Financial Analysis Assignment: Audit Report For Sportastic For Year Ending 30 June 2021

Question

Task:

Background

Sportastic is an Australian listed company producing luxury, high-tech and specialised sport shoes. The company receives its stock from production suppliers in China and distributes its products in Australia. The company has consistently maintained its profit after tax rate at around 10% annually up to the year ended June 2021, providing shareholders with a consistent dividend stream.

To stay competitive in the industry, from August 2020 the company launched a new model, where the lower mould can automatically adjust itself to avoid foot injury. The company has already made a substantial investment acquiring assets for this new model. While this new model has a short three-year lifecycle, the board of directors have been convinced that the new product will help to increase revenues by 10% and maintain the profit rate. To finance the new product investment, the company borrowed an additional $4 000 000 in September 2020 for three years. In addition, a long-term loan of $5 000 000 is due in August, 2021.

Production of the new model has been undertaken by the current suppliers in China. The new model was released to the Australian market in January 2021. Significant marketing costs to promote the new product, followed by an ongoing advertising campaign, have resulted in a large increase in promotional expense. Based on actual figures for the first six months ended 31 December 2020, the company released to the public a forecast of a 10% profit after tax rate for the year ended 30 June, 2021. As advised by management, turnover has not been impacted by COVID lockdowns due to strong demands from online sales.

The sporting product industry has become quite competitive since 2019, particularly with new large international players from the US and France entering the Australian market, offering high-tech shoes at very affordable prices. While the new Sportastic product generated a high level of revenues since being released, there has been an increase in product returns due to technical problems and an increase in negative feedback from customers. In addition, there have been issues related to poor quality control from suppliers in China. A few shipments were returned for repair. However, it has been reported that invoices for these shipments were fully paid. Sportastic pays its suppliers in USD, and there has been a sensitive fluctuation of exchange rates between AUD and USD due to market uncertainties, particularly in light of the trade disputes between Australia and China.

In the last nine months, there have been issues reported related to the process of handling customer returns and the unusual high amount of product returns recorded. For products having technical issues, customers are allowed to return the faulty item to a store within 12 months. Store staff can then write off the item returned and provide customers with a new item. Most store staff are young and employed on a casual basis, often moving on after a year or two. The company is using a perpetual inventory system, where all stock movements are captured and current balance of stock is always available. Stocktakes are conducted annually, at the end of the financial year.

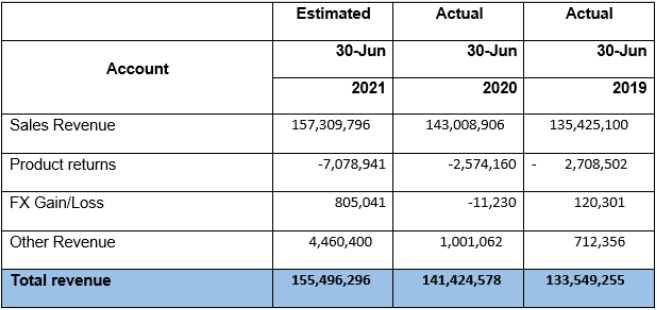

Financial Information:

|

- |

Estimated |

Actual |

Actual |

|

Account |

30-Jun |

30-Jun |

30-Jun |

|

2021 |

2020 |

2019 |

|

|

Sales Revenue |

157,309,796 |

143,008,906 |

135,425,100 |

|

Product returns |

-7,078,941 |

-2,574,160 |

- 2,708,502 |

|

FX Gain/Loss |

805,041 |

-11,230 |

120,301 |

|

Other Revenue |

4,460,400 |

1,001,062 |

712,356 |

|

Total revenue |

155,496,296 |

141,424,578 |

133,549,255 |

|

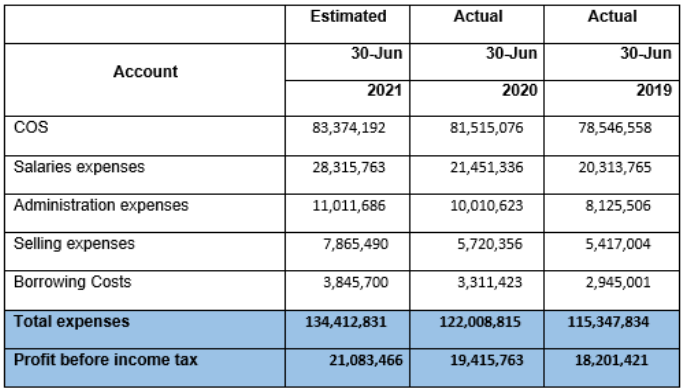

COS |

83,374,192 |

81,515,076 |

78,546,558 |

|

Salaries expenses |

28,315,763 |

21,451,336 |

20,313,765 |

|

Administration expenses |

11,011,686 |

10,010,623 |

8,125,506 |

|

Selling expenses |

7,865,490 |

5,720,356 |

5,417,004 |

|

Borrowing Costs |

3,845,700 |

3,311,423 |

2,945,001 |

|

Total expenses |

134,412,831 |

122,008,815 |

115,347,834 |

|

Profit before income tax |

21,083,466 |

19,415,763 |

18,201,421 |

|

Income Tax expense |

5,270,866 |

5,048,098 |

4,550,355 |

|

Profit after income tax |

15,812,599 |

14,367,665 |

13,651,066 |

|

- |

- |

- |

- |

|

Current assets |

- |

- |

- |

|

Cash |

10,650,120 |

12,061,680 |

10,575,150 |

|

Accounts Receivable |

21,845,000 |

20,580,400 |

18,757,824 |

|

Inventory |

16,102,457 |

13,254,785 |

12,540,125 |

|

Total current assets |

48,597,577 |

45,896,865 |

41,873,099 |

|

Non-current assets |

- |

- |

- |

|

Property, plant and equipment |

25,140,124 |

19,250,123 |

18,600,825 |

|

Intangible assets |

9,845,145 |

7,420,154 |

7,543,500 |

|

Total non-current assets |

34,985,269 |

26,670,277 |

26,144,325 |

|

Total assets |

83,582,846 |

72,567,142 |

68,017,424 |

|

- |

- |

- |

- |

|

Current Liabilities |

- |

- |

- |

|

Accounts Payable |

22,564,012 |

20,156,000 |

19,875,050 |

|

Interest Bearing Liabilities |

7,500,000 |

6,500,000 |

8,500,000 |

|

Total current liabilities |

30,064,012 |

26,656,000 |

28,375,050 |

|

Non-current liabilities |

- |

- |

- |

|

Deferred tax liabilities |

1,400,451 |

2,650,041 |

2,580,147 |

|

Interest-bearing liabilities |

22,000,000 |

18,000,000 |

16,500,000 |

|

Total non-current liabilities |

23,400,451 |

20,650,041 |

19,080,147 |

|

Total liabilities |

53,464,463 |

47,306,041 |

47,455,197 |

|

Equity |

30,118,383 |

25,261,101 |

20,562,227 |

Requirements for financial analysis assignment

Assume you are one of the audit team members who will conduct the financial report audit – year ending 30 June 2021 – for Sportastic. Using the company’s information given above, prepare a report dated June 15, 2021 for the audit manager outlining the audit plan. As it is the beginning of the audit do not prepare a final audit report/opinion. The report should cover the following areas under the suggested headings:

- Risk Assessment

From the background information given above:

- identify and explain three (3) potential HIGHinherent risks. For each risk listed, identify the associated financial accounts and key assertions that would be affected.

Please use the following table to present your answers:

|

Potential risk – description |

Accounts |

Assertions |

| - | - | - |

| - | - | - |

- identify and explain three (3) potential HIGH internal control weaknesses (control risks). For each weakness,identify the associated financial accounts and assertions, and suggest controls that can be implemented to prevent and detect potential errors.

Please use the following table to present your answers:

|

Control weakness |

Accounts |

Assertions |

Transaction level internal control |

| - | - | - | - |

| - | - | - | - |

Please note: the risk given must be key and related to the client’s characteristics/situation.

- Planning Materiality

The audit firm dictates that one planning materiality amount (and percentage if necessary) is to be used for the financial statement as a whole. The planning materiality bases are as follows:

|

Base |

Threshold (%) |

|

Profit before tax |

5-10 |

|

Turnover |

0.5-1 |

|

Gross profit |

2.0-5 |

|

Total assets |

0.5-1 |

Based on the information given and your risk assessment,

- select the base for planning materiality that you believe is most appropriate, and provide three reasons justifying the base you have chosen.

- calculate and suggest the planning materiality (amount and percentage) that you would use for the client.

(You can refer to the Grant Thornton program and textbook pages 106-107 and other resources for further understanding.)

- Analytical Procedures

As part of the risk assessment phase, you must conduct analytical procedures:

- Based on the financial information given above, conduct analytical procedures using simple comparison and common-size analysis.

- Using the planning material set out above, discuss the results of the analytical procedures by outlining six (6) potential problem areas (that is, where possible material misstatements in the financial reports exist), whether these areas are consistent with the risks identified above, and any other areas of concerns. For each potential problem area, specify the account balances and related assertions that would require attention in the audit.

Please note: for each problem identified, you must use your quantitative analysis (with detailed calculations) to support your argument.

- Conclusion

Based on the risk assessment processes and analytical procedures undertaken in the previous sections, conclude the overall level of risk, materiality of the firm and recommend the areas of audit focus.

Answer

Executive summary

The report on financial analysis assignment is based upon an Australian listed organisation Sportastic, which produces high tech, luxury and specialised in sport's shoes. The organisation usually receives stock from the supplier in China and distributes the products in Australia. To compete in the market, the organisation has launched a new model that helps the workers to avoid further injury. In this report, the financial audit report will be conducted for Sportastic based on the financial information which is provided. The report has three major sections which are risk assessment, planning materiality, and analytical procedures. The section of risk assessment, states the identification of three potential high inherent risk and internal control weaknesses. In the section on planning materiality, there will be a selection for the base of planning materiality that is appropriate and justification will be provided for the reasons chosen. Further, based on the calculation suggestion will be provided to the client. In the last section, and analytical procedures will be conducted with help of comparison and common size analysis. With the help of planning material, the results of analytical procedures are outlined with problem areas. Lastly, a conclusion is provided based on the risk assessment processes and analytical procedures which are undertaken.

Introduction

The report provides a financial report audit that is conducted by audit team members based on the financial information of an organisation i.e. Sportastic. It is an Australian listed organisation that has main operations in Australia. It specialises in sporting products and recently it faces competition from large international players usually from France and United States. The financial audit report, there will be discussed risk assessment, planning materiality, and analytical procedure (Bailey, Collins, & Abbott, 2018). With this, the overall risk and materiality of the organisation can be understood and recommendations will be provided on that basis.

Risk assessment

|

Potential risk – description |

Accounts |

Assertions |

|

There has been an increase in the product return which is because of the technical issues that Sportastic is facing and the negative feedback from consumers has increased. Moreover, there are issues which are related to control of the poor quality of products which is received from China suppliers. Thus, several shipments were returned for repair. |

Account Receivable |

Documents or product inspection |

|

Further, there were issues related to handling the process of consumer return and there is an increase in the product return. As per the complaints of consumers, the products have technical issues. |

- |

External Confirmation |

|

There is an issue in the perpetual inventory system, in which the movements of stock are captured and the current balance of that stock is available. |

- |

Physical inspection of inventory system |

|

Control weakness |

Accounts |

Assertions |

Transaction level internal control |

|

The new product that is introduced in the market has some flaws related to the design. |

- |

Understatement of the legal liability. |

- |

|

The new competitor in the market has brand recognition in the market and is successful to take market share. |

- |

Overstatement of the inventory because of obsolescence. |

- |

|

The amount due from the consumer has increased in a significant manner in the last quarter. |

- |

Overstatement of revenue because of manipulation in the financial reporting. |

- |

Planning materiality

In a business proprietor oversaw organization, benefit before expense might be the beginning stage. Notwithstanding, there are various purposes behind (model, the unpredictability of this benchmark) why an alternate benchmark might be considered more suitable. However not refered to as an illustration in the ISA, gross resources (just as net resources) may be fitting for an element with altogether higher qualities yet to be determined sheet contrasted with its pay articulation, (for example, a speculation property element). For a word related benefits plot, materiality may normally be founded on a level of the complete worth of the plan resources or the inflows/surges from managing individuals. However not normal, there are cases where complete use is more fitting than absolute pay. For instance, a foundation's degree of pay might shift starting with one year then onto the next however the consumption might be more predictable. Net resources may be a proper benchmark to use for a new business which has little income or benefits. Likewise EBITDA (profit before interest, tax assessment, deterioration and amortization) might be significant for organizations with generous financing costs (Ojo, 2019).

It doesn't appear to be preposterous to contend that a thing that makes money into a misfortune or the other way around should be material. Yet, in case that is taken to its obvious end result, eventually evaluators of a multi-billion pound business will be confronted with an exceptionally low materiality. A portion of the issues above are settled by checking out the 'standardized', for sure is all the more ordinarily alluded to as 'changed', benefit where inspectors would add back remarkable things. This brings up the issue of what kind of changes are proper and in what conditions they are fitting. The appropriate response lies in figuring out what it is that the clients of the fiscal summaries are truly zeroing in on. Plainly it appears to be sensible to incorporate things that are characterized as extraordinary in the bookkeeping structure since clients for the most part center around the hidden presentation of the business. However, regularly evaluators will likewise add back things like the compensation paid to proprietor directors (ISA 320.A9 recommends so a lot). It is additionally conceivable to utilize a normal of the benchmark (eg, the normal changed benefit before charge more than 3–5 years) which can streamline the unpredictability. Obviously, it is consistently a question of expert judgment and reviewers should be clear why they have picked a specific course. For instance, if there has been a stage change in the business, it is questionable to adopt an averaging strategy basically in light of the fact that it assisted with conveying a figure that examiners needed. Regardless, where materiality would vary generally despite the fact that the size of the business is to a great extent something very similar, now and then inspectors just need to acknowledge that changed benefit may not be fitting and an alternate benchmark, like complete income, is required.

Analytical procedures

An issue can emerge while evaluating the budget reports of a period that is pretty much than one year. ISA 320.A7 affirms that materiality ought to identify with the fiscal summaries being ready for that monetary detailing period.

ISA 320.9 exemplifies execution materiality. It is the amount(s) that is set by evaluators at underneath in the general materiality so as to diminish to a fittingly small level the chance that is the total of uncorrected and undetected misattributes that is surpassed by and large materiality. The most basic term of execution that is used is 'working materiality'.

It is used for setting the mathematical level that helps guide the evaluators for accomplishing the sufficient work (at the same time, suggestively, not all that much) to help with reviewing the assesmemnt. It shows that if inspectors basically applied the general materiality thast is done all through the arranging and shows a hands on work stage that many are facing an unnecessary challenge, and the material misquotes were not distinguished with their review work.

Normally review approaches needs implementation of the materiality that is going to be a stage of large materiality (or diversities attaching to exactly same thing). With higher evaluated threats, the rate lowers. Ordinarily the figure range staring from 75% (generally safe) to the half (ample danger).

Reviewers might mistake execution materiality for passable error. Mediocre mistake is suggested to in the process of ISA 530 Audit inspecting and also an illustration of implementation materiality when applied to the resoultion and evaluation of outcomes while assessing. Nonetheless, execution materiality is likewise used for diversified factors at the organising level. It is likewise a testimonial time that examining the results of the rest (non-testing) considerable scientific techniques.

Reviewers might have to amend generally speaking materiality during while the revision process in an event that they turned concious of information while the revision that would have made them to took a resolution an replacement sum at first. This can appear by and by the palce in general not really settled earlier in the substance's year end and depends on conjecture information (eg, the element's gauge welfare earlier charge), and the actual value diversifies essentially to estimate, and the cause is may be a spontaneous removal of a portion of the business model change being recognized.

On the off chance that the reviewers assume that a less normal materiality is ideal (and, if relevant, materiality satges for distinct classes of interchanges, account regulators or exposures), they additionally consider if it is dominant to reconsider implementation materiality, and assuming in this case, the involved domains think about the result on the earth, time plans and level of their revision strategies.

Conclusion

Thus to conlude it can be said that at the point when the not really settled that a critical danger, including a misrepresentation hazard, exists, the reviewer ought to assess the plan of the organization's controls that are expected to address extortion chances and other huge dangers and decide if those controls have been executed, if the examiner has not currently done as such while getting a comprehension of inward control.

References

Bailey, C., Collins, D. L., & Abbott, L. J. (2018). The impact of enterprise risk management on the audit process: Evidence from audit fees and audit delay. Auditing: A Journal of Practice & Theory, 37(3), 25-46.

Ojo, A. (2019). Internal Audit And Risk Management In Nigeria’s Public Sector.

Pérez-Cornejo, C., de Quevedo-Puente, E., & Delgado-García, J. B. (2019). How to manage corporate reputation? The effect of enterprise risk management systems and audit committees on corporate reputation. Financial analysis assignment European Management Journal, 37(4), 505-515.

Pérez-Cornejo, C., de Quevedo-Puente, E., & Delgado-García, J. B. (2019). How to manage corporate reputation? The effect of enterprise risk management systems and audit committees on corporate reputation. European Management Journal, 37(4), 505-515.

Tai, V. W., Lai, Y. H., & Yang, T. H. (2020). The role of the board and the audit committee in corporate risk management. The North American Journal of Economics and Finance, 54, 100879.