Discussion On Coles Financial Analysis

Question

Task:

• The assignment is designed to assess your understanding of business finance theories and explores a

number of areas within the course by applying your learning to a real company. Through this project,

you need to be able to demonstrate critical and analytical skills in academic writing, various research

synthesising skills and be able to communicate clearly and effectively.

• Please note this is a finance assignment for real business, so make sure you have the appropriate

combination of quantitative and qualitative analysis.

Suppose you are a financial analyst and you have been asked to analyse an ASX listed company. Your task

is to make a recommendation as to whether or not this company is an attractive investment opportunity.

Before you draw a conclusion, you are required to:

1) Discuss how successful the company has been at maximizing stakeholders value over analysing period.

2) Analyse the company's share price history and traded volumes over the analysing period, it can be over

the past 12 months, 2 years, or 5 years.

3) Calculate the return for investing in the company both short term and long term and identify the main

causes of its volatility in return over the corresponding holding period. The discussion of volatility

should consider economic-wide and firm-specific factors.

4) Apply the valuation technique(s) taught in this course and undertake a current valuation of the equity for

your company. Based on your calculation, would you recommend a prospective investor to buy, hold or

sell this security and why.

5) Analyse the company's dividend policy. Should the company follow a progressive dividend policy?

Critically evaluate factors that are affecting corporate dividend policy and how your company's

dividend policy may have influenced its capital structure and share price.

6) Analyse the company's capital structure. How would you describe the current capital structure for your

company and justify with reasons that should potential investors view this company as a favourable

investment choice?

7) Based on the attempt to all of above questions conclude whether your company is an attractive

investment opportunity. You should clearly explain all of your assumptions used in the valuations and

estimations and critical discuss the limitations of your analysis and any other risks that may affect

investors' decision making.

Answer

Introduction

The present study is based on the critical financial analysis and evaluation for the past two years of an ASX listed company that is; Coles financial analysis. The study aims to draw recommendation as to if or if not, this company is an attractive investment opportunity. For this aspect, it will cover its efficiency to maximize stakeholder value, its share price history, and its dividend policy and capital structure. Along with this, it would also apply the valuation technique and carry out a current equity valuation of the company, to make valid recommendations.

The success of the company in terms of maximizing stakeholder value over two years

The vision of Coles financial analysis is based on gaining the trust of Australian and establishing long-term stakeholder value. For the company, trust is mainly about being responsible and reasonable. By considering this aspect, the company maximizes its stakeholder value by giving full support to farmers and suppliers of Australia who offer them with quality and fresh goods, while also focusing on the protection of animal welfare as well as human rights. In the year 2019, the company has also created maximum value by broadly focusing of sustainability and working with suppliers on the sustainable packaging to making it easy for the customer to do recycling and manage waste (Coles Group Limited, 2019). Furthermore, the company has also delivered improvements within workplace safety, contributed to the diversity, and limitations in emission intensity to increase optimal value. In addition to this, the company also promotes local economic growth through its investment in infrastructure and new stores at the same time, making constant efforts to decrease greenhouse gas emission. Moreover, the company has also ensured maximum stakeholder value by operating with logistics partners, and for this, they reduce the environmental footprint via more effective fleet movement (Grimmer, 2018). From Coles financial analysis, the company have also realized that they can only offer a satisfactory return to their shareholder by forming long-term value for all stakeholder; suppliers, employees, customer and communities where they work. From food waste to sustainability in the food chain, they ensure value creation by supporting suppliers, making an affirmative difference in local communities and creating jobs (Lüdeke-Freund, Schaltegger and Dembek, 2019)

Figure 1: The economic value creation of Coles

(Source: Coles Group Limited, 2019).

Analysis of the share price history and traded volumes of the company

Figure 2: Coles Performance Outlook

(Source: Yahoo Finance, 2020)

It can be stated that Coles financial analysis and share prices is showing increasing trends, that means the company has been delivering stable performance in the past two years. The performance of the company in the financial year of 2019, over the twelve months the company reported 3.1 per cent increment in full-year sales revenue of group to $35 billion. Furthermore, this was propelled by growth in sales revenue throughout Supermarkets, Express, as well as Liquor and resulted in corporate documenting a 5.4 per cent increment in profit (Mickleboro, 2019).

The refreshed strategy that is intended to render on the vision of the company to become the most trustworthy Australian retailer for growing long term shareholder value, by considering this refreshed value this would result into robust earnings growth in the upcoming five years which can benefit and could lend strong support of total returns for investors (Mickleboro, 2019).

The trade volume of the company was 1,159,268 and 1,230,501 in 2019 and 2018, respectively (Coles Group, 2019). This higher volume reflects an active market and investing, which enables money managers to adjust the portfolio of investors to align with existing market conditions.

Calculation of the investing rate in the company for short and long term

The return for investment in the Coles financial analysis is computed by considering the share prices of 3 months for the short term return and one year for the long term return.

Computation of Short term return (3 months)

The share price of Coles on 3rd Feb 2020: 16.40 AUD (Coles Group Limited. 2020)

The share price of Coles on 1st May 2020: 15.14 AUD (Coles Group Limited. 2020)

Dividend in between: .3AUD

Return=

Closing rate-Opening rate+ dividend in duration of holding / Opening rate

((15.14-16.40) + + .3)/16.40

=-5.85%

In annual terms=-5.85%*4

= -23.4%

Computation of Long term return (1 year)

The share price of Coles on 1st May 2019: 12.67 AUD (Coles Group Limited. 2020)

The share price of Coles on 1st May 2020: 15.14 AUD (Coles Group Limited. 2020)

Dividend in between: 36 AUD & .3AUD

Return=

Closing rate-Opening rate+ dividend in duration of holding / Opening rate

((15.14-12.67) + .36 + .3)/12.67

=24.70%

Reasons for volatility

Based on the above calculation of short term and long term return for investing in the company, it can be noticed that there is significant volatility in return, such difference is mainly because of the following reasons –

It has been seen that, in the present era, Covid-19 affected the business operations of every company is significant adverse manner. From the period Feb 2020 to May 2020, Coles financial analysis are significantly affected by the pandemic, which leads towards a reduction in the prices, causing towards negative return. The reason behind the same is that, because of worldwide lockdown, the supply chain activities, as well as import and export activities, are affected in a major way. All these assists in a reduction in the share prices of the company. It can be noticed that, from Feb 2020 to May 2020, share prices of the company has been reduced. Although it is not only for the case of Coles financial analysis, rather than its main competitors, named as Wesfarmers, the prices of shares also reduced. It can be asserted that Covid-19 pandemic created a negative impact on the overall industry. Therefore the short term return of Coles financial analysis was negative. Apart from this, it can be asserted that, in the long term period, the return of company was 24.70%. The company has outperformed from its competitor; the same can be asserted from the graph, which is provided as below -

Figure 3 Share prices of Wesfarmers

Based on the above graph representing the Coles financial analysis, it can be noticed that, although, there is an increment in the prices of Wesfarmers in last one year, however, the prices of Coles Company was increased more than its competitors. It is because of its strategic planning and sustainable environmental practices. Apart from this, in the dynamic consumer environment as well as competitive era, Coles is investing in new technologies as well as a new strategic partnership, which leads towards significant volatility in the short term and long term return of the company.

Application of the valuation technique

In the present case of Coles financial analysis, for the computation of prices of stocks, the dividend discount model is used. It is a quantitative mechanism founded the notion that current price is worth of addition of all of its dividend payment in the future, discounted back to their current valued. This method tries to compute the fair value of security without considering the current market situations. On the other hand, this method computes the stock price by taking into account the dividend payout elements and expected return on the market. In assertion to this Coles financial analysis, if the value of stock computed by the cited method is more than the present trading prices of stock, then in such case stock is considered as undervalued, and qualifies for purchase, and vice versa.

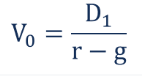

The Gordon Growth Model is founded on the presumption that in the future, the dividend would increase growth at a constant rate for an indefinite time. The formula of the cited model is -

In this case,

V0 – Present Fair value of security

D1 – Payment of the dividend for next year

r – The predicted cost of equity, which could be computed by the CAPM model

g – The constant growth rate in the dividend of the company for the indefinite period.

In this; The Capital Asset Pricing Model (CAPM) is considered as a model that helps in defining the correlation between the expected return. Further, the return on investment is seen as a variable that is unknown and has various values related to various probabilities. In short, it a model employed to evaluate a theoretically relevant required rate of return of an asset for making sound decisions regarding assets to a well-diversified company portfolio (Rossi, 2016). In this way, CAPM is a broadly used term in finance for pricing of rising securities as well as producing expected returns on assets with taking account the capital cost and associated risk

CAPM of Coles

In this case,

Rf = 1.77 (Market Risk Premium, 2020)

Market risk premium =6.68 (Market Risk Premium, 2020)

Beta = .19 (Levered/Unlevered Beta of Coles Group Ltd. ( COL | AUS). (, 2020).

Risk free rate +(Return of market - Risk free rate)*Beta’

=1.77+ (6.68)*.19

= 3.03%

Share price by the application of dividend growth model

= .3(1.03)/ 3.03-3

= 10.3

Actual share price on March 2019 is 11.86

Based on this, it can be asserted that the share of Coals Group Limited in overvalued.

Analysis of the dividend policy of the company

The dividend policy of Coles is identified by the Board of Coles at its judgment and might change over time. The Board aims to pursue a dividend policy which as relation to existing earning, accessible franking credits, cash flow, the requirement for future cash flow and captured credit metrics (Wesfarmers Limited, 2018). Subsequently, the company is expected to do distribution of 80% to 90% of underlying income to shareholders at the same time sustaining strategic flexibility.

In regards with the 2019 financial year’s dividend; the Wesfarmers has intended to make payment of an interim dividend in March with regards with the Coles earning of 5 months before the demerger. Furthermore, the Coles make payment in Sept 2019, which is the last dividend of the year-end. Therefore, the persuasive, strong cash generation of Coles in its 80% to 90% targeted dividend payout ratio reflects a progressive dividend policy, with a statement of the financial position set up to promote robust investment-grade credit profile (Smyth, 2018). Furthermore, the factors that impact the corporate dividend policy are its stability in dividend, better liquidity, better accessibility to the capital market and earning stability. Since its commitment towards 80–90% dividend payout ratio, it has been managed to increase its share price in the year 2019 and is up for over 19 per cent for the year. The integration of the debt as well as the mentioned dividend policy would impact the capital structure by disciplining the decision making of the group, especially the company would have to retain a cash conversion rate (operating cash flow to the net profit adding amortization as well as depreciation or at the top of its existing levels of approx 108% both fund its proposed capital expense and the prefigured high dividend payouts. A fully franked dividend was determined by Coles Board of 25.5 cents each share, a total of 24.0 cents each share as well as an 11.5 cents of special dividend each share for the period of Nov 2018 to June 2019.

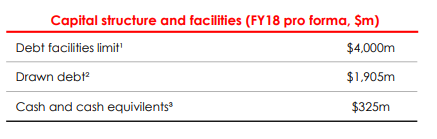

Coles financial analysis of the capital structure

Coles has been considered a demerger with net debt of approx A$2bn ($1.5bn) on its statement of financial statement to promote a BBB+ credit rating as well as operating lease commitment of about A$9.6bn, along with weighted standard lease expiry of approx 6.5 years. By considering this aspect, this new capital structure would offer demerged Coles with a robust balance sheet as well as headroom to promote an 80–90% dividend payout ratio after-tax profit (Wesfarmers, 2018).

The reasons by which potential investors would view this company as a favourable income choice, as it has combined a favourable lease commitment profile that would offer excellent access to capital as well as a balance sheet to promote dividends, best investment plans and strategic flexibility.

Figure 4: Coles Capital Structure

(Source: Wesfarmers, 2018)

Moreover, the investors would see this company as a favourable investment choice, as it has judiciously used debt and equity while also maintaining a strong balance sheet. This attracts the investors; it is because it has a lower level of debt and an extra amount of equity with a favourable indication of investment quality.

Conclusion

It can be cited that Coles financial analysis which is a well-known Australian company has gained significant benefit from approx $9 billion investment and an outstanding revolution under the ownership of Wesfarmers. It has now turned into a profit-making and mature business and would offer shareholders with cash-producing business exposure which is likely to be flexible through the economic cycles. By considering overall Coles financial analysis, yes, it is favourable to invest in the company but due to Pandemic market is highly volatile. Further, Coles financial analysis is limited to two years which cannot provide concluding evidence for an investment decision.

References

Coles Group Limited (2020). Retrieved from

Coles Group Limited, (2019). 2019 Annual Report. Sustainably feed all Australians to help them lead healthier, happier lives.. Coles financial analysis Retrieved through

Coles Group, (2019). Share price.. Retrieved through < https://www.colesgroup.com.au/investors/?page=share-price#>.

Grimmer, L., 2018. The diminished stakeholder: Examining the relationship between suppliers and supermarkets in the Australian grocery industry. Journal of Consumer Behaviour, 17(1), pp.e13-e20..

Levered/Unlevered Beta of Coles Group Ltd. ( COL | AUS). (2020). Retrieved from

Lüdeke-Freund, F., Schaltegger, S. and Dembek, K., 2019. Strategies and drivers of sustainable business model innovation. In Handbook of Sustainable Innovation. Edward Elgar Publishing.

Market Risk Premium. (2020). Retrieved from

Mickleboro, J, (2019). Why the Coles share price just surged to a record-high (Online). Retrieved through < https://www.fool.com.au/2019/09/25/why-the-coles-share-price-just-surged-to-a-record-high/>.

Rossi, M. (2016). The capital asset pricing model: a critical literature review. Global Business and Economics Review, 18(5), 604-617.

Smyth, J, (2018). Wesfarmers to keep 15% stake in Coles after demerger . Retrieved through

Wesfarmers Limited, 2018.. Retrieved through

Wesfarmers, (2018). Demerger of Coles – Briefing presentation. Retrieved through

Yahoo Finance, (2020). Coles Group Limited (COL.AX) Coles financial analysis Retrieved through < https://finance.yahoo.com/quote/COL.AX/>.