Corporate Governance Assignment: Board Evaluation Report Of Commonwealth Bank & National Australia Bank

Question

Task:

Corporate Governance Assignment: Board Evaluation report

Select a company and one of its competitors (preferably publicly listed companies due to data availability) and retrieve relevant corporate governance information. You are required to find the corporate governance information disclosed in the company’s most recent annual report (Australian companies), proxy statement (US companies), management proxy circular (Canadian companies), company website or any other company statements. For example, the Commonwealth Bank of Australia provides governance information in its annual report: (CBA Annual Report). You can usually find these documents on the organization’s or regulator’s website.

Based on the disclosed governance information and relevant governance codes and theories, evaluate how your selected board performs its conformance and performance functions, according to the following perspectives:

Board structure: Discuss the overall board structure (in terms of unitary vs two-tier) of your selected company in comparison to the competitor. Evaluate the board members in terms of executive versus non-executive directors and their affiliations with other organizations.

Board diversity: Critically evaluate and compare the board diversity of your selected company with that of the competitor firm, including diversity in skill and experience, gender, age and any other social or cultural aspects of directors.

Board committees: Compare the board committees of your selected company with those of the competitor firm. Critically evaluate the committees—for example, the committee functions and members, and their skillsets and responsibilities.

Conclusion and recommendation: Summarize your key findings and provide suggestions for improvement.

Answer

Executive Summary

This corporate governance assignment will evaluate and analyse the 2019 annual reports if two ASX listed companies to gain a better understanding of the board evaluation report by comparison. In today's business environment, the board members and board structure along with board policies play a vital role in terms of determining an excellent presentation of financial statements that tends to attract investors.

Introduction

Board evaluation reports are a critical structural tool that evaluates the efficiency and effectiveness of boards (Price, 2019). A formal assessment of a company’s board helps in measuring the team directors’ performance along with identification of the strengths, weaknesses and opportunities that help in the improvement and accordingly develop plans. The following report will analyse the board evaluation report of the Commonwealth Bank of Australia and one of its top competitors National Australia Bank. The 2019 annual report of both the banks will be analysed and based on the disclosed governance information and relevant governance theories and codes, evaluation of both the boards’ conformance and performance functions will be done in regards to various perspectives that include board structure, board diversity and board committee.

Theories to understand the relevant corporate governance concepts

To elucidate and explain the concepts of corporate governance in both Commonwealth Bank of Australia and National Australia Bank, three broad theories can be used:

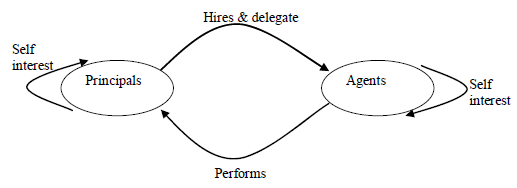

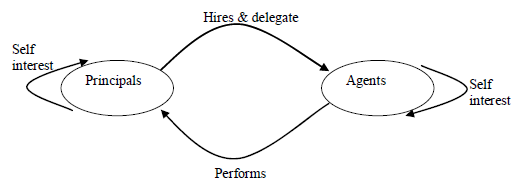

Agency Theory: The recent developments in business policies and strategic management in corporate governance are tremendously influenced by agency theory (Abid et al., 2014). The fundamental theoretical basis of the corporate government concept for both the Commonwealth Bank of Australia (CBA) and National Australia Bank (NAB) is agency costs. In both the banks, shareholders own the limited liability and joint-stock of the company along with considering the employees accountable for their responsibilities and tasks.

Figure 1: Agency Theory

Source: (Olive Board, 2018)

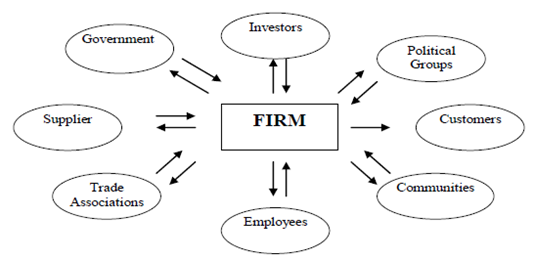

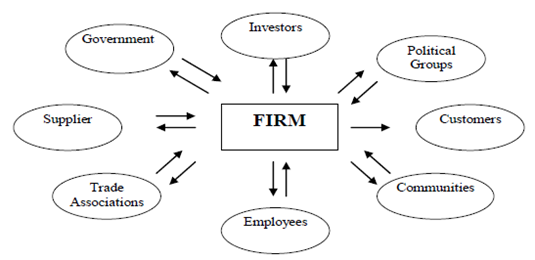

Stakeholder Theory: This theory incorporates the management’s accountability to a wide range of stakeholders (Abid et al., 2014). According to this theory, in business organizations, managers possess a wide network of relationships that can be served. Overall this theory on behalf of both the banks emphasizes managerial decision making along with the stakeholders' interest.

Figure 2: Stakeholder Theory

Source: (Olive Board, 2018)

Resource Dependency Theory: The Resource Dependency Theory emphasizes on board of directors’ role that helps in providing access to the firm's required resources (Abid et al., 2014). According to this theory, the directors of both CBA and NAB play a vital role in terms of providing and securing the essential resources that help in linking the organization to the external environment. Overall, the classification of directors can be done into four categories of business experts, insiders, community influential and support specialists.

Disclosed governance information and relevant governance codes and principles

The Commonwealth Bank of Australia (CBA) is committed to fulfilling the purpose of improving the financial wellbeing of the communities and customers and good governance is the key to CBA's ability to deliver its strategy and purpose. The bank also remains focused on supporting the business strategies’ achievement by supporting a culture that drives actions and decisions that leads to better outcomes for its stakeholders and customers. The CBA’s Code of Conduct articulates the behaviour standards that are expected from its employees while balancing the interests and engaging with the Bank’s stakeholders (CBA Annual Report, 2020). In addition to that, the bank’s Code of Conduct connects the values and purposes that that are expected to deliver the proper outcomes. Lastly, the Group Diversity and Inclusion Policy of CBA outline its commitment and approach to inclusion and diversity where every member feels respected and valued.

The National Australia Bank (NAB) has established standing board committees to get assistance in terms of carrying out responsibilities that cover the aspects of audit, risk, remuneration, matters of governance and nomination (NAB Annual Report, 2020). NAB’s Code of Conduct is based on its commitment in terms of delivering value and achieving sustainable performance based on its stakeholders and customers without any compromise on the trusted reputation and values. In addition to that, the bank’s Code of Conduct also outlines the ethical conduct and responsibility standards that the bank expects from each of its employees. Lastly, all the employees of NAB are encouraged to report or speak up against any suspected breaches of code.

Board Structure

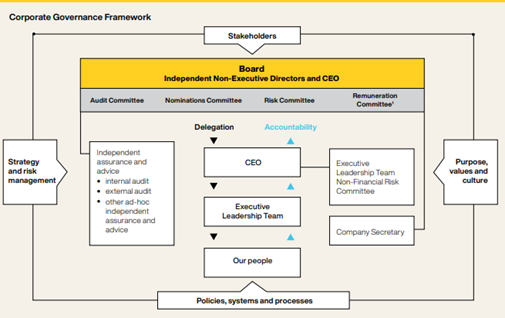

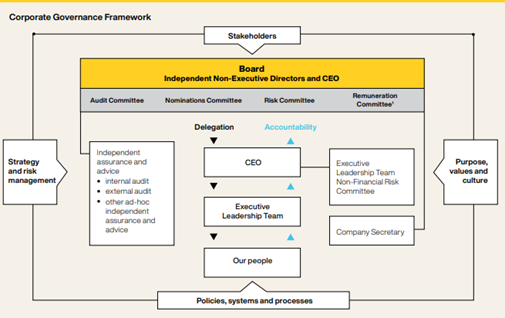

Board structure in any business organization represents the number of board members according to the size and relevancy of the company’s requirement (Nicholls and Evans, 2015). The board structure of CBA is unitary and the current membership of the board consists of one executive director and nine independent non-executive directors that include the chairman of the group as well. In addition to that, the board members of the group embed an appetite of zero tolerance for corruption, bribery and facilitation payments. The board members of CBA identify the appropriate controls and potential risks related to corruption and bribery by outlining the requirements for reporting and escalating various policy breaches.

Figure 3: Corporate governance framework of CBA

Source: (CBA Annual Report, 2020)

CBA is committed in terms of providing the best outcomes for its customers by earning the trust of the communities being served (CBA Annual Report, 2020). Overall, the board structure of CBA is unitary because it consists of both the executive and non-executive directors on a single board. There is also no clear separation of duties in CBA’s board structure as both the non-executive and executive directors sit on the same board. However, the aspect of decision-making as a result of a unitary board structure tends to be faster as all the decisions are approved by a single board.

The board structure of NAB on the other hand is also unitary as there are one CEO and Managing director of the bank associated with 8 non-executive directors. All the directors of NAB are expected to bring unfettered and independent judgment to Board deliberations by reviewing the independence of each director.

Figure 4: Corporate governance framework of NAB

Source: (NAB Annual Report, 2020)

The board structure considers the independence of each director by taking into account the factors that are outlined In ASX CGC Principles and Recommendations (3rd edition). In addition to that, the board structure of Nab is also focused on making a positive social impact that can help its community, shareholders, people and customers.

After analysing the board structure of CBA and NAB, it can be considered that, that the unitary board structure of both the banks has lacked public accountability and good management practice. Both CBA and NAB must restructure their unitary board structure to a two-tier board structure so that the services and strategy are executed by the management board whereas, the control will be handled by the supervisory board.

Board diversity

Board diversity is a significant aspect of corporate governance and this can be improved by increasing the diversity in leadership and governance that will reflect the communities being served (Kakabadse and Kakabadse, 2019).

The board diversity of CBA has set a gender diversity goal of 40% female representation to which they exceed the gender diversity goal by 50% female representation (CBA Annual Report, 2020). The bank has set a goal of achieving 47% - 50% gender equality in the role of the executive manager (CBA Annual Report, 2020). In terms of cultural diversity, CBA aims for cultural diversity in senior leaders so that the Australian population’s cultural diversity can be matched. In addition to that CBA is also committed to increasing employment of Aboriginal peoples at parity with the Australian population. Overall, CBA has planned to set a public commitment to strengthening the bank's commitment to inclusion and accessibility. The future diversity plans of CBA include the creation of a more inclusive and accessible work environment for disabled people so that the overall customer experience can be improved.

The board diversity of NAB has a core purpose to serve its customers and help the communities to prosper, so the bank aims to create a culture that embraces inclusion, equality and diversity across all aspects of its business practices (NAB Annual Report, 2020). The board diversity of NAB does not discriminate in terms of employing anyone based on sexual orientation, gender, ethnicity or any kind of disabilities. Similar to CBA, NAB also supports indigenous employment that thrives to enhance the lives of aboriginal peoples in Australia. The board diversity of NAB promotes programs in place of its Indigenous Australia and African employees so that these groups feel supported and can effectively share their ideas and insights.

After analysing the board diversity of both CBA and NAB, it is evident that the diversity in skills and experience required in the directors of both the banks is based on the requirement of cultural differences. However, CBA emphasizes maintaining a certain female representation to which NAB does not emphasize. The NAB instead focuses on African Australian Employment that provides six months of work experience in helping people find meaningful employment (NAB Annual Report, 2020). The important aspect of this diversity program is based on providing cultural awareness among people before they commence. Workforce flexibility on the other hand is prioritized more by CBA as compared to NAB.

Board Committees

A board committee is a working group identified by the group consisting of group members. The significance of board committees is that it handles a massive number of issues by possessing expert focus on specific areas (Kaczmarek and Nyuur, 2016). The board committee of CBA has four principal committees that assist in carrying out responsibilities and they are:

Audit Committee: This committee assists the board to discharge its responsibilities and consists of at least three directors who are independent and non-executive directors of the bank (CBA Annual Report, 2020). The board chair is not the committee chair and is responsible to oversee the processes for the Committee's performance. There are several responsibilities of the audit committee that is based upon accounting and financial reporting and reviewing the processes and controls.

Nomination Committee: This committee provides objectives review by overseeing and monitoring the composition of the board committee. This board also appoints the committee chair and consists of at least three directors. The company secretary of the bank can be nominated as a Committee secretary (CBA Annual Report, 2020). The major roles and responsibilities of the committee are to review and approve the relevant membership and size of the board committees. In addition to that, this committee also establishes and approves policies of the required skills to become a board member.

People and Remuneration Committee: This committee provides an objective oversight and review of the policies related to remuneration (CBA Annual Report, 2020). Through this committee, the board discharges its responsibilities related to culture, diversity and inclusion. The board appoints then chair of this committee and the role is to consider the outcome of the annual shareholder advisory.

Risk and Compliance Committee: This committee oversights and reviews the risk of all groups by setting an appetite for risk and ensuring a risk framework that is relevant (CBA Annual Report, 2020). There is a total of four directors on this committee. The roles and responsibilities of this committee are to review the group risk appetite by overseeing the RMA.

In the scenario of NAB, all the board committees are the same as compared to CBA, but there is one difference that NAB possesses, which is the nomination and governance committee. This committee is an additional committee that NAB possesses and this makes delegation of responsibilities regarding selection and removal of directors more effective. In addition to that, the customer committee of NAB oversees the significant lift given to the customers’ voice for generating a more intense focus on customer outcomes (NAB Annual Report, 2020).

Conclusion and Recommendation

In the end, it can be concluded that board evaluation reports are extremely critical in terms of evaluating the board performance of business organizations. The above report has analysed the 2019 annual report of Commonwealth Bank of Australia and National Australia Bank to get a better comparison of both the banks' board structure, board diversity and board committees. After proper analysis, it can be stated that Commonwealth Bank of Australia edges out National Australia Bank in the aspects of board structure where the unitary structure of CBA looks more effective based on the number of board members. However, it can also be suggested that both banks must emphasize establishing a two-tier structure to make the board more effective. In addition to that, in the aspects of board diversity and board committees, NAB has an advantage over CBA as CBA has emphasized too much on gender diversity, whereas NAB thrives to improve the indigenous committees more. Therefore, CBA must take stern measures to contribute more to the indigenous committee along with further diversification of its board committees especially adding a customer committee, which has become a vital aspect in the competitive environment of today.

References

Abid, G., Khan, B., Rafiq, Z. and Ahmed, A. (2014). (PDF) Theoretical Perspectives of Corporate Governance. [online] ResearchGate. Available at: https://www.researchgate.net/publication/272349786_Theoretical_Perspectives_of_Corporate_Governance [Accessed 17 Mar. 2021].

CBA Annual Report (2020). 2019 Annual Report. [online] commbank.com.au. Available at: https://www.commbank.com.au/content/dam/commbank/about-us/shareholders/pdfs/annual-reports/CBA-2019-Annual-Report.pdf [Accessed 17 Mar. 2021].

Kaczmarek, S.P. and Nyuur, R.B. (2016). (PDF) Review of the literature on board committees: taking stock and looking ahead. [online] ResearchGate. Available at: https://www.researchgate.net/publication/306028663_Review_of_the_literature_on_board_committees_ taking_stock_and_looking_ahead [Accessed 17 Mar. 2021].

Kakabadse, N. and Kakabadse, A. (2019). Improving corporate governance with functional diversity on FTSE 350 boards: directors’ perspective. [online] emeraldinsight. Available at: https://www.emerald.com/insight/content/doi/10.1108/JCMS-09-2019-0044/full/pdf?title=improving-corporate-governance-with-functional-diversity-on-ftse-350-boards-directors-perspective [Accessed 17 Mar. 2021].

NAB Annual Report (2020). ANNUAL FINANCIAL REPORT 2019. [online] capitsl.nab.com.au. Available at: https://capital.nab.com.au/docs/2019-Annual-Financial-Report.pdf [Accessed 17 Mar. 2021].

Nicholls, R. and Evans, C.M. (2015). The Nature of Competition in Australian Retail Banking. SSRN Electronic Journal, [online] 15(2). Available at: https://clmr.unsw.edu.au/sites/default/files/attached_files/nicholls_evans_working_paper_clmr_15-2_0.pdf [Accessed 17 Mar. 2021].

Olive Board (2018). Theories of Corporate Governance: Agency, Stewardship etc. [online] Paper Tyari. Available at: https://www.papertyari.com/general-awareness/management/theories-corporate-governance-agency-stewardship-etc/ [Accessed 17 Mar. 2021].

Price, N.J. (2019). How to Measure Board Effectiveness. [online] Diligent Insights. Available at: https://insights.diligent.com/board-assessments/how-measure-board-effectiveness [Accessed 17 Mar. 2021].

Appendices

Appendix 1

Appendix 2

Appendix 3

Appendix 4