Finance Management assignment on tax havens for tax management

Question

Task: how to use Finance Management assignment strategies to determine investment tax heavens?

Answer

1. Introduction

From the Finance Managementassignment research it is clear the federal government loses income tax revenue from the profits and income being shifted to low-tax countries. Tax avoidance can arise from wealthy individuals and multinational corporations, and it reflects legal as well as illegal actions. Both types of tax avoidance actions will be discussed in this report. However, there are many actions by corporations that show tax evasion rather than tax avoidance. Most of the international tax reductions made by individuals reflect evasion. The evasion can be seen in part because the United States does not possess tax on many types of income, such as income from interests paid by foreign corporate bodies. Tax evasion can be differentiated by corporate bodies or individuals, legal or illegal actions. This Finance Management assignmentclears the views on which countries are able to be considered tax havens. Their advantages and disadvantages to the corporate bodies and individuals and the reasons behind the techniques of tax optimization. Introduction of a tool for tax authorities that will help them monitor their tax legislation in the context of offshore income. Automatic Exchange for Information is helpful for maintaining the transparency of the international financial accounts of individuals by the IFCs. Discussion about the impacts on the total implication of the tool on the institutions and individuals. From automation to AI, new technologies are standing by offshore financial institutions to overcome financial complications. Streamlines programs and automated computer routines help the finance sectors to improve customer service and predict cash flow events and credit scores to detect fraudulence.

2. Finance Management assignment Tax havens and environments

Tax Havens

As per the Finance Management assignmentthere is no widespread definition for the term, yet tax havens are by and large nations or spots with low or no corporate duties that permit pariahs to set up organizations there without any problem (Galaz et al., 2018). Expense sanctuaries likewise commonly limit public exposure to organizations and their proprietors. Since data can be difficult to remove, duty sanctuaries are, once in a while, likewise called mystery locales. Expensive safe houses almost consistently deny being duty asylums. The tax haven offers foreign businesses and individuals a minimal or no tax liability on their bank deposits. Tax havens are generally used by organizations or wealthy people legally to stash money that is being earned from abroad, which helps them in avoiding higher taxes from other nations or countries (Blouin and Robinson, 2020). Tax havens help in encouraging foreign depositors and offer advantages in tax by providing legal security to the depositor as long as he pays the taxes of the home jurisdiction. A mix of remiss guidelines and mystery regulations empower companies and people to separate a portion of their pay from charge specialists in different countries. A few organizations that have generally been known for seaward expense safe house property incorporate Apple, Microsoft, Letters in order, Cisco, and Prophet.

Advantages of tax havens

The Finance Managementassignment shows the only reason high-end companies are using Tax havens is that they offer advantages in the credit area for the United States-based companies that are running offshore and earn a huge percentage of their income from that (Jones, Temouri & Cobham, 2018). The companies use Tax havens to avoid high tax rates that increase upon income increase.

• Tax havens provide various suitable tax planning opportunities to multinational industries.

• The most important benefit for a company investing in a Tax haven is that it can save taxes and save their money. Apple gained $214.9 billion from international business and owed a tax amount of $65.4 billion to the United States Government (Oxfam International, 2022). It uses Ireland as a Tax haven and saves a lot amount by the facilities provided y Tax haven.

• It helps an individual to grow, and that leads to the growth of the whole nation.

• The process implemented for saving tax is entirely legal and logical. A country that has no rules and regulations following tax implications is considered a Tax haven.

• There is no implication of tax on capital gain; therefore, business people are influenced to invest in that country.

• Tax havens provide a convenient financial environment to the investors who bring their economic inflow to the countries.

• The countries enacting tax havens benefit from the capital investment done by the companies to enhance the finance sector of that country.

• The tax-saving facilities of Tax haven encourage new investments from different countries that are having a positive impact on the economy, and the country gains profits. Nike holds an amount of $ 10.7billion from overseas business. $3.6 billion of the company would have been used as tax payment to the US if Tax haven were not used (Oxfam International, 2022). Nike invests in a Tax haven and uses Bermuda as a Tax haven. Goldman Sachs also holds billions of dollars from the offshore business and also uses Bermuda as a Tax haven.

• The Finance Management assignmentshows attracting foreign individuals or businesses, the countries acting as tax havens for companies, even if they charge a nominal rate of tax over the investment that is much lower than the original tax payment, the substantial earnings of the Tax haven countries are more in tax revenues than from any other corporate business. The country may also provide benefits to its residents by providing job offers in those investment business operations.

• A tax haven is not only helping companies and individuals to escape from tax payments but also provides many other functions that are attractive such as facilities for relocating income from high tax locations to low tax ones.

• The identities of investors are kept safe and private by the laws of Tax havens, and no information is exchanged to the government where the company belongs.

Many companies such as Microsoft, Wal-Mart, IBM, Pfizer, Chevron and many more companies running overseas are saving themselves from heavy tax liabilities and saving billions and billions of their money.

Disadvantages of tax havens

Tax haven provides major benefits to most individuals or businesses earning millions, to pay less tax and opportunities to move their money to other countries. But this comes with consequences:

1. Tax heaven can give rise to money laundering and other illegal activities. This may be beneficial in the short run, but in the long run, it will affect the economy of the country. When such multiple tax havens are brought into the investigation, there will be a chance of the global recession that was seen in 2007-2009.

2. Tax haven often has negative impacts on the country due to the involvement of suspicious clients or suppliers involved in the business. This may result in additional scrutiny of the business by the government authorities in the form of tax audits.

3. Most of the tax haven clients identified on this Finance Management assignmentare considered high-risk clients by the banks. This results in additional due diligence from them, and there will be less probability of opening corporate accounts in those banks.

4. The cost involved in operating the tax haven is often more than operating domestically. Even though the tax heaven is used to limit taxes, some investors or business finds it more useful just to stay away from the legal sights (Emmanuel and Evans, 2019).

5. Many business enterprises put their money in tax haven countries. This can become dangerous if the government is unstable and decides to take up exchange controls resulting in control of outside investments.

6. There is inequality in tax havens. If someone wants to put their money in it, there might be a requirement of bribery and other fees to hire someone specific in order to make the finances in the tax havens.

7. Tax havens may be beneficial for many businesses organization, but it also attracts higher recovery from citizens by imposing heavy import duties on the items that are imported from other countries (Garcia-Bernardo, Janský and Tørsløv, 2021).

8. There is a lack of transparency in the tax haven. The legal and administration in a tax haven are opaque, which may result in betrayal for various parties.

9. Tax haven also affects the economy of a country. It can result in inflation and lower employment opportunities. For example- many multinational companies in the USA shifted their profits to Puerto Rico in order to take advantage of the credit. This resulted in a reduction of global investment and shifted investment abroad, which led to a 38% reduction in US investments and employment opportunities by 1 million jobs.

10. People belonging to the tax haven countries often avoids tax or pays less tax. This leads to an unstable reduction of the economy of that country and gives rise to parasitic nature that solely depends on the income of other country's income. Cayman Island is one of the best examples where it imposes no direct tax on its citizens, including property, income and payroll tax. Moreover, the corporate and income tax is 0%.

Reasons behind the use of tax optimization techniques

Tax optimization is the process that involves searching and identifying the legal framework of a business and giving the possible result of effective tax planning in which the business has to pay taxes accordingly. As per the Finance Managementassignment research these optimization techniques are important for any business organization for the following reasons:

1. Tax optimization helps in reducing the tax burden of any business by providing an effective financial plan. This helps in minimizing penalties and also reduces tax risk for the business. The business can avoid any tax offence if the tax is paid accordingly.

2. It leads to additional sources of funds. The reduction of tax rates helps the reduce business enterprise to have more cash at the end of the financial year (Tuchak, 2019). This cash can be further reinvested in the company to earn more profits for the organization. Moreover, many investors will likely be interested in investing where there the business has to pay less corporate tax.

3. Tax optimization also helps business enterprises to find sources of capital from outside, which can be challenging for many small-scale businesses. The reduced tax also helps this small-scale businesses or individuals to save money and can use it in cases of emergency.

3. Change in wealth management after full implementation of AEOI

AEOI refers to the previously defined information for the purposes of tax between the competent authorities. The abbreviation AEOI stands for Automatic Exchange of Information. Any information related to tax is subject to AEOI. The increased globalization of the world has made it easier for taxpayers to make their payments outside of the domestic country as well. Many taxpayers fail to obey the tax regulations of the jurisdiction, and as a result, huge amounts of money go untaxed. Tax evasion has become a large problem for all the developed, underdeveloped, large and small jurisdictions. Later in 2014, the development of the CRS-AEOI Standard took place to make the tax payment of the financial accounts across the border more transparent (Chiocchetti,2020). After decades of unsuccessful attempts to fight tax evasion, the final implementation of the Automatic Exchange of Information by the Foreign Account Tax Compliance Act (FATCA) and the Common Reporting Standard (CRS). The implementation of first encompassing international tax-related information exchange on an automatic basis was a very important development. The reason is that tax evasion as per the Finance Management assignment findings is that it results in inequality in the socio-political environment and loss of political supremacy. Under the CRS- AEOI standards, All Financial Institutions are obliged to report the information regarding the financial accounts held by foreign residents who are liable for the tax payment to the domestic tax authorities. The framework of information exchange according to the standard required-

1. Exchange of International agreement on a legal basis between the jurisdictions for CRS-AEOI.

2. Implementation of rules by Financial Institutions for collecting and reporting information.

3. Capable Information Technology and administrative officials who will receive the information exchange.

4. Steps and measures are taken to ensure the safety and high standard confidentiality of the data.

Developing countries have excessive exposure to the risk of international tax evasion, and hence their requirement for accessing information exchange is much greater. By participating in the CRS- AEOI, developing countries can fight against their tax evasion by generating more tax revenues for meeting sustainable development goals. The impact of these international standards has been felt in the jurisdictions; The standards have made a contribution to a huge amount of increase in the numbers of registered taxpayers having their tax authorities (Ahrens and Bothner, 2020). Household assets constituted to be 67% lower than they would have been without the information exchange in the tax havens—an exchange of information by 101 jurisdictions on approx. Of 75 million financial accounts across the world were noticed in 2020. There has been an increase in information exchange of 7% over the year. There has been a correlation between the implementation of CRS-AEOI in 2017 and the decrease of currency deposits in foreign accounts in 2018 in International Financial Centers. With the improving transparency of tax purposes, the exposure of jurisdictions to all forms of IFFs is reduced. The implementation of Automatic Exchange of Information standards was challenging for the ones who were to adopt it in the early stage (Gennadi and Stanislav, 2021). However, the process of implementation varies according to the unique circumstances of jurisdictions.

3.1 Finance Management assignment – tax optimization techniques

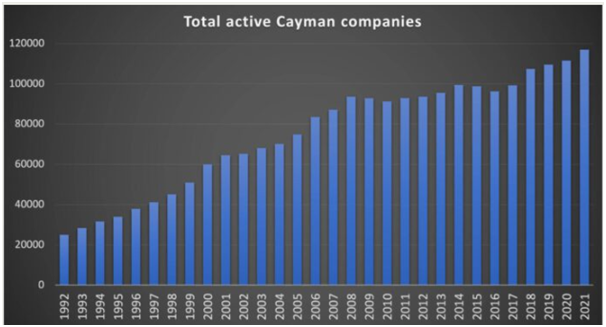

The increase in the payment of taxes has made the companies register under various tax havens that allow these companies to optimize taxes. Therefore, there is certainly an increase in tax optimization techniques. If theFinance Management assignment technique to register a company under the tax haven is being considered, then it has been found that in the case of the Cayman Islands, the number of registrations has increased significantly over the span of the last five years. For instance, in 2017 the number of companies registered on Cayman Island was 100000, which has now increased to 120000 (Klein, 2022).

Figure 1: Number of companies registered on Cayman Island

(Klein, 2022)

The Laffer curve explains the relationship between the tax rates set by the government and the revenue collected in the form of tax at that particular rate of tax (Hájek et al., 2021). As per this theory, it has been stated that if there is an increase in the taxes on production, then production will be reduced. If the tax rate is increased beyond the optimal rate of tax, the workers of the company will start to assume that their extra efforts are resulting in additional income. Hence, the employees start to work less, income falls, and the tax collected will decrease. Similar is the case currently; due to the increase in corporate tax, the companies will have to pay a higher amount in tax. Although following the Laffer curve, the companies could reduce the production; however, reducing the production will hamper the revenue generated by the company (Sanz-Sanz, 2022). Hence, lowering production is not an option. Therefore, the companies use tax optimization techniques that allow the firms to pay a lower amount of tax, thereby retaining a higher amount of income.

As per the latest disclosures from OECD, it has been found that the government across the globe is losing 500 billion dollars in tax revenue annually (McGoey, 2022). One of the reasons behind the loss is tax optimization by the companies. Therefore, it is certain that with the advent of time, the optimization of tax has increased. Nowadays, even the holding companies have increased its loan to subsidiaries and earned interest from it. The holding company will then redistribute the interest income in the form of dividends. Since the interest income is transferred to dividend income, therefore, the tax paid by the company is reduced.

All in all, the differentFinance Management assignment strategies, such as the use of tax havens and providing loans to subsidiaries, have increased. This is due to the increase in taxation rate that has created a situation that had been explained by the Laffer curve. However, the companies are not willing to reduce the revenue by reducing production since it will hamper the income of the company, thereby acting against the stakeholder theory (Freeman, Dmytriyev and Phillips, 2021). Therefore, the companies have been increasing the ways or finding new ways by which the tax could be optimized. Also, the number of start-ups has been increasing, and it can be assumed that these companies are not generating enough income in the initial years. Therefore, the inclination toward tax optimization should automatically increase, which could help the companies to generate higher income and retain a higher portion as well. Interestingly the owners or CEOs of the multinational companies are donating to charities which are understood as a way of philanthropy. For instance, Elon Musk has liquidated more than 16 billion dollars worth of shares of Tesla and has declared to donate it to the charity (Bloomberg.com, 2022). Although this is an act of peak philanthropy, however, donating these stocks will reduce the amount of tax that he owes to the government.

3.2 Implications of the US tax reform of 2017 for the management of multinational corporations

It was observed on this Finance Management assignmentthat before the introduction of amendments in the US tax law in 2017, especially prior to the introduction of the Tax Cuts and Jobs Acts (TCJA), the US multinationals often entered into the agreement of booking disproportionate amounts of profits in low tax, locations around the world. In the year 2017, it was found that US professionals reported more than 40% of their total overseas income from low-tax countries. These countries included places like the Netherlands, Ireland, and Luxembourg. This trend was found because prior to the intersection of changes and tax reforms in the year 2017, the effective tax rates in new investments Mae by these multinational companies in foreign countries were much lower than the ones applicable in the US (Gale et al., 2019). The introduction of TCJA in the US has ensured that the incentive to book profits in foreign countries or otherwise known as tax havens, is reduced significantly. The main implication of this is that more and more companies will start reporting their income under the provisions of US tax laws only, and this will increase the revenue that is generated by the US government from tax collected within the country. The implication of these changes was seen in several components of the US economy. The consumption rate of the US economy grew by around 2.6% in the subsequent year of 2018 (Davidson, 2019). In the case of revenue, it was found that the US economy was able to earn around $45 billion more than the previous amount from income tax returns as a direct result of the application or implementation of the newer reforms to prevent the act of tax avoidance using foreign countries (Gravelle and Marples, 2019). However, there were some other unwarranted trends observed by the US economy, which included a decrease in payroll tax revenues to the tune of $ 7 billion. This was coupled with a decrease in the amount of corporate tax revenue to the tune of $40 billion (everycrsreport.com, 2021). Another major implication that was observed in the case of implementation of the reforms related to the eradication of such tax havens is the reduction of the corporate effective tax rate to about 21%. The change in the individual tax rate was much smaller as compared to the one experienced in the case of the corporate tax rate. It was observed that the individual tax rate fell from 9.6% average to about 9.2% average individual tax rate. This smaller change in the drop-in average tax rate in the case of individual taxpayers can be attributed to the fact that, in most cases, it has been found that the corporates are the ones who indulge in reporting their earnings from foreign countries rather than individuals. This justifies the step taken in the year 2017 to curb the malpractice of utilizing tax havens for the purpose of avoiding paying taxes in the US at a higher tax rate. The implications of the tax changes identified on this Finance Management assignmentare made by the government are imminent, but it must be ensured that the process of bringing in changes to avoid losing tax revenue to foreign countries is kept on going.

3.3 Ethical implications and Critical discussion regarding the implication for both the company and country

There are several ethical implications for both the country as well as the company when it comes to the implementation of automatic exchange of information or AEOI. They can be listed as below:

1. As per the law of AEOI, any country that has a ratified tax treaty with the country of US, for instance, countries like Russia, China, Mexico, Argentina, etc., can simply ask the government of the United States about the identities of the individual who are likely evading tax from their home country and stashing it in the United States. Although the action taken in this regard seems correct, as evasion of money should be avoided, there is a major concern related to the ethical implications of the same (Yasa et al., 2022). It must be noted that the same laws apply to the people who are stashing their money in the countries mentioned above. i.e., the United States can, at any given point in time, ask for the information related to any individual it suspects of avoiding tax in his home country. It is a violation of the privacy of the individuals. This is because any individual who is considered unfavourable to the government and has international transactions can lose the privacy of his personal data as an excuse to find out whether he had the intention of evading tax (Maria, 2018). Due to this, the companies will refrain from opening their businesses in the US, and for the country, it will lead to a loss in revenue and employment creation.

2. It has become a federal criminal offence to stash money or other valuables in the US for the purpose of defrauding one's home country. But it must be ensured that the procedure that is used for the purpose of determining the fraudulence of the financial transactions that are undertaken by an individual or corporate body is done as per ethical principles of confidentiality (Beer, Coelho and Leduc, 2019). It has been observed that in the case of corporates, in lieu of establishing fraudulent practices, the government of the US, on many occasions, has tried to gain access to the financial statements of the companies. This kind of practice needs to be stopped immediately. The reason for this is that it can have a serious implication for the country as the businesses and individuals will not be able to trust the government in terms of protecting their fundamental rights to privacy, and this can disturb the very mantle upon which the constitution of the country is framed. In addition to this, the country will also suffer economically since major companies will try to find ways out of the US economy rather than becoming an integral part of it due to the feat of breach of confidentiality by force by the US government (Jansky et al., 2018). The Finance Management assignment research shows The companies will suffer as they will have to incur additional costs in ensuring due diligence and ensuring that no excuse is given to the government to access their files, and due to this, non-revenue generating expenses will increase for the companies.

4. Digital finance and the new finance ecosystem

AI has become an integral part of companies, and currently, it has been used in taxation as well. AI has the ability to process numerous transactions within a fraction of a time. Hence, it will assist the tax practitioners to focus on areas that are value added to the taxation. Currently, the taxation team spends 40% to 70% of their time gathering and manipulating information (ey.com, 2022). This operation can be performed by the AI within a fraction of a time.

Tax havens provide a huge benefit to individuals and organizations to save taxes; however, there are multiple disadvantages as well that are discussed in part 2 of the report. One of the disadvantages is money laundering and illegal activities. Using AI and the tons of data that the companies could harness, these kinds of illegal activities can be avoided, and the companies could still save a huge amount of tax. Also, the political structure of the tax havens is unstable, making the process of offshoring a complex and tedious action. Using AI, the companies could avoid the turmoil condition of the government. The ultimate goal of tax optimization is to reduce the tax that will increase income. As per EY, there are a number of algorithms existing that has an immediate impact on tax and have been around for a long time, which do not offer a competitive edge to the companies. Hence, the adoption of AI is a necessary thing to do which will ensure that better taxation can be achieved, allowing the companies to optimize tax in a better way.

In part 3 of the report, the introduction of CRS-AEOI and FATCA has been discussed. The introduction of these regulations has created an urgency for the companies to ensure that the optimization of taxes does not result in tax evasion. Therefore, the companies are spending a humungous amount of time in tax planning and ensuring that the taxes are minimized ethically. In doing so, a huge chunk of time is being allocated to tax planning. As per EY, in order to process 15000 transactions, the company had taken 33 hours, and the process was 95% to 97% accurate (ey.com, 2022). On the other hand, with an accuracy of 97%, AI completed the processing within 5 seconds. Even though the accuracy was not 100%, the manual time was reduced. Therefore, using the abundant data and AI companies can easily reduce the time to plan tax.

If offshore structures are considered on this Finance Management assignment, then it is certain that it is not a tool for tax evasion but rather a tax avoidance tool. However, these tax havens are prone to tax evasion as well. As per OECD, the global cost of tax havens is 500 billion dollars annually. Therefore, in the future, the regulatory bodies will monitor these tax havens very crucially, implying that the companies that are registered in these tax havens will have to be careful in their operations. Even though these companies are not evading tax, there can be instances where tax evasion can be misrepresented as tax avoidance. The emergence of AI will play a pivotal role in decreasing tax evasion by companies. The AI can make decisions using a variety of text analysis that includes analyzing information over the internet (Zheng et al., 2020). The AI can maintain its own database where it can be used to identify corruption. Based on this kind of data analysis, AI can easily help the tax authorities find out suspicious activities that can eventually lead them to find the core of the problems with taxation in a company. Therefore, it is certain that data is the new oil that will run the AI. Hence, a huge amount of data is required to be harnessed.

Transfer pricing is a practice for accounting and taxation that will allow for pricing transactions internally within the organization between the subsidiaries. This is a very hard process and requires an immense human calibre to pull through. PwC has analyzed the situation and discussed how AI is an emerging technology in the field of transfer pricing. AI can do both descriptive analysis and predictive analysis. In the case of predictive analysis, AI will gather data on different trends across the globe. Since AI can do the predictive analysis, therefore, it will predict a hypothesis that the company can easily apply during the transfer pricing mechanism (Raikov, 2021). Therefore, the manual effort is minimized to the extent that allows the company to make only the final decision. Therefore, companies that have multiple subsidiaries can use AI to conduct transfer pricing, which is relatively easier than performing manually.

The main question raised on this Finance Management assignment is whether data and AI assist offshore structures to promote tax havens and transfer pricing. The answer to it is no. This is because AI will allow regulatory bodies to monitor the financial information of the companies minutely. Hence, any kind of shortcomings on the side of the companies will be devastating for the companies. Since offshore structures are prone to tax evasion, therefore, it can be a dreadful task for companies to rely on this structure in the era of AI. However, transfer pricing is an area that can be looked at easily using AI, therefore, making it more and more accurate (Choi, Furusawa and Ishikawa, 2020). There are multiple companies that are using transfer pricing. However, it can be more accurate if they use AI. All in all, AI is set to discourage tax havens, however, elevating the presence of transfer pricing.

5. Conclusions

Based on the discussion above, it can be evidently stated that although tax havens are a great way to reduce the income tax expense of a company, however, the OECD or other regulations are finding evidence on how there are companies that exploit the nature of tax havens and use it for tax evasion. Hence, these regulatory bodies have introduced FATCA and CRS in order to monitor the taxation of the companies. The emergence of AI has become a dawning idea for these companies that are registered in tax havens. Although these companies might not be operating in bad faith, however, there might be an instance that led a company to conduct some operation that results in tax evasion. Hence the emergence of AI and the abundance of data is a serious issue for the companies, which discourages these firms from inclining toward the offshore structures of taxation. However, techniques such as transfer pricing that allow companies to optimize tax can be enhanced by using AI technology. It is evident that the way by which these AI operate is basically a data analytics and predictive analysis ecosystem. Therefore, the Finance Managementassignment concludes, till the system is fed with quality data the AI will be able to predict hypothesis that allows it to make a better transfer pricing decision.

References

Ahrens, L., and Bothner, F., 2020. The big bang: Tax evasion after automatic exchange of information under FATCA and CRS. New Political Economy, Finance Management assignment25(6), 849-864. chrome-extension://efaidnbmnnnibpcajpcglclefindmkaj/https://www.oecd.org/tax/transparency/documents/aeoi-implementation-toolkit_en.pdf

Beer, S., Coelho, M.D. and Leduc, S., (2019). Hidden treasure: The impact of automatic exchange of information on cross-border tax evasion. International Monetary Fund. https://books.google.com/books?hl=en&lr=&id=eckaEAAAQBAJ&oi=fnd&pg=PA4&dq=company+privacy+risk+for+automatic+exchange+of+ information&ots=ZiTJQkZrDk&sig=Fio1R3f2vGUTMFlIm5C4IAVYCSk

Bloomberg.com. 2022. Bloomberg - Are you a robot? [online] Available at:

Blouin, J. and Robinson, L.A., 2020. Double counting accounting: How much profit of multinational enterprises is really in tax havens? Available at SSRN 3491451.http://faculty.tuck.dartmouth.edu/images/uploads/faculty/leslie-robinson/BlouinRobinson_November2020.pdf

Chiocchetti, A., 2020. The Effects of Automatic Exchange of Information on Evaded Wealth. Finance Management assignmentchrome-extension://efaidnbmnnnibpcajpcglclefindmkaj/http://piketty.pse.ens.fr/files/Chiocchetti2020.pdf

Choi, J.P., Furusawa, T. and Ishikawa, J., 2020. Transfer pricing regulation and tax competition. Journal of International Economics, 127, p.103367.https://www.sciencedirect.com/science/article/pii/S0022199620300829

Davidson, P., 2019. The economy grew 2.6% in Q4 and 2.9% in 2018, matching the strongest yearly showing since the recession. [online] USA TODAY. Available at:

everycrsreport.com., 2021. Trends and Proposals for Corporate Tax Revenue. Finance Management assignment[online] Available at:

ey.com. 2022. [online] Available at:

Freeman, R.E., Dmytriyev, S.D. and Phillips, R.A., 2021. Stakeholder theory and the resource-based view of the firm. Journal of Management, 47(7), pp.1757-1770.https://journals.sagepub.com/doi/pdf/10.1177/0149206321993576

Galaz, V., Crona, B., Dauriach, A., Jouffray, J.B., Österblom, H. and Fichtner, J., 2018. Tax havens and global environmental degradation. Nature ecology & evolution, 2(9), pp.1352-1357.https://w3-piano.df.cl/noticias/site/artic/20180914/asocfile/20180914135209/galaz2018.pdf

Gale, W.G., Gelfond, H., Krupkin, A., Mazur, M.J. and Toder, E.J., (2019). Effects of the tax cuts and jobs act: A preliminary analysis. National Tax Journal,Finance Management assignment 71(4), pp.589-612.https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3280582

Garcia-Bernardo, J., Janský, P. and Tørsløv, T., 2021. Multinational corporations and tax havens: evidence from country-by-country reporting. International Tax and Public Finance, 28(6), pp.1519-1561.https://drive.google.com/file/d/1tuNdC6mp4gwZo2dDXmHlPBoRP6PP2IoI/view

Gennadi, T. and Stanislav, A., 2021. The Roots of Legal Problems Arising in the Course of Automatic Exchange of Information in Tax Matters Between the EU and Russia. Russian Law Journal, 9(4), pp.99-127.https://cyberleninka.ru/article/n/the-roots-of-legal-problems-arising-in-the-course-of-automatic-exchange-of-information-in-tax-matters-between-the-eu-and-russia

Gravelle, J.G. and Marples, DJ, (2019). The Economic Effects of the 2017 Tax Revision: Preliminary Observations. CRS Report, 45736. http://roostertoday.org/wp-content/uploads/2019/05/The-Economic-Effects-of-the-2017-Tax-Revision-Preliminary-Observations.pdf

Hájek, J., Šafr, K., Rotschedl, J. and Cadil, J., 2021. The Laffer curve decomposed. Ekonomický ?asopis (ISSN: 2729-7470).http://zbw.eu/econis-archiv/bitstream/11159/5575/1/176478992X_0.pdf

Jansky, P., Knobel, A., Meinzer, M. and Palanský, M., (2018). Financial Secrecy affecting the European Union: Patterns across member states, and what to do about it. Petr Janský, Andres Knobel, Markus Meinzer, Miroslav Palanský. https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3267398

Klein, M., 2022. Almost 117,000 companies registered in Cayman. [online] Cayman Compass. Finance Management assignmentAvailable at:

McGoey, S., 2022. Nearly $500 billion lost yearly to global tax abuse due mostly to corporations, new analysis says - ICIJ. [online] ICIJ. Available at:

Oxfam International. 2022. Fifty biggest global US companies stash $1.3 trillion offshore | Oxfam International. [online] Available at:

Sanz-Sanz, J.F., 2022. A full-fledged analytical model for the Laffer curve in personal income taxation. Economic Analysis and Policy, 73, pp.795-811.https://www.sciencedirect.com/science/article/pii/S031359262200008X

Tuck, T., 2019. Accounting tools and tax optimization schemes. Management and Entrepreneurship: Trends of Development, Finance Management assignment4(10), pp.8-18.https://management-journal.org.ua/index.php/journal/article/download/133/117/

Yasa, P.G.A.S., Monteiro, S., Atmaja, B.K.D., Sudiarawan, K.A. and Padmawati, N.K.T., (2022). Automatic Exchange of Information (AEoI) for Indonesian Tax Purposes: Economic Analysis of Law Approach. Lex Scientia Law Review, 6(1). https://journal.unnes.ac.id/sju/index.php/lslr/article/view/55143

Zheng, S., Trott, A., Srinivasa, S., Naik, N., Gruesbeck, M., Parkes, D.C. and Socher, R., 2020. The ai economist: Improving equality and productivity with ai-driven tax policies. arXiv preprint arXiv:2004.13332.https://arxiv.org/pdf/2004.13332Finance Management assignment