Finance assignment evaluating the financial performance of MCDONALD for two consecutive years

Question

Task: Choose a Multinational Enterprise (MNE) listed on an internationally recognised Stock Exchange for your finance assignment. Critically discuss two recent developments in the international environment appear to have impacted on your chosen company’s recent performance and development. Analyse how these two developments are likely to impact on the company in the near future. Discuss the Sources of finance and Dividend policy of the MNE’s international financial and/or risk management strategy.Analyse the financial performance (in terms of profitability, liquidity, efficiency and investment) of the company in the two most recent consecutive financial periods ( e.g. 2019/2020 or 2021/2020, ) using 8 different accounting ratios (prior year comparative figures will be available in the annual report.

Answer

Introduction

Evaluation of the company’s performance is important for assisting in the early identification of the issues and evaluating both positive and negative trends within the business activities. Through regular assessment, the business activities progress is clarified and owners, as well as managers, will have credible information for the purpose of planning. The current finance assignmentis on Mcdonald’s which is the biggest restaurant chain in terms of revenue. It serves more than 69 million customers on a daily basis in more than 100 countries and has more than 40,000 outlets (McDonald 2021). It is best known for hamburgers, French fries, and cheeseburgers and contains a host of other menus. The revenue of the company comes from restaurants and fees that are operated by franchisees. The fee varies in tune with the site, investment by the company, and other business scenarios. Revenue comprises revenue from licensing agreements and third-party revenues.

In the year 2021, the comparable sale enhanced by 17% was mainly due to strong performance in sales followed by the Covid-19 recovery (Campos 2021). The consolidated revenue enhanced by 21% moving to $23.2 billion followed by the increment in the operating income by 41% to $10.4 billion. The cash provided by operations stood at $9.1 billion which signified an increment of 46% from the previous year. The annual dividend paid by the company in 2021 amounted to $5.52 per share (McDonald 2021). The aim of the finance assignmentis to conduct an analysis of the performance of McDonald's. Moreover, the developments influencing the financial performance of McDonald's have been highlighted in the report including a detailed analysis of the capital structure.

Section – A Two recent developments in the international financial environment discussed in the finance assignment

• Covid 19

• Russia Ukraine war (and the related global inflation )

Development 1 -Covid 19

• Description of the development in the finance assignment

The pandemic and the lockdown have been a challenge for the organization and the stakeholders. COVID-19 disturbed the global chain supply. workers shortage, increment in the cost of service followed by the inability in shifting the increment of the prices. It is found in the finance assignmentthat McDonald donated $3.1 million dollars for supporting the local communities during the pandemic. The donation equated to 3 million pounds of food that included a dairy, beef, bakery, and fruit items. McDonald partnered across the system during the crisis ensuring that excess food, as well as ingredients, does to the communities (Wiener-Bronner 2021). In link with the longtime partner FDC and other charitable organizations the restaurant chain distributed food to the needy. It is found in the finance assignmentin the US where McDonald's has more than one-third of the restaurant’s the sales declined by 8.7% but were better than the predicted 9.975 declines because some of the locations functioned through the drive-through and option of delivery (Campos 2021).

• Effect on financial performance

The pandemic led to the shut of restaurants and hence the operations were limited to delivery and drive-thru. The global sales took a plunge to 23.9% for the second quarter of 2020 because it was dragged by the downfall of the international markets such as the UK, France, and America (Wiener-Bronner 2021). The overall revenue declined by 30.5 percent to $3.76 billion. The cost of operations witnessed a jump of 14% to $3.61 billion because the supply chain witnessed bottlenecks (Campos 2021). As per the finance assignmentthis led to an increment in the cost because MacDonald needed to spend more on the chicken and beef followed by the packaging materials. Simultaneously the wages even increased in the United States.

• Strategy developed

McDonald's was strongly positioned to build on digital innovations for creating a better user experience that was properly suited for the limitation imposed by the pandemic. Technology innovations such as mobile applications, self-order kiosks, and mobile order pay gave customers ways to meet their needs in an effective and safe manner. As per the finance assignmentdigital sales were enhanced by $10 billion which proved to be of major benefit to the company. The innovation helped McDonald in cutting 30 seconds from the drive-through times and moves 300 million additional cars through the drive-thru strategy during the pandemic. This helped in recovering sales and sustains the demand.

Development 2 - Russia Ukraine war discussed in the finance assignment

• Description of the development

Due to the war of Russia and Ukraine, global inflation increased by leaps and bounds signaling a disturbance in the global supply chain mainly in the food and service industry. Russia and Ukraine's absent from food-producing has destroyed the global supply chain and led to a reduction in the supply hence triggering upward pressure on the food products prices. As per the finance assignmentdue to disruption created by war, prices of foods have increased, and hence also considering the humanitarian ground, McDonald closed its operations in Russia. The chain generated a humongous 8% or $2 billion of the revenue from Russia and Ukraine which was owing to the war situation.

• Effect on financial performance>

The war came at a juncture when the economy was not able to recover from the impact of a pandemic. These factors are leading to inflation and hurting the overall economy. As per the finance assignmentMcDonald's sold all the restaurants in Russia which operated for more than 30 years hence making it one of the largest global brands to exit since the Ukraine invasion. After the shutting up of operations in Russia, McDonald's is losing $55 million per month to pay the staff, supplier, and landlord for the restaurants (Sampath 2022).

• Strategy developed

When Russia invaded Ukraine, McDonald closed the restaurants and de arched which means it sold the outlets to the franchise owner. It is found in the finance assignmentthe shutdown in Russia cost the giant more than $55 per month until reopening. The chain further supported its 62,000 employees in Russia by supporting them through salaries till the last sale was completed and has any future employment with other buyers (Sampath 2022). Further, the restaurant chain wrote off a sum of $US1.4 billion which was to be covered by the exit of investment.

Section B: Dividend Policy and Sources of Financediscussed in the finance assignment

Key elements of the McDonald’s international financial strategy

a) Dividend policy

A dividend policy can be cited as the decision taken by the company in tune with the dividend distribution to the shareholders. It is a financial decision that signals to know the dividend payout ratio which is the frequency of dividends and whether dividend needs to be paid or not. Herein the relevance theory is applicable. This theory as per the finance assignmentopines that the investors need dividends as compared to capital gain due to the uncertainty present in the capital gain. With this theory, it can be interpreted that the shareholders of McDonald's have a high expectations for the dividend. Thereby, the Bird in hand theory can be aligned with the case.

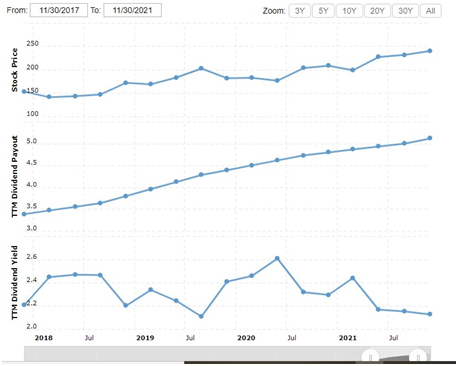

McDonald discussed in the finance assignmentpaid dividends on the common stock for 46 consecutive years and increased dividends every year. The dividend is considered a reflection of the financial well-being of the company. When a company raises a dividend it indicates that the company has a well-earning capacity and that future prospect is strong. If the investors expect that the dividend will be reduced then the share price gets lower.

The company as per the finance assignmenthas increased dividends every year wherein in 2020 the company paid a full-year dividend amounting to $5.04 per share which reflects the increment in the quarterly dividend. In 2021 the payment of the dividend is $5.12 per share. The increment in the dividend projects the confidence of the company in the on-going capability and cash flow reliability.

(NASDAQ 2021)

If an analysis is done of the dividend percentage then the combined percentage of 2021 comes to $5.12 per ordinary share. Every share contains a nominal value of 10p which indicates a healthy dividend percentage that would make the investors happy (NASDAQ 2021).

b) Capital structure>

McDonald borrowed on a long-term basis and hence contains exposure to the influence of changes in the interest rate and fluctuations in the foreign market. The debt obligation as of year-end 2020 contained $ 35.1 billion which was higher than the figure for 2019 and slightly lower than 2021 (McDonald 2021). As per the finance assignmentthe increment in 2020 can be attributed to the long-term issuance of $3.1 billion that was used to cushion the cash position in expectation of the macroeconomic and business scenario linked to COVID-19. The debt obligations of the company even contain the provision of cross acceleration and restrictions on the company followed by the mortgages of a subsidiary and its long-term debt. No presence of provision has been traced in the debt obligations of the company that would accelerate debt repayment due to the changes in the credit ratings (McDonald 2021). In the year 2019, the board authorized the borrowing of $15 billion with no particular expiration date and an outstanding of 9.5 billion remained left as on December 2020.

Further, McDonald's utilizes major capital markets, financing from banks, and derivatives for meeting the requirements of financing. The company manages the portfolio of debt in tune with the changes in the rate of interest and foreign currency rates through periodic retirement, redemption, and repurchase of debt. McDonald's does not have derivatives for the purpose of trading (McDonald 2021). The company discussed in the finance assignmentutilizes foreign currency debt for hedging the foreign currency risk linked to royalties, financing from intercompany and long-term investments and affiliates. This lessens the influence of fluctuating foreign currencies on cash flow as well as shareholder equity. The foreign currency debt was $13.7 billion and $12.9 billion for 2020 and 2019 respectively.

Section C: Ratio Analysis

i. Net profit margin

This ratio helps in ascertaining the net profit of the company and from this the net profit and the margin can be computed for the comparative years for understanding the performance of the firm (Deegan 2021). As per the finance assignmentthe net profit ratio was 24% in 2020 as against 26.49% in 2021. The increment in the net income can be linked to sales growth and the increment in revenue. As the pandemic settled and the lockdown was eased down, the food restaurant returned to normalcy. The operating expenses did not surge heavily which was one of the prominent reasons for overall good profitability.

Hence, the return to normalcy post-COVID-19, increment in the workforce, and robust sales was the reason why McDonald succeeded in 2021.

ii. Return on Assets

Return on assets indicates whether the company is earning more profit against the total assets. From the computation, it can be observed that the ROA of McDonald's has increased from 9.24% in 2020 to 14.17% in 2021.

The higher ROA can be attributed to the increment in profits. The company utilized the assets in an optimal manner and hence the returns were higher. As per the finance assignmentthe ROA is directly associated with the profitability of the company and the total assets at the end of the year. The net change witnessed in the total assets amounted to $1227.5 and the increment in the profit level from $4626.4 m in 2020 to $7558.3 in 2021 boosted the ratio

iii. Return on Equity

ROE calculates how effectively a company generates profit for the owners (Atril 2014). It can be defined as the net income relative to the value of the shareholder equity. As seen from the computation the company posted a strong profit in 2021that is 26.49% followed by an increment in equity to $7545.2. as per the finance assignmentthe increment in profit can be directly correlated to the increment in equity. Hence, the utilization of the equity has been optimal which led to betterment in the level of profits.

Liquidity ratio

iv. Current ratio

The current ratio helps in the measurement of the firm ability to repay short-term obligations within a period of 12 months (Atril 2014). The current ratio of McDonald's has declined slightly in 2021 which means is due to the decline in the level of the current assets. As the current assets level drops, the company has a lower potential in repaying. However, McDonald's discussed in the finance assignmenthas a current ratio of 1:1 meaning it has $1 of current assets for every $1 of current liabilities. Though the ideal ratio is 2 times a ratio of 1:1 is justified.

v. Quick Ratio

Quick ratio determines the company’s ability in meeting the present obligations with the help of the quick assets. The inventory is excluded in this ratio and hence is a better indicator of liquidity (Atril 2014).

The quick ratio declined in the year 2021 because the company has higher obligations. However, the business is presently having a quick ratio of 1:1 indicating a $1 of quick assets for every $1 of current liabilities. With the current quick ratio, McDonald's as per the finance assignmentwill face no difficulty while repaying the liabilities.

Gearing ratio

vi. Debt to equity

This ratio ascertains the company’s capital structure of the company (Atril 2014). The debt to equity of the company in 2020 is 7.7 times which was reduced to 4.4 times in 2021. As per the finance assignmentthis indicates that the company is having a high debt to equity in both years because McDonald's utilizes major capital markets, financing from banks and derivatives for meeting the requirements from financing

vii. Debt ratio

The debt ratio of the company stood at 66% in 2020 and 67% in 2021 indicating that the similar line of debt was used by the company. As per the finance assignmentthe debt, as well as assets, increased in the same proportion and hence the ratio changed marginally.

viii. Equity ratio

The equity ratio is the financial metric that evaluates the leverage amount used by the company. At present, the equity ratio is disturbed because the company is having negative equity (Vernimmen 2017). It is due to the fact that the liabilities of the company are more than the assets. Hence, as per the finance assignment management of the debt is an important consideration in this scenario because the liabilities are more than the assets.

Conclusion

The finance assignmentaims to provide an analysis of the recent changes in McDonald’s financial reporting followed by the financial performance. Through the analysis, it came to the forefront that the financial environment was highly disturbed by the pandemic and the Russia-Ukraine war. Both the situation led to financial losses for McDonald's and the creation of disturbance in the supply chain. It is analyzed in the finance assignmentthat though both the situation posed a threat the post-lockdown period witnessed an increment in the sales of the company raising the vision for the future prospect. Through the financial analysis, it is observed that the company’s profitability and liquidity have improved post the Covid era. The only issue is with the company’s debt and it is thereby recommended that the company should discharge some obligations and avoid any further loans. As per the finance assignmentthe management needs to consider the liabilities and have a thorough check on the economic environment which will help in bringing significant changes. In totality, the revenue and the fundamentals are strong which boasts that the company will be able to perform strongly in the long run.

References

Atril, P 2014, Financial Ratios. In: Financial Management for Decision Makers, (7th Edition). Pearson Education Limited, p. 70.

Campos, D 2021, Committing to the Core: How McDonald’s Innovated to Survive (and Thrive) During the COVID-19 Pandemic, viewed 1 December 2022 https://d3.harvard.edu/platform-digit/submission/committing-to-the-core-how-mcdonalds-innovated-to-survive-and-thrive-during-the-covid-19-pandemic/

Deegan, C. M 2016, Financial accounting. 8e edn. North Ryde, N.S.W.: McGraw-Hill Education.

McDonald 2021, McDonald annual report 2021, viewed 1 December 2022 https://stocklight.com/stocks/us/accommodation-and-food-services/nyse-mcd/mcdonald-s/annual-reports/nyse-mcd-2021-10K-21664461.pdf

NASDAQ 2021, MCD Dividend history, viewed 1 December 2022 https://www.nasdaq.com/market-activity/stocks/mcd/dividend-history

Sampath, U 2022, McDonalds to exit Russia after more than 30 years amid Ukraine war, viewed 1 December 2022 https://globalnews.ca/news/8838218/mcdonalds-russia-exit-ukraine-war/

Vernimmen, P 2017, Corporate finance : theory and practice. Fifth edn. Hoboken: Wiley.

Wiener-Bronner, D 2021, McDonald’s sales took a hit from Covid-19 restrictions, viewed 1 December 2022 https://edition.cnn.com/2021/01/28/business/mcdonalds-earnings/index.html

Appendix

|

Profitability and Market Ratios - MRW |

|||

|

|

|

|

|

|

|

|

2020 |

2021 |

|

|

|

|

|

|

Return on Assets |

Profit / Average total assets |

4730.5/ ((52626.8 + 47510.8)/2) |

7545.2 / ((53854.3 + 52626.8)/2) |

|

|

|

0.094479996 |

0.141719047 |

|

|

|

9.24% |

14.17% |

|

|

|

|

|

|

|

|

|

|

|

Return on Equity |

Profit / Average equity |

4730.5 / ((7824.9 +8210.3)/2) |

7545.2 / ((4601+7824.9)/2) |

|

|

|

0.577030533 |

0.990222036 |

|

|

|

57.70% |

85.04% |

|

|

|

|

|

|

|

|

|

|

|

Net Profit Margin |

Net profit / Sales or revenue |

4730.5/ 19207.8 |

7545.2 /23222.9 |

|

|

|

0.240860484 |

0.264919541 |

|

|

|

24.09% |

26.49% |

|

|

|

|

|

|

Liquidity Ratios - MRW |

|||

|

|

|

|

|

|

|

|

2020 |

2021 |

|

|

|

|

|

|

Current Ratio |

Total current assets / Total current liabilities |

7148.5/4020 |

6243.2/6181.2 |

|

|

|

1.778233831 |

1.010030415 |

|

|

|

1.77:1 |

01:01 |

|

|

|

|

|

|

|

|

|

|

|

Quick Ratio |

(Total current assets - Inventory) / Total current liabilities |

(7148.5-55.6) /4020 |

(6243.2 - 51.1) / 6181.2 |

|

|

|

1.764402985 |

1.001763412 |

|

|

|

1.76:1 |

01:01 |

|

|

|

|

|

|

Gearing Ratios - MRW |

|||

|

|

|

|

|

|

|

|

2020 |

2021 |

|

|

|

|

|

|

Debt to Equity |

Total debt / Total equity or Total liabilities / Total equity |

35622.7 /4601 |

35196.8/7824.9 |

|

|

or Actual debt / Total equity |

7.742382091 |

4.498051093 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Debt ratio |

Total debt / Total assets |

35622.7/53854.3 |

35196.8/52626.8 |

|

|

|

0.661464358 |

0.668799927 |

|

|

|

66% |

67% |

|

|

|

|

|

|

|

|

|

|

|

Equity Ratio |

Total equity / Total assets |

=-4601/ 53854.3 |

=7824.9/52626.8 |

|

|

|

0.414653929 |

0.148686601 |

|

|

|

41% |

15% |

|

|

|

|

|