Discussion On ASX Financial Analysis

Question

Task:

Select a company that is currently listed on the ASX.

Write a Financial Analysis Report using an essay structure to interpret a company’s most recent annual report.

Answer

Executive Summary

The report is focused on exploring the ASX financial analysis. ASX Limited is the main stock exchange for Australia popularly known as the Sydney Stock exchange that was established on 1 April 1987. The exchange has a daily turnover amounting to $4.685 billion followed by strong market capitalization of $1.9 trillion (ASX Limited 2019). Going by the value it is among the top 10 stock exchanges globally. It is the market operator and functions as a clearinghouse. Further, it evaluates the compliances of different companies listed on the exchange and educates the retail investors. The objective of the report is to prepare ASX financial analysis report by interpreting the annual report of the company.

ASX financial analysis

ASX strives to create products and services that meet the needs of the customers. Such is termed as open infrastructure solutions that leverage the expertise, independence, as well as infrastructure in different ways (ASX Limited 2019). Additionally, ASX delivered another stellar performance and ensure strong progress through the execution of the strategies. The strategies are based on technology and customer and concentrate on the development of the company for the future.

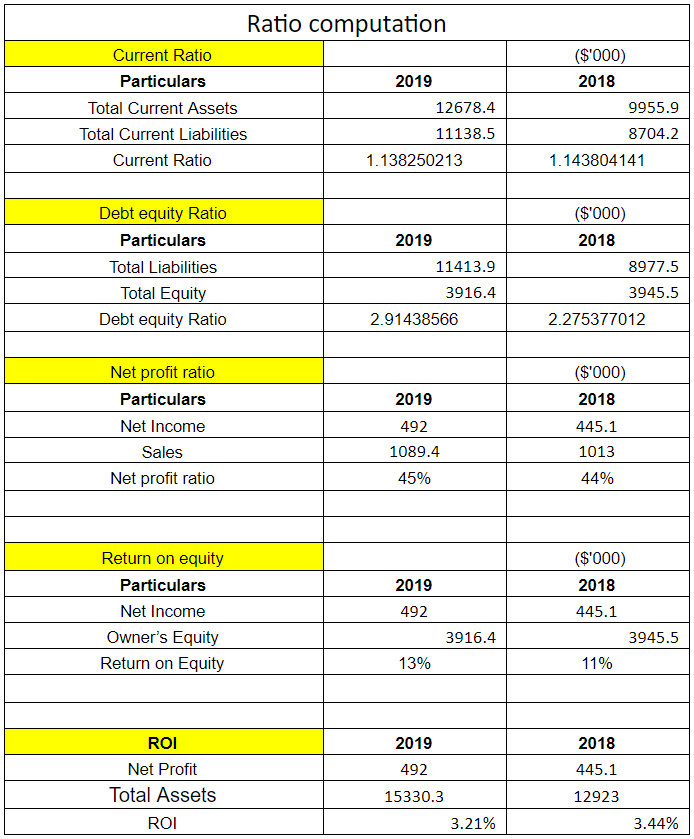

Ratio ASX financial analysis

- Return on Investments

As per the interpretation of this ratio, it is witnessed that the investment in ASX ltd will provide a return of 3.21%. The desirable return should be in the range of 5% to 12% which the company fails to provide hence it is not a highly lucrative venture. - Net profit ratio

Net profit is the profit earned by the company and denotes the earning potential (Shuli 2011). As seen from the ratio, ASX posted an increment in the year 2019. The ratio increased from 44% in 2018 to 45% in 2019 signifying a growth in the earning potential. - Return on Equity

Return on equity denotes the return generated by the equity investment. It is an important parameter as it highlights the utilization of the shareholder's fund (Shuli 2011). The ROE has shown an increment from 11% in 2018 to 13% in 2019 thereby signifying that the utilization of the funds has been effective and generated returns. - Current ratio

This ratio denotes the ability of the company to convert the assets into liquidity (Carlon 2019). This ratio helps in knowing whether the business has sufficient funds to meet the obligations. As per the calculation, it is observed that ASX financial analysis has a current ratio that is sufficient to honor the obligations. In both the years, the company has more than $1 of current assets to meet $1 of current liabilities. - Debt equity ratio

The debt equity ratio denotes the presence of equity and debt component for a company (Sherman 2015). As seen from the computation that the debt component is high for the company. Hence, a higher reliance on debt will put the company at stake.

Introduction

ASX financial analysis occupies a formidable presence in the industry and with the fundamentals it has a high opportunity to grow in the next decade. The company has made strong progress in the past three years and is operating confidently. The company further strives to vouch for new growth opportunities that will benefit the customers and the industry as a whole. The establishment of DLT is another big initiative that is attracting attention from the overall service industry.

The Balance scorecard is an important non-financial parameter that is used by the managers for checking the sub-teams and employees' activities (Roussas & McCaskill 2015).

Balance scorecard

Financial perspective

As the profitability of the company enhances, the market price, as well as share value even increases thereby enhancing the company’s reputation (Carlon 2019)

Once the profitability of the company increases, the market price and share value also increase, and ultimately the reputation of the company is also enhanced.

|

Performance Objective |

Measurement |

Target (KPI) |

|

Tangible Assets |

Assets increment (ASX Limited 2019) |

Asset addition by 10% |

|

Revenues |

Revenue growth |

Revenue increment by 25% |

|

Operating Profit |

Increment in the operating margin |

Pushing Operating Profit by 5% (ASX Limited 2019) |

Customer Perspective

|

Objective |

Measurement |

Target (KPI) |

|

Loyalty and customer retention |

Preservation of old customer data |

Retention of at least 90% customers |

|

Newer customers |

Increment in database for new customers |

Ensuring new customers in the range of 20% to 30% and listings every year |

|

Enhancement of customer services |

Attainment of goodwill by providing customer service (ASX Limited 2019) |

Customers feedback and review |

The customer perspectives are planned in a manner that enhances the listing followed by the increment in the number of customers who are trading.

Internal Perspective

|

Objective |

Measurement |

Target (KPI) |

|

Management Systems |

administration systems accountability |

Workflow reports and its development (ASX Limited 2019) |

|

Website updating |

Website visitors |

Increment of inline enquiries by 10% every year |

Innovation and Learning

|

Objective |

Measurement |

Target (KPI) |

|

Productivity & skill of employee |

Employees knowledge building (ASX Limited 2019) |

Awareness of employees |

|

up gradation of technology |

sustainable performance standards (ASX Limited 2019) |

New software’s and technology |

The employees are needed to be trained in a manner that will help to adhere to the changing environment.

The employees of ASX receive a package of fixed remuneration. Further, the ASX financial analysis even provides Short-term Incentive Plan to reward the individual contribution and performance with the shares of ASX or cash as per the role performed. Moreover, the company provides the employees to be the shareholders. In a year, the ASX employee has the opportunity to acquire ASX shares under the $1,000 General Employee Share Plan (ASX Limited 2019). The share price of ASX limited has shown formidable strength in the past 3 years and is currently trading at $82.83.

Conclusion

As per the overall discussion, it can be commented that ASX financial analysis has high fundamentals and capacity to grow further in the next decade. The ratio analysis that is a financial parameter and the non-financial parameter has been adequately noticed in the annual report and signifies the capability of the company. Hence, in lieu of it, it can be commented on the ASX financial analysis that the company is a potential buyer because it has a good return on equity followed by the net profit ratio and the current ratio. Even in the wake of the COVID-19 crisis the company, the share price depicted strong resilience and hence, every indicator classifies it as a potential stock. Hence, recommended for the stakeholders to enter a position at the current level because the momentum is strong and will definitely reach new heights in the upcoming years.

Reference

ASX Limited 2019, ASX Limited 2019 annual report & accounts, viewed 15 June 2020, https://www.asx.com.au/documents/investor-relations/AnnualReport2019.pdf

Carlon, S., 2019, Financial accounting: reporting, analysis and decision making. 6th ed. Milton, QLD John Wiley and Sons Australia, Ltd

Roussas, S. & McCaskill, A.D. 2015, The Balance Scorecard versus Traditional Measurement System, ASX financial analysis American Journal of Management, vol. 15, no. 3, pp. 36-42.

Sherman, E 2015, A manager's guide to financial analysis : Powerful tools for analyzing the numbers and making the best decisions for your business, Ama Self-Study

Shuli, I 2011, Earnings management and the quality of the financial reporting. Perspective of Innovation in Economics and Buisness (PIEB), vol. 8, no. 2, pp. 45- 48.

Appendix