Financial Management Assignment Analyzing Financial Scenarios Of Businesses

Question

Task:

Complete the following financial management assignment:

- Time Value of money – investment criteria

- You are planning to retire in 25 years time. Immediately after your retirement, you wish to go for a round the world trip lasting one year. Your monthly expenses for the trip work out to be £9000 and the first withdrawal will be made at the end of the month after your retirement. You also want to provide yourself with £35,000 a year for next 15 years on your return from the world trip. How much you should save every month to provide for the above if the effective rate of interest is 14% per annum.

- Your firm has a retirement plan that matches all employee contributions with employer contributions on a two-to-one basis. That is if an employee contributes £1,000 per year, the company will add £2,000 to make the total contribution £3,000. The firm guarantees a fixed 6 per cent return on the funds. Alternatively, you can provide for retirement yourself, and you think you can earn 9 per cent on your money. The first contribution will be made one year from today. At that time and every year thereafter, you will put £2,500 into the retirement account, the same amount as you would have contributed to the company pension fund. You plan to retire in 30 years. Are you going to be better off participating in the company scheme or making your own arrangements? Explain the basis of your answer (ignore any tax considerations).

- The manager responsible for the pension fund of Ruthin plc has to present a report to the Board of Directors on the financial position of the fund. He decides to use the position of the typical employee to illustrate the fund’s position. There is £30,000 currently held in the fund for each employee. The typical employee has 15 years to go to retirement and the company’s actuary has proposed that the company should anticipate having to fund pension payments over a retirement period of 12 years for the average employee. The average pension payment per annum is expected to be £12,000 and the rate of return expected on the pension funds investment is expected to be 6 per cent. The manager needs to determine the constant annual sum that the company needs to put into the pension fund for each of the next 15 years to be able to meet the fund’s obligations. Determine this annual sum. (Assume all payments into the fund and all pension payments are made at the end of each year.

- Explain what is meant by the internal rate of return of an investment and discuss its relationship to the NPV of an investment.

- Explain the problems posed for the use of the IRR when it is necessary (i) to choose between two investments and when (ii) investments are characterised by negative net cash flows at the end of their lives.

- Discuss and evaluate the use of the payback period as an investment criterion.

- Capital Expenditure Decisions and Investment Criteria

Raindeer plc

Raindeer PLC is a highly profitable electronics company that manufactures a range of innovative products for industrial use. Its success is based to a large extent on the ability of the company’s development group to generate new ideas that result in commercially viable products. The latest of these products is just about to undergo some final tests and a decision has to be taken whether or not to proceed with an investment in the facilities required for manufacturing. You have been asked to undertake an evaluation of this investment.

The company has already spent £750,000 on the development of this product. The final testing of the product will cost about £40,000. The head of the development group is very confident that the tests will be successful based on the work already undertaken. Another company has already offered Raindeer £1.10 million for the product’s patent and an exclusive right to its manufacture and sale, even though the final tests are still to be completed. This sum being offered is well in excess of the cost of the product’s development, but the company’s management have decided to delay their response to the offer until the result of the investment evaluation is available.

The company anticipates that the product will remain competitive for the next five years after which it is likely to be displaced by some new product that are constantly being introduced as the underlying technology evolves. In the first year it is anticipated that 35,000 units will be sold at a price of £152. From year two through to year four sales are expected to be 45,000 units per annum, but are expected to fall back to 35,000 units in year five.

The product will be manufactured in one of the company’s factories that has considerable spare capacity: it is most unlikely that the space required by the manufacture of this product will be required for any other purpose over the next five years. For the company’s internal accounting purposes all products are charged for the factory space that they utilise and this will amount to £50,000 per annum. The additional costs incurred by the company in the form of heating, lighting and power only amount to £30,000 per annum.

The machinery required for the manufacture of the product will cost £1,200,000. It will have to be depreciated for tax purposes on the basis of an annual 25 per cent writing down allowance (ie. 25 per cent of the remaining book value of the asset, the initial purchase price less the sum of the allowances claimed in previous years). At the end of the five year period the machinery will be sold or retained for use in the manufacture of other products. The resale value of machinery of this nature after being used for five years is likely to be about 30 per cent of its purchase price.

Use will also be made of some equipment already owned by the company. This could be sold today for £70,000 and is expected to maintain its resale value even if it is used for the next five years. This equipment is fully depreciated for tax purposes – it has a zero book value – but is still in good working order.

The cost of the labour and components required for the manufacture of the product has been estimated at £120 per unit for the first year, with labour accounting for 60 per cent of the cost and the components for the other 40 per cent. There are also fixed costs of £150,000 per annum stemming from the manufacturing process. The product will also be charged an allowance for general overheads through the management accounting system and this is set at 5 per cent of a product’s annual revenues. The overheads include the head office expenditure and the company’s expenditure on new product development – an important expense for the company. The initial marketing of the product will cost £200,000.

It is anticipated that the company will have to invest in working capital – holding finished products equivalent to 20 per cent of next year’s unit sales, 25 per cent of the components required for the next year, and it is expected that debtors and creditors will just about offset each other. The tax rate is 30 per cent and the required rate of return on investments of this nature is 14 per cent.

- Determine the investment’s net present value, the internal rate of return, payback period and the discounted payback period. All key assumptions should be specified and explained and an interpretation provided of results for each of the investment criteria specified. You should identify and explain the costs and benefits that you think should be included in a rational decision making process. On the basis of your analysis above, make a suitable recommendation for the company’s top management explaining the rationale behind it. (HINT : a good answer should clearly explain each figure used in the analysis – used or not).

- Assess how sensitive the calculated NPV is to three inputs employed in the analysis. Provide an interpretation of your results and comment on how valuable you think this analysis may be in taking a decision on the investment. Apart from the sensitivity analysis, use another one method (choose from scenario analysis, Monte Carlo simulation, BEP analysis) to assess your capital budgeting analysis and findings. Compare the methods used in reference to their risk probability.

- Assume that the annual rate of inflation is expected to be 4 per cent per annum for the next five years. Also assume that the required rate of return of 14 per cent you employed above is a market determined rate and incorporates an allowance for the expected rate of inflation of 4 per cent. Explain how you would take the expected rate of inflation into account in a revised analysis. (Part (a) of the question should be completed on the basis that the expected rate of inflation is zero.) Rework the NPV analysis of part a) under the revised rate and comment on your findings.

- Company Valuation

- Raglan Stores PLC has grown rapidly since its stock market flotation five years ago. Despite its rapid growth the company has been able to finance all its new development from retained earnings and employs no debt in its capital structure. The company’s earnings for the year that has just ended was 80€ MILLION, a new high, and with 200 million shares outstanding this produced EPS (earnings per share) of 40p. Last year the company re-invested 80% of its earnings and recorded a rate of growth of earnings 32%, well above the minimum rate of return of 20% sought by investors in its sector of the market. Exactly this growth is also expected for next year for the earnings.

The company has now opened stores in all the larger cities in the UK and new stores it plans to open will be located in towns with smaller markets that will produce lower turnover and profits per store. For the next 4 years or so it is anticipated that expansion will continue to be profitable, but less so than in the past even if the process is managed with the same degree of efficiency that has characterised the company’s development over the last few years. As the coverage of the UK market becomes more complete it is planned to reduce the amount of annual investment. It is anticipated that the company will again invest 80% of its earnings next year, 60% of its earnings the following year and 40% the subsequent year.

It is expected that the rate of return on new investment will fall to 35% next year, 30% the year after, and 25% three years from now. After the next three years management believes that there is unlikely to be scope for any investment offering internal rates of return of more than 20%. With the disappearance of opportunities for profitable growth it is intended in 4 years time to increase the dividends to 75% of earnings.

Required :

- Estimate the value of the company using both the dividend and earnings based models, as well as the current price of the company’s shares. Set out the assumptions on which the models are based and discuss how appropriate they appear to be in this context. Determine the contribution of Growth opportunities to the estimated value of the company.

- How would the value of the company change if the required Rate of Return was 15% ? Alternatively if it was 25% ? Comment on your reply.

- Determine the expected price/earnings ratio today. Explain the determinants of the PE in reference to the two valuation models used.

- A member of the board suggests identifying an appropriate price-earnings ratio for Raglan Stores and using this as a multiplier to derive a value for the company. Comment on this suggestion.

- The government issued a 15 year bond offering an interest rate of 12 per cent 10 years ago. Since then interest rates have fallen sharply. The bond now has five years to run to maturity and the government has just issued a five year bond offering an interest rate of 6 per cent. Determine a value for the bond that has five years to run to maturity, assume the bond has a face value of £100 and interest is paid annually. Explain your answer.

- Portfolio Theory and Analysis

The attached file (MFR & FFM Ass Returns Data.xls) gives 120 months returns for securities drawn from the FT ALL share index as well as the returns on the FT ALL share index for the period January 2009 and December 2018.

a) Choose any five securities at random and determine the average returns for each company for the 120 months along with the variance and standard deviation of these returns. Next construct an equally weighted portfolio made up of the five securities, and determine the series of monthly returns. On this basis determine the average return for the portfolio and the associated variance and standard deviation. The averages, variances, and standard deviations can be derived using the relevant Excel functions. Utilise the Excel specification for population variance and standard deviation – STDEVP and VARP – in the calculations. Explain the discuss the relationship between the average returns, average variance, and average standard deviation for the five securities and the average returns, variance, and standard deviation for the portfolio.

b) Calculate the co-variances for each pair of securities in the portfolio and on the basis of this information, and using the relevant portfolio equations, calculate the standard deviation of the returns on the portfolio using the equally weighted portfolio risk equation. Compare your results to those obtained for the portfolio in part i above. Comment and explain your findings.

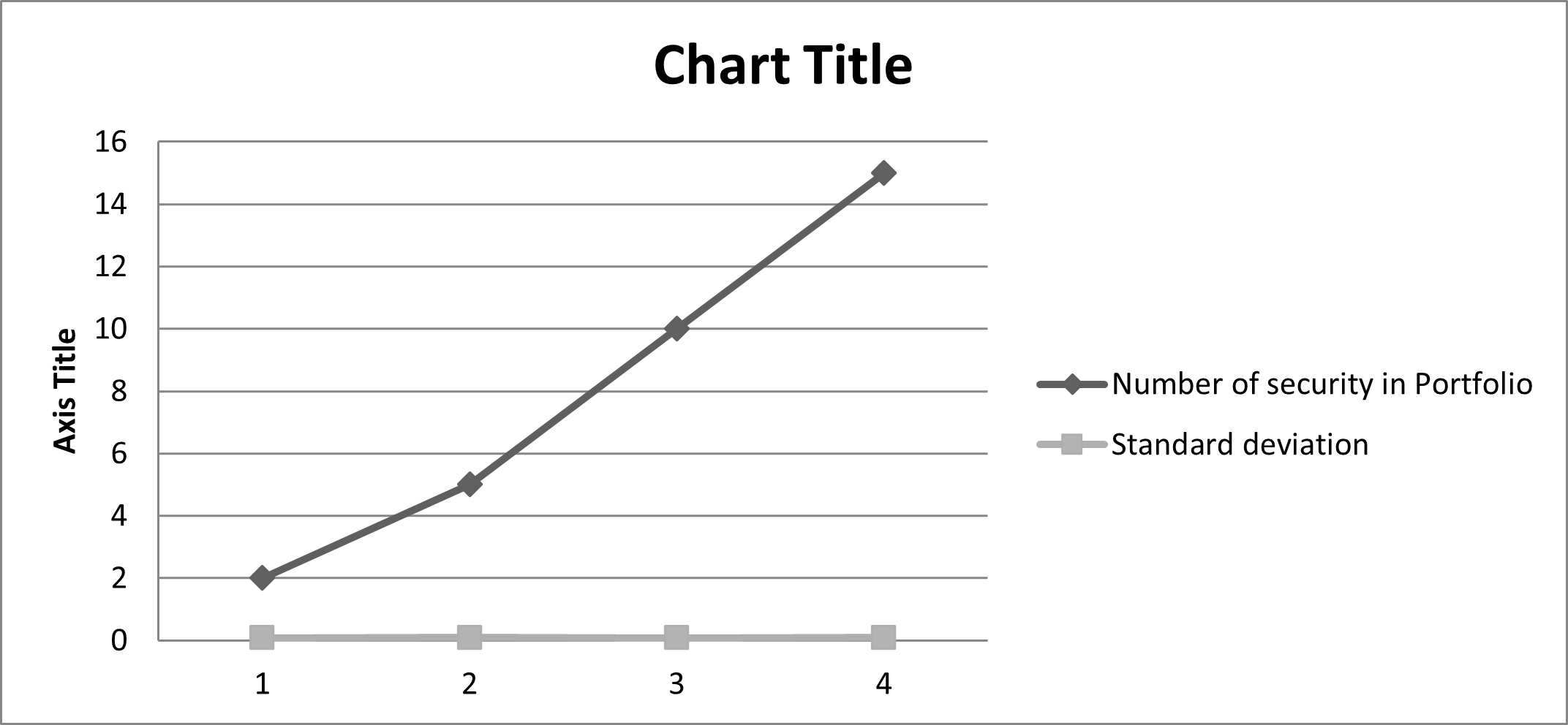

c) Choosing securities at random form equally weighted portfolios of 2, 5, 10, 15 and 20 securities determine the standard deviation of these portfolios and plot the standard deviations against the number of securities in the portfolios. Comment on your results and compare these with the results of the studies of naïve diversification. (In undertaking this analysis you can derive the results for each of the portfolios using the Excel spreadsheet – there is no need to employ the portfolio equations and estimates of co-variances etc.

d) Choose 2 companies from different sectors of economy and determine the beta of each one security by regressing the returns for the share on the returns for the FT ALL Share Index (the last column in the spreadsheet). Comment on what the value of the beta (the slope coefficients in the regression) indicates.

i. Explain what the values of the betas (the slope coefficients in the regression) indicate and discuss the factors that might explain the differences in the values of the betas of the two companies.

ii. Discuss the primary determinants of a share’s beta. (This part of the questions relates to betas in general and does not require you to focus on the companies analysed in parts a, b and c)

- Derivatives – Efficient Market Hypothesis

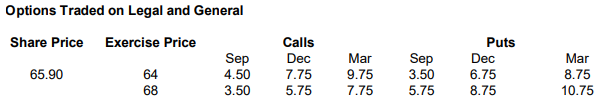

You are given the following data for a listed company as follows:

- Draw a profit diagram for an investor in a call option with an exercise price of 64 that expires in March and explain the diagram. Undertake the same analysis for the writer of the call. Comment on the contention that options are a zero sum game for the writer and investor in options.

- Explain carefully why the March calls are trading at higher prices than the December calls.

- Draw a diagram illustrating a straddle, using calls and puts expiring in March and an exercise price of 64. Explain why an investor might consider it worthwhile to invest in a straddle and comment on the expected profitability of such an investment.

- Explain what is meant by forward contracts and futures using examples. List the main advantages / disadvantages for their use.

- Explain what is meant by the efficient market hypothesis and how tests of the hypothesis are structured

- Discuss the implications of the efficient market hypothesis for financial managers and security analysts.

Answer

Answer 1 Time Value of Money Investment Criteria

(a) Calculation of monthly amount invested presented in the following section of financial management assignment -

Amount required at the time of requirement

Amount required for 35000 per year-

|

Year |

Yearly Payable Amount |

PVF |

PV |

|

0 |

0 |

1 |

0 |

|

1 |

35000 |

0.877192982 |

30702 |

|

2 |

35000 |

0.769467528 |

26931 |

|

3 |

35000 |

0.674971516 |

23624 |

|

4 |

35000 |

0.592080277 |

20723 |

|

5 |

35000 |

0.519368664 |

18178 |

|

6 |

35000 |

0.455586548 |

15946 |

|

7 |

35000 |

0.399637323 |

13987 |

|

8 |

35000 |

0.350559055 |

12270 |

|

9 |

35000 |

0.307507943 |

10763 |

|

10 |

35000 |

0.26974381 |

9441 |

|

11 |

35000 |

0.236617377 |

8282 |

|

12 |

35000 |

0.207559102 |

7265 |

|

13 |

35000 |

0.182069388 |

6372 |

|

14 |

35000 |

0.15970999 |

5590 |

|

15 |

35000 |

0.140096482 |

4903 |

|

Total Present value |

214976 |

||

Amount required for 9000 per month-

Interest rate per month = 14 /12 = 1.16 %

Amount required for monthly 9000 = 9000 / 1.16 % = 771208

Total Amount required = 771208 + 214976 = 986184

Monthly amount invested = Future value * Interest rate * ((1 + Interest rate) ^ n – 1)

Monthly amount invested = 986184 * .0116 * ((1.0116)^300 – 1) = 425.2

(b) Pay off at the company scheme –

Amount contributed per year = 2500

Company contribution per year = 5000

Total contribution per year = 7500

Expected return on investment = 6 %

Time = 30 years

FVA = 7500 / .06 * ((1.06) ^ 30-1)

FVA = 592936.4

Pay off on self-contribution –

Amount contributed per year = 2500

Expected return on investment = 9 %

Time = 30 years

FVA = 2500 / .09 * ((1.09) ^ 30-1)

FVA = 340768.8

Since the amount of retirement on the company scheme is more than the self-retirement plan than the person should invest in the company’s scheme.

(c) The fund required after 12 years is (12000 * 15) /.06 = 3000000

The annual sum invested for the required amount of 300000 at the end of 12 years is as follows-

Ordinary annuity for the future sum = Future sum / ((1+i)^t -1)/i)

= 3000000 / (1.06^12 -1) /.06)

= 177831

(d) Internal rate of return means the rate of return at which the present value of the cash outflow is equal to the present value of the cash inflow. Internal rate of return is a discount rate at which the cash flows leads towards the zero net present value of the project cash flows.

Internal rate of return and net present value is related with each other as if the internal rate of return is more than the hurdle rate or discount rate than in such case the NPV will be positive

(e) Problems in the use of IRR at the time of different issues are as below-

When the option between two investment option are choose - The high IRR is the criteria for deciding the investment project but the investment project with the lower capital with higher IRR will lead to the lower profits as compare to the high capital intensive project with lower IRR. Therefore in terms of amount the decision may be different as compare to the decision based on the IRR.

(ii) The negative cash flows at the end of the project does not impact on the IRR of the project and therefore the negative cash flows at the period end will not be considered as a special item in IRR and project evaluation.

(f) Payback period method – Payback period method is a method for the project evaluation and the project analysis tool, in the payback period method the analysis is done on the basis of the time in which the amount of the investment in the project will be get back to the organization. In the payback period method the time value of the money concept is not considered while evaluating the project and also the later cash flows are not considered in the evaluation of the project. The payback period method is considered as the easiest method for project appraisal and easy to compare.

Answer 2: Capital Budgeting

a)

|

Particulars |

0 |

1 |

2 |

3 |

4 |

5 |

|

Cost of machinery |

(1,200,000) |

- |

- |

- |

- |

- |

|

Number of units |

- |

35000 |

45000 |

45000 |

45000 |

35000 |

|

Selling price |

- |

152 |

152 |

152 |

152 |

152 |

|

Labor & Component cost per unit |

- |

120 |

120 |

120 |

120 |

120 |

|

Total sales |

- |

5,320,000 |

6,840,000 |

6,840,000 |

6,840,000 |

5,320,000 |

|

Total labour& component cost |

- |

4,200,000 |

5,400,000 |

5,400,000 |

5,400,000 |

4,200,000 |

|

Fixed cost from manufacturing |

- |

150,000 |

150,000 |

150,000 |

150,000 |

150,000 |

|

Cost of factory space |

- |

50,000 |

50,000 |

50,000 |

50,000 |

50,000 |

|

Heating, lighting and power cost |

- |

30,000 |

30,000 |

30,000 |

30,000 |

30,000 |

|

Depreciation |

- |

300,000 |

225,000 |

168,750 |

126,563 |

94,922 |

|

General overheads (5% of revenue) |

- |

266,000 |

342,000 |

342,000 |

342,000 |

266,000 |

|

Initial marking expenses |

- |

200,000 |

200,000 |

200,000 |

200,000 |

200,000 |

|

Net profit before tax |

- |

124,000 |

443,000 |

499,250 |

541,438 |

329,078 |

|

Less: Income tax |

- |

37,200 |

132,900 |

149,775 |

162,431 |

98,723 |

|

Net profit after tax |

- |

86,800 |

310,100 |

349,475 |

379,006 |

230,355 |

|

Add: Depreciation |

- |

300,000 |

225,000 |

168,750 |

126,563 |

94,922 |

|

Cash flow before working capital |

- |

386,800 |

535,100 |

518,225 |

505,569 |

325,277 |

|

Change in working capital |

(644,000) |

(184,000) |

- |

- |

184,000 |

644,000 |

|

Net cash flow |

(1,844,000) |

202,800 |

535,100 |

518,225 |

689,569 |

969,277 |

|

PVF @ 14% |

1 |

0.877 |

0.769 |

0.675 |

0.592 |

0.519 |

|

Present value of cash flow |

(1,844,000) |

177,895 |

411,742 |

349,787 |

408,280 |

503,412 |

|

Net present value |

7,116 |

- |

- |

- |

- |

- |

|

Calculation of required working capital |

||||||

|

Particulars |

0 |

1 |

2 |

3 |

4 |

5 |

|

Working capital (selling unit*152*0.20 - selling unit * 120 * 0.40*0.25) |

644000 |

828000 |

828000 |

828000 |

644000 |

0 |

|

Particulars |

0 |

1 |

2 |

3 |

4 |

5 |

|

Net cash flow |

(1,844,000) |

202,800 |

535,100 |

518,225 |

689,569 |

969,277 |

|

Cumulative cash flow |

(1,844,000) |

(1,641,200) |

(1,106,100) |

(587,875) |

101,694 |

1,070,970 |

|

Pay-back period |

3 years + 587875/689569 |

3 years 10 months |

- |

- |

- |

- |

|

Internal rate of return |

14.13% |

- |

- |

- |

- |

- |

| - | - | - | - | - | - | |

|

Particulars |

0 |

1 |

2 |

3 |

4 |

5 |

|

Present value of cash flow |

(1,844,000) |

177,895 |

411,742 |

349,787 |

408,280 |

503,412 |

|

Cumulative cash flow |

(1,844,000) |

(1,666,105) |

(1,254,363) |

(904,576) |

(496,296) |

7,116 |

|

Discounted Pay-back period |

4 years + 496296/503412 |

5 years |

- |

- |

- |

- |

| - | - | - | - | - | - | - |

Based on the above calculations, it is recommended to the company to reduce expenses and increase sales in the said project. The project has positive net present value however it is near to break-even point. Hence the company should accept the offer of sale of patent to another company.

b)

The sensitive analysis calculated for NPV within this financial management assignment at Zero. There are three inputs employed in the analysis. The three inputs are selling units, variable cost and discount rate. The discount rate at which the net present value is equal to zero is internal rate of return i.e. 14.13%. The minimum change in selling units and variable cost result in negative NPV, hence these three inputs are highly sensitive.

Based on the scenario analysis, the company has highly sensitive at discount rate as minimum change in the discount rate results in zero net present value.

Using the scenario analysis, the company has discount rate applicable is 14% and the rate at which the net present value is 14.13% means the company has zero net present value at IRR rate.

Based on the sensitive analysis and scenario analysis, it is found that the company has high risk probability related to discount rate which impact on the project selection decision.

c)

Revised rate with effect of inflation = (1+discount rate) * (1+inflation rate) – 1

= (1 + 0.14) * (1 + 0.04) – 1 = 18.56%

|

Particulars |

- |

1 |

2 |

3 |

4 |

5 |

|

Net cash flow |

(1,844,000) |

202,800 |

535,100 |

518,225 |

689,569 |

969,277 |

|

PVF @ 18.56% |

1 |

0.8435 |

0.7114 |

0.6000 |

0.5061 |

0.4269 |

|

Present value of cash flow |

(1,844,000) |

171,053 |

380,679 |

310,959 |

349,000 |

413,768 |

|

Net present value |

(218,542) |

Based on the above analysis, it is found that the company should not consider the project as the net present value is negative at the revised rate. The company should accept the offer of competitor i.e. £1.10 million.

Answer 3 Company Valuation

(1)

|

Details |

Amount |

|

Earnings |

80 |

|

Outstanding shares |

200 |

|

EPS |

0.4 |

|

DPS |

0.08 |

|

Growth |

25.6 |

|

G1 |

28 |

|

G2 |

18 |

|

G3 |

10 |

|

D1 |

0.10 |

|

D2 |

0.13 |

|

D3 |

0.15 |

|

D4 |

0.17 |

In the current case the growth rate of the company is 32*.8 = 25.6 % that is more than the cost of equity of 20 % since the high growth rate as compare to the required rate of return leads towards negative valuation of the stock and a stock value cannot be calculated as negative therefore the valuation of shre with the dividend discount model is not possible.

(2) the expected rate of return also called as cost of equity has a inverse relation with the share price and price of the security, that means if the expected rate of return is increased than the price of the security is being declined and if the expected rate of return is fall than the price of the security is being increased. In the current case since the rate of return of the security is fall from 20 % to the rate of 15 % that means the price of the security has to increase and if the rate of return of the security is increased from the level of 20 % to the level of 25 % than the price of the stock is fall below the current level of the price.

(3) In the current case since the g >ke therefore calculation of the price of the security is not possible and the price earnings ratio calculations not possible, Price earnings ratio is the relationship between the price of the security and the earnings of the company. The PE ratio refers to the number of times the price of the security is of the earnings.

The Key determinates of the PE ratio refers to the calculation of the price earnings ratio and the key determinates of the PE ratio is as below-

(i) Price of the security – Market price of the security plays a vital role in the calculation of the price earnings ratio of the security. High price leads to high PE ratio and the low prices leads towards low PE ratio.

(ii) Earnings – Earnings of the organization and the Earning per share of the security is very much determined the PE ratio. The high Earnings of the security is the reduction of the PE ratio and the low earnings will lead to high PE ratio.

4. Identification of the Appropriate PE ratio is necessary for the purpose of the valuation of the security the correct PE ratio should be based on the performance of the companies and also the performance of the market and the industry average. All these calculations and factors will help to determine the appropriate PE ratio of the organization. Therefore the suggestion of the member of board to identify the appropriate PE ratio is correct and considerable while valuation of the security of the company.

5. Valuation of Bonds –

Annual Coupon = 100 * 12% = 12

Maturity value = 100

Time = 5 years

Current interest rate = 6 %

Calculation of value of bonds –

|

Years |

Cash Flow |

PVF @ 6% |

PV |

|

1 |

12 |

0.943 |

11.32 |

|

2 |

12 |

0.890 |

10.68 |

|

3 |

12 |

0.840 |

10.08 |

|

4 |

12 |

0.792 |

9.51 |

|

5 |

112 |

0.747 |

83.69 |

|

Value of the bond |

125.27 |

||

The Value of the bond with the above calculation is 125.27 that is more than the current issue price of the bond and the fair value of the bond. The bond price that has 5 years run to the maturity is expensive than the face value because the interest rate bearer by the bond is 12 % that is more than the current preveling interest rate of 6 %.

Answer 4 Portfolio Analysis

(a)

|

Name |

Average return |

Variance |

Standard deviation |

|

4IMPRINT GROUP |

2.59% |

1.01% |

10.07% |

|

888 HOLDINGS |

1.18% |

1.42% |

11.90% |

|

AGGREKO |

0.83% |

0.87% |

9.35% |

|

ANGLO AMERICAN |

0.91% |

1.75% |

13.22% |

|

ANGLO-EASTERN PLTNS. |

0.85% |

0.46% |

6.80% |

The average return, variance and the standard deviation are related with each other the average return shows the return of the securities on a average basis for the monthly return of the past 5 years. The standard deviation shows that how much variation is expected of the return on a average basis from the mean return of the security. The variance shows the movement of the return from the average return of the security.

The average return of the portfolio is 1.27 %, variance of the portfolio is 0.36 % and the standard deviation of the portfolio is 5.96 % from the above five securities.

(b)

|

Security 1 |

Security 2 |

Covariance |

|

4IMPRINT GROUP |

888 HOLDINGS |

0.00076 |

|

4IMPRINT GROUP |

AGGREKO |

0.00173 |

|

4IMPRINT GROUP |

ANGLO AMERICAN |

0.00143 |

|

4IMPRINT GROUP |

ANGLO-EASTERN PLTNS. |

0.00231 |

|

888 HOLDINGS |

AGGREKO |

0.00055 |

|

888 HOLDINGS |

ANGLO AMERICAN |

0.00179 |

|

888 HOLDINGS |

ANGLO-EASTERN PLTNS. |

0.00118 |

|

AGGREKO |

ANGLO AMERICAN |

0.00338 |

|

AGGREKO |

ANGLO-EASTERN PLTNS. |

0.00177 |

|

ANGLO AMERICAN |

ANGLO-EASTERN PLTNS. |

0.00199 |

The equally weighted average portfolio is being calculated with the formula between the weights of the different securities and the standard deviation of different securities along with the covariance between the different pairs of the assets and securities. The standard deviation of the equally weighted portfolio calculated with the portfolio equation and calculated above as per excel function is 5.96 % that is same as per the portfolio equation.

(c)

The standard deviation of different securities is as below-

|

Number of security in Portfolio |

Standard deviation |

|

2 |

0.080430998 |

|

5 |

0.096023315 |

|

10 |

0.082695456 |

|

15 |

0.087065213 |

The standard deviation of the excess securities of different industries normally has less standard deviation as compare to the other portfolio of lesser securities of the similar industry. Yet in the current case the securities selected are random for the purpose of the calculation of the standard deviation of the securities but there is a variation in the result of the standard deviation when compare to the standard rule of the diversification because of the random selection of the securities.

(d)

(i) In the beta analysis the securities that are selected for the analysis are ANGLO-EASTERN PLTNS and 888 Holdings, the beta of the two securities with respect to FTSE 100 index is 0.71 and 1.16 respectively. The value of the beta explains the relationship between the market returns and the security return and also beta of a security explains that how the return of the security behaves on the behavior of the market return. The beta less than 1 explains that the security is less sensitive as per the market return and the beta more than 1 shows the high sensitivity of the security as compare to the market. There are different factors that may affect the beta of the securities and because of which the beta of the different securities are different such as level of debt in the company, the capital structure of the two companies.

(ii) In the business and for the different companies the determinates of the beta are various factors, such factors are as below-

- Nature of the business, business nature impact the beta of the security the most because the earnings of the securities and behavior of the stock price is depends on the basis of the nature of the business therefore nature of the business is a big determine of the beta.

- Financial leverage – Financial leverage that is the capital structure of the business is also a key determinates of the beta of the security.

- Operating leverage – Operating leverage is the relationship between the EBIT and the sales of the organization it also creates a major impact on the beta of the security.

Answer 5 Derivative Analysis

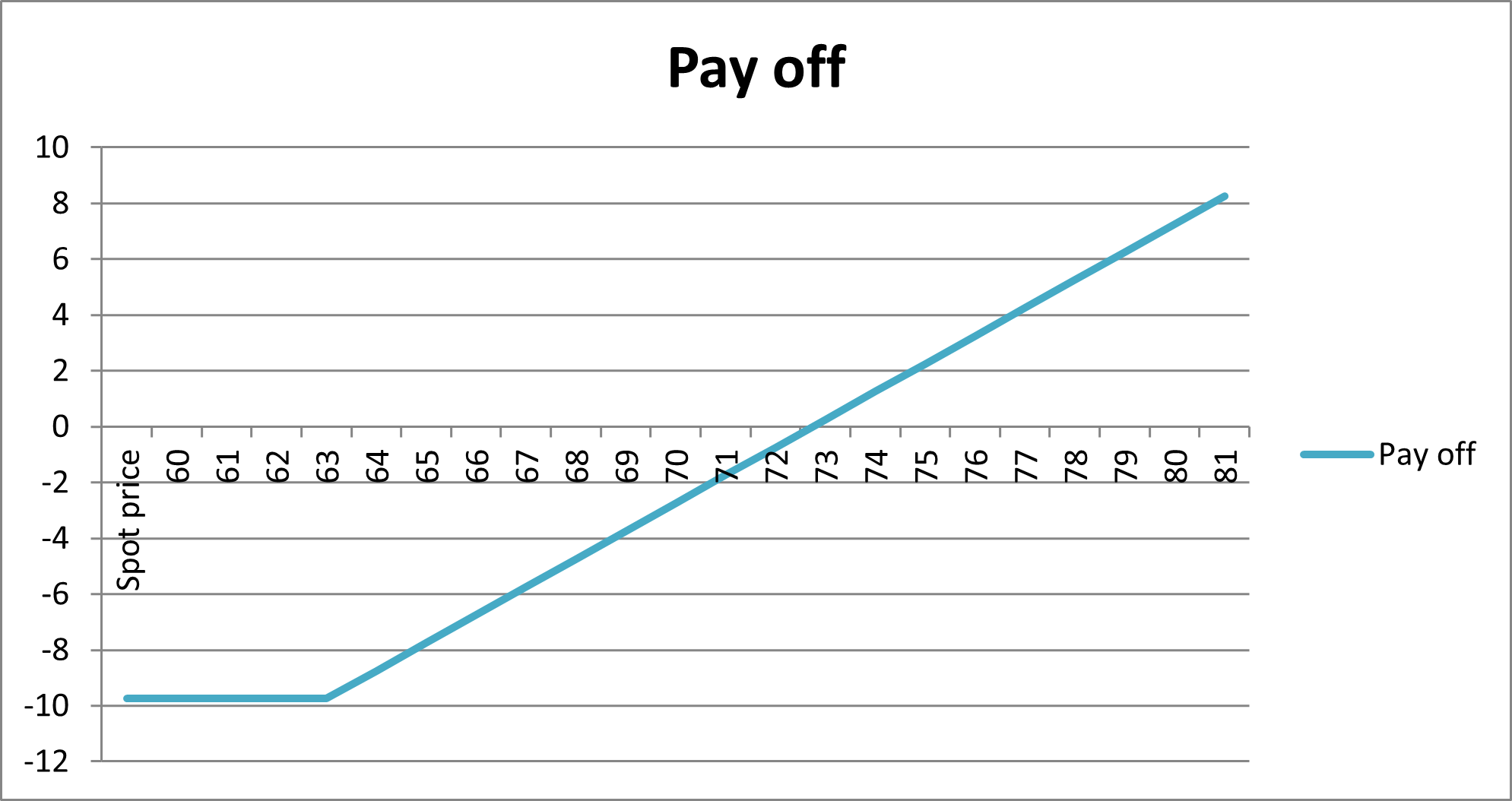

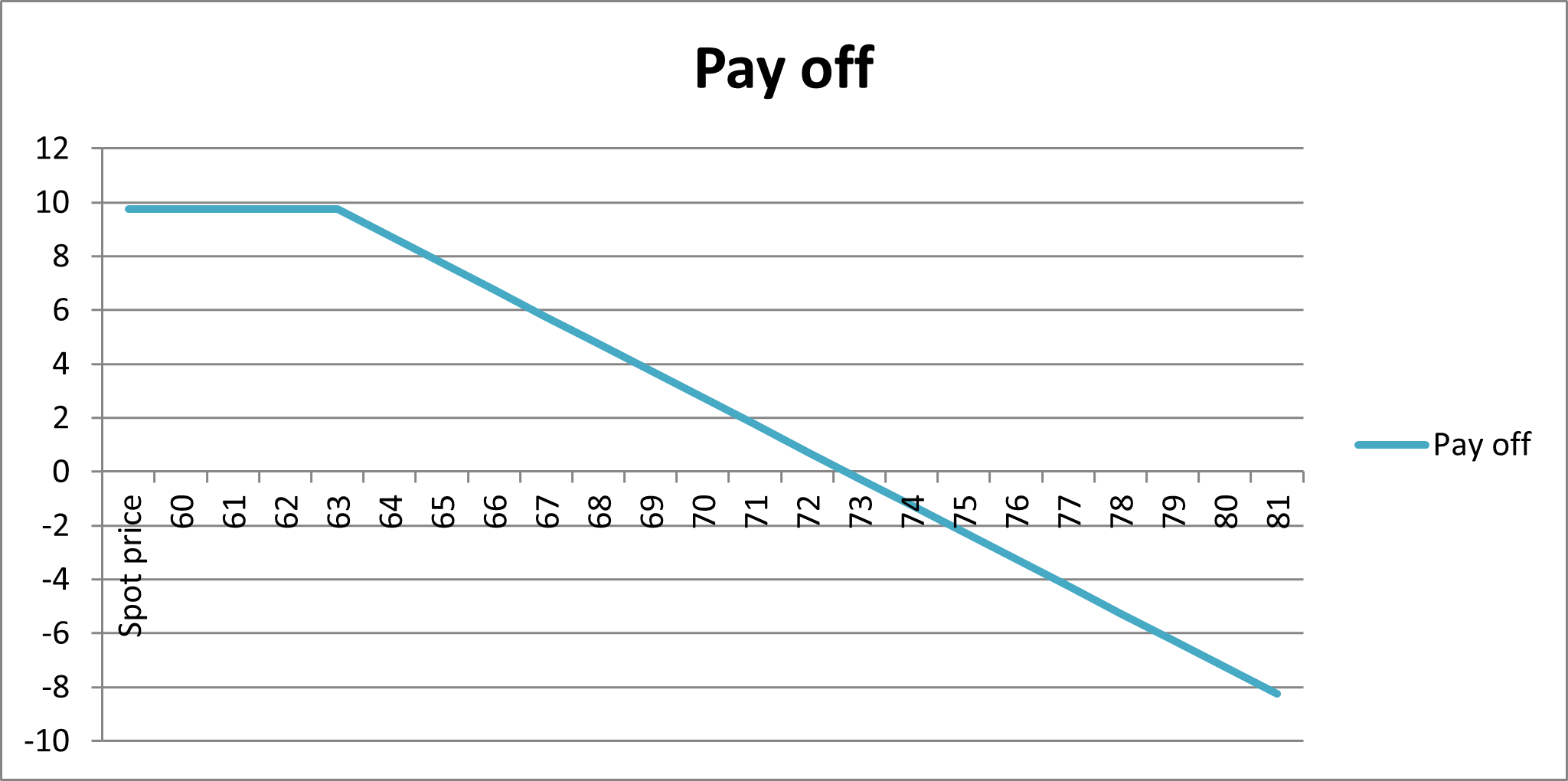

(a)

Pay off chart for option buyer

Pay off diagram for option writer

Option Buyer – Option Buyer will purchase the option at the excise price of 64 of March expiry and paid a premium of 9.75 therefore the breakeven point of the option buyer will be 64 + 9.75 = 73.75 and if the share prices crosses the price of 73.75 than there is a profit to the option buyer and below the level of the 73.75 there is a loss to the option buyer. The option buyer will get a maximum loss of 9.75 therefore below the price of 64 there is a maximum loss of 9.75.

Option seller – the maximum profit of option seller is 9.75 therefore below the price of 64 there is a maximum profit of 9.75 to the option seller and if the share price is above 73.75, than there is a loss to the option seller. The loss to the option seller is unlimited and therefore there is no limit on loss to the option seller.

(b) March calls are traded at high prices because the option premium consists of two elements that are the intrinsic value of the option and the time value of the option. Since the March options is far from current time as compare to the December time, therefore the march expiry has a higher time value and thus the option premium of march expiry traded at a high price as compare to the December price.

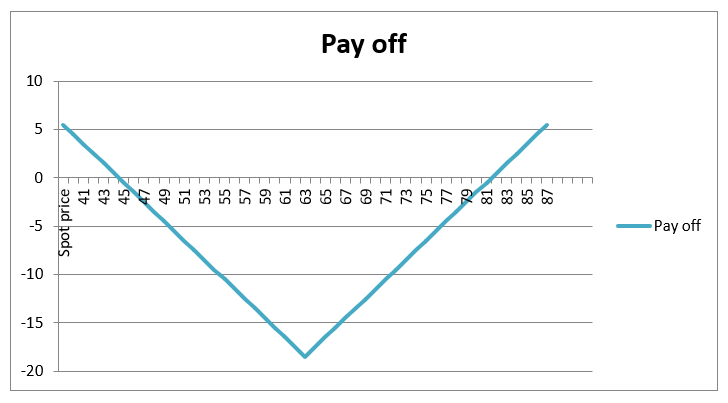

(c) Straddle strategy of options- Pay off for straddle strategy

Straddle is a strategy in which both the call option and put option at the same exercise price is purchased, the straddle strategy is used when there is huge volatility expected in the market but the direction is not expected. For the straddle investment strategy the loss is limited to the premium paid on purchasing both the option of call and put but the profit is unlimited irrespective of the direction of the market. In the current case of straddle below the price of the 45.5 and above the price of the 82.5 there is unlimited profit opportunities existed for the investor.

(d) Forward contract – Forward contract is a contract where the actual delivery of goods and actual settlement is taken place, in the forward contracts the whole contract is settled and mere the adjustment of the profit and loss is not taken place. For example if the long USD deal entered by an investor than conversion of currency is made at the time of settlement. The forward contract is used for the purpose of the hedging and provides a delta neutral hedge.

Future contract – In the future contract the at the time of settlement only the adjustment of the profits and the losses are made and not the original delivery of the goods or underlying asset is done in the future contracts. The future contract is made on the basis of the expectation and speculation. The advantage of the future contract is to hedge the current situation and position of the company. The main advantage of the future contract is no requirement of the whole goods it is a margin based system, the risk of default in the future contracts is increased and MTM margin will create difficulties in this model.

(e) Effective market hypothesis – Effective market hypothesis is based on the concept that everything I fairly discounted and adjusted in the price of the security, effective market hypothesis believes that no one can get the excess or abnormal profits by investing in the stock because all the related information and publicly known information is adjusted in the price of the security.

The market hypothesis test is structured in three major ways these includes, question related and asking the questions, creation of the hypothesis and challenge the already created hypothesis related with the market, third and last step includes the revision of the hypothesis as per above steps.

(f) Financial managers and market analyst is very much effected with the market hypothesis, in the current situation the efficient market hypothesis also impact the financial managers because the price of the stock is based on the current news and not on the basis of the past price movement of the security, In the efficient market hypothesis it is not possible for the analyst to beat the market return therefore they have to be vigilant about the market information. The financial analyst has to work hard to match their return with the market return.