Financial Analysis Assignment: Evaluating Economic Condition of Fortescue Metals

Question

Task

Select a company that is currently listed on the ASX. Write a Financial Analysis assignment that interprets the company’s most recent annual report. This report will need to be written for a stakeholder (external investor or internal manager). You must research additional information beyond the annual report about the company’s performance. Use the group financial results if the annual report presents financial results for the group and parent company. Justify the selection of financial and non-financial performance indicators that are relevant for evaluating the company’s financial performance.

Answer

Executive summary

Fortescue Metals limited selected in the present context of financial analysis assignment is a locally owned public listed company based in Australia and is listed under the ASX. The company mainly deals with the exploration, development, production and processing of iron ore. The complete process is conducted by the company and then the iron ore is ready for sale. The company runs the business operations with the help of the strength of over 5000 employees and has company operations in countries like China and Singapore apart from Australia. The headquarters of the company is situated in East Perth located in Western Australia. The financial analysis report of Fortescue metals helps in highlighting the financial strengths and weaknesses of the company and presents the economic health of the company to the investors and stakeholders.

Introduction

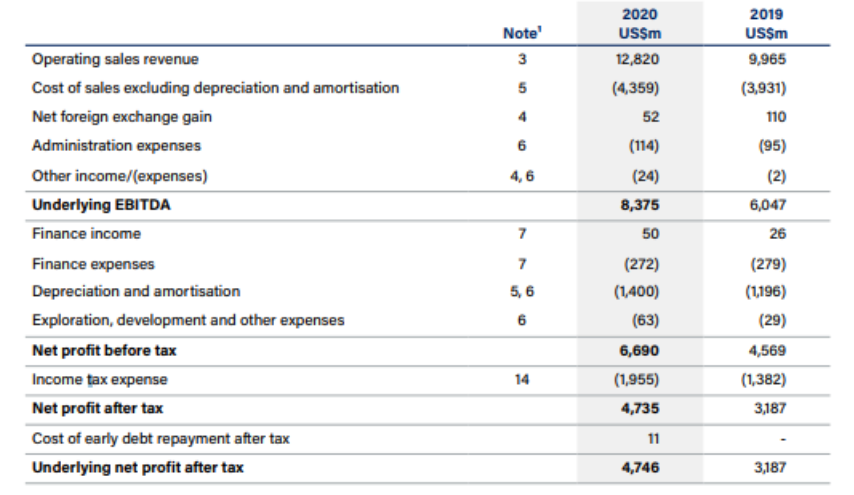

This report describes the interpretation of Fortescue Metal Limited Company’s latest annual report. The report is primarily prepared to address the stakeholders of the company. Significant changes were seen in the financial results of 2020 as compared to the previous year. There has been a considerable rise in the operating revenue sales and the underlying EBITDA has increased as compared to the 2019 report.

Analysis of the financial results

The net profit before tax has also increased in the financial year with and increased amount of 2121 million dollars which is quite a remarkable achievement. The net profit after tax deduction is also increased by an amount of 1548 million dollars. The financial report of 2020 has seen some changes as compared to the report of 2019.

Figure: 1 financial result of the company

Source: annual reports 2020

The accumulative income underlying the EBITDA in the financial year resulted in 8375 million dollars. The finance income along with the expenses of the company ruled by depreciation and other variables like exploration and development expenses resulted in an amount of 6690 million dollars that is equal to the net profit before tax (Dehran, 2018) . If the income tax expense is added to the net profit then it will amount to 4735 million dollars after-tax deduction. The debt payments are an integral factor of the net financial report of the company (V.B, 2018). The cost of early debit payment for the Fortescue Metals Company is an amount of 11 million dollars that will result in an increase in the net profit after tax to 4746 million dollars. There is a rise of about 1560 million dollars from the net profit of the financial year 2019.

Interpretation

The financial results of this particular year help in the demonstration of the sustained ability of operations that produce strong flow of cash. This feat is achieved by the thriving implementation of incorporated operations and marketing strategies (Kondratiev, 2020). The year saw a strong customer demand that helped the company to gain considerable profits from the record number of shipments. The company also delivered an optimize product mix to deliver higher margins. The impact of COVID has caused significant damage in the global economic sector. However, the Iron ore industry and Fortescue Metals gained significant advantage over other countries and companies due to the location. Australia was not heavily affected by the pandemic and so the company carried out its business operations smoothly following all the protocols. This event gave considerable amount of profit advantage as compared to the previous year.

Key performance indicators

Non financial indicator

The key performance indicators for the financial year 2020 are the variables like safety, production and costs. The health and safety along with the well being of the employees of Fortescue Metals Company are of the highest priority to the management. However, due to the pandemic of COVID 19, provisional changes were made to the site functioning rosters (Sunil, Rayapudi and Dhawan, 2019). There were other minor changes made within the operational sector like the addition of extra chartered flights and bus services to maintain the social and physical distance.

However, the pandemic or any other accidents did not cause any casualties in the organization. The company focused on plummeting the risk of fatalities and injuries with the help of exposure reduction activities by 15 per cent. An amount of 17.8 percentage reduction of risk was achieved in the financial year 2020 that proved instrumental in determining the overall success report of Fortescue Metals.

Financial key performance indicators

Production is one key performance indicators of the company that is directly related to the financial growth and development of the company. The company recorded a record shipment amount from the optimized production mix in the year 2020(Uchikoshi, 2020). The company was in an advantaged position to continue successful operations all through the pandemic situation that affected the global industries. The company had targets to leverage the capability in the value chain and improve the business volume. The combination of optimized inventory levels and capitalization of market demand resulted in the outperformance of financial year targets across all the metrics and supported the record shipment amount of 178.2 metric tons of ore. There was a considerable increase of about 6 per cent in the shipment amount as compared to the previous year.

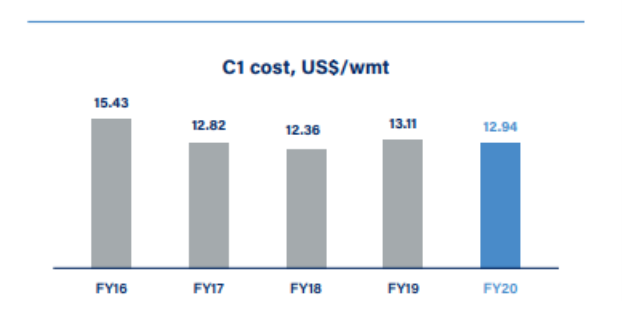

The costs associated with the focus on innovation and technology is one of the key performance indicators that the company wanted to decrease. There were some strategic initiatives associated with a reduction of costs like the 14-day payment terms of all the small business and address any cash flow challenges (V.B, 2018). The year demonstrated the ability of the company is consistently delivering sustainable price improvements through a constant focus on innovation, investment and technology. In addition to the key strategies, the company sustained evaluation and developed low-cost growth options through the exploration opportunities in Australia and other overseas countries.

Figure: 2 Cost reduction chart of Fortescue

Source: Annual Reports 2020

The chart helps in the illustration of the success of cost reduction and long term management of operational costs over the last five years. The reduction of the company operating costs and the increase of production has helped in the improvement of the financial results of the company for the year 2020. The business activities of the company are primarily exploration, development and processing of iron ore and the reduction of costs, increase of production and safety methods were instrumental in determining the financial results of the company for the year 2020.

Recommendation

The company management and operation can be held responsible for the good performance in the financial year 2020. The stakeholders can expect good profits from investment in the company. It will be a very wise decision to invest in Fortescue Metals Limited as the company has gained significant profit in a year where every other company have suffered significant losses due to the impact of the covid 19 pandemic. It is recommended that the stakeholders of the company invest in the company shares because they can expect a good return for the investment due to the various positive aspects of the key performance indicators.

Conclusion

The overall financial position and situation of the company are in a very favourable position and the company has made significant progress in the fields of key performance indicators like the production costs and safety. It is an organization that prioritizes the value of its stakeholders and employees. The company has adopted some strategies related to the reduction of costs of operation and production that will attract the stakeholders in investing in the company. The company has gained significant profits in the year 2020 that will help in nurturing the future growth of the company and increase the interest of the stakeholders.

References

Dehran, S. (2018). Digital Applications in Metals and Mining Industry. American Journal of Operations Management and Information Systems, 3(1), p.33.

Kondratiev, V.B. (2020). Covid-19 and Mining industry. Mining Industry (Gornay Promishlennost), 1(5/2020), pp.10–18.

Sunil, S.R., Rayapudi, V. and Dhawan, N. (2019). Recovery of Iron Values from Discarded Iron Ore Slimes. Mining, Metallurgy & Exploration, 1(1).

Uchikoshi, M. (2020). Industry-Academia Cooperation by Sumitomo Metal Mining Collaborative Research Unit. Materia Japan, 59(9), pp.466–471.

V.B, K. (2018). Global Mining Equipment Industry. Mining Industry Journal (Gornay Promishlennost), 139(3/2018), pp.26–34.