financial resources management assignment for Aus Biotech

Question

Task: How AusBiotech can use financial resources management assignment research techniques to improve financial management

Answer

Introduction

This financial resources management assignmentwill analyse and share recommendations relating to finance allocation with AusBiotech. Financial resource management requires a strong support from the financial tools and strategies. It is the responsibility of financial experts, business managers, or owners to keep records in order to determine where expenditures might be reduced in order to boost profitability. Cost management is used to calculate business costs for internal business decision-making, cost control, and day-to-day planning. The overall operational costs are recorded and reported using cost reports in cost accounting. This is distinct from the management accounting reports utilised in every company organisation, which include reports like cash flow predictions and profit and loss statements. This financial resources management assignment is going to discuss the role of SWOT in strategic allocation of financial resources in an Australia-based medical manufacturing company, AusBiotech. The main area of this study is to understand the role of this chosen technique in managing the company's cost figures and along with the financial resource management.

Overview of the firm

The chosen firm on thiefinancial resources management assignment isAusBiotech, a Australia's life science organisation that has worked on behalf of their members for more than thirty-five years to provide representative services in the global growth of the Australian medical service industry. The firm deals with their well-connected network of three thousand members in this sector involving therapeutics, medical technology, agri-biotech and digital health monitoring services (Blocher et al. 2022). By offering programmes to promote long-term sustainable growth, outreach and access to markets and participation and assistance for members nationally and internationally, the company is committed to the development, growth, and profitability of the Australian life science industry. The financial resources management assignmentresearch shows the brand is represented in every state of Australia, offering a nationwide network to assist members and encourage the monetisation of Australian life science in domestic and international markets.

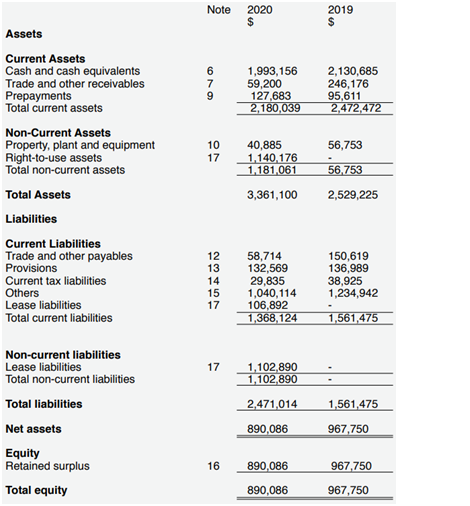

Figure 1: Financial positioning

(Source: Ausbiotech.org, 2022)

The company maintains close ties with the government and invites members to contribute their ideas and views. To maintain Australia's market edge in the life sciences on a worldwide scale, the leadership of the firm pushes for legislative changes in tax, clinical trials, copyrighted material, regulatory, and other areas. financial resources management assignmentresearch shows that Life science businesses are particularly vulnerable, and facilitating the sector's expansion and development through access to funding is essential (Pagottoet al. 2021). AusBiotech is dedicated to strengthening business-investor ties, up-skilling employees to better understand the investing sector, and fighting to maintain tax incentive laws that enable businesses to access finance. Life science businesses, from start-ups to established multinationals, research institutions, universities, specialised service providers, corporate, governmental, individual, and student members, as well as members from Australia and other countries, make up the company's user base. The company's strategic plan aims to build on the solid foundations that AusBiotech has established over the course of more than twenty-five years by developing and adapting along with the needs of the industry in order to address the anticipated opportunities and challenges and to assist the sector in realising its possibilities for nationally significant financial expansion (Booth, 2022).

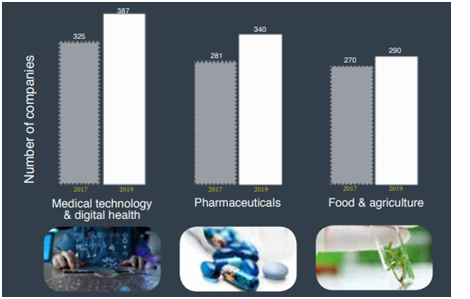

Figure 2: Australian life science industry

(Source: Ausbiotech.org, 2022)

Discussion of the chosen concept

Different methods and conceptual models are used to explain a business structure and its scope in their targeted market. In this financial resources management assignment, financial resource management and cost factors are prioritised. Hence, the chosen concept or technique is expected to analyse the company's business performance from the point-of-view of cost management. In this regard, the section has chosen the SWOT tool to talk about the cost management infrastructure of the selected medical service providers in Australia (Toouli, 2019). The idea is to understand the way of dealing with financial consequences and strengths of the company's funding sources by using this tool. This tool is helpful to understand the strengths, weaknesses, opportunities and threats of this firm's cost management process.

The main concept of using this tool is to look into the financial efficiency and funding sources of the firm. The form is associated with a huge responsibility of conducting medical services by appreciating diversity and inclusion. The form takes the responsibilities of its members and related stakeholders to the Australian biotechnology industry. The chosen tool on this financial resources management assignmentis going to discuss these areas and positive sides of dealing with the cost factors within the company. Local and international investors have a fantastic chance to invest in the booming Australian life sciences sector (Peppou, 2018). AusBiotech is dedicated to developing connections between investors and life science enterprises, enabling businesses in navigating the infamous "valley of death" and helping investors in finding cutting-edge, Australian businesses that provide excellent returns on investment. The chosen tool is going to analyse these areas of the firm. The target of this financial resources management assignment is to understand the existing cost settings and future possibilities of cost management based on the present cost analysis.

Use of SWOT in strategic allocation of financial resources

The company belongs to the 161 ASX-listed companies with a market capital of more than $200 billion. The organisation has employed nearly 240,000 members in this industry as per their annual report. An approximate of $1 billion capital has been raised by the Australian life science market. The company focuses on the membership engagement, advocacy by building their strengths in this market based on relevance and reputation for sustainable growth (McKeon, 2021). AusBiotech has ended the fiscal year in a strong position, which is noteworthy given the current financial climate. The company has always targeted to become a financially sound organisation. The chosen tool is the basis of most strategic plans. The financial resources management assignment strategic analysis of AusBiotech requires a thorough description of what the company is currently doing to secure their cost structure and what it is capable of doing to improve their cost management (Carboon et al. 2022). Following is the SWOT analysis of the company's strategic financial resources.

|

Strengths Innovative investment policies Huge partnership programs One-day investment conferences Collaboration with "BBC StoryWorks" |

Weaknesses Weak domestic supply chain during pandemic Reduced resources and poor experience of professionals Increased innovation has shown an intention of lack of experiments Pandemic has violated several areas of biotechnical industry |

|

Opportunities Following the market trends Offering biotechnology services based on globalisation requirements Continuous monitoring of environmental situation |

Threats Critical clinical trials Market competition Changing expectations through digital health commercialisation |

Table 1: Detailed SWOT of financial resources

In short, the tool has performed a good understanding of the financial resources of the firm, which indicates their strengths in financial planning along with their loopholes in financial planning. The selected tool is useful to gather relevant data on the actual condition of the firm and its future scopes. The tool demonstrates that the financial statements cover AusBiotech Ltd. as a distinct legal person with an Australian corporate and residential address (Galpin, 2021). Unless the company has an unconditional right to postpone settlement for at least a year after the conclusion of the reporting period, in which case the obligations are proffered as current provisions, the company's commitments for long-term employee benefits are presented in its financial position statement as non-current employee provisions.

Discussion

The SWOT analysis has shown that the company adopts several tricks to increase their investments in this field. Their motive is to engage the Australian community in a better and diversified medical service experience. They believe in continuous growth and expansion by offering greater networking policies and unique investment ideas. The expansion of the "Australian life sciences" sector and, Australia's position among the top five countries in the world's life sciences sector, depend on the facilitation of state-based, regional, and worldwide possibilities for investment conversations, partnerships, and agreements (Gilding et al. 2020). A variety of local and foreign specialists who are at the forefront of investment and partnership will be present at events, and Australian life science startups will have the opportunity to present their business case to an investor audience in eight minutes.

Through the informal and professional networking at the investment events and through "AusPartnering", AusBiotech's business "matching programme", the firm assists delegates in setting up one-on-one gatherings during certain events. The company encourages their stakeholders to attend these events, where they get a direct way to create partnerships by strengthening connections. The tool also focuses on their one-day investment conferences that offer unique opportunities to connect with investors around the globe. This is one of the innovative ways followed by the firm to take their business into the next level (Okongwu et al.2015). The broker meeting in "BiotechPitch" the SWOT analysis tool highlights events, which are regularly hosted across the nation to allow local brokers, investors, and financial advisers the chance to hear in-depth briefings from a number of biotechnology businesses.

The financial resources management assignmenttool also emphasises comprehending the characteristics of Australian investors and financial advisors. Due to Australia's leading position in the world in the life sciences and its wide range of investment prospects in biotechnology and pharmaceuticals, there is significant investor interest in the country's life sciences. AusBiotech is dedicated to developing connections between investors and life science enterprises, helping investors find creative financial resources by providing high-value returns on investment. The tool has shown several new concepts and ideas that are used by this life science organisation to promote diversity in their financial scheme (Borg &Bragge, 2020). This tool has offered a wide look into the company's business statistics and investment strengths. The selection of this tool is appropriate in this case as this helps the study to gain an in-depth understanding of AusBiotech's financial resources and several investment plans. The financial resources management assignmenttool is helpful in outlining the key points of the business's cost planning and financial resources. AusBiotech is pleased to share industry success stories that show fruitful collaborations and financial investments in Australian life sciences. "BBC StoryWorks" have collaborated with "The International Council of Biotechnology Associations" to produce a new biotechnology series called Nature's Building Blocks. AusBiotech is a partner of TICB as well. The business examines the carrying values of both its unique financial resources to see whether there are any signs that they have been compromised. The recoverable amount of the asset is the higher of the asset's fair value less costs to sell and value in use (Ohama, 2019). This is compared to the asset's carrying value if such an indication is present. According on the information acquired using the financial resources management assignmentSWOT tool, any difference between the asset is carrying value and it is significantly alleviated is recognised as an expense to the income statement.

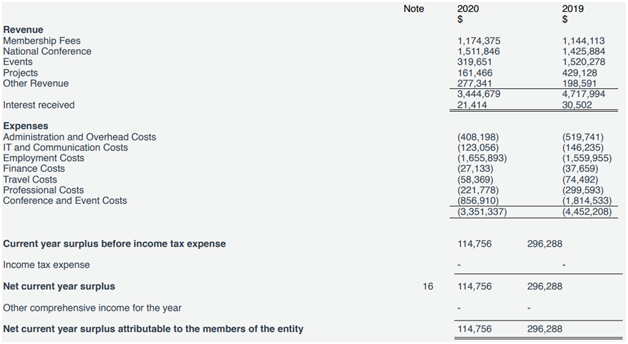

Figure 3: Statement of profit and loss

(Source: Ausbiotech.org, 2022)

Conclusion

AusBiotech is a limited by guarantee, unlisted corporation. The ability of the organisation to generate sufficient cash flows to support its activities is under the management's authority. The company's directors make sure that this goal is aligned with the overall risk management plan. The Board regularly approves and evaluates risk management procedures. Future cash-flow considerations and credit risk rules are a few of these. The financial resources management assignmenttool has displayed that financial assets and contingent obligations make up the entity's assets.

References

Journals

Blocher, E., Stout, D., Juras, P., & Smith, S. (2022). Cost Management: A Strategic Emphasis (9th ed.). Boston, MA: Richard D. Irwin, Inc. ISBN: XXXXXXXXXXX86 Embree, J. L. (2015). A Balanced Scorecard with Strategy Map. Journal of Nursing Care Quality. financial resources management assignmentVolume 30 (Issue 4). Pages 352–358 https://doi.org/10.1097/NCQ.0000000000000121

Booth, Y. (2022). A guide to pitching in a virtual world. Australasian Biotechnology, 32(1), 22-23. https://search.informit.org/doi/abs/10.3316/informit.463619923282850

Borg, K., &Bragge, P. (2020). A survey of workforce skills and capacity in the medical technology, biotechnology, pharmaceutical and digital health (MTP) sector. Melbourne, Australia: BehaviourWorks Australia, Monash Sustainable Development Institute, Monash University. https://www.mtpconnect.org.au/images/MTPC_Workplace_Skills_Report.pdf

Carboon, P., Martinez-Coll, A., & Roger, G. (2022). Gaining cornerstone investment in Australian medtech. Australasian Biotechnology, financial resources management assignment32(1), 32-33. https://search.informit.org/doi/abs/10.3316/informit.463694455167883

Galpin, K. (2021). ASX-listed healthcare sector deepens and strengthens. Australasian Biotechnology, 31(2), 36-38. https://search.informit.org/doi/abs/10.3316/informit.212615167463638

Gilding, M., Brennecke, J., Bunton, V., Lusher, D., Molloy, P. L., &Codoreanu, A. (2020). Network failure: Biotechnology firms, clusters and collaborations far from the world superclusters. Research Policy, 49(2), 103902. https://www.sciencedirect.com/science/article/abs/pii/S0048733319302203

McKeon, W. (2021). Expanding the reach of Australia's startups. Australasian Biotechnology, 31(2), 32-34. https://search.informit.org/doi/abs/10.3316/informit.209745689889875

Ohama, M. (2019). Changing standards in clinical trials. Australasian Biotechnology, 29(1), 48-50. https://search.informit.org/doi/abs/10.3316/informit.381403993500682

Okongwu, U., Brulhart, F., and Moncef, B. (2015). Causal Linkages Between Supply Chain Management Practices and Performance: A Balanced Scorecard Strategy Map Perspective. Journal of Manufacturing Technology Management. Vol. 26 No. 5. pp. 678- 702 https://doi-org.ezproxy.liberty.edu/10.1108/JMTM-01-2013-0002

Pagotto, M., Halog, A., Costa, D. F. A., & Lu, T. (2021). A Sustainability Assessment Framework for the Australian Food Industry: Integrating Life Cycle Sustainability Assessment and Circular Economy. In Life Cycle Sustainability Assessment (LCSA) (pp. 15-42). Springer, Singapore. https://link.springer.com/chapter/10.1007/978-981-16-4562-4_2 financial resources management assignment

Peppou, G. (2018). Biotechnology-driven business model archetypes: Sustainability, Innovation and Commercial Viability. Journal of Commercial Biotechnology, 24(3). https://www.proquest.com/openview/759504f34919024adbd1eadf3105b79f/1pq-origsite=gscholar&cbl=27141

Playne, M. (2021). The history of Ausbiotech: The first 15 years as the Australian biotechnology association. Australasian Biotechnology, 31(1), 38-41. https://search.informit.org/doi/abs/10.3316/informit.208609078643125

Toouli, C. (2019). The sacred word: De-risking biotech messaging. Australasian Biotechnology, 29(2), 36-37. https://search.informit.org/doi/abs/10.3316/ielapa.718921634406056

Website

Ausbiotech.org, (2022), AusBiotech- AusBioech Ltd., financial resources management assignment retrieved on August 26, 2022,