Financial Analysis Assignment: Funding & Investment Appraisal Of Zylla Limited

Question

Task:

Business Scenario for Individual Report

Introduction

You are a finance officer at Zylla Limited. The company operates a number of ferries that provide river crossing services for people, vehicles and goods across a river. Business is good and there are prospects for expansion. The management has made a decision to buy a new ferry to cater for the increased demand.

The company needs funds both for the acquisition of the ferry and to pay for the working capital requirements of the expansion. For this reason, there is a need to access short term as well as long term sources of funds. The company’s Director of Finance has asked you to produce a report, which she will use as the basis for advising the board on the viability of acquiring the new ferry and to seek approval to look for sources of funding for the company’s expansion plans.

Information on the new ferry

Ferries are normally operated profitably for five years after which they are decommissioned. They are then sold for approximately 10 percent of its cost. The estimated data on the proposed new ferry are as follows:

The company’s borrowing rate, which is the same as its cost of capital, is three percent. The discount factors for the cost of capital is provided in the above data for the relevant years.

What you must do

Write a financial analysis assignment report of one thousand words on behalf of the Director of Finance for presentation to the Board of Directors which must cover the following:

- Short term and long-term sources of finance to fund the acquisition of the ferry and for the company’s working capital needs, and

- An evaluation of various investment appraisal techniques and recommending the viability of the acquisition and operation of the new ferry based on one suitable investment appraisal technique using the data above.

Answer

Introduction

This report on financial analysis assignment is prepared by the Finance Officer of Zylla Limited engaged in providing ferry services to transport people and goods across the river. The business prospect is bright tending the organization to explore options like acquiring new ferries to expand the business. So this particular report will explore various short-term and long-term funding sources to acquire those ferries and address Zylla’s working capital requirements. The report will also run an investment appraisal mechanism to find out whether the business proposal is viable enough to proceed.

1. Funding of the business

Funding is a crucial aspect for any business and Zylla requires funds both for the short-term and long-term as well (Ogundare & Abdulsalam, 2020). Accordingly, the organization can explore various funding options to acquire the ferries and arrange the working capital.

Short-term funding options:

Short-term funding options are an effective way to source funds for the business to finance current assets and address the working capital needs like payment of suppliers (Russell, 2017). The various kinds of short term capital are as follows:

- Bank overdrafts – It is a kind of loan that the bank provides to the customer even if the account of the borrower reaches zero. It is a short-term loan that helps the borrower to pay the upcoming bills even if he is running out of money (Malmendier, 2018). It is convenient for the business to use bank overdraft to pay off the upcoming expenses without any sort of delay and maintain its credibility.

- Letter of credit – A financial institution like a bank issues the letter of credit to the suppliers on behalf of Zylla. So the company can have the supplies even without paying for those but needs to pay the institution or the issuer of the letter of credit at a later date.

- Commercial paper – Commercial paper is a debt instrument issued by companies for a period of up to 270 days or less (Shrivastava, et al., 2019). The phenomenon can help the issuer to source funds for a short stint and exploit the same to serve its purposes.

Long-term funding options:

Long-term funding is sought to strike a wholesome development of the business like acquiring assets or maintaining the organizational capital (Malmendier, 2018). The different sorts of long term capital are as follows:

- Stocks – Stocks are issued by the companies to have long-term funding options and need not be paid unless liquidation of the firm. The stock investors become the owners of the organization and take part in the decision-making of the business (Gillan, et al., 2021).

- Bonds – Bonds are debt options that the business can exploit to fund its business in the long term. The amount that the company sources from the bondholders need to be paid after a certain time, say five years along with interests (Russell, 2017). The company can exploit the bond worth by converting those into equities making them stockholders of the firm.

- Bank loans – The loans are released by financial institutions like banks for a certain amount that the organization needs to repay after a certain time, alongside interests. The amazing aspect of the bank loan is that before granting the loan, the bank carries out a business appraisal to evaluate its credibility (Brealey, et al., 2020). Thus through a bank loan, the firm can be assured that its operation is on the right track.

2. Investment appraisal

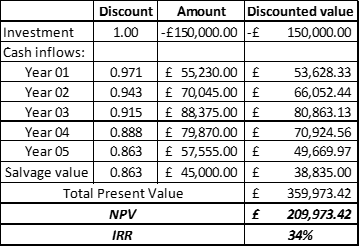

The above table shows the investment appraisal exercise conducted to evaluate the feasibility of the business proposal to acquire the ferries. The table has worked out the NPV and IRR for the business proposal.

NPV –

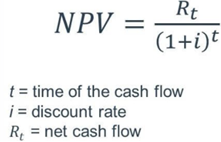

The NPV of the business proposal stands at £209,973.42 which is a positive value. The rule of the capital budgeting exercise is to accept the project if it delivers a positive value. In this case, the Zylla project will uphold the NPV to make the project to acquire the ferries acceptable. It is because NPV or the net present value shows the difference between the present worth of the cash inflows and the investment to show profitability (Vishny & Zingales, 2017). As per the capital budgeting mechanism, only a project with a positive value will be considered or else rejected. NPV is derived using the following formula:

The highlight of NPV is that it considers the time value of money making the outcome realistic. So the project is supposed to deliver suitable profitability in the forthcoming years.

IRR –

The exercise also considers the internal rate of return or IRR which shows the projected profitability of the potential investment. IRR stands for the discounted rate that makes the discounted cash flows of the NPV equivalent to zero (Shrivastava, et al., 2019). Higher the IRR, it is better for the project to prosper. In this case, the Zylla project has an IRR of 34%. It shows a higher IRR having the higher proposition to yield adequate profitability in the upcoming future.

Payback period –

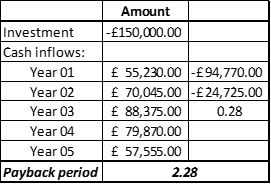

The payback period for the project stands at 2.28 years. The payback period shows how much time the investment takes to recover itself and lower the period, the project is preferable (Ogundare & Abdulsalam, 2020). It shows that the Zylla project can recover the investment worth £150,000 within 2.28 years making it a suitable investment proposition. This is because the investors can recover the investment within a shorter stint and yield profitability simultaneously.

Conclusion

The paper concludes that to source funds for the business, Zylla can avail various sorts of fund options like short and long-term funds. It can have a line of credit financing option to address working capital while there are stock or bank loan options to acquire the ferries. Again, the report shows that the Zylla project is worth considering as it has a positive NPV, higher IRR, and lower payback period. So the investment appraisal mechanism is favoring the Zylla project and ought to be carried forth to extract adequate profitability for the firm.

Bibliography

Brealey, R., Myers, S. & Allen, F., 2020. Principles of Corporate Finance. 13th ed. Reading: McGraw Hill.

Gillan, S., Koch, A. & Starks, L., 2021. Firms and social responsibility: A review of ESG and CSR research in corporate finance. Journal of Corporate Finance, p. 101889.

Malmendier, U., 2018. Behavioral corporate finance. In: Handbook of Behavioral Economics: Applications and Foundations 1. London: North-Holland, pp. 277-379.

Ogundare, E. A. & Abdulsalam, D. A., 2020. “The importance of accounting and finance for business managers”. Journal of Accounting and Finance, Volume 12, pp. 2570-2888.

Russell, M., 2017. Management incentives to recognise intangible assets. Financial analysis assignment Accounting & Finance, 57(4), pp. 211-234.

Shrivastava, P. et al., 2019. Finance and Management for the Anthropocene. Organization & Environment, 32(1), pp. 26-40.

Vishny, R. & Zingales, L., 2017. Corporate Finance. Journal of Political Economy, 125(6), pp. 1805-1812.