Financial Analysis Report On Probiotec

Question

Task:

Select a company that is currently listed on the ASX.

Write a Financial Analysis Report using an essay structure to interpret a company’s most recent

annual report.

Assessment Description

Students will write a Financial Analysis Report for a stakeholder (external investor or internal

manager) that interprets the annual report of an Australian company. The Report will clearly state

recommendations about the company’s suitability for share investment or internal management.

The company should be listed on the ASX.

Students will be assessed on the thoroughness of the financial analysis. Thoroughness requires

a logical justification of why financial and non-financial performance indicators are included in the

analysis. The analysis will be formally written to meet the expectations of a stakeholder.

The report is limited to 1000 words, plus or minus 10%, excluding title page and bibliography.

Answer

Executive Summary

Probiotec is a company selected in this financial analysis report which has established itself as a major player in the field of pharmaceuticals providing complementary medicine and other useful health products. The company began its operations in 1997 and the listing on the ASX began in November 2006 (Probiotec 2020). The growth and development of Probiotec have been powered by strong organic growth and acquisitions together with bonding with the global market leaders that want to take the business undertaking to a higher level. The financial analysis reportaims to conduct an analysis of the company by considering the financial and non-financial parameters. To aid this, ratio analysis and balance scorecard have been considered as a major tool.

Analysis on financial analysis report

In 2019, Probiotec completed the settlement and leaseback of the major facility in Laverton North followed by the initiation of the new construction of the warehousing facility. It was the major activity of the business (Probiotec Annual report 2019). The announcement of the purchase of ABS Pty Ltd has an additional boost to the company in terms of building a strong portfolio. The transaction is expected to provide additional benefits to the company in the long run.

• Ratio Interpretation

The interpretation of the ratio will provide a clear picture of the performance of Priobetic considering the year 2018 and 2019.

Current Ratio

Herein financial analysis report, this ratio denotes the presence of current assets to meet the obligations In short it denotes the liquidity available with the company. (Kim 2013) As seen from the computation, the current ratio of the company is more than the standard level of 2:1 in 2019. The ratio increased from 1.78 times in 2018 to 2.45 times in 2019.

Current Ratio ($'000)

Particulars 2019 2018

Total Current Assets 4,70,68,213 4,26,25,852

Total Current Liabilities 1,91,77,512 2,38,76,836

Current Ratio 2.454344078 1.785238714

|

Current Ratio |

|

($'000) |

|

Particulars |

2019 |

2018 |

|

Total Current Assets |

4,70,68,213 |

4,26,25,852 |

|

Total Current Liabilities |

1,91,77,512 |

2,38,76,836 |

|

Current Ratio |

2.454344078 |

1.785238714 |

Asset turnover ratio

ATO denotes the return generated through the use of assets (Ferris, Noronha&Unlu 2010). Higher ATO is better for the company as it projects better returns. For Probiotec, the ATO has increased marginally from 0.70 times in 2018 to 0.74 times in 2019. Hence, with every dollar invested the company is generating returns of 0.74 times which is weak.

|

Assets Turnover Ratio |

|

|

|

|

|

($'000) |

|

Particulars |

2019 |

2018 |

|

Sales |

7,90,91,862 |

6,64,37,258 |

|

Total Assets |

10,63,67,793 |

9,36,57,465 |

|

Asset Turnover Ratio |

0.743569644 |

0.709364256 |

Assets Turnover Ratio

($'000)

Particulars 2019 2018

Sales 7,90,91,862 6,64,37,258

Total Assets 10,63,67,793 9,36,57,465

Asset Turnover Ratio 0.743569644 0.709364256

Debt Ratio

The Debt equity ratio obtained in the financial analysis report denotes the solvency of the company and ascertains the level of debt undertaken by the company. As seen from the computation, the debt ratio has increased from 0.79 times in 2018 to 1.13 times in 2019 thereby projecting higher exposure to debt. Debt equity ratio more than 1 is a risky venture because the company is exposed to debt heavily (Carlon 2019)

|

Debt equity Ratio |

|

($'000) |

|

Particulars |

2019 |

2018 |

|

Total Liabilities |

5,65,18,821 |

4,13,11,119 |

|

Total Equity |

4,98,48,972 |

5,23,46,346 |

|

Debt Ratio |

1.13 |

0.79 |

Debt equity Ratio ($'000)

Particulars 2019 2018

Total Liabilities 5,65,18,821 4,13,11,119

Total Equity 4,98,48,972 5,23,46,346

Debt Ratio 1.13 0.79

Return on Sales

This ratio denotes the ease with which the company converts the sales into profits. For Probiotec the ROS increased from 65 in 2018 to 14% in 2019 indicating the company converted the sales into profit efficiently. Thereby, the company has done better in terms of sales conversion to profit.

|

Return on sales |

|

($'000) |

|

Particulars |

2019 |

2018 |

|

Net Income |

1,12,38,622 |

36,60,969 |

|

Sales |

7,90,91,862 |

6,64,37,258 |

|

Return on Sales |

0.142095808 |

0.055104156 |

Return on sales ($'000)

Particulars 2019 2018

Net Income 1,12,38,622 36,60,969

Sales 7,90,91,862 6,64,37,258

Return on Sales 0.142095808 0.055104156

Return on equity

ROE denotes the generation of income from the equity investment. From the computation, it is noted that Probiotec has witnessed a sharp jump from 7% in 2018 to 23% in 2019. It implies that the company made the best utilization of the funds to generate the net income.

|

Return on equity |

|

($'000) |

|

Particulars |

2019 |

2018 |

|

Net Income |

1,12,38,622 |

36,60,969 |

|

Owner’s Equity |

4,98,48,972 |

5,23,46,346 |

|

Return on Equity |

23% |

7% |

Return on equity ($'000)

Particulars 2019 2018

Net Income 1,12,38,622 36,60,969

Owner’s Equity 4,98,48,972 5,23,46,346

Return on Equity 23% 7%

Interpretation

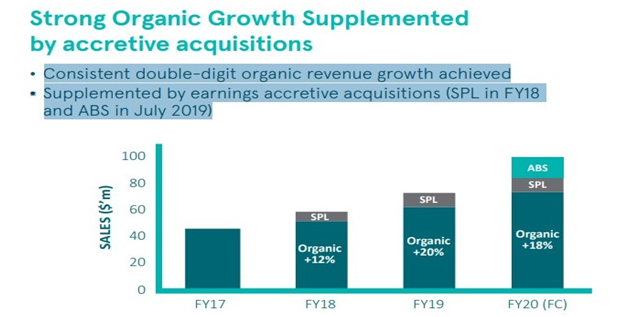

The discussion on performance measures provided within the context of financial analysis report indicates that Probiotec is best suited to provide services and results in the long run. The manufacturing facilities are based upon efficiency and fast answer to the dynamic market condition. Further, the company even adheres to the quality standards and hence, has built a strong reputation in the market (Probiotec Annual report 2019). The unmatchable double-digit organic revenue growth is an indication of the efforts put by the company (Probiotec Annual report 2019). Moreover, the acquisition has always helped the company to attain significant heights.

(Probiotec Annual report 2019)

The BSC is based upon four different parameters and the Probiotec has been discussed in the light of the same

Financial

Measurement – to increase the returns through an enhanced level of effort followed by an increment in the rate of return (Morecroft 2015)

Target (KPI) – the revenue of the group increased to $79.1 million with an increment of 19% over the past year. The growth in revenue was by dint of new and existing customers with additional work in the second half (Probiotec Annual report 2019). The group aims to target sales inquiries level, leads, and contracted level of work for an enhanced result.

Customers

Measurement – to cater to the needs of different customers by exploring new countries and focusing on different products

Target (KPI) – Development of new pharmaceutical and cosmeceutical products that will help in meeting the needs of the customers and even helps in gaining the clinical approvals required for responding to the market opportunities both nationally and internationally.

Internal

Measurement – Regular business development

Target - regular updating and evaluation of the techniques

Innovation and Growth

Measurement – the establishment of business goals and creating a diversified portfolio

Target – the addition of more products to the business for better productivity. Development of enhanced health products by concentrating on the R&D area (Tantalo&Priem 2016)

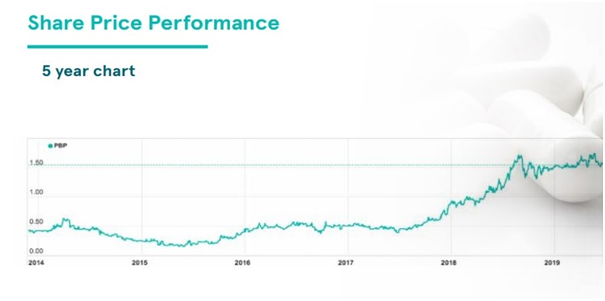

It is noted in the financial analysis reportthat the remuneration component of the company is divided into fixed and variable. The salaried positions are dependent on the role, accountability, and experience. Even the market scenario and similar jobs play a determining role in the remuneration part. Probiotec has established remuneration policies to enhance the goal between the shareholder, executives, and directors. The major strength of the company is the business in pharmaceuticals that is always in demand. The competent business helps the company to flourish. The share price of the company depicted a sharp performance in the past 5 years however due to COVID-19 it plunged to $1.61 on 24 March 2020 from a peak of $2.42. However, the COVID-19 issue has opened immense opportunities for the pharmaceutical industry

(Probiotec Annual report 2019)?

Conclusion

The shares of the company plunged in the wake of COVID-19 issue however, revival has been witnessed. Hence, viewing the entire scenario presented in the financial analysis report, it can be commented that the company has high fundamentals and potential for providing returns. As the plunge is owing to the COVID-19 issue, the same plunge can be used as an opportunity to invest in the stock. This opportunity can be availed by the stakeholder to enter the stock and assume a position. The ratio of the company points to the favourable opportunity of the stock. It can be witnessed that the company has strong ratio numbers considering the current ratio, ATO, ROS, and ROE. All such ratios identified in the financial analysis report is an indicator that the company has high potential and investment in the share will lead to significant results in the long run.

?

References

Carlon, S., 2019.Financial accounting: reporting, analysis and decision making. 6th ed. Milton,

Ferris, S.P., Noronha, G. &Unlu, E 2010, The more, merrier: an international analysis of the frequency of dividend payment. Financial analysis reportJournal of Business Finance andAccounting, vol. 37, no. 1, pp. 148–70

Kim, S 2013, Accounting quality, corporate acquisition, and financing decisions, The University of North Carolina,

Morecroft, JD 2015, Strategic modelling and business dynamics: A feedback systems approach, John Wiley & Sons, Hoboken,

Probiotec 2020, Company profile, viewed 14 June 2020, https://www.probiotec.com.au/index.php/about-us/

Probiotec Annual report 2019, Probiotec 2019 annual report & accounts,viewed 14 June 2020, http://www.probiotec.com.au/wp-content/uploads/2019/11/probiotec_annual_report_2019.pdf

Tantalo, C &Priem, R 2016, ‘Value creation through stakeholder synergy’, Strategic Management Journal, vol. 37, no. 2, pp. 314-329. ?