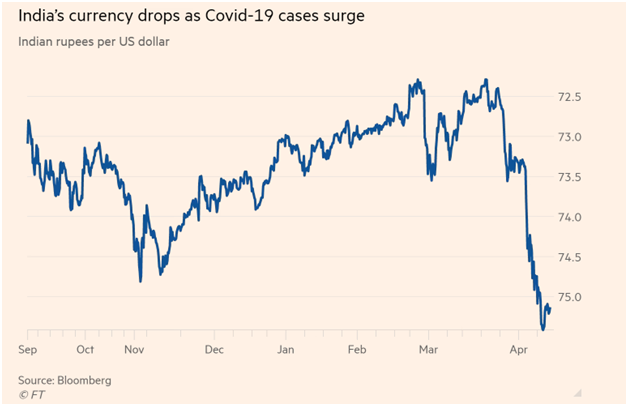

As this International Finance assignment data search it can be observed that the INR slumped past the 76 per $ mark as risk-averse investors have dumped the risky assets, followed by the relentless rise in the case of Covid-19 globally as well as in the country. As the country faces a virulent surge of coronavirus infections, India's rupee has shifted from emerging market leader to laggard, raising concerns among foreign investors that the country's fragile economic recovery could implode. Since the beginning of April, the rupee has declined roughly 3% to 75.14 per dollar, the poorest performance among a basket of two dozen emerging market peers tracked by Bloomberg, which includes Russia's rouble and Turkey's lira (News and News, 2022).

Figure 1: India's currency drops after the Covid surge

(Source: Ft.com, 2021)

Amidst the Covid-19 pandemic, the trade deficit in the country has surged more than 30% year-on-year to $20 billion in April 2021, mostly due to higher energy prices. The current account deficit reported by India is anticipated to increase from 1.5% of GDP in FY 2022 to 3%. Subsequently, the foreign investors have taken aback an amount of $19 billion from the Indian capital and money markets in the past 2 years (Ft.com, 2021). This reported a net inflow of $7 billion in 2021, $14 billion in 2020 and $19 billion in 2019.

Reasons for causing impact

The primary factor that drives INR to a significant decline margin is the rapid spread of the Covid-19 pandemic and its contagion effect. However, there are other external factors as follows that played a major role in depicting the rupee's fate-

Geopolitical risks:it is also observed on this International Finance assignmentthat the unprecedented tension among nations has triggered the risk-taking capacity for weakening the INR. In fact, the INR has been under significant pressure since the disturbance of geopolitical conditions owing to the invasion of Ukraine by Russia. This crisis has caused global inflation and thereby increased the prices of essential goods at the global level. India is the third largest importer of oil from Russia and has been witnessing a rise in the import bill caused by the soaring prices of crude oil to report high supply restrictions.

Rise in bond yield: The 10-year record of bond lasted at a high price of ?93.69 that, yielded 7.46% after reaching a high of 7.49% previously (Agrawal et al., 2020). The Indian government has requested RBI to either purchase back the bonds or undertake open market operations to cool yields that have hit the highest benchmark since 2019.

Inflation: The simultaneous effects of the UK-Russia war and Covid-19 have exaggerated the inflationary pressure in the country. The Fed's policy committee have increased the market rate by a half point, making the highest hike since 2000 and further expected to rise in the near future. Food inflation in the country accounts for half of the CPI basket that reached a high in March 2022, and it is expected to remain high due to the high price of vegetable and cooking oil worldwide (Mishra et al., 2020).

Economic impact on local companies

The Covid-19 pandemic has created different operational and financial difficulties for the local Indian companies. During the lockdowns imposed by the government to curb the pandemic, around 71.31% of the businesses dealt with decreasing cash flows, with the Indian manufacturing sector hitting the worst situation (Vanamali, 2022). In addition to this, the delay and cancellation of the projects have caused major concern in the tertiary sector of the Indian economy, especially in the retail businesses, local non-profit organisations, consultancy businesses, and education and financial services. China is a major supplier of a variety of raw resources to India. Another important factor observed on this International Financeassignment is that the Factory closures have harmed the supply chain, resulting in a sharp increase in raw material prices. Gold, masks, sanitisers, smartphones, pharmaceuticals, consumer durables, and other items have all suffered price increases recently.

Among the rest, the aviation and automobile industries have been affected the worst. The aviation and tourism industries have come to a halt due to the lack of aeroplane landings and take-offs around the world, as well as restricted travel. Hospitality entities like Hyatt Hotels Corporation, Taj Hotels, Resorts and Palaces, The Lalit Hotels and many more were severely affected nationwide during the lockdown in 2020. However, in 2021, the restaurants were allowed to open in restricted numbers, and under curfews, the overall Indian hospitality suffered majorly in financial terms (Jenaet al., 2021). The business owners servicing business loans faced a tough time in paying off their monthly EMIs. Since the pandemic, the automobile sector has suffered massive losses and a significant decline in production. In reality, major automakers such as Honda, Hyundai, Renault, and Volkswagen have seen a decline in vehicle production and sales. The International Finance assignmentresearch also found that the country's COVID-19 scenario, the vehicle sector is projected to continue under pressure in the near future (Agrawal, 2021).

Economic impact on international companies

The falling value of rupee enhances the inflation by turning the imports pricier and this, in turn, increases pressure on RBI to stalk the sliding value of the currency. An international company such as IBM continued with its growth in earning even with the economic agitations that have led to the undercut of numerous other tech organisations. Their earnings increased by 6% despite a decline in the revenue of the organisation by 3%. This achievement was reached after the tech organisations like Advanced Micro Devices Inc have held recession responsible for the increasing fears (Kumar et al., 2020). The growth in earnings of IBM does not imply that it had not suffered from the falling value of the Indian currency and the resultant inflation in the economy.

The boost in its sales has been the result of its enhanced focus on sales of technology and software services. Moreover, the company has been carrying out two businesses with profit margins that are higher than the computer business, which had offered financial support to it in the past years. However, it has been suspected as per analysis that the earning hurdle of IBM is established low to decrease the possibility of upsetting the stakeholders or investors (Gupta et al., 2021). Further, companies such as HPCL have been negatively affected due to a decline in Indian rupees. Increasing prices of oil, rupee depreciation and insufficient provisions from the government during such a period of a pandemic is the chief reason for the negative impact on certain organisations.

International Finance assignmentmacroeconomic indicators

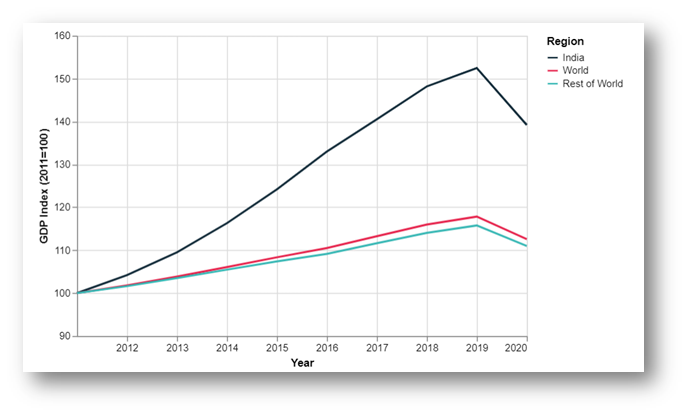

The aggregates statistics such as population, geography and the political jurisdiction collected by bureaus and agencies of the statistical organisation, Indian government and on certain occasions, some private organisations applying identical methods are termed macroeconomic trends. Covid 19 has flustered the global economy as a whole. Supplementary fiscal spending is the requirement of the situation in India. Nevertheless, if the containment strategy of India is successful, there is hope for the economy to be normal, and a 10% shortfall might be a possible scenario. As a result of the lockdown due to covid 19, the growth of GDP in India has crashed by about 23.9% in the year 2020 – 2021. This has been considered the nastiest performance of the Indian economy (Balajeeet al., 2020). On comparing the rates of national unemployment in the year 2020, the rate of 7.1% implies that the performance is comparatively poor, both in regards to reference group economies and the world average.

The rates of unemployment in the reference group economies were subdued and were even kept less by keeping the policies of the labour market generous so that employed people don't leave it due to tough situations. Despite the pandemic, supplementary financial appropriation to numerous social security measures has been comparatively low in this country as compared to others (Nath, 2020). On this International Finance assignment we observed that India might appear comparable in measures on the non-health sector against the reference group, the supplementary fiscal measures of the health sector are not even those taken by the reference group. The lenders in India such as Bank of India, State Bank of India decreased their rate of lending following the move of Reserve Bank of India of cutting down the repo rate. The rate of lending was reduced to 7.05% and the link between lending rate and repo rate was established at 6.65% (bfsi.economictimes.indiatimes.com, 2022). As per the estimates of UNCTAD, India suffered a loss of around US$348 million as a result of covid (Rakshit and Basistha, 2020).

Economic impact on the citizen of the country

The impact of the emergence of covid 19 in India has been immensely troublesome. The social distancing and lockdown strategies to overcome virus transmission had enhanced domestic violence like emotional, physical and sexual abuse. The advancement and severity of the outbreak are kind of unimaginable. Most of the Indian population was struggling to raise supplementary funds and appeal for considerable modifications in behaviour from the Indian citizen to avoid the virus transmission (Kumar et al., 2020). It was expected that the emission of greenhouse gas in India would be decreased year by year as a result of continued influence on the economic actions. Hence, it can be termed as a problem that was observed during the financial crisis that occurred in the year 2008-09 or can even be termed as the initiation of a decline of long-term nature; this depends on the policies of economic nature that the authorities have adopted and are about to implement to reply to such circumstances arising out of the disruptions caused by the emergence of covid 19 situations.

Due to the insufficiency of adequate resources identified on this International Finance assignment, the education of common people had also been impacted. Adverse impact on the performance of student learning has been observed. Online schools are responsible for giving vital learning to students even when they are not working in the offline medium. The youth and children population have immensely fewer resources for their progress and growth (Kumar et al., 2020). The underprivileged learners who already had very few resources of education beyond the school premises had suffered immensely during the pandemic in respect of food, shelter and education.

Explain and analyse the economic exposure of the country in the international situation

India is the second largest country in terms of population and even owns the crown of being the largest democratic, but this International Finance assignment also observes the poverty is a major concern in this country. The economies all over the world has been hit and impacted by covid and India seems to have suffered the most influential contraction. In the financial year 2020/21, the decline rate of GDP for a developing economy like India was 2.2%. The service sector of India was worst hit, its share in the GVA of India decreased from 55% in the year 2019-20 to 53% in the year 2021-22(Bhatejaet al., 2022). The Oxfam report indicates the crucial problems in association with income inequalities and poverty in the country. This circumstance was worsened during the emergence and advancement of the covid 19 situation. There are distinct reports made on this, and all of them have anticipated that post covid 19, the situation of poverty would worsen in the country (Bhadra, 2021). Compared to other countries, India is quite vulnerable economically post covid 19. The primary sector that is agriculture, was already witnessing a situation of decline, and with the emergence of the pandemic, it declined further.

Figure 1: Economic contraction in India during Covid 19

(Source:Bhatejaet al., 2022)

The medium scale enterprise has been badly hit due to the lockdown, and restarting it post-pandemic is not an easy task. The decreased flow of cash, the disruptions in the supply chain, the scarcity of migrant workers because of reverse migration and low demand are reasons that may continue to hinder the growth and advancement of MSME in the country. Since covid 19 the three crucial barriers that MSME in India have been facing are entire productivity, market access and acquiring access to heavy finances. In the volume of business, about 11% decline have been witnessed in the MSME of India. Around 95% of the firms faced negative impact due to the national lockdown imposed in the year 2020 (Tripathi, 2021). The factors that are responsible for such condition of MSME are capital crunch, perception of risk by financial institutions and banks and high transaction cost. The small-scale industries have been even quite exposed to the situation, and it is quite problematic for them to endure in the absence of any kind of financial assistance due to their incapacity to deal with such type of unexpected disruptions (Bhadra, 2021). Other essential extents of the service sector like travel, transport and tourism had been worst affected in the entire country. As a response from the government, announcement of collateral free loan has been made for MSME and SME. It can be defined as a good move however, there are two problems. The scheme of loan guarantee might not be successful as no NBFC or commercial bank would be ready to lend as per this scheme. Further, every SME and MSME undergo serious issues of delayed payments(Tripathy and Bisoyi, 2021). The fundamental issue that the MSME and SME is facing post covid is the payment of salaries and wages to their workforce in situation when their flow of cash is almost equivalent zero. Much larger support was expected from the commercial banks by examining condition of risk aversion by them. The collateral free loan announced is expected to help a very small segment of the SMEs and MSMEs.

Conclusion and Recommendation

From the above discussion, it can be concluded that the impact of Covid-19 on the Indian economy was mostly disruptive from the viewpoint of economic activities and loss of life. All parts of the economic activities have been negatively affected due to the loss in domestic demand for goods and services and exports sharply declining with few exceptions. In the FY 2019-2020, there was reduction of 26% in the mid cap index in the Indian stock market as well as the sensitivity index was reduced by 22%. Both the factors affected the financial stability of the investors as well as the share market. The Indian stock market over the last 2 years became more volatile and crashed several times.

It is recommended that both the RBI as well as the government of India must join hands to revive the existing INR situation and its negative impact caused by Covid-19.

• Providing opportunities to businesses and entrepreneurs: The RBI must introduce flexible business regulation in order to create a virtuous cycle of opening a great opportunity for businesses, entrepreneurs and the fiscal authority to bring the economy back on track.

• Need for structural changes to push the economy back on the growth path:this International Finance assignmentrecommends that rebalancing the policies is a necessity for the monetary and fiscal undertaking, which shall be the initial step to recovering from the crisis economic journey.

Reference List

Agrawal, A., 2021. Sustainability of airlines in India with Covid-19: Challenges ahead and possible way-outs. Journal of Revenue and Pricing Management, International Finance assignment20(4), pp.457-472.

Agrawal, S., Jamwal, A. and Gupta, S., 2020. Effect of COVID-19 on the Indian economy and supply chain.https://www.preprints.org/manuscript/202005.0148/download/final_file

Balajee, A., Tomar, S. and Udupa, G., 2020. Fiscal Situation of India in the Time of COVID-19. Indian School of Business. https://www.cafral.org.in/sfControl/content/Speech/513202065330PMIndiaFiscalCovid.pdf

Bhadra, S. (2021) "Vulnerabilities of the Rural Poor in India during pandemic COVID?19: Social Work perspective for designing sustainable emergency response", Asian Social Work and Policy Review, 15(3), pp. 221-233. DOI: 10.1111/aswp.12236.

Bhateja, R., Tyagi, M. and Tyagi, A., 2022. POST EFFECT COVID AND SERVICE SECTOR IN INDIA: A STUDY. Journal of Positive School Psychology, 6(2), pp.4759-4765.

Gupta, A., Zhu, H., Doan, M.K., Michuda, A. and Majumder, B., 2021. Economic impacts of the COVID? 19 lockdown in a remittance?dependent region. American Journal of Agricultural Economics, 103(2), pp.466-485.

India’s rupee tumbles as new Covid wave threatens recovery (2021). Available at: https://www.ft.com/content/e81875ef-4c78-4f63-b53c-e8458688f6b2 (Accessed: 6 June 2022).

Indian Banks cut Interest Rates following RBI COVID-19 measures - ET BFSI (2022). Available at: https://bfsi.economictimes.indiatimes.com/news/banking/indian-banks-cut-interest-rates-following-rbi-covid-19-measures/74896358 (Accessed: 7 June 2022).

Jena, P.R., Majhi, R., Kalli, R., Managi, S. and Majhi, B., 2021. Impact of COVID-19 on GDP of major economies: Application of the artificial neural network forecaster. Economic Analysis and Policy, 69, pp.324-339.

Kumar, S., Maheshwari, V., Prabhu, J., Prasanna, M., Jayalakshmi, P., Suganya, P., Malar, B.A. and Jothikumar, R., 2020. Social economic impact of COVID-19 outbreak in India. International Journal of Pervasive Computing and Communications. International Finance assignmenthttps://scholar.archive.org/work/53dmpmq465dxfjqnozqh2yitqe/access/wayback/https://www.emerald.com/insight/content/doi/10.1108/IJPCC-06-2020-0053/full/pdf?title=social-economic-impact-of-covid-19-outbreak-in-india

Mishra, A.K., Rath, B.N. and Dash, AK, 2020. Does the Indian financial market nosedive because of the COVID-19 outbreak, in comparison to after demonetisation and the GST?.Emerging Markets Finance and Trade, 56(10), pp.2162-2180.

Nath, H.K., 2020. Covid-19: Macroeconomic impacts and policy issues in India. Space and Culture, India, 8(1), pp.1-13.

News, B. and News, I. (2022) Explained: What led to record fall in rupee and how it may affect economy - Times of India, The Times of India. Available at: https://timesofindia.indiatimes.com/business/india-business/explained-what-led-to-record-fall-in-rupee-and-how-it-may-affect-economy/articleshow/91499419.cms (Accessed: 6 June 2022).

Poddar, AK, 2020. Impact of COVID-19 on Indian Economy-A Review Ajay Kumar Poddar* and Brijendra Singh Yadav2. Horizon, 2, pp.15-22.

Rakshit, B. and Basistha, D. (2020) "Can India stay immune enough to combat

Tripathi, A. (2021) MSMEs in India – Post Covid Scenario, Times of India Blog. Available at: https://timesofindia.indiatimes.com/blogs/agyeya/msmes-in-india-post-covid-scenario/ (Accessed: 7 June 2022).

Tripathy, S. and Bisoyi, T., 2021. Detrimental impact of COVID-19 pandemic on micro, small and medium enterprises in India. Jharkhand J. Dev. Manag. Stud, 19, pp.8651-8660.

Vanamali, K. (2022) How a weaker rupee will impact the Indian economy and people?,International Finance assignment Business-standard.com. Available at: https://www.business-standard.com/podcast/economy-policy/how-a-weaker-rupee-will-impact-the-indian-economy-and-people-122051100115_1.html (Accessed: 6 June 2022).