Finance Assignment Evaluating Financial Business Scenarios

Question

Task:

The questions to be answered within this finance assignment are;

Week 1

What are the five basis principles of finance? Briefly explain them (no more than 250 words).

Week 2

Little Book LTD has total assets of $860,000. There are 75,000 shares of stock outstanding, total book value of $750,000 with a market value of $12 a share. The firm has a profit margin of 6.5% and a total asset turnover of 1.5.

Required:

a) Calculate the company’s EPS?

b) What is the market –to- book ratio?

Week 3

Fifteen years ago, you deposited $12,500 into an investment fund. Five years ago, you added an additional $20,000 to that account. You earned 8%, compounded semi-annually, for the first ten years, and 6.5%, compounded annually, for the last five years.

Required:

a) What is the effective annual interest rate (EAR) you would get for your investment in the first 10 years?

b) How much money do you have in your account today?

c) If you wish to have $85,000 now, how much should you have invested 15 years ago?

Week 4

Giant Equipment Ltd. is considering two projects to invest next year. Both projects have the same start-up costs. Project A will produce annual cash flows of $42,000 at the beginning of each year for eight years. Project B will produce cash flows of $48,000 at the end of each year for seven years. The company requires a 12% return.

Required:

a) Which project should the company select and why?

b) Which project should the company select if the interest rate is 14% at the cash flows in Project B is also at the beginning of each year?

Week 5

Rachel is a financial investor who actively buys and sells in the securities market. Now she has a portfolio of all blue chips, including: $13,500 of Share A, $7,600 of Share B, $14,700 of Share C, and $5,500 of Share D.

Required:

a) Compute the weights of the assets in Rachel’s portfolio?

b) If Rachel’s portfolio has provided her with returns of 9.7%, 12.4%, -5.5% and 17.2% over the past four years, respectively. Calculate the geometric average return of the portfolio for this period.

c) Assume that expected return of the stock A in Rachel’s portfolio is 13.6% this year. The risk premium on the stocks of the same industry are 4.8%, betas of these stocks is 1.5 and the inflation rate was 2.7%. Calculate the risk-free rate of return using Capital Market Asset Pricing Model (CAPM).

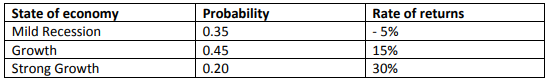

d) Following is forecast for economic situation and Rachel’s portfolio returns next year, calculate the expected return, variance and standard deviation of the portfolio.

Answer

Week 1

Following are the basic principles of finance presented in this finance assignment:

Time value of Money: This principle is based on the theory that money has its value which implies that the value money today has is certainly greater than its value in the future as there is an interest addition to the value of money held.

Risk Requires some reward: In finance, the concept of risk and rewards go parallel. An investment with a potential of higher risk will certainly be the riskier in comparison to the investment option which has low return generating capacity. Risk is the degree of uncertainty attached with the return of the investment.

Cash Flows matters: The cash flows in any business matters equally as profit matters. Without adequate cash balances business cannot survive in long run. It is always possible that business with high profits face financial problems such as liquidity and insolvency in the event of low balances of cash in the business.

Financial markets are influenced by the information: The investors in the financial markets react quickly to the news and information relevant directly or indirectly to their investment options and the positive news leads to hike in the stock prices and the negative news causes the fall in the stock prices in the financial markets.

Differing interests of shareholders and managers: Managers have to act as the agents of the shareholders and they are given incentives for this. If managers do not act towards maximizing the returns of the shareholders, they would have to bear high agency cost.

Week 2

|

Given |

|

|

Asset Turnover Ratio |

1.5 |

|

Total Assets |

$ 860,000 |

|

Profit Margin |

6.50% |

|

Total Outstanding Shares |

75000 |

|

Market Value Per Share |

$ 12 |

|

Total Book Value |

$ 750,000 |

Part a

|

EPS =Net Income/ Total Outstanding Shares |

|

EPS = 83850/75000 |

|

EPS= $ 1.118 |

|

Workings |

|

Asset Turnover Ratio = Net Sales/ Total Assets |

|

1.5= Net Sales / 860000 |

|

Net Sales= $ 860000 x 1.5 |

|

Net Sales= $ 1,290,000 |

|

Profit Margin = Net Income/Net Sales Net income = Net sales x profit margin |

|

Net Income= $ 1290000 x 6.50% |

|

Net Income= $ 83,850 |

Part b

|

Market to Book Ratio= Total Market Capitalization/ Total Book Value |

|

Market to Book Ratio= $ 900,000/ $ 750,000 |

|

Market to Book Ratio=1.2 |

Workings

|

Total Market Capitalization= Market Value Per Share x Number of Shares |

|

Total Market Capitalization= $12 x 75000 |

|

Total Market Capitalization= $ 900,000 |

Week 3

Part a

Effective Annual Rate= ((1+ (Quoted Interest Rate/m))m)-1

M= number of compounding periods

EAR = [(1+ (0.08/2)2]-1

[1+ (0.08/ 2)2]-1

EAR = 8.16%

Part b

Given:

|

Amount Invested= $12500 |

|

Investment Term= 15 years |

|

Interest Rate= 1-10th Year= 8%, 11th-15th Year= 6.5% |

|

Compounding = 1st -10th Year Semi Annually, 11th to 15th Year= Annually |

FV = PV (1 + r)t

Amount after 10 Years

PV= 12500

r= 0.08/2 = 0.04

t= 10 x 2 = 20

FV = 12500x (1+0.04)20

Amount after 10 Years= $ 27,389.04

Amount After 15 Years

PV= = $ 27,389.04

r= 0.065

t= 5

FV=?

FV= ($ 27,389.04 + $ 20,000) x (1+0.065)5

=$ 64,927.09

Part c

Amount to be invested 15 years back to obtain a sum of $ 85000 today will be calculated as follows

If $85,000 is to be accumulated at the end of 15 years, at the end of 10 years following amount should be accumulated:

Present Value = Future Value/ (1+r) n

Future Value = $ 85000

t= 5

r= 6.5%

PV = $85,000/(1+.065)5

PV= $ 62,039.87

To accumulate $ 62,039.87 at the end of year 10, now the following amount should be invested considering the additional investment at the end of 10th year for $ 20,000:

FV= $ 62,039.87

t= 10*2

r= 0.08/2 = 0.04

PV= ($ 62,039.87 -20000)/ (1+0.04)20

PV= $19,186.45

So the amount should have invested 15 years back is $ 19186.45

Week 4:

Part a

Given

|

Project A |

Project B |

|

|

Initial Outflow |

Not Known but Same in both projects |

|

|

Annual Cash Flows |

$ 42,000.00 |

$ 48,000.00 |

|

Project Duration |

8 Years |

7 Years |

|

Occurrence of Cash Flows |

Beginning of the year |

End of the year |

|

Rate of Return |

12% |

12% |

PVA of Project A: Annuity Due

PVA n= PMT x [(1-(1+i)-n]/i) ] x 1+ i

PMT= $42000

n= 8

i= 0.12

PVA8 = 42,000{[1- (1+0.12)-8]/0.12} (1+0.12)

PVA8= $ 233,677.78

PVA of Project B: Ordinary Annuity

PVA n= PMT x [1-(1+i)-n]/i

PMT = $48,000

n = 7

i =0.12

PVA7 = $48,000 [1-(1+0.12)-7 ] /0.12

= $ 219,060.31

Note: Given the same initial investment in both the project, Project A shall be selected as it has higher present value of cash flows which means that it will generate more returns.

Part b

Given

|

Project A |

Project B |

|

|

Initial Outflow |

Not Known but Same in both projects |

|

|

Annual Cash Flows |

$ 42,000.00 |

$ 48,000.00 |

|

Project Duration |

8 Years |

7 Years |

|

Occurrence of Cash Flows |

Beginning of the year |

Beginning of the year |

|

Rate of Return |

14% |

14% |

PVA of Project A: Annuity Due

PVA n= PMT x [(1-(1+i)-n]/i) ] x (1+ i)

PMT= $42000

n= 8

i= 0.14

PVA8 = 42,000{[1- (1+0.14)-8]/0.14} x (1+0.14)

PVA8= $ 218,212.158

PVA of Project B: Annuity Due

PVA n= PMT x [1-(1+i)-n]/I x (1+ i)

PMT = $48,000

n = 7

i =0.14

PVA7 = $48,000 {[1-(1+0.14)-7] /0.14} x (1+0.14)

PVA7 = $ 234,656.04

Note: In the changed scenario, Project B shall be accepted as it has higher returns.

Week 5

Part a: Weights of portfolio assets

|

Portfolio Assets |

Quantity |

Weight |

|

Share A |

13500 |

32.69% |

|

Share B |

7600 |

18.40% |

|

Share C |

14700 |

35.59% |

|

Share D |

5500 |

13.32% |

|

Total |

41300 |

100.00% |

Share A = 13500/41300 = 32.69%

Share B= 7600/41300= 18.40%

Share C= 14700/41300= 35.59%

Share D= 5500/41300= 13.32%

Part b: Geometric Average Return of the Portfolio

Given:

|

Yearly Returns |

Portfolio Return |

|

RYear1 |

9.70% |

|

RYear2 |

12.40% |

|

RYear3 |

-5.50% |

|

RYear4 |

17.20% |

Calculation:

GAR= [(1+Ryear1) × (1+Ryear 2) ×…. × (1+Ryear n )]1/n - 1

GAR= ((1+0.097) x (1+0.124) x (1-0.055) x (1+.172)) 1/4-1

GAR= (1.097 x 1.124 x 0.945 x 1.172)1/4-1

GAR=(1.366)0.25-1

GAR= 8.10%

Part c

|

Data Information E(Ri) = 13.6% Rf =? Risk Premium = [E(Rm) – Rf] = 4.8% ?i = 1.5 |

|

Calculation: CAPM Model, ke= Risk Free Rate + Beta (Risk Premium) or |

E(Ri) = Rf + ?i [E(Rm) – Rf] 13.6%= Risk Free Rate + 1.5(4.8%) |

13.6%= Risk Free Rate + 7.2% |

Risk Free Rate= 13.6%-7.2% |

Risk Free Rate= 6.40% |

|

Inflation adjusted Risk Free Rate=( (1+Risk Free Rate)/ (1 + Inflationary Rate))-1 |

Inflation adjusted Risk Free Rate=((1+ 6.40%)/ (1 + 2.70%))-1 |

Inflation adjusted Risk Free Rate= 3.60% |

Part d

|

State of Economy and Denotations |

Rate of Return |

Probability |

|

Mild Recession =A |

-5.00% |

0.35 |

|

Growth=B |

15.00% |

0.45 |

|

Strong Growth=C |

30.00% |

0.2 |

Expected Return of Portfolio

E(rp) = W(A) * E(r A) + W(B) * E(r B) + W(C) * E(r C)

= (-0.05 x0.35) + (0.15 x 0.45) + (0.30 x 0.20)

= -0.0175 + 0.0675 + 0.0600

= 11%

Standard Deviation of Portfolio

?P = (wA2?A2 + wB2 ?B2 + wC2?C2 + 2wAwB?A?B?AB + 2wBwC?B?C?BC + 2wAwC?A?C?AC)1/2

Variance= [(-0.05-0.11)2 x 0.35] + [(0.15-0.11)2 x 0.45] + [(0.30-0.11)2 x 0.20]

Variance = 0.0169

Standard Deviation = ?0.0169

Standard Deviation= 0.85%

Appendix

Finance Assignment Question 4

|

State of economy |

Rate of Return |

Probability |

Calculation |

Expected Return |

|

Mild Recession |

-5% |

0.35 |

(-0.05 x0.35) |

-1.75% |

|

Growth |

15% |

0.45 |

(0.15 x 0.45) |

6.75% |

|

Strong Growth |

30% |

0.20 |

(0.30 x 0.20) |

6.00% |

|

Expected Return of Portfolio |

11% |

Variance and Standard Deviation

|

Rate of Return |

Deviation |

(Deviation)2 |

Calculation |

Deviation2 x probability |

|

|

Mild Recession |

-5.00% |

-16% |

2.56% |

2.56% x 0.35 |

0.90% |

|

Growth |

15.00% |

4% |

0.16% |

0.16% x 0.45 |

0.07% |

|

Strong Growth |

30.00% |

19% |

3.61% |

3.61% x 0.20 |

0.72% |

|

Variance |

1.69% |

Workings

Deviation=

|

State |

Calculation |

Deviation= x-x' |

|

Mild Recession |

(5%)-11% |

-16% |

|

Growth |

15%-11% |

4% |

|

Strong Growth |

30%-11% |

19% |

Standard Deviation and Variance=

Variance= 1.69%

Standard Deviation = (Variance) 1/2

Standard Deviation = (1.69%) 1/2

Standard Deviation = 0.85%