Corporate Finance Assignment: Merger Acquisition Of Amazon & Whole Foods Market

Question

Task:

You are required to select any merger /acquisition deal of your choice that has occurred within the last 10years in the sectors listed below and perform the tasks (a-c) for the acquirer (an if possible the target as well):

- Financial

- Technology

- Energy (oil, power, etc.)

- Automobile and Aviation

- Pharmaceuticals

- Critically reflect on the rationale for the merger/acquisition and its financing.

- Examine the performance by using suitable financial indicators such as profitability ratios (comparing pre and post-merger/acquisition financial ratios). Your analysis should make use of statistical techniques, for example, t-test in the examination of these ratios.

Throughout this corporate finance assignment, examine whether the official announcement elicited stock market reaction in the context of shareholder value. You may use theories such as the Efficient Market Hypothesis to examine this requirement. Event Study technique is highly recommended for this investigation.

Answer

1. Introduction

The current corporate finance assignment provides an in-depth analysis on the merger or acquisition between Amazon and Whole Foods Market that was the most successful in 2017. The report is developed to deliver in-depth knowledge about various objectives of the acquisition. The announcement of the acquisition between Amazon.com Inc. and Whole Foods Market cost $13.7 billion (Berthene, 2019). Amazon merger with Whole Foods Market gave birth to various concepts. Amazon able to sale more than two thousand products of whole Foods in their market place (Faherty et al., 2017). The report aims to establish an investigative analysis of both companies' economic context within the acquisition life cycle. The information will also evaluate the impact of the announcement about the merger between Amazon and Whole Foods Market in the stock market. Amazon uses business technology to grow its revenue. Digital platform is different from traditional platform of business. Digital platform combines various technology and power of the internet to cross the geographical contains (Kellachan, 2018).Whole Foods Market integrated technology to increase its yearly turnover. The purpose of the report is to understand the financial aspect of the acquisition.

2. Critical reflection on the rationale for the merger/acquisition

Amazon is an online, cloud-based American company. The total net sales of Amazon have estimated at US $ 136 billion. The market capitalisation of Amazon is US $ 465 billion(Watanabe et al., 2020). Whole Foods Market is an American natural and organic food supermarket. The estimated market capitalization of the company is $ 13.46 billion. Both of the companies experienced the benefit of the acquisition. The benefits are –

The benefit of Amazon is likely to increase in the future. In 2018, the Whole Foods stores started increasing their profit. Amazon also builds various lockers for delivery to increase Whole Foods Market products' sale in the stores' multiple locations. Special discounts were available for amazon prime members to attract customers to buy Whole Foods products(Thu, 2020).

The main benefit that Whole Foods Market gets from the deal was that it would be a national market by leaving its regional existence. Amazon is trying to deliver fresh foods to its customers. It is a very challenging procedure. The process is very costly and complicated. Whole Foods Market was suffering to provide the fresh delivery of the food to its customers. Amazon Fresh is likely to resolve the problem.

3. Examination of performance by Amazon after the acquisition

Financial management is crucial and necessary for the first's growth, and it is also essential in the case of a firm's survival factors. All the stakeholders of a firm are interested in seeing sensible financial decisions that can help both the firm and the stakeholders in the future (Arnold & Lewis, 2019). The decision to buy Whole Foods Market was successful. After making the deal, whole Foods products price was decreased by almost twenty per cent than any other supermarket chain (Cheng, 2019). According to studies, Whole Foods Market's command over the regional market has decreases thirteen per cent from twenty per cent.

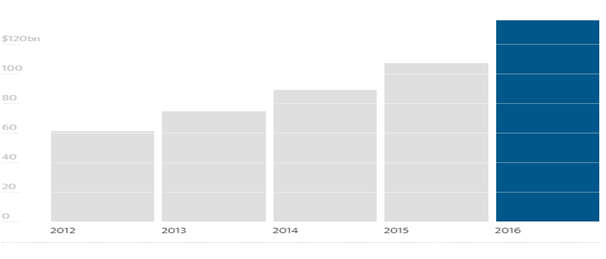

The figure is showing the revenue of amazon increased in 2016 (Butler & Wood, 2017)

In the national supermarket chain, the price premium gap of Whole Foods remains twenty-seven per cent. The deal created antitrust between the federal trade commission and the Department of Justice. However, the deal approved by shareholders. The performance of amazon after the acquisition has both positive and negative review provided by the customers. The customers have strong trust in case of cost and delivery quality of the company.

It helps in the growth of selling Amazon Fresh products. The customers commented that the stocking of the products has a wide range of issues, and its quality is not good (Bonazzo, 2018). However, the selling rate of the grocery increased in 2019 due to Covid-19. There are various infrastructural issues present in the Whole Foods Market, such as low in-house staffs, inferior product quality, unprotected product packaging and handling.

4. Relevant financial and statistical analysis

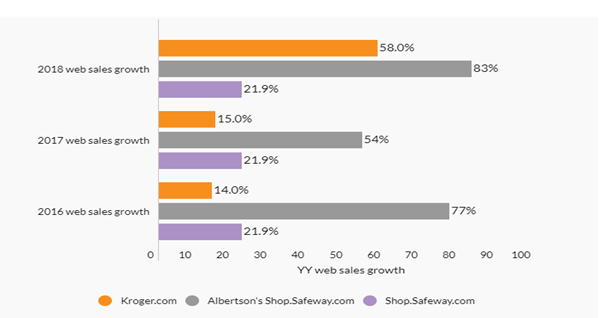

After Amazon merger with Whole Foods Market, the growth of online grocery store sales increases immensely. Customers are more inclined to buy from various online stores such as Amazon, Kroger, Alberson’s shop and shop.safeway.com that offline store(Romeo, 2019).

Figure 1is showing the growth of online grocery stores from 2016 to 2018 (Dastin, 2020)

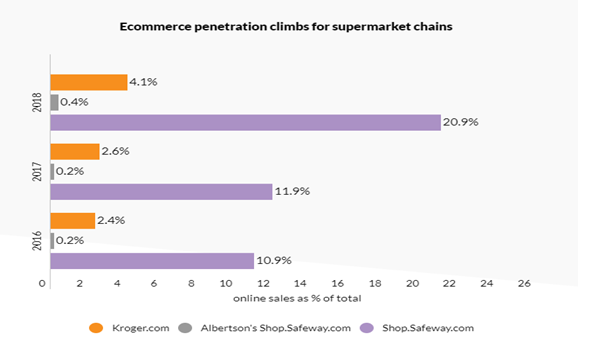

Amazon and Whole Foods Market merger increase e-commerce penetration in the supermarket chain industry(Grilo, 2019). The statistics are showing considerable growth in using e-commerce facilities after 2017.

Figure 2 is showing the massive growth in e-commerce usage in supermarket chain (Dastin, 2020)

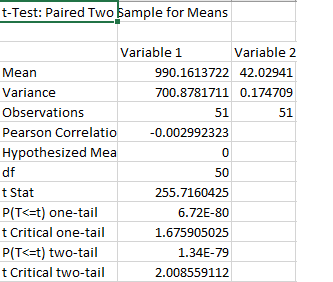

Amazon is growing its revenue for the last few years, whereas Whole Foods sales' revenue was falling. In 2016 the profitability of amazon was 0.02842, whereas the profitability of Whole Foods Market was 0.078. Amazon initiated the merger idea with Whole Food market to spread the Amazon service in online grocery stores(Brites, 2018). After the acquisition in 2017, the Whole Food Market share increases by twenty-eight per cent (Ablan& Ahmed, 2017). The report conducted a t-test between the companies to analyse the economic context.

Figure 3 is showing the t-test result (Created by the author)

The t-test is done assuming unequal variance. The value of p less than 0.05 is statistically significant. When the value of the p is higher than 0.05 is not statistically significant and tend the null hypothesis. The one tail and two-tailed p-value are higher than 0.05. thus the null hypothesis is rejected.

The stock value of amazon is +35.77, and the stock value of Whole Foods Market is +43.84. The stock values are indicating the success rate of the merger between the two companies.

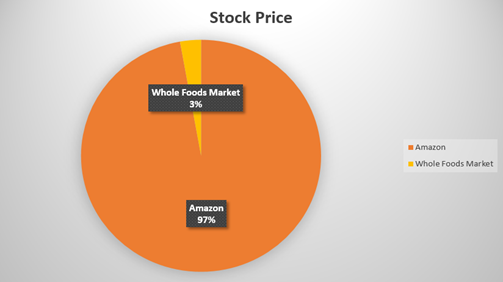

Figure 4 is showing the stock price of Amazon and Whole Foods Market (Created by author)

The stock market shares of amazon showing huge dominancy over Whole Foods Market.

The figure is showing the growing share of amazon from2012 to 2017 (Butler & Wood, 2017)

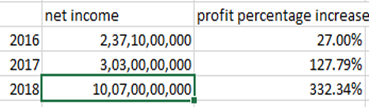

The profit of Amazon will likely to increase.

The figure is showing the inclining profit of amazon (created by the author)

5. The impact of official announcement

5.1. Efficient Market Hypothesis

The efficient market hypothesis stated that the stocks intended to trade at fair value on the exchange. An investor cannot purchase or sell undervalued stocks for inflated prices. It noted that share prices deliver in-depth information(Rossi & Gunardi, 2018). The efficient market hypothesis has three types of interest aspects – Weak, semi-strong and strong.

Both companies' stock price increased, providing the fact that the adequate marketing hypothesis has a strong interest rate. The initial offers by amazon were $ 41 per share, and Whole Foods Market demanded $45 per share, according to the Security and Exchange Commission(Meyer, 2017). The last offer from Amazon was $42 for each share.

5.2. Recommendation for the current investigation

- Whole Foods Market products cost was ten to twenty per cent high in the supermarket chain. Amazon decreases the products' price to attract more customer to buy quality and branded product with low-price.

2. After acquiring the Whole Food market, Amazon wanted to challenge the already existing supermarket and dominate the online grocery delivery business through its world-class services (?irjevskis, 2020).

- The deal is beneficial for the shareholders of Amazon. They will be likely to earn $10 billion from the acquisition.

- Amazon will provide two hours’ delivery plan to the prime members for grocery shopping.

- The vital path to increase revenue from the merger activity is to include various products to choose from. It is essential to increase inventory space to provide continuous services (Tran et al. 2020).

- Amazon will also need to check on the quality of the product delivered to the customers.

5.3. Market reaction

Amazon and Whole Foods acquisition challenge various online and offline retailers to transform their technological aspects in the e-business strategy. The controversy created that Amazon will dominate the supermarket chain area and transform it into online grocery stores ("The Amazon-Whole Foods acquisition is a wake-up call for retailers.", 2018). The acquisition was facing various challenges in the case of delivery perspective. The quality of the Whole Foods is declining (Bonazzo, 2018).

"Amazon is getting into o0ffline as well as online." – said retail analyst Clive Black (Butler & Wood, 2017). The announcement has enormous effects on the small retail sellers. The deal decreases the trust between the Federal Trade Commission and the Department of justice. Online selling stores have less margin compared to physical stores. It was predicted that, the whole Food Market will fall under the profit margin. It increases the competitive behaviour in the online retails stores.

6. Conclusion

The report investigated various factors and analysis data of the acquisition between Amazon and Whole Foods Market. The announcement of the news developed controversies. The details analysis showed that amazon would likely grow revenue and financial profit from the merger activity. It will be likely to challenge small and big supermarket chains in both online and offline scenario.

According to the report, amazon increases the share value of Whole Foods Market by reducing its price. The cloud-based technology applied by amazon helps the regional market to be national. Amazon targeted its colossal customer database to increase the sale in the online grocery stores. The merger was successful for both Amazon and Whole Foods Market. the stock value rapidly increases within a year of the merger.

7. References

Arnold, G., & Lewis, D. S. (2019). Corporate Financial Management. Pearson UK., https://books.google.co.in/books?id=LvSMDwAAQBAJ&lpg=PT23&ots=55dyNzfe1e&dq=Arnold%2C%20G.%2C%20%26%20Lewis%2C%20D.%20S.%20(2019).%20Corporate%20Financial%20Management.%20Pearson%20UK.&lr&pg=PT24#v=onepage&q&f=false

Brites, A. (2018). Whole foods market takeover by Amazon. com (p. p 1-45)., https://run.unl.pt/bitstream/10362/35667/1/BRITES_2018.pdf

Faherty, E., Huang, K., & Land, R. (2017). The Amazon Monopoly: Is Amazon’s Private Label Business the Tipping Point? p 1-51. Online at https://mpra.ub.uni-muenchen.de/83672/ MPRA Paper No. 83672, posted 09 Jan 2018 05:08 UTC

Grilo, P. T. F. (2019). Case study: the acquisition of Whole Foods Market, Inc. by Amazon. com, Inc. (p. p 1-157). http://hdl.handle.net/10400.14/30466

Kellachan, D. (2018). Should Amazon Be Broken Up? An Analysis of Valuations and US Antitrust Laws in the 21st Century Economy. 1–41. https://www.stern.nyu.edu/sites/default/files/assets/documents/2018%20Kellachan.pdf

Romeo, G. (2019). Case-study: price negotiation between Amazon and whole foods (p. p 1-27). http://hdl.handle.net/10362/69195

Rossi, M., & Gunardi, A. (2018). Efficient Market Hypothesis And Stock Market Anomalies: Empirical Evidence In Four European Countries. Journal of Applied Business Research (JABR), 34(1), 183-192. https://doi.org/10.19030/jabr.v34i1.10111

Watanabe, C., Tou, Y., & Neittaanmäki, P. (2020). Institutional systems inducing R&D in Amazon-the role of an investor surplus toward stakeholder capitalization. Technology in Society, 63, 101290. https://doi.org/10.1016/j.techsoc.2020.101290

Website citation:

Ablan, J., & Ahmed, S. (2017). Short-sellers lose as Amazon acquires Whole Foods. Retrieved 1 March 2021, from https://www.reuters.com/article/idUSKBN19720M

Argus, D., & Samson, D. (2021). NAB (B): NAB’s Acquisition Strategy. In Strategic Leadership for Business Value Creation (pp. 209-245). Palgrave Macmillan, Singapore. From https://link.springer.com/chapter/10.1007/978-981-15-9430-4_7

Berthene, A. (2019). How Amazon's Whole Foods acquisition changed the grocery industry. Retrieved 1 March 2021, from https://www.digitalcommerce360.com/2019/06/21/how-amazons-whole-foods-acquisition-changed-the-grocery-industry/#:~:text=Amazon%20(No.,60%20cities%20via%20Prime%20Now

Bonazzo, J. (2018). Year 1 of Amazon-Whole Foods Merger Featured High Profits, Internal Strife. Retrieved 1 March 2021, from https://observer.com/2018/06/amazon-whole-foods-first-year-problems/

Butler, S., & Wood, Z. (2017). Amazon to buy Whole Foods Market in $13.7bn deal. Retrieved 1 March 2021, from https://www.theguardian.com/business/2017/jun/16/amazon-buy-whole-foods-market-organic-food-fresh

Cheng, A. (2019). Two Years After Amazon Deal, Whole Foods Is Still Working To Shed Its ‘Whole Paycheck’ Image. Retrieved 1 March 2021, from https://www.forbes.com/sites/andriacheng/2019/08/28/two-years-under-amazon-whole-foods-still-has-its-work-cut-out-to-erase-the-whole-paycheck-image/?sh=35660bf74227

?irjevskis, A. (2020). Do Synergies Pop up Magically in Digital Transformation-Based Retail M&A? Valuing Synergies with Real Options Application. Journal of Open Innovation: Technology, Market, and Complexity, 6(1), 18. From

Fan, Y., & Yang, C. (2020). Merger, Product Variety and Firm Entry: the Retail Craft Beer Market in California. From http://ijssei.in/index.php/ijssei/article/view/255 http://www-personal.umich.edu/~yingfan/Fan_Yang_beer.pdf https://www.mdpi.com/2199-8531/6/1/18

Meyer, Z. (2017). Whole Foods shareholders vote in favor of Amazon deal. Retrieved 1 March 2021, from https://www.usatoday.com/story/money/2017/08/23/whole-foods-shareholders-vote-favor-amazon-deal/593275001/

The Amazon-Whole Foods acquisition is a wake-up call for retailers. (2018). Retrieved 1 March 2021, from https://www2.deloitte.com/us/en/pages/consumer-business/articles/amazon-whole-foods-acquisition.html

Thu, M. H. (2020). THE EFFECTS OF SYNERGY ON MAKING M&A DECISIONS. Economics, (4 (47)). From https://cyberleninka.ru/article/n/the-effects-of-synergy-on-making-m-a-decisions

Tran, M. D., Tran, H. N., Tran, B. M., & Thanh, K. H. (2020). A study on merger and acquisition in retailing industry of Vietnam. International Journal of Social Science and Economics Invention, 6(11), 374-TO. From