Financial Management Assignment: Financial Analysis Of Business Cases

Question

Task:

Complete the following financial management assignment tasks:

TASK 1:

- Explain your understanding of the risk/return relationship and why it is so important in Financial Management.

- What are the 3 key decision areas for a Finance Manager? Give an example of each one in practice.

- What should be the primary objective of a commercial firm? How does this work in reality and what other objectives might be important for the company?

TASK 2:

1.Calculate the following ratios for Rio Tinto plc for the year ended 31st December 2019.

- Return on Capital Employed

- Inventory Turnover (stock days)

- Debtor ratio (debtors’ days)

- Creditor ratio (creditor days)

- Current ratio

- Quick ratio

- Debt/equity ratio

- Interest cover

- Return on Equity

- Price Earnings Ratio (P/E Ratio)

Additional Information Share price at close of business on 31st December 2019 = 4,503 pence £/$ exchange rate @ 31st December 2019 = $1.326

- Using the 2019 ratios you calculated in question 1 and the 2020 ratios calculated in the session 2 topic 1 lecture write a brief report (500 words in total) which compares the performance of Rio Tinto plc across both years.

TASK 3:

- It is November 2021 and ATMS Plc has the following capital structure:

1) 6.5% redeemable bonds- Par value £100 (redeemable November 2025)

2) 8% irredeemable bonds- Par value £100

3) Ordinary shares- Nominal value 10p

4) 7% Preference shares- Nominal Value £1

Market Values

5) 6.5% redeemable bonds- £1,000,000 in total with each bond currently priced at £108

6) 8% irredeemable bonds- £2,000,000 in total with each bond currently priced at £115

7) Ordinary Shares- £4,000,000 in total with each share currently priced at 126p

8) 7% preference shares- £500,000 in total with each share currently priced at 82p

Additional Information

1) The total ordinary share dividend proposed but not paid is 5.5p with an established year on year growth rate of 8%

2) ATMS Plc pays corporation tax at 20%

Required- Calculate the individual cost of each of the 4 sources of capital and then the after tax Weighted Average Cost of Capital (WACC) of ATMS Plc

- DT plc has £20m of sales per year all of which are made on 60 days credit terms DT’s CFO is considering offering a 10% discount for early payment (within 20 days) It is forecast that 40% of DT’s customers will take the discount and the remaining 60% will continue to pay in 60 days.

The short-term borrowing interest rate is 15% Required Calculate whether the proposed discount will result in a net saving or cost for DT plc

TASK 4:

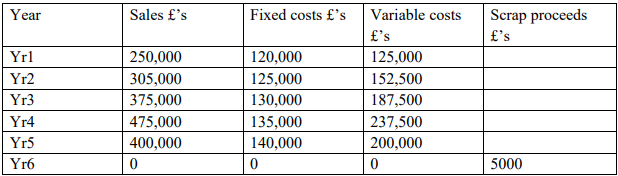

Bonsall Plc are a manufacturing company who produce components for high performance motorcycles. The product research team have been working on a new lightweight handlebar which they are now proposing to launch. The production and sales teams have supplied the following data to you- Bonsall’s Finance Manager.

A new machine will be required to produce the handlebar at a cost of £150,000 payable immediately.

After 5 years the sales team forecast that the product will become obsolete and hence the handlebar will be withdrawn from sale. At this point the original machine will be sold for an expected scrap value of £5,000.

Bonsall use a discount rate of 10% to appraise new investments. For an investment to be authorised it must meet or exceed the following targets:

- NPV- positive at 10% discount rate

- IRR- 15%

- Undiscounted Payback- 3yrs or less

Required

Using the information above for the new project calculate:

1) The undiscounted payback

2) The Net Present Value and

3) The Internal Rate of Return Considering your answers state whether the project is acceptable.

Answer

Financial Management Assignment Task 1

- Risk and return are an important part of financial management. Some investments are more risker than the other but have more return. But there is more guarantee that there will be more return if we take more risk. While taking financial decision the firms should compare the expected risk with the expected return. Diversification enables you to reduce the risk associated with your portfolio (Alieid, 2016). Shares mostly have less risk more than bonds, as the market is more volatile for overall bond structures but not for the shares, investment in shares is less risky and mostly the companies do that for long term association companies and be the shareholder for that company. In case the company is unsuccessful than they end up losing all their money and in case the company makes profit than they will be successful and earn more returns. In case of bonds but the market is very volatile and there are lot of risks involved, like we see that most of the bonds pay interest that have variable rate of return depending on how the market is performing and principal needs to be paid on timely basis whereas in case the bond owners fail to pay the principal they might be held legally liable. Thus, we see that when a person decides which area they want to invest in, the most basic thing that they need to consider is how much risk is there and whether they are getting that much return in lieu of that.

- Financing decisions are an integral part of any organisation and plays an important part in management of the finances of the company. The finance manager is responsible in any organisation for doing the same and taking decisions effectively. He is responsible for making sure that the overall money of the company is used in such a manner that the returns earned are maximum and there are no issues with the liquidity position of the company because of that. There are three key areas in which the finance managers take important decisions and is responsible for the overall well-being of the company. These three areas are stated below-

- Investment Decisions – These are known as capital budgeting decisions. The overall resources of the company are rare and must be put to the most maximum use to earn the maximum return, these decisions relate to the careful selection of the assets of the company that are to be put maximum use. The firms put their money in procuring the current assets and the fixed assets of the company. The factors that affect the investment decisions are profits, cash flow of the venture and investment criteria. One of the most common example of investment decision are capital budgeting decision, where the manager has two projects, and they need to choose one which would be more profitable in the long run for the company (Alexander, 2016).

- Financing Decision- It deals with the overall components of the various securities in the capital structure of the company. These decisions are mostly related to from where and how the business acquires funds. A firm makes more profit, and the overall investors wealth is also improved based on the ways the company is investing its funds and the overall capital is also built accordingly. Thus, we see that financing decision is an important job of the managers and the major factors that affects the financing decisions are risk, return, cash flow position, control, the condition of the market among others. An example related to the same, is when the managers decide whether they want to invest the capital of the company in some shares or bonds and they analyze the overall risk and reward associated with the same which will help them in building the overall portfolio of the company. Building portfolio is an important financing decision that the manager need to take and is very important for gaining long term returns and minimising the overall associated risk (Choy, 2018).

- Dividend Decision – It relates to distribution of the profit of the company to the shareholders. The manager has alternative whether they want to distribute the profit to the shareholders or they want to retain it in the capital of the company. The key factors that affect the dividend decisions are earnings of the company, dependability in earnings, balancing the dividends and the overall development opportunity for the firm. The overall attitude of the shareholders also plays an important role in the same. Example for the same is managers deciding whether they want to give out dividends or not (Buchanan, Cao, Liljeblom, & Weihrich, 2017).

- The main aim of any commercial firm is to increase their profit and provide maximum return to the shareholders who are investing their money in the company. Thus, the basic aim is shareholder wealth maximisation and profit maximisation, most of the commercial firm works on this concept. However, in reality this is not the case and there are many other factors that the companies should focus on other than profit maximisation that would help them in sustaining in the long run. Most of the operations that the company does is to increase their profit position and earn the maximum return possible from the same. But nowadays we see that the companies are adopting more sustainable approach that would help them in keeping all their stakeholders happy and not just the shareholders who are investing in the company. Other objectives are stated below-

- Productivity and Development of the people, the employees should be properly trained, and quality of work life balance should be improved for the employees. The aim should be to provide all the resources that the employees might need to stay productive in the long run for the development of their resources (Linden & Freeman, 2017).

- Excellent customer services and taking care of the needs of the customers is very important.

- The mission statement of the company will consist of the core values of the company. It states the overall beliefs that the company holds in regard to the customer interaction, responsibility of the employees and employee satisfaction.

- The company should aim for sustainable growth based on the historical data and future projections. It requires good use of the resources of the company that would help them in finances and personnel (Hoogervorst & Prada, 2015).

- The firm should aim at maintaining a very healthy cash flow and that would be reflective of the overall liquidity position of the company and will give a brief outlook on the overall resources that the company is having for future growth.

- The firm should also aim for maintaining a very healthy competition with his competitors and should make sure that they are taking important steps that would help them in doing good in their business (Heminway, 2017).

In most cases they ask is that there should be safe opportunity to make sure that the overall money that they have invested should not go waste and that invested money should give them their return. Shareholders plays on the factor of risk and reward simultaneously and see that which are the areas in which they want to invest long term and short term (Meroño-Cerdán, Lopez-Nicolas, & Molina-Castillo, 2017). Thus, this is very important that long term investment or short-term investment, the time value of money should be taken into consideration than only the returns are lucrative and the capital is well utilized in case the capital is not used accordingly than that investment will not make any sense and thus it becomes important and very much to be considered the overall returns those investments are bearing in lieu of the overall risk an investor is taking. Financial management works on the concept of money-making money and thus care should be taken to invest in such areas where the overall expense ratio is less, and profit is more. Given the volatile market that depends on assumptions and other factors, people can end up earning double of their capital in a day or losing all the money that they have and thus we should see to it that investment is done in such a manner in these areas where the rate of risk is very high that the overall return is positive, and capital should be protected at all costs in all such sectors (Liu, Jin, Xie, & Skitmore, 2017).

Thus, we see in reality a company has multiple objectives and they should work towards achieving the same as all of these would help in healthy operations of their company and would help them in earning maximum profits and sustaining in the long run. So, in case we see that the management has failed in achieving any of the other objectives then they would not be able to aim for profit maximization which is their main objective. Thus, overall operations of the firm need to be stable and thus the returns would be more in that case. Thus, these are the objectives that the company should achieve in the long run for their overall betterment.

Assignment Task 2

- The ratios have been calculated below for the years 2020 and 2019 and summarized in the below table:

|

Sl. No. |

Ratios |

2020 |

2019 |

|

1 |

Return on Capital Employed |

20.0% |

15.3% |

|

2 |

Inventory Turnover (stock days) |

108.20 |

89.97 |

|

3 |

Debtor ratio (debtors’ days) |

20.81 |

17.73 |

|

4 |

Creditor ratio (creditor days) |

86.30 |

74.17 |

|

5 |

Current ratio (times) |

1.8 |

1.6 |

|

6 |

Quick ratio (times) |

1.5 |

1.2 |

|

7 |

Debt/equity ratio |

25.5% |

28.9% |

|

8 |

Interest cover (times) |

64 |

21 |

|

9 |

Return on Equity |

20.0% |

15.4% |

|

10 |

Price Earnings Ratio (P/E Ratio) |

12.4 |

12.2 |

- From the above table, we can see that the return on capital employed has increased from 15.3% in 2019 to 20% in 2020. This implies that the profitability of the company has increased which has resulted in more returns on the overall capital employed. This a healthy return considering the industry average which ranges between 12-15%.

Secondly the inventory turnover implies in how many days, the inventory is getting converted to sales and in case of Rio Tinto, this has increased from 90 days to 108 days which is a cause of concern as the inventory holding period is high and it also implies the company might be holding large closing stock. One of the primary reason for the same may be pandemic due to which the companies tend to maintain higher inventory to avoid supply issues (Sithole, Chandler, Abeysekera, & Paas, 2017).

In terms of debtor’s days, it has decreased for Rio Tinto implying that now it takes 21 days to recover the cash for credit sales made as compared to 18 days it used to take in 2020, which clearly shows the collection efficiency of the company.

Creditor days shows the number of days in which the outstanding creditors are being paid as the same has increased from 74 days in 2019 to 86 days in 2020 which is again a positive sign for the company as it has been able to negotiate better on the credit days which will help in positive working capital cycle and cash cycle for the company (Vieira, O’Dwyer, & Schneider, 2017). The current and quick ratios are both liquidity ratios which shows if the company has ability to pay off the current liabilities with the help of the current assets if the need arises. It checks the sufficiency of the short-term assets. In case of Rio Tinto, both the current as well as quick ratio has improved from 1.6 times and 1.2 times to 1.8 times and 1.5 times respectively. This is due to increase in current assets base particularly cash and cash equivalents. The ideal current and quick ratio is considered to be 2 times and 1 times respectively and hence it can be said that Rio Tinto is having healthy liquidity.

Debt equity ratio shows the proportion of debt and equity in overall capital. Here, it has decreased marginally from 28.9% in 2019 to 25.5% in 2020 which implies reduction in debt and it is good sign for the company. Another solvency ratio – interest coverage has increased significantly from 21 times in 2019 to 64 times in 2020 implies that company is having good enough profits to pay off interest expenses. This is due to sharp rise in profitability coupled with decrease in interest expenses (Goldmann, 2016).

Return on equity is profit earned by company on the equity shareholder’s funds’ employed and the same has increased from 15.4% to 20% which is a positive sign for the equity shareholders. Lastly, in terms of P/E ratio, the company has seen improvement from 12.2 times to 12.4 times meaning the valuation of company has increased compared to previous year. The EPS as well as the share price has increased versus previous year.

Assignment Task 3

- The individual cost of capital for 4 sources of capital has been shown below:

|

Calculation of cost of capital |

|

|

Redeemable Bonds |

= Interest Expense * (1-Tax Rate) |

|

= 6.5%*(1-0.20) |

|

|

5.20% |

|

|

Irredeemable Bonds |

= Annual Interest (after tax) / Market Value |

|

= 8%*(1-0.20)/115*100% |

|

|

5.57% |

|

|

Ordinary Shares |

= ((Dividends/share next year) / Current share price) + Dividend growth rate |

|

(using dividend capitalization model) |

= (5.5/126)+0.08 |

|

12.4% |

|

|

Preference Shares |

= Annual Dividend / Market Value |

|

= 7/82 |

|

|

8.54% |

The WACC of ATMS Plc has been shown below:

|

Sources of Capital |

Market Values (£) |

Weightage |

Cost of capital |

WACC |

|

Redeemable Bonds |

1000000 |

13.3% |

5.20% |

0.69% |

|

Irredeemable Bonds |

2000000 |

26.7% |

5.57% |

1.48% |

|

Ordinary Shares |

4000000 |

53.3% |

12.4% |

6.59% |

|

Preference Shares |

500000 |

6.7% |

8.54% |

0.57% |

|

7500000 |

9.34% |

|||

- In the given case, the company wants to offer 10% discount of early payment within 20 days.

The usual credit period is 60 days and the cost of borrowing is 15%.

We are assuming that the interest rate is 15% for 60 days (Belton, 2017). Since 60% of the customers will still be paying in 60 days,

Scenario 1: Cost to company for balance 40% in case discount is given

= Cost of discount - Savings of interest cost for 40 days

= (£20m*40%*10% discount) - (£20m*40%*40 days/60 days*15% p.a.)= £(0.8m – 0.8m) = 0

Scenario 2: Cost to company for balance 40% in case discount is not given

= (£20m*40%*15% p.a.) = £1.2m

Hence the above calculation shows that proposed discount will result in net savings for the company.

Assignment Task 4

As per the given inputs, the workings are as follows:

|

Year |

0 |

1 |

2 |

3 |

4 |

5 |

|

Sales (£) |

- |

250,000 |

305,000 |

375,000 |

475,000 |

400,000 |

|

Less: Variable cost |

- |

125,000 |

152,500 |

187,500 |

237,500 |

200,000 |

|

Less: Fixed cost |

- |

120,000 |

125,000 |

130,000 |

135,000 |

140,000 |

|

Profit |

- |

5,000 |

27,500 |

57,500 |

102,500 |

60,000 |

|

|

|

|

|

|

|

|

|

Initial Outflow - cost of machine |

(150,000) |

|

|

|

|

|

|

Yearly inflow |

|

5,000 |

27,500 |

57,500 |

102,500 |

60,000 |

|

Scrap value of machine |

|

|

|

|

|

5,000 |

|

Net Cash flow |

(150,000) |

5,000 |

27,500 |

57,500 |

102,500 |

65,000 |

|

Discounting Factor @10% |

1.0000 |

0.9091 |

0.8264 |

0.7513 |

0.6830 |

0.6209 |

|

Discounted Cash flow |

(150,000) |

4,545 |

22,727 |

43,201 |

70,009 |

40,360 |

|

NPV (£) |

|

|

|

|

|

30,842 |

|

IRR (%) |

|

|

|

|

|

5.29% |

|

Payback period ( in years) |

|

|

|

|

|

4.24 |

|

|

|

|

|

|

|

|

- The undiscounted payback period is 4.24 years vs 3 years or less as per the acceptable criteria. Hence, as per this criteria, the project should be rejected.

- The net present value is £30842 which is positive at 10% discount rate and hence as per this criteria, project is acceptable (Ben-Horin & Kroll, 2017)

- The internal rate of return is 5.29% which is less than the criteria of 15% and hence the project is not acceptable (Magni & Martin, 2017).

References

Alexander, F. (2016). The Changing Face of Accountability. The Journal of Higher Education, 71(4), 411-431. Retrieved from https://doi.org/10.1080/00221546.2000.11778843

Alieid, E. E. (2016). The Role of Accounting Information Systems in Making Investment Decisions. Internal Auditing & Risk Management, 11(2), 233-242.

Belton, P. (2017). Competitive Strategy: Creating and Sustaining Superior Performance (Vol. 2). London: Macat International ltd.

Ben-Horin, M., & Kroll, Y. (2017). A simple intuitive NPV-IRR consistent ranking. The Quarterly Review of Economics and Finance, 66(1), 108-114.

Buchanan, B., Cao, C., Liljeblom, E., & Weihrich, S. (2017). Taxation and Dividend Policy: The Muting Effect of Agency Issues and Shareholder Conflicts. Journal of Corporate Finance, 42, 179-197.

Choy, Y. K. (2018). Cost-benefit Analysis, Values, Wellbeing and Ethics: An Indigenous Worldview Analysis. Ecological Economics, 3(1), 145. doi:https://doi.org/10.1016/j.ecolecon.2017.08.005

Goldmann, K. (2016). Financial Liquidity and Profitability Management in Practice of Polish Business. Financial Environment and Business Development, 4(3), 103-112.

Heminway, J. (2017). Shareholder Wealth Maximization as a Function of Statutes, Decisional Law, and Organic Documents. SSRN, 1-35.

Hoogervorst, H., & Prada, M. (2015). Working in the Public Interest. Financial management assignment The IFRS Foundation and the IASB, 1-12.

Linden, B., & Freeman, R. (2017). Profit and Other Values: Thick Evaluation in Decision Making. Business Ethics Quarterly, 27(3), 353-379. Retrieved from https://doi.org/10.1017/beq.2017.1

Liu, J., Jin, F., Xie, Q., & Skitmore, M. (2017). Improving risk assessment in financial feasibility of international engineering projects: A risk driver perspective. International Journal of Project Management, 35(2), 204-211.

Magni, C. A., & Martin, J. D. (2017). The reinvestment rate assumption fallacy for IRR and NPV. Available at SSRN 3090678.

Meroño-Cerdán, A., Lopez-Nicolas, C., & Molina-Castillo, F. (2017). Risk aversion, innovation and performance in family firms. Economics of Innovation and new technology, 1-15.

Sithole, S., Chandler, P., Abeysekera, I., & Paas, F. (2017). Benefits of guided self-management of attention on learning accounting. Journal of Educational Psychology, 109(2), 220. Retrieved from http://psycnet.apa.org/buy/2016-21263-001

Vieira, R., O’Dwyer, B., & Schneider, R. (2017). Aligning Strategy and Performance Management Systems. SAGE Journals, 30(1), 23-48.